Key Insights

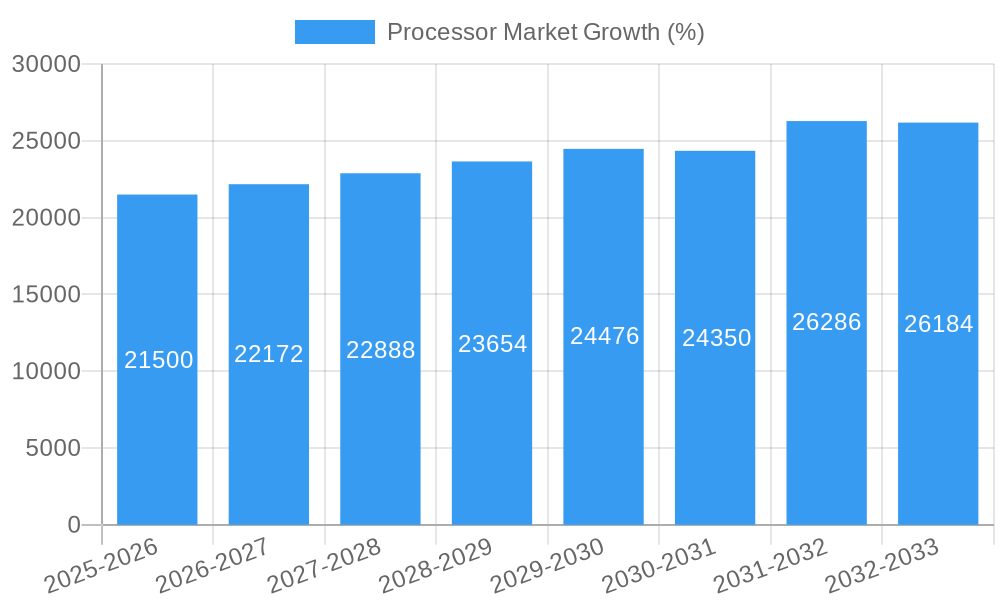

The processor market, encompassing CPUs, APUs, and server processors, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 4.30% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for high-performance computing across diverse sectors, including data centers, artificial intelligence, and the burgeoning Internet of Things (IoT), fuels significant market expansion. Advancements in semiconductor technology, leading to more powerful and energy-efficient processors, further stimulate growth. The rising adoption of cloud computing and edge computing necessitates greater processing power, creating sustained demand. Competitive innovation among key players like Nvidia, Intel, AMD, Qualcomm, and Apple (among others) continues to push technological boundaries, leading to improved product offerings and heightened market competition. While supply chain disruptions and geopolitical uncertainties pose potential restraints, the overall trajectory indicates a positive outlook for the processor market.

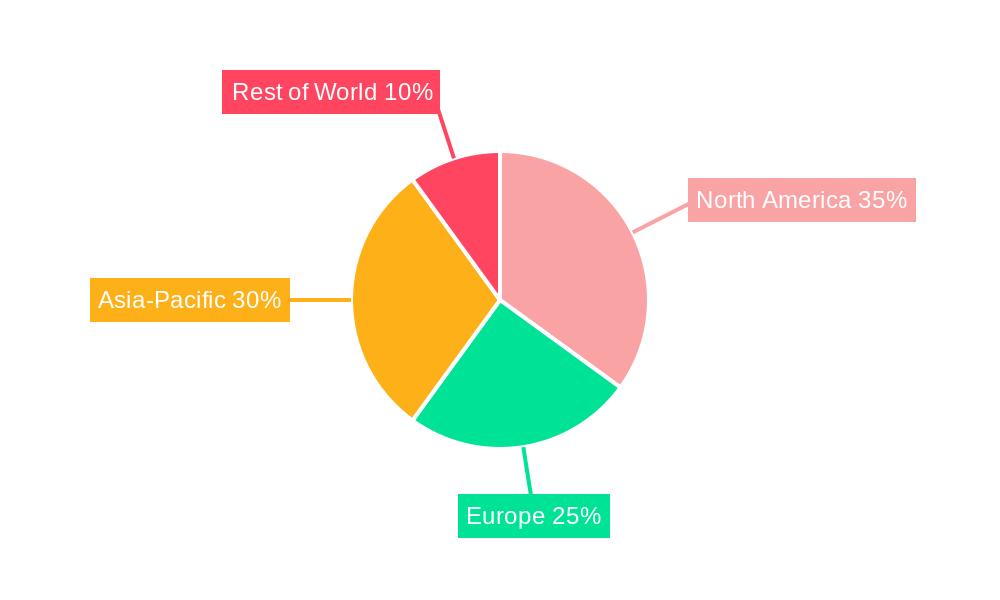

Segment-wise, the CPU segment currently holds a dominant market share, owing to its widespread use in personal computers and laptops. However, the APU (Accelerated Processing Unit) segment is expected to witness faster growth due to its increasing adoption in embedded systems and mobile devices. Geographic analysis reveals strong growth in regions like China, Taiwan, and the United States, reflecting these regions' advanced technological infrastructure and significant consumer demand. However, the "Rest of the World" segment also presents a considerable growth opportunity, driven by increasing digitalization across emerging economies. The forecast period (2025-2033) suggests sustained growth based on current trends, with the market expected to reach a significant size by 2033. Further analysis would require specific market size data for 2025 to accurately project future values. However, based on a 4.30% CAGR and estimations of current market dynamics, substantial growth is anticipated.

Processor Market Report: 2019-2033 Forecast

This comprehensive report delivers an in-depth analysis of the global processor market, providing crucial insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable data for strategic decision-making. The report covers key players like Nvidia, MediaTek, Intel, AMD, Apple, Qualcomm, and more, analyzing market segments including CPUs and APUs (Accelerated Processing Units) within server and other applications. Discover detailed market dynamics, technological trends, competitive landscapes, and growth opportunities within this rapidly evolving sector.

Processor Market Market Dynamics & Concentration

The processor market exhibits a dynamic interplay of concentration, innovation, and regulatory influences. Major players like Intel, AMD, and Nvidia hold significant market share, though the landscape is increasingly competitive with the rise of specialized processors for AI and mobile applications. The market share distribution in 2024 is estimated as follows: Intel (xx%), AMD (xx%), Nvidia (xx%), Qualcomm (xx%), MediaTek (xx%), and others (xx%). This concentration is further impacted by mergers and acquisitions (M&A). Between 2019 and 2024, approximately xx M&A deals were recorded, signifying a consolidation trend within the industry. Innovation drivers, particularly in AI and high-performance computing, are shaping market growth. Regulatory frameworks concerning data privacy and antitrust concerns influence market operations. The existence of product substitutes, such as specialized ASICs (Application-Specific Integrated Circuits), creates competitive pressure. End-user trends, particularly the increasing demand for high-performance computing across diverse sectors, are key factors driving market growth.

Processor Market Industry Trends & Analysis

The global processor market is characterized by robust growth, driven by technological advancements and burgeoning demand across various sectors. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, with projections indicating a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the shift towards more power-efficient architectures and the adoption of advanced manufacturing processes like 5nm and 3nm nodes, are significantly impacting market dynamics. Consumer preferences are increasingly oriented towards higher performance, energy efficiency, and integrated functionalities. Intense competitive dynamics, including price wars and product differentiation strategies, are shaping the market landscape. Market penetration is high in developed regions, but there's significant scope for growth in emerging markets with increasing digitalization.

Leading Markets & Segments in Processor Market

The North American region dominates the processor market, driven by strong demand from data centers, high-tech industries, and individual consumers. Strong economic policies, robust infrastructure, and a high concentration of technology companies contribute to this dominance. Within product segments, CPUs maintain the largest market share, while the APU segment is experiencing significant growth fueled by the increasing adoption of cloud computing and AI applications.

- Key Drivers for North American Dominance:

- High technological advancement and innovation.

- Robust infrastructure to support high-performance computing.

- Strong consumer demand for advanced electronics.

- Significant investments in research and development.

- Favorable regulatory environment.

The Asia-Pacific region, with its rapidly expanding technological infrastructure and significant manufacturing base, is poised for substantial growth during the forecast period. Europe also presents notable growth opportunities with its increasing focus on digital transformation.

Processor Market Product Developments

Recent product developments showcase a strong trend towards higher core counts, improved clock speeds, and enhanced energy efficiency. Innovative architectures incorporating specialized cores for AI and machine learning are gaining traction. These developments aim to meet the increasing demand for higher processing power in applications ranging from smartphones and laptops to data centers and high-performance computing systems. The focus on improved thermal management and reduced power consumption is also prominent, catering to the growing environmental concerns.

Key Drivers of Processor Market Growth

Several factors are driving growth in the processor market. Technological advancements, such as the development of more powerful and energy-efficient architectures, are a primary driver. The increasing demand for high-performance computing across various sectors, including data centers, artificial intelligence, and gaming, fuels market expansion. Furthermore, favorable economic conditions and supportive government policies in key regions are also contributing to growth. The rising adoption of cloud computing and the Internet of Things (IoT) is further expanding the market for processors.

Challenges in the Processor Market Market

The processor market faces several challenges, including increasing manufacturing costs associated with advanced node technologies. Supply chain disruptions can significantly impact production and availability, while intense competition leads to price pressure and reduced profit margins. Furthermore, stringent regulatory requirements related to environmental sustainability and data privacy add complexity to market operations. These factors collectively contribute to market volatility and necessitate effective strategic management.

Emerging Opportunities in Processor Market

Emerging opportunities in the processor market stem from several key factors. Significant technological breakthroughs in areas such as quantum computing and neuromorphic computing offer long-term growth potential. Strategic partnerships and collaborations across industries are creating new avenues for market expansion. Expansion into new geographical markets, particularly in emerging economies, presents substantial untapped potential. Focus on energy-efficient designs and sustainable manufacturing is creating unique market niches.

Leading Players in the Processor Market Sector

Key Milestones in Processor Market Industry

- September 2022: Intel introduced the 13th Gen Intel Core processor family, significantly enhancing performance for gaming, streaming, and recording.

- February 2023: MediaTek launched the Dimensity 7200 chipset, focusing on improved gaming and photography capabilities in smartphones, emphasizing energy efficiency and ultra-slim design capabilities.

Strategic Outlook for Processor Market Market

The processor market is projected to experience sustained growth throughout the forecast period, driven by ongoing technological advancements and increasing demand from diverse sectors. Strategic opportunities lie in developing specialized processors for emerging technologies like AI and quantum computing. Companies focused on innovation, energy efficiency, and strategic partnerships are best positioned to capture market share and drive long-term growth. Expansion into high-growth markets and effective supply chain management are crucial for success in this competitive landscape.

Processor Market Segmentation

-

1. Type of Product

-

1.1. CPU

- 1.1.1. Client (Desktop and Laptop)

- 1.1.2. Server

-

1.2. APU

- 1.2.1. Smartphone

- 1.2.2. Tablet

- 1.2.3. Smart Television

- 1.2.4. Smart Speakers

- 1.2.5. Other Ap

-

1.1. CPU

-

2. Geography ***

- 2.1. China (including Hong Kong)

- 2.2. Taiwan

- 2.3. United States

- 2.4. Latin America

- 2.5. Middle East and Africa

Processor Market Segmentation By Geography

- 1. China

- 2. Taiwan

- 3. United States

- 4. Latin America

- 5. Middle East and Africa

Processor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones; Growing Adoption of Cloud Computing

- 3.2.2 Big Data Analytics

- 3.2.3 and AI

- 3.3. Market Restrains

- 3.3.1. Cyber Security concerns may hinder the growth of the sports betting kiosk market

- 3.4. Market Trends

- 3.4.1. APUs to Acquire a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Processor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 5.1.1. CPU

- 5.1.1.1. Client (Desktop and Laptop)

- 5.1.1.2. Server

- 5.1.2. APU

- 5.1.2.1. Smartphone

- 5.1.2.2. Tablet

- 5.1.2.3. Smart Television

- 5.1.2.4. Smart Speakers

- 5.1.2.5. Other Ap

- 5.1.1. CPU

- 5.2. Market Analysis, Insights and Forecast - by Geography ***

- 5.2.1. China (including Hong Kong)

- 5.2.2. Taiwan

- 5.2.3. United States

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Taiwan

- 5.3.3. United States

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 6. China Processor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 6.1.1. CPU

- 6.1.1.1. Client (Desktop and Laptop)

- 6.1.1.2. Server

- 6.1.2. APU

- 6.1.2.1. Smartphone

- 6.1.2.2. Tablet

- 6.1.2.3. Smart Television

- 6.1.2.4. Smart Speakers

- 6.1.2.5. Other Ap

- 6.1.1. CPU

- 6.2. Market Analysis, Insights and Forecast - by Geography ***

- 6.2.1. China (including Hong Kong)

- 6.2.2. Taiwan

- 6.2.3. United States

- 6.2.4. Latin America

- 6.2.5. Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 7. Taiwan Processor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 7.1.1. CPU

- 7.1.1.1. Client (Desktop and Laptop)

- 7.1.1.2. Server

- 7.1.2. APU

- 7.1.2.1. Smartphone

- 7.1.2.2. Tablet

- 7.1.2.3. Smart Television

- 7.1.2.4. Smart Speakers

- 7.1.2.5. Other Ap

- 7.1.1. CPU

- 7.2. Market Analysis, Insights and Forecast - by Geography ***

- 7.2.1. China (including Hong Kong)

- 7.2.2. Taiwan

- 7.2.3. United States

- 7.2.4. Latin America

- 7.2.5. Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 8. United States Processor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 8.1.1. CPU

- 8.1.1.1. Client (Desktop and Laptop)

- 8.1.1.2. Server

- 8.1.2. APU

- 8.1.2.1. Smartphone

- 8.1.2.2. Tablet

- 8.1.2.3. Smart Television

- 8.1.2.4. Smart Speakers

- 8.1.2.5. Other Ap

- 8.1.1. CPU

- 8.2. Market Analysis, Insights and Forecast - by Geography ***

- 8.2.1. China (including Hong Kong)

- 8.2.2. Taiwan

- 8.2.3. United States

- 8.2.4. Latin America

- 8.2.5. Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 9. Latin America Processor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 9.1.1. CPU

- 9.1.1.1. Client (Desktop and Laptop)

- 9.1.1.2. Server

- 9.1.2. APU

- 9.1.2.1. Smartphone

- 9.1.2.2. Tablet

- 9.1.2.3. Smart Television

- 9.1.2.4. Smart Speakers

- 9.1.2.5. Other Ap

- 9.1.1. CPU

- 9.2. Market Analysis, Insights and Forecast - by Geography ***

- 9.2.1. China (including Hong Kong)

- 9.2.2. Taiwan

- 9.2.3. United States

- 9.2.4. Latin America

- 9.2.5. Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 10. Middle East and Africa Processor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 10.1.1. CPU

- 10.1.1.1. Client (Desktop and Laptop)

- 10.1.1.2. Server

- 10.1.2. APU

- 10.1.2.1. Smartphone

- 10.1.2.2. Tablet

- 10.1.2.3. Smart Television

- 10.1.2.4. Smart Speakers

- 10.1.2.5. Other Ap

- 10.1.1. CPU

- 10.2. Market Analysis, Insights and Forecast - by Geography ***

- 10.2.1. China (including Hong Kong)

- 10.2.2. Taiwan

- 10.2.3. United States

- 10.2.4. Latin America

- 10.2.5. Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 11. China Processor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Taiwan Processor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. United States Processor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of the World Processor Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Nvidia

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Mediatek

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Intel

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 AMD

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Apple*List Not Exhaustive

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Qualcomm

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Nvidia

List of Figures

- Figure 1: Global Processor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: China Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Taiwan Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Taiwan Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: United States Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: United States Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: China Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 11: China Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 12: China Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 13: China Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 14: China Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 15: China Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Taiwan Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 17: Taiwan Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 18: Taiwan Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 19: Taiwan Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 20: Taiwan Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Taiwan Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: United States Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 23: United States Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 24: United States Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 25: United States Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 26: United States Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 27: United States Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Latin America Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 29: Latin America Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 30: Latin America Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 31: Latin America Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 32: Latin America Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 35: Middle East and Africa Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 36: Middle East and Africa Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 37: Middle East and Africa Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 38: Middle East and Africa Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Middle East and Africa Processor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Processor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 3: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 4: Global Processor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 14: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 15: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 17: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 18: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 20: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 21: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 23: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 24: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 26: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 27: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Processor Market?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the Processor Market?

Key companies in the market include Nvidia, Mediatek, Intel, AMD, Apple*List Not Exhaustive, Qualcomm.

3. What are the main segments of the Processor Market?

The market segments include Type of Product, Geography ***.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones; Growing Adoption of Cloud Computing. Big Data Analytics. and AI.

6. What are the notable trends driving market growth?

APUs to Acquire a Significant Share.

7. Are there any restraints impacting market growth?

Cyber Security concerns may hinder the growth of the sports betting kiosk market.

8. Can you provide examples of recent developments in the market?

February 2023: MediaTek introduced the Dimensity 7200 chipset to amplify gaming and photography smartphone experiences. Dimensity 7200 utilizes the same TSMC 4nm second-generation process as the Dimensity 9200 and is highly suitable for ultra-slim designs in a range of shapes. The octa-core CPU combines two Arm Cortex-A715 cores, which have the ability to run at up to 2.8GHz, with six Cortex-A510 cores, enabling users to easily switch between apps and get the most out of each one.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Processor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Processor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Processor Market?

To stay informed about further developments, trends, and reports in the Processor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence