Key Insights

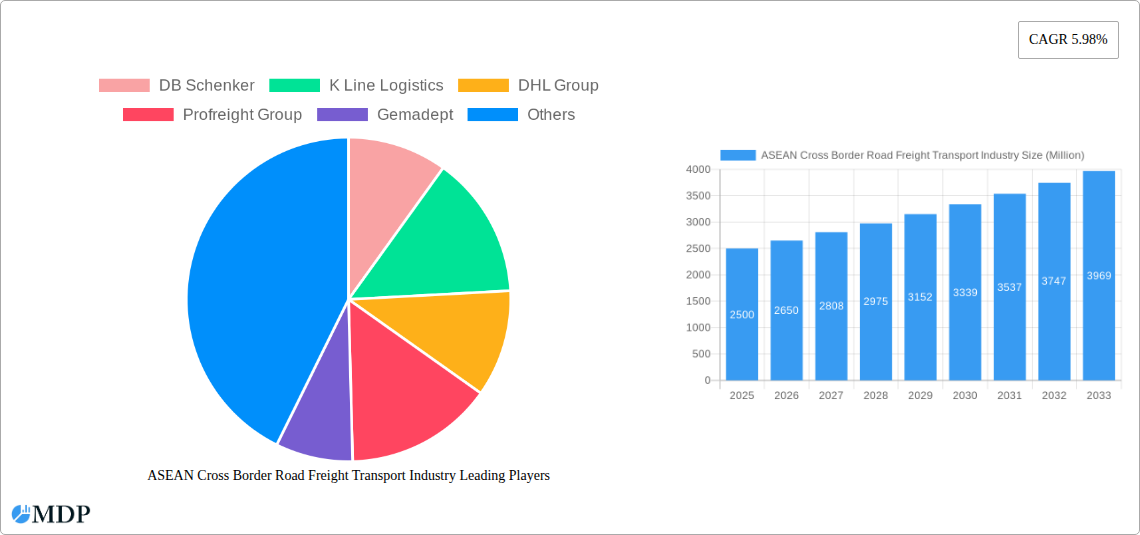

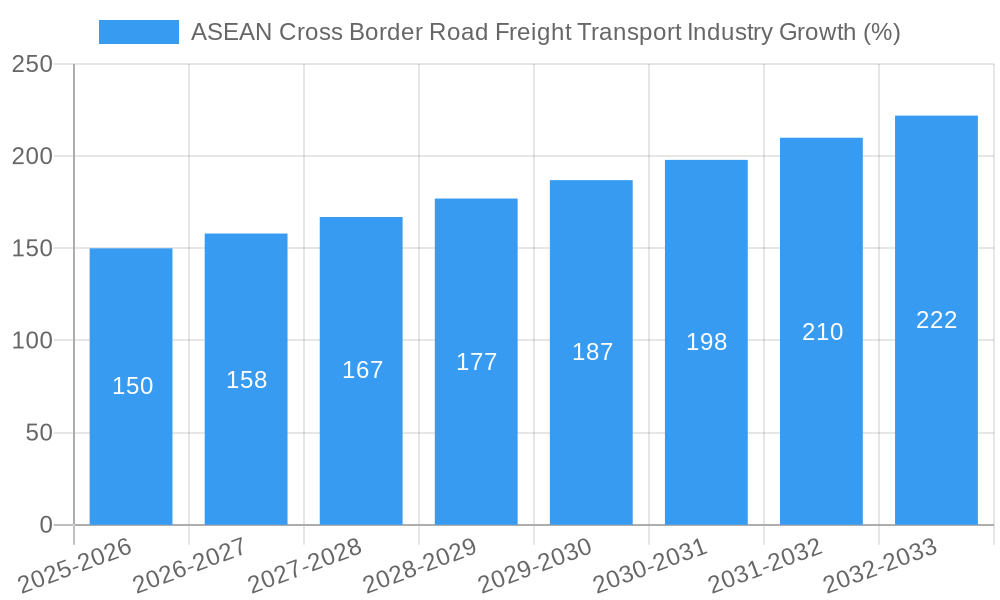

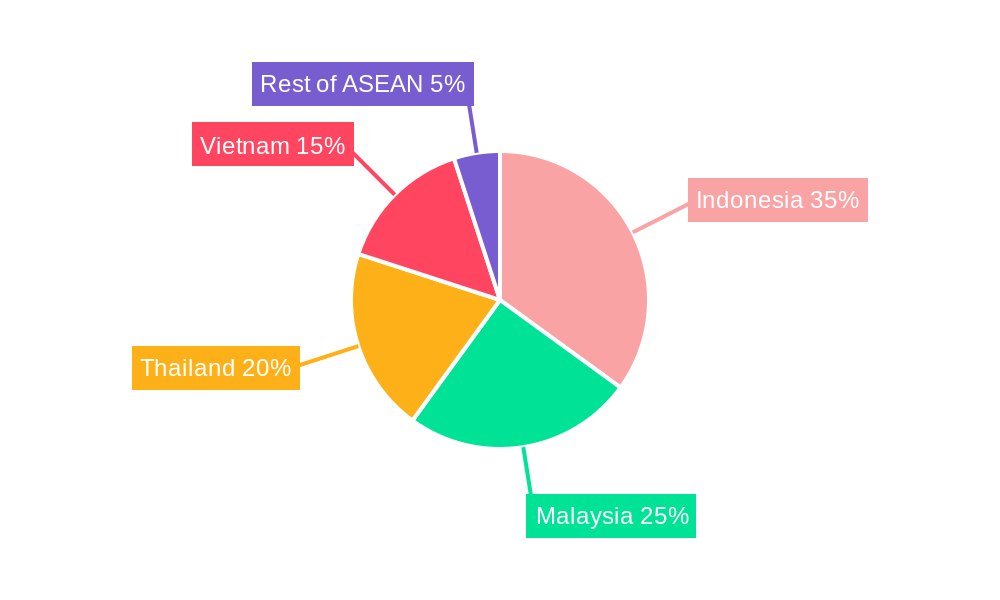

The ASEAN Cross-Border Road Freight Transport market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing intra-ASEAN trade, expanding e-commerce activities, and the development of improved road infrastructure connecting the region's major economies. This burgeoning market exhibits a Compound Annual Growth Rate (CAGR) of 5.98%, indicating a substantial rise in transportation volume and revenue throughout the forecast period (2025-2033). Key growth drivers include the rising demand for faster and more cost-effective delivery solutions across borders, particularly for time-sensitive goods. The manufacturing, construction, and agricultural sectors are significant contributors to this growth, with consistent demand for raw materials and finished goods. However, challenges such as inconsistent border regulations, varying road conditions across the region, and potential logistical bottlenecks pose restraints to the market's full potential. The segmentation by end-user industry reveals that the manufacturing, construction, and agricultural sectors are driving most of the growth in the ASEAN region. Indonesia, Malaysia, Thailand, and Vietnam are crucial markets within the ASEAN bloc, contributing significantly to the overall market size, with Indonesia likely being the largest market due to its economic size and production capabilities. Leading players such as DB Schenker, DHL Group, and Kerry Logistics Network Limited are actively competing to secure market share, highlighting the industry's high competitive intensity.

The continued growth of the ASEAN Economic Community (AEC) and efforts to streamline cross-border trade processes are expected to positively influence the market's trajectory. Further infrastructure investments and harmonization of transport regulations across member states will facilitate smoother cross-border transportation, potentially accelerating the market's CAGR. The increasing preference for just-in-time inventory management in various industries also fuels demand for efficient road freight services, reinforcing the market's positive outlook. Despite the challenges, the long-term outlook for the ASEAN Cross-Border Road Freight Transport market remains optimistic, driven by economic growth and the continued integration of the ASEAN region. The increasing adoption of technology, such as tracking systems and digital logistics platforms, is further streamlining operations and enhancing efficiency within the industry.

ASEAN Cross Border Road Freight Transport Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the ASEAN cross-border road freight transport industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers crucial data and actionable strategies for success. The report covers key markets (Indonesia, Malaysia, Thailand, Vietnam, and Rest of ASEAN), segments (Agriculture, Fishing & Forestry, Construction, Manufacturing, Oil & Gas, Mining & Quarrying, Wholesale & Retail Trade, Others), and leading players including DB Schenker, K Line Logistics, DHL Group, Profreight Group, Gemadept, MOL Logistics, Overland Total Logistic, Konoike Group, Yatfai Group, Tiong Nam Logistics, and Kerry Logistics Network Limited. The projected market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

ASEAN Cross Border Road Freight Transport Industry Market Dynamics & Concentration

The ASEAN cross-border road freight transport market is characterized by moderate concentration, with a few large players holding significant market share, while numerous smaller companies compete for the remaining business. The market share of the top 5 players is estimated at xx%. Innovation is driven by technological advancements such as telematics, GPS tracking, and route optimization software, improving efficiency and transparency. Regulatory frameworks, however, vary across ASEAN countries, posing challenges to seamless cross-border operations. Product substitutes, such as rail and sea freight, exert competitive pressure, particularly for long-haul transport. End-user trends indicate a growing demand for faster and more reliable delivery services, fueled by the expansion of e-commerce. M&A activity has been relatively low in recent years, with only xx deals recorded between 2019-2024. This suggests consolidation opportunities exist for larger players seeking to expand market share and geographic reach.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: Telematics, GPS tracking, route optimization software.

- Regulatory Frameworks: Varied across ASEAN countries, impacting cross-border operations.

- Product Substitutes: Rail and sea freight.

- End-User Trends: Growing demand for faster, reliable delivery (e-commerce driven).

- M&A Activity: xx deals between 2019-2024.

ASEAN Cross Border Road Freight Transport Industry Industry Trends & Analysis

The ASEAN cross-border road freight transport industry is experiencing robust growth, driven by increasing intra-ASEAN trade, expanding manufacturing sectors, and the rise of e-commerce. Technological disruptions, such as the adoption of autonomous vehicles and digital freight platforms, are transforming logistics operations, increasing efficiency and reducing costs. Consumer preferences are shifting towards faster and more reliable delivery services, prompting companies to invest in advanced technologies and infrastructure. The competitive landscape is intensifying, with established players facing challenges from emerging logistics providers and technology companies. The market is expected to grow at a CAGR of xx% from 2025 to 2033, with market penetration reaching xx% by 2033. This growth is fueled by factors such as improving infrastructure, government initiatives to promote regional trade and the rapid expansion of the e-commerce sector within the ASEAN region.

Leading Markets & Segments in ASEAN Cross Border Road Freight Transport Industry

Thailand and Vietnam are currently the leading markets for cross-border road freight transport in ASEAN, driven by their strong manufacturing bases and strategic locations. Indonesia, while possessing a large market size, faces infrastructure challenges impacting its growth potential. Malaysia benefits from its well-developed infrastructure and position as a key trading hub.

- Thailand: Strong manufacturing base, strategic location, well-developed infrastructure.

- Vietnam: Rapid economic growth, increasing foreign investment, expanding manufacturing sector.

- Indonesia: Large market size, but faces infrastructure challenges.

- Malaysia: Well-developed infrastructure, key trading hub.

- Rest of ASEAN: Significant growth potential, varying levels of development.

The Manufacturing, Wholesale and Retail Trade, and Construction sectors are the dominant segments, accounting for xx% of total market volume in 2025. The agriculture, fishing, and forestry segment shows moderate growth, influenced by improving infrastructure in rural areas.

- Manufacturing: Large volume of goods transported across borders.

- Wholesale & Retail Trade: Driven by the growth of e-commerce and consumer goods.

- Construction: Demand for materials and equipment transportation for infrastructure projects.

ASEAN Cross Border Road Freight Transport Industry Product Developments

Recent product innovations focus on enhancing efficiency, transparency, and security within the supply chain. This includes the adoption of GPS tracking systems, digital freight platforms, and specialized vehicles for temperature-sensitive goods. These advancements cater to the growing demand for faster and more reliable delivery services, giving companies a competitive edge in the market. The integration of blockchain technology is also gaining traction, providing greater security and traceability for cross-border shipments.

Key Drivers of ASEAN Cross Border Road Freight Transport Industry Growth

The growth of the ASEAN cross-border road freight transport industry is fueled by several key factors: Firstly, the increasing volume of intra-ASEAN trade, driven by economic integration initiatives like the ASEAN Economic Community (AEC). Secondly, significant investments in infrastructure development across the region are improving connectivity and reducing transportation costs. Thirdly, the rapid expansion of e-commerce is increasing demand for faster and more reliable delivery services.

Challenges in the ASEAN Cross Border Road Freight Transport Industry Market

Several challenges hinder the growth of the industry. Inconsistent regulatory frameworks across ASEAN countries create complexities in cross-border operations. Supply chain disruptions, such as border delays and traffic congestion, lead to increased transportation times and costs. Intense competition among logistics providers puts downward pressure on pricing. These factors combined create an estimated xx Million loss annually.

Emerging Opportunities in ASEAN Cross Border Road Freight Transport Industry

The adoption of advanced technologies like autonomous vehicles and AI-powered logistics platforms presents significant opportunities for growth and efficiency gains. Strategic partnerships between logistics providers and technology companies are creating innovative solutions to enhance supply chain visibility and optimize transportation networks. Expanding into underserved markets within ASEAN, focusing on rural areas and less developed economies, offers considerable untapped potential.

Leading Players in the ASEAN Cross Border Road Freight Transport Industry Sector

- DB Schenker

- K Line Logistics

- DHL Group

- Profreight Group

- Gemadept

- MOL Logistics

- Overland Total Logistic

- Konoike Group

- Yatfai Group

- Tiong Nam Logistics

- Kerry Logistics Network Limited

Key Milestones in ASEAN Cross Border Road Freight Transport Industry Industry

- June 2023: DHL Express deploys 24 electric vans in Jakarta and Bandung, expanding its electric fleet for last-mile delivery. This reflects the industry's growing focus on sustainability.

- June 2023: Chery Malaysia partners with Tiong Nam Logistics for spare parts warehousing and transportation, highlighting increasing collaboration in the automotive sector.

- May 2023: Kerry Express partners with All Speedy Co. to expand delivery services through 7-Eleven outlets, demonstrating the importance of strategic partnerships for wider market reach.

Strategic Outlook for ASEAN Cross Border Road Freight Transport Industry Market

The ASEAN cross-border road freight transport market presents significant long-term growth potential, driven by continued economic integration, infrastructure development, and the expansion of e-commerce. Companies that invest in technology, build strategic partnerships, and adapt to evolving regulatory landscapes will be well-positioned to capitalize on emerging opportunities. Focus on sustainability and efficient operations will be crucial for sustained success in this competitive market.

ASEAN Cross Border Road Freight Transport Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

ASEAN Cross Border Road Freight Transport Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN Cross Border Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 K Line Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Profreight Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gemadept

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MOL Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Overland Total Logistic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Konoike Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yatfai Grou

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tiong Nam Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kerry Logistics Network Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global ASEAN Cross Border Road Freight Transport Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 3: North America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 4: North America ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: North America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: South America ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 7: South America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 8: South America ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 11: Europe ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 12: Europe ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 15: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 16: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 19: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 20: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 5: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 10: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 15: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 26: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: GCC ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: North Africa ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 34: Global ASEAN Cross Border Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Japan ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: South Korea ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: ASEAN ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Oceania ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Cross Border Road Freight Transport Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the ASEAN Cross Border Road Freight Transport Industry?

Key companies in the market include DB Schenker, K Line Logistics, DHL Group, Profreight Group, Gemadept, MOL Logistics, Overland Total Logistic, Konoike Group, Yatfai Grou, Tiong Nam Logistics, Kerry Logistics Network Limited.

3. What are the main segments of the ASEAN Cross Border Road Freight Transport Industry?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

June 2023: DHL Express has geared up to electrify its last-mile delivery fleet by deploying 24 electric vans in Jakarta and Bandung. The new electric vehicles will join the existing fleet which includes four electric vans and six electric bikes serving areas in Jakarta and Surabaya.June 2023: Chery Malaysia signed a logistic services agreement with Tiong Nam Logistics Holdings Berhad, which is responsible for spare parts warehousing and transportation logistics services. Tiong Nam Logistics has obtained the rights to handle Chery’s spare parts warehousing and transportation in Malaysia, including heavy-duty vehicle models such as TIGGO 8 PRO and OMODA5.May 2023: Kerry Express (KEX),has announced a partnership with All Speedy Co, a subsidiary of CP All, to extend its services to 7-Eleven branches across the country. This cooperation between Kerry Express and All Speedy is aimed at increasing the availability of their express parcel delivery service by leveraging the extensive nationwide network of 7-Eleven outlets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Cross Border Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Cross Border Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Cross Border Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the ASEAN Cross Border Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence