Key Insights

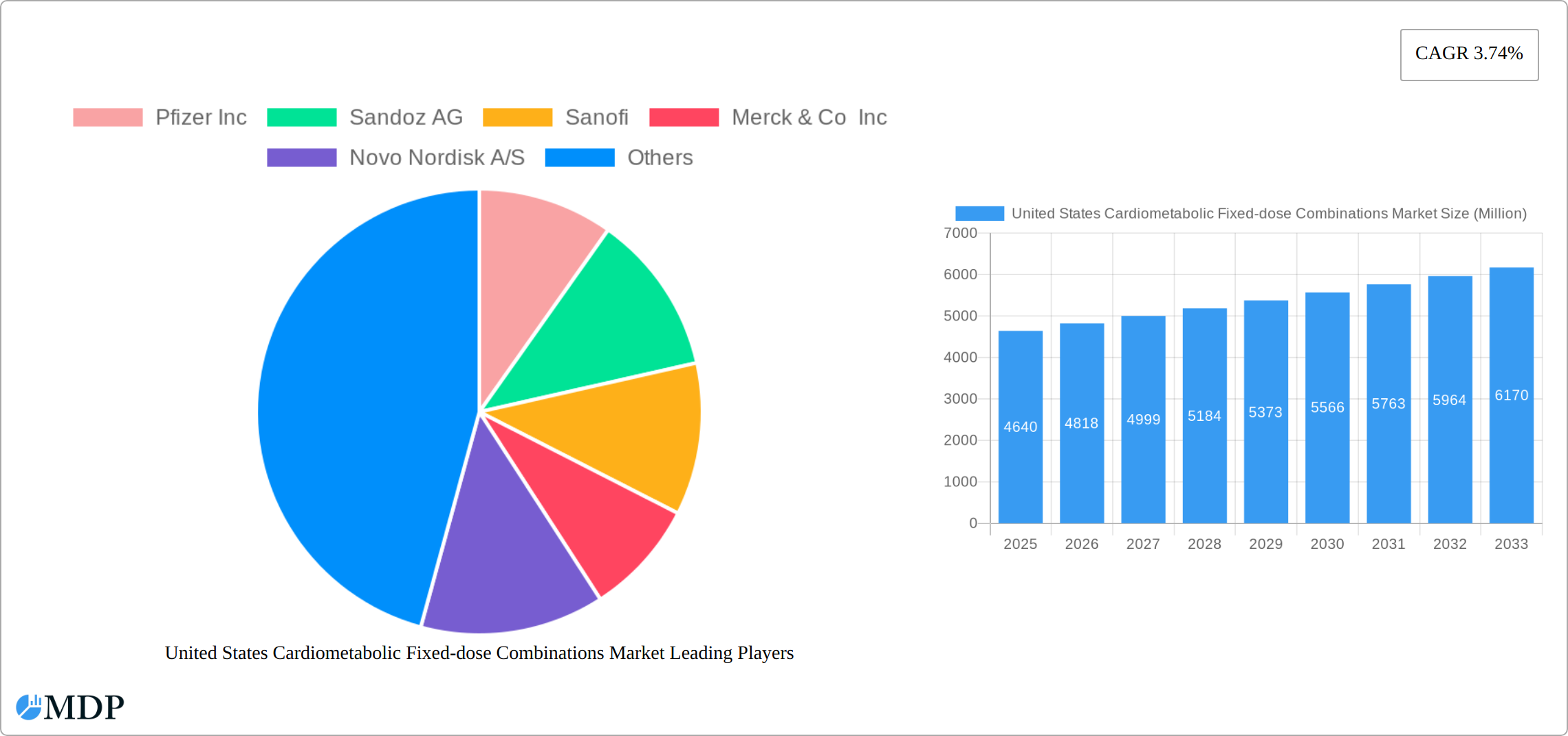

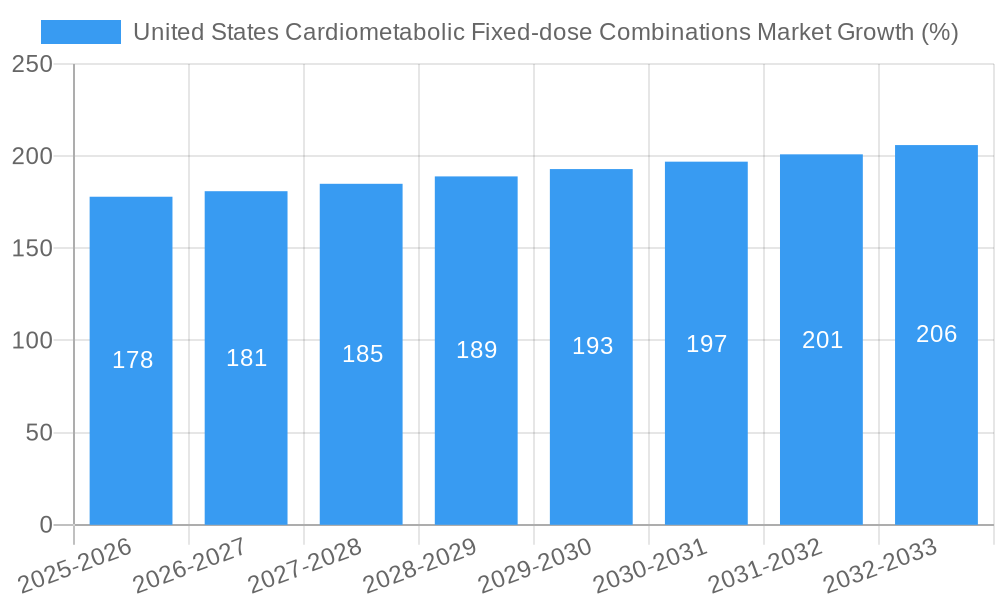

The United States cardiometabolic fixed-dose combinations market, valued at $4.64 billion in 2025, is projected to experience steady growth, driven by the increasing prevalence of cardiometabolic diseases like hypertension, diabetes, and dyslipidemia. The aging population and rising lifestyle-related risk factors, such as obesity, sedentary lifestyles, and unhealthy diets, significantly contribute to this market expansion. Furthermore, the convenience and improved patient adherence associated with fixed-dose combinations, compared to taking multiple individual medications, are key drivers. While the market faces restraints such as potential side effects and drug interactions inherent in combination therapies, ongoing research and development into safer and more effective formulations are mitigating these concerns. The market's segmentation likely includes various combinations targeting specific cardiometabolic conditions, such as antihypertensive/lipid-lowering combinations or antihypertensive/diabetes medications. Major pharmaceutical companies, including Pfizer, Sanofi, and Merck, dominate the market, leveraging their extensive research capabilities and established distribution networks. A projected CAGR of 3.74% from 2025 to 2033 suggests a continued, albeit moderate, expansion of this market, influenced by factors like ongoing innovation in drug development and evolving treatment guidelines.

The market's growth trajectory is expected to be influenced by several factors. Firstly, advancements in drug development leading to newer, more effective fixed-dose combinations with improved safety profiles will stimulate growth. Secondly, the increasing focus on preventative care and early intervention strategies within healthcare systems should lead to higher adoption rates. However, cost-effectiveness considerations and the stringent regulatory landscape governing new drug approvals could act as potential restraints. The competition among major pharmaceutical players is intense, with each striving to improve its market share through strategic alliances, mergers, and acquisitions, as well as through the development of innovative products. The geographical distribution within the US market likely shows higher concentrations in regions with larger aging populations and higher prevalence of cardiometabolic diseases.

United States Cardiometabolic Fixed-dose Combinations Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States cardiometabolic fixed-dose combinations market, offering invaluable insights for stakeholders across the pharmaceutical and healthcare industries. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future growth opportunities. The report includes detailed analysis of market size (in Millions), CAGR, and market penetration for key segments.

United States Cardiometabolic Fixed-dose Combinations Market Market Dynamics & Concentration

The United States cardiometabolic fixed-dose combinations market is characterized by a moderately concentrated landscape with several major players holding significant market share. Key drivers of market innovation include advancements in drug delivery systems, the development of novel combination therapies targeting multiple metabolic pathways, and ongoing research into personalized medicine approaches. The regulatory framework, including the FDA approval process, plays a crucial role in shaping market dynamics. The availability of effective substitutes, such as monotherapies and lifestyle interventions, influences market competition. End-user trends, such as increasing awareness of cardiometabolic diseases and a growing preference for convenient treatment options, are driving market growth. Mergers and acquisitions (M&A) activity is relatively high, with companies strategically acquiring smaller players to expand their product portfolios and market presence.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025 (estimated).

- M&A Activity: An estimated xx M&A deals occurred within the cardiometabolic fixed-dose combinations market between 2019 and 2024.

- Innovation Drivers: Advancements in drug delivery, novel combination therapies, and personalized medicine are key drivers.

- Regulatory Landscape: The FDA approval process significantly influences market entry and product lifecycle.

- Product Substitutes: The availability of monotherapies and lifestyle modifications present competitive challenges.

United States Cardiometabolic Fixed-dose Combinations Market Industry Trends & Analysis

The US cardiometabolic fixed-dose combinations market exhibits a robust growth trajectory, driven by factors such as the rising prevalence of cardiometabolic diseases (including diabetes, hypertension, and dyslipidemia), an aging population, and increasing healthcare expenditure. Technological disruptions, such as advancements in diagnostic tools and personalized medicine, are reshaping the market landscape. Consumer preferences are shifting toward convenient, effective, and well-tolerated treatment options, further fueling market growth. Competitive dynamics are intense, with companies focusing on innovation, strategic partnerships, and market expansion strategies to gain a competitive edge. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Leading Markets & Segments in United States Cardiometabolic Fixed-dose Combinations Market

The dominant segment within the US cardiometabolic fixed-dose combinations market is currently the treatment of type 2 diabetes, followed by hypertension and dyslipidemia management. This dominance stems from several factors:

- High Prevalence: The high and growing prevalence of type 2 diabetes in the US population.

- Favorable Reimbursement Policies: Governmental and private insurance coverage for these treatments.

- Strong Pipeline: Significant ongoing research and development of new combination therapies.

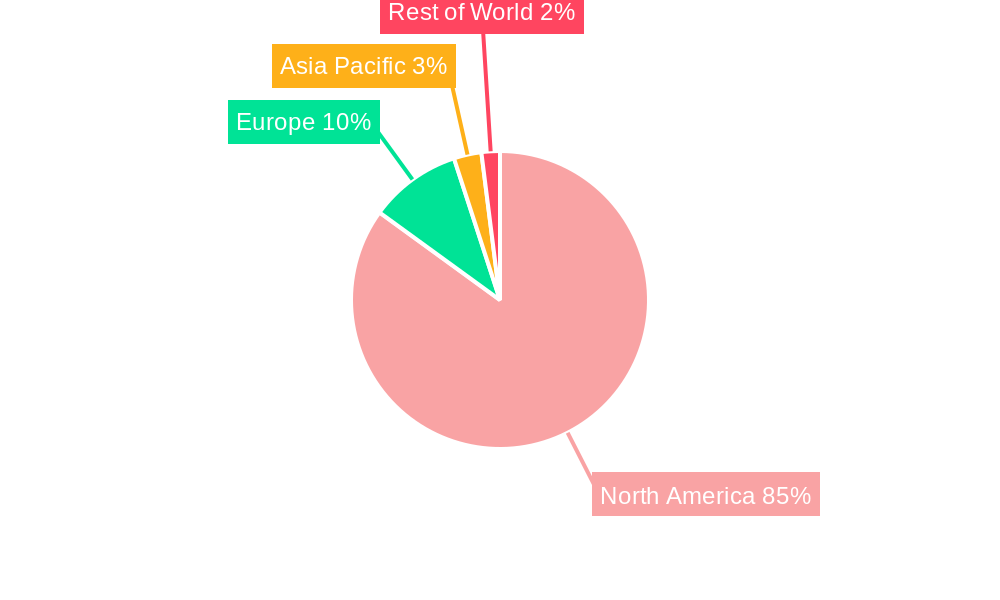

The leading geographical market is the urban areas of the Eastern and Western coasts, reflecting higher healthcare access, prevalence of the target diseases, and stronger economic development.

- Economic Policies: Governmental initiatives to control healthcare costs influence market access and pricing.

- Healthcare Infrastructure: A robust healthcare infrastructure supports market growth.

United States Cardiometabolic Fixed-dose Combinations Market Product Developments

Recent product innovations have focused on developing fixed-dose combinations with improved efficacy, safety, and tolerability profiles. These advancements include the incorporation of novel drug molecules, improved formulations for enhanced bioavailability, and the development of combination therapies targeting multiple cardiometabolic risk factors. This trend reflects a shift towards personalized medicine, with the aim to offer tailored treatment options based on individual patient needs and characteristics. The market fit for these innovative products is strong, given the significant unmet medical need for effective and convenient treatment of cardiometabolic diseases.

Key Drivers of United States Cardiometabolic Fixed-dose Combinations Market Growth

Several factors contribute to the significant growth of this market.

- Rising Prevalence of Cardiometabolic Diseases: The increasing prevalence of diabetes, hypertension, and dyslipidemia drives demand.

- Technological Advancements: Innovations in drug delivery and combination therapies improve treatment options.

- Favorable Regulatory Environment: Supportive regulatory frameworks encourage the development and market entry of new products.

Challenges in the United States Cardiometabolic Fixed-dose Combinations Market Market

Despite the strong growth prospects, the market faces significant challenges.

- High Research & Development Costs: The considerable investment needed to develop new drugs poses a barrier.

- Stringent Regulatory Approvals: The rigorous regulatory hurdles increase the time and cost associated with product launches.

- Intense Competition: The market is highly competitive, leading to price pressures.

Emerging Opportunities in United States Cardiometabolic Fixed-dose Combinations Market

The long-term growth of this market is fueled by several factors.

- Technological Breakthroughs: Further advancements in drug delivery, personalized medicine, and combination therapies will drive innovation.

- Strategic Partnerships: Collaborative efforts between pharmaceutical companies and healthcare providers can enhance market penetration.

- Expansion into Emerging Markets: Targeting underserved populations and expanding into new geographic areas offer significant opportunities.

Leading Players in the United States Cardiometabolic Fixed-dose Combinations Market Sector

- Pfizer Inc

- Sandoz AG

- Sanofi

- Merck & Co Inc

- Novo Nordisk A/S

- Boehringer Ingelheim International GmbH

- Azurity Pharmaceuticals Inc

- Rehab-Robotics Company Limited

- AstraZeneca

*List Not Exhaustive

Key Milestones in United States Cardiometabolic Fixed-dose Combinations Market Industry

- September 2024: Eli Lilly and Company announced positive topline results from the QWINT-1 and QWINT-3 phase 3 clinical trials evaluating once-weekly insulin efsitora alfa. This could significantly impact the market with the introduction of a novel insulin regimen.

- August 2024: NewAmsterdam Pharma initiated a phase III trial for a fixed-dose combination of obicetrapib and ezetimibe. Positive results (expected October 2024) could lead to a new competitive entry in the lipid-lowering market.

- March 2024: Empros Pharma commenced dosing in a Phase III trial for an obesity fixed-dose combination therapy. Successful completion could expand treatment options for obesity-related cardiometabolic conditions.

Strategic Outlook for United States Cardiometabolic Fixed-dose Combinations Market Market

The future of the US cardiometabolic fixed-dose combinations market is promising. Continued innovation in drug development, coupled with strategic partnerships and market expansion strategies, will fuel growth. The focus on personalized medicine and the development of combination therapies targeting multiple metabolic pathways will significantly shape the market landscape. The market's long-term potential is driven by the persistent high prevalence of cardiometabolic diseases and the continuous efforts of pharmaceutical companies to deliver more effective and convenient treatment options.

United States Cardiometabolic Fixed-dose Combinations Market Segmentation

-

1. Disease Type

- 1.1. Hypertension

- 1.2. Diabetes

- 1.3. Dyslipidemia

- 1.4. Others

-

2. Formulation Type

- 2.1. Oral Tablets and Capsules

- 2.2. Injectable Combinations

United States Cardiometabolic Fixed-dose Combinations Market Segmentation By Geography

- 1. United States

United States Cardiometabolic Fixed-dose Combinations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cardiometabolic Diseases Across the Country; Continuous Innovations in Drug Formulation and Delivery

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalence of Cardiometabolic Diseases Across the Country; Continuous Innovations in Drug Formulation and Delivery

- 3.4. Market Trends

- 3.4.1. Hypertension is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cardiometabolic Fixed-dose Combinations Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Hypertension

- 5.1.2. Diabetes

- 5.1.3. Dyslipidemia

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Formulation Type

- 5.2.1. Oral Tablets and Capsules

- 5.2.2. Injectable Combinations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Pfizer Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sandoz AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sanofi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck & Co Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Novo Nordisk A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boehringer Ingelheim International GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Azurity Pharmaceuticals Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rehab-Robotics Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AstraZeneca*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Pfizer Inc

List of Figures

- Figure 1: United States Cardiometabolic Fixed-dose Combinations Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Cardiometabolic Fixed-dose Combinations Market Share (%) by Company 2024

List of Tables

- Table 1: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Disease Type 2019 & 2032

- Table 4: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Disease Type 2019 & 2032

- Table 5: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Formulation Type 2019 & 2032

- Table 6: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Formulation Type 2019 & 2032

- Table 7: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Disease Type 2019 & 2032

- Table 10: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Disease Type 2019 & 2032

- Table 11: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Formulation Type 2019 & 2032

- Table 12: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Formulation Type 2019 & 2032

- Table 13: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cardiometabolic Fixed-dose Combinations Market?

The projected CAGR is approximately 3.74%.

2. Which companies are prominent players in the United States Cardiometabolic Fixed-dose Combinations Market?

Key companies in the market include Pfizer Inc, Sandoz AG, Sanofi, Merck & Co Inc, Novo Nordisk A/S, Boehringer Ingelheim International GmbH, Azurity Pharmaceuticals Inc, Rehab-Robotics Company Limited, AstraZeneca*List Not Exhaustive.

3. What are the main segments of the United States Cardiometabolic Fixed-dose Combinations Market?

The market segments include Disease Type, Formulation Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cardiometabolic Diseases Across the Country; Continuous Innovations in Drug Formulation and Delivery.

6. What are the notable trends driving market growth?

Hypertension is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Prevalence of Cardiometabolic Diseases Across the Country; Continuous Innovations in Drug Formulation and Delivery.

8. Can you provide examples of recent developments in the market?

September 2024: Eli Lilly and Company published positive topline results from the QWINT-1 and QWINT-3, phase 3 clinical trials, which evaluated once-weekly insulin efsitora alfa (efsitora) in adults with type 2 diabetes who were either insulin-naïve or had switched from daily basal insulin injections.August 2024: NewAmsterdam Pharma initiated a phase III randomized trial in the United States to evaluate the efficacy, safety, and tolerability of the fixed-dose combination of obicetrapib 10 mg and ezetimibe 10 mg as an adjunct to diet and maximally tolerated lipid-lowering therapy. The study started in August 2024, and the results are expected by October 2024.March 2024: Empros Pharma initiated the dosing of the first subjects in its obesity fixed-dose combination therapy during a Phase III trial b in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cardiometabolic Fixed-dose Combinations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cardiometabolic Fixed-dose Combinations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cardiometabolic Fixed-dose Combinations Market?

To stay informed about further developments, trends, and reports in the United States Cardiometabolic Fixed-dose Combinations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence