Key Insights

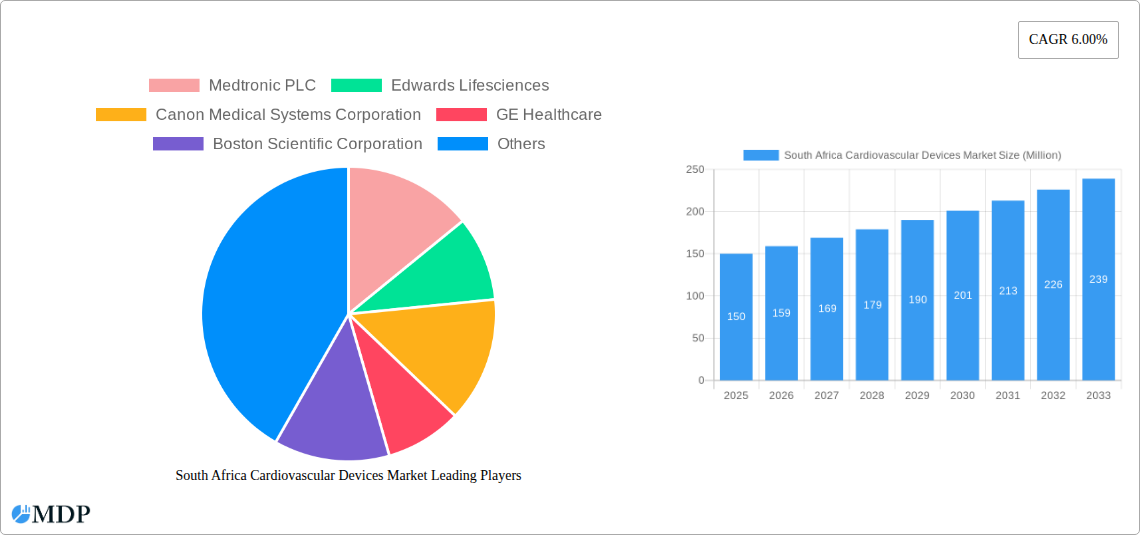

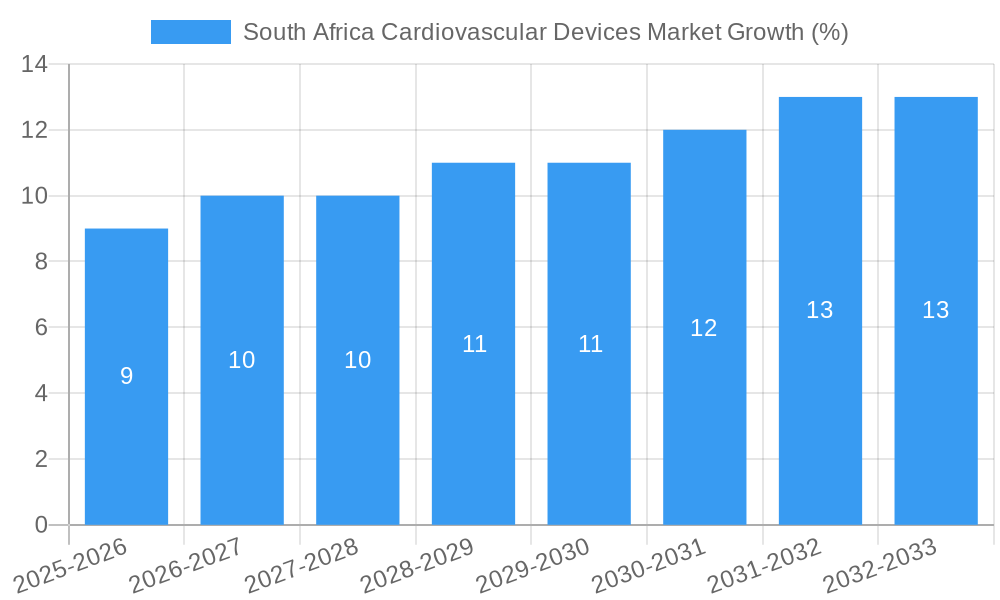

The South African cardiovascular devices market, while smaller than global counterparts, presents significant growth opportunities. Driven by increasing prevalence of cardiovascular diseases (CVDs) like coronary artery disease, heart failure, and arrhythmias, coupled with rising healthcare expenditure and improved healthcare infrastructure, the market is projected to experience robust expansion. The aging population and a growing incidence of lifestyle-related diseases like diabetes and hypertension further fuel this demand. While precise market sizing for South Africa is unavailable, considering the 6.00% CAGR and a global market value in the billions, a reasonable estimation places the 2025 South African market size at approximately $150 million USD. This figure is derived by applying reasonable regional market share assumptions based on comparable African economies and the overall growth rate. The market is segmented into diagnostic and monitoring devices (including pacemakers, implantable cardioverter-defibrillators, and diagnostic catheters) and therapeutic and surgical devices (such as stents, valves, and surgical instruments). Diagnostic devices currently hold a larger market share, but therapeutic devices are expected to witness faster growth due to advancements in minimally invasive procedures and increasing affordability. Key players like Medtronic, Boston Scientific, and Abbott Laboratories are actively participating, though local players and distributors also play significant roles. Challenges include limited healthcare access in certain regions, high device costs, and regulatory hurdles. However, ongoing investments in public health infrastructure and a rising middle class are expected to mitigate these challenges and fuel future growth.

The forecast period (2025-2033) anticipates continued market expansion. The 6.00% CAGR suggests a considerable increase in market value by 2033. Growth will be influenced by factors such as government initiatives aimed at improving cardiovascular healthcare, the increasing adoption of advanced technologies, and partnerships between international and local healthcare providers. The focus will likely shift towards more advanced and less invasive procedures, driving the demand for sophisticated therapeutic devices. Further research focusing on specific device types within the South African market will provide a more granular view of the market's dynamics and future potential. However, the overall trajectory points towards a positive and expanding market in the coming years, offering promising opportunities for market players.

South Africa Cardiovascular Devices Market Report: 2019-2033

Unlocking Growth Opportunities in a Dynamic Healthcare Landscape

This comprehensive report provides an in-depth analysis of the South Africa cardiovascular devices market, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving sector. From market dynamics and leading players to emerging trends and future projections, this report is your essential guide to understanding the South African cardiovascular devices market from 2019 to 2033. The report covers the period from 2019 to 2024 (Historical Period), with 2025 as the Base and Estimated Year, and forecasts extending to 2033 (Forecast Period). The market size is projected in Millions.

South Africa Cardiovascular Devices Market Dynamics & Concentration

This section analyzes the competitive landscape, identifying key trends influencing market concentration, innovation, and regulatory aspects. We delve into market share dynamics, M&A activity, and the influence of substitute products and evolving end-user preferences.

The South African cardiovascular devices market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. Market share data for 2024 indicates that the top five players—Medtronic PLC, Edwards Lifesciences, Boston Scientific Corporation, Abbott Laboratories, and GE Healthcare—collectively account for approximately xx% of the total market. This concentration is primarily attributed to the strong brand reputation, extensive product portfolios, and robust distribution networks of these multinational players.

- Innovation Drivers: Technological advancements in minimally invasive procedures, remote patient monitoring, and artificial intelligence are key drivers of innovation.

- Regulatory Framework: The regulatory landscape is characterized by the South African Health Products Regulatory Authority (SAHPRA), which plays a significant role in shaping market access and product approvals. Stringent regulatory requirements necessitate considerable investment in compliance.

- Product Substitutes: The availability of alternative treatment options, such as lifestyle modifications and pharmaceutical interventions, exerts some competitive pressure on the cardiovascular devices market.

- End-User Trends: Growing awareness of cardiovascular diseases, coupled with an aging population and rising prevalence of lifestyle-related conditions, fuels demand for advanced cardiovascular devices.

- M&A Activities: The number of M&A deals in the South African cardiovascular devices market between 2019 and 2024 is estimated at xx, reflecting strategic consolidation and expansion efforts by major players.

South Africa Cardiovascular Devices Market Industry Trends & Analysis

This section examines the key trends shaping the South African cardiovascular devices market, including market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. We provide a comprehensive overview of market evolution from 2019 to 2024 and project future trajectories. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced diagnostic and therapeutic devices is projected to increase significantly, driven by factors including increased healthcare expenditure and rising adoption of minimally invasive procedures. The increasing prevalence of cardiovascular diseases like coronary artery disease, heart failure, and arrhythmias are pushing this growth.

Technological advancements continue to redefine the market landscape, with a focus on innovation in areas such as minimally invasive surgery, remote patient monitoring, and the integration of AI-powered diagnostic tools. Consumer preferences are shifting towards technologically advanced devices that provide improved accuracy, efficacy, and patient comfort. Competitive dynamics are shaped by factors such as product differentiation, pricing strategies, and market access strategies.

Leading Markets & Segments in South Africa Cardiovascular Devices Market

This section identifies the dominant regions, countries, and segments within the South African cardiovascular devices market, analyzing the key drivers of market dominance.

- Device Type: The Therapeutic and Surgical Devices segment holds the largest market share, driven by the high prevalence of cardiovascular diseases requiring interventions. The Diagnostic and Monitoring Devices segment is also experiencing significant growth, driven by increased adoption of advanced diagnostic techniques.

- Key Drivers:

- Economic Policies: Government initiatives aimed at strengthening healthcare infrastructure and increasing access to medical technology positively impact market growth.

- Healthcare Infrastructure: Investments in upgrading hospital facilities and expanding healthcare access in underserved areas are crucial factors driving market expansion.

- Prevalence of Cardiovascular Diseases: The high prevalence of heart disease in South Africa is a significant driver of demand for cardiovascular devices.

The dominance of the Therapeutic and Surgical Devices segment can be attributed to the considerable number of patients requiring interventions for conditions such as coronary artery disease, valvular heart disease, and arrhythmias. This segment is characterized by the use of advanced technologies, including minimally invasive procedures and implantable devices that offer improved treatment outcomes.

South Africa Cardiovascular Devices Market Product Developments

Recent product innovations have focused on minimally invasive procedures, advanced imaging techniques, and improved device functionality. These advancements enhance treatment accuracy, reduce recovery times, and improve overall patient outcomes. The integration of Artificial Intelligence (AI) and machine learning algorithms is transforming diagnostic capabilities, leading to earlier and more accurate diagnoses. Moreover, the development of smart devices that provide remote patient monitoring facilitates proactive intervention and improved disease management. These technological trends align perfectly with the growing demand for high-quality, efficient, and patient-centric healthcare solutions.

Key Drivers of South Africa Cardiovascular Devices Market Growth

The growth of the South Africa cardiovascular devices market is driven by a confluence of factors. The increasing prevalence of cardiovascular diseases, fueled by lifestyle changes and an aging population, significantly boosts demand for advanced diagnostic and therapeutic devices. Government initiatives aimed at improving healthcare infrastructure and access to medical technology further stimulate market expansion. Technological advancements, resulting in more effective and minimally invasive procedures, also contribute to the growth. Furthermore, rising healthcare expenditure and insurance coverage play a crucial role in making advanced cardiovascular devices more accessible to a wider patient population.

Challenges in the South Africa Cardiovascular Devices Market Market

The South African cardiovascular devices market faces challenges such as limited healthcare infrastructure in certain regions, resulting in unequal access to advanced medical technology. High costs associated with advanced devices can also restrict affordability for a substantial portion of the population. Stringent regulatory requirements, while essential for ensuring safety and efficacy, can also increase the time and cost associated with product approvals. Finally, competition from established multinational players poses a significant challenge for smaller domestic companies.

Emerging Opportunities in South Africa Cardiovascular Devices Market

Significant opportunities exist in expanding access to advanced cardiovascular devices in underserved regions, leveraging telemedicine for remote patient monitoring and management, and developing innovative solutions tailored to the specific needs of the South African population. Strategic partnerships between international and domestic companies can facilitate technology transfer and enhance local manufacturing capabilities. Investing in healthcare infrastructure and workforce development will play a crucial role in maximizing the potential of this market. Furthermore, focusing on preventative care initiatives can help reduce the long-term burden of cardiovascular diseases.

Leading Players in the South Africa Cardiovascular Devices Market Sector

- Medtronic PLC

- Edwards Lifesciences

- Canon Medical Systems Corporation

- GE Healthcare

- Boston Scientific Corporation

- Abbott Laboratories

- W L Gore & Associates

- Cardinal Health Inc

- Siemens AG

Key Milestones in South Africa Cardiovascular Devices Market Industry

- September 2021: Merck Foundation provides 100 new Cardiovascular preventive experts to mark World Heart Day 2021 in 25 countries in Africa and Asia. This initiative significantly bolsters the preventative healthcare landscape and may indirectly drive future demand for diagnostic and therapeutic devices.

- June 2022: South African Society of Cardiovascular Intervention represents South Africa in a virtual hub Endovascular Cardiac Complications session. This highlights the increasing focus on advanced intervention techniques and knowledge sharing within the country.

Strategic Outlook for South Africa Cardiovascular Devices Market Market

The South Africa cardiovascular devices market holds significant long-term growth potential, driven by an aging population, increasing prevalence of cardiovascular diseases, and ongoing technological advancements. Strategic opportunities exist in expanding access to affordable and high-quality devices, enhancing healthcare infrastructure, and investing in innovative solutions. Strategic partnerships and investments in research and development will play a crucial role in shaping the future of this dynamic market. Focusing on preventative care initiatives alongside advanced treatment options will be pivotal to ensuring a sustainable and impactful healthcare system.

South Africa Cardiovascular Devices Market Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Device

- 1.2.3. Catheter

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Devices

South Africa Cardiovascular Devices Market Segmentation By Geography

- 1. South Africa

South Africa Cardiovascular Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Cardiovascular Disorders; Growing Public Awareness and Rapid Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments and Procedures and Stringent Regulatory Scenario

- 3.4. Market Trends

- 3.4.1. Cardiac Rhythm Management Device Segment is Expected to Show Better Growth in the Forecast Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Cardiovascular Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Device

- 5.1.2.3. Catheter

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. South Africa South Africa Cardiovascular Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Cardiovascular Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Cardiovascular Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Cardiovascular Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Cardiovascular Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Cardiovascular Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Medtronic PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Edwards Lifesciences

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Canon Medical Systems Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 GE Healthcare

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Boston Scientific Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abbott Laboratories

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 W L Gore & Associates

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Cardinal Health Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Siemens AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Medtronic PLC

List of Figures

- Figure 1: South Africa Cardiovascular Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Cardiovascular Devices Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Cardiovascular Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Cardiovascular Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: South Africa Cardiovascular Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 5: South Africa Cardiovascular Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa Cardiovascular Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: South Africa Cardiovascular Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Cardiovascular Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: South Africa South Africa Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa South Africa Cardiovascular Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Sudan South Africa Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sudan South Africa Cardiovascular Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Uganda South Africa Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Uganda South Africa Cardiovascular Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Tanzania South Africa Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania South Africa Cardiovascular Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Kenya South Africa Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya South Africa Cardiovascular Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of Africa South Africa Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Africa South Africa Cardiovascular Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: South Africa Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 22: South Africa Cardiovascular Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 23: South Africa Cardiovascular Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South Africa Cardiovascular Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Cardiovascular Devices Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the South Africa Cardiovascular Devices Market?

Key companies in the market include Medtronic PLC, Edwards Lifesciences, Canon Medical Systems Corporation, GE Healthcare, Boston Scientific Corporation, Abbott Laboratories, W L Gore & Associates, Cardinal Health Inc, Siemens AG.

3. What are the main segments of the South Africa Cardiovascular Devices Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Cardiovascular Disorders; Growing Public Awareness and Rapid Technological Advancements.

6. What are the notable trends driving market growth?

Cardiac Rhythm Management Device Segment is Expected to Show Better Growth in the Forecast Years.

7. Are there any restraints impacting market growth?

High Cost of Instruments and Procedures and Stringent Regulatory Scenario.

8. Can you provide examples of recent developments in the market?

June 2022- South African Society of Cardiovascular Intervention represents South Africa in a virtual hub Endovascular Cardiac Complications session.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Cardiovascular Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Cardiovascular Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Cardiovascular Devices Market?

To stay informed about further developments, trends, and reports in the South Africa Cardiovascular Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence