Key Insights

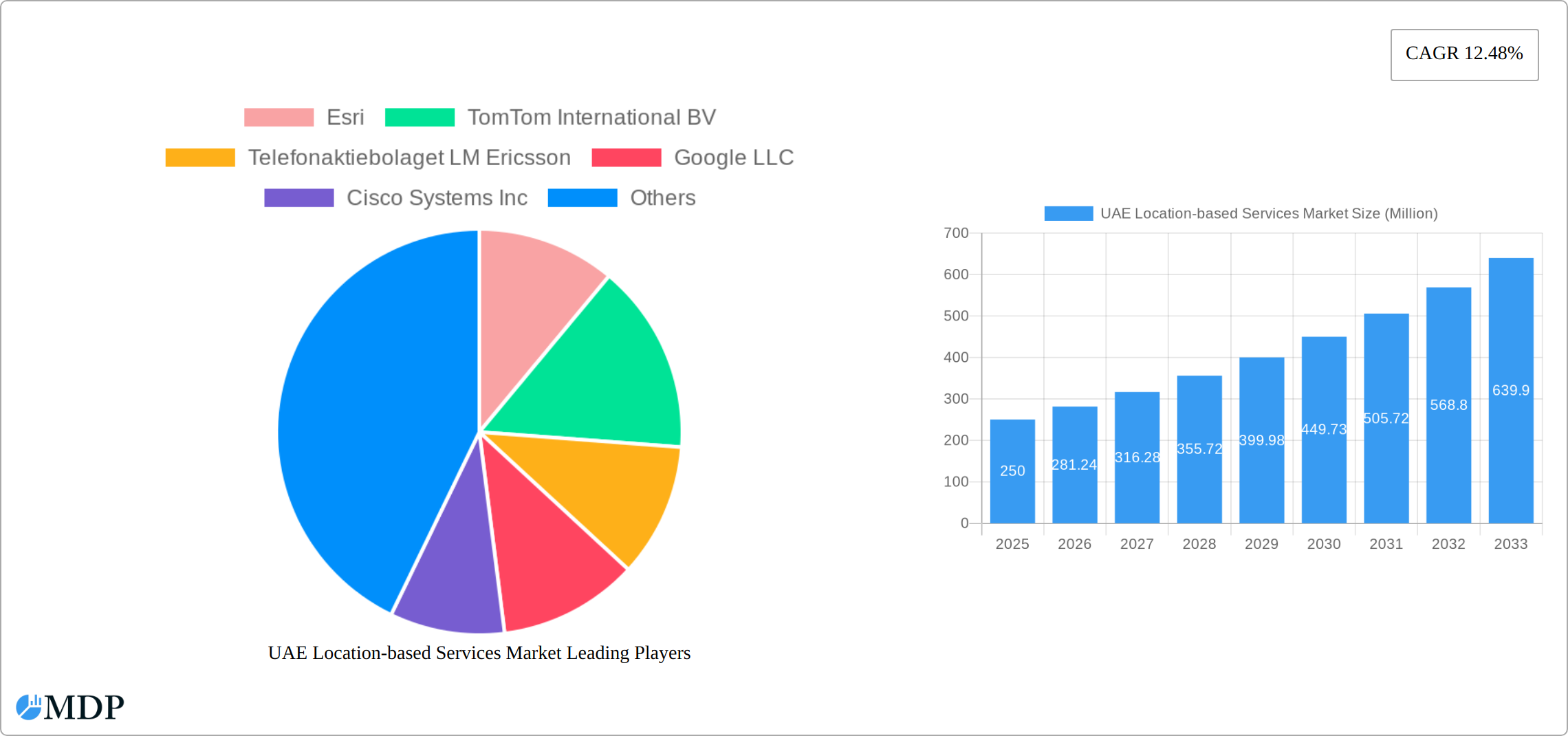

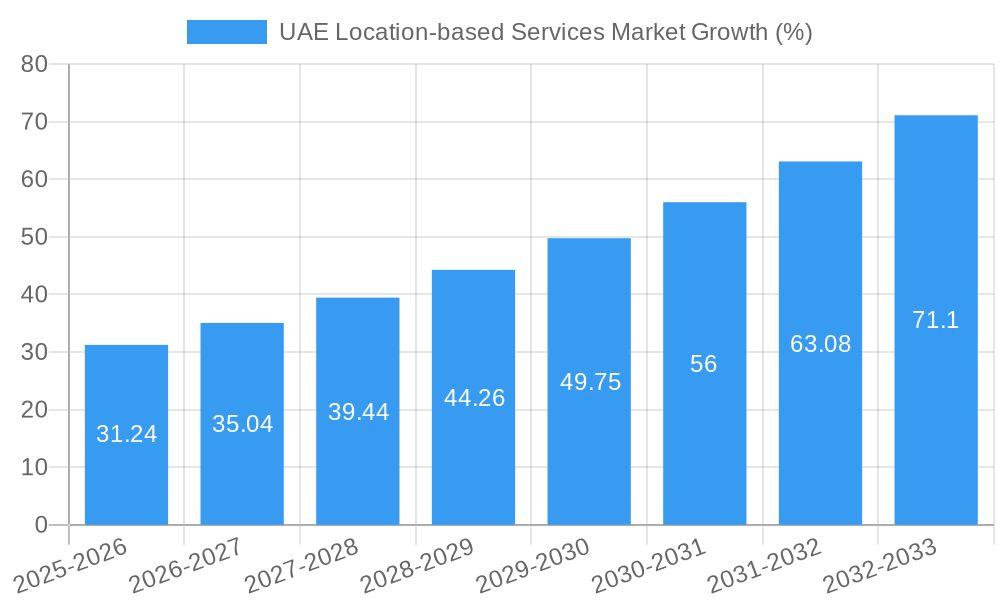

The UAE Location-based Services (LBS) market is experiencing robust growth, driven by the nation's rapid technological advancements, burgeoning smart city initiatives, and increasing smartphone penetration. The market, valued at approximately $X million in 2025 (estimated based on provided CAGR and market size information, assuming a logical extrapolation of available data), is projected to maintain a Compound Annual Growth Rate (CAGR) of 12.48% from 2025 to 2033. Key drivers include the expanding adoption of LBS across various sectors such as transportation and logistics, fueled by the need for efficient route optimization and delivery management. The growth of e-commerce and the rising demand for location-based advertising further propel market expansion. Furthermore, the UAE's strategic focus on developing smart city infrastructure creates a fertile ground for LBS adoption, with applications ranging from intelligent traffic management to improved public safety and resource optimization. The increasing availability of high-quality location data and advancements in GPS technology also contribute to this growth trajectory.

Significant market segmentation exists across components (hardware, software, services), location (indoor, outdoor), applications (mapping, business intelligence, advertising, social networking), and end-users (transportation, IT, healthcare, government, etc.). While the transportation and logistics sector currently dominates, growth is expected across all segments, particularly in sectors like healthcare (using LBS for patient tracking and emergency response) and BFSI (for location-based fraud detection and risk management). However, challenges remain, including data privacy concerns and the need for robust cybersecurity infrastructure to ensure the secure and responsible use of location data. Nonetheless, given the UAE's proactive digital transformation strategy and its focus on innovation, the long-term outlook for the LBS market remains highly positive. Further research into specific segment performance and competitive landscape is recommended for a more detailed understanding.

UAE Location-Based Services Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UAE Location-Based Services (LBS) market, offering invaluable insights for businesses, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report covers market dynamics, industry trends, leading segments, key players, and future opportunities. The market is expected to reach xx Million by 2033, showcasing substantial growth potential. This report leverages high-impact keywords like "UAE Location-Based Services Market," "Indoor Positioning," "Mapping and Navigation," and "LBS Market Size," ensuring maximum search visibility.

UAE Location-based Services Market Market Dynamics & Concentration

The UAE LBS market exhibits a moderately concentrated landscape, with key players like Esri, TomTom International BV, Telefonaktiebolaget LM Ericsson, Google LLC, and Cisco Systems Inc holding significant market share. The market is driven by continuous technological innovation, particularly in areas like 5G deployment, IoT integration, and AI-powered analytics. The regulatory environment, while generally supportive of technological advancement, faces ongoing refinement to address data privacy and security concerns. Product substitutes, such as traditional navigation methods, are gradually losing ground due to the increasing sophistication and affordability of LBS solutions. End-user trends indicate a growing demand for personalized and context-aware LBS applications across various sectors. M&A activity has been moderate, with approximately xx deals recorded between 2019 and 2024, primarily focused on consolidating technological capabilities and expanding market reach. Market concentration is expected to slightly increase by 2033 due to strategic partnerships and acquisitions, with the top 5 players estimated to hold approximately xx% of the market share.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025, projected to increase to xx% by 2033.

- Innovation Drivers: 5G deployment, IoT integration, AI-powered analytics.

- Regulatory Framework: Supportive, with ongoing refinements on data privacy and security.

- Product Substitutes: Traditional navigation methods are declining in market share.

- End-User Trends: Increasing demand for personalized and context-aware LBS applications.

- M&A Activity: Approximately xx deals between 2019 and 2024, focusing on technology and market expansion.

UAE Location-based Services Market Industry Trends & Analysis

The UAE LBS market is experiencing robust growth, driven by factors like rapid urbanization, increasing smartphone penetration, and government initiatives promoting smart city development. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of advanced location technologies like RTLS (Real-Time Location Systems) and UWB (Ultra-Wideband), are transforming LBS applications. Consumer preferences are shifting towards highly personalized, seamless, and secure LBS experiences. Competitive dynamics are characterized by strategic partnerships, technological innovation, and a focus on developing niche applications. Market penetration of LBS solutions is high in urban areas, while opportunities for growth exist in rural regions. The focus on improving the accuracy of location data, integrating LBS with other smart technologies, and ensuring robust data security are key elements shaping the evolution of this sector.

Leading Markets & Segments in UAE Location-based Services Market

Within the UAE LBS market, the Outdoor segment dominates the By Location category, fueled by the widespread adoption of navigation and mapping applications. The Software component leads in the By Component segment due to its crucial role in enabling various LBS applications. The Mapping and Navigation application segment shows the highest market share within the By Application category due to its prevalence in both personal and commercial sectors. In terms of By End-User, the Transportation and Logistics sector demonstrates substantial market share driven by the need for efficient fleet management and real-time tracking.

- Key Drivers (By Segment):

- Outdoor: High smartphone penetration, increasing reliance on navigation apps.

- Software: Crucial role in enabling LBS applications, flexible deployments and cost-effectiveness.

- Mapping & Navigation: High adoption in personal and commercial usage.

- Transportation & Logistics: Demand for efficient fleet management and real-time tracking.

- Dominance Analysis: Outdoor locations and Software components, the Mapping and Navigation application, and the Transportation and Logistics end-user segment currently dominate the market, primarily due to higher user adoption and associated economic benefits. However, the Indoor segment is poised for rapid growth with developing technologies like RTLS.

UAE Location-based Services Market Product Developments

Recent product developments highlight a strong focus on enhancing accuracy, integration, and user experience. The introduction of advanced indoor positioning systems, such as Pointr's single-site system at Reem Mall, demonstrates the growing demand for precise location data in indoor environments. The integration of LBS with other technologies, such as IoT and AI, enables the development of sophisticated applications for various sectors, like smart city management and personalized advertising. The market continues to witness a trend towards cloud-based LBS solutions, offering scalability and cost-effectiveness. The ongoing development of hybrid positioning systems combining GPS and other technologies like Wi-Fi and Bluetooth is enhancing location accuracy even in challenging environments.

Key Drivers of UAE Location-based Services Market Growth

Several factors fuel the growth of the UAE LBS market. The significant investments in infrastructure, particularly 5G networks, provide the backbone for advanced LBS applications. Government initiatives promoting smart city development and digital transformation are creating a favorable environment for market expansion. The increasing adoption of smartphones and mobile internet further boosts LBS adoption rates. Finally, the burgeoning tourism sector and the increasing demand for location-based services within industries like logistics and transportation fuel market growth.

Challenges in the UAE Location-based Services Market Market

The UAE LBS market faces challenges relating to data security and privacy concerns, especially concerning the handling of sensitive location data. The high initial investment required for implementing advanced LBS infrastructure can pose a barrier to entry for smaller players. Furthermore, the competitive landscape, with established global players vying for market share, creates intense pressure on profitability. The successful navigation of these hurdles requires proactive regulatory oversight, strategic partnerships, and continuous innovation.

Emerging Opportunities in UAE Location-based Services Market

The future of the UAE LBS market looks promising, with several emerging opportunities. The growing adoption of IoT devices and the expansion of 5G networks will lead to improved location accuracy and the development of new LBS applications. Strategic partnerships between technology providers and industry verticals will unlock valuable synergies and market expansion. The increasing focus on personalized LBS experiences presents a significant opportunity for businesses to develop tailored solutions catering to specific customer needs. The development of advanced analytics capabilities for LBS data will enhance business decision-making and drive efficiency.

Leading Players in the UAE Location-based Services Market Sector

- Esri

- TomTom International BV

- Telefonaktiebolaget LM Ericsson

- Google LLC

- Cisco Systems Inc

- IBM Corporation

- Zebra Technologies Corp

- Location Solutions Telemetics LLC

- GapMaps

- ALE International

Key Milestones in UAE Location-based Services Market Industry

- May 2023: Pointr launches advanced indoor location system at Reem Mall, Abu Dhabi, showcasing growing demand for indoor positioning solutions.

- March 2023: Comtech awarded USD 29 Million contract by Yahsat for location-based technologies, boosting market growth.

Strategic Outlook for UAE Location-based Services Market Market

The UAE LBS market is poised for sustained growth, driven by technological advancements, supportive government policies, and increasing demand across various sectors. Businesses can capitalize on this growth by focusing on innovation, strategic partnerships, and the development of niche LBS applications catering to specific industry needs. The focus on data security, personalization, and seamless integration with other smart technologies will be critical for success in this rapidly evolving market.

UAE Location-based Services Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Location

- 2.1. Indoor

- 2.2. Outdoor

-

3. Application

- 3.1. Mapping and Navigation

- 3.2. Business Intelligence and Analytics

- 3.3. Location-based Advertising

- 3.4. Social Networking and Entertainment

- 3.5. Other Applications

-

4. End-User

- 4.1. Transportation and Logistics

- 4.2. IT and Telecom

- 4.3. Healthcare

- 4.4. Government

- 4.5. BFSI

- 4.6. Hospitality

- 4.7. Manufacturing

- 4.8. Other End-Users

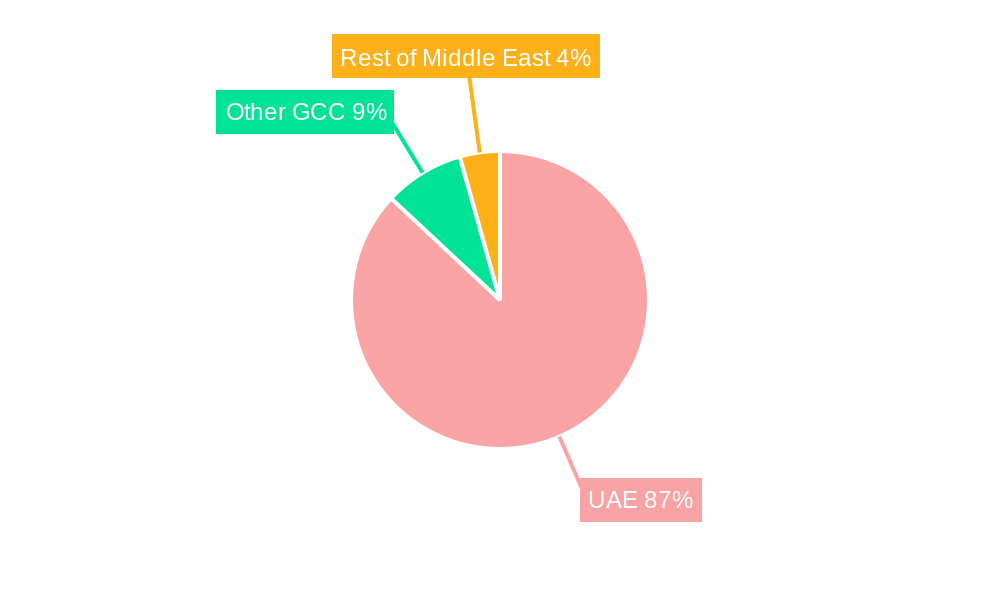

UAE Location-based Services Market Segmentation By Geography

-

1. MEA

- 1.1. UAE

- 1.2. South Africa

- 1.3. Saudi Arabia

- 1.4. Rest Of MEA

UAE Location-based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The development of Smart City Projects in The Country is Driving The Market Growth; The Growing Trend of Digitalization in the Country Supported by the Adoption of Smart Connected Devices

- 3.3. Market Restrains

- 3.3.1. The Risk of Data Privacy Breaching Due to the Use of Location Data in the Solutions; The Non-Availability of Good Network Connectivity in the Rural Areas of the Country

- 3.4. Market Trends

- 3.4.1. The development of Smart City Projects in the Country is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. UAE Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Mapping and Navigation

- 5.3.2. Business Intelligence and Analytics

- 5.3.3. Location-based Advertising

- 5.3.4. Social Networking and Entertainment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Transportation and Logistics

- 5.4.2. IT and Telecom

- 5.4.3. Healthcare

- 5.4.4. Government

- 5.4.5. BFSI

- 5.4.6. Hospitality

- 5.4.7. Manufacturing

- 5.4.8. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. MEA

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Esri

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TomTom International BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Telefonaktiebolaget LM Ericsson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IBM Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zebra Technologies Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Location Solutions Telemetics LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GapMaps

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALE International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Esri

List of Figures

- Figure 1: UAE Location-based Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: UAE Location-based Services Market Share (%) by Company 2024

List of Tables

- Table 1: UAE Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: UAE Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: UAE Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: UAE Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: UAE Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: UAE Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: UAE Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: UAE Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 9: UAE Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 10: UAE Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: UAE Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: UAE Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: UAE UAE Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa UAE Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Saudi Arabia UAE Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest Of MEA UAE Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Location-based Services Market?

The projected CAGR is approximately 12.48%.

2. Which companies are prominent players in the UAE Location-based Services Market?

Key companies in the market include Esri, TomTom International BV, Telefonaktiebolaget LM Ericsson, Google LLC, Cisco Systems Inc, IBM Corporation, Zebra Technologies Corp, Location Solutions Telemetics LLC, GapMaps, ALE International.

3. What are the main segments of the UAE Location-based Services Market?

The market segments include Component, Location, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The development of Smart City Projects in The Country is Driving The Market Growth; The Growing Trend of Digitalization in the Country Supported by the Adoption of Smart Connected Devices.

6. What are the notable trends driving market growth?

The development of Smart City Projects in the Country is Driving the Market Growth.

7. Are there any restraints impacting market growth?

The Risk of Data Privacy Breaching Due to the Use of Location Data in the Solutions; The Non-Availability of Good Network Connectivity in the Rural Areas of the Country.

8. Can you provide examples of recent developments in the market?

May 2023: Pointr, a leading provider of indoor positioning and mapping solutions, introduced an advanced single-site indoor location system at the prestigious Reem Mall in Abu Dhabi, United Arab Emirates. This system covers all public areas of the mall and offers a cutting-edge indoor location experience through the Reem Mall guest app. This development showcases the increasing demand for indoor positioning and mapping solutions in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Location-based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Location-based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Location-based Services Market?

To stay informed about further developments, trends, and reports in the UAE Location-based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence