Key Insights

The Asia-Pacific (APAC) road freight industry is experiencing robust growth, driven by the region's expanding economies, burgeoning e-commerce sector, and increasing industrialization. A 5.98% Compound Annual Growth Rate (CAGR) indicates a significant market expansion, with the total market size exceeding $XX million in 2025. Key growth drivers include rising cross-border trade, particularly within rapidly developing Southeast Asian nations, the need for efficient last-mile delivery solutions to cater to the booming e-commerce market, and the ongoing investments in infrastructure development across the region, including improved road networks. While the short-haul segment currently dominates, long-haul transportation is poised for substantial growth, fueled by the increasing distances goods need to travel to reach expanding markets. The industry is also witnessing a shift towards temperature-controlled transportation, driven by the growth in perishable goods trade, particularly in the food and agricultural sectors. However, challenges remain, including fluctuating fuel prices, driver shortages, and stringent regulatory environments that vary across the APAC nations, impacting operational efficiency and costs. The diverse segmentations, encompassing various goods configurations (fluid and solid), temperature control needs, and end-user industries (manufacturing, agriculture, construction, etc.), present both opportunities and complexities for market players. The competitive landscape is characterized by a mix of global giants like Maersk and DHL, along with regional players vying for market share. Looking ahead, the APAC road freight industry is projected to continue its upward trajectory throughout the forecast period (2025-2033), with further segment-specific growth dependent on evolving consumer demands and infrastructure developments.

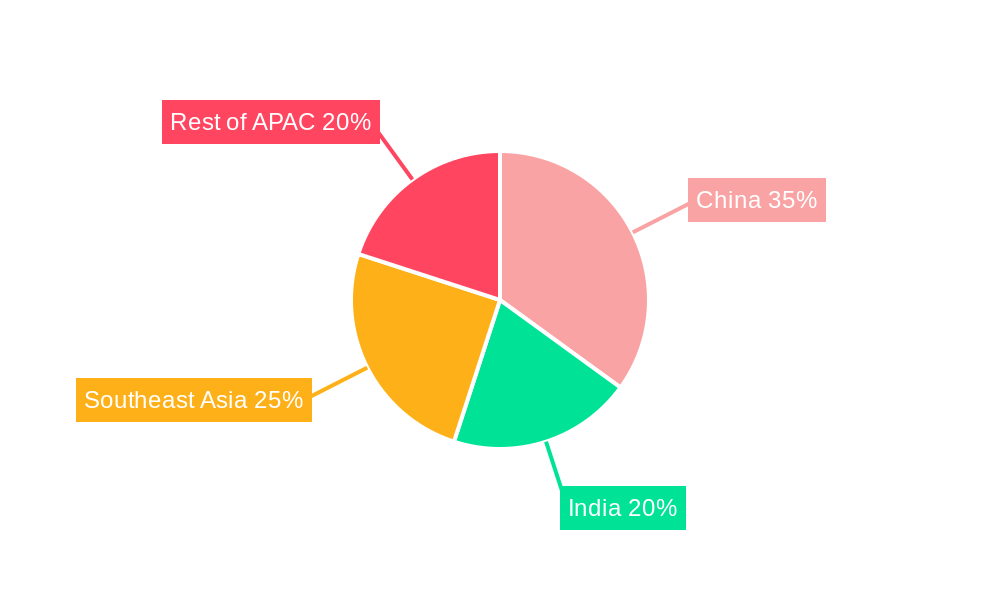

The dominance of Full Truck Load (FTL) shipments is likely to persist, though the Less than Truck Load (LTL) segment is also expected to show considerable growth due to increased demand for smaller, more frequent deliveries. The increasing adoption of containerization, especially in international trade, is improving efficiency and reducing damage. China, India, and other Southeast Asian countries are expected to be key growth drivers within the region, contributing significantly to the overall market expansion. Strategic partnerships, technological innovations (e.g., improved logistics software and route optimization tools), and a focus on sustainable practices will be crucial for companies to navigate the complexities and capitalize on the opportunities within this dynamic and rapidly evolving market.

APAC Road Freight Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) road freight industry, covering market size, growth drivers, challenges, and opportunities from 2019 to 2033. The report utilizes data from 2019-2024 (historical period) and projects the market until 2033 (forecast period), with 2025 as the base year and estimated year. This report is essential for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market. Key segments analyzed include long-haul and short-haul transportation, various goods configurations (fluid and solid goods), temperature-controlled and non-temperature-controlled shipments, and diverse end-user industries across major APAC countries. The report also examines market concentration, competitive dynamics, and key players' strategic moves. Millions are used for all values throughout the report.

APAC Road Freight Industry Market Dynamics & Concentration

The APAC road freight market is characterized by a moderately concentrated landscape, with several major players dominating significant market shares. A P Moller - Maersk, Nippon Express Holdings, DHL Group, Rhenus Group, Kintetsu Group Holdings Co Ltd, C.H. Robinson, Expeditors International of Washington Inc, and CMA CGM Group represent some of the key players. In 2025, the top five players are estimated to collectively hold approximately xx% of the market share. Innovation is a key driver, fueled by technological advancements in fleet management, route optimization, and automation. Regulatory frameworks vary across APAC countries, impacting operational costs and efficiency. The industry faces competition from alternative modes of transportation, such as rail and air freight, particularly for long-haul distances. End-user trends, particularly towards e-commerce and just-in-time delivery, drive demand for faster and more reliable road freight services. Furthermore, M&A activities are prevalent, with an estimated xx number of deals recorded between 2019 and 2024, indicating consolidation within the industry.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- Innovation Drivers: Technological advancements in fleet management, route optimization, and automation.

- Regulatory Frameworks: Vary significantly across APAC nations, affecting operational costs.

- Product Substitutes: Rail and air freight pose competition, especially for long-haul routes.

- End-User Trends: E-commerce growth fuels demand for faster, reliable road freight.

- M&A Activities: Approximately xx M&A deals recorded between 2019 and 2024.

APAC Road Freight Industry Industry Trends & Analysis

The APAC road freight industry is experiencing robust growth, driven by expanding e-commerce, increasing urbanization, and robust industrial output across the region. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further fueled by technological disruptions such as the adoption of telematics, GPS tracking, and advanced route planning software, enhancing efficiency and reducing operational costs. Consumer preferences are shifting towards faster delivery times and greater transparency in the supply chain. Intense competition among players necessitates continuous improvement in service offerings, pricing strategies, and customer relationship management. Market penetration of advanced technologies like autonomous vehicles and electric trucks is gradually increasing, though adoption faces challenges related to infrastructure and regulatory approval.

Leading Markets & Segments in APAC Road Freight Industry

China remains the dominant market within the APAC region, accounting for approximately xx% of the total market value in 2025. India and Indonesia also represent substantial and rapidly growing markets.

Key Drivers:

- Economic Growth: Strong GDP growth in key economies like China, India, and Indonesia fuels demand.

- Infrastructure Development: Investments in road networks and logistics infrastructure enhance connectivity.

- Government Policies: Supportive government policies promoting trade and logistics development.

Segment Dominance:

- Distance: Long-haul transportation holds a larger market share compared to short-haul, driven by inter-regional trade.

- Goods Configuration: Solid goods account for a higher percentage of the market due to the dominance of manufacturing and retail sectors.

- Temperature Control: Non-temperature controlled freight constitutes a major segment, representing the majority of road freight shipments.

- End-User Industry: Manufacturing, Wholesale and Retail Trade, and Construction are the leading end-user industries for road freight services.

- Destination: Domestic freight transportation currently commands a larger market share than international freight.

- Truckload Specification: Full-Truck-Load (FTL) dominates the market due to economies of scale and efficiency in transportation.

- Containerization: Non-Containerized freight is currently more prevalent due to the nature of much of the transported goods.

APAP Road Freight Industry Product Developments

Recent product innovations focus on enhancing efficiency and sustainability within the APAP road freight industry. This includes advancements in telematics for real-time tracking and fleet management, the adoption of route optimization software and the growing integration of electric vehicles and alternative fuel options to address environmental concerns. These developments provide considerable competitive advantage by improving delivery times, reducing operational costs, and enhancing sustainability profiles.

Key Drivers of APAC Road Freight Industry Growth

The APAC road freight industry's growth is spurred by several key factors. First, burgeoning e-commerce fuels demand for efficient last-mile delivery solutions. Second, expanding manufacturing and industrial sectors require extensive transportation networks. Third, government initiatives to improve infrastructure, such as road networks, further bolster the industry. Finally, technological advancements in fleet management and logistics optimization enhance efficiency and reduce operational costs.

Challenges in the APAC Road Freight Industry Market

The APAC road freight industry faces several challenges. Firstly, infrastructure limitations in certain regions cause logistical bottlenecks and delays. Secondly, driver shortages and high labor costs increase operating expenses. Thirdly, stringent regulations regarding emissions and safety compliance add compliance burden and operational complexity. These factors collectively impact profitability and operational efficiency.

Emerging Opportunities in APAP Road Freight Industry

Long-term growth is poised to be driven by technological advancements like autonomous vehicles and drones for last-mile delivery, and strategic partnerships between logistics providers and technology companies leading to improved efficiency, transparency, and data-driven decision-making. Moreover, expanding into less-penetrated markets within the APAC region presents significant growth potential.

Leading Players in the APAC Road Freight Industry Sector

- A P Moller - Maersk

- Nippon Express Holdings

- DHL Group

- Rhenus Group

- Kintetsu Group Holdings Co Ltd

- C H Robinson

- Expeditors International of Washington Inc

- CMA CGM Group

Key Milestones in APAC Road Freight Industry Industry

- January 2024: DHL Express deploys a final Boeing 777 freighter in Singapore, boosting APAC-Americas connectivity (1,224 tons total payload capacity).

- November 2023: DHL Express launches expanded Central Asia Hub in Hong Kong (EUR 562 million investment), its largest infrastructural investment in APAC.

- October 2023: Volvo, Renault, and CMA CGM announce a joint venture to develop electric vans for logistics.

Strategic Outlook for APAC Road Freight Industry Market

The APAC road freight market presents substantial growth potential due to sustained economic expansion, e-commerce boom, and infrastructure development. Strategic opportunities lie in leveraging technological advancements for improved efficiency and sustainability, forging strategic alliances to broaden market reach, and focusing on niche market segments to gain a competitive edge. The industry is poised for significant transformation through technology adoption and strategic collaborations.

APAC Road Freight Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

APAC Road Freight Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Road Freight Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America APAC Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 6.3.1. Full-Truck-Load (FTL)

- 6.3.2. Less than-Truck-Load (LTL)

- 6.4. Market Analysis, Insights and Forecast - by Containerization

- 6.4.1. Containerized

- 6.4.2. Non-Containerized

- 6.5. Market Analysis, Insights and Forecast - by Distance

- 6.5.1. Long Haul

- 6.5.2. Short Haul

- 6.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 6.6.1. Fluid Goods

- 6.6.2. Solid Goods

- 6.7. Market Analysis, Insights and Forecast - by Temperature Control

- 6.7.1. Non-Temperature Controlled

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America APAC Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 7.3.1. Full-Truck-Load (FTL)

- 7.3.2. Less than-Truck-Load (LTL)

- 7.4. Market Analysis, Insights and Forecast - by Containerization

- 7.4.1. Containerized

- 7.4.2. Non-Containerized

- 7.5. Market Analysis, Insights and Forecast - by Distance

- 7.5.1. Long Haul

- 7.5.2. Short Haul

- 7.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 7.6.1. Fluid Goods

- 7.6.2. Solid Goods

- 7.7. Market Analysis, Insights and Forecast - by Temperature Control

- 7.7.1. Non-Temperature Controlled

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe APAC Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 8.3.1. Full-Truck-Load (FTL)

- 8.3.2. Less than-Truck-Load (LTL)

- 8.4. Market Analysis, Insights and Forecast - by Containerization

- 8.4.1. Containerized

- 8.4.2. Non-Containerized

- 8.5. Market Analysis, Insights and Forecast - by Distance

- 8.5.1. Long Haul

- 8.5.2. Short Haul

- 8.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 8.6.1. Fluid Goods

- 8.6.2. Solid Goods

- 8.7. Market Analysis, Insights and Forecast - by Temperature Control

- 8.7.1. Non-Temperature Controlled

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa APAC Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 9.3.1. Full-Truck-Load (FTL)

- 9.3.2. Less than-Truck-Load (LTL)

- 9.4. Market Analysis, Insights and Forecast - by Containerization

- 9.4.1. Containerized

- 9.4.2. Non-Containerized

- 9.5. Market Analysis, Insights and Forecast - by Distance

- 9.5.1. Long Haul

- 9.5.2. Short Haul

- 9.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 9.6.1. Fluid Goods

- 9.6.2. Solid Goods

- 9.7. Market Analysis, Insights and Forecast - by Temperature Control

- 9.7.1. Non-Temperature Controlled

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific APAC Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 10.3.1. Full-Truck-Load (FTL)

- 10.3.2. Less than-Truck-Load (LTL)

- 10.4. Market Analysis, Insights and Forecast - by Containerization

- 10.4.1. Containerized

- 10.4.2. Non-Containerized

- 10.5. Market Analysis, Insights and Forecast - by Distance

- 10.5.1. Long Haul

- 10.5.2. Short Haul

- 10.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 10.6.1. Fluid Goods

- 10.6.2. Solid Goods

- 10.7. Market Analysis, Insights and Forecast - by Temperature Control

- 10.7.1. Non-Temperature Controlled

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 A P Moller - Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nippon Express Holdings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rhenus Grou

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kintetsu Group Holdings Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 C H Robinson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Expeditors International of Washington Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CMA CGM Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Global APAC Road Freight Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC Road Freight Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 3: North America APAC Road Freight Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 4: North America APAC Road Freight Industry Revenue (Million), by Destination 2024 & 2032

- Figure 5: North America APAC Road Freight Industry Revenue Share (%), by Destination 2024 & 2032

- Figure 6: North America APAC Road Freight Industry Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 7: North America APAC Road Freight Industry Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 8: North America APAC Road Freight Industry Revenue (Million), by Containerization 2024 & 2032

- Figure 9: North America APAC Road Freight Industry Revenue Share (%), by Containerization 2024 & 2032

- Figure 10: North America APAC Road Freight Industry Revenue (Million), by Distance 2024 & 2032

- Figure 11: North America APAC Road Freight Industry Revenue Share (%), by Distance 2024 & 2032

- Figure 12: North America APAC Road Freight Industry Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 13: North America APAC Road Freight Industry Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 14: North America APAC Road Freight Industry Revenue (Million), by Temperature Control 2024 & 2032

- Figure 15: North America APAC Road Freight Industry Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 16: North America APAC Road Freight Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America APAC Road Freight Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America APAC Road Freight Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 19: South America APAC Road Freight Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 20: South America APAC Road Freight Industry Revenue (Million), by Destination 2024 & 2032

- Figure 21: South America APAC Road Freight Industry Revenue Share (%), by Destination 2024 & 2032

- Figure 22: South America APAC Road Freight Industry Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 23: South America APAC Road Freight Industry Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 24: South America APAC Road Freight Industry Revenue (Million), by Containerization 2024 & 2032

- Figure 25: South America APAC Road Freight Industry Revenue Share (%), by Containerization 2024 & 2032

- Figure 26: South America APAC Road Freight Industry Revenue (Million), by Distance 2024 & 2032

- Figure 27: South America APAC Road Freight Industry Revenue Share (%), by Distance 2024 & 2032

- Figure 28: South America APAC Road Freight Industry Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 29: South America APAC Road Freight Industry Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 30: South America APAC Road Freight Industry Revenue (Million), by Temperature Control 2024 & 2032

- Figure 31: South America APAC Road Freight Industry Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 32: South America APAC Road Freight Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: South America APAC Road Freight Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe APAC Road Freight Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 35: Europe APAC Road Freight Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 36: Europe APAC Road Freight Industry Revenue (Million), by Destination 2024 & 2032

- Figure 37: Europe APAC Road Freight Industry Revenue Share (%), by Destination 2024 & 2032

- Figure 38: Europe APAC Road Freight Industry Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 39: Europe APAC Road Freight Industry Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 40: Europe APAC Road Freight Industry Revenue (Million), by Containerization 2024 & 2032

- Figure 41: Europe APAC Road Freight Industry Revenue Share (%), by Containerization 2024 & 2032

- Figure 42: Europe APAC Road Freight Industry Revenue (Million), by Distance 2024 & 2032

- Figure 43: Europe APAC Road Freight Industry Revenue Share (%), by Distance 2024 & 2032

- Figure 44: Europe APAC Road Freight Industry Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 45: Europe APAC Road Freight Industry Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 46: Europe APAC Road Freight Industry Revenue (Million), by Temperature Control 2024 & 2032

- Figure 47: Europe APAC Road Freight Industry Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 48: Europe APAC Road Freight Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Europe APAC Road Freight Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa APAC Road Freight Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 51: Middle East & Africa APAC Road Freight Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 52: Middle East & Africa APAC Road Freight Industry Revenue (Million), by Destination 2024 & 2032

- Figure 53: Middle East & Africa APAC Road Freight Industry Revenue Share (%), by Destination 2024 & 2032

- Figure 54: Middle East & Africa APAC Road Freight Industry Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 55: Middle East & Africa APAC Road Freight Industry Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 56: Middle East & Africa APAC Road Freight Industry Revenue (Million), by Containerization 2024 & 2032

- Figure 57: Middle East & Africa APAC Road Freight Industry Revenue Share (%), by Containerization 2024 & 2032

- Figure 58: Middle East & Africa APAC Road Freight Industry Revenue (Million), by Distance 2024 & 2032

- Figure 59: Middle East & Africa APAC Road Freight Industry Revenue Share (%), by Distance 2024 & 2032

- Figure 60: Middle East & Africa APAC Road Freight Industry Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 61: Middle East & Africa APAC Road Freight Industry Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 62: Middle East & Africa APAC Road Freight Industry Revenue (Million), by Temperature Control 2024 & 2032

- Figure 63: Middle East & Africa APAC Road Freight Industry Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 64: Middle East & Africa APAC Road Freight Industry Revenue (Million), by Country 2024 & 2032

- Figure 65: Middle East & Africa APAC Road Freight Industry Revenue Share (%), by Country 2024 & 2032

- Figure 66: Asia Pacific APAC Road Freight Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 67: Asia Pacific APAC Road Freight Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 68: Asia Pacific APAC Road Freight Industry Revenue (Million), by Destination 2024 & 2032

- Figure 69: Asia Pacific APAC Road Freight Industry Revenue Share (%), by Destination 2024 & 2032

- Figure 70: Asia Pacific APAC Road Freight Industry Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 71: Asia Pacific APAC Road Freight Industry Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 72: Asia Pacific APAC Road Freight Industry Revenue (Million), by Containerization 2024 & 2032

- Figure 73: Asia Pacific APAC Road Freight Industry Revenue Share (%), by Containerization 2024 & 2032

- Figure 74: Asia Pacific APAC Road Freight Industry Revenue (Million), by Distance 2024 & 2032

- Figure 75: Asia Pacific APAC Road Freight Industry Revenue Share (%), by Distance 2024 & 2032

- Figure 76: Asia Pacific APAC Road Freight Industry Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 77: Asia Pacific APAC Road Freight Industry Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 78: Asia Pacific APAC Road Freight Industry Revenue (Million), by Temperature Control 2024 & 2032

- Figure 79: Asia Pacific APAC Road Freight Industry Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 80: Asia Pacific APAC Road Freight Industry Revenue (Million), by Country 2024 & 2032

- Figure 81: Asia Pacific APAC Road Freight Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Road Freight Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Road Freight Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global APAC Road Freight Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Global APAC Road Freight Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Global APAC Road Freight Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Global APAC Road Freight Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Global APAC Road Freight Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Global APAC Road Freight Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Global APAC Road Freight Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global APAC Road Freight Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: Global APAC Road Freight Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 12: Global APAC Road Freight Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 13: Global APAC Road Freight Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 14: Global APAC Road Freight Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 15: Global APAC Road Freight Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 16: Global APAC Road Freight Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 17: Global APAC Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global APAC Road Freight Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 22: Global APAC Road Freight Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 23: Global APAC Road Freight Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 24: Global APAC Road Freight Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 25: Global APAC Road Freight Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 26: Global APAC Road Freight Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 27: Global APAC Road Freight Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 28: Global APAC Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global APAC Road Freight Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 33: Global APAC Road Freight Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 34: Global APAC Road Freight Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 35: Global APAC Road Freight Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 36: Global APAC Road Freight Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 37: Global APAC Road Freight Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 38: Global APAC Road Freight Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 39: Global APAC Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United Kingdom APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Germany APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Benelux APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Nordics APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global APAC Road Freight Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 50: Global APAC Road Freight Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 51: Global APAC Road Freight Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 52: Global APAC Road Freight Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 53: Global APAC Road Freight Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 54: Global APAC Road Freight Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 55: Global APAC Road Freight Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 56: Global APAC Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Turkey APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Israel APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: GCC APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: North Africa APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East & Africa APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global APAC Road Freight Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 64: Global APAC Road Freight Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 65: Global APAC Road Freight Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 66: Global APAC Road Freight Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 67: Global APAC Road Freight Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 68: Global APAC Road Freight Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 69: Global APAC Road Freight Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 70: Global APAC Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 71: China APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: India APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Japan APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Korea APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: ASEAN APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Oceania APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Rest of Asia Pacific APAC Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Road Freight Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the APAC Road Freight Industry?

Key companies in the market include A P Moller - Maersk, Nippon Express Holdings, DHL Group, Rhenus Grou, Kintetsu Group Holdings Co Ltd, C H Robinson, Expeditors International of Washington Inc, CMA CGM Group.

3. What are the main segments of the APAC Road Freight Industry?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

January 2024: DHL Express has commenced services for the final Boeing 777 freighter deployed at the South Asia Hub in Singapore. With a payload capability of 102 tons, the aircraft joins the four other Boeing 777 freighters already deployed in Singapore to boost inter-continental connectivity between the Asia Pacific and the Americas. Sporting a dual DHL-Singapore Airlines (SIA) livery, these five freighters provide a total of 1,224 tons of payload capacity to meet growing customer demand for international express shipping services.November 2023: DHL Express has launched its state-of-the-art, expanded Central Asia Hub (CAH) in Hong Kong, amid fast-growing global trade in recent years. The total investment into the Central Asia Hub is EUR 562 million, making it the largest infrastructural investment by DHL Express in Asia Pacific. The Hub is one of three DHL Express global hubs connecting Asia Pacific with the rest of the world and also supports intra-Asia trade.October 2023: Truck and industrial equipment maker Volvo, auto maker Renault, and shipping giant CMA CGM unveiled a joint venture that would create a company aimed at developing a new series of electric vans. The partnership would provide electric urban transportation for companies in the logistics and transportation sector seeking to decarbonize their fleets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Road Freight Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Road Freight Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Road Freight Industry?

To stay informed about further developments, trends, and reports in the APAC Road Freight Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence