Key Insights

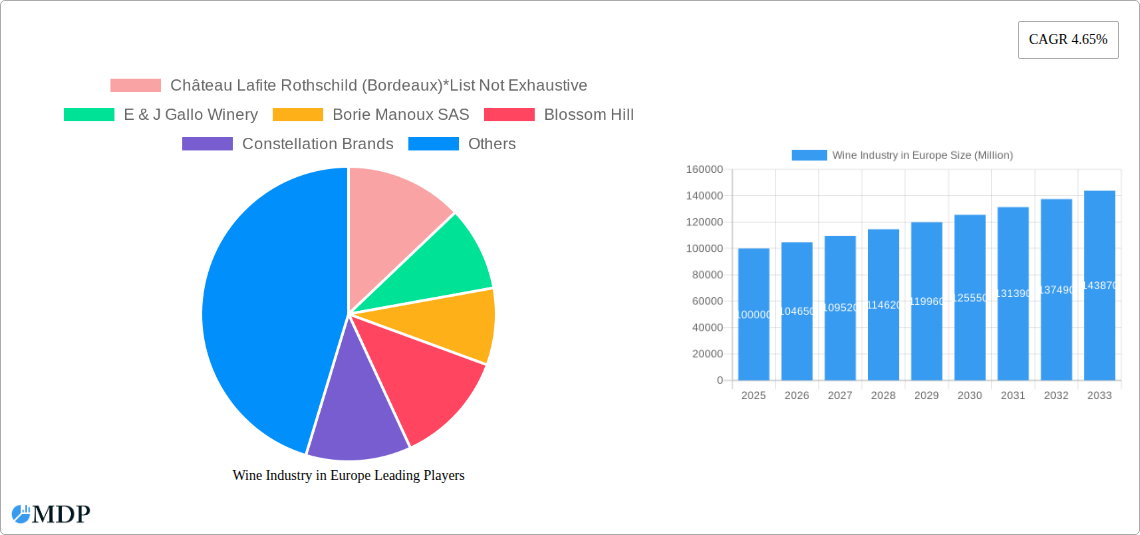

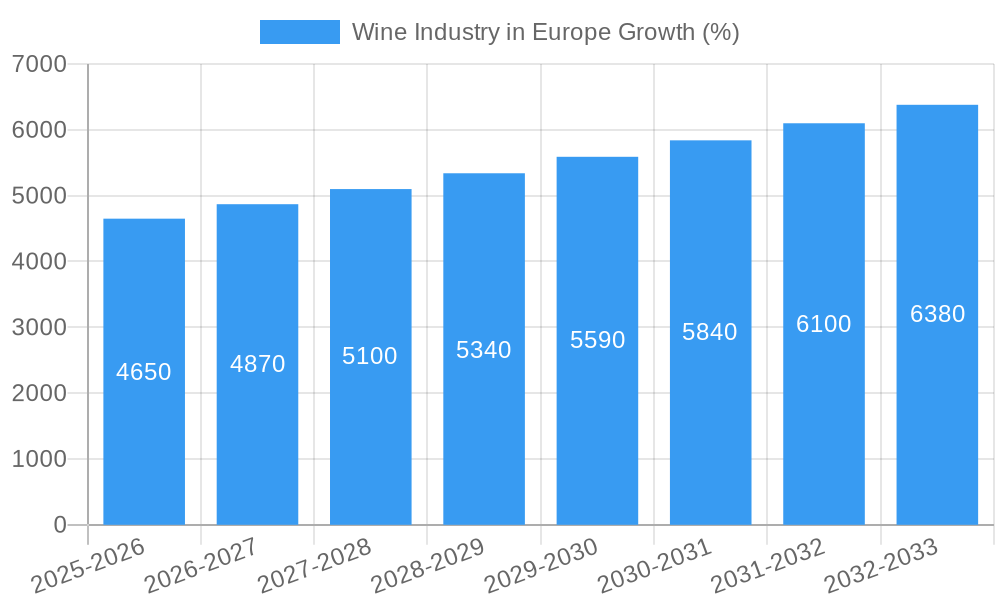

The European wine market, a significant global player, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.65% from 2025 to 2033. This growth is driven by several factors. The increasing popularity of premium wines, particularly among younger consumers seeking sophisticated and high-quality experiences, fuels demand. Furthermore, evolving consumer preferences towards healthier lifestyles contribute to the market's expansion, with a noticeable shift towards lighter-bodied wines like rosé. The robust tourism sector in major European wine-producing countries also boosts sales, particularly in the on-trade segment. However, the market faces challenges, including fluctuating grape yields due to climate change and increasing competition from other alcoholic beverages. The on-trade segment, heavily reliant on restaurant and hospitality, is vulnerable to economic downturns and changing consumer habits. Nonetheless, the off-trade channel, comprising supermarkets and online retailers, is expected to continue its growth trajectory, driven by consumer convenience and the wider availability of a diverse range of wines. Segmentation within the market shows strong performance across still and sparkling wines, with red wine continuing to hold a substantial market share, though rosé's popularity is steadily increasing.

The leading players in the European wine market, including established houses like Château Lafite Rothschild and E&J Gallo Winery, alongside newer, innovative brands, contribute to the market's dynamic landscape. Geographic variations in growth are expected, with countries such as France, Italy, and Germany remaining key contributors. However, the UK and other Northern European markets are anticipated to show promising growth owing to changing consumer tastes and increased disposable incomes. Successful market players will need to adapt to shifting consumer preferences, invest in sustainable practices, and leverage digital channels to enhance brand visibility and reach new customer segments. The market's long-term outlook remains positive, indicating substantial opportunities for established and emerging players willing to navigate the evolving dynamics of the European wine industry.

Europe Wine Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the European wine industry, encompassing market dynamics, trends, leading players, and future prospects. With a focus on the period 2019-2033 (base year 2025), this study offers invaluable insights for industry stakeholders, investors, and anyone seeking to understand this dynamic sector. The report utilizes real market data and avoids placeholders, offering concrete figures and projections where available.

Wine Industry in Europe Market Dynamics & Concentration

The European wine market, valued at €XX Billion in 2024, exhibits a moderately concentrated landscape. While a few multinational giants hold significant market share, a large number of smaller, regional producers contribute significantly to the overall production and diversity of the market. Market concentration is influenced by several factors:

- Innovation Drivers: Consumer demand for organic, biodynamic, and sustainably produced wines fuels innovation in viticulture and winemaking techniques. This leads to premiumization and niche market development.

- Regulatory Frameworks: EU regulations on labeling, production methods, and alcohol content significantly influence market structure and competition. These regulations vary by country and region.

- Product Substitutes: The rise of non-alcoholic and low-alcohol beverages presents a challenge, while ready-to-drink cocktails and other alcoholic beverages create further competition.

- End-User Trends: Growing health consciousness among consumers impacts consumption patterns, with a shift towards healthier alternatives such as light-bodied wines and low-alcohol options. Experiential consumption also drives demand for premium and unique wine varieties.

- M&A Activities: The number of mergers and acquisitions in the European wine industry is expected to remain significant at xx deals per year in the forecast period, driven by companies seeking expansion and economies of scale. For instance, E & J Gallo Winery's acquisition of 30+ brands from Constellation Brands reflects this trend. Major players like Pernod Ricard and Treasury Wine Estates actively participate in strategic acquisitions, influencing market concentration. The market share of the top 5 players is estimated to be around XX% in 2025.

Wine Industry in Europe Industry Trends & Analysis

The European wine industry is characterized by several key trends impacting growth and market dynamics. A CAGR of XX% is projected for the forecast period (2025-2033), primarily driven by:

- Evolving Consumer Preferences: Consumers increasingly seek premiumization, authenticity, and sustainable production methods. This trend fuels demand for organic, biodynamic, and naturally produced wines. The rising popularity of rosé and sparkling wines also contributes to overall market growth.

- Market Growth Drivers: The increasing disposable incomes in certain European regions and the growing popularity of wine tourism are contributing factors to market growth. Also, rising demand for premium wines and the expansion into emerging markets are key driving forces.

- Technological Disruptions: Technological advancements in viticulture and winemaking processes, such as precision viticulture and improved wine preservation techniques, are enhancing efficiency and improving product quality. The adoption of e-commerce and digital marketing platforms significantly enhance market access and consumer engagement.

- Competitive Dynamics: Intense competition exists among established players and smaller, regional producers. Competition focuses on product differentiation, brand building, and effective marketing strategies to attract the target market. The rise of direct-to-consumer sales channels further intensifies the competitive landscape. Market penetration of premium wines is expected to reach XX% by 2033.

Leading Markets & Segments in Wine Industry in Europe

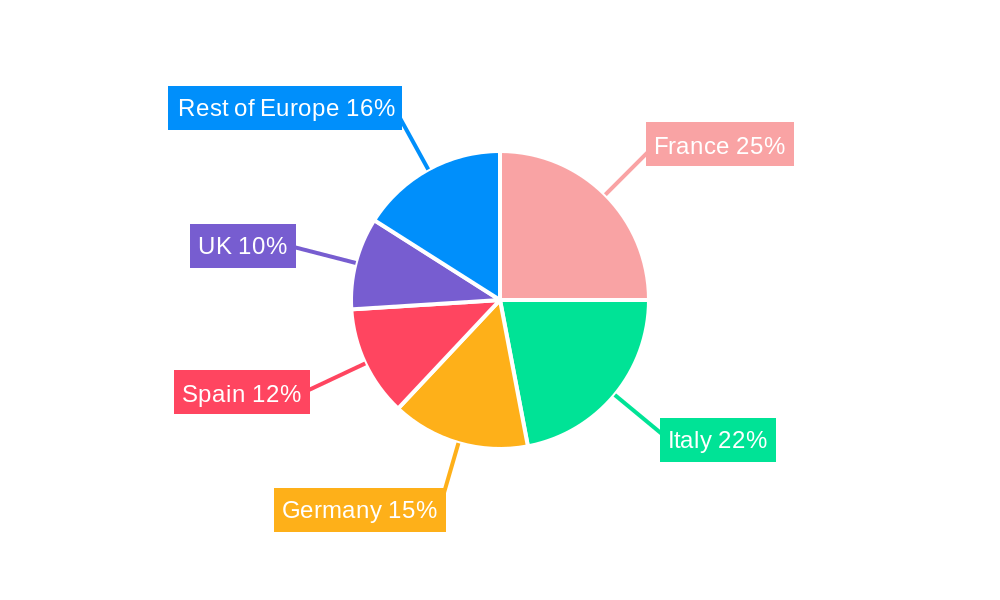

France continues to dominate the European wine market in terms of both production and export. Italy and Spain also hold significant positions, primarily in specific segments. In terms of market segments:

- Color: Red wine remains the most dominant color segment.

- Product Type: Still wine commands a significant market share, but the sparkling wine segment is experiencing notable growth due to increasing consumer preference for celebratory and upscale occasions.

- Distribution Channel: The off-trade channel (retail) maintains the largest share of the market, while the on-trade channel (restaurants and bars) contributes to premium wine sales and revenue.

Key Drivers for Leading Regions:

- France: Strong brand reputation, diverse terroir, and established winemaking expertise.

- Italy: Large production capacity, wide range of grape varietals, and thriving tourism.

- Spain: Cost-effective production, growing popularity of certain varietals (e.g., Tempranillo), and expanding export markets.

France's dominance is fueled by factors such as its established reputation for high-quality wine production, diversified terroir offering varied wine styles, and a mature wine tourism sector. Italy leverages its vast production capacity and wide range of grape varietals to satisfy diversified consumer tastes. Spain benefits from cost-effective production and the increasing popularity of its wines in global markets.

Wine Industry in Europe Product Developments

The European wine industry shows ongoing product innovation. This includes the development of organic, biodynamic, and low-alcohol wines to address evolving consumer preferences. Technological advancements in winemaking processes result in more consistent quality and efficiency gains. The focus is on meeting the specific preferences of various consumer segments through product diversification and differentiation. This ranges from introducing new varietals and blends to crafting unique packaging designs enhancing the overall consumer experience.

Key Drivers of Wine Industry in Europe Growth

Several factors are driving growth in the European wine industry:

- Technological advancements: Precision viticulture and improved winemaking techniques enhance quality and efficiency.

- Economic growth: Rising disposable incomes in many European countries fuel demand for premium wines.

- Favorable regulatory environments: Supportive policies in certain regions encourage investment and production.

Challenges in the Wine Industry in Europe Market

The European wine industry faces challenges including:

- Climate change: Extreme weather events impact grape yields and wine quality. The quantifiable impact is seen in reduced crop yields, resulting in increased production costs.

- Competition: Intense competition from both established players and new market entrants create pressure on prices and profitability.

- Supply chain disruptions: The impact of disruptions caused by unforeseen factors such as pandemics, affecting production, logistics, and distribution.

Emerging Opportunities in Wine Industry in Europe

The European wine industry presents various opportunities, including:

- Expanding into new markets: Untapped potential exists in expanding into emerging markets, driven by increased international demand for European wines.

- Leveraging e-commerce: The increasing use of e-commerce presents opportunities for wine producers to reach new customers, leading to improved sales.

- Strategic partnerships: Collaborations between wine producers and other businesses (e.g., food companies, tourism agencies) can create synergistic opportunities.

Leading Players in the Wine Industry in Europe Sector

- Château Lafite Rothschild (Bordeaux)

- E & J Gallo Winery

- Borie Manoux SAS

- Blossom Hill

- Constellation Brands

- Pernod Ricard SA (Brancott)

- Financière Pinault SCA (Groupe Artemis SA)

- Treasury Wine Estates (Wolf Blass)

- Louis Roederer

- Castel Group (Baron de Lestac)

Key Milestones in Wine Industry in Europe Industry

- July 2022: Pernod Ricard launches a European pilot program for its digital labeling project, aiming for greater transparency.

- August 2021: Pernod Ricard UK launches Cafayate and Leaps & Bounds, a new range of Australian wines inspired by dogs.

- January 2021: E. & J. Gallo Winery completes the acquisition of over 30 wine brands from Constellation Brands.

Strategic Outlook for Wine Industry in Europe Market

The European wine industry is poised for continued growth, driven by evolving consumer preferences, technological innovation, and strategic partnerships. Focusing on sustainability, premiumization, and targeted marketing strategies will be key for success. The market's capacity to adapt to changing consumer demands and leveraging emerging technologies creates significant opportunities for growth and expansion in the coming years.

Wine Industry in Europe Segmentation

-

1. Product Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Other Product Types

-

2. Color

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

- 2.4. Other Wines

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Specialty Stores

- 3.2.3. Online Retail Stores

- 3.2.4. Other Distribution Channels

Wine Industry in Europe Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. France

- 4. Germany

- 5. Italy

- 6. Rest of Europe

Wine Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Large Vineyard Area is Likely to Drive the Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Color

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.2.4. Other Wines

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Online Retail Stores

- 5.3.2.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Germany

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Still Wine

- 6.1.2. Sparkling Wine

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Color

- 6.2.1. Red Wine

- 6.2.2. Rose Wine

- 6.2.3. White Wine

- 6.2.4. Other Wines

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-trade

- 6.3.2. Off-trade

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Specialty Stores

- 6.3.2.3. Online Retail Stores

- 6.3.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Still Wine

- 7.1.2. Sparkling Wine

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Color

- 7.2.1. Red Wine

- 7.2.2. Rose Wine

- 7.2.3. White Wine

- 7.2.4. Other Wines

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-trade

- 7.3.2. Off-trade

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Specialty Stores

- 7.3.2.3. Online Retail Stores

- 7.3.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Still Wine

- 8.1.2. Sparkling Wine

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Color

- 8.2.1. Red Wine

- 8.2.2. Rose Wine

- 8.2.3. White Wine

- 8.2.4. Other Wines

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-trade

- 8.3.2. Off-trade

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Specialty Stores

- 8.3.2.3. Online Retail Stores

- 8.3.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Germany Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Still Wine

- 9.1.2. Sparkling Wine

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Color

- 9.2.1. Red Wine

- 9.2.2. Rose Wine

- 9.2.3. White Wine

- 9.2.4. Other Wines

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. On-trade

- 9.3.2. Off-trade

- 9.3.2.1. Supermarkets/Hypermarkets

- 9.3.2.2. Specialty Stores

- 9.3.2.3. Online Retail Stores

- 9.3.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Still Wine

- 10.1.2. Sparkling Wine

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Color

- 10.2.1. Red Wine

- 10.2.2. Rose Wine

- 10.2.3. White Wine

- 10.2.4. Other Wines

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. On-trade

- 10.3.2. Off-trade

- 10.3.2.1. Supermarkets/Hypermarkets

- 10.3.2.2. Specialty Stores

- 10.3.2.3. Online Retail Stores

- 10.3.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Still Wine

- 11.1.2. Sparkling Wine

- 11.1.3. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Color

- 11.2.1. Red Wine

- 11.2.2. Rose Wine

- 11.2.3. White Wine

- 11.2.4. Other Wines

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. On-trade

- 11.3.2. Off-trade

- 11.3.2.1. Supermarkets/Hypermarkets

- 11.3.2.2. Specialty Stores

- 11.3.2.3. Online Retail Stores

- 11.3.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Germany Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 13. France Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. Italy Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Château Lafite Rothschild (Bordeaux)*List Not Exhaustive

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 E & J Gallo Winery

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Borie Manoux SAS

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Blossom Hill

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Constellation Brands

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Pernod Ricard SA (Brancott)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Financière Pinault SCA (Groupe Artemis SA)

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Treasury Wine Estates (Wolf Blass)

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Louis Roederer

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Castel Group (Baron de Lestac)

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Château Lafite Rothschild (Bordeaux)*List Not Exhaustive

List of Figures

- Figure 1: Wine Industry in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Wine Industry in Europe Share (%) by Company 2024

List of Tables

- Table 1: Wine Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 4: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Wine Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 16: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 20: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 24: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 28: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 32: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 36: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wine Industry in Europe?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the Wine Industry in Europe?

Key companies in the market include Château Lafite Rothschild (Bordeaux)*List Not Exhaustive, E & J Gallo Winery, Borie Manoux SAS, Blossom Hill, Constellation Brands, Pernod Ricard SA (Brancott), Financière Pinault SCA (Groupe Artemis SA), Treasury Wine Estates (Wolf Blass), Louis Roederer, Castel Group (Baron de Lestac).

3. What are the main segments of the Wine Industry in Europe?

The market segments include Product Type, Color, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Large Vineyard Area is Likely to Drive the Market in the Region.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

Pernod Ricard has announced the launch of a digital labeling project that will cover its entire portfolio, including wine and spirits. The project, under which every bottle of Pernod Ricard's products carries its QR code on the back label, is being implemented to provide consumers with more transparency on ingredient and health information. According to Pernod Richard, a European pilot program for the digital label solution will begin in July 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wine Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wine Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wine Industry in Europe?

To stay informed about further developments, trends, and reports in the Wine Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence