Key Insights

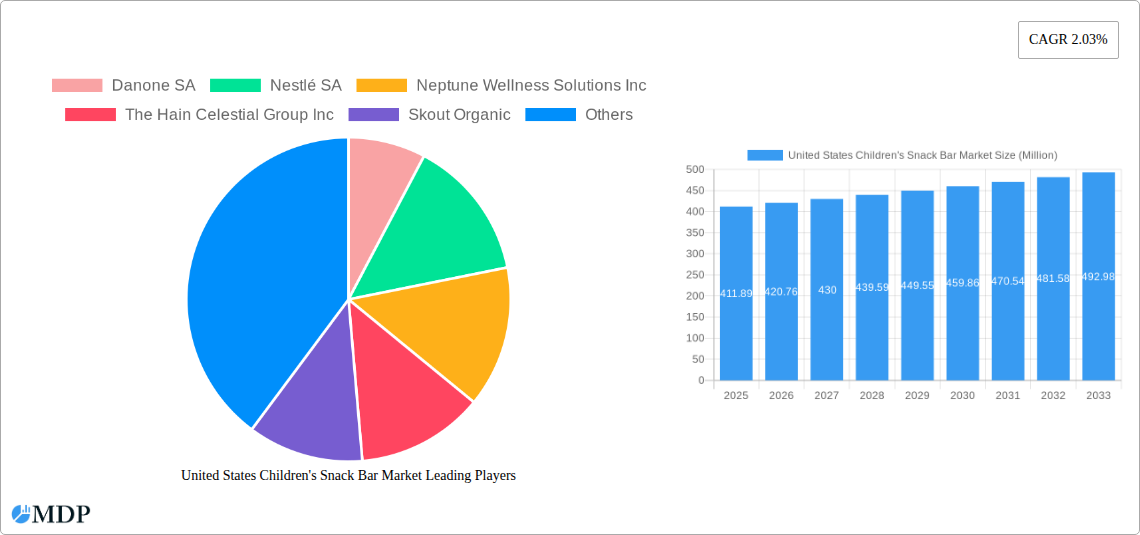

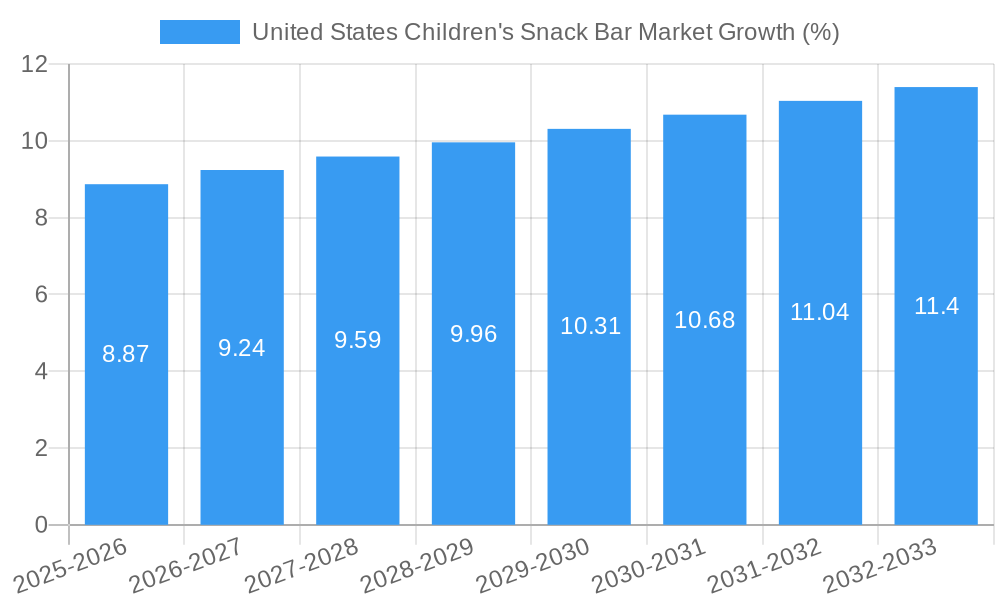

The United States children's snack bar market, valued at $411.89 million in 2025, is projected to experience steady growth, driven by increasing health consciousness among parents and a rising demand for convenient, nutritious options for their children. The Compound Annual Growth Rate (CAGR) of 2.03% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. Key drivers include the growing prevalence of busy lifestyles, leading to increased reliance on convenient snack options, and a greater emphasis on providing children with snacks that contribute to their overall well-being. This trend is further fueled by the increasing availability of organic and healthier snack bars specifically formulated to meet the nutritional needs of children, catering to the demand for reduced sugar and improved ingredient quality. However, factors such as fluctuating raw material prices and intense competition among established and emerging brands could act as restraints to market growth. The market segmentation, although not explicitly provided, likely includes categories based on ingredients (organic, whole grain, fruit-based, etc.), nutritional value (low sugar, high protein), and price points. Major players like Danone, Nestlé, and Mondelez International are actively engaged in product innovation and marketing strategies to capture significant market share, reflecting the competitive landscape.

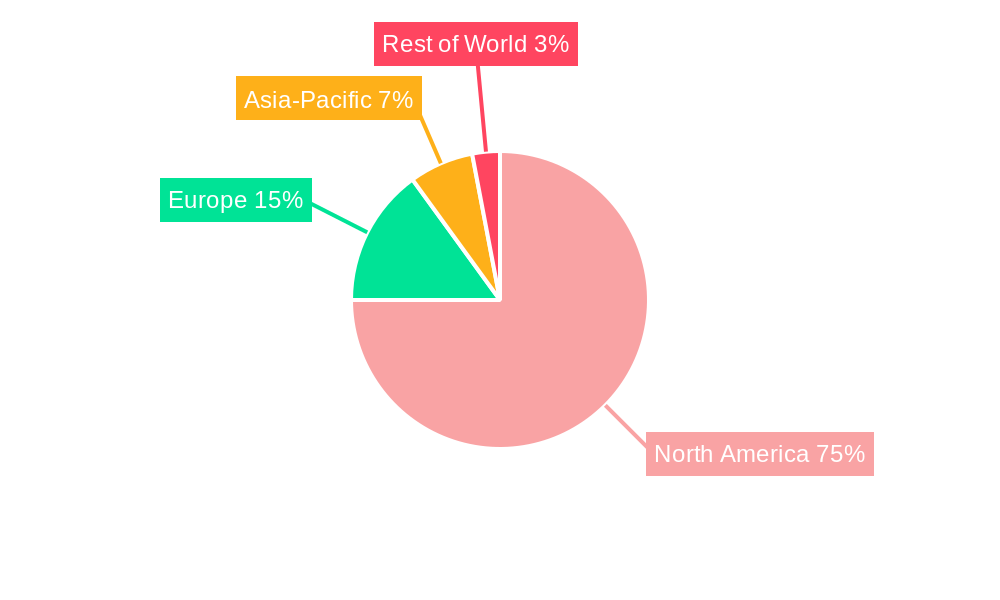

The forecast period (2025-2033) suggests a continued expansion of the market, with growth potentially accelerating due to evolving consumer preferences and product innovations. While the provided data doesn't offer precise segment breakdowns or regional specifics, we can infer regional dominance by North America (the US being a significant market) and competition based on factors such as product differentiation (e.g., organic versus conventional), marketing strategies (targeting health-conscious parents), and price competitiveness. The successful players in this market will likely be those who can effectively balance the consumer demand for healthy, convenient, and affordable options for their children. This requires navigating the complexities of raw material costs, maintaining brand loyalty, and adapting to evolving consumer trends in children's nutrition.

United States Children's Snack Bar Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the United States children's snack bar market, offering invaluable insights for stakeholders across the food and beverage industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report utilizes rigorous data analysis and market intelligence to deliver actionable strategies for growth and success. The report covers key market dynamics, industry trends, leading players, and future opportunities within this rapidly evolving sector. The market size is expected to reach xx Million by 2033.

United States Children's Snack Bar Market Market Dynamics & Concentration

The United States children's snack bar market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of smaller, niche players and the increasing prevalence of private labels demonstrate a dynamic and competitive environment. Market share analysis reveals that the top 5 players collectively hold approximately 60% of the market, while the remaining share is dispersed amongst numerous smaller brands. Innovation drives growth within the sector, with a focus on healthier formulations, functional ingredients, and appealing packaging. Stringent regulations regarding ingredients, labeling, and marketing to children also play a significant role in shaping market dynamics. The market experiences notable M&A activity, with an average of xx deals annually in the historical period (2019-2024). Product substitutes, such as fresh fruits, yogurt tubes, and other portable snacks, exert competitive pressure. However, the convenience and portability of snack bars often outweigh these substitutes. End-user trends toward healthier and more convenient options significantly fuel market growth.

United States Children's Snack Bar Market Industry Trends & Analysis

The US children's snack bar market demonstrates robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by several key trends: the increasing prevalence of busy lifestyles and the consequent demand for convenient snacks, a rising focus on healthier and nutritious snack options, and innovative product launches that cater to evolving consumer preferences. Technological disruptions have resulted in improved manufacturing techniques, leading to greater efficiency and better product quality. Consumer preference for organic, gluten-free, and allergen-free snack bars is driving significant innovation. Market penetration of organic and specialty snack bars is also rising, reflecting a shift towards premium and healthier alternatives. Competitive dynamics are marked by intense innovation and brand building, with key players vying to capture market share through product diversification and strategic marketing initiatives. Market penetration for organic snack bars is estimated at xx% in 2025, while the market penetration of gluten-free snack bars is at approximately xx%.

Leading Markets & Segments in United States Children's Snack Bar Market

The Western region of the United States currently represents the dominant market for children's snack bars. This dominance is attributed to several factors:

- Higher disposable incomes leading to increased spending on premium snack options.

- Greater awareness of health and wellness, driving demand for healthier snack alternatives.

- Strong retail infrastructure supporting wider product distribution.

- Higher adoption of convenience-oriented lifestyles.

A detailed analysis of consumer demographics and purchasing behavior within this region reveals a preference for organic, functional, and individually-wrapped snack bars. The market is segmented by product type (e.g., granola bars, fruit bars, energy bars), age group (e.g., toddlers, school-aged children, teenagers), and distribution channel (e.g., supermarkets, convenience stores, online retailers). The granola bar segment holds a significant market share, largely driven by its versatility and adaptability to various flavors and formulations.

United States Children's Snack Bar Market Product Developments

Recent product developments in the US children's snack bar market highlight a strong focus on functional ingredients, improved nutrition profiles, and enhanced taste. Manufacturers are increasingly incorporating probiotics, prebiotics, vitamins, and minerals to improve the nutritional value of snack bars. Technological advancements in food processing have resulted in the creation of snack bars with longer shelf lives and improved texture. The emphasis is on producing snack bars that are both tasty and nutritious, catering to the demands of health-conscious parents and the preferences of children. This increased focus on healthy ingredients and functional benefits is a significant differentiator in the competitive landscape.

Key Drivers of United States Children's Snack Bar Market Growth

Several key drivers fuel the growth trajectory of the US children's snack bar market. Firstly, the increasing prevalence of busy lifestyles necessitates convenient and portable snack options. Secondly, growing awareness of childhood nutrition and the escalating demand for healthier snacks propel market expansion. Thirdly, innovative product formulations, such as the incorporation of functional ingredients and the development of allergen-free options, create new market segments and drive growth. Finally, favorable government regulations and policies that support the production and distribution of healthier food products foster market development.

Challenges in the United States Children's Snack Bar Market Market

Despite significant growth, the market faces several challenges. Stringent regulatory requirements regarding ingredient labeling and marketing to children pose hurdles for manufacturers. Supply chain disruptions, fluctuating raw material costs, and intense competition among established brands and emerging players create significant pressure on profitability. Consumer preferences for natural and organic products necessitate constant innovation and increased production costs. These factors collectively affect the overall growth potential of the market.

Emerging Opportunities in United States Children's Snack Bar Market

The market presents numerous promising growth opportunities. Technological breakthroughs in food processing and packaging create opportunities for innovative products with enhanced shelf life and reduced environmental impact. Strategic partnerships between established food brands and smaller, specialized producers can drive product diversification and market expansion. Targeting niche market segments, such as children with specific dietary needs (e.g., allergies, intolerances), opens up avenues for growth. Expansion into underserved geographic regions offers untapped market potential.

Leading Players in the United States Children's Snack Bar Market Sector

- Danone SA

- Nestlé SA

- Neptune Wellness Solutions Inc

- The Hain Celestial Group Inc

- Skout Organic

- Ready Set Food!

- Cerebelly

- Sun-maid Growers of California

- Mondelez International Inc

- Mars Inc

Key Milestones in United States Children's Snack Bar Market Industry

- July 2023: Cerebelly launched its organic smart bars at Publix stores across the southeastern US, significantly expanding its distribution network.

- June 2023: READY. SET. FOOD! collaborated with Daniel Tiger's Neighborhood, leveraging brand recognition to introduce new toddler-friendly snack bars and facilitate allergen introduction.

- May 2023: Nestlé SA's Milo brand launched a new protein-rich snack bar, enhancing its product portfolio and targeting a health-conscious segment.

Strategic Outlook for United States Children's Snack Bar Market Market

The future of the US children's snack bar market is bright, driven by ongoing health and wellness trends, increasing demand for convenience, and continuous product innovation. Strategic opportunities lie in focusing on premium and specialized snack bars, expanding distribution networks through e-commerce and direct-to-consumer channels, and leveraging strategic partnerships for wider market reach. By adapting to evolving consumer preferences and leveraging technological advancements, market players can capitalize on this significant growth potential.

United States Children's Snack Bar Market Segmentation

-

1. Age

- 1.1. 6 Months - 2 Years

- 1.2. 2-4 Years

- 1.3. 4-6 years

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

United States Children's Snack Bar Market Segmentation By Geography

- 1. United States

United States Children's Snack Bar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenient and On-the-go Snacking Options Enticing Parents; Health-focused Children's Snack Bars Augmenting Market Demand

- 3.3. Market Restrains

- 3.3.1. Convenient and On-the-go Snacking Options Enticing Parents; Health-focused Children's Snack Bars Augmenting Market Demand

- 3.4. Market Trends

- 3.4.1. Supermarkets/Hypermarkets Remain a Significant Distribution Channel

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Children's Snack Bar Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Age

- 5.1.1. 6 Months - 2 Years

- 5.1.2. 2-4 Years

- 5.1.3. 4-6 years

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Age

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Danone SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestlé SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neptune Wellness Solutions Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Hain Celestial Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skout Organic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ready Set Food!

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cerebelly

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sun-maid Growers of California

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondelez International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mars Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Danone SA

List of Figures

- Figure 1: United States Children's Snack Bar Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Children's Snack Bar Market Share (%) by Company 2024

List of Tables

- Table 1: United States Children's Snack Bar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Children's Snack Bar Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United States Children's Snack Bar Market Revenue Million Forecast, by Age 2019 & 2032

- Table 4: United States Children's Snack Bar Market Volume Million Forecast, by Age 2019 & 2032

- Table 5: United States Children's Snack Bar Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: United States Children's Snack Bar Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: United States Children's Snack Bar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Children's Snack Bar Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: United States Children's Snack Bar Market Revenue Million Forecast, by Age 2019 & 2032

- Table 10: United States Children's Snack Bar Market Volume Million Forecast, by Age 2019 & 2032

- Table 11: United States Children's Snack Bar Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: United States Children's Snack Bar Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: United States Children's Snack Bar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Children's Snack Bar Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Children's Snack Bar Market?

The projected CAGR is approximately 2.03%.

2. Which companies are prominent players in the United States Children's Snack Bar Market?

Key companies in the market include Danone SA, Nestlé SA, Neptune Wellness Solutions Inc, The Hain Celestial Group Inc, Skout Organic, Ready Set Food!, Cerebelly, Sun-maid Growers of California, Mondelez International Inc, Mars Inc *List Not Exhaustive.

3. What are the main segments of the United States Children's Snack Bar Market?

The market segments include Age, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 411.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Convenient and On-the-go Snacking Options Enticing Parents; Health-focused Children's Snack Bars Augmenting Market Demand.

6. What are the notable trends driving market growth?

Supermarkets/Hypermarkets Remain a Significant Distribution Channel.

7. Are there any restraints impacting market growth?

Convenient and On-the-go Snacking Options Enticing Parents; Health-focused Children's Snack Bars Augmenting Market Demand.

8. Can you provide examples of recent developments in the market?

July 2023: Cerebelly launched its bars at Publix stores throughout the southeast United States. Cerebelly claimed to offer an assortment of organic smart bars throughout Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Virginia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Children's Snack Bar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Children's Snack Bar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Children's Snack Bar Market?

To stay informed about further developments, trends, and reports in the United States Children's Snack Bar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence