Key Insights

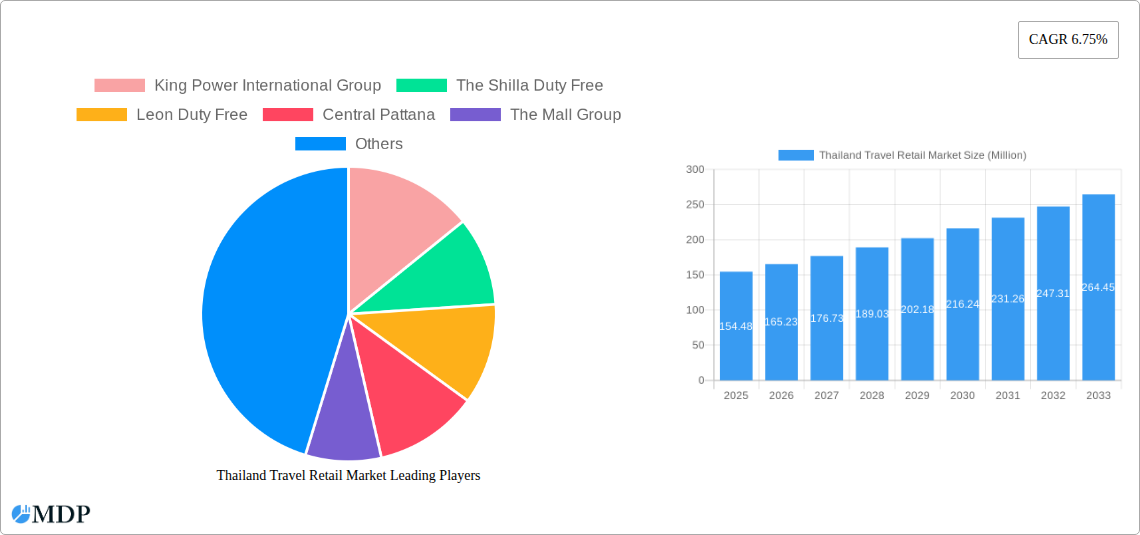

The Thailand travel retail market, valued at $154.48 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.75% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Thailand's burgeoning tourism sector, known for its vibrant culture and attractive destinations, significantly contributes to the market's dynamism. Increased inbound tourist arrivals, particularly from high-spending Asian markets, directly translate into higher sales within airports, duty-free shops, and other travel retail outlets. Secondly, the rising disposable incomes of both domestic and international travelers enhance purchasing power, driving demand for luxury goods and premium products commonly found in travel retail settings. Strategic partnerships between retailers and airlines, coupled with innovative marketing strategies targeting specific traveler demographics, also contribute to this growth. Furthermore, the government's initiatives to improve infrastructure and enhance the overall tourist experience further bolster the market's positive trajectory.

Thailand Travel Retail Market Market Size (In Million)

However, the market also faces challenges. Fluctuations in global economic conditions and exchange rates can impact consumer spending. Increased competition from online retailers and the rise of e-commerce also pose a threat to traditional brick-and-mortar travel retail outlets. Successfully navigating these challenges requires a strong focus on omnichannel strategies, personalized customer experiences, and continuous adaptation to evolving consumer preferences. Key players in the market, including King Power International Group, The Shilla Duty Free, and others, are actively competing to capitalize on growth opportunities, investing in improved retail spaces, expanded product offerings, and enhanced customer service to maintain a competitive edge. The strategic location of Thailand as a major tourism hub in Southeast Asia ensures a continued positive outlook for the foreseeable future, despite these external factors.

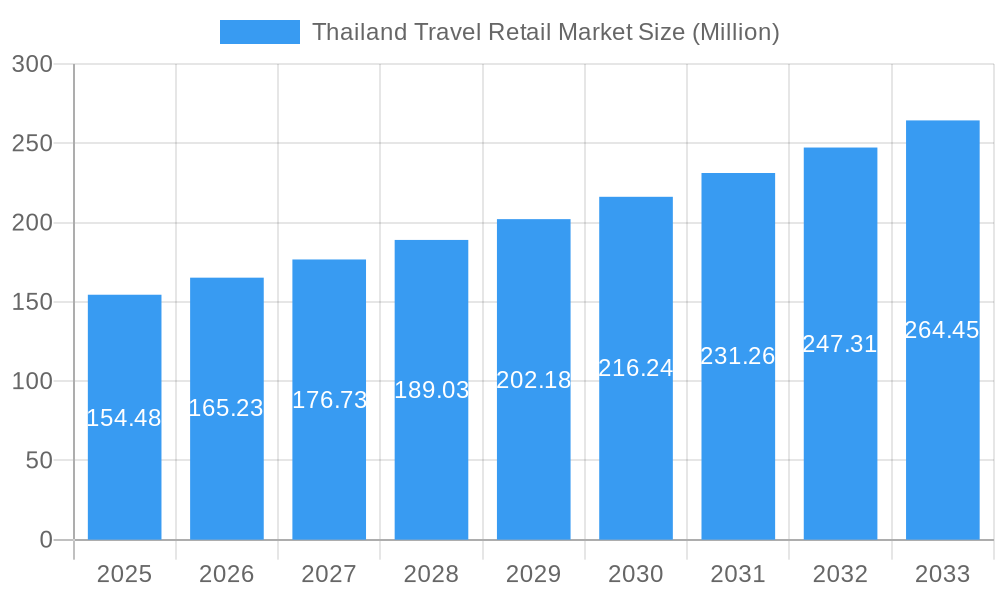

Thailand Travel Retail Market Company Market Share

Thailand Travel Retail Market Report: 2019-2033

Unlocking Growth Opportunities in Thailand's Thriving Travel Retail Sector

This comprehensive report provides an in-depth analysis of the Thailand travel retail market, covering the period 2019-2033. We delve into market dynamics, industry trends, leading players, and future growth potential, offering invaluable insights for businesses and investors seeking to capitalize on this dynamic market. With a focus on key segments and incorporating data up to November 2023, this report is your essential guide to navigating the complexities and opportunities of the Thai travel retail landscape. The report utilizes data from the base year 2025 and provides forecasts for 2025-2033, building upon historical data from 2019-2024. Estimated market values are presented in Millions.

Thailand Travel Retail Market Market Dynamics & Concentration

The Thailand travel retail market exhibits a moderately concentrated structure, with a few major players commanding significant market share. King Power International Group, The Shilla Duty Free, and Leon Duty Free are among the leading operators, but the market also accommodates a considerable number of smaller, regional players. Market concentration is influenced by factors such as airport concessions, brand licensing agreements, and strategic partnerships.

- Market Share: King Power International Group holds an estimated xx% market share in 2025, followed by The Shilla Duty Free at xx% and Leon Duty Free at xx%. The remaining share is distributed among numerous smaller players.

- Innovation Drivers: Technological advancements, such as personalized shopping experiences through mobile apps and data analytics, are driving innovation. The increasing adoption of omnichannel strategies also contributes to the market's dynamic nature.

- Regulatory Frameworks: Government regulations regarding duty-free allowances, import tariffs, and airport concessions significantly impact market dynamics. Changes in these regulations can create both opportunities and challenges for businesses.

- Product Substitutes: The availability of similar products online or in domestic retail channels acts as a constraint. Travel retailers need to offer unique value propositions and exclusive products to compete effectively.

- End-User Trends: The rising disposable income of Thai and international travelers, coupled with a growing preference for luxury and premium products, is shaping demand. Experiential retail formats are gaining traction.

- M&A Activities: The number of M&A deals in the Thailand travel retail market has been relatively modest in recent years, with approximately xx deals recorded between 2019 and 2024. However, further consolidation is anticipated as larger players seek to expand their market reach and product portfolio.

Thailand Travel Retail Market Industry Trends & Analysis

The Thailand travel retail market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is estimated at xx%. This growth is fueled by an increase in inbound and outbound tourism, rising disposable incomes, and the increasing popularity of duty-free shopping among both domestic and international tourists. Market penetration of travel retail in Thailand is estimated at xx% in 2025, with significant potential for future expansion. Technological disruptions, such as the rise of e-commerce and digital payment options, are transforming the industry landscape. Consumer preferences are shifting towards personalized experiences, sustainable products, and seamless omnichannel shopping journeys. Competitive dynamics are intense, with established players facing competition from emerging brands and new retail formats. The market is witnessing an expansion of offerings beyond traditional duty-free goods, with a greater emphasis on lifestyle products, food and beverage, and local artisanal crafts.

Leading Markets & Segments in Thailand Travel Retail Market

Suvarnabhumi Airport and Phuket International Airport dominate the Thailand travel retail market, capturing the bulk of sales volume. These airports' strategic locations and high passenger traffic make them particularly attractive to retailers. The luxury goods and cosmetics segments are the most lucrative, attracting higher spending levels from affluent tourists.

- Key Drivers of Dominance:

- High Tourist Traffic: Suvarnabhumi and Phuket airports handle millions of passengers annually, creating a vast pool of potential customers.

- Strategic Location: Their proximity to major tourist destinations and convenient access further enhance their attractiveness.

- Infrastructure Development: Continuous upgrades and expansion of airport infrastructure support the growth of retail spaces.

- Government Policies: Supportive government policies related to tourism and duty-free shopping encourage industry development.

The dominance of Suvarnabhumi and Phuket is likely to remain consistent throughout the forecast period, although the emergence of new airport infrastructure and regional developments may gradually introduce some degree of market share diversification.

Thailand Travel Retail Market Product Developments

Product innovation is driven by consumer demand for unique, high-quality goods, often incorporating local Thai elements. Technologically advanced products, such as wearable technology and smart beauty devices, are gaining popularity. Brands are emphasizing sustainability and ethical sourcing, catering to the growing environmental consciousness of consumers. The competitive advantage lies in offering exclusive products, personalized shopping experiences, and seamless integration of online and offline channels.

Key Drivers of Thailand Travel Retail Market Growth

Several factors contribute to the market's growth trajectory: The sustained growth of tourism in Thailand, coupled with rising disposable incomes, significantly fuels demand for travel retail products. Government initiatives aimed at boosting tourism infrastructure and easing travel restrictions further contribute. Technological advancements, such as e-commerce platforms and improved logistics, enhance efficiency and expand market reach.

Challenges in the Thailand Travel Retail Market Market

The market faces some significant challenges. Economic fluctuations and changes in tourist arrival numbers can directly affect sales. Supply chain disruptions and increasing competition, coupled with regulatory changes, pose ongoing risks. The increasing prevalence of online shopping presents a significant alternative for consumers, demanding that travel retailers provide unique value propositions to compete effectively. These factors can collectively impact annual sales revenue by an estimated xx Million.

Emerging Opportunities in Thailand Travel Retail Market

The increasing adoption of omnichannel strategies offers lucrative opportunities for market expansion. Strategic partnerships with local businesses and artisan communities enhance product diversification and add local appeal. Technological innovations such as augmented reality (AR) and virtual reality (VR) technologies can enhance the shopping experience and elevate brand engagement. The continued growth of luxury tourism presents significant opportunities for high-end retailers, particularly in the cosmetics and fashion segments.

Leading Players in the Thailand Travel Retail Market Sector

- King Power International Group

- The Shilla Duty Free

- Leon Duty Free

- Central Pattana

- The Mall Group

- Jaidee Duty Free

- SIAM Gems Group

- Paradise Duty Free

- Regent Plaza Group

- Bangkok Airways

- The Airways International

- Airports of Thailand

- JR Duty Free

Key Milestones in Thailand Travel Retail Market Industry

- October 2023: Foreo opens a new outlet at Don Mueang Airport in collaboration with King Power, expanding its presence in Thailand's travel retail sector.

- November 2023: PTT Oil and Retail Business announces a $900 Million investment to expand its operations across Southeast Asia, leveraging the region's economic growth.

Strategic Outlook for Thailand Travel Retail Market Market

The Thailand travel retail market holds substantial long-term growth potential. Strategic investments in technology, infrastructure, and customer experience will be crucial for success. Focus on personalization, sustainability, and omnichannel integration will shape the future of the market. Collaboration with local communities and tourism bodies will further enhance the sector's competitiveness and attract a wider customer base. The market's trajectory suggests continued expansion, exceeding xx Million in revenue by 2033.

Thailand Travel Retail Market Segmentation

-

1. Product Type

- 1.1. Beauty and Personal Care

- 1.2. Wines and Spirits

- 1.3. Tobacco

- 1.4. Eatables

- 1.5. Fashion Accessories and Hard Luxury

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Distribution Channels (Borders, Downtown)

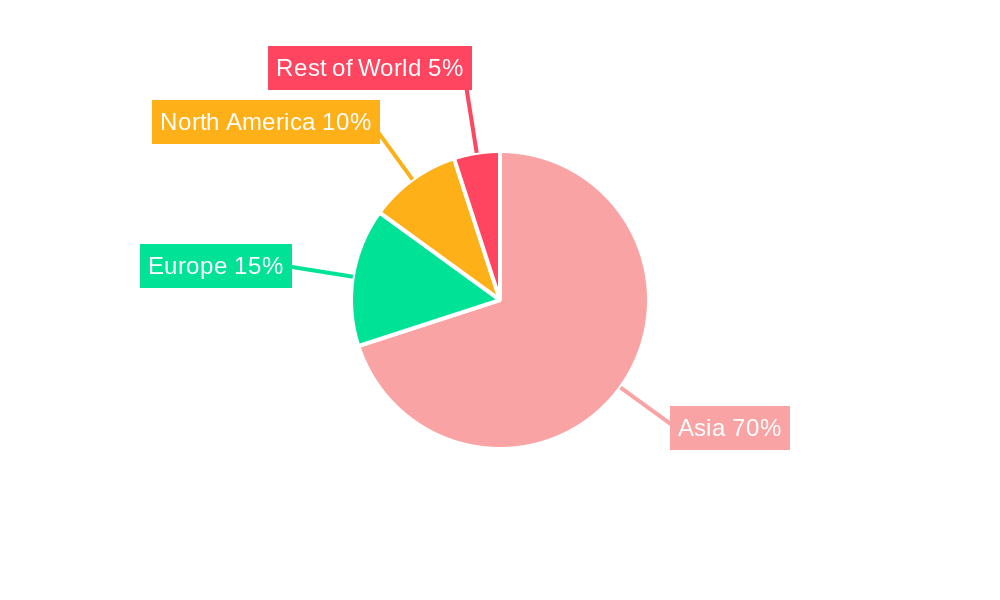

Thailand Travel Retail Market Segmentation By Geography

- 1. Thailand

Thailand Travel Retail Market Regional Market Share

Geographic Coverage of Thailand Travel Retail Market

Thailand Travel Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in Thailand is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beauty and Personal Care

- 5.1.2. Wines and Spirits

- 5.1.3. Tobacco

- 5.1.4. Eatables

- 5.1.5. Fashion Accessories and Hard Luxury

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Distribution Channels (Borders, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 King Power International Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Shilla Duty Free

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leon Duty Free

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Central Pattana

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Mall Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jaidee Duty Free

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIAM Gems Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paradise Duty Free

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Regent Plaza Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bangkok Airways

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Airways International

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Airports of Thailand

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 JR Duty Free**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 King Power International Group

List of Figures

- Figure 1: Thailand Travel Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Travel Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Thailand Travel Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Thailand Travel Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Thailand Travel Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Thailand Travel Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Travel Retail Market?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Thailand Travel Retail Market?

Key companies in the market include King Power International Group, The Shilla Duty Free, Leon Duty Free, Central Pattana, The Mall Group, Jaidee Duty Free, SIAM Gems Group, Paradise Duty Free, Regent Plaza Group, Bangkok Airways, The Airways International, Airports of Thailand, JR Duty Free**List Not Exhaustive.

3. What are the main segments of the Thailand Travel Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.48 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in Thailand is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Foreo broadens its presence in Thailand's travel retail sector with a new outlet at Don Mueang Airport. This expansion, in collaboration with King Power, builds upon Foreo's existing launches at Suvarnabhumi and Phuket airports, along with its presence in King Power Rangnam, King Power Srivaree Complex, and King Power Phuket downtown stores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Travel Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Travel Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Travel Retail Market?

To stay informed about further developments, trends, and reports in the Thailand Travel Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence