Key Insights

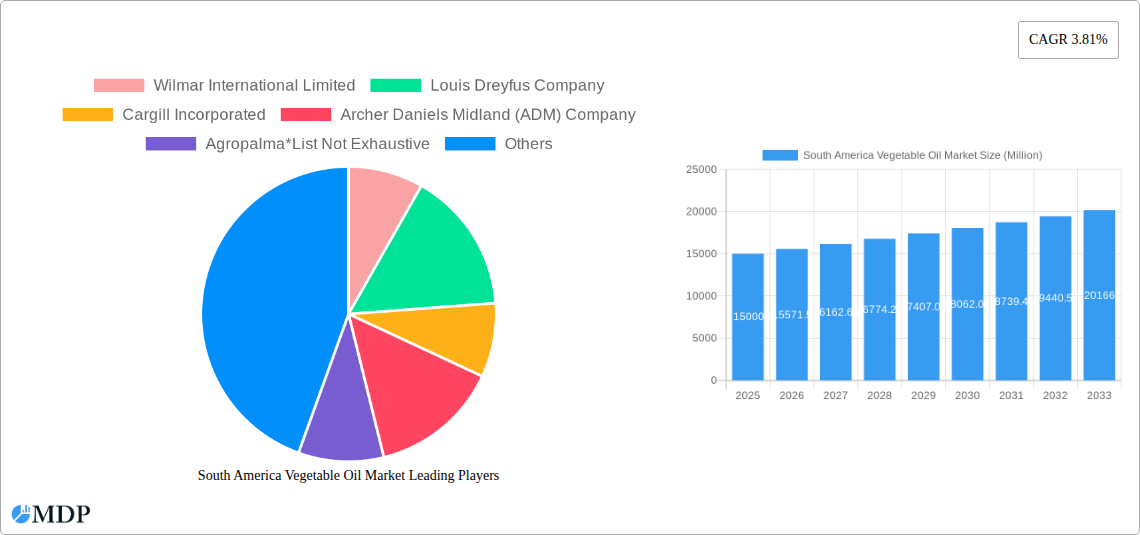

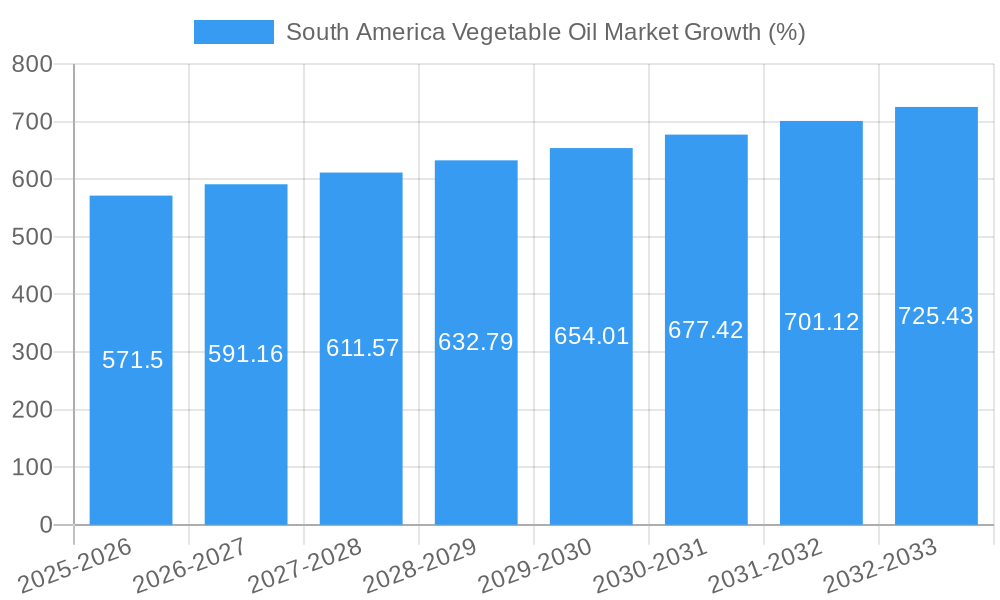

The South American vegetable oil market, currently valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and market size), is projected to experience robust growth at a Compound Annual Growth Rate (CAGR) of 3.81% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning food processing and biofuel industries within the region are driving significant demand for vegetable oils like soybean, palm, and sunflower oil. Increasing consumption of processed foods and rising incomes are bolstering demand in the food application segment. Simultaneously, growing government initiatives supporting sustainable agriculture and biofuel production are contributing to market growth. Brazil and Argentina, the largest economies in South America, represent substantial market shares, fueled by their extensive agricultural land and established production infrastructure. However, challenges remain, including fluctuating crude oil prices (affecting biofuel demand), climate change impacting crop yields, and potential disruptions to global supply chains. These factors could influence the market's trajectory and necessitate strategic adjustments by market players.

The competitive landscape is characterized by a mix of multinational corporations and regional players. Major players such as Wilmar International Limited, Cargill Incorporated, and Bunge Limited are leveraging their global reach and established supply chains to maintain market dominance. However, local companies are also strengthening their positions by focusing on specific niche markets and catering to regional preferences. The market segmentation by oil type (palm, soybean, rapeseed, sunflower, olive, and others) and application (food, feed, industrial) provides opportunities for specialized businesses. Future growth will likely be influenced by advancements in oil extraction techniques, sustainable farming practices, and innovative product development catering to health-conscious consumers, potentially shifting demand towards healthier alternatives like olive oil and away from less healthy options. This necessitates a focus on sustainable and efficient production practices to ensure long-term growth in a market sensitive to environmental concerns.

South America Vegetable Oil Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Vegetable Oil Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to present a detailed overview of market dynamics, trends, key players, and future prospects. Expect actionable insights that will shape your understanding and strategy within this dynamic market. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

South America Vegetable Oil Market Market Dynamics & Concentration

The South American vegetable oil market is characterized by a moderate level of concentration, with several multinational corporations and regional players dominating the landscape. Market share data reveals that the top five players—Wilmar International Limited, Louis Dreyfus Company, Cargill Incorporated, Archer Daniels Midland (ADM) Company, and Bunge Limited—account for approximately xx% of the total market share in 2025. However, the presence of numerous smaller, regional players fosters competition and innovation.

The market’s growth is driven by several key factors:

- Increasing demand for biofuels: The growing focus on renewable energy sources is pushing the demand for vegetable oils as feedstock for biodiesel and sustainable aviation fuel (SAF).

- Expanding food and feed industries: The rising population and increasing consumption of processed foods and animal feed fuels the demand for vegetable oils in these sectors.

- Technological advancements: Innovations in oil extraction, refining, and processing technologies enhance efficiency and product quality.

- Government regulations and policies: Supportive government policies promoting sustainable agriculture and biofuel production positively impact market growth.

- Product substitution: Vegetable oils increasingly substitute traditional fats and oils in various applications, driven by health and environmental concerns.

The market has witnessed a moderate level of M&A activity in recent years. Between 2019 and 2024, there were approximately xx merger and acquisition deals recorded, primarily focused on expanding production capacity, securing supply chains, and gaining access to new markets. This activity is expected to continue, with larger players actively seeking to consolidate their market positions.

South America Vegetable Oil Market Industry Trends & Analysis

The South American vegetable oil market is experiencing significant transformation driven by several key trends. Market growth is primarily fuelled by rising demand from the food and feed industries, a growing preference for healthier cooking oils, and the increasing adoption of vegetable oils in industrial applications like cosmetics and biofuels. The market exhibits a CAGR of xx% from 2025 to 2033. This growth is expected to be propelled by continuous innovation in oil extraction and refining, resulting in higher yields and improved product quality. Technological disruptions, such as the introduction of advanced processing techniques and automation, are enhancing efficiency and sustainability across the value chain. Consumer preferences are shifting towards healthier and more sustainable options, driving demand for organic and sustainably sourced vegetable oils. The competitive dynamics are characterized by intense competition among major players, leading to price wars and strategic partnerships to secure supply chains and expand market reach. Market penetration of sustainably sourced vegetable oils is gradually increasing, reaching an estimated xx% in 2025.

Leading Markets & Segments in South America Vegetable Oil Market

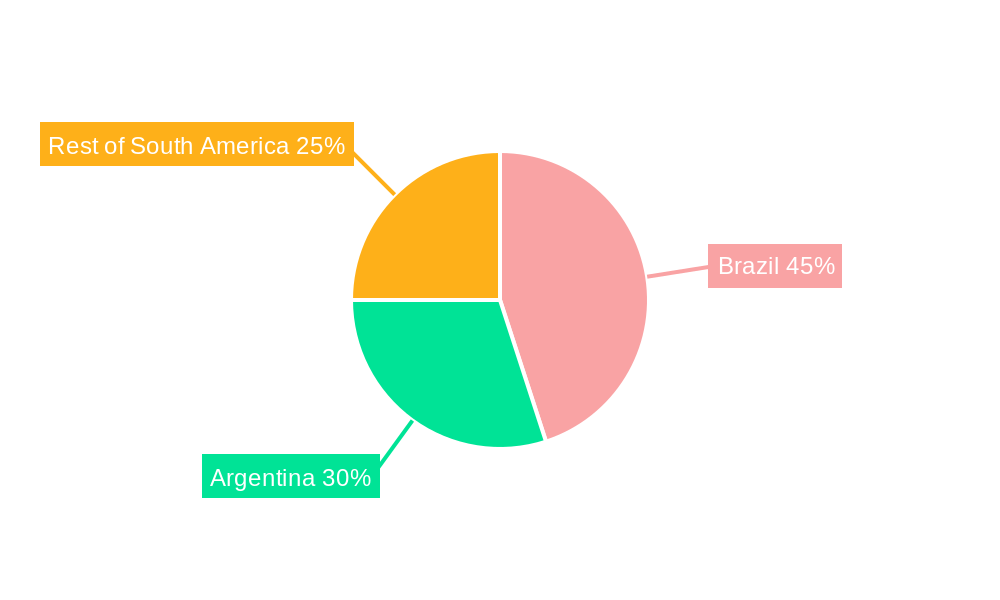

Brazil emerges as the dominant market in South America for vegetable oils, accounting for approximately xx% of the regional market share in 2025. Its large agricultural sector, favorable climate, and established infrastructure contribute to its leading position. Argentina and Colombia also represent significant markets, albeit with smaller shares.

Dominant Segments:

Type: Soybean oil holds the largest market share within the type segment, driven by its widespread use in food and feed applications. Palm oil occupies the second position, followed by sunflower and rapeseed oil, each catering to niche markets.

Application: The food industry is the dominant application segment, consuming a significant portion of the vegetable oil produced. This is followed by the feed industry, with industrial applications showing a gradual increase in demand.

Key Drivers for Brazil's Dominance:

- Favorable climate and fertile land: Brazil's vast agricultural lands and suitable climatic conditions are conducive to large-scale vegetable oil production.

- Government support and incentives: Government policies and initiatives aimed at promoting agricultural development and biofuel production have positively impacted the industry.

- Established infrastructure: Well-developed infrastructure, including transportation and logistics networks, facilitates the efficient movement of vegetable oil across the country.

South America Vegetable Oil Market Product Developments

Recent product developments in the South American vegetable oil market are focused on enhancing sustainability, improving nutritional value, and expanding applications. Companies are increasingly investing in technologies that reduce their environmental footprint and enhance efficiency in oil extraction and processing. The focus on organic and sustainably sourced oils is increasing, aligning with consumer demand for healthier and more environmentally friendly products. New applications are being explored, including the growing use of vegetable oils in the production of biofuels and bio-based materials.

Key Drivers of South America Vegetable Oil Market Growth

Several factors are driving the growth of the South American vegetable oil market. Technological advancements in oil extraction and processing enhance efficiency and yield. Economic growth and rising disposable incomes increase consumer spending on processed foods and animal products, boosting demand. Government policies promoting sustainable agriculture and biofuel production contribute to the market's expansion. These factors collectively shape the market's trajectory towards sustained growth.

Challenges in the South America Vegetable Oil Market Market

The South American vegetable oil market faces several challenges. Fluctuations in agricultural commodity prices impact profitability and market stability. Supply chain disruptions due to logistics issues or adverse weather conditions pose significant risks. Intense competition among producers can lead to price wars, eroding profit margins. Moreover, regulatory changes or environmental concerns might introduce further complexities, influencing market dynamics.

Emerging Opportunities in South America Vegetable Oil Market

The market presents several promising opportunities. Technological breakthroughs in biofuel production can create new revenue streams for companies. Strategic partnerships among producers and end-users can create synergies and improve market access. Expansion into new markets and product diversification can lead to higher profitability and reduced dependency on existing segments. These opportunities pave the way for long-term market expansion and sustained growth.

Leading Players in the South America Vegetable Oil Market Sector

- Wilmar International Limited

- Louis Dreyfus Company

- Cargill Incorporated

- Archer Daniels Midland (ADM) Company

- Agropalma

- AAK AB (formerly AarhusKarlshamn)

- Bunge Limited

- Sime Darby Plantation Berhad

- Olam International

- Aceitera General Deheza

Key Milestones in South America Vegetable Oil Market Industry

- July 2021: Agropalma partnered with Ciranda to expand organic palm oil production, targeting the organic food sector. This signals increasing demand for sustainable products.

- April 2022: Vibra Energia SA, in collaboration with Brasil BioFuels, entered the palm oil-based jet fuel market, indicating a significant shift towards sustainable aviation fuel.

- October 2022: BrasilBiofuels announced plans to construct Brazil's first SAF facility in Manaus, utilizing palm oil as feedstock. This development underscores the growing importance of biofuels in the region.

Strategic Outlook for South America Vegetable Oil Market Market

The South American vegetable oil market is poised for substantial growth, driven by increasing demand for biofuels and sustainable products. Strategic partnerships and technological advancements are key to unlocking future potential. Companies focusing on sustainability, innovation, and efficient supply chain management are well-positioned to capture significant market share in the years to come. The market’s trajectory shows consistent growth, with opportunities for both established players and new entrants to thrive.

South America Vegetable Oil Market Segmentation

-

1. Type

- 1.1. Palm Oil

- 1.2. Soybean Oil

- 1.3. Rapeseed Oil

- 1.4. Sunflower Oil

- 1.5. Olive Oil

- 1.6. Other Types

-

2. Application

- 2.1. Food

- 2.2. Feed

- 2.3. Industrial

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Vegetable Oil Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Vegetable Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Processed Foods; Strategic Initiatives by Companies Uplifting Market Growth

- 3.3. Market Restrains

- 3.3.1. Availability of Substitute Products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Biofuels to Support the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Palm Oil

- 5.1.2. Soybean Oil

- 5.1.3. Rapeseed Oil

- 5.1.4. Sunflower Oil

- 5.1.5. Olive Oil

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food

- 5.2.2. Feed

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Palm Oil

- 6.1.2. Soybean Oil

- 6.1.3. Rapeseed Oil

- 6.1.4. Sunflower Oil

- 6.1.5. Olive Oil

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food

- 6.2.2. Feed

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Palm Oil

- 7.1.2. Soybean Oil

- 7.1.3. Rapeseed Oil

- 7.1.4. Sunflower Oil

- 7.1.5. Olive Oil

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food

- 7.2.2. Feed

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Palm Oil

- 8.1.2. Soybean Oil

- 8.1.3. Rapeseed Oil

- 8.1.4. Sunflower Oil

- 8.1.5. Olive Oil

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food

- 8.2.2. Feed

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Wilmar International Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Louis Dreyfus Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cargill Incorporated

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Archer Daniels Midland (ADM) Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Agropalma*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AAK AB (formerly AarhusKarlshamn)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Bunge Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sime Darby Plantation Berhad

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Olam International

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Aceitera General Deheza

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Wilmar International Limited

List of Figures

- Figure 1: South America Vegetable Oil Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Vegetable Oil Market Share (%) by Company 2024

List of Tables

- Table 1: South America Vegetable Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Vegetable Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Vegetable Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Vegetable Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Vegetable Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Vegetable Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Vegetable Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Vegetable Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Vegetable Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Vegetable Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Vegetable Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South America Vegetable Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Vegetable Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Vegetable Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Vegetable Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South America Vegetable Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Vegetable Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Vegetable Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Vegetable Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South America Vegetable Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Vegetable Oil Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Vegetable Oil Market?

The projected CAGR is approximately 3.81%.

2. Which companies are prominent players in the South America Vegetable Oil Market?

Key companies in the market include Wilmar International Limited, Louis Dreyfus Company, Cargill Incorporated, Archer Daniels Midland (ADM) Company, Agropalma*List Not Exhaustive, AAK AB (formerly AarhusKarlshamn), Bunge Limited, Sime Darby Plantation Berhad, Olam International, Aceitera General Deheza.

3. What are the main segments of the South America Vegetable Oil Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Processed Foods; Strategic Initiatives by Companies Uplifting Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Biofuels to Support the Market Growth.

7. Are there any restraints impacting market growth?

Availability of Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: BrasilBiofuels announced its plans to build Brazil's first sustainability aviation fuel facility in Manaus using technology developed by Denmark's Topsoe Haldor. The company claimed that they would use palm oil which they will grow in Brazil, as feedstock for the biorefinery to meet the growing demand for renewable fuels, including SAF.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Vegetable Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Vegetable Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Vegetable Oil Market?

To stay informed about further developments, trends, and reports in the South America Vegetable Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence