Key Insights

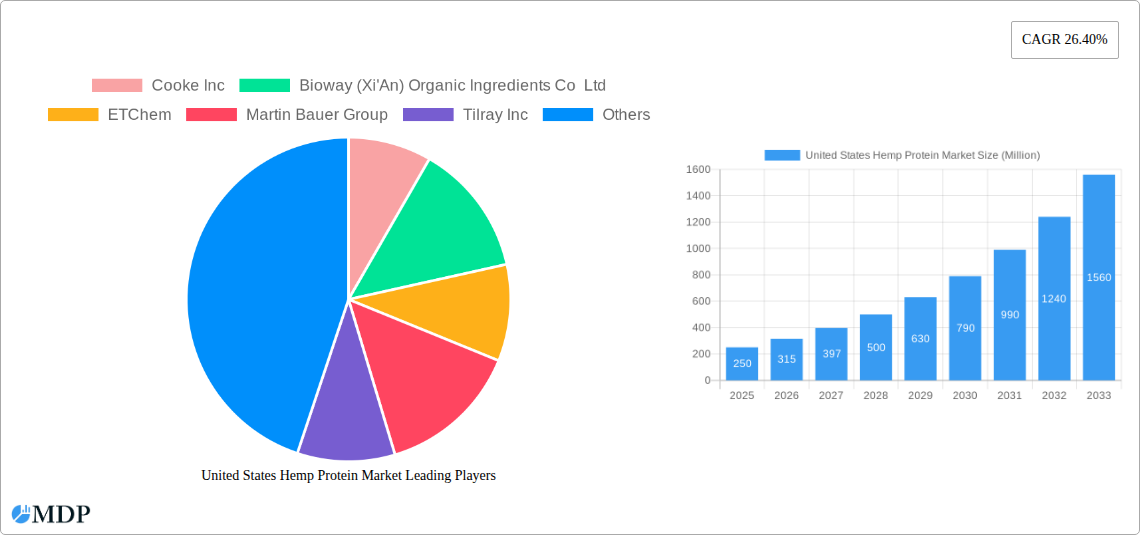

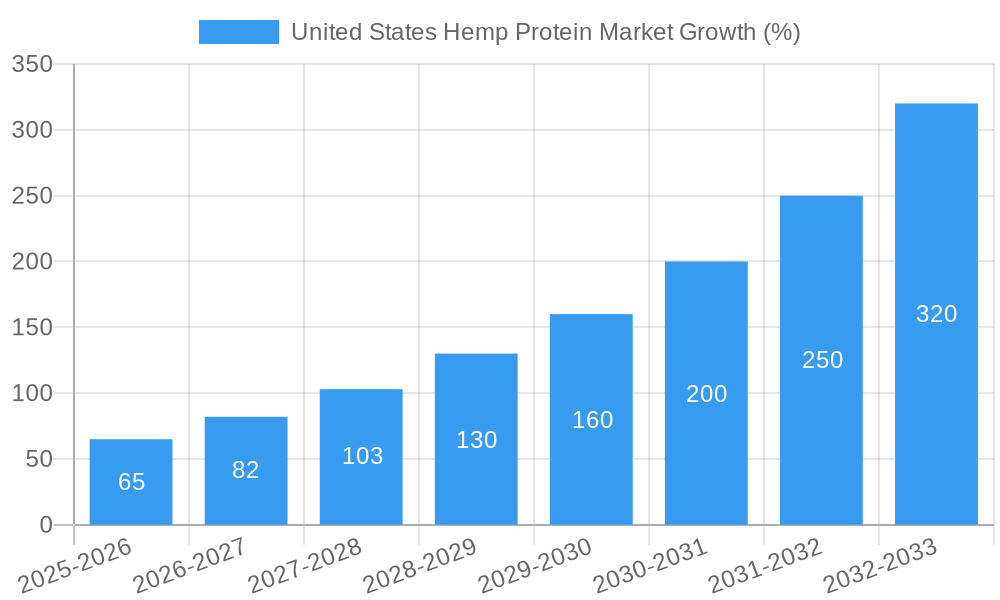

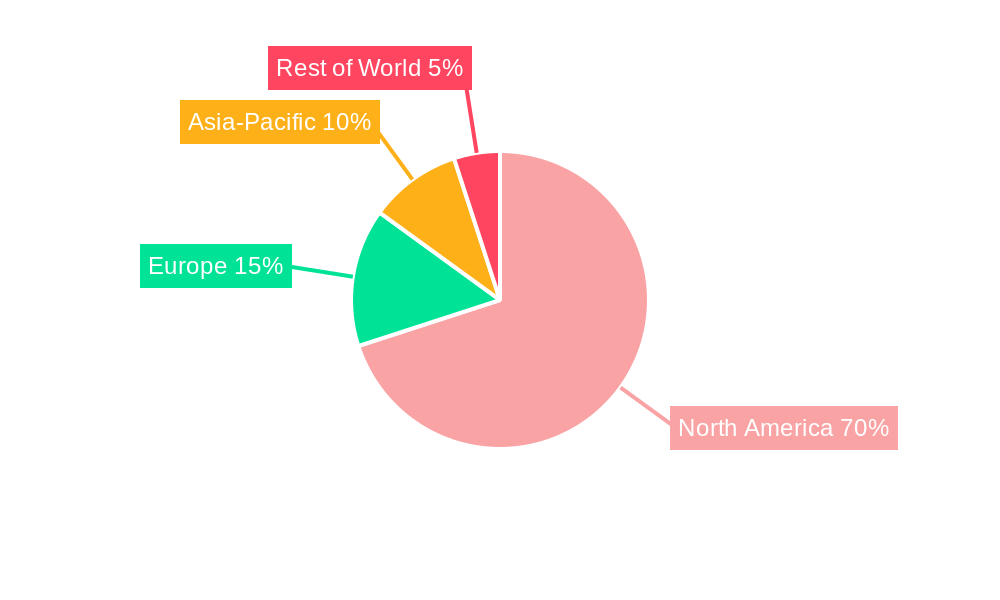

The United States hemp protein market is experiencing robust growth, fueled by the increasing consumer demand for plant-based protein sources and the rising awareness of hemp's nutritional benefits. With a compound annual growth rate (CAGR) of 26.40% from 2019 to 2024, the market demonstrates significant potential. The surge in popularity of veganism and vegetarianism, coupled with concerns about the environmental impact of traditional animal agriculture, are key drivers. Furthermore, the growing recognition of hemp protein's complete amino acid profile and its high fiber content are contributing factors. The market segmentation reveals strong performance across various end-user categories, with meat alternatives, dairy alternatives, and protein bars and shakes leading the charge. This is further amplified by the expanding health and wellness industry, pushing demand for protein supplements and functional foods. The North American region, particularly the United States, is a key market player due to high consumer awareness and favorable regulatory landscapes. Major players in the industry are constantly innovating, introducing new hemp-based products to meet evolving consumer preferences and tap into specific market niches like sports nutrition and functional foods. The forecast period (2025-2033) anticipates continued expansion, driven by sustained consumer interest, product diversification, and ongoing research into hemp's health benefits.

The market's growth trajectory will likely be influenced by several factors, including ongoing research into the health benefits of hemp protein, the development of new and innovative product formulations, and the regulatory environment surrounding hemp cultivation and processing. Challenges such as fluctuating hemp prices and potential supply chain limitations could impact the market's growth. However, the overarching trend remains positive, with increasing market penetration across various segments. The market’s maturation will likely lead to increased competition and consolidation, prompting companies to focus on cost optimization and strategic partnerships to maintain their market share. Continued investment in research and development will also play a crucial role in driving innovation and broadening the appeal of hemp protein to a wider consumer base. Strategic marketing campaigns highlighting hemp protein's sustainability and health benefits are also expected to propel market growth.

United States Hemp Protein Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Hemp Protein Market, offering valuable insights for stakeholders across the value chain. From market dynamics and concentration to leading players and future opportunities, this report covers all crucial aspects, providing actionable intelligence for strategic decision-making. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. This report will equip you with data-driven insights into market trends, segment performance, and competitive landscape, enabling you to capitalize on the burgeoning opportunities within this dynamic market.

United States Hemp Protein Market Market Dynamics & Concentration

The United States hemp protein market exhibits a moderately concentrated landscape, with a handful of key players holding significant market share. However, the market is experiencing considerable dynamism due to several factors. Innovation is a primary driver, with ongoing research into enhancing protein content, texture, and overall nutritional value of hemp protein. Regulatory frameworks, while evolving, play a critical role in shaping market growth and accessibility. The existence of substitute protein sources (soy, whey) introduces competitive pressure, prompting hemp protein manufacturers to emphasize unique benefits such as sustainability and complete amino acid profiles.

End-user trends heavily influence market demand, with increasing consumer awareness of health and wellness fueling the growth of plant-based protein options. Mergers and acquisitions (M&A) are also shaping the industry, indicating consolidation and strategic expansion. For example, Tilray Inc.’s acquisition of Manitoba Harvest significantly altered market dynamics. While precise market share figures for individual players are commercially sensitive, it's evident that larger players are leveraging M&A to gain a competitive edge and broaden their product portfolios. The number of M&A deals within the sector increased significantly in 2019-2021, suggesting increased competition and a drive for market consolidation.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Enhanced protein content, improved texture, sustainable sourcing.

- Regulatory Framework: Evolving, impacting market accessibility.

- Product Substitutes: Soy, whey protein.

- End-User Trends: Growing demand for plant-based and healthy protein options.

- M&A Activity: Significant increase in recent years, indicating consolidation.

United States Hemp Protein Market Industry Trends & Analysis

The United States hemp protein market is experiencing robust growth, driven by several key factors. The increasing consumer demand for plant-based proteins, fueled by health consciousness and concerns about sustainability, is a primary driver. Technological advancements in hemp cultivation and processing are enhancing the quality and yield of hemp protein, making it more competitive. The market is witnessing a shift in consumer preferences towards clean-label products, free from artificial ingredients and additives, further boosting demand for natural hemp protein options. The competitive landscape is dynamic, with both established food companies and specialized hemp producers vying for market share. This competitive intensity fosters innovation and drives down prices.

The Compound Annual Growth Rate (CAGR) for the US hemp protein market during the historical period (2019-2024) is estimated at xx%, demonstrating significant growth. Market penetration is increasing steadily as consumer awareness and product availability improve. However, challenges such as inconsistent regulatory environments across different states and concerns about potential contaminants remain to be addressed.

Leading Markets & Segments in United States Hemp Protein Market

While precise regional data is commercially sensitive, the key growth drivers for various segments within the market can be outlined. The food and beverage sector dominates the hemp protein market, with significant application in various product categories.

End User Segments:

- Food and Beverages: This segment is the largest, driven by the increasing demand for plant-based alternatives. Meat alternatives, dairy alternatives, baked goods, protein bars, and snacks all benefit from the inclusion of hemp protein.

- Sport/Performance Nutrition: The demand for hemp protein in sports nutrition products (protein shakes, powders, supplements) is growing rapidly due to its high protein content and amino acid profile.

- Nutrition: Hemp protein is increasingly used in supplements and energy drinks, catering to consumers seeking a natural source of plant-based protein.

Key Drivers (vary by segment):

- Economic Policies: Government support for hemp cultivation and processing can significantly impact market growth.

- Infrastructure: Efficient supply chains and processing facilities are essential for ensuring sufficient supply and consistent product quality.

- Consumer Preferences: The growing preference for plant-based protein options is a major driver across all segments.

The dominance of specific regions is influenced by factors such as hemp cultivation conditions, regulatory frameworks, and consumer purchasing behavior. Western states, with a history of hemp cultivation, are likely to be leading market regions.

United States Hemp Protein Market Product Developments

Product innovation is a key aspect of the United States hemp protein market. Companies are focusing on improving the texture and taste of hemp protein to enhance consumer acceptance. Novel applications are also emerging, with hemp protein being incorporated into a wider range of food products. This includes the development of functional foods and beverages that leverage the unique nutritional profile of hemp protein, such as products enhanced with omega-3 fatty acids and fiber. Companies are emphasizing sustainable sourcing and environmentally friendly processing methods, further enhancing the appeal of hemp protein to health-conscious consumers. Technological advancements, such as advanced extraction and processing techniques, are contributing to the production of higher-quality, more palatable hemp protein products.

Key Drivers of United States Hemp Protein Market Growth

The growth of the US hemp protein market is fueled by several factors: growing consumer awareness of the health benefits of plant-based proteins, increasing demand for sustainable and environmentally friendly food choices, and technological advancements that improve hemp protein production and quality. Supportive government policies and regulations that facilitate hemp cultivation and processing also play a significant role. The rise of veganism and vegetarianism further stimulates demand for plant-based protein alternatives.

Challenges in the United States Hemp Protein Market Market

Despite its considerable potential, the US hemp protein market faces several challenges. Inconsistencies in state-level regulations regarding hemp cultivation and processing pose obstacles to consistent supply and market expansion. Supply chain issues, especially relating to sourcing high-quality hemp biomass, can impact production and price stability. Competition from established protein sources like soy and whey protein adds pressure on hemp protein manufacturers to establish a clear value proposition. These challenges translate to higher production costs and potentially limit overall market growth in the short-term.

Emerging Opportunities in United States Hemp Protein Market

Significant opportunities exist for long-term growth in the US hemp protein market. Technological breakthroughs in hemp cultivation and processing promise to increase yields and improve product quality, leading to greater cost-efficiency and wider market penetration. Strategic partnerships between hemp producers, food manufacturers, and retailers can streamline supply chains and facilitate product distribution. Expanding market reach through targeted marketing campaigns and increased product diversification into novel food and beverage applications will propel the market forward.

Leading Players in the United States Hemp Protein Market Sector

- Cooke Inc

- Bioway (Xi'An) Organic Ingredients Co Ltd

- ETChem

- Martin Bauer Group

- Tilray Inc

- Axiom Foods Inc

- A Costantino & C SpA

- Green Source Organics

- Foodcom SA

Key Milestones in United States Hemp Protein Market Industry

- February 2019: Tilray acquired Manitoba Harvest, significantly expanding its presence in the hemp food market.

- December 2019: Privateer Holdings Inc. merged with Tilray Brands Inc., creating a larger player in the cannabis and hemp industry.

- July 2021: Tilray's Manitoba Harvest subsidiary launched a research partnership focused on improving hemp and pea protein, demonstrating a commitment to innovation within the sector.

Strategic Outlook for United States Hemp Protein Market Market

The future of the US hemp protein market appears bright. Continued technological advancements, coupled with growing consumer demand for plant-based proteins and supportive regulatory environments, will drive substantial market growth. Companies that prioritize innovation, sustainable practices, and strategic partnerships are well-positioned to capture significant market share. The market's potential for expansion into new product categories and geographic regions offers further opportunities for future growth. Further market consolidation is expected as companies seek to leverage economies of scale and expand their market reach.

United States Hemp Protein Market Segmentation

-

1. End User

-

1.1. Food and Beverages

-

1.1.1. By Sub End User

- 1.1.1.1. Bakery

- 1.1.1.2. Snacks

-

1.1.1. By Sub End User

-

1.2. Supplements

- 1.2.1. Elderly Nutrition and Medical Nutrition

- 1.2.2. Sport/Performance Nutrition

-

1.1. Food and Beverages

United States Hemp Protein Market Segmentation By Geography

- 1. United States

United States Hemp Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hemp Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Food and Beverages

- 5.1.1.1. By Sub End User

- 5.1.1.1.1. Bakery

- 5.1.1.1.2. Snacks

- 5.1.1.1. By Sub End User

- 5.1.2. Supplements

- 5.1.2.1. Elderly Nutrition and Medical Nutrition

- 5.1.2.2. Sport/Performance Nutrition

- 5.1.1. Food and Beverages

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. United States United States Hemp Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada United States Hemp Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico United States Hemp Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Cooke Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bioway (Xi'An) Organic Ingredients Co Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ETChem

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Martin Bauer Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Tilray Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Axiom Foods Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 A Costantino & C SpA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Green Source Organics

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Foodcom SA

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Cooke Inc

List of Figures

- Figure 1: United States Hemp Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Hemp Protein Market Share (%) by Company 2024

List of Tables

- Table 1: United States Hemp Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Hemp Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 3: United States Hemp Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United States Hemp Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States United States Hemp Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada United States Hemp Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico United States Hemp Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Hemp Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 9: United States Hemp Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hemp Protein Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the United States Hemp Protein Market?

Key companies in the market include Cooke Inc, Bioway (Xi'An) Organic Ingredients Co Ltd, ETChem, Martin Bauer Group, Tilray Inc, Axiom Foods Inc, A Costantino & C SpA, Green Source Organics, Foodcom SA.

3. What are the main segments of the United States Hemp Protein Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

July 2021: Tilray Brands Inc.'s subsidiary Manitoba Harvest announced a new research partnership to drive innovation in hemp and pea protein with a consortium of industry leaders through Protein Industries Canada to develop new hemp and pea varieties with increased protein content, differential starch content, and improved texture.December 2019: Privateer Holdings Inc. merged with Tilray Brands Inc., a global pioneer in cannabis research, cultivation, production, and distribution.February 2019: Tilray acquired Manitoba Harvest from Compass Group Diversified Holdings LLC. Manitoba Harvest is one of the largest hemp food manufacturers and distributes a broad-based portfolio of hemp-based products. It is the parent company of Hemp Oil Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hemp Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hemp Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hemp Protein Market?

To stay informed about further developments, trends, and reports in the United States Hemp Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence