Key Insights

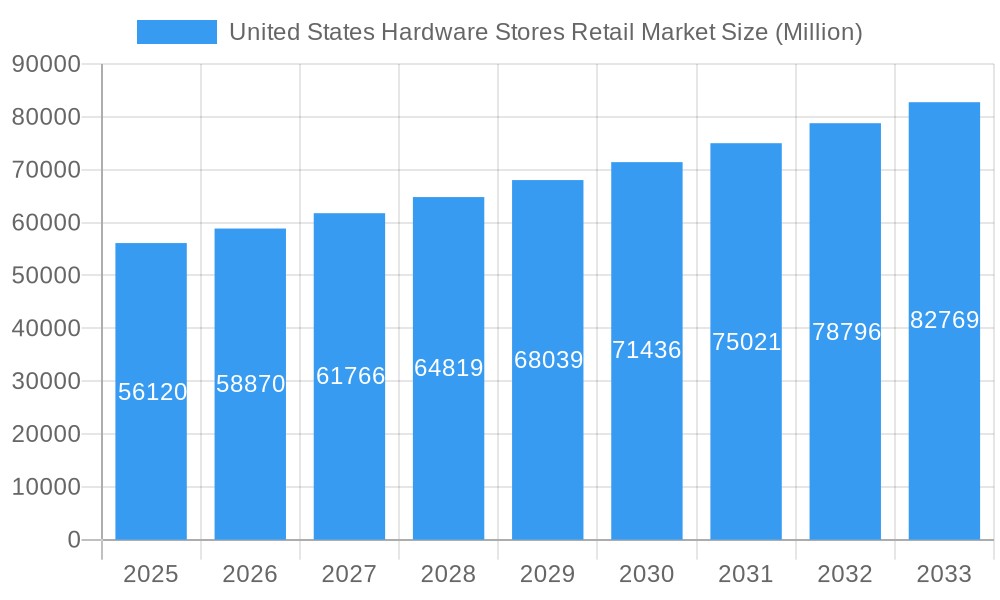

The United States hardware stores retail market, valued at $56.12 billion in 2025, is projected to experience robust growth, driven by a consistent CAGR of 4.89% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the ongoing surge in home improvement and renovation projects, spurred by a rising homeowner population and increasing disposable incomes, significantly boosts demand for hardware and related products. Secondly, the growing popularity of DIY (Do It Yourself) culture encourages consumers to undertake home maintenance and repair tasks independently, further driving sales. Thirdly, the increasing adoption of e-commerce platforms by established players and smaller retailers broadens market reach and accessibility, leading to increased sales. Finally, strategic initiatives by major players, including product diversification, omnichannel strategies, and expansion into new geographic areas, contribute significantly to market growth.

United States Hardware Stores Retail Market Market Size (In Billion)

However, the market also faces certain challenges. Competition from large home improvement chains like Home Depot and Lowe's, necessitates smaller, independent stores to differentiate themselves through specialized services, curated product selections, and strong customer relationships. Fluctuations in raw material prices and supply chain disruptions can impact profitability and product availability. Furthermore, economic downturns can dampen consumer spending on discretionary items like home improvement projects, affecting overall market growth. Despite these headwinds, the long-term outlook for the US hardware stores retail market remains positive, with continued growth driven by underlying demographic trends, technological advancements, and the enduring appeal of homeownership. The competitive landscape features established giants like Home Depot and Lowe's, alongside smaller regional players and specialty hardware stores, each catering to distinct market segments.

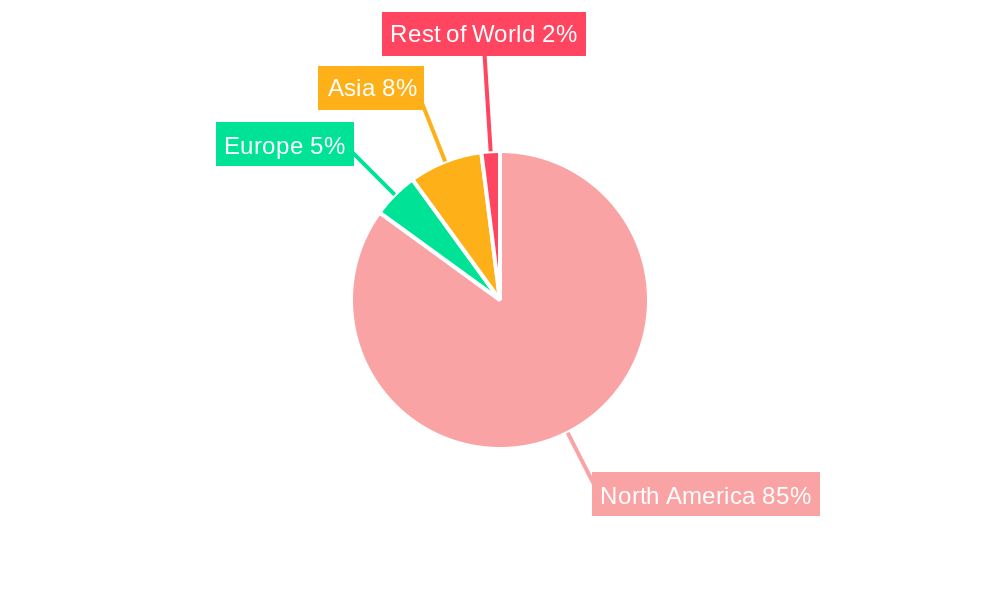

United States Hardware Stores Retail Market Company Market Share

United States Hardware Stores Retail Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Hardware Stores Retail Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future opportunities. The report leverages rigorous data analysis and incorporates key industry events to provide a holistic understanding of this dynamic sector.

United States Hardware Stores Retail Market Market Dynamics & Concentration

The US hardware stores retail market is a highly competitive landscape dominated by a few key players, yet characterized by significant fragmentation at the local and regional levels. The market concentration ratio (CR4) for the top four players (Home Depot, Lowe's, Menards, Ace Hardware) stands at approximately xx%, indicating a moderate level of concentration with substantial opportunity for smaller players. Innovation, driven by technological advancements in e-commerce and supply chain management, is a major force reshaping the market. Regulatory frameworks, including building codes and environmental regulations, significantly impact product offerings and operational strategies. Product substitution, primarily from online retailers offering similar products, poses a considerable challenge. End-user trends, including DIY home improvement projects and a growing focus on sustainability, are shaping demand.

Mergers and acquisitions (M&A) activity has been notably active, particularly in the expansion of service offerings. For the period 2019-2024, there were approximately xx M&A deals, signifying consolidation and strategic expansion within the industry.

Market Share (2024 Estimate):

- Home Depot Inc: xx%

- Lowe's Companies Inc: xx%

- Menard Inc: xx%

- Ace Hardware: xx%

- Others: xx%

Key M&A Drivers: Geographic expansion, service diversification, and increased market share.

United States Hardware Stores Retail Market Industry Trends & Analysis

The US hardware stores retail market exhibits a robust growth trajectory, driven by several key factors. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be xx%, fueled by rising disposable incomes, increasing homeownership rates, and a surge in DIY home improvement projects. Technological disruptions, including e-commerce platforms and omnichannel strategies, have significantly altered the retail landscape. Consumer preferences are shifting towards convenient online purchasing, personalized service, and sustainable products. Competitive dynamics are marked by fierce competition among large national chains and smaller, localized players, with each striving to offer unique value propositions. Market penetration of online sales continues to rise, currently estimated at xx% in 2024, projected to reach xx% by 2033. This growth is primarily driven by improved logistics and enhanced online shopping experiences.

Leading Markets & Segments in United States Hardware Stores Retail Market

The Southeast and Southwest regions of the United States represent the leading markets for hardware stores, driven by robust population growth and a high concentration of new housing developments. Specific states like Florida, Texas, and Georgia show exceptionally strong performance. This dominance is attributed to several key drivers:

- Economic Policies: Favorable tax incentives and pro-growth policies stimulate construction and renovation activities.

- Infrastructure Development: Ongoing infrastructure projects create significant demand for hardware and building materials.

- Population Growth: A rising population necessitates more housing and related improvement projects.

The dominance of these regions is further cemented by the presence of major hardware retailers with extensive store networks strategically located across these areas. Furthermore, a significant portion of the market is attributed to professional contractors, who contribute a substantial volume of sales. Analysis shows that professional contractors account for approximately xx% of total market revenue in these key regions.

United States Hardware Stores Retail Market Product Developments

Recent product innovations focus on smart home technology integration, sustainable and eco-friendly materials, and enhanced online ordering and delivery systems. Companies are emphasizing value-added services such as installation assistance and home improvement consultations to create a differentiated offering. The focus is on integrating technology to improve customer experience and optimize operations. This is evidenced by the increasing adoption of inventory management software and automated warehousing systems to reduce costs and improve efficiency.

Key Drivers of United States Hardware Stores Retail Market Growth

Several factors propel the growth of the US hardware stores retail market:

- Rising Disposable Incomes: Increased purchasing power fuels demand for home improvements and renovations.

- Homeownership Rates: Growing homeownership contributes directly to the demand for home improvement products.

- Technological Advancements: E-commerce and innovative product offerings enhance market reach and customer engagement.

- DIY Culture: The increasing popularity of DIY projects fuels demand for tools and supplies.

Challenges in the United States Hardware Stores Retail Market Market

The market faces significant challenges:

- Supply Chain Disruptions: Global supply chain complexities impact product availability and pricing. The impact of these disruptions on the industry's profitability is estimated at xx Million dollars annually.

- Economic Slowdowns: Recessions and economic uncertainty dampen consumer spending on discretionary items like home improvements.

- Intense Competition: The presence of large national chains and numerous smaller players creates intense competition.

Emerging Opportunities in United States Hardware Stores Retail Market

Emerging opportunities lie in several key areas:

- Expansion into Rural Markets: Untapped potential exists in underserved rural areas.

- Strategic Partnerships: Collaborations with contractors and online platforms expand market reach.

- Technological Innovation: The adoption of AR/VR and AI-powered tools enhances customer experience and efficiency.

Leading Players in the United States Hardware Stores Retail Market Sector

- Home Depot Inc

- Lowe's Companies Inc

- Menard Inc

- Ace Hardware

- True Value Hardware

- 84 Lumber

- Handy Andy Home Improvement Centers Inc

- Hippo Hardware and Trading Company

- Orchard Supply Hardware

- Harbor Freight Tools

Key Milestones in United States Hardware Stores Retail Market Industry

- September 2023: Lowe's extended its multi-year agreement with the NFL, launching a comprehensive marketing campaign. This strategic move is expected to significantly boost brand awareness and drive sales.

- June 2023: Ace Hardware's acquisition of 12 home services companies expands its service offerings and strengthens its position in the home improvement sector. This acquisition signals a move towards comprehensive home solutions rather than just hardware.

Strategic Outlook for United States Hardware Stores Retail Market Market

The future of the US hardware stores retail market appears bright, with significant growth potential driven by continued population growth, rising homeownership, and technological advancements. Strategic opportunities lie in expanding e-commerce capabilities, offering personalized services, and leveraging strategic partnerships to capture market share. Focusing on sustainable and eco-friendly products will also resonate with environmentally conscious consumers, creating a unique competitive advantage.

United States Hardware Stores Retail Market Segmentation

-

1. Product Type

- 1.1. Door Hardware

- 1.2. Building Materials

- 1.3. Kitchen and Toilet Products

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Offline

- 2.2. Online

United States Hardware Stores Retail Market Segmentation By Geography

- 1. United States

United States Hardware Stores Retail Market Regional Market Share

Geographic Coverage of United States Hardware Stores Retail Market

United States Hardware Stores Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Home Improvement and Renovation Projects

- 3.3. Market Restrains

- 3.3.1. Rise in Home Improvement and Renovation Projects

- 3.4. Market Trends

- 3.4.1. Increased Focus on Home Improvement and Renovation Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hardware Stores Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Door Hardware

- 5.1.2. Building Materials

- 5.1.3. Kitchen and Toilet Products

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Home Depot Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lowe's Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Menard Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ace Hardware

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 True Value Hardware

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 84 Lumber

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Handy Andy Home Improvement Centers Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hippo Hardware and Trading Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orchard Supply Hardware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Harbor Freight Tools

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Home Depot Inc

List of Figures

- Figure 1: United States Hardware Stores Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Hardware Stores Retail Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: United States Hardware Stores Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Hardware Stores Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: United States Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: United States Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: United States Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: United States Hardware Stores Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Hardware Stores Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hardware Stores Retail Market?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the United States Hardware Stores Retail Market?

Key companies in the market include Home Depot Inc, Lowe's Companies Inc, Menard Inc, Ace Hardware, True Value Hardware, 84 Lumber, Handy Andy Home Improvement Centers Inc, Hippo Hardware and Trading Company, Orchard Supply Hardware, Harbor Freight Tools.

3. What are the main segments of the United States Hardware Stores Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Home Improvement and Renovation Projects.

6. What are the notable trends driving market growth?

Increased Focus on Home Improvement and Renovation Projects.

7. Are there any restraints impacting market growth?

Rise in Home Improvement and Renovation Projects.

8. Can you provide examples of recent developments in the market?

September 2023: Lowe declared the extension of its multi-year agreement with the NFL for the current year's season. The collaboration will commence with a comprehensive marketing campaign, including a national television commercial, an updated lineup of Lowe's Home Team players, and the introduction of a limited-edition DIY Wrist Coach accessory.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hardware Stores Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hardware Stores Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hardware Stores Retail Market?

To stay informed about further developments, trends, and reports in the United States Hardware Stores Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence