Key Insights

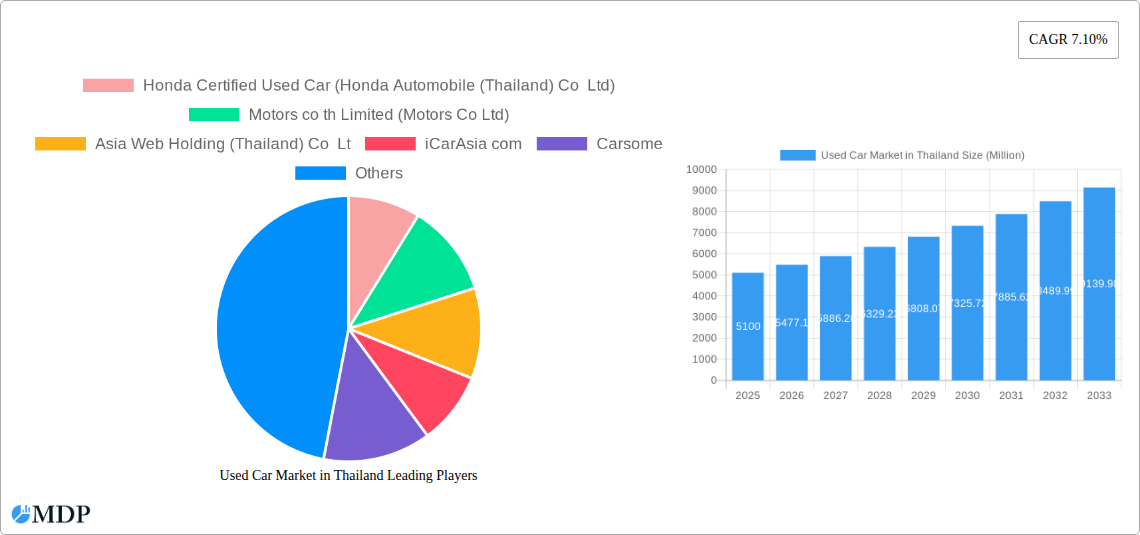

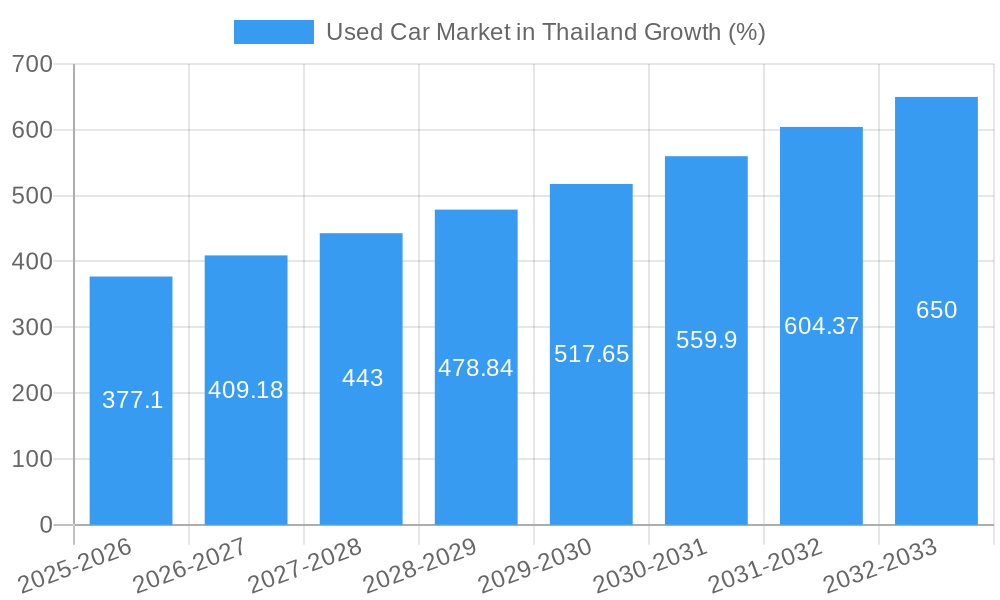

The Thai used car market, valued at 5.10 billion USD in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.10% from 2025 to 2033. This growth is fueled by several key factors. Increasing vehicle ownership in a rapidly developing economy like Thailand, coupled with a preference for more affordable transportation options, drives significant demand for used cars. The rise of online platforms and organized dealerships is enhancing market transparency and consumer trust, leading to higher transaction volumes. Furthermore, evolving consumer preferences towards SUVs and MPVs, reflected in the segment breakdown, contribute to this expanding market. While factors such as fluctuating fuel prices and economic uncertainty could pose some challenges, the overall positive economic outlook and the increasing sophistication of the used car market infrastructure suggest continued growth.

The market segmentation reveals interesting dynamics. The organized sector, while currently smaller than the unorganized segment, is witnessing rapid growth due to its ability to offer better quality assurance and financing options. The SUV and MPV segments are experiencing disproportionately high growth compared to hatchbacks and sedans, indicating a shift in consumer preferences toward larger vehicles. The increasing adoption of online booking platforms underscores the growing influence of digital technologies in the Thai automotive landscape. Leading players like Honda Certified Used Car, Motors Co Ltd, and Carsome are leveraging these trends to solidify their market positions, highlighting the competitive nature of this expanding market. Continued investment in infrastructure and technology, alongside effective marketing strategies, will be crucial for companies seeking to capitalize on the long-term growth potential of the Thai used car market.

Unlock Growth in Thailand's Booming Used Car Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a deep dive into the dynamic used car market in Thailand, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed analysis spanning the period from 2019 to 2033, including a base year of 2025 and forecast period of 2025-2033, this report unlocks the potential of this rapidly evolving sector. Explore key segments, leading players, and emerging trends to navigate this lucrative market. Projected market value exceeds xx Million by 2033.

Used Car Market in Thailand: Market Dynamics & Concentration

The Thai used car market, valued at xx Million in 2024, demonstrates a complex interplay of factors influencing its growth and concentration. Market share is currently dominated by a mix of organized and unorganized vendors, with organized players like Honda Certified Used Cars and Carsome gradually increasing their market presence. The level of market concentration is moderate, with a few large players and numerous smaller independent sellers. Innovation is driven by technological advancements in online platforms and vehicle inspection technologies, alongside regulatory changes aimed at improving transparency and consumer protection. The market faces competition from new car sales, but the affordability of used vehicles continues to be a major driving force. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, indicating a potential for increased consolidation.

- Market Concentration: Moderate, with a mix of large organized and numerous smaller unorganized players.

- Innovation Drivers: Online platforms, vehicle inspection technologies, and regulatory changes.

- Regulatory Framework: Evolving to improve transparency and consumer protection.

- Product Substitutes: New car sales, particularly in lower price segments.

- End-User Trends: Growing preference for certified pre-owned vehicles and online purchasing.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Used Car Market in Thailand: Industry Trends & Analysis

The Thai used car market exhibits strong growth potential, driven by factors such as increasing vehicle ownership, a preference for more affordable transportation options, and the rising popularity of online car buying platforms. The market is witnessing a significant shift towards organized players, who offer greater transparency, certified vehicles, and improved customer service. Technological advancements, such as online marketplaces and digital inspection tools, are streamlining the buying and selling process. Consumer preferences are evolving, with a growing demand for certified pre-owned cars and vehicles with extended warranties. Competitive dynamics are characterized by increased competition amongst organized players and a gradual shift towards more transparent and regulated market practices. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, with market penetration of online platforms steadily increasing to approximately xx% by 2024.

Leading Markets & Segments in Used Car Market in Thailand

The Thai used car market is geographically widespread, with no single dominant region. However, Bangkok and surrounding areas represent the largest segment due to higher population density and greater economic activity.

- By Vendor Type: The organized sector is experiencing faster growth driven by increased consumer trust and better services.

- By Vehicle Type: SUVs and MPVs are experiencing the highest demand due to their practicality and family-oriented appeal. Sedans still hold a significant share, while hatchbacks represent a more budget-conscious segment.

- By Fuel Type: Petrol remains the dominant fuel type, although diesel vehicles maintain a substantial presence, particularly in commercial segments. Other fuel types remain niche.

- By Booking Type: Online bookings are experiencing rapid growth, driven by convenience and wider reach. Offline sales still represent a large share of the market.

Key Drivers:

- Favorable economic conditions, stimulating consumer purchasing power.

- Developing infrastructure, enhancing accessibility across regions.

- Government policies supporting automotive sector growth.

Used Car Market in Thailand: Product Developments

Recent product innovations focus on enhancing the customer experience through improved online platforms, certified vehicle inspections, and extended warranties. This reflects a market trend towards greater transparency and trust. Technological advancements like AI-powered vehicle valuation tools and virtual inspections are gaining traction, offering increased convenience and efficiency. These developments are strongly impacting market fit by attracting tech-savvy buyers and streamlining the transaction process.

Key Drivers of Used Car Market in Thailand Growth

Several factors are fueling the growth of Thailand's used car market:

- Rising affordability: Used cars offer a more budget-friendly alternative to new vehicles.

- Technological advancements: Online platforms and digital tools enhance transparency and convenience.

- Favorable economic conditions: A growing middle class boosts demand for personal transportation.

- Government initiatives: Regulations promoting market transparency and consumer protection.

Challenges in the Used Car Market in Thailand

The Thai used car market faces challenges, including:

- Lack of transparency in pricing: Some unorganized sellers may lack transparency in pricing and vehicle history.

- Supply chain disruptions: Global supply chain issues can impact the availability of parts and services.

- Competition from new car sales and leasing: Attractive financing options for new cars challenge the used car market. These factors collectively contribute to an estimated xx% decrease in annual growth potential.

Emerging Opportunities in Used Car Market in Thailand

The used car market in Thailand presents significant opportunities:

- Expansion of online platforms: Increased online penetration offers greater reach and efficiency.

- Growth of certified pre-owned vehicles: Building consumer trust in used car quality is crucial.

- Development of specialized services: Offering tailored services (financing, insurance, maintenance) enhances the customer experience.

- Strategic partnerships: Collaboration with financial institutions and after-sales service providers expands the market reach.

Leading Players in the Used Car Market in Thailand Sector

- Honda Certified Used Car (Honda Automobile (Thailand) Co Ltd)

- Motors co th Limited (Motors Co Ltd)

- Asia Web Holding (Thailand) Co Lt

- iCarAsia com

- Carsome

- UsedcarBangkok com

- CARS24 Group Thailand Co Ltd

- SiamMotorworld

- Pixy Asia Co Ltd

Key Milestones in Used Car Market in Thailand Industry

- February 2022: Carsome Group planned to build more used car refurbishment centers in Malaysia, Indonesia, and Thailand, anticipating growing demand.

- March 2022: Carsome partnered with PTT Oil and Retail Business to expand its network and boost online sales.

- January 2022: CARS24 launched its application, providing access to over 1,200 certified used cars. These developments significantly impacted market dynamics by increasing consumer access, promoting online sales, and improving the quality and transparency of used cars offered.

Strategic Outlook for Used Car Market in Thailand Market

The Thai used car market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and increased market organization. Strategic opportunities lie in expanding online platforms, enhancing consumer trust through certification programs, and developing value-added services. The market’s future potential is significant, with projections indicating substantial growth over the next decade, exceeding xx Million by 2033.

Used Car Market in Thailand Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

- 2.3. Other Fuel Types

-

3. Booking Type

- 3.1. Online

- 3.2. Offline

-

4. Vendor Type

- 4.1. Organized

- 4.2. Unorganized

Used Car Market in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Market in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diverse Selection Among Car Models Is Anticipated To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Counterfeit and Illegally Imported Vehicles Is Restraining The Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration Will Drive Online Segment Of The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vendor Type

- 5.4.1. Organized

- 5.4.2. Unorganized

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports U

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Petrol

- 6.2.2. Diesel

- 6.2.3. Other Fuel Types

- 6.3. Market Analysis, Insights and Forecast - by Booking Type

- 6.3.1. Online

- 6.3.2. Offline

- 6.4. Market Analysis, Insights and Forecast - by Vendor Type

- 6.4.1. Organized

- 6.4.2. Unorganized

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports U

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Petrol

- 7.2.2. Diesel

- 7.2.3. Other Fuel Types

- 7.3. Market Analysis, Insights and Forecast - by Booking Type

- 7.3.1. Online

- 7.3.2. Offline

- 7.4. Market Analysis, Insights and Forecast - by Vendor Type

- 7.4.1. Organized

- 7.4.2. Unorganized

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports U

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Petrol

- 8.2.2. Diesel

- 8.2.3. Other Fuel Types

- 8.3. Market Analysis, Insights and Forecast - by Booking Type

- 8.3.1. Online

- 8.3.2. Offline

- 8.4. Market Analysis, Insights and Forecast - by Vendor Type

- 8.4.1. Organized

- 8.4.2. Unorganized

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports U

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Petrol

- 9.2.2. Diesel

- 9.2.3. Other Fuel Types

- 9.3. Market Analysis, Insights and Forecast - by Booking Type

- 9.3.1. Online

- 9.3.2. Offline

- 9.4. Market Analysis, Insights and Forecast - by Vendor Type

- 9.4.1. Organized

- 9.4.2. Unorganized

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports U

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Petrol

- 10.2.2. Diesel

- 10.2.3. Other Fuel Types

- 10.3. Market Analysis, Insights and Forecast - by Booking Type

- 10.3.1. Online

- 10.3.2. Offline

- 10.4. Market Analysis, Insights and Forecast - by Vendor Type

- 10.4.1. Organized

- 10.4.2. Unorganized

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honda Certified Used Car (Honda Automobile (Thailand) Co Ltd)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Motors co th Limited (Motors Co Ltd)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Asia Web Holding (Thailand) Co Lt

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 iCarAsia com

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Carsome

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 UsedcarBangkok com

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CARS24 Group Thailand Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SiamMotorworld

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pixy Asia Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Honda Certified Used Car (Honda Automobile (Thailand) Co Ltd)

List of Figures

- Figure 1: Global Used Car Market in Thailand Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Thailand Used Car Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 3: Thailand Used Car Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Used Car Market in Thailand Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 5: North America Used Car Market in Thailand Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 6: North America Used Car Market in Thailand Revenue (Million), by Fuel Type 2024 & 2032

- Figure 7: North America Used Car Market in Thailand Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 8: North America Used Car Market in Thailand Revenue (Million), by Booking Type 2024 & 2032

- Figure 9: North America Used Car Market in Thailand Revenue Share (%), by Booking Type 2024 & 2032

- Figure 10: North America Used Car Market in Thailand Revenue (Million), by Vendor Type 2024 & 2032

- Figure 11: North America Used Car Market in Thailand Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 12: North America Used Car Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Used Car Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Used Car Market in Thailand Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: South America Used Car Market in Thailand Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: South America Used Car Market in Thailand Revenue (Million), by Fuel Type 2024 & 2032

- Figure 17: South America Used Car Market in Thailand Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 18: South America Used Car Market in Thailand Revenue (Million), by Booking Type 2024 & 2032

- Figure 19: South America Used Car Market in Thailand Revenue Share (%), by Booking Type 2024 & 2032

- Figure 20: South America Used Car Market in Thailand Revenue (Million), by Vendor Type 2024 & 2032

- Figure 21: South America Used Car Market in Thailand Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 22: South America Used Car Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Used Car Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Used Car Market in Thailand Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Europe Used Car Market in Thailand Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Europe Used Car Market in Thailand Revenue (Million), by Fuel Type 2024 & 2032

- Figure 27: Europe Used Car Market in Thailand Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 28: Europe Used Car Market in Thailand Revenue (Million), by Booking Type 2024 & 2032

- Figure 29: Europe Used Car Market in Thailand Revenue Share (%), by Booking Type 2024 & 2032

- Figure 30: Europe Used Car Market in Thailand Revenue (Million), by Vendor Type 2024 & 2032

- Figure 31: Europe Used Car Market in Thailand Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 32: Europe Used Car Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Used Car Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Used Car Market in Thailand Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Middle East & Africa Used Car Market in Thailand Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Middle East & Africa Used Car Market in Thailand Revenue (Million), by Fuel Type 2024 & 2032

- Figure 37: Middle East & Africa Used Car Market in Thailand Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 38: Middle East & Africa Used Car Market in Thailand Revenue (Million), by Booking Type 2024 & 2032

- Figure 39: Middle East & Africa Used Car Market in Thailand Revenue Share (%), by Booking Type 2024 & 2032

- Figure 40: Middle East & Africa Used Car Market in Thailand Revenue (Million), by Vendor Type 2024 & 2032

- Figure 41: Middle East & Africa Used Car Market in Thailand Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 42: Middle East & Africa Used Car Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Used Car Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Used Car Market in Thailand Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 45: Asia Pacific Used Car Market in Thailand Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 46: Asia Pacific Used Car Market in Thailand Revenue (Million), by Fuel Type 2024 & 2032

- Figure 47: Asia Pacific Used Car Market in Thailand Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 48: Asia Pacific Used Car Market in Thailand Revenue (Million), by Booking Type 2024 & 2032

- Figure 49: Asia Pacific Used Car Market in Thailand Revenue Share (%), by Booking Type 2024 & 2032

- Figure 50: Asia Pacific Used Car Market in Thailand Revenue (Million), by Vendor Type 2024 & 2032

- Figure 51: Asia Pacific Used Car Market in Thailand Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 52: Asia Pacific Used Car Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Used Car Market in Thailand Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Used Car Market in Thailand Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Used Car Market in Thailand Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Used Car Market in Thailand Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Global Used Car Market in Thailand Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 5: Global Used Car Market in Thailand Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 6: Global Used Car Market in Thailand Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Used Car Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Used Car Market in Thailand Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: Global Used Car Market in Thailand Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: Global Used Car Market in Thailand Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 11: Global Used Car Market in Thailand Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 12: Global Used Car Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Used Car Market in Thailand Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Global Used Car Market in Thailand Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 18: Global Used Car Market in Thailand Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 19: Global Used Car Market in Thailand Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 20: Global Used Car Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Used Car Market in Thailand Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 25: Global Used Car Market in Thailand Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 26: Global Used Car Market in Thailand Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 27: Global Used Car Market in Thailand Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 28: Global Used Car Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Used Car Market in Thailand Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 39: Global Used Car Market in Thailand Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 40: Global Used Car Market in Thailand Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 41: Global Used Car Market in Thailand Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 42: Global Used Car Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Used Car Market in Thailand Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Global Used Car Market in Thailand Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 51: Global Used Car Market in Thailand Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 52: Global Used Car Market in Thailand Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 53: Global Used Car Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Used Car Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market in Thailand?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Used Car Market in Thailand?

Key companies in the market include Honda Certified Used Car (Honda Automobile (Thailand) Co Ltd), Motors co th Limited (Motors Co Ltd), Asia Web Holding (Thailand) Co Lt, iCarAsia com, Carsome, UsedcarBangkok com, CARS24 Group Thailand Co Ltd, SiamMotorworld, Pixy Asia Co Ltd.

3. What are the main segments of the Used Car Market in Thailand?

The market segments include Vehicle Type, Fuel Type, Booking Type, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Diverse Selection Among Car Models Is Anticipated To Drive The Market Growth.

6. What are the notable trends driving market growth?

Rising Internet Penetration Will Drive Online Segment Of The Market.

7. Are there any restraints impacting market growth?

Counterfeit and Illegally Imported Vehicles Is Restraining The Market Growth.

8. Can you provide examples of recent developments in the market?

January 2022: CARS24 launched the CARS24 application to enhance the customer experience and allow customers to access the most significant certified company-owned used cars, over 1,200 in one app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market in Thailand?

To stay informed about further developments, trends, and reports in the Used Car Market in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence