Key Insights

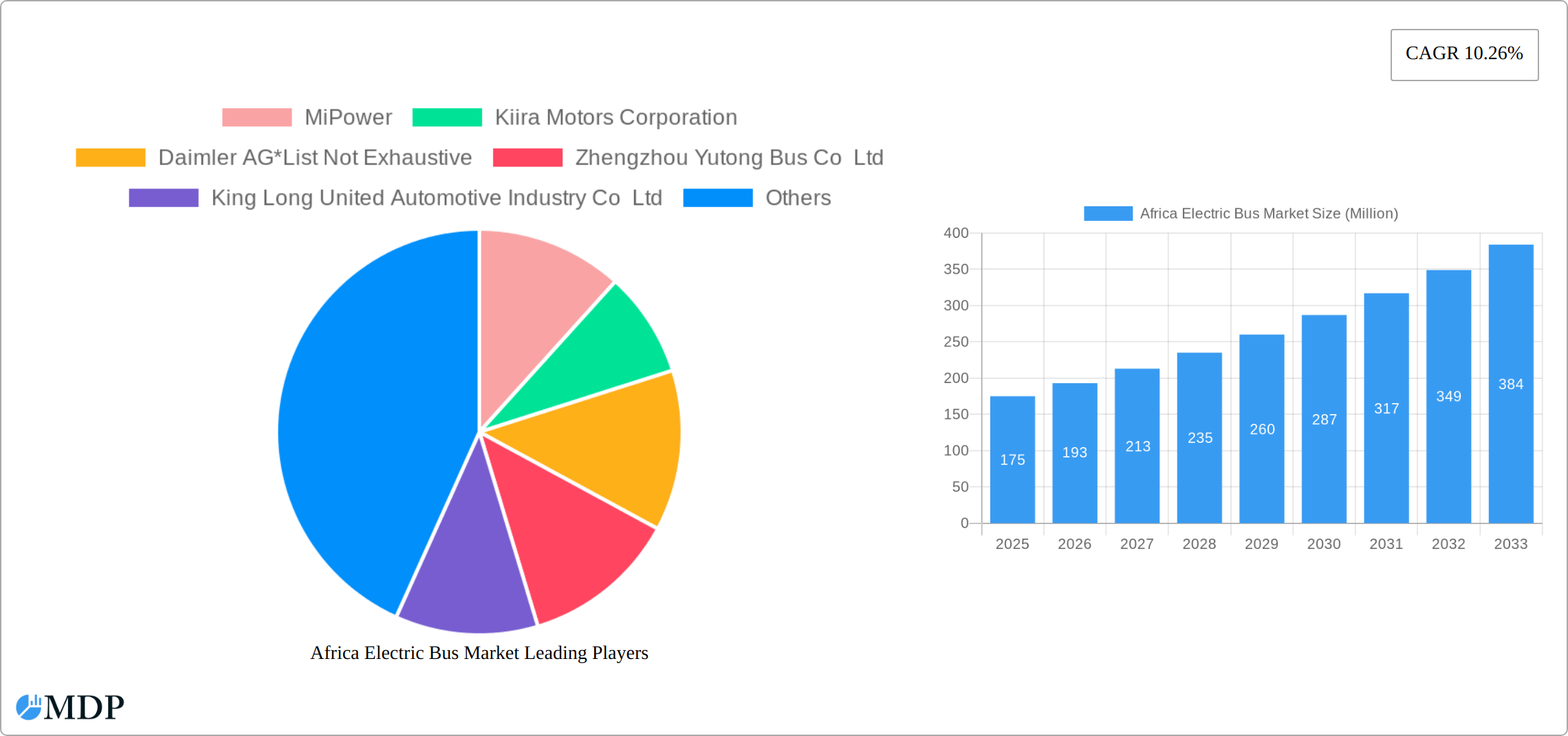

The African electric bus market is poised for significant growth, driven by increasing urbanization, government initiatives promoting sustainable transportation, and rising environmental concerns. A compound annual growth rate (CAGR) of 10.26% from 2019 to 2024 suggests a robust market expansion, and this momentum is expected to continue through 2033. While precise market sizing for 2025 is unavailable, extrapolating from the provided CAGR and considering factors such as increasing government investment in public transit infrastructure and the growing adoption of electric vehicles globally, a reasonable estimate for the 2025 market size would place it in the range of $150-$200 million. South Africa, Morocco, and Egypt are currently leading the market, benefiting from relatively developed infrastructure and government support for electric mobility. However, the "Rest of Africa" segment shows strong potential for future growth as infrastructure improves and awareness of environmental benefits increases. Key drivers include government policies incentivizing electric vehicle adoption, a growing need for sustainable public transportation solutions in rapidly expanding cities, and the decreasing cost of battery technology making electric buses more economically viable. Challenges remain, including the need for robust charging infrastructure development across the continent and addressing the initial high capital cost of electric buses compared to traditional diesel buses. The market is segmented by propulsion type (Battery Electric and Plug-in Hybrid Electric), consumer type (Government and Fleet Operators), and country, allowing for targeted market entry strategies.

The competitive landscape is dynamic, with both international players like Daimler AG, BYD Auto Co Ltd, and Zhongtong Bus Holding Co Ltd, and local manufacturers like MiPower and Kiira Motors Corporation vying for market share. The entry of international companies brings advanced technology and established supply chains, while local players offer localized solutions and potentially lower costs. The future success of companies in this market hinges on the ability to adapt to the specific needs and challenges of different African nations, offering tailored solutions that consider infrastructure limitations, electricity grid reliability, and the economic realities of various regions. As technological advancements continue to reduce the cost and improve the efficiency of electric buses, the market is expected to experience an accelerated period of growth and consolidation, leading to greater integration of sustainable transportation across the African continent.

Africa Electric Bus Market: A Comprehensive Report (2019-2033)

Dive deep into the burgeoning Africa electric bus market with this comprehensive report, providing in-depth analysis and forecasting from 2019 to 2033. This crucial resource offers actionable insights for stakeholders, investors, and industry professionals seeking to navigate this rapidly evolving sector. With a focus on key market segments, leading players like BYD Auto Co Ltd and Zhengzhou Yutong Bus Co Ltd, and crucial industry developments, this report is your essential guide to understanding the opportunities and challenges within the African electric bus landscape. The report covers a comprehensive study period from 2019-2033, with a base year of 2025 and a forecast period from 2025-2033.

Africa Electric Bus Market Market Dynamics & Concentration

This section analyzes the competitive landscape of the Africa electric bus market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is currently characterized by a relatively low concentration, with several key players vying for market share. However, the landscape is rapidly evolving, with increasing consolidation expected in the coming years.

- Market Share: BYD Auto Co Ltd and Zhengzhou Yutong Bus Co Ltd currently hold a significant share of the market, estimated at xx% and xx%, respectively, in 2025. Other players, including MiPower and Kiira Motors Corporation, hold smaller but growing shares. The remaining market share is distributed amongst numerous smaller players.

- Innovation Drivers: Stringent emission regulations in key African cities, coupled with the growing need for sustainable transportation solutions, are driving innovation in electric bus technology. This includes advancements in battery technology, charging infrastructure, and vehicle design optimized for African conditions.

- Regulatory Frameworks: Government policies and incentives are playing a crucial role in shaping the market. Several African nations are implementing policies to encourage the adoption of electric vehicles, including subsidies, tax breaks, and the establishment of charging infrastructure.

- Product Substitutes: Traditional diesel and gasoline buses remain the primary competitors to electric buses, although their market share is expected to decline significantly in the coming years due to increasing environmental concerns and rising fuel costs. However, alternative fuel buses (e.g., CNG, hydrogen) also represent some competition in the near future.

- End-User Trends: The government sector and fleet operators represent the primary consumer base, demonstrating a strong preference for electric buses for mass transit, driven by the need to reduce carbon emissions and improve air quality in cities.

- M&A Activities: The number of M&A deals in the Africa electric bus market has been relatively low in recent years (xx deals in 2024), but is expected to increase as the market matures and larger players seek to consolidate their market positions.

Africa Electric Bus Market Industry Trends & Analysis

This section provides an in-depth analysis of the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The Africa electric bus market is witnessing exponential growth, driven by a multitude of factors. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. This growth is fueled by increasing urbanization, rising environmental concerns, and supportive government policies. Technological disruptions, such as advancements in battery technology and charging infrastructure, are further accelerating market expansion. Consumer preferences are shifting towards cleaner, more efficient transportation solutions, further driving demand for electric buses. The competitive landscape is becoming increasingly dynamic, with both established and new players vying for market share. The market is also seeing increasing pressure to develop locally produced solutions in order to foster economic development and address the logistical issues of imported electric vehicles.

Leading Markets & Segments in Africa Electric Bus Market

South Africa, Morocco, and Egypt currently dominate the African electric bus market, representing a combined xx% market share in 2025. However, other regions, such as the "Rest of Africa," are poised for significant growth.

By Propulsion Type: Battery electric buses hold the largest market share (xx%), reflecting the technological advancements and cost-effectiveness of this technology compared to plug-in hybrid electric vehicles, which only command xx% of the market in 2025.

By Consumer Type: Government and fleet operators are the primary consumers of electric buses, accounting for xx% and xx% of the market respectively, driven by policies incentivizing green transit and the advantages of bulk purchases and operational efficiency.

By Country:

- South Africa: Strong government support and existing infrastructure for mass transit contribute to its leading position.

- Morocco: Investments in renewable energy and sustainable transportation initiatives are bolstering the electric bus market.

- Egypt: Rapid urbanization and a focus on improving public transportation are driving demand.

- Rest of Africa: This segment shows considerable growth potential, driven by increasing awareness of environmental issues and the need for sustainable transportation solutions.

Africa Electric Bus Market Product Developments

The Africa electric bus market is witnessing significant product innovation, focused on addressing the unique challenges of the African context, such as challenging terrains and varying climatic conditions. Manufacturers are developing buses with improved battery life, enhanced durability, and cost-effective maintenance. These innovations, coupled with the introduction of rapid charging technologies, are enhancing the overall market appeal. A focus on local manufacturing and assembly is emerging as well, creating new opportunities.

Key Drivers of Africa Electric Bus Market Growth

Several factors are driving the growth of the Africa electric bus market. These include:

- Government regulations and incentives: Many African governments are implementing policies to encourage electric vehicle adoption, including subsidies and tax breaks.

- Technological advancements: Advancements in battery technology, charging infrastructure, and vehicle design are making electric buses more affordable and practical.

- Environmental concerns: The increasing awareness of air pollution and climate change is driving demand for cleaner transportation solutions.

- Economic benefits: Electric buses offer significant cost savings compared to diesel buses, due to lower fuel costs and reduced maintenance.

Challenges in the Africa Electric Bus Market Market

Despite the significant growth potential, several challenges hinder the Africa electric bus market's development:

- High initial investment costs: The upfront cost of electric buses remains a significant barrier to adoption, particularly for smaller operators.

- Limited charging infrastructure: The lack of adequate charging infrastructure in many African cities restricts the widespread deployment of electric buses.

- Supply chain disruptions: Global supply chain issues can impact the availability of components and lead to increased costs.

- Technical expertise and maintenance: A shortage of skilled technicians to maintain and repair electric buses is a concern.

Emerging Opportunities in Africa Electric Bus Market

The Africa electric bus market presents numerous opportunities for long-term growth. These include:

- Technological breakthroughs: Continuous innovation in battery technology, charging infrastructure, and vehicle design will further enhance the appeal of electric buses.

- Strategic partnerships: Collaborations between manufacturers, governments, and private investors can facilitate the market's expansion.

- Market expansion: The untapped potential in many African countries presents significant opportunities for growth.

Leading Players in the Africa Electric Bus Market Sector

- MiPower

- Kiira Motors Corporation

- Daimler AG

- Zhengzhou Yutong Bus Co Ltd

- King Long United Automotive Industry Co Ltd

- BYD Auto Co Ltd

- Zhongtong Bus Holding Co Ltd

Key Milestones in Africa Electric Bus Market Industry

- August 2022: ROAM launches its first all-electric bus, the ROAM Rapid, designed for mass transit in Africa.

- January 2022: Opibus unveils Kenya's first African-designed and manufactured electric bus.

Strategic Outlook for Africa Electric Bus Market Market

The Africa electric bus market is poised for substantial growth in the coming years, driven by a confluence of factors, including supportive government policies, technological advancements, and increasing environmental awareness. Strategic partnerships, investment in charging infrastructure, and the development of locally relevant products will be crucial to unlocking the market's full potential. Focus on addressing the challenges of high initial investment costs and limited charging infrastructure will be key to wider adoption and sustainable market growth.

Africa Electric Bus Market Segmentation

-

1. Propulsion Type

- 1.1. Battery Electric

- 1.2. Plug-In Hybrid Electric

-

2. Consumer Type

- 2.1. Government

- 2.2. Fleet Operators

Africa Electric Bus Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Electric Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding the Presence of Automobile Assembly Plants in Ghana to Drive Demand in Target Market

- 3.3. Market Restrains

- 3.3.1. High Import Tariffs and Taxes on Vehicles May Stymie Industry Expansion

- 3.4. Market Trends

- 3.4.1. Battery Electric Bus to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Battery Electric

- 5.1.2. Plug-In Hybrid Electric

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Government

- 5.2.2. Fleet Operators

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. South Africa Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 MiPower

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kiira Motors Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Daimler AG*List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Zhengzhou Yutong Bus Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 King Long United Automotive Industry Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BYD Auto Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Zhongtong Bus Holding Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 MiPower

List of Figures

- Figure 1: Africa Electric Bus Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Electric Bus Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Electric Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Electric Bus Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Africa Electric Bus Market Revenue Million Forecast, by Consumer Type 2019 & 2032

- Table 4: Africa Electric Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Electric Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Africa Electric Bus Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 13: Africa Electric Bus Market Revenue Million Forecast, by Consumer Type 2019 & 2032

- Table 14: Africa Electric Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Nigeria Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Egypt Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ethiopia Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Morocco Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ghana Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Algeria Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ivory Coast Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Electric Bus Market?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the Africa Electric Bus Market?

Key companies in the market include MiPower, Kiira Motors Corporation, Daimler AG*List Not Exhaustive, Zhengzhou Yutong Bus Co Ltd, King Long United Automotive Industry Co Ltd, BYD Auto Co Ltd, Zhongtong Bus Holding Co Ltd.

3. What are the main segments of the Africa Electric Bus Market?

The market segments include Propulsion Type, Consumer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding the Presence of Automobile Assembly Plants in Ghana to Drive Demand in Target Market.

6. What are the notable trends driving market growth?

Battery Electric Bus to Witness Growth.

7. Are there any restraints impacting market growth?

High Import Tariffs and Taxes on Vehicles May Stymie Industry Expansion.

8. Can you provide examples of recent developments in the market?

In August 2022, ROAM, a Swedish-Kenyan mobility company, launched its first all-electric bus built for mass transit in Africa, following the launch of its first production-intent model of electric motorcycles. The ROAM Rapid is an electric bus that was created to address the unique challenges of public transportation in Nairobi and throughout Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Electric Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Electric Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Electric Bus Market?

To stay informed about further developments, trends, and reports in the Africa Electric Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence