Key Insights

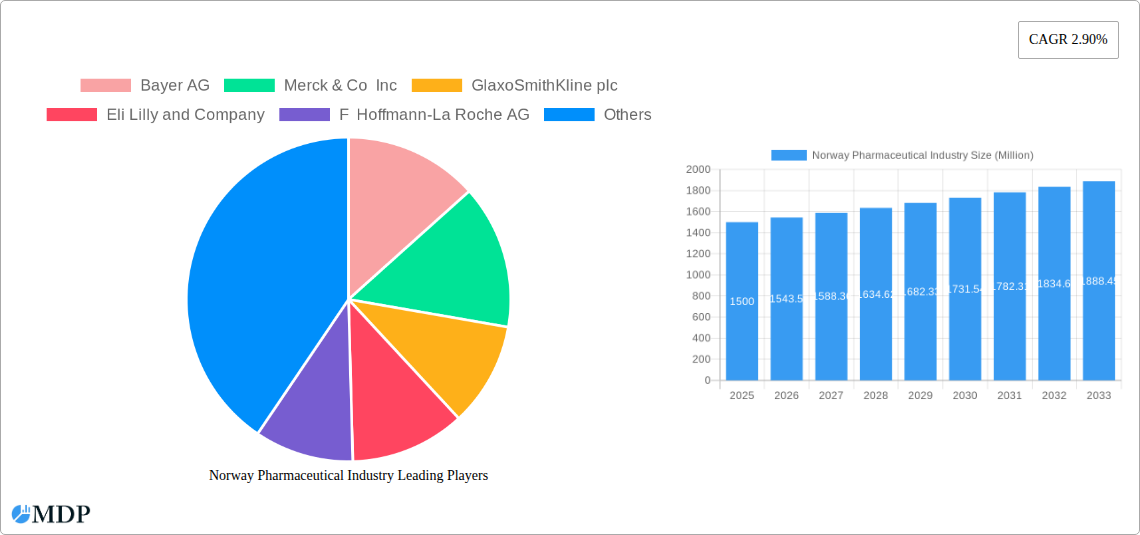

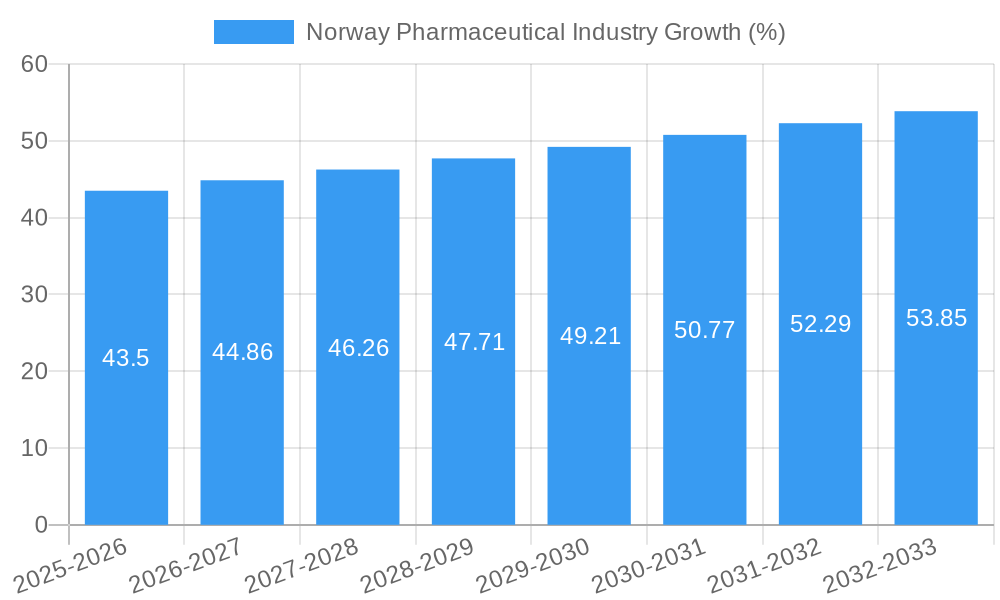

The Norwegian pharmaceutical market, valued at approximately 1500 million (USD) in 2025, exhibits a steady growth trajectory, projected to reach approximately 1800 million (USD) by 2033, reflecting a compound annual growth rate (CAGR) of 2.90%. This growth is driven by several factors. An aging population necessitates increased demand for chronic disease management medications, particularly within segments like cardiovascular drugs, alimentary tract and metabolism treatments, and neurological medications. Furthermore, rising healthcare expenditure per capita and a robust healthcare infrastructure contribute to market expansion. Increased government initiatives focusing on improved access to medicines and the adoption of innovative drug delivery systems are also propelling growth. However, stringent regulatory frameworks and price controls imposed by the Norwegian government act as a significant restraint, limiting profit margins for pharmaceutical companies. The market is segmented by drug type (branded vs. generic), prescription type (prescription and OTC), and therapeutic class, with a notable presence of major multinational pharmaceutical players like Bayer, Merck, GSK, and Roche, indicating a high level of competition and sophisticated market dynamics.

The competitive landscape is intensely competitive, with established multinational pharmaceutical companies vying for market share. Generic drug penetration is a notable trend, influenced by both cost-consciousness among consumers and government policies favoring cost-effective treatment options. The growth of the biopharmaceutical segment, along with the increasing prevalence of chronic illnesses such as diabetes and cardiovascular disease, continues to shape market dynamics. Looking ahead, success in the Norwegian pharmaceutical market will depend on strategic pricing strategies, effective engagement with healthcare professionals, and an understanding of evolving regulatory requirements. Companies that successfully navigate these challenges and adapt to the specific needs of the Norwegian healthcare system are poised for significant growth in the coming years.

Norway Pharmaceutical Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Norway pharmaceutical industry, covering market dynamics, leading players, key trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers crucial insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report utilizes the latest data to provide actionable intelligence, including market size forecasts (in Millions) and detailed segment analysis.

Norway Pharmaceutical Industry Market Dynamics & Concentration

The Norwegian pharmaceutical market, valued at xx Million in 2024, exhibits a moderately concentrated landscape with a few major multinational players holding significant market share. Market concentration is influenced by factors such as stringent regulatory frameworks, high R&D investments, and the presence of strong intellectual property protection. Innovation drivers include the growing prevalence of chronic diseases, increasing demand for advanced therapies, and government initiatives promoting healthcare advancements. Mergers and acquisitions (M&A) activity plays a significant role in shaping the competitive landscape, with xx M&A deals recorded between 2019 and 2024. The average market share of the top 5 companies is estimated at xx%. Key factors influencing market dynamics include:

- Stringent Regulatory Environment: The Norwegian Medicines Agency (Norges legemiddelverk) imposes strict regulations impacting market entry and product approval.

- High R&D Expenditure: Significant investments in research and development drive innovation and the launch of new therapies.

- Generic Competition: The increasing penetration of generic drugs exerts downward pressure on prices, impacting profitability for branded drug manufacturers.

- End-User Trends: Growing awareness of health issues and a preference for innovative treatments contribute to market growth.

Norway Pharmaceutical Industry Industry Trends & Analysis

The Norwegian pharmaceutical industry demonstrates robust growth, driven by factors such as an aging population, rising prevalence of chronic diseases, increased healthcare expenditure, and a supportive government policy framework. The market experienced a CAGR of xx% during the historical period (2019-2024), and is projected to maintain a healthy growth trajectory throughout the forecast period (2025-2033), reaching an estimated xx Million by 2033. Technological advancements, including personalized medicine, biosimilars, and digital health solutions, are reshaping the industry, impacting consumer preferences and competitive dynamics. The market penetration of innovative therapies is gradually increasing, with notable growth observed in areas such as oncology and immunology. Furthermore, the shift towards value-based healthcare models presents both challenges and opportunities for pharmaceutical companies operating in Norway.

Leading Markets & Segments in Norway Pharmaceutical Industry

While Norway is a relatively small market, the leading segments are driven by a combination of factors. The prescription drug market dominates, reflecting the prevalence of chronic conditions.

Dominant Segments:

- Prescription Drugs (Rx): This segment constitutes the largest portion of the market, driven by the increasing prevalence of chronic diseases like cardiovascular diseases, diabetes, and cancer.

- ATC/Therapeutic Class: The Cardiovascular System, Alimentary Tract and Metabolism, and Nervous System therapeutic classes represent significant market shares, reflecting prevalent health conditions within the Norwegian population.

- Drug Type: Branded drugs continue to hold a larger market share compared to generics, though generic penetration is gradually increasing.

Key Drivers:

- High Healthcare Expenditure: Norway's robust healthcare system and relatively high per capita expenditure on healthcare support pharmaceutical market growth.

- Aging Population: The increasing elderly population contributes significantly to demand for medications addressing age-related health conditions.

- Government Initiatives: Government policies focused on improving healthcare access and promoting innovative therapies positively impact market growth.

Norway Pharmaceutical Industry Product Developments

Technological advancements significantly influence product development in the Norwegian pharmaceutical industry. Biosimilars are gaining traction, offering cost-effective alternatives to branded biologics. Digital health solutions are being integrated to improve patient care and treatment adherence. There’s a growing focus on personalized medicine, tailoring treatments to individual patient needs. This focus on innovation, coupled with a stringent regulatory environment, shapes the competitive landscape, requiring pharmaceutical companies to demonstrate clinical efficacy and safety to secure market approval.

Key Drivers of Norway Pharmaceutical Industry Growth

Several factors contribute to the growth of the Norwegian pharmaceutical industry. These include:

- Technological Advancements: Innovation in drug discovery, development, and delivery systems fuels market expansion.

- Economic Growth: A stable economy and increasing disposable incomes enable higher healthcare spending.

- Favorable Regulatory Environment: While stringent, the regulatory framework encourages innovation while ensuring patient safety.

Challenges in the Norway Pharmaceutical Industry Market

The Norwegian pharmaceutical market faces several challenges:

- Stringent Regulatory Approvals: The lengthy and rigorous approval process increases time-to-market for new drugs.

- Price Controls: Government price regulations can limit profitability for pharmaceutical companies.

- Generic Competition: The rising penetration of generics intensifies competition and exerts pressure on prices.

Emerging Opportunities in Norway Pharmaceutical Industry

The Norwegian pharmaceutical market presents opportunities for growth through:

- Strategic Partnerships: Collaborations between pharmaceutical companies and healthcare providers can improve access and efficiency.

- Digital Health Integration: Leveraging digital platforms to enhance patient engagement and treatment adherence.

- Focus on Personalized Medicine: Developing and commercializing tailored therapies can capture significant market share.

Leading Players in the Norway Pharmaceutical Industry Sector

- Bayer AG

- Merck & Co Inc

- GlaxoSmithKline plc

- Eli Lilly and Company

- F Hoffmann-La Roche AG

- AstraZeneca plc

- AbbVie Inc

- Bristol Myers Squibb Company

- Boehringer Ingelheim

- Sanofi S A

Key Milestones in Norway Pharmaceutical Industry Industry

- November 2021: Hepro AS receives final approval for the Dosell pharmaceutical robot, marking a significant advancement in automation within the Norwegian pharmaceutical market.

- September 2021: Launch of the Oslo Medicines Initiative, a public-private collaboration enhancing medicine accessibility for the Norwegian population.

Strategic Outlook for Norway Pharmaceutical Industry Market

The Norwegian pharmaceutical market is poised for sustained growth, driven by technological advancements, an aging population, and a supportive regulatory environment. Strategic partnerships, investment in digital health solutions, and a focus on personalized medicine will be crucial for companies seeking to capitalize on the market's potential. The increasing emphasis on value-based healthcare will require pharmaceutical companies to demonstrate the long-term clinical and economic benefits of their products to maintain market share.

Norway Pharmaceutical Industry Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Cardiovascular System

- 1.2. Dermatologicals

- 1.3. Genito Urinary System and Sex Hormones

- 1.4. Anti-infective for Systemic Use

- 1.5. Antineoplastic and Immunomodulating Agents

- 1.6. Musculoskeletal System

- 1.7. Nervous System

- 1.8. Respiratory System

- 1.9. Other ATC/Therapeutic Classes

-

2. Drug Type

- 2.1. Branded

- 2.2. Generic

-

3. Prescription Type

- 3.1. Prescription Drugs (Rx)

- 3.2. Over the Counter (OTC) Drugs

Norway Pharmaceutical Industry Segmentation By Geography

- 1. Norway

Norway Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Good Societal and Economical Conditions; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Rules

- 3.4. Market Trends

- 3.4.1. Prescription Drugs Segment in Norway is Expected to Witness a Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Cardiovascular System

- 5.1.2. Dermatologicals

- 5.1.3. Genito Urinary System and Sex Hormones

- 5.1.4. Anti-infective for Systemic Use

- 5.1.5. Antineoplastic and Immunomodulating Agents

- 5.1.6. Musculoskeletal System

- 5.1.7. Nervous System

- 5.1.8. Respiratory System

- 5.1.9. Other ATC/Therapeutic Classes

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Branded

- 5.2.2. Generic

- 5.3. Market Analysis, Insights and Forecast - by Prescription Type

- 5.3.1. Prescription Drugs (Rx)

- 5.3.2. Over the Counter (OTC) Drugs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GlaxoSmithKline plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eli Lilly and Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 F Hoffmann-La Roche AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AstraZeneca plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AbbVie Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bristol Myers Squibb Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sanofi S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Norway Pharmaceutical Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Pharmaceutical Industry Share (%) by Company 2024

List of Tables

- Table 1: Norway Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Pharmaceutical Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Norway Pharmaceutical Industry Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 4: Norway Pharmaceutical Industry Volume K Unit Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 5: Norway Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 6: Norway Pharmaceutical Industry Volume K Unit Forecast, by Drug Type 2019 & 2032

- Table 7: Norway Pharmaceutical Industry Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 8: Norway Pharmaceutical Industry Volume K Unit Forecast, by Prescription Type 2019 & 2032

- Table 9: Norway Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Norway Pharmaceutical Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Norway Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Norway Pharmaceutical Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Norway Pharmaceutical Industry Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 14: Norway Pharmaceutical Industry Volume K Unit Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 15: Norway Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 16: Norway Pharmaceutical Industry Volume K Unit Forecast, by Drug Type 2019 & 2032

- Table 17: Norway Pharmaceutical Industry Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 18: Norway Pharmaceutical Industry Volume K Unit Forecast, by Prescription Type 2019 & 2032

- Table 19: Norway Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Norway Pharmaceutical Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Pharmaceutical Industry?

The projected CAGR is approximately 2.90%.

2. Which companies are prominent players in the Norway Pharmaceutical Industry?

Key companies in the market include Bayer AG, Merck & Co Inc, GlaxoSmithKline plc, Eli Lilly and Company, F Hoffmann-La Roche AG, AstraZeneca plc, AbbVie Inc, Bristol Myers Squibb Company, Boehringer Ingelheim, Sanofi S A .

3. What are the main segments of the Norway Pharmaceutical Industry?

The market segments include ATC/Therapeutic Class, Drug Type, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Good Societal and Economical Conditions; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

Prescription Drugs Segment in Norway is Expected to Witness a Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Rules.

8. Can you provide examples of recent developments in the market?

In November 2021, Hepro AS has last issued final approval of the new version of Dosell and has officially approved the pharmaceutical robot in its entirety for the Norwegian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Norway Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence