Key Insights

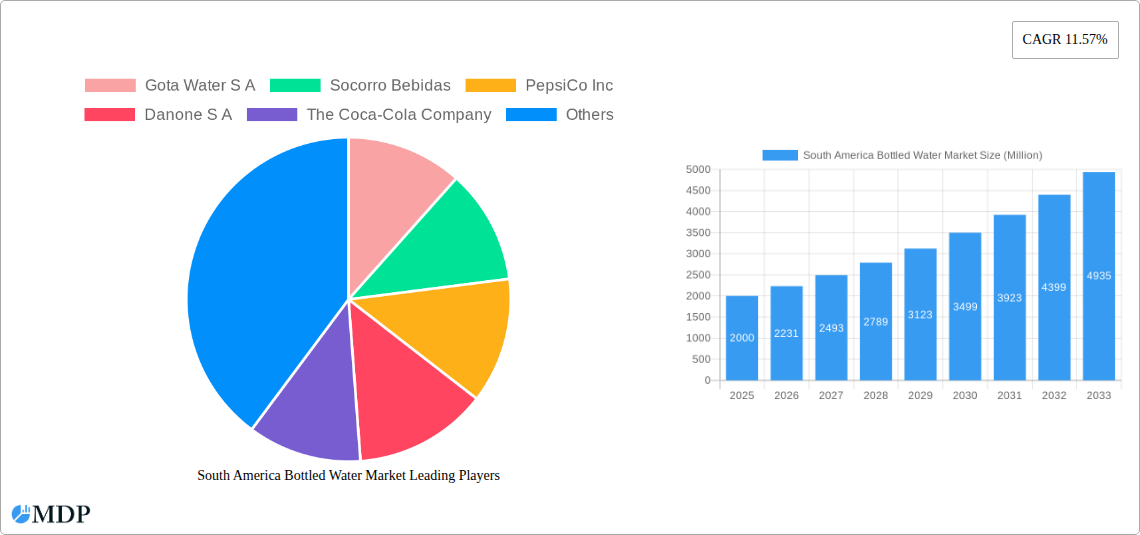

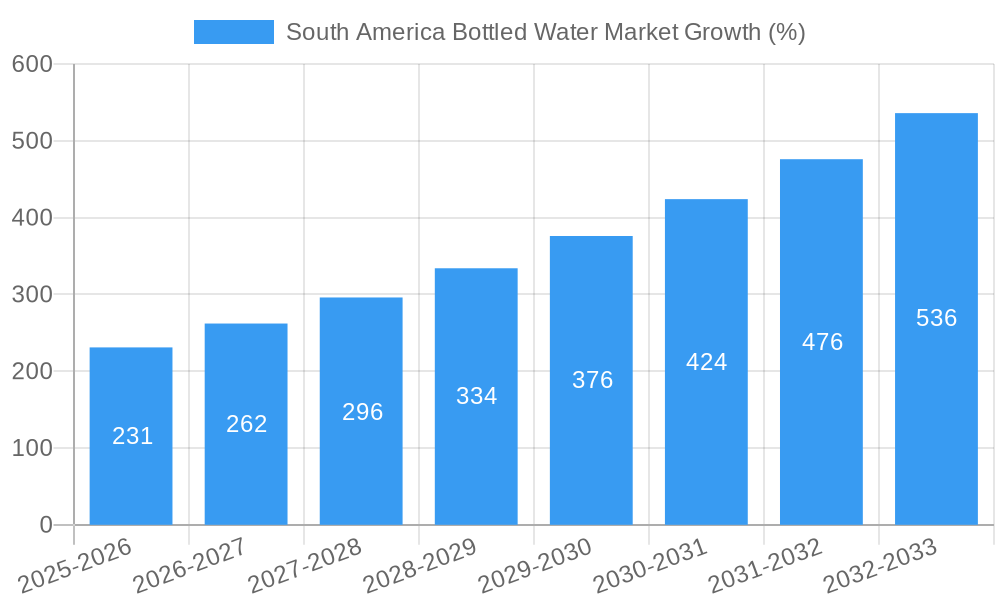

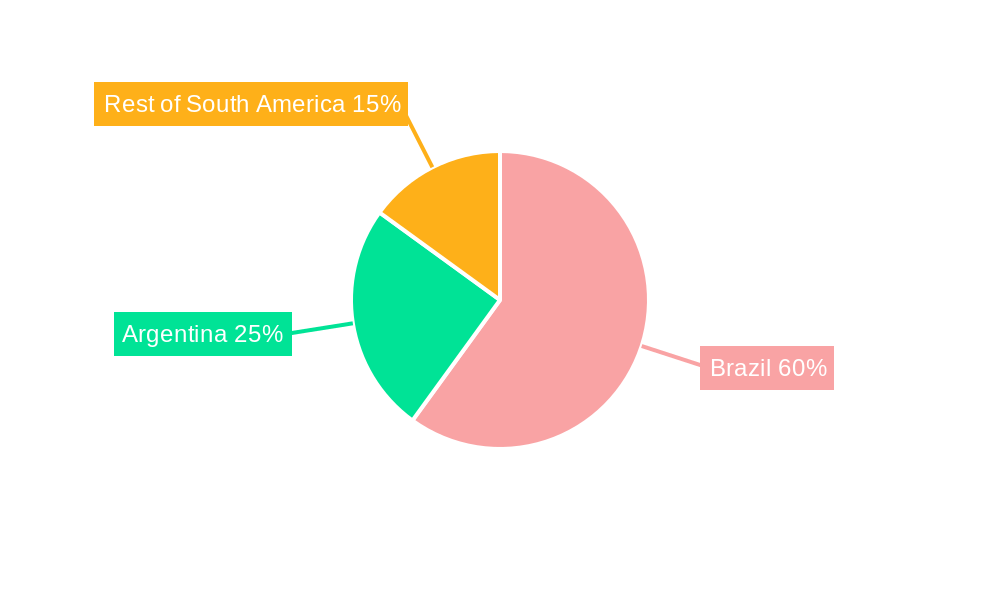

The South American bottled water market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.57% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes across the region, particularly in urban centers like São Paulo and Buenos Aires, are fueling increased consumption of packaged beverages, including bottled water. Growing health consciousness among consumers, coupled with concerns about tap water quality in some areas, is further bolstering demand for safer and more convenient alternatives. The market's segmentation reveals strong performance across various distribution channels, with supermarkets/hypermarkets, convenience stores, and online retail experiencing significant growth. The preference for specific water types also contributes to market dynamism; still water maintains a larger market share, but sparkling and functional waters are witnessing substantial growth driven by health and wellness trends. Brazil, with its large population and established beverage industry, is the dominant market within South America, followed by Argentina and the rest of the region. Key players like Coca-Cola, PepsiCo, Nestlé, and regional brands are vying for market share through product diversification, strategic partnerships, and aggressive marketing campaigns.

However, market expansion is not without its challenges. The fluctuating exchange rates in some South American economies can impact pricing and profitability for bottled water companies. Environmental concerns regarding plastic waste generated from bottled water consumption are also increasing, leading to growing demand for sustainable packaging solutions and potentially impacting growth in the long term. Competition from other beverage categories, such as juices and soft drinks, also poses a challenge. Despite these constraints, the strong underlying drivers, including rising incomes and growing health awareness, suggest that the South American bottled water market will maintain its significant growth trajectory throughout the forecast period. Furthermore, successful implementation of sustainable packaging and marketing strategies addressing environmental concerns will be crucial for sustained market success.

South America Bottled Water Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America bottled water market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report delivers a holistic view of market dynamics, trends, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key players analyzed include Gota Water S A, Socorro Bebidas, PepsiCo Inc, Danone S A, The Coca-Cola Company, Minalba Brasil, Poty Cia de Bebidas, AlunCo, and Nestlé S A. The report segments the market by distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, On-Trade, Other Distribution Channels) and product type (Still Water, Sparkling Water, Functional Water).

South America Bottled Water Market Dynamics & Concentration

The South American bottled water market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. Market concentration is moderately high, with a few major players holding significant market share. However, the presence of numerous regional and local brands creates a competitive landscape. Innovation, driven by consumer demand for functional waters and sustainable packaging, plays a crucial role. Regulatory frameworks, varying across countries, impact production and labeling requirements. The rise of health consciousness contributes to the growth of functional waters, while the increasing availability of substitutes like tap water and other beverages presents competitive pressure.

- Market Share: The top 5 players hold an estimated xx% market share collectively (2024 data).

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily focused on expanding distribution networks and product portfolios. Examples include the Danone S.A. and CCU alliance in Argentina (May 2022).

- Innovation Drivers: Consumer demand for healthier options (functional waters) and sustainable packaging (recyclable cans) fuels innovation.

- Regulatory Frameworks: Varying regulations across countries impact labeling, water source regulations, and environmental standards.

South America Bottled Water Market Industry Trends & Analysis

The South American bottled water market is experiencing robust growth, driven by several key trends. Rising disposable incomes and urbanization are leading to increased consumption of bottled water, particularly in urban centers. Changing consumer preferences towards healthier beverages and the growing popularity of functional waters are further boosting market growth. Technological advancements in packaging and distribution are enhancing efficiency and sustainability. However, intense competition among established players and the entry of new entrants keep the market dynamic. The market exhibits a segmented structure based on product type (still, sparkling, functional) and distribution channels, presenting diverse growth opportunities. Price sensitivity varies significantly across different consumer segments and regions within South America.

- CAGR (2025-2033): xx%

- Market Penetration: xx% in urban areas, lower in rural areas.

Leading Markets & Segments in South America Bottled Water Market

Brazil dominates the South American bottled water market, followed by other major economies like Argentina, Colombia, and Chile. This dominance is driven by a large population, high per capita income, and well-established distribution networks. Within distribution channels, supermarkets/hypermarkets hold the largest share due to their wide reach and established supply chains. Still water remains the dominant product type, driven by its affordability and broad consumer acceptance. However, functional waters are experiencing strong growth, presenting opportunities for innovative products.

- Key Drivers in Brazil: Large population, expanding middle class, and robust retail infrastructure.

- Key Drivers in Argentina: Growing urban population and increasing disposable incomes.

- Key Drivers in Colombia: Rising demand for healthy and convenient beverages.

- Dominant Segment: Supermarkets/Hypermarkets account for approximately xx% of the market share due to extensive reach and consumer preference for organized retail. Still water represents approximately xx% of total market volume.

South America Bottled Water Market Product Developments

Recent product developments focus on sustainability and consumer health. Several brands have launched recyclable packaging, including infinitely recyclable cans (Socorro Bebidas). There's a growing trend towards functional waters infused with vitamins, minerals, or other beneficial ingredients. These innovations cater to health-conscious consumers while addressing environmental concerns, enhancing brand image and market competitiveness. The launch of limited-edition products tied to major events, like the World Cup (Minalba Brasil), also provides a valuable marketing tactic.

Key Drivers of South America Bottled Water Market Growth

Several factors propel the South American bottled water market's growth. Rising disposable incomes, particularly in urban areas, fuel higher consumption. Increased awareness of health and hygiene, combined with the convenience of bottled water, drives adoption. Government regulations regarding water quality and sanitation also indirectly contribute by raising consumer confidence in bottled water safety. Technological advancements in packaging and distribution improve efficiency and reach.

Challenges in the South America Bottled Water Market Market

The market faces challenges, including intense competition, price fluctuations in raw materials (plastic, labels), and logistical hurdles in certain regions. Variations in regulatory frameworks across countries increase the complexity of operations. Supply chain disruptions (due to infrastructure or political issues) can impact production and distribution, creating instability. Furthermore, consumer concerns about plastic waste and environmental impact create a sustainability challenge for the industry.

Emerging Opportunities in South America Bottled Water Market

Emerging opportunities exist in expanding into underserved rural markets, focusing on developing sustainable packaging solutions, and introducing innovative functional waters with unique health benefits. Strategic partnerships with local distributors and retailers can enhance market reach. Technological advancements in water purification and packaging will improve production efficiency and reduce environmental impact. Leveraging digital marketing strategies will increase brand visibility and strengthen consumer relationships.

Leading Players in the South America Bottled Water Market Sector

- PepsiCo Inc

- Danone S A

- The Coca-Cola Company

- Nestlé S A

- Gota Water S A

- Socorro Bebidas

- Minalba Brasil

- Poty Cia de Bebidas

- AlunCo

Key Milestones in South America Bottled Water Market Industry

- October 2022: Minalba Brasil launched a World Cup-themed limited edition of Mineral Water Indaiá, boosting brand visibility.

- August 2022: Socorro Bebidas partnered with Crown Holdings to introduce infinitely recyclable cans for its Acqussima brand, enhancing sustainability.

- May 2022: CCU's strategic alliance with Danone S.A. in Argentina strengthened market presence and enriched product offerings.

Strategic Outlook for South America Bottled Water Market Market

The South American bottled water market presents significant growth potential driven by increasing urbanization, rising disposable incomes, and growing health consciousness. Strategic opportunities include expanding into niche segments (functional waters), investing in sustainable packaging, and capitalizing on e-commerce growth for efficient distribution. Focus on innovation, brand building, and effective distribution strategies will be critical for success in this competitive market.

South America Bottled Water Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Bottled Water Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Bottled Water Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Spending Towards Bottled Water

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil South America Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Gota Water S A

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Socorro Bebidas

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 PepsiCo Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Danone S A

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 The Coca-Cola Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Minalba Brasil

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Poty Cia de Bebidas

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 AlunCo

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nestlé S A

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Gota Water S A

List of Figures

- Figure 1: South America Bottled Water Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Bottled Water Market Share (%) by Company 2024

List of Tables

- Table 1: South America Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Bottled Water Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: South America Bottled Water Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: South America Bottled Water Market Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 5: South America Bottled Water Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: South America Bottled Water Market Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 7: South America Bottled Water Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: South America Bottled Water Market Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: South America Bottled Water Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: South America Bottled Water Market Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: South America Bottled Water Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: South America Bottled Water Market Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: South America Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: South America Bottled Water Market Volume K Units Forecast, by Region 2019 & 2032

- Table 15: South America Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South America Bottled Water Market Volume K Units Forecast, by Country 2019 & 2032

- Table 17: Brazil South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Brazil South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Argentina South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: South America Bottled Water Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 24: South America Bottled Water Market Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 25: South America Bottled Water Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 26: South America Bottled Water Market Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 27: South America Bottled Water Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 28: South America Bottled Water Market Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 29: South America Bottled Water Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 30: South America Bottled Water Market Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 31: South America Bottled Water Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 32: South America Bottled Water Market Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 33: South America Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Bottled Water Market Volume K Units Forecast, by Country 2019 & 2032

- Table 35: Brazil South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Brazil South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 37: Argentina South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Argentina South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: Chile South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Chile South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: Colombia South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Colombia South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 43: Peru South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Peru South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 45: Venezuela South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Venezuela South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 47: Ecuador South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ecuador South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 49: Bolivia South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Bolivia South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 51: Paraguay South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Paraguay South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 53: Uruguay South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Uruguay South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Bottled Water Market?

The projected CAGR is approximately 11.57%.

2. Which companies are prominent players in the South America Bottled Water Market?

Key companies in the market include Gota Water S A, Socorro Bebidas, PepsiCo Inc, Danone S A, The Coca-Cola Company, Minalba Brasil, Poty Cia de Bebidas, AlunCo, Nestlé S A.

3. What are the main segments of the South America Bottled Water Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Increasing Consumer Spending Towards Bottled Water.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

In October 2022, Mineral Water Indaiá, a brand of Minalba Brasil, launched an exclusive edition in celebration of the World Cup, held this year in Qatar. The launch features a special design for the time, with a label designed with the colors of the Brazilian flag in two versions such as 500 ml sparkling water and 1.5 liters still water. The product was available from October to December.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Bottled Water Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Bottled Water Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Bottled Water Market?

To stay informed about further developments, trends, and reports in the South America Bottled Water Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence