Key Insights

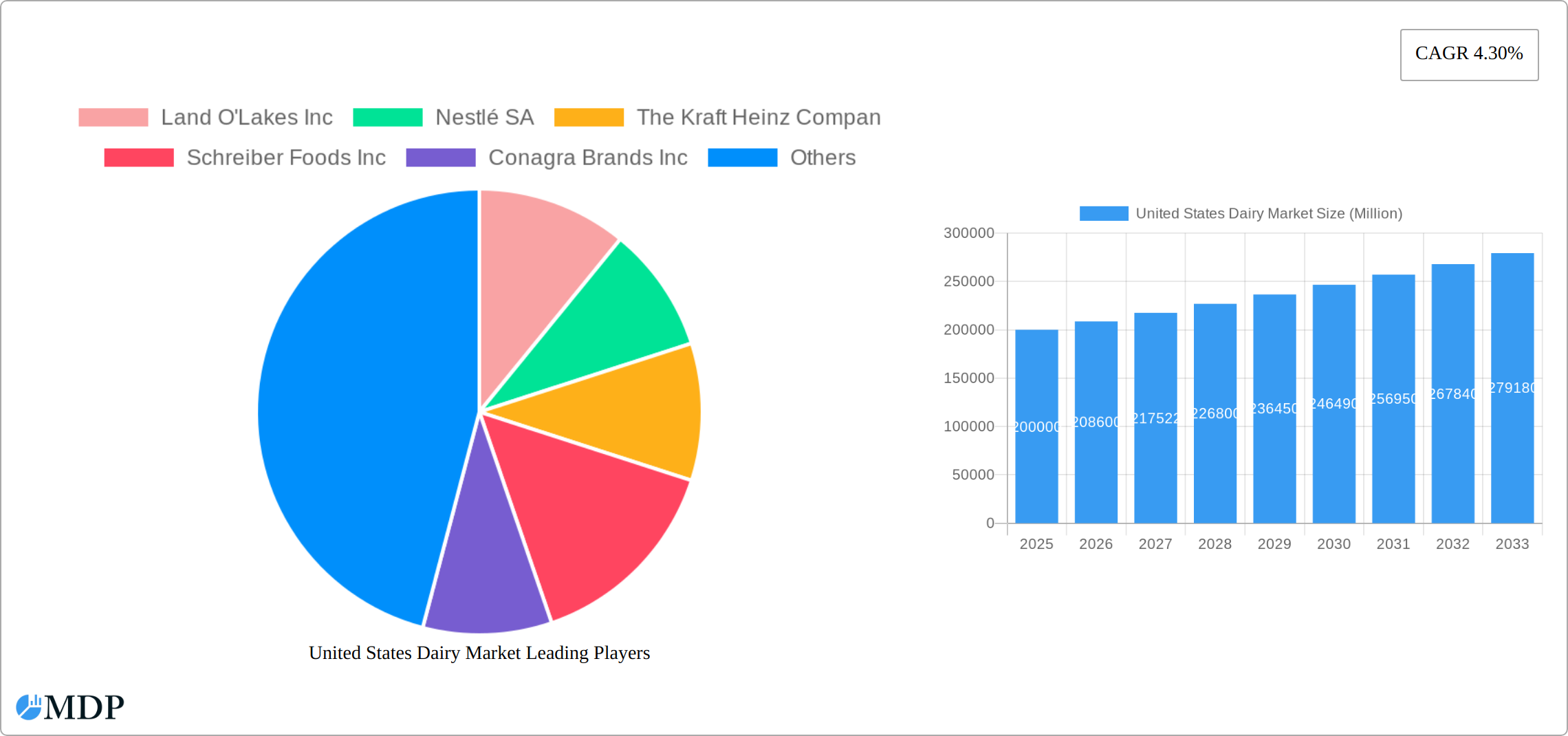

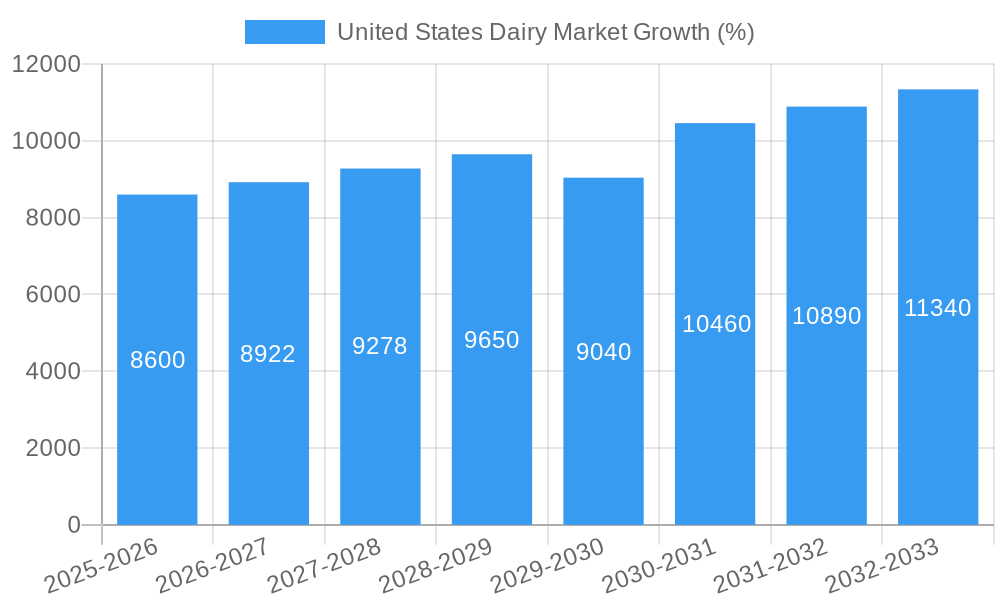

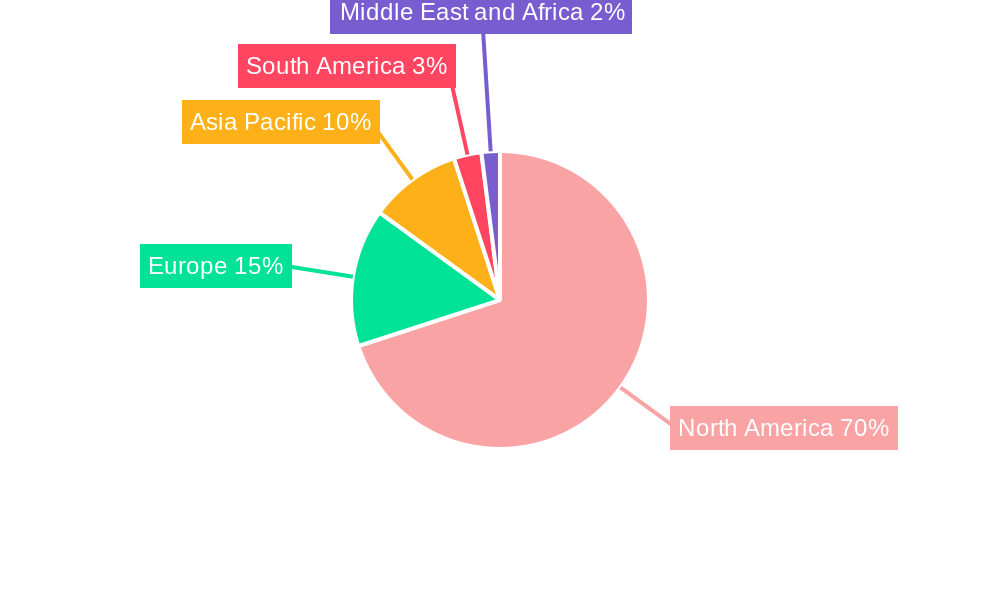

The United States dairy market, a significant segment of the global food and beverage industry, exhibits robust growth potential. With a current market size estimated in the billions (a precise figure requires more detailed data than provided), the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.30% from 2025 to 2033. This growth is fueled by several key drivers. Increasing consumer demand for dairy products, particularly among health-conscious individuals seeking protein and calcium-rich options, is a major factor. Innovation within the dairy industry, including the development of novel products like lactose-free milk and Greek yogurt, caters to evolving consumer preferences and expands market segments. Furthermore, the growing food service sector, encompassing restaurants, cafes, and institutions, presents significant opportunities for dairy product sales. The increasing use of dairy in processed foods also contributes to the overall market expansion. However, the market faces certain challenges. Fluctuations in milk production due to factors like weather patterns and feed costs can impact supply and price stability. Furthermore, growing consumer interest in plant-based alternatives necessitates strategic adaptation by dairy producers to maintain market share. Segmentation analysis reveals a dynamic landscape, with off-trade channels (e.g., supermarkets, grocery stores) dominating distribution, alongside a substantial on-trade presence (restaurants, bars). Leading companies such as Land O'Lakes, Nestlé, and Kraft Heinz actively compete within this market, leveraging brand recognition and product diversification to maintain competitiveness. Regional variations in consumption patterns and market dynamics exist, with the North American market projected to remain a significant contributor to overall market value.

The competitive landscape within the U.S. dairy market requires ongoing adaptation. Established players face pressure from smaller, regional producers emphasizing sustainability and local sourcing. Strategies to address consumer health concerns and sustainability initiatives are critical for success. The projected growth trajectory suggests continued investment in research and development, efficient production methods, and strategic marketing campaigns to capitalize on market expansion while effectively navigating the evolving consumer landscape. Government regulations regarding labeling and food safety also play a significant role and demand continuous attention. Successfully navigating these dynamics will be key to securing long-term market success within the U.S. dairy sector.

United States Dairy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States dairy market, covering market dynamics, industry trends, leading segments, key players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The report utilizes data from the historical period (2019-2024) and estimated data for 2025 to provide a robust and predictive analysis. Key market segments analyzed include Butter, and distribution channels include Off-Trade and On-Trade (Warehouse clubs, gas stations, etc.).

United States Dairy Market Market Dynamics & Concentration

The United States dairy market is characterized by a complex interplay of factors influencing its concentration and dynamism. Market share is heavily concentrated amongst large multinational players and domestic dairy cooperatives, creating both opportunities and challenges for smaller enterprises. The market exhibits moderate concentration, with the top five players holding an estimated xx% market share in 2025. Innovation is a key driver, with companies constantly seeking to develop new products and improve existing ones. Stringent regulatory frameworks governing food safety and labeling impact production and distribution. The market also faces competition from plant-based alternatives, pushing for innovation in dairy products. Consumer preferences, particularly towards healthier and more sustainable options, are influencing product development and marketing strategies.

- Mergers & Acquisitions (M&A): The dairy sector witnesses significant M&A activity, with xx deals recorded between 2019 and 2024. These deals often focus on expanding product portfolios, gaining access to new markets, and optimizing production capabilities.

- Market Share Concentration: The top five players in 2025 are projected to hold xx% of the market share.

- Innovation Drivers: Healthier options, extended shelf life products, and convenience are key innovation drivers.

- Regulatory Framework: FDA regulations and labeling requirements significantly impact market operations.

United States Dairy Market Industry Trends & Analysis

The US dairy market exhibits a robust growth trajectory, fueled by several key factors. The market has shown a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by rising consumer demand, particularly for value-added dairy products like yogurt and cheese. Technological advancements in production and processing have enhanced efficiency and product quality, contributing to market expansion. However, competitive pressures from plant-based alternatives and fluctuations in raw material prices pose challenges. Changing consumer preferences towards organic and sustainable dairy products are driving a shift in supply chains and production practices. Market penetration of organic dairy products is increasing at a rate of xx% annually.

Leading Markets & Segments in United States Dairy Market

The Off-Trade distribution channel dominates the US dairy market for butter, accounting for approximately xx% of total sales in 2025. This dominance stems from the widespread availability of butter in supermarkets, hypermarkets, and convenience stores. The On-Trade segment, encompassing warehouse clubs and gas stations, holds a smaller but steadily growing share, driven by increasing demand in these retail channels.

Key Drivers for Off-Trade Dominance:

- Extensive retail network.

- Established supply chains.

- Convenient access for consumers.

Growth Potential in On-Trade Segment:

- Growing consumer preference for convenience.

- Expansion of warehouse club and gas station retail formats.

- Strategic partnerships between dairy companies and retail chains.

United States Dairy Market Product Developments

The US dairy market witnesses continuous product innovation, with a focus on enhancing shelf life, improving nutritional profiles, and catering to diverse consumer preferences. Technological advancements such as high-pressure processing (HPP) and ultra-high temperature (UHT) processing enable longer shelf life, reducing waste and expanding distribution possibilities. Growing demand for organic, grass-fed, and lactose-free dairy products drives product diversification. The market is also seeing the rise of convenient, single-serving options and innovative flavor combinations.

Key Drivers of United States Dairy Market Growth

Several factors contribute to the growth of the US dairy market. Technological advancements in processing and packaging enhance efficiency and product quality. Growing consumer demand for dairy products, especially value-added ones, is a key driver. Favorable economic conditions increase disposable income, allowing consumers to spend more on dairy products. Government support programs and policies promoting dairy farming also contribute to market growth.

Challenges in the United States Dairy Market Market

The US dairy market faces significant challenges, including volatile raw material prices, impacting profitability. Supply chain disruptions due to unforeseen events (e.g., weather conditions, transportation issues) can hinder market stability. Stringent regulatory compliance costs and intense competition from both domestic and international players create pressure on margins. The increasing popularity of plant-based milk alternatives poses a threat to the traditional dairy market.

Emerging Opportunities in United States Dairy Market

Several opportunities exist for growth in the US dairy market. The rising demand for functional and fortified dairy products with added health benefits creates scope for innovation. Strategic partnerships between dairy companies and food technology startups can accelerate product development and market penetration. Expansion into new markets and exploring export opportunities can provide significant growth potential. Technological breakthroughs in sustainable farming practices can improve the environmental footprint of the dairy industry.

Leading Players in the United States Dairy Market Sector

- Land O'Lakes Inc

- Nestlé SA

- The Kraft Heinz Company

- Schreiber Foods Inc

- Conagra Brands Inc

- Danone SA

- California Dairies Inc

- Dairy Farmers of America Inc

- Continental Dairy Facilities LLC

- Groupe Lactalis

- Froneri International Limited

- Prairie Farms Dairy Inc

Key Milestones in United States Dairy Market Industry

- August 2022: Dairy Farmers of America acquired two shelf-extended facilities of SmithFoods, aiming to capitalize on the growing demand for longer shelf-life products.

- November 2022: The Kraft Heinz Company launched the cheesecake kit Philly Handbag, demonstrating innovation in product offerings.

- December 2022: Lactalis Canada acquired Kraft Heinz's Grated Cheese business in Canada, expanding its presence in the ambient category.

Strategic Outlook for United States Dairy Market Market

The US dairy market is poised for continued growth, driven by innovation, evolving consumer preferences, and strategic partnerships. Companies focused on developing sustainable, value-added, and convenient dairy products will be well-positioned to capitalize on future opportunities. Strategic investments in technology and supply chain optimization will be crucial for maintaining competitiveness and ensuring long-term success in this dynamic market.

United States Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

United States Dairy Market Segmentation By Geography

- 1. United States

United States Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry

- 3.3. Market Restrains

- 3.3.1. Health Concerns Pertaining to the Excessive Consumption of Fats and Oils

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Dairy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North America United States Dairy Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 6.1.4 Rest of North America

- 7. Europe United States Dairy Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Germany

- 7.1.3 France

- 7.1.4 Russia

- 7.1.5 Italy

- 7.1.6 Spain

- 7.1.7 Rest of Europe

- 8. Asia Pacific United States Dairy Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 India

- 8.1.2 China

- 8.1.3 Japan

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. South America United States Dairy Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of South America

- 10. Middle East and Africa United States Dairy Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 South Africa

- 10.1.2 Saudi Arabia

- 10.1.3 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Land O'Lakes Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestlé SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Kraft Heinz Compan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Schreiber Foods Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Conagra Brands Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danone SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 California Dairies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dairy Farmers of America Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Continental Dairy Facilities LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Groupe Lactalis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Froneri International Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Prairie Farms Dairy Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Land O'Lakes Inc

List of Figures

- Figure 1: United States Dairy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Dairy Market Share (%) by Company 2024

List of Tables

- Table 1: United States Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 3: United States Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United States Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: India United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United States Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East and Africa United States Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United States Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 33: United States Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: United States Dairy Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Dairy Market?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the United States Dairy Market?

Key companies in the market include Land O'Lakes Inc, Nestlé SA, The Kraft Heinz Compan, Schreiber Foods Inc, Conagra Brands Inc, Danone SA, California Dairies Inc, Dairy Farmers of America Inc, Continental Dairy Facilities LLC, Groupe Lactalis, Froneri International Limited, Prairie Farms Dairy Inc.

3. What are the main segments of the United States Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Health Concerns Pertaining to the Excessive Consumption of Fats and Oils.

8. Can you provide examples of recent developments in the market?

December 2022: Lactalis Canada acquired Kraft Heinz's Grated Cheese business in Canada, marking its entry into the ambient category.November 2022: The Kraft Heinz Company launched the cheesecake kit Philly Handbag.August 2022: Dairy Farmers of America acquired two shelf-extended facilities of SmithFoods. The strategy of this acquisition was to assist the corporation in capitalizing on the market's growing demand for products with extended shelf lives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Dairy Market?

To stay informed about further developments, trends, and reports in the United States Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence