Key Insights

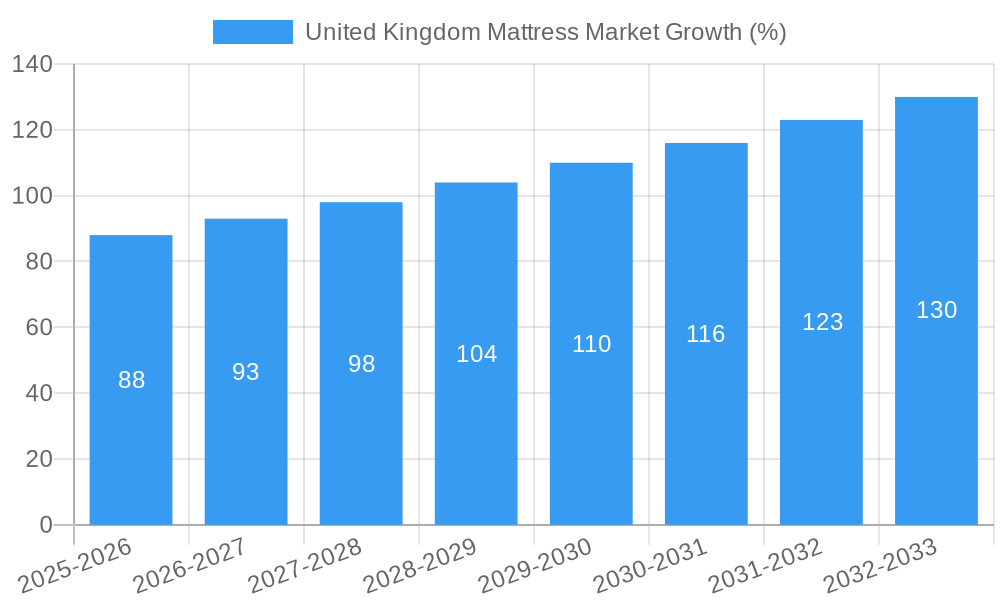

The United Kingdom mattress market, valued at approximately £1.58 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 5.42% from 2025 to 2033. This expansion is driven by several key factors. Increasing disposable incomes are allowing consumers to invest in higher-quality mattresses for improved sleep and health. The rise of e-commerce has broadened access to a wider range of products and brands, fostering competition and driving innovation. Furthermore, a growing awareness of the importance of sleep hygiene and its impact on overall well-being is fueling demand for specialized mattresses catering to specific sleep preferences and health needs. The market segments are diverse, with innerspring mattresses maintaining a significant share, yet memory foam and latex options are experiencing rapid growth due to their comfort and ergonomic benefits. The residential sector dominates the application segment, though the commercial sector, encompassing hotels and hospitality, is also showing promising growth. Online distribution channels are gaining traction, mirroring the broader e-commerce trends in the UK retail landscape. Leading brands such as Silentnight, Simba, and Vispring compete alongside a mix of smaller, specialized manufacturers, creating a dynamic and competitive market.

The market faces some challenges, however. Fluctuations in raw material costs, particularly for foam and natural latex, can impact profitability. Economic downturns could also affect consumer spending on non-essential items like premium mattresses. Furthermore, increased competition from international brands and the potential for supply chain disruptions could pose risks. Nevertheless, the long-term outlook for the UK mattress market remains positive, driven by population growth, urbanization, and the increasing focus on health and wellness. The market is expected to see continued innovation in materials and designs, including the emergence of smart mattresses and personalized sleep solutions. The growth will likely be skewed towards premium and specialized segments reflecting evolving consumer preferences. Successful players will need to focus on effective marketing strategies that highlight product quality, comfort, and health benefits to maintain a strong market position.

United Kingdom Mattress Market: A Comprehensive Market Report (2019-2033)

This meticulously researched report provides a deep dive into the dynamic United Kingdom mattress market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a comprehensive analysis spanning the period from 2019 to 2033, including a detailed forecast from 2025 to 2033 (Base Year: 2025, Estimated Year: 2025), this report unveils the key trends, challenges, and opportunities shaping this multi-Million pound industry.

United Kingdom Mattress Market Dynamics & Concentration

The UK mattress market exhibits a moderately concentrated landscape, with several major players commanding significant market share. Market concentration is influenced by brand recognition, distribution networks, and innovative product offerings. While precise market share figures for individual companies are not publicly available for all players, leading brands like Silentnight, Simba, and Vispring hold considerable influence. The market has witnessed a notable increase in mergers and acquisitions (M&A) activity over the past few years (xx M&A deals in 2019-2024), driven primarily by the desire for expansion and enhanced market positioning. Innovation is a key driver, with companies continually introducing new materials, technologies (like smart mattresses), and designs to cater to evolving consumer preferences. Stringent regulatory frameworks, particularly concerning fire safety and material composition, significantly impact manufacturing processes and product development. The market also faces competition from substitute products, such as sleep systems and alternative bedding options. Consumer trends, including a rising demand for premium, eco-friendly, and health-conscious mattresses, further shape market dynamics.

- Market Concentration: Moderately Concentrated

- M&A Activity: xx deals (2019-2024)

- Key Innovation Drivers: New materials, smart technology, eco-friendly designs

- Regulatory Impact: Stringent fire safety and material regulations

- Substitute Products: Alternative bedding, sleep systems

United Kingdom Mattress Market Industry Trends & Analysis

The UK mattress market demonstrates robust growth, driven by a combination of factors. The market is experiencing a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several key factors: rising disposable incomes, increasing awareness of sleep hygiene, a growing preference for premium mattresses, and the proliferation of online sales channels. Technological advancements, particularly in materials science and smart-home integration, contribute significantly to product innovation and differentiation. Consumer preferences are shifting towards mattresses offering superior comfort, support, and durability, reflecting a greater emphasis on health and wellness. Competitive dynamics are intense, with companies employing various strategies, including product differentiation, branding, and aggressive marketing campaigns, to gain a larger market share. Market penetration of online sales channels is rapidly increasing, reaching xx% in 2024 and is expected to reach xx% by 2033.

Leading Markets & Segments in United Kingdom Mattress Market

The residential segment overwhelmingly dominates the UK mattress market, accounting for approximately xx% of total sales in 2024. Within the product type segment, memory foam and innerspring mattresses hold the largest shares, with memory foam gaining increasing popularity. Online distribution channels are rapidly gaining traction, although offline retail remains a significant player.

- Dominant Segment: Residential (xx%)

- Leading Product Type: Memory Foam and Innerspring

- Key Distribution Channel Growth: Online

Key Drivers:

- Residential Segment: Rising household incomes, increased homeownership.

- Memory Foam: Enhanced comfort, pressure relief, technological advancements.

- Online Distribution: Convenience, wider selection, competitive pricing.

United Kingdom Mattress Market Product Developments

Recent product developments focus on incorporating advanced materials such as advanced foam blends, hybrid designs combining different materials for optimized support and comfort, and the integration of smart technologies for sleep tracking and personalized comfort settings. These innovations address the growing consumer demand for personalized sleep experiences and enhanced health benefits. Competitive advantages are derived from superior comfort, durability, technological innovation, and effective branding and marketing.

Key Drivers of United Kingdom Mattress Market Growth

Several factors fuel the UK mattress market's expansion. Rising disposable incomes allow consumers to invest in higher-quality mattresses. Increased awareness of sleep hygiene and its impact on overall health is also a significant driver. The growing popularity of online shopping provides consumers with greater choice and convenience. Finally, continuous product innovation provides consumers with diverse choices to meet their individual needs and preferences.

Challenges in the United Kingdom Mattress Market Market

The UK mattress market faces challenges, including the increasing costs of raw materials impacting profitability. Intense competition from both established and emerging brands puts pressure on pricing and margins. Furthermore, concerns about sustainability and ethical sourcing of materials present challenges to manufacturers.

Emerging Opportunities in United Kingdom Mattress Market

Significant growth opportunities exist within the UK mattress market. The increasing demand for customizable and personalized mattresses presents substantial potential. The integration of smart technology offers a powerful avenue for product differentiation and value creation. Expanding into niche segments, such as eco-friendly and specialized medical mattresses, presents further growth avenues.

Leading Players in the United Kingdom Mattress Market Sector

- Ila Bank

- Eureeca

- Blue Group Hold Co Ltd

- Magniflex

- Cwallet

- Sleepeezee Holdings Ltd

- Carpenter Ltd

- Airsprung Group plc

- Tempur

- Bayzat

- Silentnight Group Ltd

- Vispring

- Simba

- Harrison Spinks Beds Ltd

Key Milestones in United Kingdom Mattress Market Industry

- April 2023: MattressNextDay partners with Simba, boosting sales for both brands.

- April 2023: The Register of Approved Mattress Recyclers (RAMR) launched, promoting responsible recycling practices.

Strategic Outlook for United Kingdom Mattress Market Market

The UK mattress market holds significant long-term growth potential. Strategic partnerships, technological innovation, and a focus on sustainability will be crucial for success. Companies that adapt to evolving consumer preferences and leverage digital channels effectively will be best positioned to capture market share and drive growth in the coming years.

United Kingdom Mattress Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United Kingdom Mattress Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Interior Trends is Driving the Market Growth; Growing Real Estate and Construction Industry

- 3.3. Market Restrains

- 3.3.1. Price Sensitivity is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rapidly Increasing Mattress Sales through Online Retailers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Mattress Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America United Kingdom Mattress Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United Kingdom Mattress Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United Kingdom Mattress Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United Kingdom Mattress Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa United Kingdom Mattress Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ila Bank

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eureeca

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blue Group Hold Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Magniflex

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cwallet**List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sleepeezee Holdings Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carpenter Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Airsprung Group plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tempur

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bayzat

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Silentnight Group Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vispring

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Simba

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Harrison Spinks Beds Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Ila Bank

List of Figures

- Figure 1: United Kingdom Mattress Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Mattress Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Mattress Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: United Kingdom Mattress Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: United Kingdom Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: United Kingdom Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: United Kingdom Mattress Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: United Kingdom Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United Kingdom Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United Kingdom Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Mattress Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 19: United Kingdom Mattress Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: United Kingdom Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 21: United Kingdom Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 22: United Kingdom Mattress Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 23: United Kingdom Mattress Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Mattress Market?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the United Kingdom Mattress Market?

Key companies in the market include Ila Bank, Eureeca, Blue Group Hold Co Ltd, Magniflex, Cwallet**List Not Exhaustive, Sleepeezee Holdings Ltd, Carpenter Ltd, Airsprung Group plc, Tempur, Bayzat, Silentnight Group Ltd, Vispring, Simba, Harrison Spinks Beds Ltd.

3. What are the main segments of the United Kingdom Mattress Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Interior Trends is Driving the Market Growth; Growing Real Estate and Construction Industry.

6. What are the notable trends driving market growth?

Rapidly Increasing Mattress Sales through Online Retailers.

7. Are there any restraints impacting market growth?

Price Sensitivity is Restraining the Market.

8. Can you provide examples of recent developments in the market?

April 2023: The UK-based bed retailer MattressNextDay announced a partnership with the brand Simba. Simba is a boxed-mattress brand and received over 50 awards for its products. The partnership is expected to benefit both companies to boost sales in the UK market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Mattress Market?

To stay informed about further developments, trends, and reports in the United Kingdom Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence