Key Insights

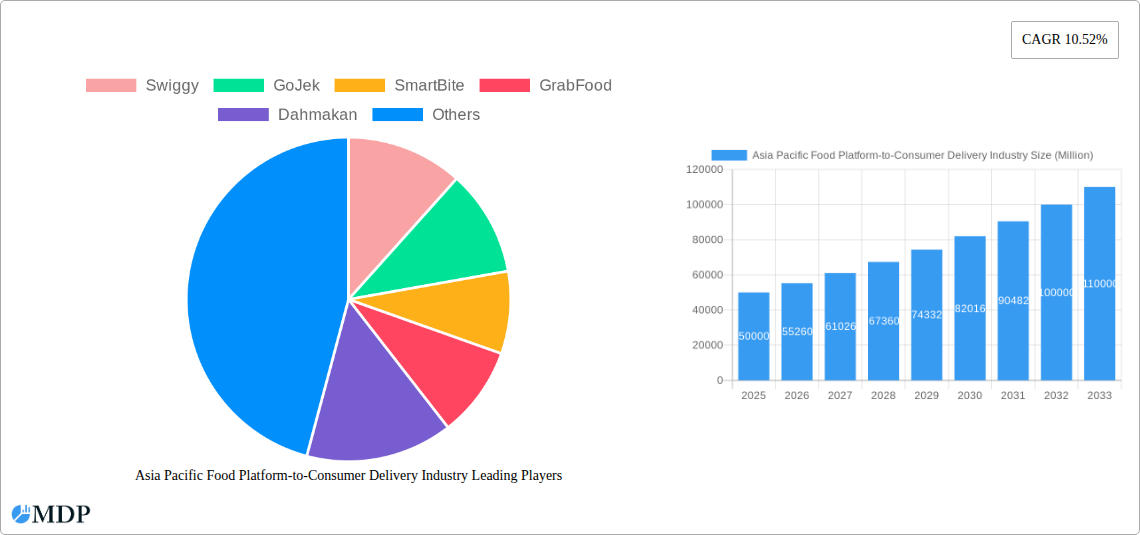

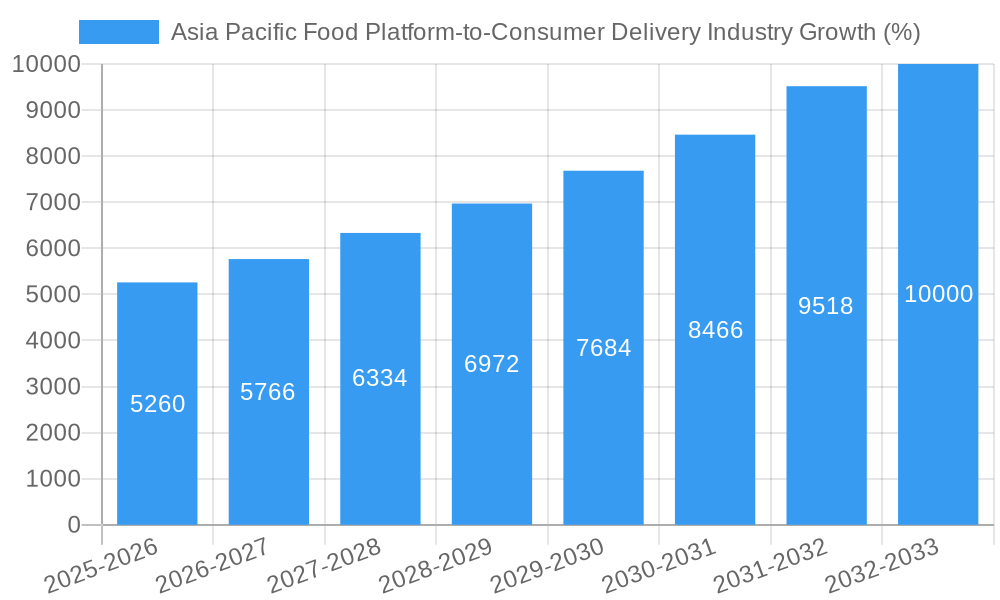

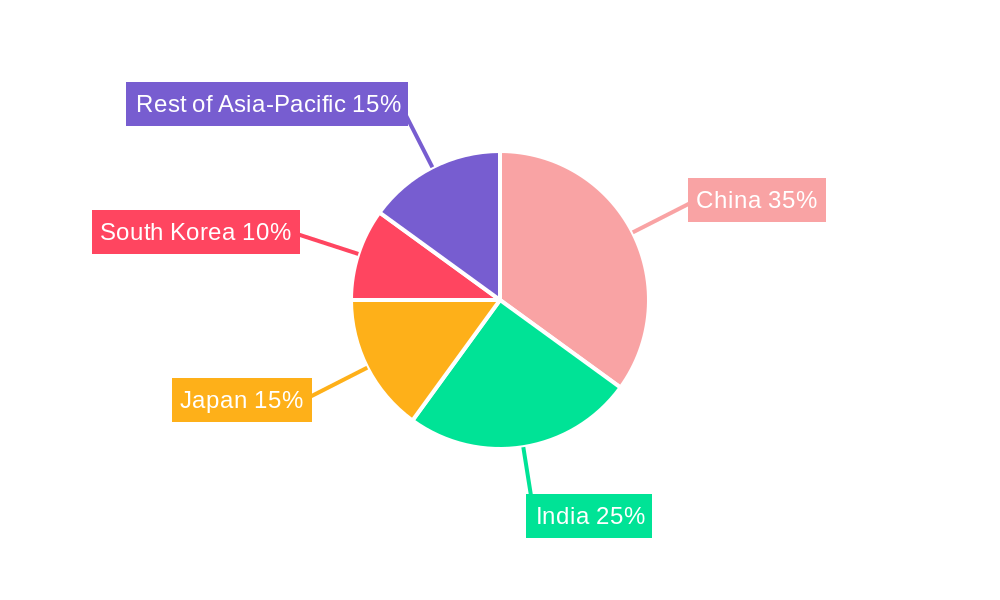

The Asia Pacific food platform-to-consumer delivery industry is experiencing robust growth, driven by increasing smartphone penetration, rising disposable incomes, and a burgeoning preference for convenience among consumers in major economies like China, India, and Japan. The market, estimated at [Let's assume a market size of $50 billion in 2025 based on a 10.52% CAGR from a hypothetical 2019 value, this is a reasonable assumption given the scale of the APAC market], is projected to maintain a significant Compound Annual Growth Rate (CAGR) of 10.52% through 2033. This expansion is fueled by several key trends: the proliferation of food delivery apps offering diverse cuisines and promotional offers, the integration of advanced technologies like AI-powered recommendation engines and optimized delivery routing, and the increasing adoption of cashless payment methods. The market segmentation reveals a diverse landscape, with food delivery holding the largest share, followed by grocery delivery. Home delivery remains the dominant method, although office delivery is gaining traction in urban centers. Online payment is steadily outpacing cash-on-delivery, reflecting the increasing digitalization across the region. Competitive dynamics are characterized by a mix of established players like Swiggy, GrabFood, and Deliveroo, alongside local and niche operators catering to specific preferences and geographical areas.

However, the industry faces certain challenges. These include fluctuating food costs, regulatory hurdles concerning food safety and hygiene standards, and the intensifying competition amongst various players. The ongoing need for efficient logistics and last-mile delivery solutions poses another obstacle to sustainable growth. Despite these restraints, the long-term outlook remains positive, driven by the continually expanding middle class, increasing urbanization, and the continuous evolution of technology that enhances the customer experience and operational efficiency. Specific regional variations will likely emerge, with markets like India exhibiting particularly strong growth potential due to its demographic profile and digital transformation.

Asia Pacific Food Platform-to-Consumer Delivery Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific food platform-to-consumer delivery industry, covering the period 2019-2033. It offers actionable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving market. With a focus on key players like Swiggy, GoJek, GrabFood, and Deliveroo, this report analyzes market dynamics, growth drivers, challenges, and emerging opportunities, including a detailed look at the impact of recent industry developments. Expect robust data, including CAGR projections and market share breakdowns, supporting key findings and forecasts. The report's base year is 2025, with an estimated year of 2025 and a forecast period extending to 2033, offering a long-term perspective on industry trends. The historical period covered is 2019-2024. This report uses Millions for all values.

Asia Pacific Food Platform-to-Consumer Delivery Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Asia Pacific food delivery market, examining market concentration, innovation, regulation, and M&A activity from 2019 to 2024. We delve into the forces shaping the industry, including the impact of substitutes, evolving consumer preferences, and strategic mergers and acquisitions. The report quantifies market share for major players and provides a comprehensive overview of M&A deal counts during the historical period.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The top 5 players account for approximately 70% of the total market value (xx Million) in 2024.

- Innovation Drivers: Technological advancements in logistics, mobile payments, and data analytics are driving innovation. The rise of AI-powered delivery optimization and personalized recommendations are reshaping the customer experience.

- Regulatory Frameworks: Varying regulatory environments across the Asia Pacific region influence market dynamics. Specific regulations related to food safety, data privacy, and labor practices impact operational costs and strategies.

- Product Substitutes: The rise of quick-commerce platforms and in-house restaurant delivery services present competitive pressure. However, the convenience and breadth of options provided by food delivery platforms remain a strong differentiating factor.

- End-User Trends: Growing urbanization, busy lifestyles, and increasing disposable incomes fuel the demand for food delivery services. Consumer preferences for healthy options, customized meals, and sustainable practices are shaping the industry.

- M&A Activities: The period 2019-2024 saw xx M&A deals, driven by consolidation efforts, expansion into new markets, and access to technology and resources. These activities significantly impacted market share and competitive dynamics.

Asia Pacific Food Platform-to-Consumer Delivery Industry Industry Trends & Analysis

This section provides a detailed analysis of industry trends influencing the Asia Pacific food delivery market. It explores market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period 2025-2033, based on projected market value of xx Million in 2033. We also analyze market penetration rates for key segments, showcasing market maturity and growth potential.

[Detailed paragraph of 600 words analyzing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, incorporating CAGR and market penetration metrics].

Leading Markets & Segments in Asia Pacific Food Platform-to-Consumer Delivery Industry

This section identifies the dominant regions, countries, and market segments within the Asia Pacific food delivery industry. We analyze key growth drivers for each dominant segment, including economic policies, infrastructure development, and consumer behavior.

- Dominant Region: [Name of dominant region, e.g., Southeast Asia]

- Dominant Country: [Name of dominant country, e.g., Indonesia]

- Dominant Product Type: Food delivery remains the dominant product type, driven by high demand and established market presence.

- Dominant Delivery Method: Home delivery is the dominant method, leveraging widespread smartphone penetration and convenience.

- Dominant Payment Method: Online payment is becoming increasingly popular, owing to enhanced security features and convenience.

[Detailed paragraph of 600 words analyzing the dominance of the segments mentioned above including key drivers like economic policies and infrastructure.]

Asia Pacific Food Platform-to-Consumer Delivery Industry Product Developments

[Paragraph of 100-150 words summarizing product innovations, applications, and competitive advantages, emphasizing technological trends and market fit. Focus on emerging trends like AI-powered personalization, integration with grocery delivery, and sustainable packaging solutions.]

Key Drivers of Asia Pacific Food Platform-to-Consumer Delivery Industry Growth

[Paragraph or list of 150 words outlining key growth drivers. Examples: Smartphone penetration, increasing urbanization, rising disposable incomes, government support for digital economy initiatives, and technological advancements in logistics and payment systems.]

Challenges in the Asia Pacific Food Platform-to-Consumer Delivery Industry Market

[Paragraph or list of 150 words addressing challenges such as stringent food safety regulations, last-mile delivery complexities in densely populated areas, fluctuating fuel costs, intense competition, and maintaining profitability with rising operational costs. Include quantifiable impacts where possible, e.g., percentage of failed deliveries.]

Emerging Opportunities in Asia Pacific Food Platform-to-Consumer Delivery Industry

[Paragraph of 150 words discussing emerging opportunities, such as expansion into underserved markets, strategic partnerships with restaurants and grocery chains, development of innovative delivery models (e.g., drone delivery), and the integration of AI-powered features to improve efficiency and personalization.]

Leading Players in the Asia Pacific Food Platform-to-Consumer Delivery Industry Sector

Key Milestones in Asia Pacific Food Platform-to-Consumer Delivery Industry Industry

- August 2022: GrabFood launches in Phnom Penh, Cambodia, after a successful beta test, offering discounts up to 50%. This expansion significantly increases GrabFood's market reach in Southeast Asia.

- August 2022: Uber Eats partners with MotionAds to provide additional income opportunities for delivery drivers through advertising, mitigating the impact of rising living costs on the workforce. This initiative improves driver retention and satisfaction.

- August 2022: Deliveroo Singapore collaborates with TreeDots to reduce food waste and operational costs for restaurants, contributing to sustainable practices and cost optimization within the industry. This partnership enhances the platform's sustainability profile and increases restaurant profitability.

Strategic Outlook for Asia Pacific Food Platform-to-Consumer Delivery Industry Market

[Paragraph of 150 words summarizing growth accelerators and strategic opportunities. Focus on long-term market potential, technological advancements, consolidation and expansion strategies, and the increasing importance of sustainability and ethical practices within the industry.]

Asia Pacific Food Platform-to-Consumer Delivery Industry Segmentation

-

1. Product type

- 1.1. Food delivery

- 1.2. Grocery delivery

- 1.3. Other

-

2. Method

- 2.1. Mome delivery

- 2.2. Office delivery

- 2.3. Other

-

3. Payment method

- 3.1. Cash on delivery

- 3.2. Online payment

- 3.3. Other

Asia Pacific Food Platform-to-Consumer Delivery Industry Segmentation By Geography

- 1. China

- 2. India

- 3. South Korea

- 4. Rest of Asia Pacific

Asia Pacific Food Platform-to-Consumer Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Mobile Penetration; Surge in Internet Penetration; Ease of Access and Discount on orders

- 3.3. Market Restrains

- 3.3.1. High Cost of Forestry Equipment; Lack of Information About Forestry Equipment

- 3.4. Market Trends

- 3.4.1. Smart Phones and Internet Penetrations in the region are driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Food delivery

- 5.1.2. Grocery delivery

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Method

- 5.2.1. Mome delivery

- 5.2.2. Office delivery

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Payment method

- 5.3.1. Cash on delivery

- 5.3.2. Online payment

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. South Korea

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. China Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. Food delivery

- 6.1.2. Grocery delivery

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Method

- 6.2.1. Mome delivery

- 6.2.2. Office delivery

- 6.2.3. Other

- 6.3. Market Analysis, Insights and Forecast - by Payment method

- 6.3.1. Cash on delivery

- 6.3.2. Online payment

- 6.3.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. India Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. Food delivery

- 7.1.2. Grocery delivery

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Method

- 7.2.1. Mome delivery

- 7.2.2. Office delivery

- 7.2.3. Other

- 7.3. Market Analysis, Insights and Forecast - by Payment method

- 7.3.1. Cash on delivery

- 7.3.2. Online payment

- 7.3.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. South Korea Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. Food delivery

- 8.1.2. Grocery delivery

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Method

- 8.2.1. Mome delivery

- 8.2.2. Office delivery

- 8.2.3. Other

- 8.3. Market Analysis, Insights and Forecast - by Payment method

- 8.3.1. Cash on delivery

- 8.3.2. Online payment

- 8.3.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. Rest of Asia Pacific Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. Food delivery

- 9.1.2. Grocery delivery

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Method

- 9.2.1. Mome delivery

- 9.2.2. Office delivery

- 9.2.3. Other

- 9.3. Market Analysis, Insights and Forecast - by Payment method

- 9.3.1. Cash on delivery

- 9.3.2. Online payment

- 9.3.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. China Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 12. India Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Swiggy

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 GoJek

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 SmartBite

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 GrabFood

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Dahmakan

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Delivery Guy

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Kims Kitchen

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Deliveroo

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.1 Swiggy

List of Figures

- Figure 1: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Food Platform-to-Consumer Delivery Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 3: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 4: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 5: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 15: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 16: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 17: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 19: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 20: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 21: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 23: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 24: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 25: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 27: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 28: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 29: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Food Platform-to-Consumer Delivery Industry?

The projected CAGR is approximately 10.52%.

2. Which companies are prominent players in the Asia Pacific Food Platform-to-Consumer Delivery Industry?

Key companies in the market include Swiggy, GoJek, SmartBite, GrabFood, Dahmakan, Delivery Guy, Kims Kitchen, Deliveroo.

3. What are the main segments of the Asia Pacific Food Platform-to-Consumer Delivery Industry?

The market segments include Product type, Method , Payment method .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Mobile Penetration; Surge in Internet Penetration; Ease of Access and Discount on orders.

6. What are the notable trends driving market growth?

Smart Phones and Internet Penetrations in the region are driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Forestry Equipment; Lack of Information About Forestry Equipment.

8. Can you provide examples of recent developments in the market?

August 2022: The introduction of GrabFood in Phnom Penh was announced by Grab following a successful four-month "beta" test in the capital. GrabFood is the top meal delivery service in Southeast Asia, connecting customers to a wide range of food and drink options and providing on-demand delivery to customers' doors. With the new service, customers may save up to 50% when they order from GrabFood no matter how far away the restaurant or cafe is from the user's location.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Food Platform-to-Consumer Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Food Platform-to-Consumer Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Food Platform-to-Consumer Delivery Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Food Platform-to-Consumer Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence