Key Insights

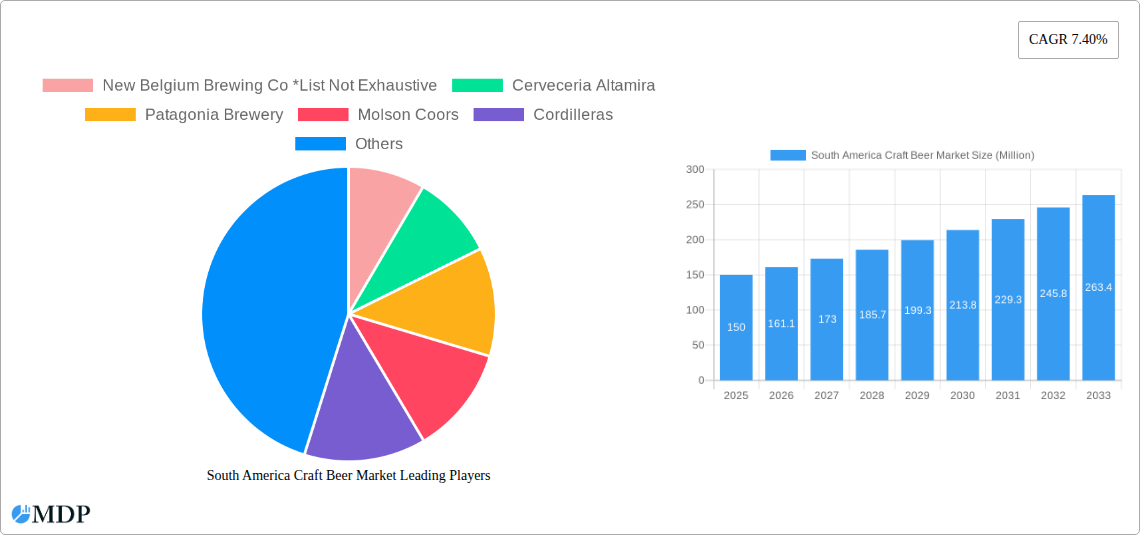

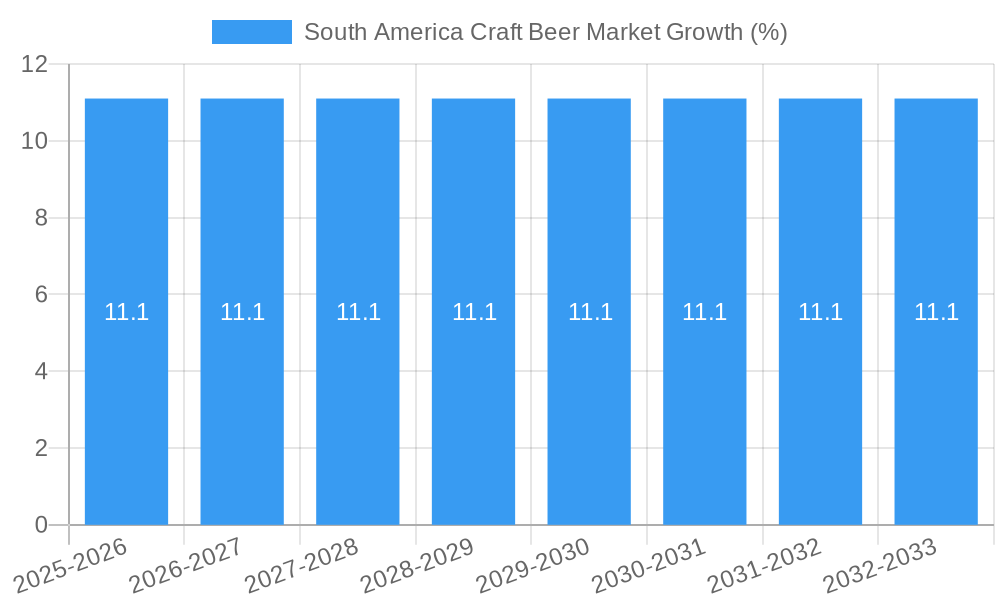

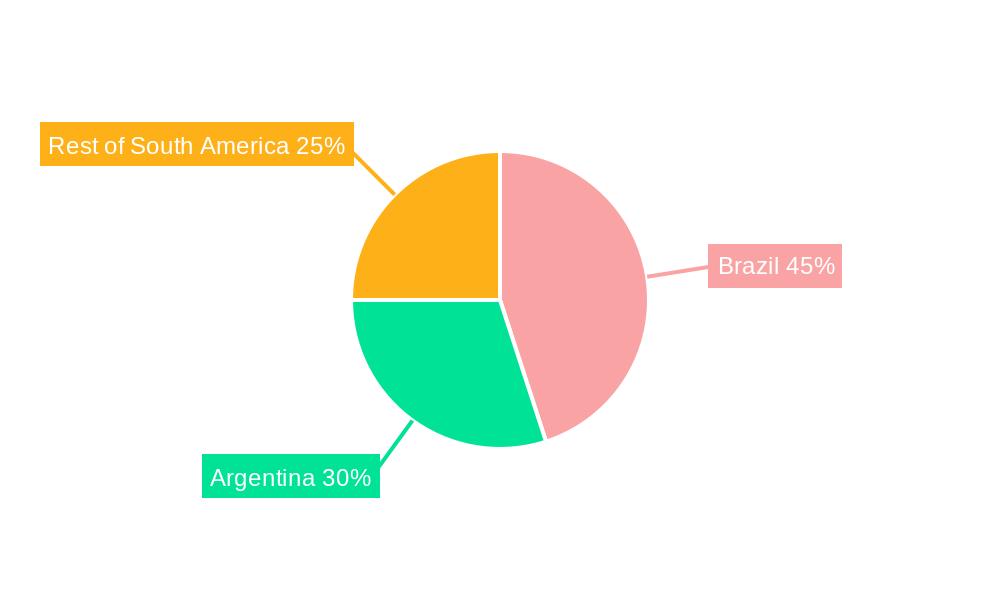

The South American craft beer market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a 7.40% CAGR through 2033. This expansion is fueled by several key factors. Rising disposable incomes, particularly amongst younger demographics, are driving increased spending on premium beverages like craft beer. A burgeoning middle class with a growing appreciation for unique and high-quality products further contributes to market expansion. Furthermore, the increasing popularity of craft beer festivals and events, along with a rise in craft beer tourism, is fostering brand awareness and consumer interest. The presence of established breweries like Patagonia Brewery and newcomers alike is boosting competition and innovation, leading to a diverse product landscape. Strong local production and distribution networks within key markets like Brazil and Argentina contribute to market accessibility.

However, challenges persist. High import tariffs and excise duties on imported ingredients and finished products can increase production costs. Fluctuating currency exchange rates also pose a risk, impacting the profitability of both domestic and international players. Furthermore, the market remains somewhat fragmented, with a range of small to medium-sized breweries competing against established global players. This competitive landscape necessitates strategic marketing and distribution strategies to achieve sustainable market share gains. The varying regulatory environments across South American nations also present a challenge for consistent growth and market penetration. Despite these challenges, the long-term outlook remains positive, driven by strong consumer demand and increasing investment in the sector. The market segmentation into Ale, Pilsner, and Pale Lagers; Specialty Beers; and Others, coupled with on-trade and off-trade distribution channels, presents opportunities for targeted growth strategies across various product offerings and sales channels.

South America Craft Beer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the South America craft beer market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to deliver actionable intelligence. The report covers key market segments, leading players, and emerging trends, providing a clear roadmap for success in the South American craft beer landscape. Expect detailed analysis on market dynamics, growth drivers, challenges, and lucrative opportunities. Discover the key players shaping the market, including New Belgium Brewing Co, Cerveceria Altamira, Patagonia Brewery, Molson Coors, Cordilleras, The Boston Beer Company Inc, Anheuser-Busch InBev SA/NV, Feral Brewing co, Bogota Beer Company, and Heineken NV.

South America Craft Beer Market Market Dynamics & Concentration

This section delves into the competitive landscape of the South American craft beer market. We analyze market concentration, identifying key players and their respective market shares. The report examines innovation drivers, such as the rising popularity of specialty beers and the adoption of new brewing techniques. We also explore the regulatory frameworks influencing the market, including licensing requirements and alcohol content regulations. Furthermore, we assess the impact of product substitutes, such as other alcoholic beverages and non-alcoholic alternatives, and analyze end-user trends, focusing on evolving consumer preferences and purchasing habits. Finally, we examine M&A activities in the industry, including the number and value of deals, to highlight consolidation trends and strategic partnerships. The analysis will cover the period from 2019 to 2024, providing a historical context for understanding current market dynamics. Market share data will be provided for key players where available. The number of M&A deals within the historical period will also be outlined, with xx representing the estimated number.

South America Craft Beer Market Industry Trends & Analysis

This section provides a detailed analysis of the South American craft beer market trends, focusing on the factors driving market growth and shaping its future. We examine the Compound Annual Growth Rate (CAGR) of the market during the historical period (2019-2024) and project the CAGR for the forecast period (2025-2033). The analysis covers various factors, including evolving consumer preferences towards premium and craft beers, the impact of technological disruptions on brewing processes and distribution channels, and the competitive dynamics amongst established breweries and emerging craft brewers. Specific attention will be given to market penetration rates of craft beer within the South American beverage market and the influence of changing demographics and lifestyle trends on consumption patterns. The effect of economic conditions and consumer spending power on market growth will also be analyzed. We analyze the impact of changing consumer preferences toward specific beer types, such as ales, pilsners, and specialty beers, along with the changing popularity of on-trade vs. off-trade distribution. The analysis will highlight the market penetration of these different segments and the factors influencing their growth.

Leading Markets & Segments in South America Craft Beer Market

This section identifies the dominant regions, countries, and segments within the South American craft beer market. We analyze market leadership by region and country, highlighting key factors that have propelled these markets' growth. These drivers could include favorable economic policies, well-developed infrastructure supporting distribution and logistics, or unique cultural factors fostering a strong craft beer culture. The analysis will delve into the leading segments by type (Ales, Pilsners and Pale Lagers, Specialty Beers, Others) and distribution channel (On-Trade, Off-Trade), identifying the highest-performing segments and discussing the contributing factors. We provide a detailed breakdown of market share within each segment and highlight the key drivers and trends responsible for their dominance. The factors affecting the performance of the on-trade and off-trade channels are also thoroughly explored, accounting for changes in regulations, consumer behavior, and technological advancements in distribution.

By Type:

- Ales: xx Million market share in 2025

- Pilsners and Pale Lagers: xx Million market share in 2025

- Specialty Beers: xx Million market share in 2025

- Others: xx Million market share in 2025

By Distribution Channel:

- On-Trade: xx Million market share in 2025

- Off-Trade: xx Million market share in 2025

South America Craft Beer Market Product Developments

This section summarizes recent product innovations in the South American craft beer market. We examine new product launches, highlighting their key features, target markets, and competitive advantages. The analysis focuses on technological trends impacting product development, including the use of new ingredients, brewing techniques, and packaging solutions. We also assess the market fit of these new products, analyzing their adoption rates and their impact on consumer preferences. The discussion includes an assessment of the effectiveness of different marketing strategies employed by leading brewers to launch their new products successfully.

Key Drivers of South America Craft Beer Market Growth

Several factors are driving the growth of the South American craft beer market. Rising disposable incomes across key regions are increasing consumer spending on premium beverages. A growing young adult population with a penchant for diverse and high-quality experiences is driving increased consumption. Technological advancements in brewing processes and packaging are allowing for improved efficiency and enhanced product quality, adding to the appeal. Furthermore, changing government regulations, particularly concerning the licensing and production of craft beer, are creating a more favorable environment for industry growth. These factors are expected to foster continued expansion of the South American craft beer market over the forecast period.

Challenges in the South America Craft Beer Market Market

Despite the positive outlook, the South American craft beer market faces several challenges. Stringent regulatory requirements related to alcohol production and distribution can create barriers to entry for new players and increase compliance costs. Supply chain complexities and the cost of high-quality ingredients can impact production efficiency and profitability. Intense competition from established international and domestic players requires craft breweries to continuously innovate and differentiate their offerings. These challenges can significantly affect market expansion and profitability for both small and large breweries operating within South America.

Emerging Opportunities in South America Craft Beer Market

The South American craft beer market presents significant long-term growth opportunities. The increasing adoption of e-commerce platforms provides new avenues for distribution and market expansion. Strategic partnerships between craft breweries and local businesses can broaden market reach and strengthen brand visibility. Technological advancements, such as AI-driven production optimization, could create efficiencies and improve sustainability. Finally, targeting specific niche consumer segments with tailored product offerings can unlock significant market potential. These opportunities represent key growth drivers for the coming decade.

Leading Players in the South America Craft Beer Market Sector

- New Belgium Brewing Co

- Cerveceria Altamira

- Patagonia Brewery

- Molson Coors

- Cordilleras

- The Boston Beer Company Inc

- Anheuser-Busch InBev SA/NV

- Feral Brewing co

- Bogota Beer Company

- Heineken NV

Key Milestones in South America Craft Beer Market Industry

August 2021: Feral Brewing co. launched Runt pale ale, a mid-strength alternative with a 3.5% ABV. This introduction broadened the company's product portfolio and appealed to a wider consumer base.

March 2022: Heineken launched the world's first virtual beer for the metaverse, a pioneering marketing initiative showcasing innovative approaches to product promotion and brand engagement.

April 2022: Ambev, Anheuser-Busch's Brazilian brewer, invested USD 154 Million in a new eco-sustainable glass plant in Parana, Brazil. This investment demonstrates a commitment to sustainability and highlights the increasing importance of eco-friendly practices within the industry.

Strategic Outlook for South America Craft Beer Market Market

The South American craft beer market holds substantial future potential. Continued investment in innovative brewing techniques and sustainable practices will enhance the appeal of craft beers. Strategic collaborations among breweries and expansion into new markets will broaden the market's reach. Capitalizing on the growing demand for premium and niche craft beers through targeted marketing campaigns will drive continued expansion. Overall, the South American craft beer market is poised for strong growth, presenting numerous opportunities for businesses to thrive in this exciting sector.

South America Craft Beer Market Segmentation

-

1. Type

- 1.1. Ales

- 1.2. Pilsners and Pale Lagers

- 1.3. Specialty Beers

- 1.4. Others

-

2. Distriburtion Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Online Channel

- 2.2.2. Offline Channel

-

3. Geography

- 3.1. Argentina

- 3.2. Brazil

- 3.3. Rest of South America

South America Craft Beer Market Segmentation By Geography

- 1. Argentina

- 2. Brazil

- 3. Rest of South America

South America Craft Beer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. The increasing number of microbreweries elevates the demand for craft beer

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Craft Beer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ales

- 5.1.2. Pilsners and Pale Lagers

- 5.1.3. Specialty Beers

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Online Channel

- 5.2.2.2. Offline Channel

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Argentina

- 5.3.2. Brazil

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Argentina

- 5.4.2. Brazil

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Argentina South America Craft Beer Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ales

- 6.1.2. Pilsners and Pale Lagers

- 6.1.3. Specialty Beers

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Online Channel

- 6.2.2.2. Offline Channel

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Argentina

- 6.3.2. Brazil

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil South America Craft Beer Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ales

- 7.1.2. Pilsners and Pale Lagers

- 7.1.3. Specialty Beers

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Online Channel

- 7.2.2.2. Offline Channel

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Argentina

- 7.3.2. Brazil

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Craft Beer Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ales

- 8.1.2. Pilsners and Pale Lagers

- 8.1.3. Specialty Beers

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Online Channel

- 8.2.2.2. Offline Channel

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Argentina

- 8.3.2. Brazil

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Craft Beer Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Craft Beer Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Craft Beer Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 New Belgium Brewing Co *List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Cerveceria Altamira

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Patagonia Brewery

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Molson Coors

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cordilleras

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 The Boston Beer Company Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Anheuser-Busch InBev SA/NV

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Feral Brewing co

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bogota Beer Company

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Heineken NV

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 New Belgium Brewing Co *List Not Exhaustive

List of Figures

- Figure 1: South America Craft Beer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Craft Beer Market Share (%) by Company 2024

List of Tables

- Table 1: South America Craft Beer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Craft Beer Market Volume liter Forecast, by Region 2019 & 2032

- Table 3: South America Craft Beer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South America Craft Beer Market Volume liter Forecast, by Type 2019 & 2032

- Table 5: South America Craft Beer Market Revenue Million Forecast, by Distriburtion Channel 2019 & 2032

- Table 6: South America Craft Beer Market Volume liter Forecast, by Distriburtion Channel 2019 & 2032

- Table 7: South America Craft Beer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: South America Craft Beer Market Volume liter Forecast, by Geography 2019 & 2032

- Table 9: South America Craft Beer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South America Craft Beer Market Volume liter Forecast, by Region 2019 & 2032

- Table 11: South America Craft Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America Craft Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 13: Brazil South America Craft Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil South America Craft Beer Market Volume (liter) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Craft Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina South America Craft Beer Market Volume (liter) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America South America Craft Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America South America Craft Beer Market Volume (liter) Forecast, by Application 2019 & 2032

- Table 19: South America Craft Beer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: South America Craft Beer Market Volume liter Forecast, by Type 2019 & 2032

- Table 21: South America Craft Beer Market Revenue Million Forecast, by Distriburtion Channel 2019 & 2032

- Table 22: South America Craft Beer Market Volume liter Forecast, by Distriburtion Channel 2019 & 2032

- Table 23: South America Craft Beer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: South America Craft Beer Market Volume liter Forecast, by Geography 2019 & 2032

- Table 25: South America Craft Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Craft Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 27: South America Craft Beer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: South America Craft Beer Market Volume liter Forecast, by Type 2019 & 2032

- Table 29: South America Craft Beer Market Revenue Million Forecast, by Distriburtion Channel 2019 & 2032

- Table 30: South America Craft Beer Market Volume liter Forecast, by Distriburtion Channel 2019 & 2032

- Table 31: South America Craft Beer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: South America Craft Beer Market Volume liter Forecast, by Geography 2019 & 2032

- Table 33: South America Craft Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Craft Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 35: South America Craft Beer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: South America Craft Beer Market Volume liter Forecast, by Type 2019 & 2032

- Table 37: South America Craft Beer Market Revenue Million Forecast, by Distriburtion Channel 2019 & 2032

- Table 38: South America Craft Beer Market Volume liter Forecast, by Distriburtion Channel 2019 & 2032

- Table 39: South America Craft Beer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: South America Craft Beer Market Volume liter Forecast, by Geography 2019 & 2032

- Table 41: South America Craft Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: South America Craft Beer Market Volume liter Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Craft Beer Market?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the South America Craft Beer Market?

Key companies in the market include New Belgium Brewing Co *List Not Exhaustive, Cerveceria Altamira, Patagonia Brewery, Molson Coors, Cordilleras, The Boston Beer Company Inc, Anheuser-Busch InBev SA/NV, Feral Brewing co, Bogota Beer Company, Heineken NV.

3. What are the main segments of the South America Craft Beer Market?

The market segments include Type, Distriburtion Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

The increasing number of microbreweries elevates the demand for craft beer.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

In April 2022, Anheuser-Busch's Brazilian brewer, Ambev invested USD 154 million in a new eco-sustainable glass plant in Parana, Brazil. The new glass plant provides sustainable glass bottles for the packaging of craft beer. The glass plant is able to run on biofuels, use cutting-edge technology to assure excellent water and energy efficiency, and operate on 100% renewable electricity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Craft Beer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Craft Beer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Craft Beer Market?

To stay informed about further developments, trends, and reports in the South America Craft Beer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence