Key Insights

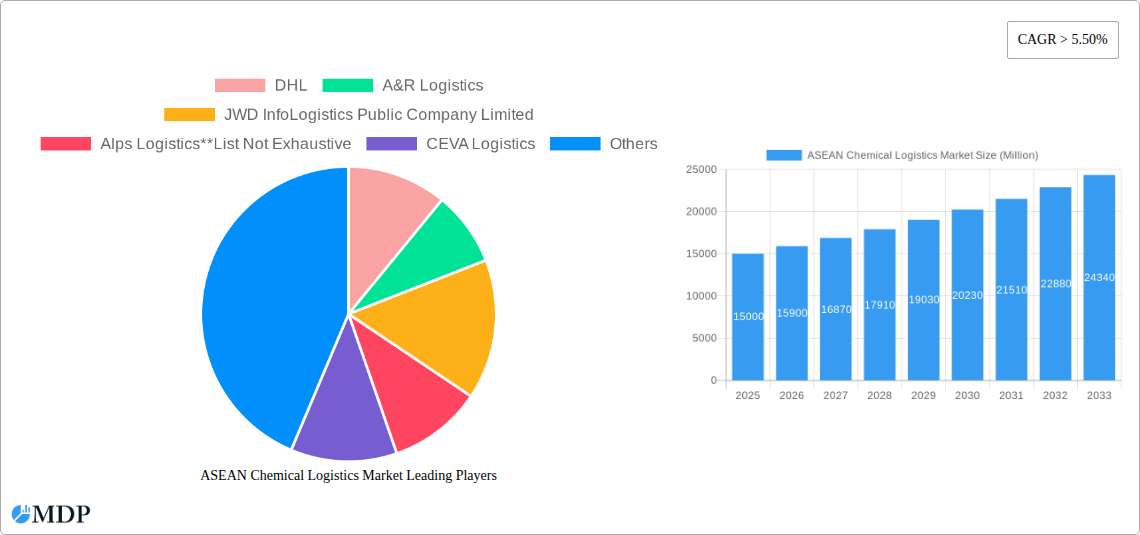

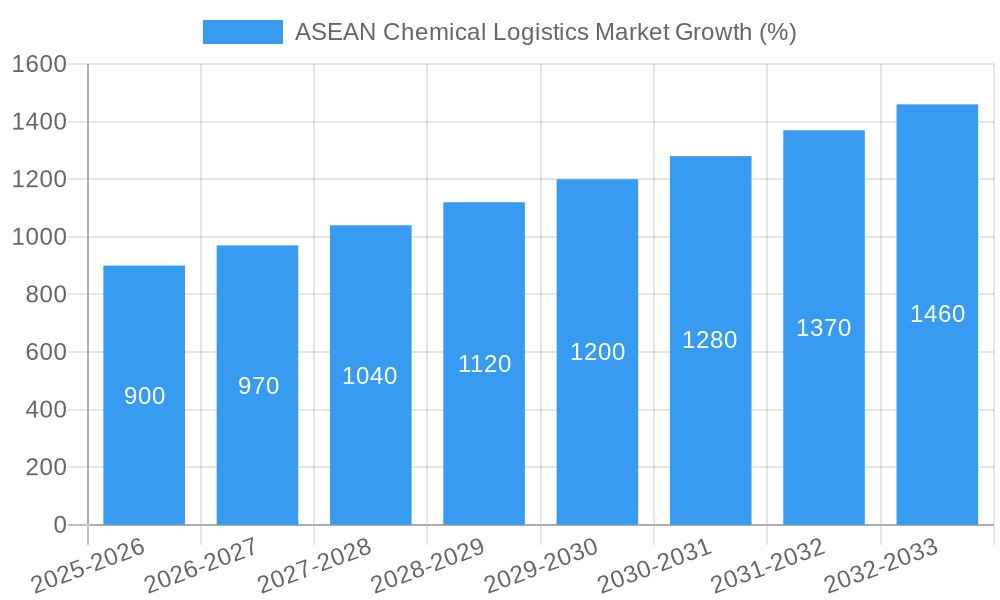

The ASEAN chemical logistics market is experiencing robust growth, driven by the expanding chemical industry across the region and the increasing demand for efficient and reliable transportation and warehousing solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 5.50% indicates a significant upward trajectory projected through 2033. Key drivers include rising investments in infrastructure development, particularly in transportation networks, a surge in e-commerce activities boosting the need for last-mile delivery services, and the increasing adoption of advanced technologies like blockchain and AI for improved supply chain visibility and efficiency. Furthermore, the growth of specialized chemical segments, such as pharmaceuticals and specialty chemicals, is fueling demand for specialized logistics solutions, including temperature-controlled transportation and hazardous materials handling. Growth is also being propelled by governmental initiatives promoting regional economic integration and trade facilitation within ASEAN. While challenges exist such as port congestion and regulatory complexities, the overall market outlook remains positive, with significant opportunities for logistics providers specializing in chemical transportation, warehousing, and value-added services.

The market segmentation reveals strong performance across various modes of transportation, with roadways currently dominating due to accessibility and cost-effectiveness. However, the demand for faster and more reliable delivery options is driving growth in airways and railways, particularly for time-sensitive shipments of high-value chemicals. The pharmaceutical and specialty chemical industries are significant end-users, demanding high levels of safety, security, and compliance with stringent regulations. The growing adoption of green logistics practices, driven by increasing environmental concerns, presents a notable trend, with logistics companies increasingly investing in sustainable transportation options and eco-friendly warehousing solutions. Competition is intense, with both established multinational companies and local players vying for market share. Future growth will depend on continuous improvements in infrastructure, technology adoption, and the ability of logistics providers to adapt to evolving customer demands and regulatory frameworks within the dynamic ASEAN landscape.

ASEAN Chemical Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN Chemical Logistics Market, offering invaluable insights for stakeholders across the industry. With a focus on market dynamics, key players, and future trends, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base year and forecast extending to 2033. The report analyzes the market valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

ASEAN Chemical Logistics Market Market Dynamics & Concentration

The ASEAN chemical logistics market is experiencing significant growth driven by the burgeoning chemical and related industries within the region. Market concentration is moderately high, with several multinational players and a growing number of regional operators vying for market share. Key players such as DHL, A&R Logistics, JWD InfoLogistics Public Company Limited, Alps Logistics, CEVA Logistics, Agility Logistics, CT Logistics, Tiong Nam Logistics Holdings BhD, Eagles Air & Sea, BDP International, Rinchem, and Rhenus Logistics, dominate various segments. However, the market is witnessing increased competition from smaller, specialized logistics providers focusing on niche areas such as green logistics and hazardous materials handling.

Innovation is a key driver, with companies investing in advanced technologies like AI-powered route optimization, blockchain for enhanced supply chain transparency, and automated warehousing systems to improve efficiency and reduce costs. Regulatory frameworks, while generally supportive of economic growth, vary across ASEAN nations. Harmonization of regulations would further streamline cross-border logistics. Product substitutes are limited, reflecting the specialized nature of chemical handling. End-user trends are leaning towards greater emphasis on sustainability and safety, driving demand for green logistics solutions. M&A activity is relatively frequent, with larger players acquiring smaller companies to expand their service portfolios and geographical reach. The number of M&A deals in the past five years is estimated at xx. Market share is largely determined by operational efficiency, network reach, specialized services, and customer relationships.

ASEAN Chemical Logistics Market Industry Trends & Analysis

The ASEAN chemical logistics market's growth is fueled by several factors. Expanding industrialization, particularly in manufacturing and pharmaceuticals, is a primary driver. Increased cross-border trade within ASEAN, facilitated by regional economic agreements, further boosts demand for efficient logistics solutions. Technological advancements, including the Internet of Things (IoT) and big data analytics, are improving supply chain visibility and optimization. The market is witnessing a rise in e-commerce, leading to a greater need for last-mile delivery solutions for chemical products. Consumer preferences are shifting towards sustainability and environmentally friendly logistics practices, pushing the growth of the green logistics segment. Intense competition among players necessitates continuous innovation and cost optimization to maintain market share and profitability. The market penetration of advanced technologies such as automated guided vehicles (AGVs) and warehouse management systems (WMS) is gradually increasing, projected to reach xx% by 2033.

Leading Markets & Segments in ASEAN Chemical Logistics Market

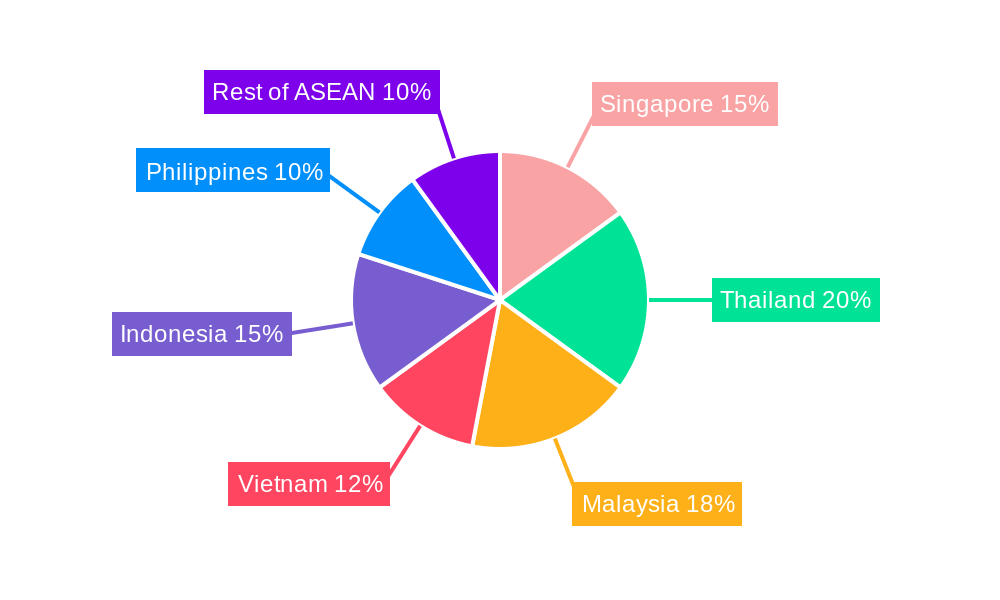

While the entire ASEAN region presents growth opportunities, certain countries and segments exhibit stronger performance. Singapore, Malaysia, and Thailand are leading markets, driven by established manufacturing bases and robust infrastructure.

- By Service: Transportation currently holds the largest market share, followed by warehousing and distribution. The consulting and management services segment is projected to see significant growth due to the increasing complexity of chemical logistics.

- By Mode of Transportation: Roadways are the dominant mode, reflecting the high density of road networks across the region. However, railways and waterways are gradually gaining importance for long-haul transportation, especially for bulk chemical shipments.

- By End User: The pharmaceutical and specialty chemical industries are major drivers of market demand, followed by the oil and gas and cosmetic sectors. Each of these industries exhibits particular logistical needs and safety requirements. Government policies promoting economic diversification and investment in infrastructure play a crucial role in shaping segment dominance. The availability of skilled labor is another crucial factor.

ASEAN Chemical Logistics Market Product Developments

Recent years have witnessed significant product innovation in the ASEAN chemical logistics market. The focus is on enhancing efficiency, improving safety, and reducing environmental impact. Companies are adopting advanced technologies such as IoT sensors for real-time tracking, AI for predictive maintenance, and blockchain technology for improved transparency and traceability. These innovations cater to the growing demand for secure, efficient, and sustainable logistics solutions.

Key Drivers of ASEAN Chemical Logistics Market Growth

Several factors propel the ASEAN chemical logistics market's growth. Firstly, increasing industrialization and manufacturing activity across the region significantly boost demand for chemical logistics services. Secondly, economic integration initiatives within ASEAN, such as the ASEAN Economic Community (AEC), facilitate cross-border trade and increase logistical requirements. Finally, technological advancements in transportation, warehousing, and information technology enhance efficiency and lower costs.

Challenges in the ASEAN Chemical Logistics Market Market

The ASEAN chemical logistics market faces challenges. Varied regulatory frameworks across different ASEAN countries complicate cross-border operations. Supply chain disruptions due to geopolitical events, natural disasters, or pandemics can impact operations and cause significant delays. Intense competition, especially from established multinational players, pressures profit margins. These factors create uncertainty and hinder consistent market expansion. The impact of these challenges can be quantified by analyzing lost revenue due to delays and the additional costs incurred to comply with varied regulations.

Emerging Opportunities in ASEAN Chemical Logistics Market

Significant opportunities exist for market expansion. The increasing adoption of sustainable and green logistics practices presents a significant opportunity for companies offering eco-friendly solutions. Strategic partnerships between logistics providers and technology companies can lead to innovative solutions. Further expansion into less-developed markets within ASEAN can unlock substantial growth potential.

Leading Players in the ASEAN Chemical Logistics Market Sector

- DHL

- A&R Logistics

- JWD InfoLogistics Public Company Limited

- Alps Logistics

- CEVA Logistics

- Agility Logistics

- CT Logistics

- Tiong Nam Logistics Holdings BhD

- Eagles Air & Sea

- BDP International

- Rinchem

- Rhenus Logistics

Key Milestones in ASEAN Chemical Logistics Market Industry

- October 2022: Rinchem's new chemical warehouse in Malaysia (45,000 sq ft, 3100 pallet positions) signifies expanding capacity for hazardous goods storage.

- February 2022: Leschaco's new chemical and dangerous goods warehouse in Port Klang, Malaysia (120,000 sq ft, 13,000 pallet positions) highlights the growing demand for contract logistics in the region.

- October 2021: The FLS Supply Chain Centers joint venture in Thailand underscores investment in specialized warehousing for hazardous chemicals, including processing and repackaging facilities.

Strategic Outlook for ASEAN Chemical Logistics Market Market

The ASEAN chemical logistics market is poised for sustained growth, driven by increasing industrialization, regional economic integration, and technological advancements. Strategic opportunities lie in adopting innovative technologies, focusing on sustainable solutions, and establishing strategic partnerships to capture growing market share. Companies that can adapt to evolving regulations and proactively address supply chain challenges will be best positioned to capitalize on this market's significant potential.

ASEAN Chemical Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Consulting & Management Services

- 1.4. Customs & Security

- 1.5. Green Logistics

- 1.6. Others

-

2. Mode of Transportation

- 2.1. Roadways

- 2.2. Railways

- 2.3. Airways

- 2.4. Waterways

- 2.5. Pipelines

-

3. End User

- 3.1. Pharmaceutical Industry

- 3.2. Specialty Chemical Industry

- 3.3. Oil and Gas Industry

- 3.4. Cosmetic Industry

- 3.5. Others

-

4. Geography

- 4.1. Singapore

- 4.2. Thailand

- 4.3. Malaysia

- 4.4. Vietnam

- 4.5. Indonesia

- 4.6. Philippines

- 4.7. Rest of ASEAN

ASEAN Chemical Logistics Market Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Malaysia

- 4. Vietnam

- 5. Indonesia

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Chemical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in Demand for Specialty Chemicals in ASEAN Countries Increasing Trade Logistics Activity; Partnerships and Collaborations Between Major Players in the Chemical Logistics Market are Being Formed for the Creation of Innovative Goods and Technologically Enhanced Services

- 3.3. Market Restrains

- 3.3.1. Complexities Related to Chemical Logistics; High Cost Involved in the Transportation of Chemicals

- 3.4. Market Trends

- 3.4.1. The Rise in Chemical Production is Expected to Propel the Growth of the Chemical Logistics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Consulting & Management Services

- 5.1.4. Customs & Security

- 5.1.5. Green Logistics

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.2.1. Roadways

- 5.2.2. Railways

- 5.2.3. Airways

- 5.2.4. Waterways

- 5.2.5. Pipelines

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical Industry

- 5.3.2. Specialty Chemical Industry

- 5.3.3. Oil and Gas Industry

- 5.3.4. Cosmetic Industry

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Singapore

- 5.4.2. Thailand

- 5.4.3. Malaysia

- 5.4.4. Vietnam

- 5.4.5. Indonesia

- 5.4.6. Philippines

- 5.4.7. Rest of ASEAN

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Singapore

- 5.5.2. Thailand

- 5.5.3. Malaysia

- 5.5.4. Vietnam

- 5.5.5. Indonesia

- 5.5.6. Philippines

- 5.5.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Singapore ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Consulting & Management Services

- 6.1.4. Customs & Security

- 6.1.5. Green Logistics

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6.2.1. Roadways

- 6.2.2. Railways

- 6.2.3. Airways

- 6.2.4. Waterways

- 6.2.5. Pipelines

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical Industry

- 6.3.2. Specialty Chemical Industry

- 6.3.3. Oil and Gas Industry

- 6.3.4. Cosmetic Industry

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Singapore

- 6.4.2. Thailand

- 6.4.3. Malaysia

- 6.4.4. Vietnam

- 6.4.5. Indonesia

- 6.4.6. Philippines

- 6.4.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Thailand ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Consulting & Management Services

- 7.1.4. Customs & Security

- 7.1.5. Green Logistics

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 7.2.1. Roadways

- 7.2.2. Railways

- 7.2.3. Airways

- 7.2.4. Waterways

- 7.2.5. Pipelines

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical Industry

- 7.3.2. Specialty Chemical Industry

- 7.3.3. Oil and Gas Industry

- 7.3.4. Cosmetic Industry

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Singapore

- 7.4.2. Thailand

- 7.4.3. Malaysia

- 7.4.4. Vietnam

- 7.4.5. Indonesia

- 7.4.6. Philippines

- 7.4.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Malaysia ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Consulting & Management Services

- 8.1.4. Customs & Security

- 8.1.5. Green Logistics

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 8.2.1. Roadways

- 8.2.2. Railways

- 8.2.3. Airways

- 8.2.4. Waterways

- 8.2.5. Pipelines

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical Industry

- 8.3.2. Specialty Chemical Industry

- 8.3.3. Oil and Gas Industry

- 8.3.4. Cosmetic Industry

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Singapore

- 8.4.2. Thailand

- 8.4.3. Malaysia

- 8.4.4. Vietnam

- 8.4.5. Indonesia

- 8.4.6. Philippines

- 8.4.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Vietnam ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehous

- 9.1.3. Consulting & Management Services

- 9.1.4. Customs & Security

- 9.1.5. Green Logistics

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 9.2.1. Roadways

- 9.2.2. Railways

- 9.2.3. Airways

- 9.2.4. Waterways

- 9.2.5. Pipelines

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical Industry

- 9.3.2. Specialty Chemical Industry

- 9.3.3. Oil and Gas Industry

- 9.3.4. Cosmetic Industry

- 9.3.5. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Singapore

- 9.4.2. Thailand

- 9.4.3. Malaysia

- 9.4.4. Vietnam

- 9.4.5. Indonesia

- 9.4.6. Philippines

- 9.4.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Indonesia ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehous

- 10.1.3. Consulting & Management Services

- 10.1.4. Customs & Security

- 10.1.5. Green Logistics

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 10.2.1. Roadways

- 10.2.2. Railways

- 10.2.3. Airways

- 10.2.4. Waterways

- 10.2.5. Pipelines

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical Industry

- 10.3.2. Specialty Chemical Industry

- 10.3.3. Oil and Gas Industry

- 10.3.4. Cosmetic Industry

- 10.3.5. Others

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Singapore

- 10.4.2. Thailand

- 10.4.3. Malaysia

- 10.4.4. Vietnam

- 10.4.5. Indonesia

- 10.4.6. Philippines

- 10.4.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Philippines ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Transportation

- 11.1.2. Warehous

- 11.1.3. Consulting & Management Services

- 11.1.4. Customs & Security

- 11.1.5. Green Logistics

- 11.1.6. Others

- 11.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 11.2.1. Roadways

- 11.2.2. Railways

- 11.2.3. Airways

- 11.2.4. Waterways

- 11.2.5. Pipelines

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Pharmaceutical Industry

- 11.3.2. Specialty Chemical Industry

- 11.3.3. Oil and Gas Industry

- 11.3.4. Cosmetic Industry

- 11.3.5. Others

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Singapore

- 11.4.2. Thailand

- 11.4.3. Malaysia

- 11.4.4. Vietnam

- 11.4.5. Indonesia

- 11.4.6. Philippines

- 11.4.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Rest of ASEAN ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Service

- 12.1.1. Transportation

- 12.1.2. Warehous

- 12.1.3. Consulting & Management Services

- 12.1.4. Customs & Security

- 12.1.5. Green Logistics

- 12.1.6. Others

- 12.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 12.2.1. Roadways

- 12.2.2. Railways

- 12.2.3. Airways

- 12.2.4. Waterways

- 12.2.5. Pipelines

- 12.3. Market Analysis, Insights and Forecast - by End User

- 12.3.1. Pharmaceutical Industry

- 12.3.2. Specialty Chemical Industry

- 12.3.3. Oil and Gas Industry

- 12.3.4. Cosmetic Industry

- 12.3.5. Others

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Singapore

- 12.4.2. Thailand

- 12.4.3. Malaysia

- 12.4.4. Vietnam

- 12.4.5. Indonesia

- 12.4.6. Philippines

- 12.4.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Service

- 13. Singapore ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Thailand ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Malaysia ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Vietnam ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Indonesia ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Philippines ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1.

- 19. Rest of ASEAN ASEAN Chemical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 19.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 19.1.1.

- 20. Competitive Analysis

- 20.1. Global Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 DHL

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 A&R Logistics

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 JWD InfoLogistics Public Company Limited

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Alps Logistics**List Not Exhaustive

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 CEVA Logistics

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Agility Logistics

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 CT Logistics

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Tiong Nam Logistics Holdings BhD

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Eagles Air & Sea

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 BDP International

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.11 Rinchem

- 20.2.11.1. Overview

- 20.2.11.2. Products

- 20.2.11.3. SWOT Analysis

- 20.2.11.4. Recent Developments

- 20.2.11.5. Financials (Based on Availability)

- 20.2.12 Rhenus Logistics

- 20.2.12.1. Overview

- 20.2.12.2. Products

- 20.2.12.3. SWOT Analysis

- 20.2.12.4. Recent Developments

- 20.2.12.5. Financials (Based on Availability)

- 20.2.1 DHL

List of Figures

- Figure 1: Global ASEAN Chemical Logistics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Singapore ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Singapore ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Thailand ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Thailand ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Malaysia ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Malaysia ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Vietnam ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Vietnam ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Indonesia ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Indonesia ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Philippines ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Philippines ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Rest of ASEAN ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Rest of ASEAN ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Singapore ASEAN Chemical Logistics Market Revenue (Million), by Service 2024 & 2032

- Figure 17: Singapore ASEAN Chemical Logistics Market Revenue Share (%), by Service 2024 & 2032

- Figure 18: Singapore ASEAN Chemical Logistics Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 19: Singapore ASEAN Chemical Logistics Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 20: Singapore ASEAN Chemical Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 21: Singapore ASEAN Chemical Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 22: Singapore ASEAN Chemical Logistics Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Singapore ASEAN Chemical Logistics Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Singapore ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Singapore ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Thailand ASEAN Chemical Logistics Market Revenue (Million), by Service 2024 & 2032

- Figure 27: Thailand ASEAN Chemical Logistics Market Revenue Share (%), by Service 2024 & 2032

- Figure 28: Thailand ASEAN Chemical Logistics Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 29: Thailand ASEAN Chemical Logistics Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 30: Thailand ASEAN Chemical Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 31: Thailand ASEAN Chemical Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 32: Thailand ASEAN Chemical Logistics Market Revenue (Million), by Geography 2024 & 2032

- Figure 33: Thailand ASEAN Chemical Logistics Market Revenue Share (%), by Geography 2024 & 2032

- Figure 34: Thailand ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Thailand ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Malaysia ASEAN Chemical Logistics Market Revenue (Million), by Service 2024 & 2032

- Figure 37: Malaysia ASEAN Chemical Logistics Market Revenue Share (%), by Service 2024 & 2032

- Figure 38: Malaysia ASEAN Chemical Logistics Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 39: Malaysia ASEAN Chemical Logistics Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 40: Malaysia ASEAN Chemical Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 41: Malaysia ASEAN Chemical Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 42: Malaysia ASEAN Chemical Logistics Market Revenue (Million), by Geography 2024 & 2032

- Figure 43: Malaysia ASEAN Chemical Logistics Market Revenue Share (%), by Geography 2024 & 2032

- Figure 44: Malaysia ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Malaysia ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Vietnam ASEAN Chemical Logistics Market Revenue (Million), by Service 2024 & 2032

- Figure 47: Vietnam ASEAN Chemical Logistics Market Revenue Share (%), by Service 2024 & 2032

- Figure 48: Vietnam ASEAN Chemical Logistics Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 49: Vietnam ASEAN Chemical Logistics Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 50: Vietnam ASEAN Chemical Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 51: Vietnam ASEAN Chemical Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 52: Vietnam ASEAN Chemical Logistics Market Revenue (Million), by Geography 2024 & 2032

- Figure 53: Vietnam ASEAN Chemical Logistics Market Revenue Share (%), by Geography 2024 & 2032

- Figure 54: Vietnam ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 55: Vietnam ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 56: Indonesia ASEAN Chemical Logistics Market Revenue (Million), by Service 2024 & 2032

- Figure 57: Indonesia ASEAN Chemical Logistics Market Revenue Share (%), by Service 2024 & 2032

- Figure 58: Indonesia ASEAN Chemical Logistics Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 59: Indonesia ASEAN Chemical Logistics Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 60: Indonesia ASEAN Chemical Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 61: Indonesia ASEAN Chemical Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 62: Indonesia ASEAN Chemical Logistics Market Revenue (Million), by Geography 2024 & 2032

- Figure 63: Indonesia ASEAN Chemical Logistics Market Revenue Share (%), by Geography 2024 & 2032

- Figure 64: Indonesia ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 65: Indonesia ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Philippines ASEAN Chemical Logistics Market Revenue (Million), by Service 2024 & 2032

- Figure 67: Philippines ASEAN Chemical Logistics Market Revenue Share (%), by Service 2024 & 2032

- Figure 68: Philippines ASEAN Chemical Logistics Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 69: Philippines ASEAN Chemical Logistics Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 70: Philippines ASEAN Chemical Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 71: Philippines ASEAN Chemical Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 72: Philippines ASEAN Chemical Logistics Market Revenue (Million), by Geography 2024 & 2032

- Figure 73: Philippines ASEAN Chemical Logistics Market Revenue Share (%), by Geography 2024 & 2032

- Figure 74: Philippines ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 75: Philippines ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 76: Rest of ASEAN ASEAN Chemical Logistics Market Revenue (Million), by Service 2024 & 2032

- Figure 77: Rest of ASEAN ASEAN Chemical Logistics Market Revenue Share (%), by Service 2024 & 2032

- Figure 78: Rest of ASEAN ASEAN Chemical Logistics Market Revenue (Million), by Mode of Transportation 2024 & 2032

- Figure 79: Rest of ASEAN ASEAN Chemical Logistics Market Revenue Share (%), by Mode of Transportation 2024 & 2032

- Figure 80: Rest of ASEAN ASEAN Chemical Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 81: Rest of ASEAN ASEAN Chemical Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 82: Rest of ASEAN ASEAN Chemical Logistics Market Revenue (Million), by Geography 2024 & 2032

- Figure 83: Rest of ASEAN ASEAN Chemical Logistics Market Revenue Share (%), by Geography 2024 & 2032

- Figure 84: Rest of ASEAN ASEAN Chemical Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 85: Rest of ASEAN ASEAN Chemical Logistics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 4: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: ASEAN Chemical Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: ASEAN Chemical Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: ASEAN Chemical Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: ASEAN Chemical Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: ASEAN Chemical Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: ASEAN Chemical Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: ASEAN Chemical Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 22: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 23: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 27: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 28: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 32: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 33: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 34: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 35: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 37: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 38: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 39: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 42: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 43: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 44: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 45: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 47: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 48: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 49: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 52: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2019 & 2032

- Table 53: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 54: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 55: Global ASEAN Chemical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Chemical Logistics Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the ASEAN Chemical Logistics Market?

Key companies in the market include DHL, A&R Logistics, JWD InfoLogistics Public Company Limited, Alps Logistics**List Not Exhaustive, CEVA Logistics, Agility Logistics, CT Logistics, Tiong Nam Logistics Holdings BhD, Eagles Air & Sea, BDP International, Rinchem, Rhenus Logistics.

3. What are the main segments of the ASEAN Chemical Logistics Market?

The market segments include Service, Mode of Transportation, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in Demand for Specialty Chemicals in ASEAN Countries Increasing Trade Logistics Activity; Partnerships and Collaborations Between Major Players in the Chemical Logistics Market are Being Formed for the Creation of Innovative Goods and Technologically Enhanced Services.

6. What are the notable trends driving market growth?

The Rise in Chemical Production is Expected to Propel the Growth of the Chemical Logistics Market.

7. Are there any restraints impacting market growth?

Complexities Related to Chemical Logistics; High Cost Involved in the Transportation of Chemicals.

8. Can you provide examples of recent developments in the market?

October 2022: Rinchem is nearing the completion of a brand-new chemical warehouse based in Malaysia slated to be ready in Q2 of 2023. While the company currently has two other warehouses in the Asia Pacific (Taiwan & South Korea), this will be Rinchem's first warehouse located in Malaysia. The 45,000 sq. ft. dangerous goods warehouse will have the capacity to store 3100 pallet positions. Rinchem's warehouses are custom-built to support the proper segregation of various hazard classes and to offer multiple temperature zones.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Chemical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Chemical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Chemical Logistics Market?

To stay informed about further developments, trends, and reports in the ASEAN Chemical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence