Key Insights

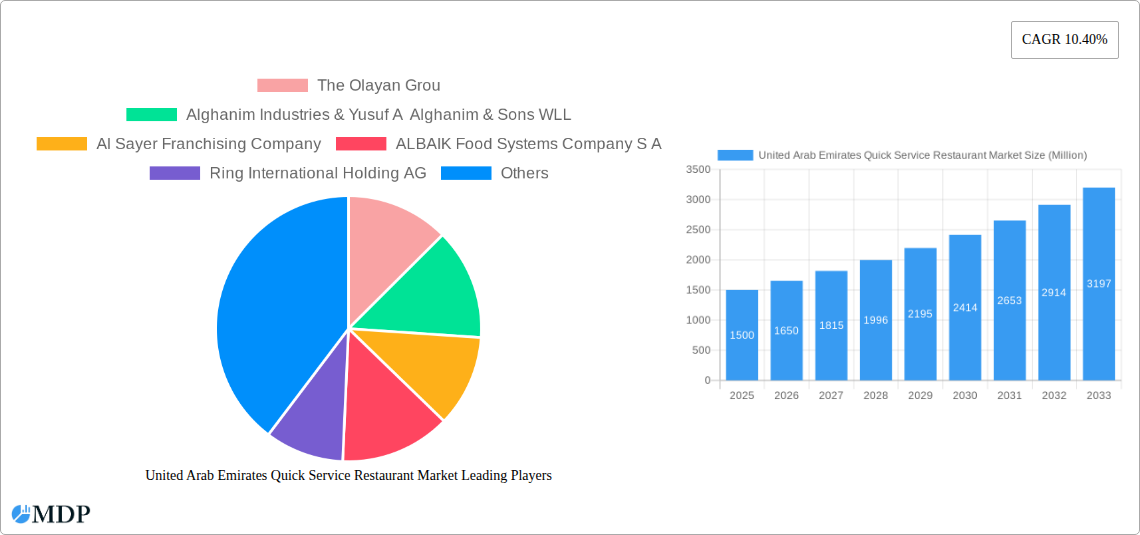

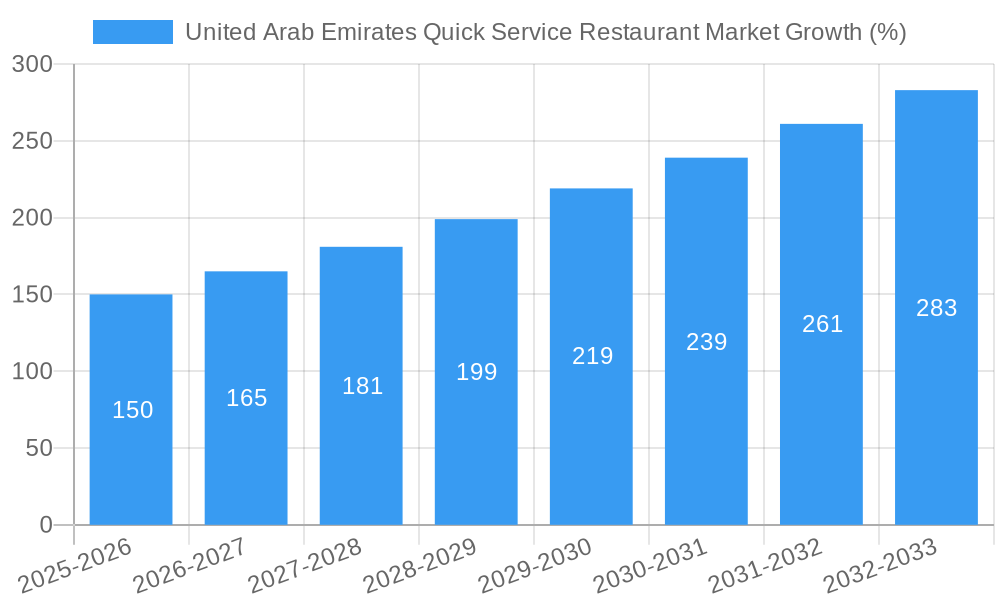

The United Arab Emirates (UAE) Quick Service Restaurant (QSR) market is experiencing robust growth, driven by a burgeoning population, increasing disposable incomes, and a strong preference for convenient and affordable dining options. The market's diverse culinary landscape, encompassing bakeries, burgers, ice cream, meat-based cuisines, pizza, and other QSR offerings, caters to a wide range of consumer preferences. The presence of both chained and independent outlets across various locations – leisure, lodging, retail, standalone, and travel – ensures widespread accessibility. A significant contributing factor to market expansion is the high concentration of tourists and expatriates in the UAE, fueling demand for diverse and readily available food choices. The market's CAGR of 10.40% from 2019-2033 suggests a consistently strong trajectory, with projections indicating substantial market expansion over the forecast period (2025-2033). Key players such as The Olayan Group, Alghanim Industries, and Americana Restaurants International are leveraging their established brands and operational expertise to capture significant market share. The competitive landscape is dynamic, with both established players and emerging brands vying for consumer attention through innovative menu offerings, strategic location choices, and enhanced customer experience initiatives.

The segmentation of the UAE QSR market provides valuable insights into specific growth drivers. For instance, the popularity of international fast-food chains suggests a strong demand for familiar brands, while the growth of local and regional cuisines reflects the increasing preference for authentic and diverse dining experiences. The strategic location of QSR outlets near leisure destinations, lodging facilities, and transportation hubs underscores the importance of convenience for consumers. Future market growth will likely be fueled by technological advancements in the food service industry, including online ordering and delivery platforms, personalized customer experiences, and a growing focus on healthy and sustainable food options. Competition will intensify as companies invest in brand building, operational efficiency, and menu innovation to maintain their competitive edge within this expanding market. The continued influx of tourists and the growing UAE population will ensure a persistent upward trend for the foreseeable future.

United Arab Emirates Quick Service Restaurant (QSR) Market Report: 2019-2033

Dive deep into the lucrative United Arab Emirates Quick Service Restaurant market with this comprehensive report, offering invaluable insights for strategic decision-making. This in-depth analysis covers the period 2019-2033, providing historical data (2019-2024), an estimated overview for 2025, and a robust forecast up to 2033. Unlock the potential of this dynamic market with detailed segmentation by cuisine (Bakeries, Burger, Ice Cream, Meat-based Cuisines, Pizza, Other QSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). Identify key players, understand market trends, and uncover emerging opportunities.

United Arab Emirates Quick Service Restaurant Market Market Dynamics & Concentration

The UAE QSR market exhibits a dynamic interplay of factors driving its growth and concentration. Market concentration is relatively high, with a few large players holding significant market share. For example, M H Alshaya Co WLL and Americana Restaurants International PLC command substantial portions of the market, estimated at xx% and yy% respectively in 2025. However, the market also accommodates a substantial number of smaller, independent outlets, particularly in niche cuisine segments. Innovation is a key driver, with constant introductions of new cuisines, menu items, and technological advancements like online ordering and delivery platforms. The UAE's robust regulatory framework supports fair competition and food safety standards, but navigating these regulations can present challenges for smaller operators. Product substitutes, including home-cooked meals and meal delivery services, exert competitive pressure, prompting QSRs to continually enhance their offerings. End-user trends, influenced by factors like health consciousness and increasing disposable incomes, significantly shape consumer choices. The market has witnessed several mergers and acquisitions (M&A) in recent years, with an estimated xx M&A deals concluded between 2019 and 2024. These activities consolidate market power and accelerate growth.

United Arab Emirates Quick Service Restaurant Market Industry Trends & Analysis

The UAE QSR market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors. A burgeoning population with diverse culinary preferences, increasing disposable incomes, and a high concentration of tourists create a substantial demand for quick and convenient meal options. Technological disruptions, including the proliferation of food delivery apps and online ordering systems, have significantly expanded market reach and convenience. Consumer preferences are shifting towards healthier options, prompting QSRs to introduce healthier menu items and adapt to evolving dietary needs. Competitive dynamics are intense, with established players and new entrants vying for market share through innovative marketing, menu diversification, and strategic partnerships. Market penetration of QSRs is high, with a significant percentage of the population regularly utilizing their services. This signifies a mature yet dynamic market ripe for further expansion and evolution. The current market size is estimated at ZZZ Million in 2025, projected to reach xxx Million by 2033.

Leading Markets & Segments in United Arab Emirates Quick Service Restaurant Market

The UAE QSR market demonstrates robust growth across multiple segments and locations.

Dominant Cuisine: Burger and Pizza remain dominant segments, accounting for a combined xx% of the market in 2025, driven by their wide appeal and established presence. However, segments like Meat-based cuisines and other QSR cuisines are experiencing a surge in popularity because of increased demand for ethnic foods and more diverse menus.

Outlet Type: Chained outlets command the lion’s share of the market. Their established brand recognition, consistent quality, and efficient operations contribute to their dominance. However, independent outlets, particularly those offering niche cuisines, are playing a significant role in catering to specific consumer demands.

Location: Retail locations hold the largest share of the market due to high foot traffic in malls and shopping centers. However, leisure and travel locations are gaining traction, benefiting from increased tourism and recreational activities.

Key Drivers:

- Strong Economic Growth: The UAE's robust economy and increasing disposable incomes fuel consumer spending on food and beverages.

- Tourism Boom: The continuous influx of tourists creates consistent demand for QSR services.

- Favorable Government Policies: Supportive regulations and infrastructure developments foster a thriving business environment.

United Arab Emirates Quick Service Restaurant Market Product Developments

The UAE QSR market is witnessing continuous product innovation, with a focus on healthier options, customized meals, and enhanced convenience. Technological advancements like automated ordering kiosks and personalized mobile apps enhance customer experience. Competitive advantages are driven by unique menu offerings, efficient operations, superior customer service, and strategic branding. The market emphasizes the integration of technology and evolving consumer preferences for healthier and more personalized dining experiences.

Key Drivers of United Arab Emirates Quick Service Restaurant Market Growth

The UAE QSR market's growth is propelled by several factors. Technological advancements, including online ordering and delivery platforms, have significantly expanded market reach and convenience. Economic prosperity and rising disposable incomes fuel consumer spending on food services. Supportive government regulations, including food safety standards and streamlined business licensing procedures, create a favorable investment climate. The growing tourist population and diverse demographics further contribute to this robust growth.

Challenges in the United Arab Emirates Quick Service Restaurant Market Market

The UAE QSR market faces challenges including intense competition, stringent food safety regulations that demand significant investment in compliance, and potential supply chain disruptions affecting ingredient availability and costs. Fluctuating food prices and labor costs also impact profitability. These factors require operators to adopt efficient strategies to maintain competitiveness and profitability.

Emerging Opportunities in United Arab Emirates Quick Service Restaurant Market

The UAE QSR market presents significant opportunities for growth, fueled by technological advancements in automation, personalized offerings, and data-driven customer relationship management. Strategic partnerships with technology providers and food delivery platforms enhance market reach and efficiency. Expansion into underserved locations and segments, such as health-conscious options and specialized ethnic cuisines, offers significant potential for market penetration.

Leading Players in the United Arab Emirates Quick Service Restaurant Market Sector

- The Olayan Group

- Alghanim Industries & Yusuf A Alghanim & Sons WLL

- Al Sayer Franchising Company

- ALBAIK Food Systems Company S A

- Ring International Holding AG

- Americana Restaurants International PLC

- M H Alshaya Co WLL

- Kamal Osman Jamjoom Group LLC

- Apparel Group

- AlAmar Foods Company

Key Milestones in United Arab Emirates Quick Service Restaurant Market Industry

- October 2022: Maristo Hospitality opened Sisi's Eatery, expanding the Australian cuisine segment.

- December 2022: Apparel Group launched its 250th Tim Hortons store, showcasing significant expansion plans.

- January 2023: Maristo Hospitality's master franchise agreement with German Doner Kebab signals the entry of a new, popular international brand into the UAE market.

Strategic Outlook for United Arab Emirates Quick Service Restaurant Market Market

The UAE QSR market is poised for continued expansion, driven by increasing urbanization, tourism growth, and technological advancements. Strategic opportunities lie in focusing on health-conscious options, personalized customer experiences, and leveraging technology for operational efficiency and marketing effectiveness. Expansion into niche segments and strategic partnerships will further solidify market leadership and capitalize on the significant growth potential of this dynamic sector.

United Arab Emirates Quick Service Restaurant Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Arab Emirates Quick Service Restaurant Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Increase in the number of QSRs and rise in demand for fast food to fuel the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. UAE United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 The Olayan Grou

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alghanim Industries & Yusuf A Alghanim & Sons WLL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Al Sayer Franchising Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ALBAIK Food Systems Company S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ring International Holding AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Americana Restaurants International PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 M H Alshaya Co WLL

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kamal Osman Jamjoom Group LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Apparel Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AlAmar Foods Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Olayan Grou

List of Figures

- Figure 1: United Arab Emirates Quick Service Restaurant Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Quick Service Restaurant Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 4: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Cuisine 2019 & 2032

- Table 5: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 6: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 7: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 8: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 9: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 11: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 13: UAE United Arab Emirates Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: UAE United Arab Emirates Quick Service Restaurant Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 15: South Africa United Arab Emirates Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa United Arab Emirates Quick Service Restaurant Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia United Arab Emirates Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia United Arab Emirates Quick Service Restaurant Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of MEA United Arab Emirates Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of MEA United Arab Emirates Quick Service Restaurant Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 21: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 22: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Cuisine 2019 & 2032

- Table 23: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 24: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 25: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 26: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 27: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Quick Service Restaurant Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the United Arab Emirates Quick Service Restaurant Market?

Key companies in the market include The Olayan Grou, Alghanim Industries & Yusuf A Alghanim & Sons WLL, Al Sayer Franchising Company, ALBAIK Food Systems Company S A, Ring International Holding AG, Americana Restaurants International PLC, M H Alshaya Co WLL, Kamal Osman Jamjoom Group LLC, Apparel Group, AlAmar Foods Company.

3. What are the main segments of the United Arab Emirates Quick Service Restaurant Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Increase in the number of QSRs and rise in demand for fast food to fuel the market growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

January 2023: Maristo Hospitality signed a master franchisee agreement with German Doner Kebab (GDK), with plans to expand in the United Arab Emirates and the Middle East.December 2022: Apparel Group launched its 250th Tim Hortons store across the Middle East with a new store in Dubai's Mirdif City Centre. It plans to open 500 outlets across the region by 2025.October 2022: Maristo Hospitality opened Sisi's Eatery, its Australian cuisine restaurant, in Dubai Hills Mall, Dubai, United Arab Emirates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence