Key Insights

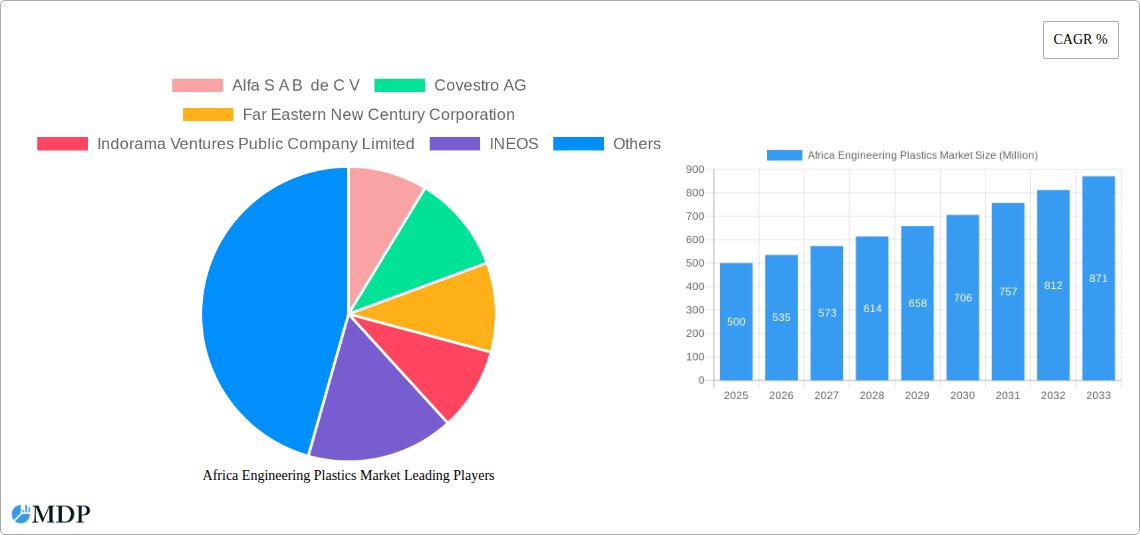

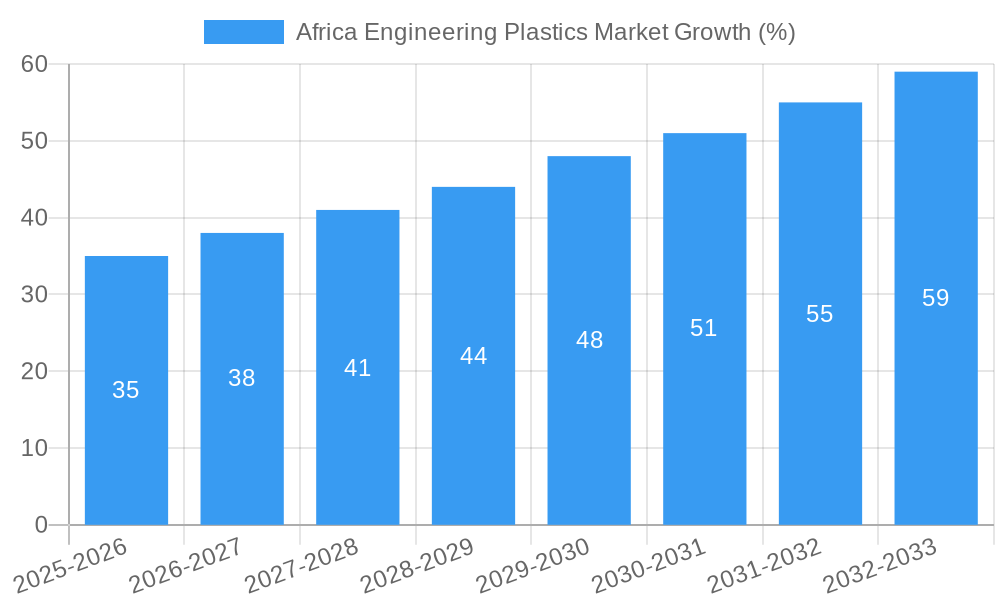

The Africa Engineering Plastics Market is poised for significant growth, driven by the continent's burgeoning infrastructure development, expanding automotive industry, and rising demand for durable consumer goods. While precise market sizing data is unavailable, a reasonable estimation, based on global trends and regional economic forecasts, places the market value at approximately $500 million USD in 2025. A Compound Annual Growth Rate (CAGR) of 7% is projected for the forecast period of 2025-2033, fueled primarily by increased government investments in infrastructure projects (roads, bridges, buildings), a growing middle class with increased disposable income, and the adoption of advanced manufacturing techniques. Key market segments include packaging, automotive components, and electrical and electronics applications. The presence of established players like SABIC and Indorama Ventures, alongside regional manufacturers, suggests a dynamic and competitive landscape. However, challenges remain, including inconsistent energy supply, limited skilled labor, and the need for further investment in manufacturing infrastructure to fully capitalize on the market's potential. Overcoming these restraints will be crucial to achieving sustained, high growth within the projected timeframe.

The forecast for the African Engineering Plastics market anticipates a robust trajectory over the next decade. The predicted 7% CAGR indicates a substantial market expansion, reaching an estimated value of approximately $900 million by 2033. This growth is expected to be regionally diverse, with nations experiencing rapid industrialization and urbanization demonstrating faster expansion. Significant opportunities lie in partnerships between multinational corporations and local businesses, facilitating knowledge transfer and capacity building. Moreover, sustainable and recycled plastic initiatives will play a critical role in shaping the industry's future, aligning with global environmental concerns and driving innovation within the sector. Companies are likely to focus on developing high-performance, specialized plastics to meet specific regional demands, adapting their product portfolios to the unique requirements of the African market.

Africa Engineering Plastics Market: A Comprehensive Report (2019-2033)

Unlock the growth potential of the booming Africa Engineering Plastics market with this in-depth report. This comprehensive analysis provides a detailed overview of market dynamics, trends, leading players, and future prospects, offering invaluable insights for businesses, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Africa Engineering Plastics Market Market Dynamics & Concentration

The African engineering plastics market is characterized by a moderately concentrated landscape, with key players vying for market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory frameworks. While precise market share figures for individual players remain proprietary, the market demonstrates a dynamic interplay between established international players and local manufacturers.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market. This concentration is expected to slightly increase over the forecast period, driven by mergers and acquisitions (M&A) activity.

Innovation Drivers: Ongoing innovation in material science, particularly focused on sustainable and high-performance polymers, is a significant growth driver. The demand for lightweight, durable, and cost-effective materials across various industries is fueling this trend.

Regulatory Frameworks: Variability in regulatory frameworks across different African nations influences market dynamics. Harmonization efforts and increasing focus on sustainability standards are shaping the industry landscape.

Product Substitutes: The market faces competition from alternative materials, including metals and composites. However, the superior properties of engineering plastics, such as lightweight nature and high strength-to-weight ratios, provide a competitive edge in many applications.

End-User Trends: Growth is primarily driven by robust growth in construction, automotive, packaging and electronics sectors. The rising middle class and urbanization within Africa contribute to increased demand for these industries’ products, boosting the need for engineering plastics.

M&A Activities: The number of M&A deals in the Africa engineering plastics market has been relatively low in recent years (approximately xx deals between 2019 and 2024), but is projected to see a moderate increase, driven by strategic acquisitions of local players by multinational corporations.

Africa Engineering Plastics Market Industry Trends & Analysis

The Africa engineering plastics market is experiencing significant growth, driven by several key factors. The market's CAGR during the historical period (2019-2024) was xx%, and it is projected to reach xx Million by the estimated year (2025). This growth is primarily attributed to:

- Rising infrastructure development: The continent's ongoing investment in infrastructure projects (roads, buildings, energy) fuels the demand for high-performance engineering plastics.

- Growth of the automotive industry: The automotive sector's expansion is a major driver, with increasing demand for lightweight components in vehicles.

- Packaging sector boom: The growing food and beverage industry and e-commerce boost the demand for durable and protective plastic packaging.

- Technological advancements: Innovations in material science are leading to the development of high-performance plastics with enhanced properties, broadening their applications.

- Increased consumer spending: A rising middle class with increased disposable income fuels demand for goods manufactured using engineering plastics.

- Government initiatives: Policies promoting industrialization and manufacturing within Africa create a supportive environment for the engineering plastics market. Market penetration of engineering plastics is relatively low compared to developed regions, indicating substantial untapped potential. However, increased awareness of its superior properties and the emergence of local manufacturing facilities are improving market penetration.

Leading Markets & Segments in Africa Engineering Plastics Market

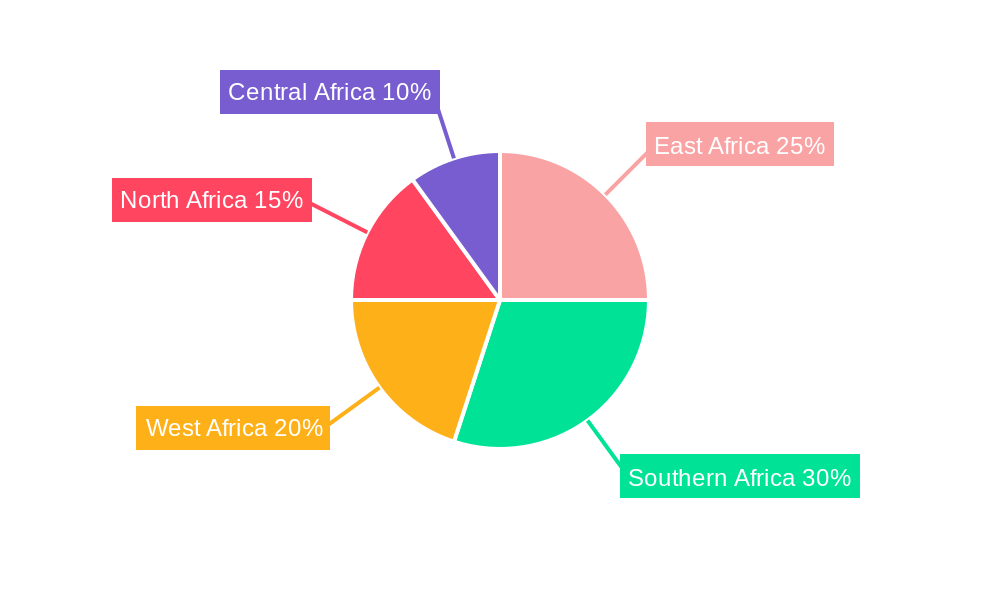

While data on precise market segmentation is limited, it is evident that South Africa holds a dominant position within the African engineering plastics market, followed by Nigeria, Egypt, and Kenya. This dominance stems from several factors:

South Africa: South Africa's established manufacturing base, relatively developed infrastructure, and presence of multinational corporations make it the leading market.

- Economic policies: Government incentives for manufacturing and industrial development have stimulated the sector.

- Infrastructure: Relatively advanced infrastructure compared to other African nations facilitates production and distribution.

- Presence of large companies: Multinational corporations and local manufacturers contribute to robust production and demand.

Other key markets: Nigeria, Egypt, and Kenya are experiencing rapid growth due to increasing urbanization, industrialization, and infrastructure development.

Segment Dominance: While detailed segment data is currently unavailable, the packaging, automotive, and construction segments are likely to be the largest contributors to overall market revenue, due to the high demand for engineering plastics within these industries.

Africa Engineering Plastics Market Product Developments

Recent product innovations in the African engineering plastics market reflect a focus on sustainability, performance, and cost-effectiveness. Major players are introducing new grades of polymers with improved properties like enhanced durability, lighter weight, and improved resistance to chemicals and heat. This trend is driven by the need to meet stringent regulatory requirements and enhance product quality across diverse applications. The adoption of sustainable manufacturing practices, including recycled content integration, is gaining momentum.

Key Drivers of Africa Engineering Plastics Market Growth

The growth of the Africa engineering plastics market is propelled by several interconnected factors:

- Rapid urbanization: Increasing urbanization is driving demand for construction materials and consumer goods, increasing engineering plastics consumption.

- Industrialization: The growing manufacturing sector fuels demand for high-performance engineering plastics in various applications.

- Infrastructure development: Government investments in infrastructure projects are creating a significant demand for durable and lightweight materials.

- Technological advancements: Innovation in material science leads to enhanced product properties and broadened applications.

- Favorable government policies: Initiatives promoting industrial growth and supporting local manufacturing stimulate market expansion.

Challenges in the Africa Engineering Plastics Market Market

The Africa engineering plastics market faces several challenges:

- Infrastructure limitations: Inadequate infrastructure in some regions hinders efficient production, distribution, and transportation.

- Supply chain disruptions: Global supply chain issues can impact raw material availability and increase production costs.

- High energy costs: Electricity costs can significantly impact the operational cost of manufacturing plants.

- Lack of skilled workforce: A shortage of skilled labor can constrain production capacity and innovation.

- Competition from alternative materials: Competition from other materials, like metals, requires ongoing innovation to retain market share.

Emerging Opportunities in Africa Engineering Plastics Market

Several emerging opportunities are poised to drive long-term growth:

- Focus on sustainable solutions: The growing emphasis on environmentally friendly materials creates significant opportunities for bio-based and recycled content engineering plastics.

- Expansion of local manufacturing: Increased local manufacturing capacity can reduce import reliance, increase accessibility, and create jobs.

- Strategic partnerships: Collaborations between international players and local businesses can accelerate market development and technology transfer.

- Investment in research and development: Investing in R&D for advanced materials will broaden the range of applications and drive innovation.

Leading Players in the Africa Engineering Plastics Market Sector

- Alfa S A B de C V

- Covestro AG

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- INEOS

- JBF Industries Ltd

- Reliance Industries Limited

- Röhm GmbH

- SABIC

- Safripol division of KAP Diversified Industrial (Pty) Lt

Key Milestones in Africa Engineering Plastics Market Industry

- August 2022: INEOS launched a comprehensive range of sustainable ABS solutions (Novodur ECO), achieving up to -71% PCF savings compared to non-ECO versions. This significantly impacts the market by offering environmentally conscious options.

- August 2022: INEOS introduced Novodur E3TZ, a high-performance extrusion-grade ABS suitable for food trays, sanitaryware, and luggage, broadening product applications.

- February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications, expanding market penetration into high-growth sectors.

Strategic Outlook for Africa Engineering Plastics Market Market

The Africa engineering plastics market holds significant long-term growth potential driven by sustained infrastructure development, industrialization, and rising consumer demand. Strategic partnerships, investments in sustainable solutions, and a focus on local manufacturing capabilities will be key to capitalizing on this potential. Players who adapt to changing regulatory frameworks and invest in research and development will be best positioned for success in this dynamic market.

Africa Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Africa Engineering Plastics Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Alfa S A B de C V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Covestro AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Far Eastern New Century Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indorama Ventures Public Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 INEOS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JBF Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reliance Industries Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Röhm GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SABIC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Safripol division of KAP Diversified Industrial (Pty) Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Alfa S A B de C V

List of Figures

- Figure 1: Africa Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Africa Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Africa Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Africa Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 7: Africa Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Nigeria Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Africa Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Ethiopia Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Morocco Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Ghana Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Algeria Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ivory Coast Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Engineering Plastics Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Africa Engineering Plastics Market?

Key companies in the market include Alfa S A B de C V, Covestro AG, Far Eastern New Century Corporation, Indorama Ventures Public Company Limited, INEOS, JBF Industries Ltd, Reliance Industries Limited, Röhm GmbH, SABIC, Safripol division of KAP Diversified Industrial (Pty) Lt.

3. What are the main segments of the Africa Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.August 2022: INEOS announced the introduction of an extension to its high-performance Novodur line of specialty ABS products. The new Novodur E3TZ is an extrusion grade that is suitable for a variety of applications, including food trays, sanitary applications, and suitcases.August 2022: INEOS announced the introduction of a comprehensive range of sustainable solutions for its specialty ABS product group Novodur addressing applications in a range of industries, including automotive, electronics, and household. The individual grades come with a significant product carbon footprint (PCF) saving of up to -71% as compared to the respective non-ECO product reference.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Africa Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence