Key Insights

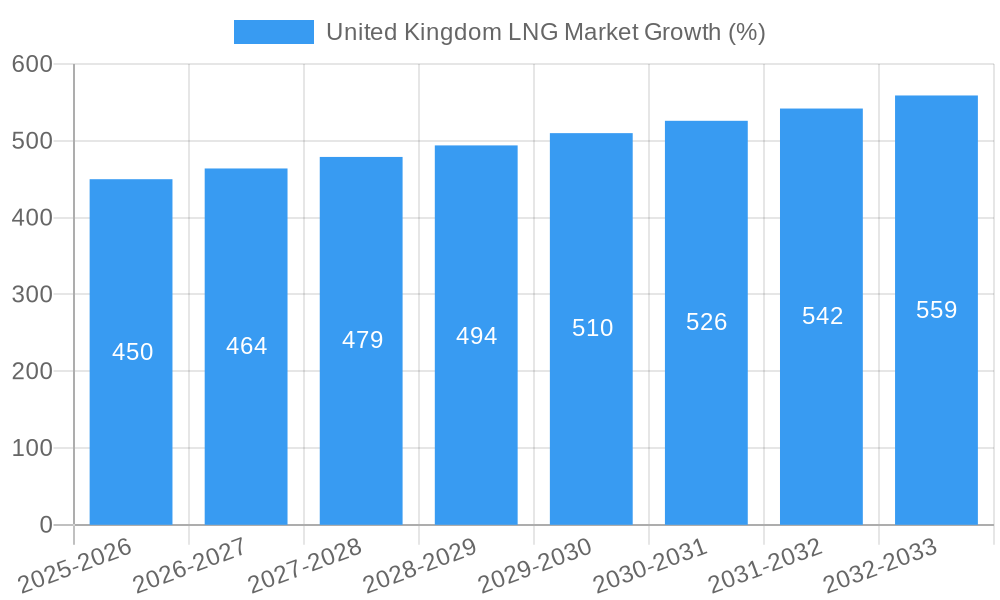

The United Kingdom LNG market is experiencing robust growth, driven by increasing energy demands and a strategic shift towards cleaner energy sources. While the UK has traditionally relied heavily on natural gas from the North Sea, declining domestic production and a commitment to reducing carbon emissions are fueling the demand for Liquefied Natural Gas (LNG) imports. This shift is supported by government policies promoting energy security and diversification, along with the expansion of LNG import infrastructure, including regasification terminals. The period from 2019 to 2024 witnessed a considerable market expansion, and this positive momentum is projected to continue throughout the forecast period (2025-2033). The fluctuating global LNG prices, coupled with geopolitical factors, will undeniably influence the market's trajectory. However, the UK's commitment to energy security and the growing need for flexible gas supply are expected to ensure steady growth, potentially exceeding a Compound Annual Growth Rate (CAGR) of 3% over the next decade.

The market's growth is not solely dependent on large-scale industrial consumers; the residential and commercial sectors also contribute significantly. Furthermore, the growing adoption of LNG as a transportation fuel, particularly in the heavy-duty vehicle sector, presents a new avenue for market expansion. Technological advancements in LNG production and transportation, alongside increasing efficiency in regasification, are expected to further reduce costs and enhance the overall competitiveness of LNG in the UK energy mix. Competitive dynamics within the market will also shape the future, with established players vying for market share alongside new entrants. Regulatory frameworks and environmental policies will play a crucial role in guiding the market's development, ensuring sustainable and responsible growth. We can expect continued investment in infrastructure and technology to support the anticipated growth of this vital energy sector.

United Kingdom LNG Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom LNG market, covering market dynamics, industry trends, leading segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and businesses seeking to understand the current landscape and future potential of the UK LNG sector. High-traffic keywords such as "UK LNG market," "LNG market analysis," "LNG industry trends," "UK energy market," and "LNG supply chain" are strategically incorporated throughout the report to maximize search engine visibility and attract relevant audiences.

United Kingdom LNG Market Market Dynamics & Concentration

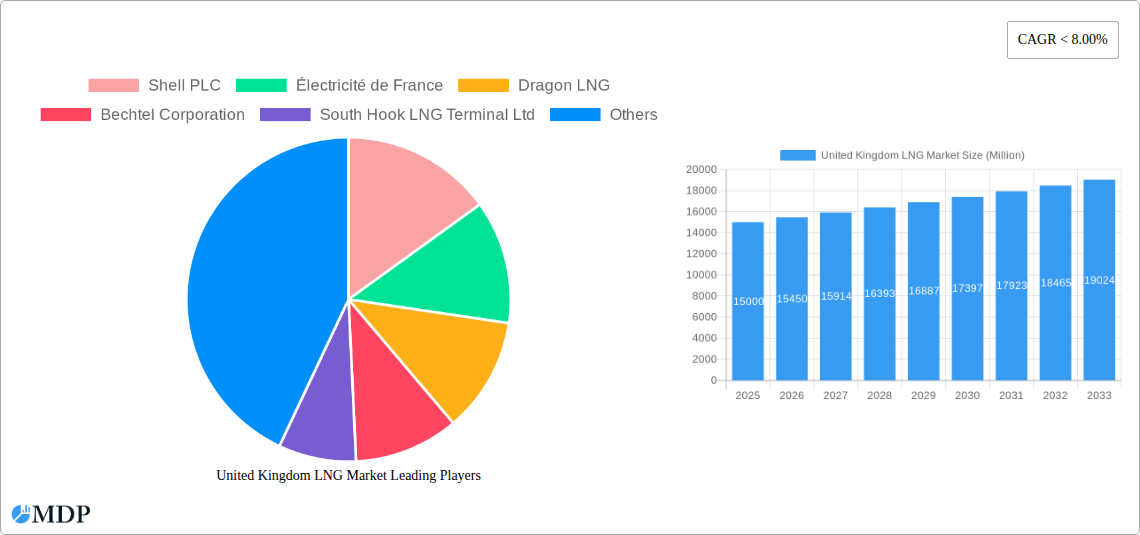

The UK LNG market exhibits a moderately concentrated landscape, dominated by major players such as Shell PLC, Électricité de France, and Dragon LNG. Market share analysis reveals Shell PLC holding approximately xx% of the market in 2025, followed by Électricité de France with xx% and Dragon LNG with xx%. The market's dynamics are shaped by several factors:

- Innovation Drivers: Technological advancements in LNG liquefaction, transportation, and regasification are driving efficiency gains and cost reductions.

- Regulatory Frameworks: Government policies related to energy security and emissions reduction significantly influence market growth and investment decisions. The UK's commitment to reducing carbon emissions is creating both opportunities and challenges for LNG.

- Product Substitutes: Competition from renewable energy sources, such as wind and solar power, and the increasing adoption of hydrogen, present challenges to LNG's market share.

- End-User Trends: The power generation sector remains the primary consumer of LNG, although growing demand from transportation and other industrial applications is expected.

- M&A Activities: The number of M&A deals in the UK LNG sector has seen a xx% increase from 2021-2024, driven by consolidation efforts and the need for strategic partnerships. Major players are actively seeking to expand their infrastructure and market presence.

United Kingdom LNG Market Industry Trends & Analysis

The UK LNG market is characterized by a CAGR of xx% during the forecast period (2025-2033). Market penetration is expected to increase significantly as the UK seeks to diversify its energy sources and reduce reliance on imported natural gas. Several factors are driving this growth:

- Market Growth Drivers: Increasing energy demand, stringent environmental regulations promoting cleaner energy sources (while LNG remains a transition fuel), and government initiatives to boost energy security are key drivers.

- Technological Disruptions: Advancements in LNG technologies are improving efficiency, reducing emissions, and creating new applications for LNG.

- Consumer Preferences: The shift towards cleaner energy is driving demand for LNG as a comparatively lower-emission fuel source compared to coal.

- Competitive Dynamics: Intense competition among existing and new entrants in the LNG market is fostering innovation and driving down prices.

Leading Markets & Segments in United Kingdom LNG Market

The power generation sector dominates the UK LNG market, accounting for approximately xx% of total consumption in 2025. This dominance is primarily attributed to:

- Key Drivers for Power Generation Dominance:

- Reliable Energy Source: LNG provides a stable and reliable energy supply to meet fluctuating electricity demand.

- Existing Infrastructure: The UK possesses established LNG import terminals and gas distribution networks.

- Government Support: Policies supporting the transition to cleaner fuels have indirectly supported LNG as a transition fuel.

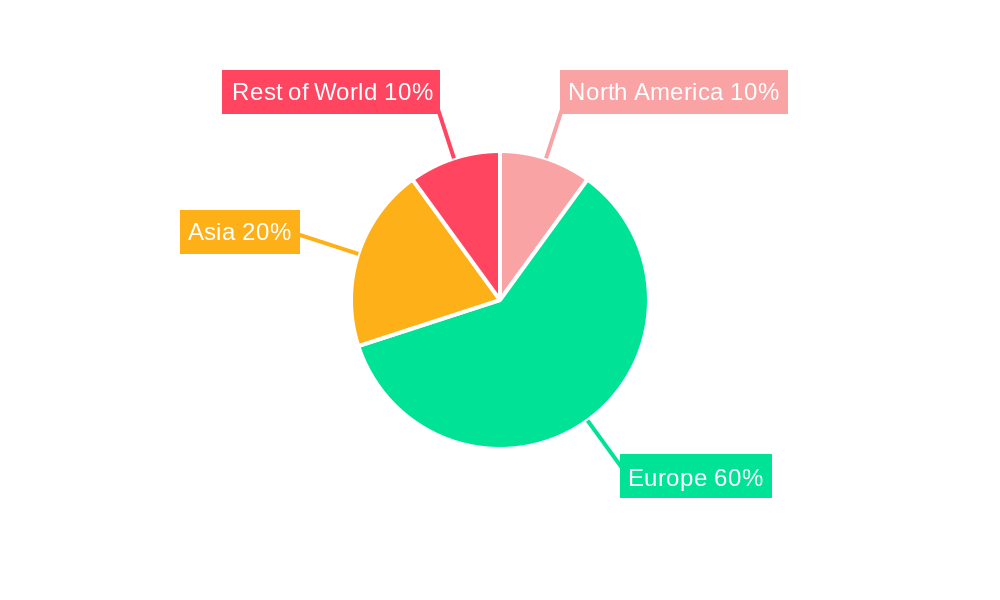

While transportation and other applications segments show significant growth potential, their market share is currently considerably smaller. A detailed analysis of regional variations within the UK market reveals that demand is highly concentrated in the south of England due to higher energy consumption.

United Kingdom LNG Market Product Developments

Recent product developments focus on improving the efficiency and environmental performance of LNG technologies. This includes innovations in liquefaction processes, improved storage and transportation solutions, and the development of cleaner burning LNG blends. These advancements are enhancing LNG's competitiveness and expanding its application range. The market is seeing a shift towards more efficient regasification technologies to minimize environmental impact.

Key Drivers of United Kingdom LNG Market Growth

Several factors are driving the growth of the UK LNG market:

- Energy Security: Diversifying energy sources reduces dependence on a single supplier.

- Technological Advancements: Improvements in LNG technologies are making it more cost-effective and environmentally friendly.

- Government Policies: Initiatives promoting cleaner energy sources are indirectly boosting LNG demand as a transition fuel.

Challenges in the United Kingdom LNG Market Market

The UK LNG market faces various challenges:

- Regulatory Uncertainty: Changing regulations related to emissions and energy security can create uncertainty for investors.

- Supply Chain Disruptions: Global geopolitical events can disrupt LNG supplies, increasing prices and impacting energy security.

- Competition from Renewables: The increasing competitiveness of renewable energy sources poses a significant challenge to LNG's long-term market share.

Emerging Opportunities in United Kingdom LNG Market

Significant opportunities exist for the UK LNG market:

- Technological Breakthroughs: Innovations in carbon capture and storage technologies can enhance LNG's environmental profile.

- Strategic Partnerships: Collaborations between LNG suppliers, infrastructure developers, and energy companies can accelerate market growth.

- Market Expansion: Increasing LNG use in transportation and other industrial applications can expand market size.

Leading Players in the United Kingdom LNG Market Sector

- Shell PLC

- Électricité de France

- Dragon LNG

- Bechtel Corporation

- South Hook LNG Terminal Ltd

- Ramboll Group A/S

- Fluor Corporation

- Npower Limited

Key Milestones in United Kingdom LNG Market Industry

- August 2022: Delfin LNG signs a deal to supply 1 Million metric tons of LNG annually to Centrica, signifying a potential shift towards floating LNG export terminals and long-term supply agreements. This indicates a growing confidence in the UK's LNG market.

Strategic Outlook for United Kingdom LNG Market Market

The UK LNG market is poised for continued growth, driven by ongoing energy demand and the need for energy diversification. Strategic investments in infrastructure, technological innovation, and sustainable practices will be crucial for maximizing the market's potential. The long-term outlook remains positive, particularly if technological advancements in emission reduction and carbon capture are successfully implemented. This could potentially extend the lifespan of LNG as a transition fuel, leading to consistent demand for the coming years.

United Kingdom LNG Market Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. Transportation

- 1.3. Other Applications

United Kingdom LNG Market Segmentation By Geography

- 1. United Kingdom

United Kingdom LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Transportation Segment to dominate the market during the forecast period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. Transportation

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 7. United Kingdom United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 8. France United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 9. Spain United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 10. Italy United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 11. Spain United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 12. Belgium United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 13. Netherland United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 14. Nordics United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Europe United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Shell PLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Électricité de France

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Dragon LNG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Bechtel Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 South Hook LNG Terminal Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ramboll Group A/S

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Fluor Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Npower Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Shell PLC

List of Figures

- Figure 1: United Kingdom LNG Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom LNG Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: United Kingdom LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United Kingdom LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: United Kingdom United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Spain United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Spain United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Belgium United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherland United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Nordics United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: United Kingdom LNG Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom LNG Market?

The projected CAGR is approximately < 8.00%.

2. Which companies are prominent players in the United Kingdom LNG Market?

Key companies in the market include Shell PLC, Électricité de France, Dragon LNG, Bechtel Corporation, South Hook LNG Terminal Ltd, Ramboll Group A/S, Fluor Corporation, Npower Limited.

3. What are the main segments of the United Kingdom LNG Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Drivers; Restraints.

6. What are the notable trends driving market growth?

Transportation Segment to dominate the market during the forecast period..

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In August 2022, Houston-based Delfin LNG signed a deal to supply LNG to a United Kingdom energy company that plans to construct a floating LNG export terminal off Louisiana's coast. This agreement involves Delfin LNG providing 1 million metric tons of LNG annually to Centrica, an energy company located in Windsor, England, which owns British Gas and Bord Gais Energy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom LNG Market?

To stay informed about further developments, trends, and reports in the United Kingdom LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence