Key Insights

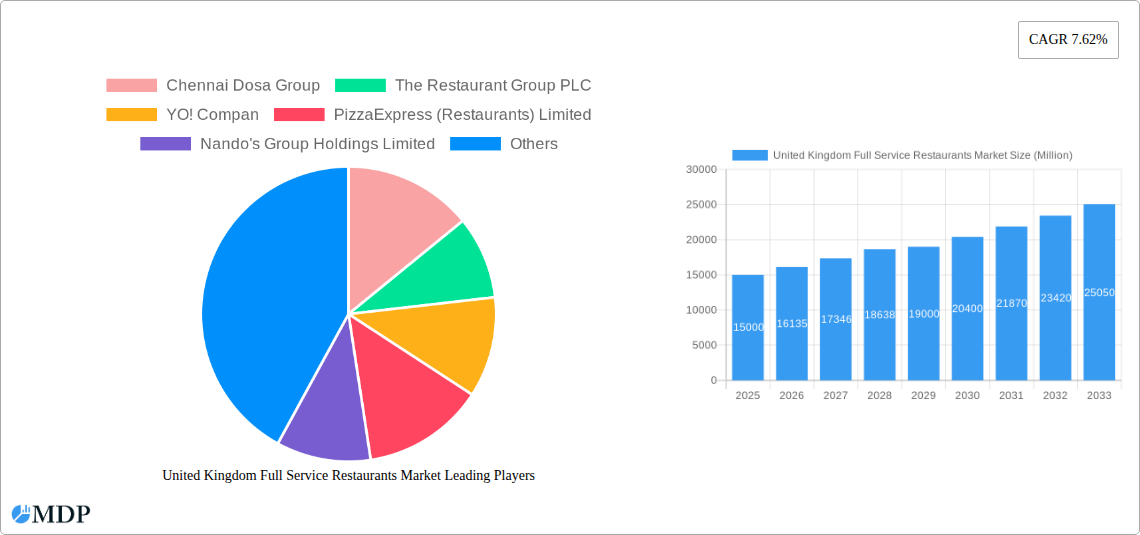

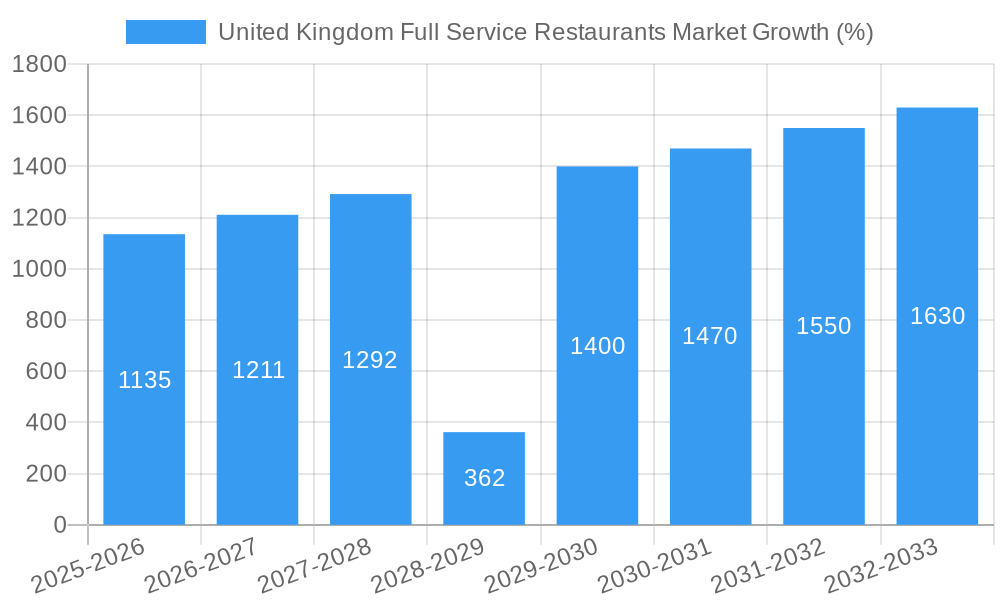

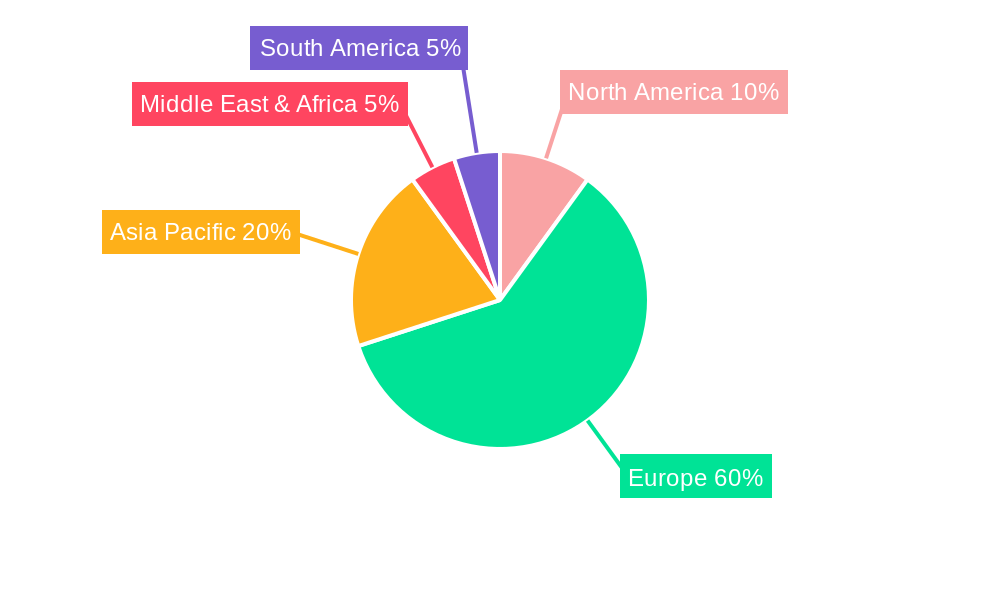

The United Kingdom Full Service Restaurant (FSR) market, exhibiting a robust CAGR of 7.62%, presents a dynamic landscape shaped by evolving consumer preferences and economic conditions. The market's segmentation reveals key trends: while chained outlets maintain a significant presence, independent restaurants are experiencing growth fueled by consumer demand for unique culinary experiences and local flavors. The leisure and lodging segments are significant contributors, driven by tourism and increased leisure spending. Within cuisine types, Asian and European cuisines hold considerable market share, while the rising popularity of global cuisines like Latin American and Middle Eastern options indicates a growing consumer adventurousness. The market's geographic distribution shows concentration in major UK cities, with London likely commanding the largest share. Competitive pressures are substantial, with established players like PizzaExpress and Nando's competing against smaller, independent operators and international chains. Challenges include fluctuating ingredient costs, labor shortages, and economic uncertainty impacting consumer spending. However, strategic investments in technology, improved customer service, and innovative menu offerings are key strategies driving market expansion.

The forecast period (2025-2033) suggests continued growth, albeit at a pace potentially influenced by macroeconomic factors. The sustained popularity of diverse cuisines, the rise of experiential dining, and the increasing emphasis on sustainability and ethical sourcing will likely shape future market dynamics. Successful players will be those who can adapt to evolving consumer demands, optimize operations for efficiency, and effectively leverage technological advancements to enhance the customer experience. Specifically, the independent outlet segment is poised for notable growth, driven by the increasing popularity of unique and locally sourced dining experiences. Data suggests that while chained outlets continue to dominate market share, the independent sector’s adaptability and focus on personalized service will contribute to a shift in market dynamics over the coming years. Expansion into untapped regional markets and strategic partnerships with local suppliers will also play a key role in future market growth.

United Kingdom Full Service Restaurants Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom Full Service Restaurants (FSR) market, offering valuable insights for stakeholders seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth opportunities. The market size is predicted to reach xx Million by 2033, showcasing significant growth potential.

United Kingdom Full Service Restaurants Market Dynamics & Concentration

The UK FSR market is characterized by a diverse range of players, from large multinational chains to independent, locally-owned establishments. Market concentration is moderate, with several key players holding significant market share, but also allowing space for smaller businesses to thrive. Innovation is a crucial driver, with restaurants constantly seeking new menu items, technologies, and service models to attract and retain customers. The regulatory framework, including food safety regulations and licensing requirements, significantly influences operational costs and market entry barriers. Substitute products, such as fast-casual dining and home-delivered meals, pose a competitive challenge. Consumer trends, including health consciousness, sustainability concerns, and evolving preferences for diverse culinary experiences, are constantly reshaping market demands. Mergers and acquisitions (M&A) activity is frequent, with larger chains expanding their portfolio and smaller businesses seeking strategic alliances. In the last 5 years, there were approximately xx M&A deals in the UK FSR market, with an average deal value of xx Million. Leading players such as The Restaurant Group PLC and Mitchells & Butlers PLC frequently drive consolidation. The market share of the top 5 players is estimated at xx% in 2025.

United Kingdom Full Service Restaurants Market Industry Trends & Analysis

The UK FSR market demonstrates robust growth, driven by several key factors. Rising disposable incomes and a growing preference for dining out contribute to increased demand. Technological advancements, particularly in online ordering and delivery platforms, are transforming the customer experience. Consumer preferences are diversifying, with increasing demand for ethnic cuisines and personalized dining experiences. The competitive landscape is dynamic, with both established chains and new entrants vying for market share. The Compound Annual Growth Rate (CAGR) for the UK FSR market during the forecast period (2025-2033) is estimated at xx%. Market penetration of online ordering and delivery services is increasing rapidly, expected to reach xx% by 2033. The increasing popularity of experience-led dining and the growth of the delivery market are driving significant growth, offsetting challenges such as inflationary pressures.

Leading Markets & Segments in United Kingdom Full Service Restaurants Market

The UK FSR market showcases a diverse segment landscape. European cuisine continues to dominate, followed by Asian and North American cuisines. However, other cuisines, such as Latin American and Middle Eastern, are gaining traction.

- Cuisine: European cuisine holds the largest market share, driven by its familiarity and broad appeal. Asian cuisine is experiencing rapid growth due to increasing consumer interest in diverse culinary experiences. North American cuisine maintains a strong presence.

- Outlet: Chained outlets hold a significant portion of the market share, benefiting from brand recognition and economies of scale. Independent outlets retain a considerable presence, offering unique dining experiences and contributing to the overall market diversity.

- Location: Standalone restaurants represent a significant proportion of the market. Leisure and retail locations are also popular. Lodging and travel segments are showing growth as more hotels and airports incorporate high-quality FSR options.

The dominance of specific segments is influenced by several factors, including consumer preferences, economic conditions, and geographical variations. London, as a major metropolitan area, remains a key market driver, attracting both domestic and international tourists. Strong infrastructure and favorable economic policies support this growth, and government initiatives promoting tourism also contribute positively.

United Kingdom Full Service Restaurants Market Product Developments

Recent years have witnessed significant product innovations in the UK FSR market. New menu items, focusing on health trends and catering to diverse dietary needs, are constantly being introduced. Technological advancements, such as automated ordering systems and customized mobile applications, are improving operational efficiency and the customer experience. The rise of plant-based and sustainable options reflect growing consumer preferences. These developments enhance the competitive advantages of restaurants that embrace innovation and adapt to changing consumer needs.

Key Drivers of United Kingdom Full Service Restaurants Market Growth

Several key factors fuel the growth of the UK FSR market:

- Rising Disposable Incomes: Increased disposable incomes allow consumers to spend more on dining out.

- Technological Advancements: Online ordering, delivery platforms, and automated systems enhance efficiency and customer experience.

- Changing Consumer Preferences: Growing demand for diverse cuisines, healthier options, and unique experiences drives innovation.

- Tourism: A robust tourism sector contributes significantly to the market's growth.

Challenges in the United Kingdom Full Service Restaurants Market

The UK FSR market faces certain challenges:

- Inflationary Pressures: Rising food and labor costs impact profitability.

- Supply Chain Disruptions: Global events can disrupt ingredient sourcing and increase costs.

- Intense Competition: The market is highly competitive, with both established chains and new entrants vying for customers.

- Regulatory Compliance: Food safety and licensing requirements necessitate significant investments and operational adjustments.

Emerging Opportunities in United Kingdom Full Service Restaurants Market

Significant growth opportunities exist in the UK FSR market. Technological innovation, such as AI-driven customer service, smart kitchen technologies, and data-driven personalization, offers potential for enhanced efficiency and customer satisfaction. Strategic partnerships with delivery platforms and other businesses can extend market reach and brand visibility. Expanding into underserved geographical areas or focusing on niche culinary offerings presents further growth opportunities.

Leading Players in the United Kingdom Full Service Restaurants Market Sector

- Chennai Dosa Group

- The Restaurant Group PLC

- YO! Compan

- PizzaExpress (Restaurants) Limited

- Nando's Group Holdings Limited

- The Big Table Group Limited

- TGI Fridays Franchisor LLC

- Mitchells & Butlers PLC

- Prezzo Holdings Limited

- The Azzuri Group

- Pizza Hut (U K ) Limited

Key Milestones in United Kingdom Full Service Restaurants Market Industry

- October 2022: Pizza Hut UK launched "Melts," a new product line, expanding its menu offerings and potentially attracting new customer segments.

- November 2022: PizzaExpress partnered with Just Eat and Uber Eats, leveraging delivery platforms to capitalize on the increased demand during the Winter World Cup.

- February 2023: The Big Table Group implemented PolyAI's conversational assistant, improving customer service and supporting its expansion plans, demonstrating an increased focus on customer experience.

Strategic Outlook for United Kingdom Full Service Restaurants Market

The UK FSR market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and strategic initiatives by market players. Opportunities lie in personalized dining experiences, sustainable practices, and leveraging data to enhance operational efficiency. Strategic partnerships and expansion into new markets will be crucial for long-term success. The market's future growth will depend on adapting to changing consumer needs and effectively navigating challenges like inflation and supply chain disruptions.

United Kingdom Full Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Asian

- 1.2. European

- 1.3. Latin American

- 1.4. Middle Eastern

- 1.5. North American

- 1.6. Other FSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Kingdom Full Service Restaurants Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Full Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein

- 3.4. Market Trends

- 3.4.1 A significant rise in tourist arrivals is driving substantial growth in the market

- 3.4.2 and new trends in dining contributing the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Asian

- 5.1.2. European

- 5.1.3. Latin American

- 5.1.4. Middle Eastern

- 5.1.5. North American

- 5.1.6. Other FSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. South America United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Brazil

- 7.1.2 Argentina

- 7.1.3 Rest of South America

- 8. Europe United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Germany

- 8.1.2 France

- 8.1.3 Italy

- 8.1.4 United Kingdom

- 8.1.5 Netherlands

- 8.1.6 Rest of Europe

- 9. Asia Pacific United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 China

- 9.1.2 Japan

- 9.1.3 India

- 9.1.4 South Korea

- 9.1.5 Taiwan

- 9.1.6 Australia

- 9.1.7 Rest of Asia-Pacific

- 10. Middle East & Africa United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 UAE

- 10.1.2 South Africa

- 10.1.3 Saudi Arabia

- 10.1.4 Rest of MEA

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Chennai Dosa Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Restaurant Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 YO! Compan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PizzaExpress (Restaurants) Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nando's Group Holdings Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Big Table Group Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TGI Fridays Franchisor LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mitchells & Butlers PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Prezzo Holdings Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Azzuri Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pizza Hut (U K ) Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Chennai Dosa Group

List of Figures

- Figure 1: United Kingdom Full Service Restaurants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Full Service Restaurants Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Germany United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia-Pacific United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: UAE United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Saudi Arabia United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of MEA United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 35: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 36: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 37: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Full Service Restaurants Market?

The projected CAGR is approximately 7.62%.

2. Which companies are prominent players in the United Kingdom Full Service Restaurants Market?

Key companies in the market include Chennai Dosa Group, The Restaurant Group PLC, YO! Compan, PizzaExpress (Restaurants) Limited, Nando's Group Holdings Limited, The Big Table Group Limited, TGI Fridays Franchisor LLC, Mitchells & Butlers PLC, Prezzo Holdings Limited, The Azzuri Group, Pizza Hut (U K ) Limited.

3. What are the main segments of the United Kingdom Full Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

A significant rise in tourist arrivals is driving substantial growth in the market. and new trends in dining contributing the market growth.

7. Are there any restraints impacting market growth?

Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein.

8. Can you provide examples of recent developments in the market?

February 2023: The Big Table Group announced that it would use PolyAI's customer-led conversational assistant to enhance customer service and foster its expansion. The Big Table Group added that it had accomplished its goal of answering 100% of customer calls at its Bella Italia and Café Rouge restaurants owing to PolyAI.November 2022: Just Eat and Uber Eats collaborated with PizzaExpress. To address the increased demand for delivery before the first-ever Winter World Cup, expected to be a popular time for American Hots and Peronis to be delivered straight to consumers' doors, PizzaExpress engaged in these new collaborations.October 2022: Pizza Hut introduced "Melts," a new product category with a wide range of offerings, including Pizza Hut MeltsTM. Pizza Hut MeltsTM are cheesy, crunchy, stuffed with toppings, and served with a perfectly matched dip.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Full Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Full Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Full Service Restaurants Market?

To stay informed about further developments, trends, and reports in the United Kingdom Full Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence