Key Insights

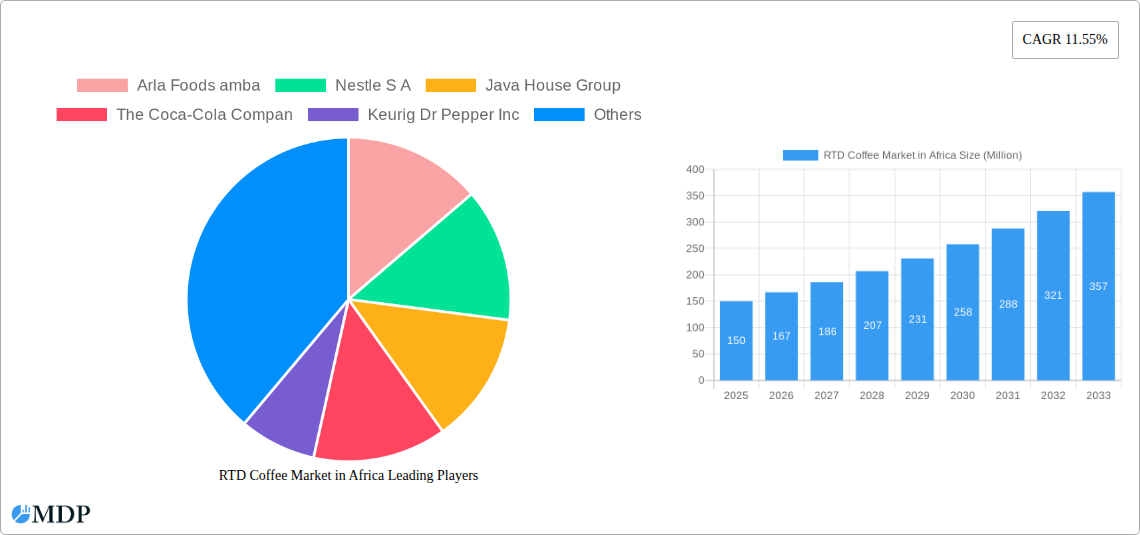

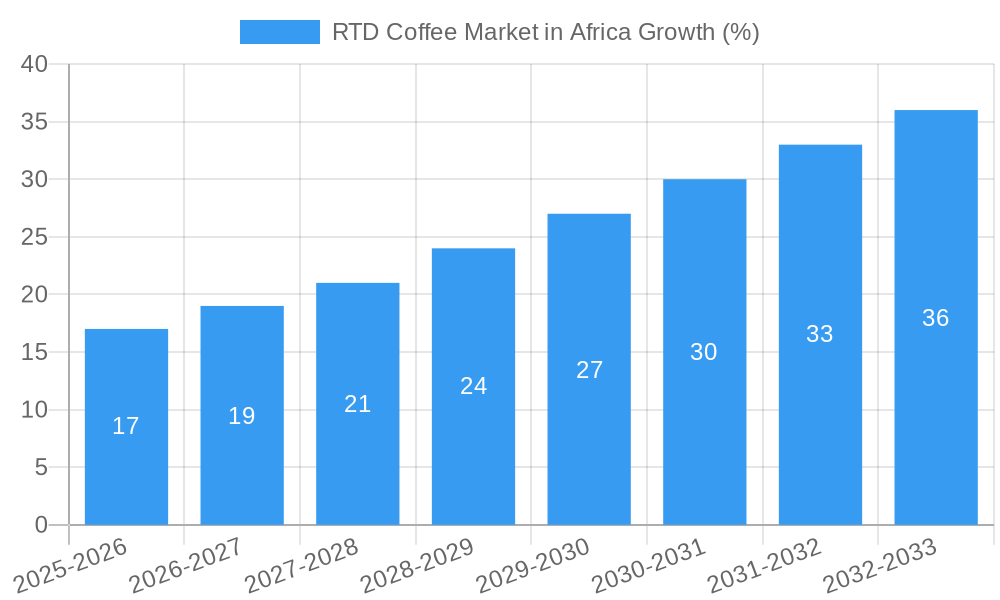

The Ready-to-Drink (RTD) coffee market in Africa is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and a growing preference for convenient and on-the-go beverage options. The market's compound annual growth rate (CAGR) of 11.55% from 2019 to 2024 suggests a significant expansion, projected to continue throughout the forecast period (2025-2033). Key growth drivers include the rising popularity of cold brew and iced coffee variations, catering to Africa's warm climate. Furthermore, the diversification of packaging options, including PET bottles, cans, and aseptic packages, enhances product accessibility and shelf life, further boosting market penetration. While data on the exact market size in 2025 isn't provided, extrapolating from the CAGR and considering the market’s momentum, a reasonable estimation would place the market value in the tens to hundreds of millions of USD range. This projection considers the varied stages of economic development across different African regions and the consequent differing levels of RTD coffee consumption. The on-trade segment (cafes, restaurants) is likely contributing significantly to the market's growth, alongside the increasingly popular off-trade channels (supermarkets, convenience stores).

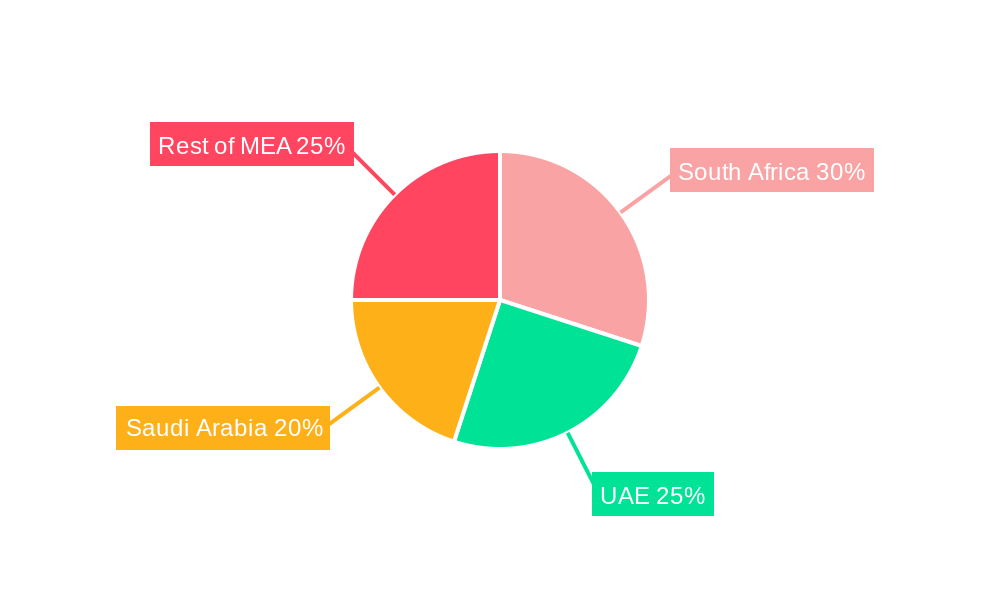

The competitive landscape is characterized by a mix of global giants like Nestlé and Coca-Cola, alongside regional players and local brands. These companies are focusing on product innovation, strategic partnerships, and effective distribution networks to gain market share. Challenges remain, including the price sensitivity of some consumer segments, infrastructure limitations in certain regions, and the need to overcome potential cultural preferences for traditional coffee consumption methods. However, the overall market outlook remains highly positive, with considerable potential for continued expansion and diversification across various segments and geographies within Africa. Specific focus on regions like the UAE, South Africa, and Saudi Arabia within the Middle East & Africa region, will significantly impact overall market growth projections.

Ready-to-Drink (RTD) Coffee Market in Africa: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Ready-to-Drink (RTD) coffee market in Africa, offering invaluable insights for stakeholders across the value chain. From market dynamics and concentration to leading players and emerging opportunities, this report equips you with the knowledge to navigate this rapidly evolving landscape. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Unlock the potential of the African RTD coffee market – download your copy today!

RTD Coffee Market in Africa: Market Dynamics & Concentration

The African RTD coffee market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently moderate, with a few key players holding significant shares, but with numerous smaller, regional brands also contributing. Innovation is a key driver, with new product launches, particularly in cold brew and iced coffee segments, catering to evolving consumer preferences. Regulatory frameworks vary across the continent, impacting market entry and operations. Product substitutes, including traditional brewed coffee and tea, pose a competitive challenge. End-user trends, shifting towards convenience and premiumization, are shaping market demand. Finally, M&A activities, although not currently prevalent on a large scale, could significantly reshape market dynamics in the coming years.

- Market Share: The top 5 players currently hold approximately xx% of the market share.

- M&A Deal Count (2019-2024): xx deals.

- Innovation Drivers: Growing demand for convenient and premium coffee options.

- Regulatory Landscape: Varied across African nations, affecting market access and operations.

- Product Substitutes: Traditional brewed coffee and tea remain strong competitors.

RTD Coffee Market in Africa: Industry Trends & Analysis

The African RTD coffee market is experiencing significant growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing young population with a penchant for convenient, premium beverages. Technological advancements in packaging and production are enhancing product quality and shelf life, while also lowering costs. Consumer preferences are shifting towards healthier options, influencing product formulation and marketing strategies. This shift toward premiumisation and convenient formats is fuelling the RTD market's expansion. The competitive landscape is dynamic, with both international and local players vying for market share. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is currently estimated at xx%, projected to reach xx% by 2033.

Leading Markets & Segments in RTD Coffee Market in Africa

The RTD coffee market in Africa exhibits regional variations in growth and consumption patterns. While several countries are witnessing rapid expansion, specific regions and segments demonstrate significantly higher growth potential.

Dominant Segment Analysis:

- Distribution Channel: The off-trade channel (e.g., supermarkets, convenience stores) currently dominates, driven by its wide reach and accessibility. However, the on-trade sector (e.g., cafes, restaurants) is witnessing substantial growth, especially in urban areas.

- Soft Drink Type: Iced coffee is currently the leading soft drink type, owing to its broad appeal and refreshing nature. However, Cold Brew is emerging rapidly, driven by its unique flavor profile and premium positioning.

- Packaging Type: PET bottles are the most prevalent packaging type due to their cost-effectiveness and recyclability. Aseptic packages are gaining traction, particularly for longer shelf life.

Key Drivers by Segment:

- Off-trade: Increased retail infrastructure, improved distribution networks, and rising disposable incomes.

- On-trade: Growth of the café culture, particularly in urban centers, and rising tourism.

- Iced Coffee: Preference for refreshing beverages, especially in warmer climates.

- Cold Brew Coffee: Increasing consumer interest in specialty coffee and premium experiences.

- PET Bottles: Cost-effectiveness, ease of use, and recyclability.

RTD Coffee Market in Africa: Product Developments

The RTD coffee market in Africa is witnessing continuous product innovation. Manufacturers are focusing on developing healthier options, such as low-sugar or organic varieties, to cater to changing consumer preferences. The introduction of new flavors, formats, and packaging types aims to enhance consumer appeal and brand differentiation. Cold brew, with its smooth texture and unique taste profile, represents a key innovation. This trend is being fueled by advances in extraction and preservation techniques and a growing consumer awareness of higher-quality coffee options.

Key Drivers of RTD Coffee Market in Africa Growth

Several factors are driving the growth of the African RTD coffee market. Rising disposable incomes across several African countries are boosting consumer spending on premium beverages. Rapid urbanization is creating a larger market for convenient and readily available options. A young and growing population constitutes a significant consumer base for RTD coffee. The expanding retail and foodservice infrastructure in several regions improves access to these products. Finally, technological innovations are continuously refining manufacturing and packaging processes, leading to cost-efficiency and higher quality products.

Challenges in the RTD Coffee Market in Africa Market

The RTD coffee market in Africa faces several challenges. Inconsistent infrastructure across many regions can make distribution and logistics costly and inefficient. The regulatory landscape is complex and varies across countries, making it difficult for businesses to navigate compliance requirements. Competition from established beverage brands, both international and local, puts pressure on margins. Furthermore, fluctuating commodity prices for coffee beans can impact manufacturing costs. These challenges are estimated to reduce market growth by approximately xx% annually.

Emerging Opportunities in RTD Coffee Market in Africa

Several emerging trends present significant opportunities for growth in the African RTD coffee market. The increasing adoption of e-commerce platforms opens new avenues for direct-to-consumer sales and market expansion. The growing popularity of health and wellness trends creates demand for healthier, functional RTD coffee options. Strategic partnerships between international and local companies are facilitating knowledge transfer and market penetration. Investing in sustainable and ethically sourced coffee beans can attract environmentally conscious consumers, enhancing brand image and market share.

Leading Players in the RTD Coffee Market in Africa Sector

- Arla Foods amba

- Nestle S A

- Java House Group

- The Coca-Cola Company

- Keurig Dr Pepper Inc

- King Car Group

Key Milestones in RTD Coffee Market in Africa Industry

- January 2023: Goldex Morocco opened a second Costa Coffee store in Casablanca, signaling expansion plans for the brand in Morocco.

- August 2023: Java House launched a ready-to-drink cold brew coffee, indicating a shift towards innovation and premium offerings in the Kenyan market.

- December 2023: Goldex Morocco planned to launch five new Costa Coffee outlets in Morocco by the end of Q3 2023, signifying significant investment and market expansion in the Moroccan RTD coffee market.

Strategic Outlook for RTD Coffee Market in Africa Market

The African RTD coffee market holds immense potential for future growth. Strategic investments in infrastructure development, technological advancements, and sustainable sourcing practices will be crucial for sustained expansion. Focusing on product innovation, catering to evolving consumer preferences, and leveraging digital marketing strategies can drive market penetration. Collaborative partnerships between international and local players will facilitate market access and knowledge sharing, accelerating overall market development. The RTD coffee market in Africa is poised for significant expansion in the coming years, presenting lucrative opportunities for companies that can effectively address the market's unique challenges and capitalize on its growth drivers.

RTD Coffee Market in Africa Segmentation

-

1. Soft Drink Type

- 1.1. Cold Brew Coffee

- 1.2. Iced coffee

- 1.3. Other RTD Coffee

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Specialty Stores

- 3.1.4. Supermarket/Hypermarket

- 3.1.5. Others

- 3.2. On-trade

-

3.1. Off-trade

RTD Coffee Market in Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

RTD Coffee Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Cold Brew Coffee

- 5.1.2. Iced coffee

- 5.1.3. Other RTD Coffee

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Specialty Stores

- 5.3.1.4. Supermarket/Hypermarket

- 5.3.1.5. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. Cold Brew Coffee

- 6.1.2. Iced coffee

- 6.1.3. Other RTD Coffee

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Aseptic packages

- 6.2.2. Glass Bottles

- 6.2.3. Metal Can

- 6.2.4. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Off-trade

- 6.3.1.1. Convenience Stores

- 6.3.1.2. Online Retail

- 6.3.1.3. Specialty Stores

- 6.3.1.4. Supermarket/Hypermarket

- 6.3.1.5. Others

- 6.3.2. On-trade

- 6.3.1. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. Cold Brew Coffee

- 7.1.2. Iced coffee

- 7.1.3. Other RTD Coffee

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Aseptic packages

- 7.2.2. Glass Bottles

- 7.2.3. Metal Can

- 7.2.4. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Off-trade

- 7.3.1.1. Convenience Stores

- 7.3.1.2. Online Retail

- 7.3.1.3. Specialty Stores

- 7.3.1.4. Supermarket/Hypermarket

- 7.3.1.5. Others

- 7.3.2. On-trade

- 7.3.1. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. Cold Brew Coffee

- 8.1.2. Iced coffee

- 8.1.3. Other RTD Coffee

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Aseptic packages

- 8.2.2. Glass Bottles

- 8.2.3. Metal Can

- 8.2.4. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Off-trade

- 8.3.1.1. Convenience Stores

- 8.3.1.2. Online Retail

- 8.3.1.3. Specialty Stores

- 8.3.1.4. Supermarket/Hypermarket

- 8.3.1.5. Others

- 8.3.2. On-trade

- 8.3.1. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. Cold Brew Coffee

- 9.1.2. Iced coffee

- 9.1.3. Other RTD Coffee

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Aseptic packages

- 9.2.2. Glass Bottles

- 9.2.3. Metal Can

- 9.2.4. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Off-trade

- 9.3.1.1. Convenience Stores

- 9.3.1.2. Online Retail

- 9.3.1.3. Specialty Stores

- 9.3.1.4. Supermarket/Hypermarket

- 9.3.1.5. Others

- 9.3.2. On-trade

- 9.3.1. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. Cold Brew Coffee

- 10.1.2. Iced coffee

- 10.1.3. Other RTD Coffee

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Aseptic packages

- 10.2.2. Glass Bottles

- 10.2.3. Metal Can

- 10.2.4. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Off-trade

- 10.3.1.1. Convenience Stores

- 10.3.1.2. Online Retail

- 10.3.1.3. Specialty Stores

- 10.3.1.4. Supermarket/Hypermarket

- 10.3.1.5. Others

- 10.3.2. On-trade

- 10.3.1. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. UAE RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 12. South Africa RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 13. Saudi Arabia RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 14. Rest of MEA RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Arla Foods amba

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Nestle S A

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Java House Group

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 The Coca-Cola Compan

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Keurig Dr Pepper Inc

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 King Car Group

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Arla Foods amba

List of Figures

- Figure 1: Global RTD Coffee Market in Africa Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 3: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 5: North America RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 6: North America RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 7: North America RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 8: North America RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 11: North America RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 13: South America RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 14: South America RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 15: South America RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 16: South America RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South America RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South America RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 19: South America RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 21: Europe RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 22: Europe RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 23: Europe RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 24: Europe RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 29: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 30: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 31: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 32: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 37: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 38: Asia Pacific RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 39: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 40: Asia Pacific RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global RTD Coffee Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global RTD Coffee Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 12: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 13: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 19: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 20: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 26: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 27: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 39: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 40: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Turkey RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Israel RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: GCC RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: North Africa RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East & Africa RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 49: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 50: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 51: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 52: China RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: India RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: South Korea RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: ASEAN RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Oceania RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RTD Coffee Market in Africa?

The projected CAGR is approximately 11.55%.

2. Which companies are prominent players in the RTD Coffee Market in Africa?

Key companies in the market include Arla Foods amba, Nestle S A, Java House Group, The Coca-Cola Compan, Keurig Dr Pepper Inc, King Car Group.

3. What are the main segments of the RTD Coffee Market in Africa?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

December 2023: Costa Coffee’s Moroccan franchisee Goldex Morocco has planned to launch five new outlets in Morocco by the end of Q3 2023 at a cost of USD m. Two will be in Casablanca, two in Rabat and the final outlet will be opened in Bouskoura.August 2023: Java House has launched its latest innovation, cold brew coffee, a ready-to-drink made from 100% Kenyan Arabica coffee beans.The innovation was a collaboration between Java House; KEVIAN, manufacturer of Afia and Pick n Peel fruit juices, and dairy processor Bio Food Products Ltd.January 2023: Goldex Morocco, part of UK-based Goldex Investments Group, opened a second Costa Coffee store in Casablanca in May 2023. Goldex Investments Group further plans to open six or seven more outlets in 2024, probably in Casablanca, Rabat, Tangier, and Agadir. It aims to have opened 30 to 40 cafes within the next five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RTD Coffee Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RTD Coffee Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RTD Coffee Market in Africa?

To stay informed about further developments, trends, and reports in the RTD Coffee Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence