Key Insights

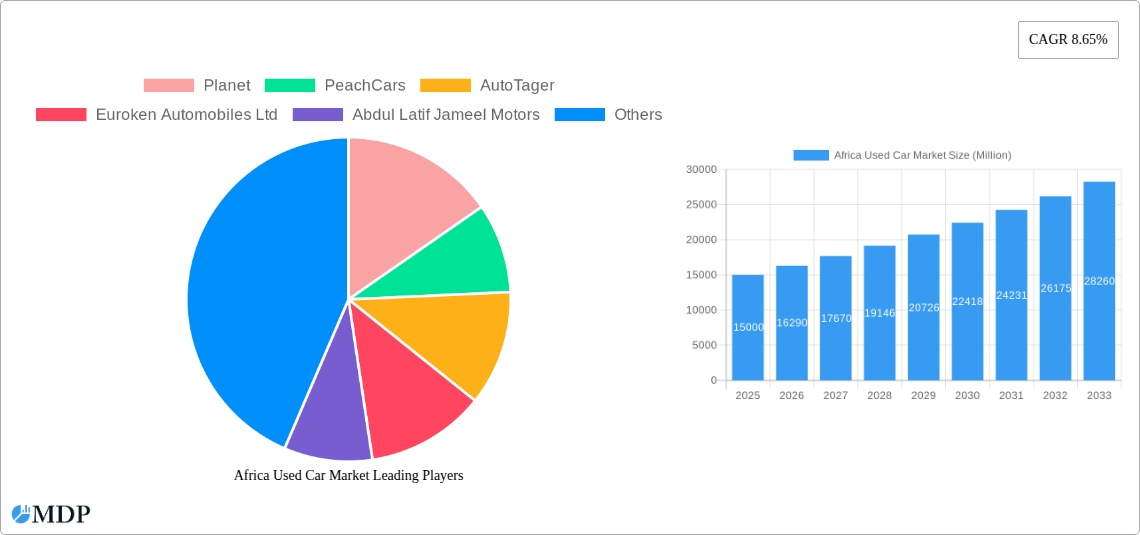

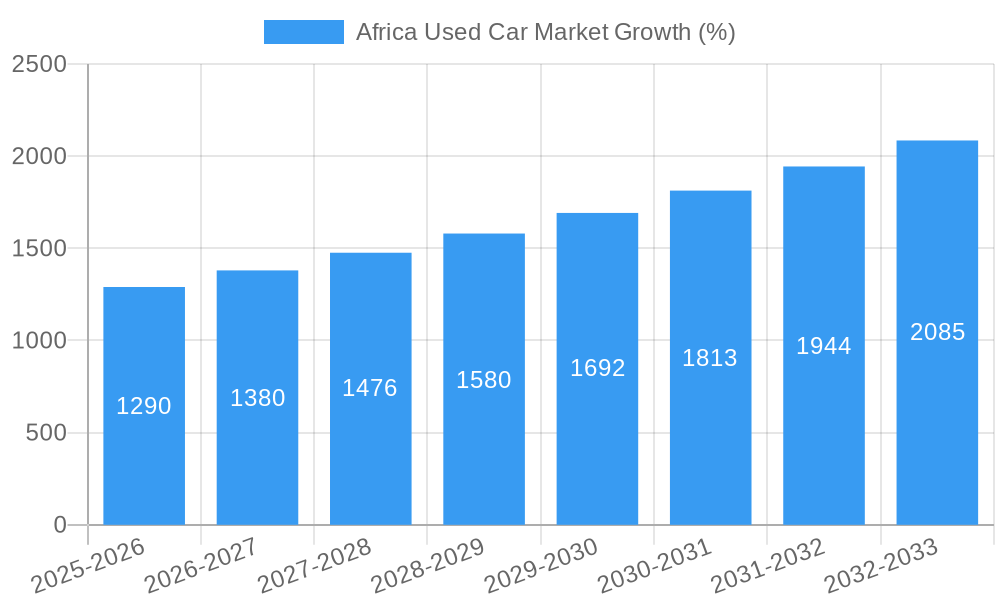

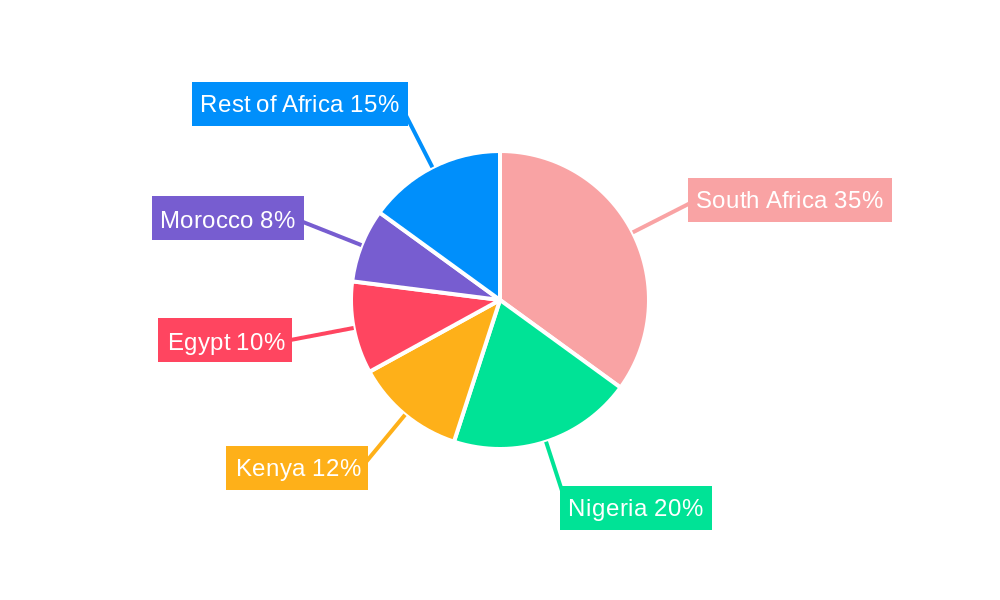

The African used car market, valued at approximately $X million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 8.65% from 2025 to 2033. This expansion is driven by several factors. Rising disposable incomes across several African nations, coupled with a burgeoning middle class, fuels increased demand for personal vehicles. Limited access to new vehicles due to high prices and import restrictions pushes consumers towards the more affordable used car market. The proliferation of online marketplaces and mobile-first technology is also significantly impacting market growth, facilitating easier vehicle searches, transactions, and information access. Furthermore, the increasing availability of financing options, such as car loans and leasing, is making used car ownership more accessible. However, challenges persist, including inconsistent vehicle quality, limited access to comprehensive vehicle history reports, and concerns about fraud. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, MPVs), vendor type (organized and unorganized dealerships), and geographic location (South Africa, Morocco, Algeria, Egypt, Nigeria, Ghana, Kenya, and the Rest of Africa). South Africa, owing to its relatively developed economy and infrastructure, currently holds the largest market share, but other nations like Nigeria and Kenya are demonstrating significant growth potential. The dominance of organized dealers is likely to increase as consumer trust and transparency become increasingly important.

The competitive landscape is marked by both international and local players, including major automotive companies and a burgeoning ecosystem of online platforms. Competition is fierce, pushing companies to refine their offerings and improve customer service to gain market share. The forecast suggests continued growth, but success will hinge on adapting to local market nuances, building trust through robust quality checks and transparent pricing, and leveraging technology to streamline transactions. Companies focusing on providing comprehensive financing options, warranties, and post-purchase services will likely be best positioned for long-term success. Future growth will also be influenced by government regulations on vehicle imports, infrastructure development impacting logistics, and evolving consumer preferences.

Africa Used Car Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Africa used car market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Africa Used Car Market Market Dynamics & Concentration

The African used car market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is relatively fragmented, with a multitude of both organized and unorganized players vying for market share. However, a trend towards consolidation is emerging, driven by strategic mergers and acquisitions (M&A) activities. In 2024, an estimated xx Million M&A deals were recorded, contributing to increased market consolidation. Several key factors are shaping the market dynamics:

- Innovation Drivers: The adoption of online platforms and digital technologies is revolutionizing the buying and selling process, improving transparency, and expanding reach.

- Regulatory Frameworks: Varying regulatory landscapes across different African countries influence market access and operational efficiency. Harmonization of regulations could significantly boost market growth.

- Product Substitutes: Public transportation and ride-hailing services pose some competition, particularly in urban areas.

- End-User Trends: Growing urbanization, rising disposable incomes, and a preference for affordable transportation fuel the demand for used vehicles.

- M&A Activities: As witnessed by recent acquisitions like Autochek Africa's purchase of KIFAL Auto, M&A activity is consolidating the market and enhancing operational capabilities. Major players are strategically acquiring smaller players to increase their market share and expand their geographical reach. The top 5 players account for approximately xx% of the market share in 2024.

Africa Used Car Market Industry Trends & Analysis

The African used car market is experiencing remarkable growth, driven by several factors. Technological advancements, changing consumer preferences, and a burgeoning automotive industry are reshaping the landscape. The market witnessed a CAGR of xx% from 2019 to 2024, primarily fueled by increasing affordability and the expansion of online marketplaces.

- Market Growth Drivers: Rising urbanization, increasing disposable incomes, and a preference for personal mobility are key factors propelling market expansion. The affordability of used cars compared to new vehicles is a significant driver.

- Technological Disruptions: Online platforms like AutoTrader South Africa and OLX Group are transforming the buying experience, increasing transparency, and simplifying the transaction process.

- Consumer Preferences: Buyers increasingly prioritize fuel efficiency, affordability, and reliability in their used car purchases.

- Competitive Dynamics: The market is witnessing intensified competition among both organized and unorganized players, leading to innovative offerings and improved customer service. Market penetration of organized players is expected to reach xx% by 2033.

Leading Markets & Segments in Africa Used Car Market

South Africa, Nigeria, and Egypt represent the largest markets in the African used car market. However, significant growth potential exists in other countries like Morocco, Algeria, and Kenya.

By Vehicle Type:

- Sports Utility Vehicles (SUVs): The segment holds the largest market share due to its versatility and suitability for diverse terrains.

- Sedans: This segment maintains a substantial market share due to affordability and fuel efficiency.

- Hatchbacks: A significant segment, particularly popular in urban areas.

- Multi-Purpose Vehicles (MPVs): A growing segment catering to families and businesses.

By Vendor:

- Organized Sector: This sector is experiencing rapid growth, driven by online platforms and established dealerships.

- Unorganized Sector: This sector remains a significant part of the market, but its share is gradually declining due to increased formalization and the rise of online platforms.

By Country:

- South Africa: Benefits from developed infrastructure and established automotive sector.

- Nigeria: A large and rapidly growing market with considerable potential.

- Egypt: A significant market with a growing middle class and increasing demand for personal vehicles.

- Morocco, Algeria, Kenya, Ghana, Rest of Africa: Exhibiting strong growth potential due to increasing urbanization and economic development. Key drivers in these regions include improving infrastructure, supportive economic policies, and a young, growing population.

Africa Used Car Market Product Developments

Recent product innovations focus on enhancing the online buying experience, providing more transparent vehicle history reports, and offering financing options. Technological advancements such as virtual inspections and online auctions are improving customer experience and efficiency. The increasing integration of digital tools and technologies is improving transparency and reducing information asymmetry.

Key Drivers of Africa Used Car Market Growth

Several factors are driving the growth of the African used car market.

- Technological Advancements: Online platforms and mobile apps are simplifying the buying and selling process, increasing transparency, and expanding reach.

- Economic Growth: Rising disposable incomes in several African countries fuel the demand for personal vehicles.

- Favorable Government Policies: Initiatives to improve infrastructure and encourage automotive sector development positively influence market expansion.

Challenges in the Africa Used Car Market Market

The market faces several challenges, including:

- Regulatory Hurdles: Inconsistent regulations across different countries create operational complexities.

- Supply Chain Issues: Maintaining a reliable and efficient supply chain can be challenging due to infrastructural limitations in some regions.

- Competitive Pressures: Intense competition among established players and new entrants necessitates continuous innovation and strategic adjustments. This competition leads to price wars, affecting profit margins in some segments.

Emerging Opportunities in Africa Used Car Market

Significant opportunities exist for growth, including:

- Technological Breakthroughs: Innovations in vehicle inspection technologies, financing solutions, and online platforms will further enhance the market.

- Strategic Partnerships: Collaborations between established players and local businesses can expand market reach and operational efficiency.

- Market Expansion: Untapped potential exists in several African countries, representing lucrative expansion opportunities for businesses.

Leading Players in the Africa Used Car Market Sector

- Planet42

- PeachCars

- AutoTager

- Euroken Automobiles Ltd

- Abdul Latif Jameel Motors

- Cars 4 Africa

- Cardealers africa

- Global Cars Trading FZ LLC

- cars2africa

- Autochek Africa

- AutoTrader South Africa

- Cars

- KIFAL Auto

- Abi Sayara

- Al-Futtaim Group

- Mogo Auto LTD

- Schulenburg Motors

- We Buy Cars (Pty) Ltd

- Yallamotor

- Carzami

- OLX Group

- CarMax East Africa Lt

- Sylndr

Key Milestones in Africa Used Car Market Industry

- May 2023: Cars45 and Jiji partnered with Suzuki to revolutionize used car sales in Nigeria, showcasing inspected vehicles on the Cars45 platform.

- May 2022: Autochek Africa acquired KIFAL Auto, expanding its presence into North Africa.

Strategic Outlook for Africa Used Car Market Market

The future of the African used car market is bright. Continued technological advancements, economic growth, and strategic partnerships will drive significant growth. The market's potential is vast, offering considerable opportunities for businesses to capitalize on the rising demand for affordable and reliable transportation across the continent. Focusing on enhancing the customer experience through technology and building robust supply chains will be critical for success.

Africa Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedan

- 1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

-

2. Vendor

- 2.1. Organized

- 2.2. Unorganized

Africa Used Car Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost Associated With the New Cars and Affordability Concerns Drive the Market; Others

- 3.3. Market Restrains

- 3.3.1. Stringent Governmental Regulations and Import Taxes Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Investments by Several Companies is Likely to Strengthen the Demand Trajectory for Used Car Market -

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vendor

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. South Africa Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Planet

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PeachCars

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 AutoTager

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Euroken Automobiles Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Abdul Latif Jameel Motors

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Cars 4 Africa

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cardealers africa

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Global Cars Trading FZ LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 cars2africa

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Autochek Africa

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 AutoTrader South Africa

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Cars

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 KIFAL Auto

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Abi Sayara

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Al-Futtaim Group

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Mogo Auto LTD

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Schulenburg Motors

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 We Buy Cars (Pty) Ltd

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Yallamotor

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Carzami

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.21 OLX Group

- 12.2.21.1. Overview

- 12.2.21.2. Products

- 12.2.21.3. SWOT Analysis

- 12.2.21.4. Recent Developments

- 12.2.21.5. Financials (Based on Availability)

- 12.2.22 CarMax East Africa Lt

- 12.2.22.1. Overview

- 12.2.22.2. Products

- 12.2.22.3. SWOT Analysis

- 12.2.22.4. Recent Developments

- 12.2.22.5. Financials (Based on Availability)

- 12.2.23 Sylndr

- 12.2.23.1. Overview

- 12.2.23.2. Products

- 12.2.23.3. SWOT Analysis

- 12.2.23.4. Recent Developments

- 12.2.23.5. Financials (Based on Availability)

- 12.2.1 Planet

List of Figures

- Figure 1: Africa Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Africa Used Car Market Revenue Million Forecast, by Vendor 2019 & 2032

- Table 4: Africa Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Africa Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 13: Africa Used Car Market Revenue Million Forecast, by Vendor 2019 & 2032

- Table 14: Africa Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Nigeria Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Egypt Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ethiopia Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Morocco Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ghana Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Algeria Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ivory Coast Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Used Car Market?

The projected CAGR is approximately 8.65%.

2. Which companies are prominent players in the Africa Used Car Market?

Key companies in the market include Planet, PeachCars, AutoTager, Euroken Automobiles Ltd, Abdul Latif Jameel Motors, Cars 4 Africa, Cardealers africa, Global Cars Trading FZ LLC, cars2africa, Autochek Africa, AutoTrader South Africa, Cars, KIFAL Auto, Abi Sayara, Al-Futtaim Group, Mogo Auto LTD, Schulenburg Motors, We Buy Cars (Pty) Ltd, Yallamotor, Carzami, OLX Group, CarMax East Africa Lt, Sylndr.

3. What are the main segments of the Africa Used Car Market?

The market segments include Vehicle Type, Vendor.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Cost Associated With the New Cars and Affordability Concerns Drive the Market; Others.

6. What are the notable trends driving market growth?

Increasing Investments by Several Companies is Likely to Strengthen the Demand Trajectory for Used Car Market -.

7. Are there any restraints impacting market growth?

Stringent Governmental Regulations and Import Taxes Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Nigeria-based Cars45 and Jiji signed a new deal with Suzuki. This collaboration aims to revolutionize used car buying and selling by combining the strengths of all three players. Suzuki is utilizing the expertise and resources of Cars45 and Jiji to enhance market growth. Additionally, inspected and verified Suzuki used cars will be showcased on the Cars45 platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Used Car Market?

To stay informed about further developments, trends, and reports in the Africa Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence