Key Insights

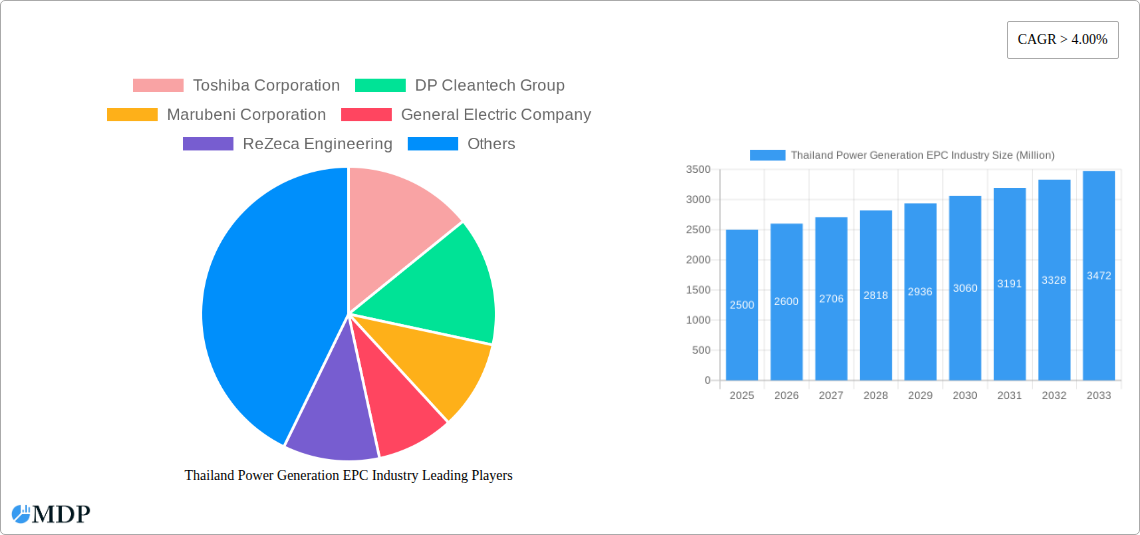

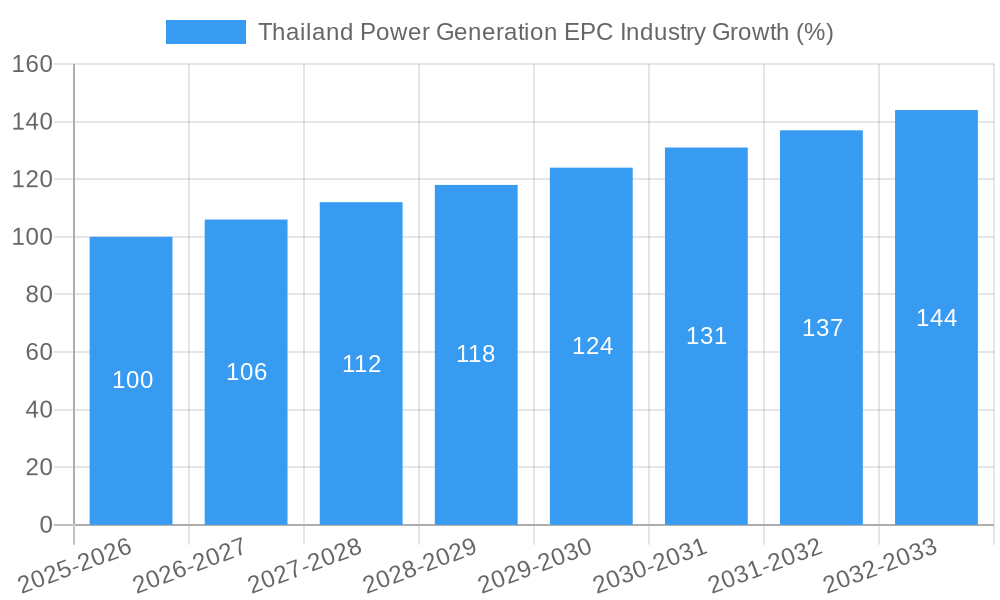

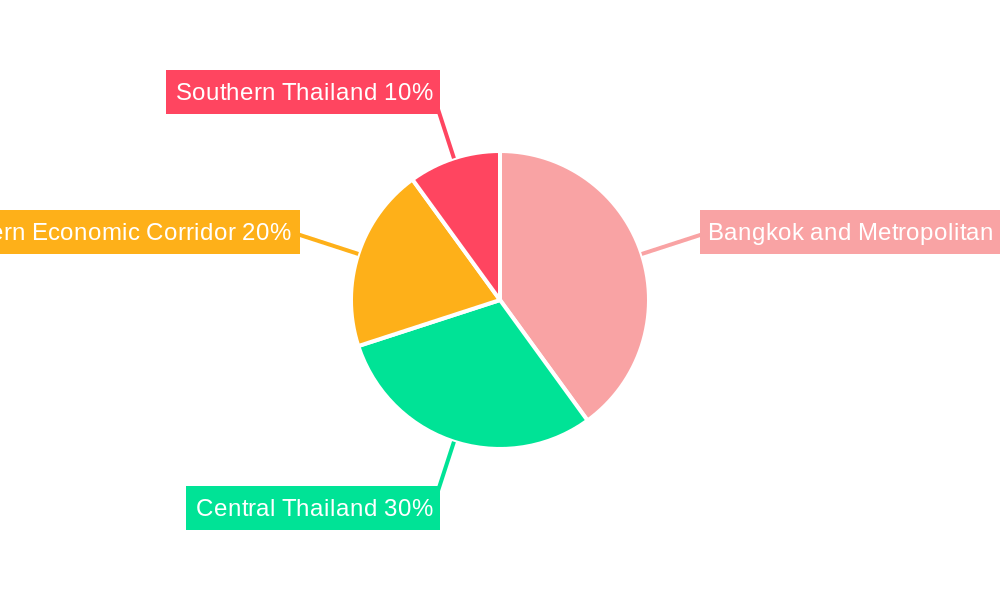

The Thailand power generation engineering, procurement, and construction (EPC) industry is experiencing robust growth, driven by increasing energy demand fueled by economic expansion and urbanization, particularly in Bangkok and its surrounding areas. A compound annual growth rate (CAGR) exceeding 4% from 2019 to 2033 points to a significant market expansion. Key drivers include government initiatives promoting renewable energy sources like solar and wind power to diversify the energy mix and reduce reliance on fossil fuels. The transition towards cleaner energy is a major trend, leading to increased investment in renewable energy EPC projects. However, regulatory hurdles and potential grid infrastructure limitations pose challenges. The market is segmented by end-use (utilities, industrial, commercial), power plant type (coal-fired, gas-fired, renewable – solar, wind, hydropower), and geographic region within Thailand (Bangkok Metropolitan Area, Central Thailand, Eastern Economic Corridor, Southern Thailand). Major players like Toshiba, DP Cleantech, Marubeni, General Electric, and local firms like Grimm Power are actively competing in this dynamic market. The industry is witnessing a shift toward larger-scale projects and increasing focus on optimizing project lifecycle management for efficiency and cost reduction.

The projected market size for 2025 serves as a base for forecasting future growth. Given the 4%+ CAGR and considering the significant investments in infrastructure and renewable energy projects planned for Thailand, a conservative estimate suggests a steady increase in market value over the forecast period (2025-2033). The continued expansion of the Eastern Economic Corridor, a key driver of industrial growth, will further fuel demand for power generation EPC services. Competition is expected to remain intense, with both international and domestic companies vying for project contracts. The success of companies will hinge on their ability to offer competitive pricing, demonstrate technological expertise, and effectively navigate the regulatory landscape.

Thailand Power Generation EPC Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Thailand Power Generation Engineering, Procurement, and Construction (EPC) industry, offering invaluable insights for stakeholders from 2019 to 2033. With a focus on market dynamics, leading players, and future growth opportunities, this report is essential for strategic decision-making. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. The report analyzes key segments including Coal-Fired, Gas-Fired, Renewable Energy (Solar, Wind, Hydropower), and focuses on key regions: Bangkok and Metropolitan Area, Central Thailand, Eastern Economic Corridor, and Southern Thailand, across end-use sectors like Utilities, Industrial, and Commercial. Expect detailed analysis on companies such as Toshiba Corporation, DP Cleantech Group, Marubeni Corporation, General Electric Company, ReZeca Engineering, Black and Veatch Corporation, Mitsubishi Heavy Industries Ltd, and Grimm Power Public Company Limited. The report reveals a market valued at xx Million USD in 2025, projecting a xx% CAGR through 2033.

Thailand Power Generation EPC Industry Market Dynamics & Concentration

The Thailand power generation EPC market exhibits a moderately concentrated landscape, with several multinational and domestic players vying for market share. Market concentration is influenced by factors such as project size, technological expertise, and regulatory approvals. The market share of the top five players in 2025 is estimated at approximately xx%. Innovation is driven by the need for enhanced efficiency, reduced emissions, and integration of renewable energy sources. The regulatory framework, while supportive of renewable energy integration, necessitates compliance with stringent environmental and safety standards. Product substitution mainly revolves around the transition from traditional fossil fuel-based plants to renewable energy solutions. End-user trends demonstrate a growing preference for sustainable and cost-effective power generation solutions. The M&A landscape witnessed xx deals between 2019 and 2024, reflecting strategic consolidation and expansion within the sector.

- Market Concentration: Top 5 players hold xx% market share in 2025.

- Innovation Drivers: Efficiency gains, emission reduction, renewable energy integration.

- Regulatory Framework: Stringent environmental and safety standards.

- M&A Activity: xx deals recorded between 2019 and 2024.

Thailand Power Generation EPC Industry Industry Trends & Analysis

The Thailand power generation EPC market is characterized by significant growth, driven by increasing energy demand, government initiatives promoting renewable energy, and infrastructure development. The market is witnessing a technological disruption with the adoption of advanced technologies such as smart grids, energy storage systems, and digitalization of power plants. Consumer preferences are increasingly shifting toward sustainable and reliable power sources. The competitive dynamics are characterized by both domestic and international players competing for projects, with price, technology, and project execution capabilities being key differentiators. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Market penetration of renewable energy technologies is steadily increasing, driven by government support and falling costs.

Leading Markets & Segments in Thailand Power Generation EPC Industry

The Bangkok and Metropolitan Area dominates the Thailand power generation EPC market, owing to high energy demand and concentrated infrastructure development. Central Thailand and the Eastern Economic Corridor also represent significant markets, driven by industrial growth and government initiatives. The Utilities segment holds the largest share of the market due to its substantial power generation capacity. Gas-fired power plants currently represent a major segment, but there is significant growth in renewable energy power plants.

- Key Drivers for Bangkok and Metropolitan Area: High energy demand, existing infrastructure.

- Key Drivers for Central Thailand: Industrial growth, government investment.

- Key Drivers for Eastern Economic Corridor: Government incentives, infrastructure development.

- Dominant End-Use Segment: Utilities

- Dominant Plant Type: Gas-fired power plants, with growing renewable energy segment.

Thailand Power Generation EPC Industry Product Developments

Recent product developments focus on enhancing efficiency, reducing emissions, and integrating renewable energy sources. Companies are increasingly adopting advanced technologies such as combined cycle gas turbines, high-efficiency solar panels, and smart grid technologies to enhance their offerings. This focus on innovation allows companies to gain a competitive edge by providing superior performance, reliability, and cost-effectiveness to their clients. The market is also witnessing the emergence of hybrid power plants combining different energy sources to optimize efficiency and reduce reliance on fossil fuels.

Key Drivers of Thailand Power Generation EPC Industry Growth

Several factors fuel the growth of the Thailand power generation EPC industry. Increasing energy demand across all sectors necessitates expanded power generation capacity. Government policies and incentives promoting renewable energy adoption are significantly boosting investment in solar, wind, and hydropower projects. Furthermore, infrastructure development initiatives across various regions of Thailand create opportunities for new power generation projects.

Challenges in the Thailand Power Generation EPC Industry Market

The industry faces several challenges. Regulatory hurdles and approvals for new projects can cause delays. Supply chain disruptions and volatility in material costs affect project timelines and profitability. Intense competition among domestic and international EPC players necessitates aggressive pricing strategies. These combined challenges influence project margins and overall market dynamics.

Emerging Opportunities in Thailand Power Generation EPC Industry

The long-term growth of the Thailand power generation EPC market is driven by several factors. Technological breakthroughs in renewable energy generation and storage create new opportunities. Strategic partnerships among EPC players, technology providers, and energy companies enhance project execution and innovation. The government’s continuing focus on infrastructure development will drive demand for new power generation facilities. These opportunities present attractive prospects for companies that are able to adapt and innovate.

Leading Players in the Thailand Power Generation EPC Industry Sector

- Toshiba Corporation

- DP Cleantech Group

- Marubeni Corporation

- General Electric Company

- ReZeca Engineering

- Black and Veatch Corporation

- Mitsubishi Heavy Industries Ltd

- Grimm Power Public Company Limited

Key Milestones in Thailand Power Generation EPC Industry Industry

- July 2021: Kawasaki Heavy Industries receives order for gas engines for RATCH Cogeneration Expansion Project (30 MW addition to 110 MW plant).

- September 2020: Mitsubishi Power signs contract to build a 1.4 GW natural gas-fired power plant for Hin Kong Power company Limited (two-phase project, commercial operation expected March 2024 and January 2025).

Strategic Outlook for Thailand Power Generation EPC Industry Market

The Thailand power generation EPC market holds significant growth potential driven by sustained energy demand growth, government support for renewable energy, and continued infrastructure investments. Companies that successfully navigate regulatory challenges, embrace technological innovation, and forge strategic partnerships are positioned to capture significant market share and achieve strong growth in the coming years. Focus on efficiency improvements, sustainable solutions, and flexible project execution models will be critical for success.

Thailand Power Generation EPC Industry Segmentation

- 1. Conventional Thermal Power

- 2. Renewables

- 3. Other Source Types

Thailand Power Generation EPC Industry Segmentation By Geography

- 1. Thailand

Thailand Power Generation EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Shift towards Renewable Energy4.; Less Electricity Generation Cost from Bioenergy

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investments

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Power Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Power Generation EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Conventional Thermal Power

- 5.2. Market Analysis, Insights and Forecast - by Renewables

- 5.3. Market Analysis, Insights and Forecast - by Other Source Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Conventional Thermal Power

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Toshiba Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DP Cleantech Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marubeni Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Electric Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ReZeca Engineering

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Black and Veatch Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grimm Power Public Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Toshiba Corporation

List of Figures

- Figure 1: Thailand Power Generation EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Power Generation EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Power Generation EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Power Generation EPC Industry Revenue Million Forecast, by Conventional Thermal Power 2019 & 2032

- Table 3: Thailand Power Generation EPC Industry Revenue Million Forecast, by Renewables 2019 & 2032

- Table 4: Thailand Power Generation EPC Industry Revenue Million Forecast, by Other Source Types 2019 & 2032

- Table 5: Thailand Power Generation EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Thailand Power Generation EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Thailand Power Generation EPC Industry Revenue Million Forecast, by Conventional Thermal Power 2019 & 2032

- Table 8: Thailand Power Generation EPC Industry Revenue Million Forecast, by Renewables 2019 & 2032

- Table 9: Thailand Power Generation EPC Industry Revenue Million Forecast, by Other Source Types 2019 & 2032

- Table 10: Thailand Power Generation EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Power Generation EPC Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Thailand Power Generation EPC Industry?

Key companies in the market include Toshiba Corporation, DP Cleantech Group, Marubeni Corporation, General Electric Company, ReZeca Engineering, Black and Veatch Corporation, Mitsubishi Heavy Industries Ltd, Grimm Power Public Company Limited.

3. What are the main segments of the Thailand Power Generation EPC Industry?

The market segments include Conventional Thermal Power, Renewables, Other Source Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Shift towards Renewable Energy4.; Less Electricity Generation Cost from Bioenergy.

6. What are the notable trends driving market growth?

Conventional Thermal Power Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investments.

8. Can you provide examples of recent developments in the market?

In July 2021, Kawasaki Heavy Industries Ltd announced that it received an order from Singapore-based Jurong Engineering Ltd. (JEL) for four Kawasaki Green Gas Engines to be used in the RATCH Cogeneration Expansion Project in Thailand. The order was placed through Kawasaki Gas Turbine Asia Sdn Bhd (KGA), which is based in Kuala Lumpur, Malaysia. In the RATCH Cogeneration Expansion Project, a 30 MW class gas engine power plant will be added to a 110 MW combined-cycle power plant operated by RATCH Cogeneration Company Limited, which operates under the parent company and major Thai power producer RATCH Group Public Company Limited.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Power Generation EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Power Generation EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Power Generation EPC Industry?

To stay informed about further developments, trends, and reports in the Thailand Power Generation EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence