Key Insights

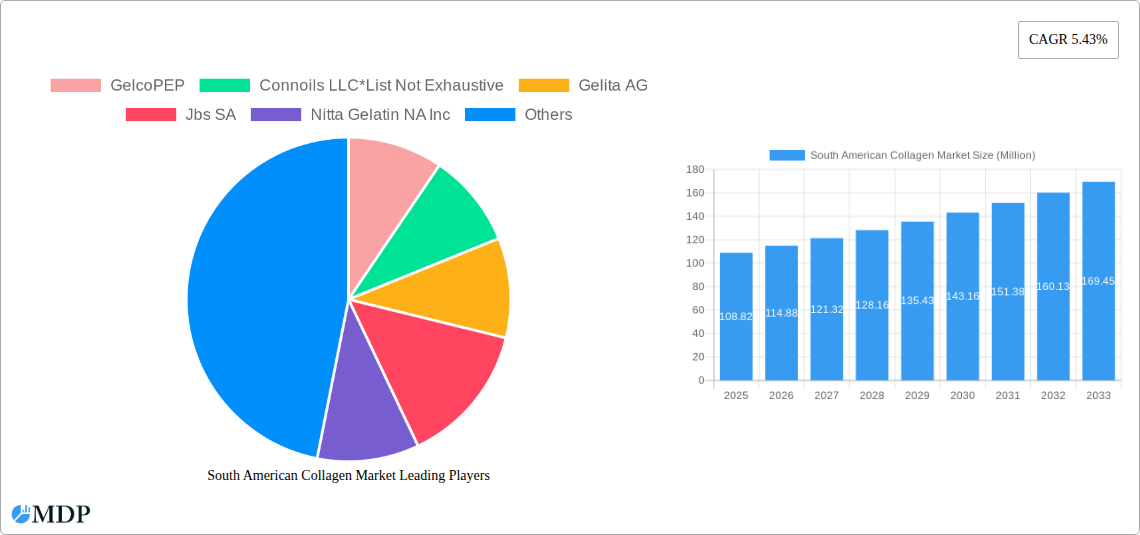

The South American collagen market, valued at $108.82 million in 2025, is projected to experience robust growth, driven by increasing demand across diverse applications. The rising popularity of collagen-based dietary supplements, fueled by growing health consciousness and awareness of collagen's benefits for skin, joint health, and overall well-being, is a key driver. Furthermore, the burgeoning food and beverage industry in the region, particularly in Brazil and Argentina, is incorporating collagen into various products, enhancing their nutritional profile and texture. The cosmetics and personal care sector also contributes significantly, with collagen used extensively in anti-aging creams, lotions, and other beauty products. While the exact breakdown of market share across applications and sources (animal-based vs. marine-based) is not provided, it's reasonable to assume that dietary supplements and cosmetics/personal care hold significant portions, given global trends. The presence of established players like Gelita AG, Rousselot, and JBS SA, along with local companies like Gelnex Industria and Bioiberica, indicates a mature but competitive market landscape.

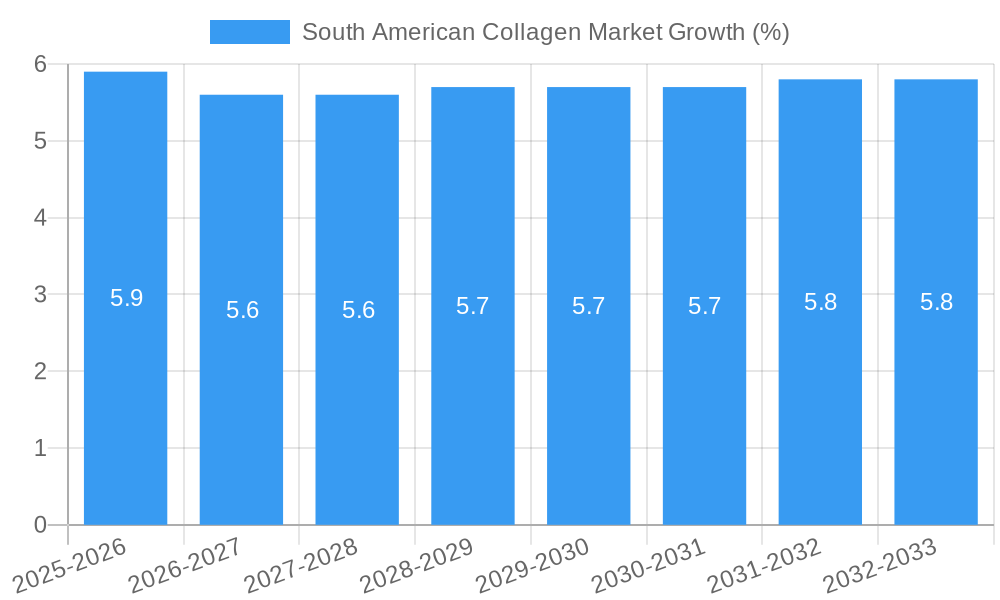

The market's Compound Annual Growth Rate (CAGR) of 5.43% from 2019-2033 suggests a steady expansion. This growth trajectory is likely influenced by rising disposable incomes, increasing urbanization, and the growing preference for premium and functional food and beverage products. Potential restraints could include fluctuating raw material prices, stringent regulatory frameworks surrounding food and cosmetic ingredients, and the potential for consumer skepticism regarding the efficacy of collagen supplements. However, innovation in collagen extraction and processing techniques, along with the development of novel collagen-based products, are expected to mitigate these challenges. Brazil and Argentina, with their relatively large and developed economies, likely constitute the lion's share of the South American market, though further regional breakdown is needed for precise analysis. The forecast period (2025-2033) promises continued growth based on current trends and the continued expansion of the health and wellness sector within South America.

South American Collagen Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South American collagen market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils the market's dynamics, key trends, leading players, and future growth potential. Expect detailed segmentation analysis by application (Dietary Supplements, Meat Processing, Food and Beverage, Cosmetics and Personal Care, Other Applications) and source (Animal-based Collagen, Marine-based Collagen), revealing lucrative opportunities and potential challenges. The report features a detailed competitive landscape, highlighting key players like GelcoPEP, Connoils LLC, Gelita AG, JBS SA, Nitta Gelatin NA Inc, Gelnex Industria, Rousselot, Novaprom, PB Leiner, and Bioiberica, among others. Discover the projected market size, CAGR, and market share dynamics, enabling you to make informed decisions and capitalize on emerging opportunities in this rapidly expanding market.

South American Collagen Market Market Dynamics & Concentration

The South American collagen market is experiencing significant growth, driven by increasing demand across diverse applications and fueled by notable mergers and acquisitions (M&A) activity. Market concentration is moderate, with a few major players holding significant market share, but a fragmented landscape also exists, especially among smaller, regional players. Innovation is a key driver, with companies focusing on developing new collagen types, extraction methods, and applications. Regulatory frameworks, while generally favorable, vary across countries and present some challenges to standardization. Product substitutes, such as plant-based alternatives, are emerging but currently hold a small market share, largely due to the superior functional properties of collagen. End-user trends are shaped by increasing consumer awareness of health and wellness, specifically related to skin, joint, and gut health, driving the demand for collagen-based dietary supplements and personal care products.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- M&A Activity: Significant increase in M&A activity in recent years, with xx deals recorded between 2019 and 2024. This points to an industry ripe for consolidation.

- Innovation Drivers: Development of new collagen types (e.g., hydrolyzed collagen peptides), improved extraction techniques, and exploration of novel applications.

- Regulatory Frameworks: Vary across South American countries, with some inconsistencies creating challenges for consistent product standardization.

South American Collagen Market Industry Trends & Analysis

The South American collagen market is characterized by robust growth, driven by a confluence of factors. The market's Compound Annual Growth Rate (CAGR) from 2019-2024 was xx%, and is projected to reach xx% from 2025-2033. Key drivers include rising consumer awareness of health and wellness benefits associated with collagen consumption (e.g., improved skin elasticity, joint health), increasing demand from the food and beverage industry for functional ingredients, and growth in the cosmetics and personal care sectors. Technological advancements in collagen extraction and processing are enabling the production of higher-quality, more standardized products. This is further enhanced by increased investment in research and development, focusing on creating specialized collagen formulations for targeted applications. However, challenges exist, including fluctuations in raw material costs and the potential for increased competition from plant-based alternatives. Market penetration varies across applications, with dietary supplements and cosmetics and personal care showing significant growth. Competitive dynamics are shaped by both established global players and regional producers, leading to intense price competition in some segments.

Leading Markets & Segments in South American Collagen Market

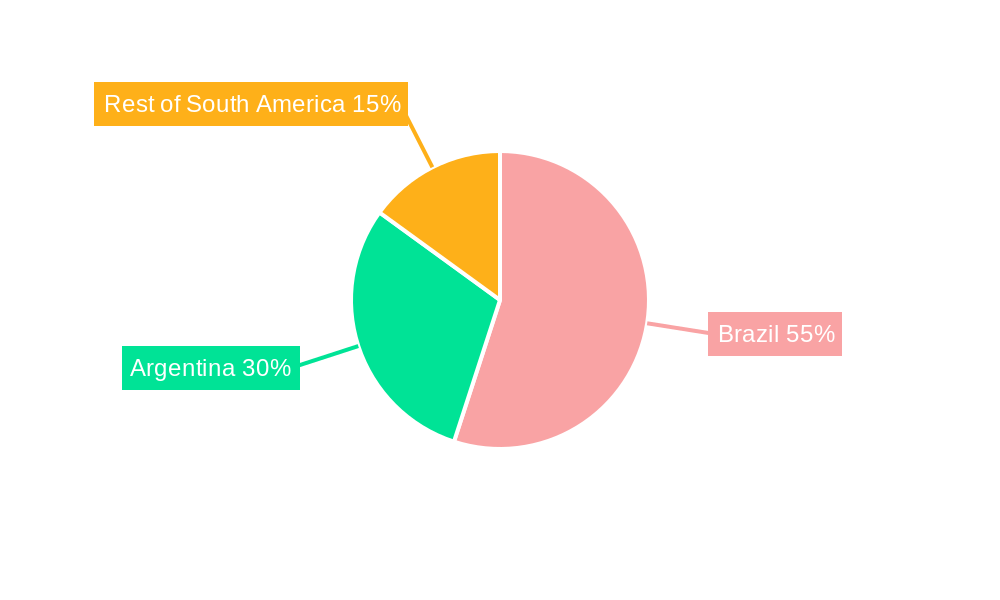

Brazil holds the dominant position within the South American collagen market, accounting for xx% of the total market value in 2024, due to its large population, robust food and beverage industry, and significant investments in the sector. Other key markets include Argentina, Colombia, and Mexico.

Leading Application Segments:

- Dietary Supplements: Fastest-growing segment driven by increasing health consciousness.

- Cosmetics and Personal Care: Strong growth propelled by the demand for anti-aging and skin-health products.

- Food and Beverage: Steady growth with increasing use in functional foods and beverages.

Leading Source Segment:

Animal-based Collagen: Remains the dominant source due to established production infrastructure and cost-effectiveness.

Marine-based Collagen: Experiencing growth due to increasing consumer demand for sustainable and ethically sourced products.

Key Drivers for Brazil's Dominance: Large and growing consumer market, well-established food processing industry, significant investments in collagen production infrastructure, favorable government regulations.

South American Collagen Market Product Developments

Recent product developments focus on innovative collagen formulations with enhanced functionalities, including hydrolyzed collagen peptides for improved absorption, specialized collagen types targeting specific health benefits (e.g., type II collagen for joint health), and the development of collagen-based functional ingredients for use in various food and beverage products. Companies are also emphasizing sustainable and ethically sourced collagen, catering to the growing consumer demand for environmentally friendly products. These innovations improve product efficacy, expand applications, and enhance competitive advantages.

Key Drivers of South American Collagen Market Growth

Several factors are driving the growth of the South American collagen market: the rising popularity of collagen-based dietary supplements due to increased consumer awareness of health and wellness benefits; increasing demand for collagen in food and beverage and cosmetic applications; technological advancements resulting in more efficient and cost-effective collagen extraction and processing methods; and substantial investments by major companies in expanding production capacity. Government support for the development of the food processing industry in several countries also adds to the growth momentum.

Challenges in the South American Collagen Market

The South American collagen market faces challenges including price fluctuations in raw materials, particularly bovine hides and fish skins; inconsistent regulatory frameworks across various countries, creating challenges for standardization and market entry; and the potential for increased competition from plant-based collagen alternatives, although this is currently limited. Supply chain disruptions, exacerbated by geopolitical events, have also impacted production and distribution in the recent past. These challenges need to be addressed to ensure sustained market growth.

Emerging Opportunities in South American Collagen Market

The South American collagen market presents numerous opportunities. The expansion of e-commerce channels provides new avenues for direct-to-consumer sales, driving increased product accessibility. Strategic partnerships between collagen producers and food and beverage companies will lead to the development of new innovative products incorporating collagen as a key ingredient. Technological breakthroughs in collagen extraction and processing continue to improve product quality and reduce production costs, fueling market expansion. Furthermore, the growing interest in sustainable and ethically sourced collagen creates opportunities for companies prioritizing environmentally friendly practices.

Leading Players in the South American Collagen Market Sector

- GelcoPEP

- Connoils LLC

- Gelita AG

- JBS SA

- Nitta Gelatin NA Inc

- Gelnex Industria

- Rousselot

- Novaprom

- PB Leiner

- Bioiberica

Key Milestones in South American Collagen Market Industry

- August 2022: JBS SA invested approximately USD 78.1 Million in a new collagen processing facility in Brazil, significantly expanding its production capacity and bolstering its position in the food and beverage segment.

- September 2022: Darling Ingredients acquired five facilities in South America, increasing their gelatin and collagen production capacity by 46,000 metric tons. This acquisition significantly broadened their South American market presence.

- November 2022: Acquion Food Tech, a new Brazilian venture, launched operations with a planned investment of USD 46.6 million over four years to produce collagen and gelatin. This signifies significant new investment and capacity additions to the market.

Strategic Outlook for South American Collagen Market Market

The South American collagen market is poised for continued strong growth, driven by increasing consumer demand, technological innovation, and rising investments. Strategic opportunities exist for companies focusing on product differentiation through innovative formulations, sustainable sourcing practices, and expansion into new market segments. Collaboration with research institutions and government agencies to develop new applications and overcome regulatory hurdles will further accelerate market development. Focus on delivering high-quality, ethically sourced collagen to a growing consumer base will be crucial for achieving long-term success in this dynamic market.

South American Collagen Market Segmentation

-

1. Source

- 1.1. Animal-based Collagen

- 1.2. Marine-based Collagen

-

2. Application

- 2.1. Dietary Supplements

- 2.2. Meat Processing

- 2.3. Food and Beverage

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Colombia

- 3.3. Rest of South America

South American Collagen Market Segmentation By Geography

- 1. Brazil

- 2. Colombia

- 3. Rest of South America

South American Collagen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing applications of collagen in meat processing; Growing collagen application in food and beverage industry

- 3.3. Market Restrains

- 3.3.1. Availability of potential alternatives

- 3.4. Market Trends

- 3.4.1. Growing Demand for Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal-based Collagen

- 5.1.2. Marine-based Collagen

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dietary Supplements

- 5.2.2. Meat Processing

- 5.2.3. Food and Beverage

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Colombia

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Colombia

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Brazil South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Animal-based Collagen

- 6.1.2. Marine-based Collagen

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dietary Supplements

- 6.2.2. Meat Processing

- 6.2.3. Food and Beverage

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Colombia

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Colombia South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Animal-based Collagen

- 7.1.2. Marine-based Collagen

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dietary Supplements

- 7.2.2. Meat Processing

- 7.2.3. Food and Beverage

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Colombia

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Rest of South America South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Animal-based Collagen

- 8.1.2. Marine-based Collagen

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dietary Supplements

- 8.2.2. Meat Processing

- 8.2.3. Food and Beverage

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Colombia

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Brazil South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 GelcoPEP

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Connoils LLC*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gelita AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Jbs SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nitta Gelatin NA Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Gelnex Industria

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rousselot

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Novaprom

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 PB Leiner

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Bioiberica

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 GelcoPEP

List of Figures

- Figure 1: South American Collagen Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South American Collagen Market Share (%) by Company 2024

List of Tables

- Table 1: South American Collagen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South American Collagen Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: South American Collagen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South American Collagen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South American Collagen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South American Collagen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South American Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South American Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South American Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South American Collagen Market Revenue Million Forecast, by Source 2019 & 2032

- Table 11: South American Collagen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South American Collagen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South American Collagen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South American Collagen Market Revenue Million Forecast, by Source 2019 & 2032

- Table 15: South American Collagen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South American Collagen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South American Collagen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South American Collagen Market Revenue Million Forecast, by Source 2019 & 2032

- Table 19: South American Collagen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South American Collagen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South American Collagen Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South American Collagen Market?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the South American Collagen Market?

Key companies in the market include GelcoPEP, Connoils LLC*List Not Exhaustive, Gelita AG, Jbs SA, Nitta Gelatin NA Inc, Gelnex Industria, Rousselot, Novaprom, PB Leiner, Bioiberica.

3. What are the main segments of the South American Collagen Market?

The market segments include Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 108.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing applications of collagen in meat processing; Growing collagen application in food and beverage industry.

6. What are the notable trends driving market growth?

Growing Demand for Dietary Supplements.

7. Are there any restraints impacting market growth?

Availability of potential alternatives.

8. Can you provide examples of recent developments in the market?

November 2022: Acquion Food Tech, a new Brazilian venture led by entrepreneur André Albuquerque, begins operations with a plan to invest BRL 250 million (USD 46.6 million) over the next four years to produce collagen and gelatin for the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South American Collagen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South American Collagen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South American Collagen Market?

To stay informed about further developments, trends, and reports in the South American Collagen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence