Key Insights

The United Arab Emirates (UAE) drug delivery devices market is experiencing robust growth, driven by factors such as a rising prevalence of chronic diseases, increasing geriatric population, and growing healthcare expenditure. The market is characterized by a diverse range of delivery methods, including nasal, oral, injectable, transdermal, and topical devices, with injectable and transdermal devices witnessing significant adoption due to their efficacy and convenience. Technological advancements, particularly in areas like smart drug delivery systems and personalized medicine, are further fueling market expansion. The increasing adoption of innovative drug delivery systems is streamlining medication administration, improving patient compliance, and enhancing therapeutic outcomes. Significant investments in the healthcare infrastructure of the UAE, along with the government’s focus on improving healthcare accessibility and affordability, are also positively impacting market growth. However, challenges remain, including high costs associated with advanced drug delivery technologies, stringent regulatory approvals, and a potential shortage of skilled healthcare professionals.

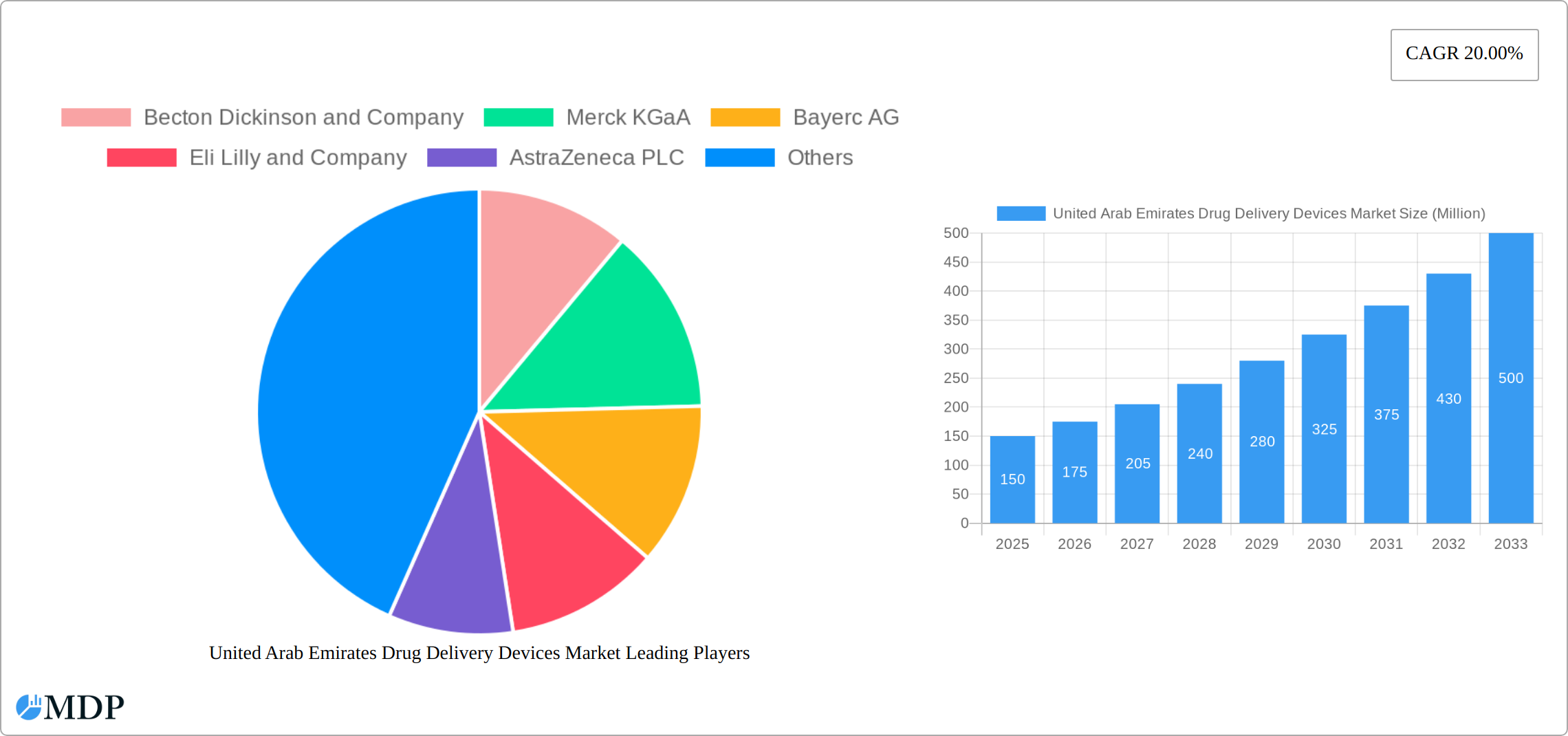

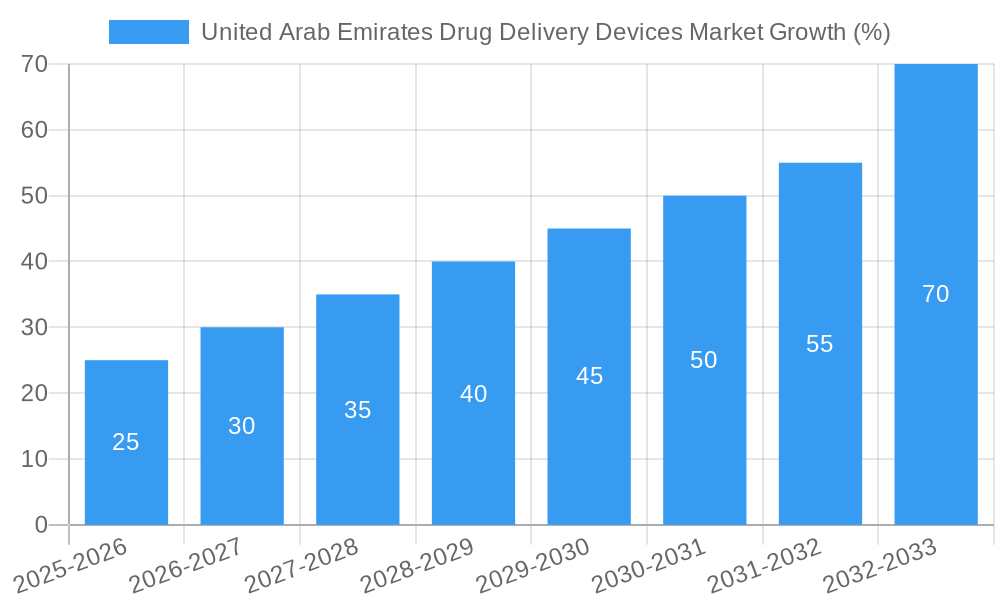

Despite the challenges, the UAE's commitment to advanced medical technologies and its strategic position as a regional healthcare hub suggests strong future growth prospects. The market segmentation reveals a higher demand for injectable and transdermal drug delivery systems, reflecting the preference for effective and convenient methods. Major players like Becton Dickinson, Merck KGaA, and others are actively engaged in the market, contributing to its dynamism through continuous innovation and product launches. Given the overall global CAGR of 20% and the relatively high healthcare spending in the UAE, a conservative estimate for the UAE market’s CAGR would be between 15-18% for the forecast period. This projection considers potential market saturation and regional economic fluctuations. The continued expansion of private healthcare facilities and increasing adoption of innovative drug delivery solutions will likely drive further growth in the coming years.

United Arab Emirates Drug Delivery Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United Arab Emirates (UAE) drug delivery devices market, covering the period 2019-2033. With a focus on market dynamics, leading players, and future growth opportunities, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages a robust data analysis approach, including market sizing, segmentation, and competitive landscape assessment, utilizing the base year of 2025 and forecast period of 2025-2033 with a historical review from 2019-2024. The projected market value is xx Million for 2025.

United Arab Emirates Drug Delivery Devices Market Dynamics & Concentration

The UAE drug delivery devices market is experiencing significant growth driven by factors such as the rising prevalence of chronic diseases, increasing healthcare expenditure, and government initiatives to improve healthcare infrastructure. Market concentration is moderate, with a few major players dominating specific segments. However, the market is witnessing increased competition due to the entry of new players and technological advancements. Innovation is a key driver, with companies investing heavily in research and development to bring new and improved drug delivery devices to the market. The regulatory framework plays a significant role in shaping market dynamics, with stringent regulations ensuring product safety and efficacy. The presence of effective product substitutes and evolving end-user preferences influence market trends. Furthermore, mergers and acquisitions (M&A) activities are shaping the competitive landscape. Recent M&A deal counts in this market suggest a consolidation trend (xx deals in the last 5 years, with an average deal value of xx Million). Key market share metrics demonstrate that the top 5 players account for approximately xx% of the overall market share in 2025.

United Arab Emirates Drug Delivery Devices Market Industry Trends & Analysis

The UAE drug delivery devices market is projected to witness robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by several factors, including the increasing adoption of advanced drug delivery technologies, such as smart inhalers and wearable drug delivery systems. Technological disruptions, such as the rise of personalized medicine and digital health solutions, are further shaping market trends. Consumer preferences are shifting towards more convenient and user-friendly drug delivery devices, driving demand for innovative products. Competitive dynamics are intensifying, with companies focusing on product differentiation, strategic partnerships, and market expansion strategies. Market penetration for advanced drug delivery systems remains relatively low (xx%) but is projected to increase significantly during the forecast period due to government initiatives and rising awareness.

Leading Markets & Segments in United Arab Emirates Drug Delivery Devices Market

The injectable segment currently dominates the UAE drug delivery devices market, accounting for approximately xx% of the total market share in 2025. This dominance is driven by several factors including:

- High Prevalence of Chronic Diseases: The rising prevalence of chronic diseases, such as diabetes and cardiovascular diseases, requiring injectable medications, fuels this segment's growth.

- Robust Healthcare Infrastructure: The UAE's well-developed healthcare infrastructure, including hospitals and clinics, supports the widespread use of injectable drug delivery systems.

- Government Initiatives: Government initiatives to improve healthcare access and quality further contribute to the dominance of the injectable segment.

Other segments, such as oral and transdermal, are also experiencing significant growth, driven by increasing consumer preference for convenient and user-friendly drug delivery options. However, the injectable segment is expected to maintain its leading position throughout the forecast period.

United Arab Emirates Drug Delivery Devices Market Product Developments

Recent years have witnessed significant product innovations in the UAE drug delivery devices market. Companies are focusing on developing advanced drug delivery systems with enhanced efficacy, safety, and convenience. Technological advancements, such as the integration of smart sensors and digital connectivity, are transforming drug delivery devices, enabling real-time monitoring and personalized treatment. These innovations are improving patient compliance and treatment outcomes, thereby increasing market acceptance and driving market expansion.

Key Drivers of United Arab Emirates Drug Delivery Devices Market Growth

Several factors contribute to the growth of the UAE drug delivery devices market: Technological advancements are enabling the development of more sophisticated and efficient drug delivery systems. Government initiatives focused on improving healthcare infrastructure and access are boosting market growth. Economic factors, such as rising healthcare expenditure and increased disposable income, further propel market expansion. Favorable regulatory policies encouraging innovation and foreign investment contribute significantly.

Challenges in the United Arab Emirates Drug Delivery Devices Market Market

The UAE drug delivery devices market faces challenges such as stringent regulatory approvals leading to longer product launch times, potentially impacting market entry for new players. Supply chain disruptions and dependence on imports affect product availability and pricing. Intense competition among established players creates price pressures, impacting profit margins.

Emerging Opportunities in United Arab Emirates Drug Delivery Devices Market

The UAE drug delivery devices market presents several growth opportunities. The increasing adoption of personalized medicine, coupled with technological breakthroughs such as nanotechnology and 3D printing, is creating avenues for innovation and growth. Strategic collaborations between pharmaceutical companies and technology providers are fostering the development of advanced drug delivery systems. Expansion into untapped segments, such as specialized drug delivery for niche therapeutic areas, holds significant promise.

Leading Players in the United Arab Emirates Drug Delivery Devices Market Sector

- Becton Dickinson and Company

- Merck KGaA

- Bayer AG

- Eli Lilly and Company

- AstraZeneca PLC

- F Hoffmann-La Roche Ltd

- Johnson and Johnson

- GlaxoSmithKline PLC

- Pfizer Inc

Key Milestones in United Arab Emirates Drug Delivery Devices Market Industry

- June 2022: ADQ's acquisition of Birgi Mefar Group (BMG) significantly boosted the UAE's capacity for sterile injectable product manufacturing, impacting the injectable devices segment positively.

- October 2022: The AED 260 million (USD 70.79 million) partnership to manufacture medical equipment locally, including syringes and administration devices, signals a move towards domestic production and potentially reduced reliance on imports.

Strategic Outlook for United Arab Emirates Drug Delivery Devices Market Market

The UAE drug delivery devices market exhibits promising growth potential, driven by increasing healthcare expenditure, technological advancements, and supportive government policies. Strategic opportunities lie in focusing on innovation, developing targeted therapies, and leveraging partnerships to expand market reach. Companies focusing on personalized medicine and digital health solutions are likely to gain a significant competitive advantage. The future of the market hinges on embracing technological innovation and catering to the evolving needs of patients and healthcare providers.

United Arab Emirates Drug Delivery Devices Market Segmentation

-

1. Mode of Delivery

- 1.1. Nasal

- 1.2. Oral

- 1.3. Injectable

- 1.4. Transdermal

- 1.5. Topical

- 1.6. Others (Pulmonary, Rectal, Occular, Implantable)

United Arab Emirates Drug Delivery Devices Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Drug Delivery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases and Growth in the Biologics Market; Increased Understanding of Drug Metabolism and Growing Requirement of Controlled Drug Release and Technological Advancements

- 3.3. Market Restrains

- 3.3.1 High Cost of Development

- 3.3.2 Regulatory Concern and Risk of Needlestick Injuries

- 3.4. Market Trends

- 3.4.1. Oral Segment Expects to Register a High CAGR in the United Arab Emirates Drug Delivery Devices Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Delivery

- 5.1.1. Nasal

- 5.1.2. Oral

- 5.1.3. Injectable

- 5.1.4. Transdermal

- 5.1.5. Topical

- 5.1.6. Others (Pulmonary, Rectal, Occular, Implantable)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Mode of Delivery

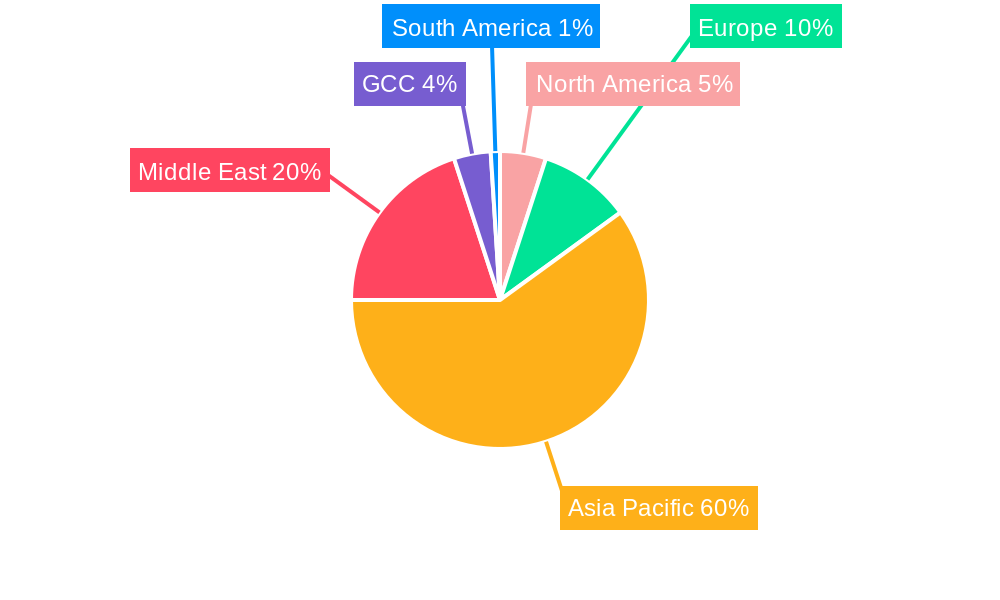

- 6. North America United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. Europe United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Asia Pacific United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Middle East United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. GCC United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. South America United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Becton Dickinson and Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Merck KGaA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bayerc AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Eli Lilly and Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AstraZeneca PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 F Hoffmann-La Roche Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Johnson and Johnson

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 GlaxoSmithKline PLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Pfizer Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: United Arab Emirates Drug Delivery Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Drug Delivery Devices Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 4: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 5: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 20: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 21: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Drug Delivery Devices Market?

The projected CAGR is approximately 20.00%.

2. Which companies are prominent players in the United Arab Emirates Drug Delivery Devices Market?

Key companies in the market include Becton Dickinson and Company, Merck KGaA, Bayerc AG, Eli Lilly and Company, AstraZeneca PLC, F Hoffmann-La Roche Ltd, Johnson and Johnson, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the United Arab Emirates Drug Delivery Devices Market?

The market segments include Mode of Delivery.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases and Growth in the Biologics Market; Increased Understanding of Drug Metabolism and Growing Requirement of Controlled Drug Release and Technological Advancements.

6. What are the notable trends driving market growth?

Oral Segment Expects to Register a High CAGR in the United Arab Emirates Drug Delivery Devices Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Development. Regulatory Concern and Risk of Needlestick Injuries.

8. Can you provide examples of recent developments in the market?

October 2022: Abu Dhabi Medical Devices Company, the Abu Dhabi Ports Group, and Abu Dhabi Polymers Company partnered with PureHealth, for AED 260 million (USD 70.79 million) to manufacture medical equipment, such as medical syringes, administration devices, and blood collection tubes, locally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Drug Delivery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Drug Delivery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Drug Delivery Devices Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Drug Delivery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence