Key Insights

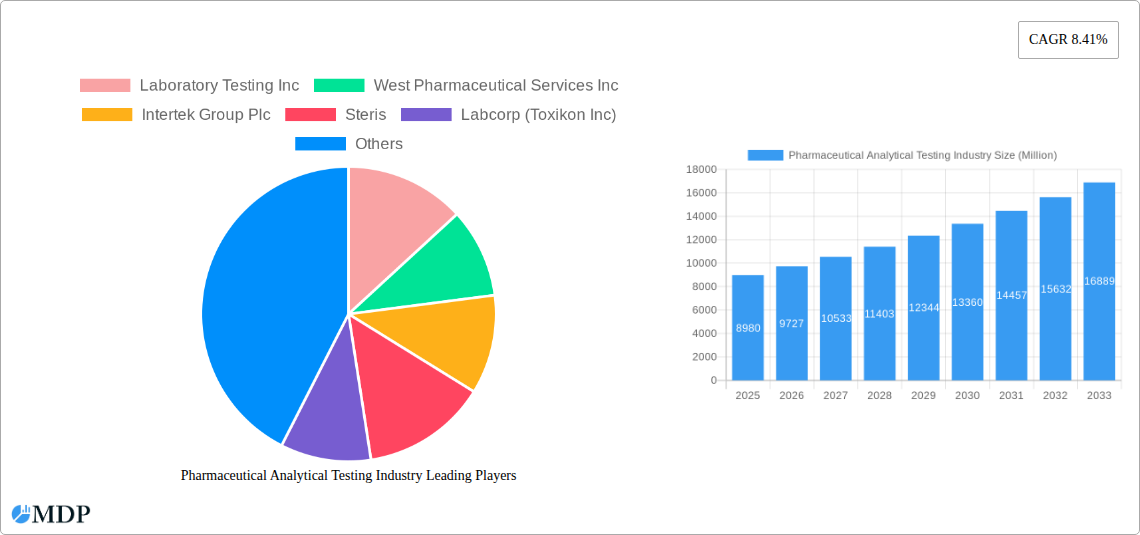

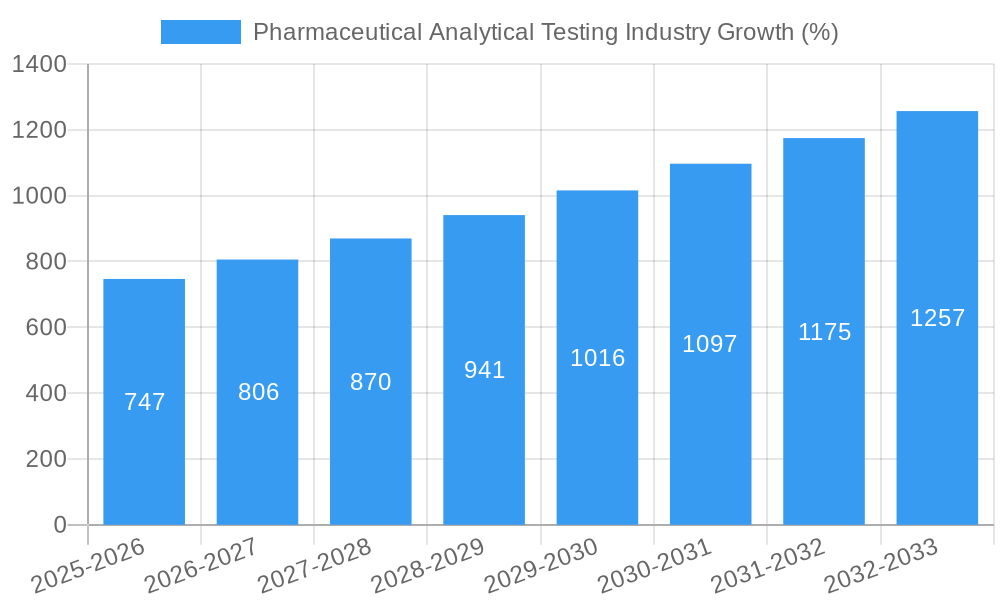

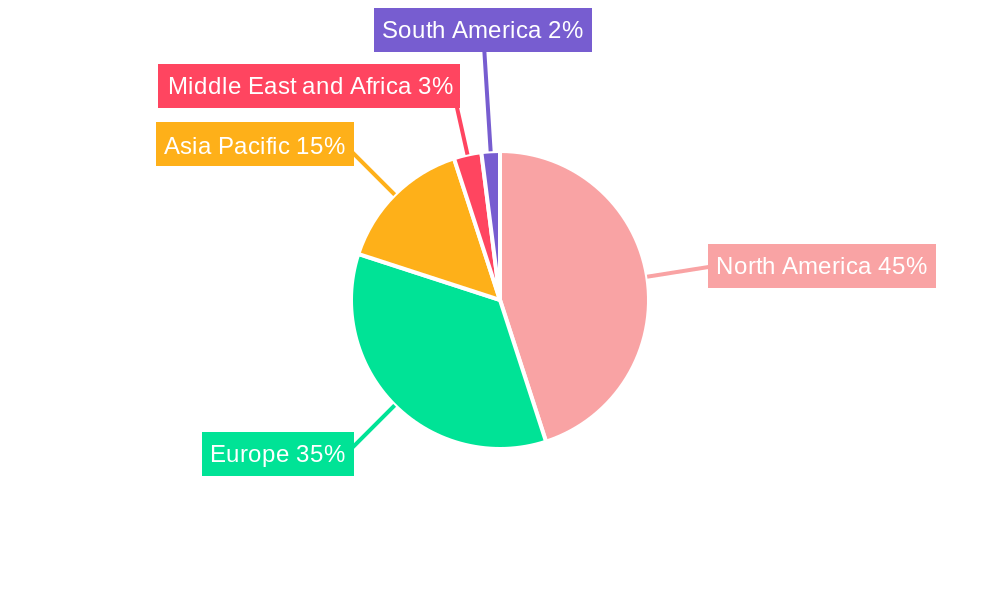

The pharmaceutical analytical testing market, valued at $8.98 billion in 2025, is projected to experience robust growth, driven by stringent regulatory requirements for drug safety and efficacy, the rising prevalence of chronic diseases necessitating increased drug development, and the expanding global pharmaceutical industry. The market's Compound Annual Growth Rate (CAGR) of 8.41% from 2025 to 2033 indicates substantial future expansion. Key service segments include bioanalytical testing, method development & validation, stability testing, and drug substance testing, each contributing significantly to the overall market value. The growing demand for sophisticated analytical techniques, such as mass spectrometry and chromatography, is further fueling market growth. North America and Europe currently dominate the market share due to well-established pharmaceutical industries and robust regulatory frameworks, but the Asia-Pacific region is poised for significant growth, driven by increasing pharmaceutical production and investments in advanced analytical technologies within countries like China and India.

Competitive pressures among established players like Laboratory Testing Inc, West Pharmaceutical Services Inc, Intertek Group Plc, Steris, Labcorp (Toxikon Inc), Eurofins Scientific, SGS SA, Boston Analytical, and Pace Analytical Services are driving innovation and the development of advanced analytical testing services. Challenges for the industry include managing the complexities of evolving regulatory guidelines, ensuring data integrity and accuracy, and optimizing cost-effectiveness in a highly competitive landscape. However, the long-term outlook remains positive due to continuous advancements in analytical technologies, the increasing need for personalized medicine, and the growing emphasis on ensuring the quality, safety, and efficacy of pharmaceutical products worldwide. The market will likely see further consolidation as larger players acquire smaller specialized firms, leading to enhanced capabilities and broader service offerings.

Pharmaceutical Analytical Testing Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Pharmaceutical Analytical Testing industry, offering valuable insights for stakeholders, investors, and industry professionals. The report covers market dynamics, leading players, emerging trends, and future growth prospects, focusing on the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report utilizes data from the historical period of 2019-2024 and leverages expert analysis for reliable projections.

Pharmaceutical Analytical Testing Industry Market Dynamics & Concentration

The Pharmaceutical Analytical Testing market is characterized by a moderately concentrated landscape with several key players commanding significant market share. Laboratory Testing Inc., West Pharmaceutical Services Inc., Intertek Group Plc, Steris, Labcorp (Toxikon Inc.), Eurofins Scientific, SGS SA, Boston Analytical, and Pace Analytical Services are among the prominent players. While precise market share data for each company remains proprietary, it's estimated that the top five players hold approximately 60% of the global market share in 2025. This concentration is primarily driven by their extensive testing capabilities, global reach, and established client networks.

The market’s growth is propelled by several innovation drivers, including the increasing adoption of advanced analytical techniques like LC-MS, GC-MS, and HPLC, which enhance precision and efficiency. Stringent regulatory frameworks governing drug development and approval, such as those enforced by the FDA and EMA, also significantly contribute to market demand. While some substitution exists with smaller, specialized labs offering niche services, the industry's reliance on quality assurance makes the need for accredited and experienced laboratories paramount. End-user trends, particularly the growing focus on personalized medicine and biologics, further stimulate demand for sophisticated analytical testing. The past five years have also witnessed a moderate level of M&A activity, estimated at around 20 deals annually. This strategic consolidation reflects players' efforts to enhance their capabilities and expand their global presence.

Pharmaceutical Analytical Testing Industry Industry Trends & Analysis

The Pharmaceutical Analytical Testing market is experiencing robust growth driven by various factors. The increasing prevalence of chronic diseases globally is fueling the demand for new drugs and therapies, directly increasing the need for robust analytical testing throughout the drug development lifecycle. Technological advancements, particularly in automation and high-throughput screening, are enhancing the efficiency and speed of testing, reducing costs, and accelerating drug development timelines. Consumer preference for higher quality, safer, and more effective medications implicitly boosts the demand for meticulous analytical testing to ensure product safety and efficacy. The rise of biosimilars and personalized medicine presents both opportunities and challenges, with the former driving demand for comparative analytical studies, while the latter necessitates highly specialized and personalized testing methods. Competitive dynamics are shaping the market, with companies continually investing in cutting-edge technologies and expanding their service portfolios to remain competitive. This results in a competitive environment with a focus on innovation and speed to market. The market witnessed a CAGR of approximately 8% during 2019-2024, and we project a CAGR of xx% during 2025-2033, with increased market penetration projected especially in emerging economies.

Leading Markets & Segments in Pharmaceutical Analytical Testing Industry

While detailed regional breakdowns are provided in the full report, North America currently holds the largest market share, due to robust pharmaceutical R&D spending, stringent regulations, and the presence of major pharmaceutical companies. Europe follows closely in second place with a significant market share, largely because of similar factors to North America. The Asia-Pacific region exhibits the highest growth potential, driven by rising healthcare expenditure and an expanding pharmaceutical industry.

By Service Type:

- Bioanalytical Testing: This segment is the largest, driven by the growing prominence of biologics and the need for precise pharmacokinetic and pharmacodynamic analysis.

- Method Development & Validation: High demand stems from the need for reliable and validated analytical methods for new drug entities and generic drugs.

- Stability Testing: This remains a crucial segment, reflecting the regulatory requirements for demonstrating the stability and shelf-life of pharmaceutical products.

- Drug Substances Testing: This is a significant segment, focused on ensuring the purity, identity, and quality of the raw materials and active pharmaceutical ingredients.

- Other Service Types: This encompasses a variety of specialized testing services, contributing to market diversification.

Key Drivers: Stringent regulatory compliance mandates, increasing R&D investment by pharmaceutical companies, the growing prevalence of chronic diseases, and technological advancements all contribute to segment growth.

Pharmaceutical Analytical Testing Industry Product Developments

Recent product innovations have focused on integrating advanced analytical technologies with automation and data analytics for improved efficiency and accuracy. For instance, many labs now offer fully automated systems for high-throughput screening, significantly reducing turnaround time and improving consistency. The development of miniaturized and portable testing devices is expanding the accessibility and scope of pharmaceutical analysis, enabling point-of-care testing and on-site quality control. These developments offer competitive advantages through faster results, reduced costs, and improved data management, thereby improving market fit and meeting evolving industry needs.

Key Drivers of Pharmaceutical Analytical Testing Industry Growth

The industry's growth is primarily fueled by stringent regulatory requirements for drug quality and safety, necessitating thorough analytical testing at each stage of the drug development process. The continuous rise in the global prevalence of chronic diseases directly increases the demand for new and innovative therapies, which in turn boosts the need for analytical testing. Technological advancements, including automation and sophisticated analytical techniques, drive efficiency and accuracy, leading to faster drug development and cost reduction. Additionally, significant R&D investments by pharmaceutical companies are key drivers in this industry.

Challenges in the Pharmaceutical Analytical Testing Industry Market

The industry faces challenges including stringent regulatory compliance requirements, increasing demand for specialized testing services, and intense competition among testing providers. These factors impact market growth via increased operational costs, specialized equipment requirements, and necessitate maintaining a highly qualified workforce. Furthermore, supply chain disruptions can impact the availability of reagents and equipment, potentially delaying testing and impacting overall profitability. The industry also faces price pressures from customers seeking cost-effective testing solutions.

Emerging Opportunities in Pharmaceutical Analytical Testing Industry

The Pharmaceutical Analytical Testing market is poised for significant growth due to technological advancements, particularly the development of AI-driven analytical tools and advanced mass spectrometry techniques. Strategic partnerships between analytical testing companies and pharmaceutical companies are also creating new avenues for growth. Expansion into emerging markets with growing pharmaceutical industries, especially in Asia and Latin America, presents significant growth opportunities. Overall, focusing on speed, accuracy, and data analysis will become crucial for companies' long-term success.

Leading Players in the Pharmaceutical Analytical Testing Industry Sector

- Laboratory Testing Inc.

- West Pharmaceutical Services Inc.

- Intertek Group Plc

- Steris

- Labcorp (Toxikon Inc.)

- Eurofins Scientific

- SGS SA

- Boston Analytical

- Pace Analytical Services

Key Milestones in Pharmaceutical Analytical Testing Industry Industry

January 2024: Kindeva Drug Delivery launched a new global business unit dedicated to analytical services, expanding its capabilities in the pharmaceutical, biopharmaceutical, and medical device sectors. This broadened their service portfolio and significantly increased their market reach.

March 2024: LGM Pharma invested over USD 2 Million to expand its analytical testing services and increase drug delivery suppository manufacturing capacity by 50% at its Rosenberg, Texas facility. This expansion indicates a strong belief in the growth potential of the analytical testing market, particularly within specialized areas like drug delivery systems.

Strategic Outlook for Pharmaceutical Analytical Testing Industry Market

The future of the Pharmaceutical Analytical Testing market is bright, driven by the continuous advancement of technologies and the increased demand for high-quality, safe, and effective pharmaceutical products. Companies that strategically invest in advanced technologies, such as AI and automation, and that expand their service offerings to meet the evolving needs of the pharmaceutical industry will be well-positioned for significant growth. Strategic partnerships and acquisitions will further consolidate market share and drive innovation. Focusing on data analytics and providing comprehensive solutions will be crucial for success in this increasingly competitive market.

Pharmaceutical Analytical Testing Industry Segmentation

-

1. Service Type

- 1.1. Bioanalytical Testing

- 1.2. Method Development & Validation

- 1.3. Stability Testing

- 1.4. Drug Substances Testing

- 1.5. Other Service Types

Pharmaceutical Analytical Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pharmaceutical Analytical Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Clinical Trials; Focus on Analytical Testing of Biologics and Biosimilars; Increased Trend of Outsourcing Laboratory Testing Services

- 3.3. Market Restrains

- 3.3.1. Complex Regulatory Framework for Maintaining Laboratories; Challenges in the Development of Proper Analytical Techniques

- 3.4. Market Trends

- 3.4.1. Stability Testing Segment is Expected to Exhibit a Significant Market Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Bioanalytical Testing

- 5.1.2. Method Development & Validation

- 5.1.3. Stability Testing

- 5.1.4. Drug Substances Testing

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Bioanalytical Testing

- 6.1.2. Method Development & Validation

- 6.1.3. Stability Testing

- 6.1.4. Drug Substances Testing

- 6.1.5. Other Service Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Bioanalytical Testing

- 7.1.2. Method Development & Validation

- 7.1.3. Stability Testing

- 7.1.4. Drug Substances Testing

- 7.1.5. Other Service Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Bioanalytical Testing

- 8.1.2. Method Development & Validation

- 8.1.3. Stability Testing

- 8.1.4. Drug Substances Testing

- 8.1.5. Other Service Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East and Africa Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Bioanalytical Testing

- 9.1.2. Method Development & Validation

- 9.1.3. Stability Testing

- 9.1.4. Drug Substances Testing

- 9.1.5. Other Service Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. South America Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Bioanalytical Testing

- 10.1.2. Method Development & Validation

- 10.1.3. Stability Testing

- 10.1.4. Drug Substances Testing

- 10.1.5. Other Service Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. North America Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Laboratory Testing Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 West Pharmaceutical Services Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Intertek Group Plc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Steris

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Labcorp (Toxikon Inc)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Eurofins Scientific

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SGS SA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Boston Analytical

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Pace Analytical Services

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Laboratory Testing Inc

List of Figures

- Figure 1: Global Pharmaceutical Analytical Testing Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 13: North America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 14: North America Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 17: Europe Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 18: Europe Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 21: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 22: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 25: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 26: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: South America Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 29: South America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 30: South America Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: South America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: GCC Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Africa Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 31: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 36: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 44: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Australia Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 52: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: GCC Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Africa Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 57: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Brazil Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Argentina Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Analytical Testing Industry?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Pharmaceutical Analytical Testing Industry?

Key companies in the market include Laboratory Testing Inc, West Pharmaceutical Services Inc, Intertek Group Plc, Steris, Labcorp (Toxikon Inc), Eurofins Scientific, SGS SA, Boston Analytical, Pace Analytical Services.

3. What are the main segments of the Pharmaceutical Analytical Testing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Clinical Trials; Focus on Analytical Testing of Biologics and Biosimilars; Increased Trend of Outsourcing Laboratory Testing Services.

6. What are the notable trends driving market growth?

Stability Testing Segment is Expected to Exhibit a Significant Market Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Complex Regulatory Framework for Maintaining Laboratories; Challenges in the Development of Proper Analytical Techniques.

8. Can you provide examples of recent developments in the market?

March 2024: LGM Pharma invested over USD 2 million to expand its analytical testing services and include drug delivery suppository manufacturing capabilities by 50% in its facility in Rosenburg, Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Analytical Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Analytical Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Analytical Testing Industry?

To stay informed about further developments, trends, and reports in the Pharmaceutical Analytical Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence