Key Insights

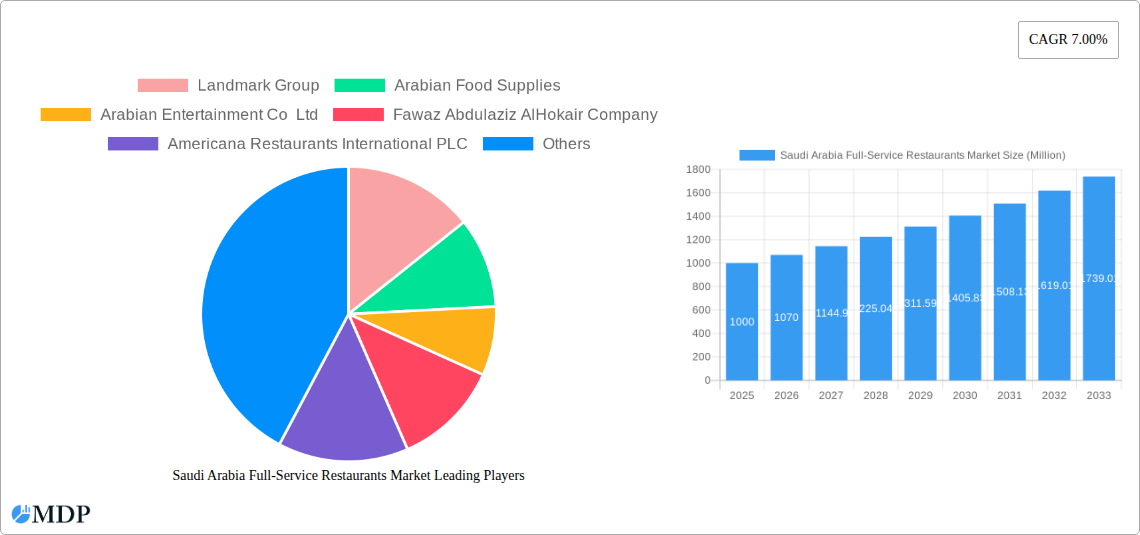

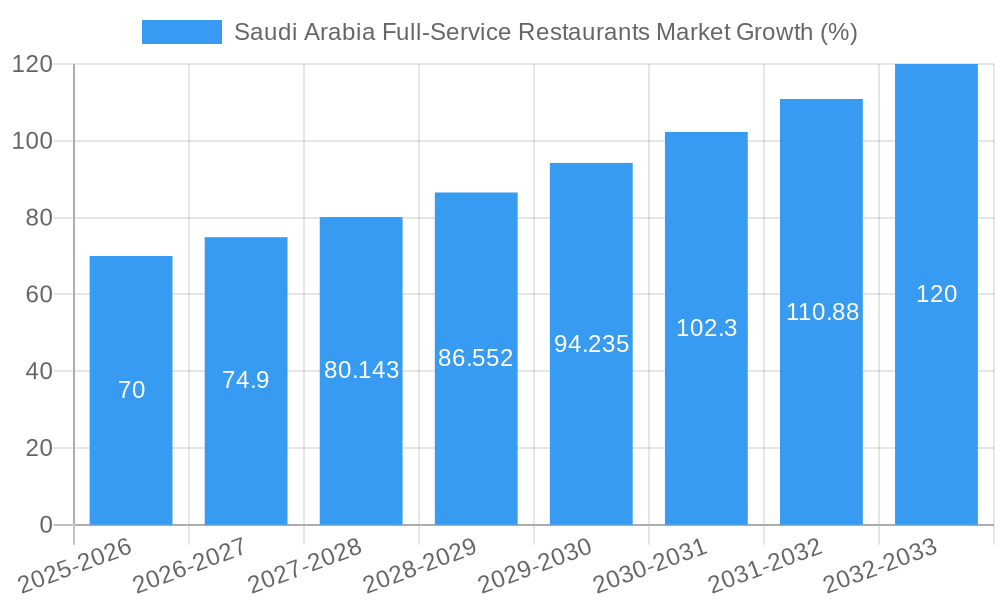

The Saudi Arabia full-service restaurant (FSR) market exhibits robust growth potential, driven by a burgeoning population, rising disposable incomes, and a shift towards diverse culinary experiences. The market's 7% CAGR (2019-2033) indicates a significant expansion, with the value expected to surpass several billion dollars by 2033 (precise figure dependent on the 2025 market size; assuming a 2025 market size of $1 billion for illustrative purposes, this would mean a market size over $2 billion by 2033). Key drivers include increasing tourism, a young and increasingly affluent population embracing diverse dining options, and government initiatives promoting the hospitality sector. Popular cuisines such as Asian, European, and Middle Eastern are expected to dominate, fueled by consumer preference and restaurant diversification strategies. While the chained outlet segment currently holds a significant market share, independent outlets are expected to gain traction, especially with the rise of locally-owned and unique dining concepts. Location-wise, leisure and retail locations are expected to witness the highest growth, reflecting changing consumer habits and the development of integrated entertainment and retail spaces. Challenges include maintaining food quality, consistency, and affordability, especially during periods of economic fluctuation. The competitive landscape is characterized by both international and local players, with established brands like Landmark Group and Americana Restaurants International PLC vying for market share alongside newer entrants.

The segmentation of the Saudi Arabia FSR market offers valuable insights for strategic investment and expansion. While the existing segments of Cuisine (Asian, European, Latin American, Middle Eastern, North American, Other), Outlet (Chained, Independent), and Location (Leisure, Lodging, Retail, Standalone, Travel) provide a comprehensive overview, future analyses should consider sub-segmentations within these categories, such as specific Asian cuisines (e.g., Japanese, Thai, Chinese) or types of retail locations (e.g., malls vs. street-front restaurants). Understanding consumer preferences within these sub-segments will be crucial for optimizing marketing strategies and identifying untapped market niches. Furthermore, analyzing the impact of factors such as food delivery services and evolving consumer preferences toward healthier and sustainable dining options will be essential for predicting long-term growth trajectories. The success of FSRs in Saudi Arabia will depend on adapting to these evolving dynamics, creating memorable dining experiences and delivering value for money.

Saudi Arabia Full-Service Restaurants Market Report: 2019-2033

Unlocking the Potential of Saudi Arabia's Thriving FSR Sector: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia full-service restaurants (FSR) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading segments, key players, and future growth prospects. The study incorporates rigorous data analysis, identifying lucrative opportunities and potential challenges within this rapidly evolving market. The report's detailed segmentation by cuisine (Asian, European, Latin American, Middle Eastern, North American, Other FSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel) provides a granular understanding of the market landscape.

Saudi Arabia Full-Service Restaurants Market Market Dynamics & Concentration

The Saudi Arabian FSR market is characterized by a dynamic interplay of factors influencing its growth and concentration. The market exhibits a moderate level of concentration, with a few large players commanding significant market share, while numerous smaller, independent restaurants contribute substantially to the overall market volume. Landmark Group, Americana Restaurants International PLC, and M H Alshaya Co WLL are among the prominent players, each contributing approximately xx% to xx% of the total market share in 2025 (estimated). Innovation is a key driver, with restaurants continually introducing new concepts, cuisines, and technologies to enhance the dining experience. The regulatory framework, while evolving, plays a significant role in shaping market operations and expansion. Product substitutes, such as fast-casual dining and home delivery services, exert competitive pressure. Changing consumer preferences, particularly towards healthier options and diverse culinary experiences, are impacting menu offerings and operational strategies. The market has witnessed xx M&A deals between 2019 and 2024, indicating significant consolidation activity.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller establishments.

- Innovation Drivers: Introduction of new cuisines, technologies (e.g., online ordering, delivery platforms), and restaurant concepts.

- Regulatory Framework: Evolving regulatory landscape influencing market operations and expansion.

- Product Substitutes: Competition from fast-casual restaurants and home delivery services.

- End-User Trends: Shifting consumer preferences towards healthier choices and diverse culinary experiences.

- M&A Activity: xx M&A deals recorded from 2019 to 2024, indicating ongoing market consolidation.

Saudi Arabia Full-Service Restaurants Market Industry Trends & Analysis

The Saudi Arabia FSR market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: rising disposable incomes, a young and growing population, increased tourism, and government initiatives promoting economic diversification. Technological advancements, such as online ordering and delivery platforms, are significantly impacting market dynamics, enhancing convenience for consumers and efficiency for businesses. Consumer preferences are evolving towards diverse culinary experiences, leading to the emergence of new cuisines and restaurant concepts. Competitive dynamics are intense, with existing players expanding their offerings and new entrants vying for market share. Market penetration of full-service restaurants in major urban areas is high, exceeding xx%, while there’s potential for significant expansion in less developed regions.

Leading Markets & Segments in Saudi Arabia Full-Service Restaurants Market

The Middle Eastern cuisine segment dominates the Saudi Arabia FSR market, followed by Asian and North American cuisines. Chained outlets constitute a significant portion of the market, benefiting from economies of scale and brand recognition. Standalone locations are prevalent in major cities and tourist destinations, while retail and leisure locations are also crucial for reaching diverse customer segments.

- Cuisine: Middle Eastern cuisine holds the largest market share (estimated at xx% in 2025), driven by strong local demand and cultural preferences.

- Outlet: Chained outlets dominate, leveraging brand recognition and operational efficiencies.

- Location: Standalone restaurants are widespread in major cities, while retail and leisure locations play a vital role in accessibility and market reach.

Key Drivers for Dominant Segments:

- Middle Eastern Cuisine: Strong cultural affinity, readily available ingredients, and established customer base.

- Chained Outlets: Economies of scale, consistent brand experience, and efficient operations.

- Standalone Restaurants: Flexibility in location, menu customization, and direct customer interaction.

Saudi Arabia Full-Service Restaurants Market Product Developments

Recent product innovations focus on enhancing the dining experience through personalized service, technological integration (e.g., mobile ordering apps, contactless payment systems), and diverse menu offerings catering to evolving consumer preferences. Companies are increasingly emphasizing health-conscious options, unique culinary experiences, and creating immersive atmospheres to attract and retain customers. Technological integration provides competitive advantages in terms of efficiency, cost-effectiveness, and customer engagement.

Key Drivers of Saudi Arabia Full-Service Restaurants Market Growth

The Saudi Arabian FSR market's growth is propelled by several factors: a burgeoning population with rising disposable incomes, expanding tourism sector, government support for economic diversification (Vision 2030), and increasing adoption of technology within the industry. These factors create a favorable environment for restaurant expansion and innovation, driving market growth.

Challenges in the Saudi Arabia Full-Service Restaurants Market Market

Challenges include high operating costs, stringent regulatory requirements (e.g., licensing, food safety standards), intense competition, and fluctuations in food prices. These challenges affect profitability and sustainability for businesses in the industry, requiring strategic adaptations to mitigate their impact. The impact of these challenges is estimated to reduce overall market growth by approximately xx% annually.

Emerging Opportunities in Saudi Arabia Full-Service Restaurants Market

Emerging opportunities lie in expanding into underserved markets, embracing technology for increased efficiency and customer engagement, focusing on healthy and diverse culinary options, and leveraging strategic partnerships to expand reach and brand visibility. These opportunities will contribute substantially to market growth in the forecast period.

Leading Players in the Saudi Arabia Full-Service Restaurants Market Sector

- Landmark Group

- Arabian Food Supplies

- Arabian Entertainment Co Ltd

- Fawaz Abdulaziz AlHokair Company

- Americana Restaurants International PLC

- M H Alshaya Co WLL

- Bloomin' Brands Inc

- RAVE Restaurant Group

- Al Faisaliah Group

Key Milestones in Saudi Arabia Full-Service Restaurants Market Industry

- 2020: Introduction of stringent food safety regulations.

- 2021: Significant increase in online food delivery services.

- 2022: Launch of several new restaurant concepts focusing on healthy and diverse cuisines.

- 2023: Expansion of major restaurant chains into new regions.

Strategic Outlook for Saudi Arabia Full-Service Restaurants Market Market

The Saudi Arabian FSR market presents significant long-term growth potential driven by sustained economic growth, tourism expansion, and changing consumer preferences. Strategic opportunities exist for players who can adapt to evolving market dynamics, embrace technological advancements, and offer diverse and high-quality dining experiences. The focus on innovation, customer experience, and strategic partnerships will be crucial for success in this dynamic market.

Saudi Arabia Full-Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Asian

- 1.2. European

- 1.3. Latin American

- 1.4. Middle Eastern

- 1.5. North American

- 1.6. Other FSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

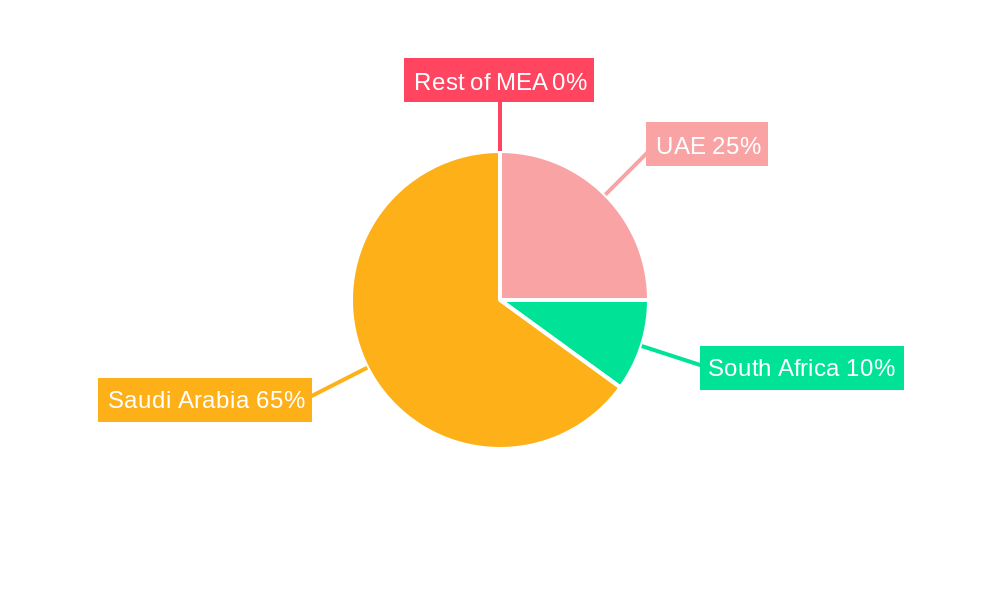

Saudi Arabia Full-Service Restaurants Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Full-Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. The rapid surge in the ex-pat population from Asian countries playing a pivotal role in propelling the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Full-Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Asian

- 5.1.2. European

- 5.1.3. Latin American

- 5.1.4. Middle Eastern

- 5.1.5. North American

- 5.1.6. Other FSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. UAE Saudi Arabia Full-Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Saudi Arabia Full-Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Saudi Arabia Full-Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Saudi Arabia Full-Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Landmark Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Arabian Food Supplies

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Arabian Entertainment Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fawaz Abdulaziz AlHokair Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Americana Restaurants International PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 M H Alshaya Co WLL

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bloomin' Brands Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 RAVE Restaurant Grou

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Al Faisaliah Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Landmark Group

List of Figures

- Figure 1: Saudi Arabia Full-Service Restaurants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Full-Service Restaurants Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Saudi Arabia Full-Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Saudi Arabia Full-Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Saudi Arabia Full-Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Saudi Arabia Full-Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 12: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 13: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: Saudi Arabia Full-Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Full-Service Restaurants Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Saudi Arabia Full-Service Restaurants Market?

Key companies in the market include Landmark Group, Arabian Food Supplies, Arabian Entertainment Co Ltd, Fawaz Abdulaziz AlHokair Company, Americana Restaurants International PLC, M H Alshaya Co WLL, Bloomin' Brands Inc, RAVE Restaurant Grou, Al Faisaliah Group.

3. What are the main segments of the Saudi Arabia Full-Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

The rapid surge in the ex-pat population from Asian countries playing a pivotal role in propelling the market growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Full-Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Full-Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Full-Service Restaurants Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Full-Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence