Key Insights

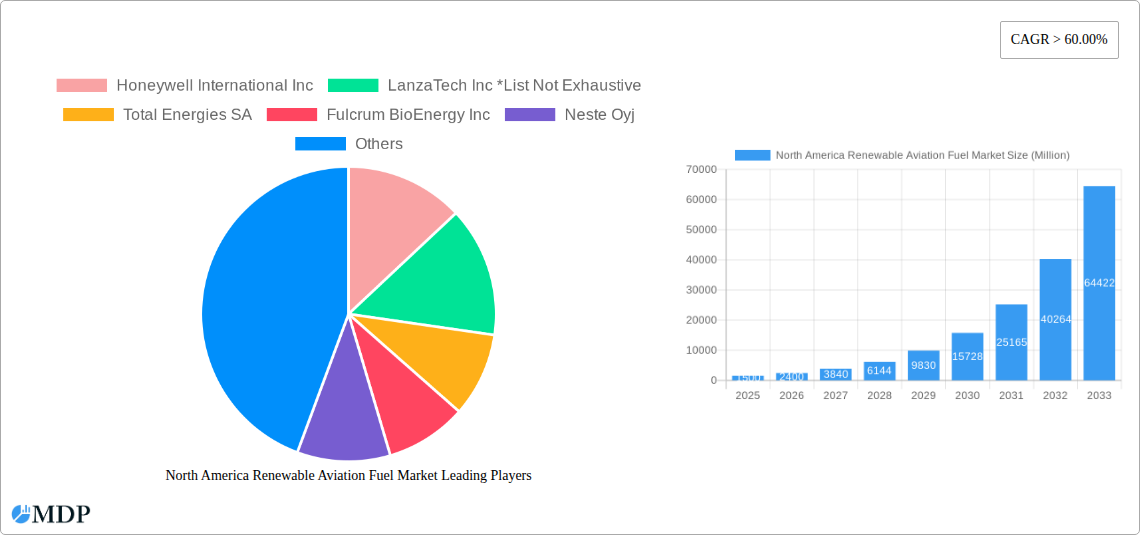

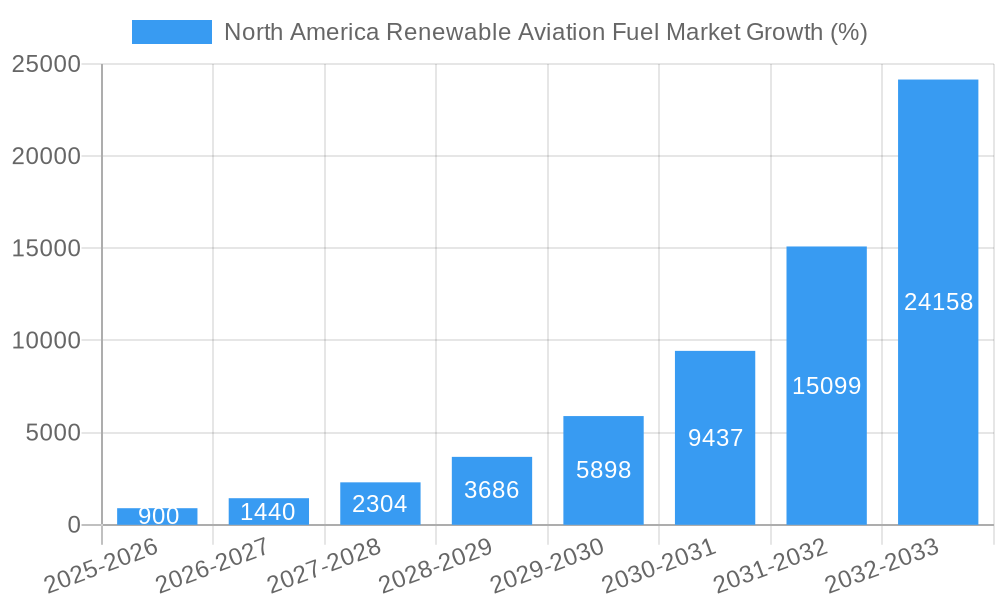

The North American renewable aviation fuel (RAF) market is experiencing explosive growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 60% from 2025 to 2033. This surge is driven by stringent environmental regulations aimed at reducing aviation's carbon footprint, coupled with increasing consumer demand for sustainable travel options. Key technological advancements in Fischer-Tropsch (FT) synthesis, Hydroprocessed Esters and Fatty Acids (HEFA), Synthesized Iso-Paraffinic (SIP), and Alcohol-to-Jet (AJT) production processes are fueling this expansion. The commercial aviation sector currently dominates the application segment, but the defense sector is also emerging as a significant contributor, demanding sustainable fuel solutions for its operations. Major players like Honeywell International Inc, LanzaTech Inc, Total Energies SA, and Neste Oyj are actively investing in research and development, expanding production capacity, and securing supply chains to meet this burgeoning demand. The market's rapid expansion is also facilitated by supportive government policies and incentives promoting the adoption of RAFs. However, challenges remain, including the relatively high production costs compared to traditional jet fuel and the need for further infrastructure development to facilitate widespread RAF distribution and integration into existing airport fueling systems.

Despite these challenges, the long-term outlook for the North American RAF market remains exceptionally positive. The significant environmental benefits, coupled with the growing awareness of climate change, are strong drivers of market growth. Furthermore, ongoing technological innovations promise to reduce production costs and improve the efficiency of RAF production, making it increasingly competitive with conventional jet fuel. The strategic focus of major industry players on research and development, coupled with the continued support from government agencies, is expected to overcome the current hurdles and solidify the long-term sustainability of the RAF market in North America. The market segmentation by technology and application provides opportunities for specialized players to focus on niche areas, further accelerating market expansion.

North America Renewable Aviation Fuel Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Renewable Aviation Fuel market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, industry trends, leading players, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. Key segments analyzed include Fischer-Tropsch (FT), Hydroprocessed Esters and Fatty Acids (HEFA), Synthesisized Iso-Paraffinic (SIP), and Alcohol-to-Jet (AJT) technologies, with applications across commercial, defense, and other sectors. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Renewable Aviation Fuel Market Market Dynamics & Concentration

The North America renewable aviation fuel market is characterized by a moderate level of concentration, with several major players holding significant market share. However, the market is also witnessing increasing participation from smaller companies and startups, driven by technological innovations and supportive government policies. Market share data for 2024 indicates that the top 5 players hold approximately xx% of the market, while the remaining xx% is fragmented among numerous smaller players. The market is dynamic, with frequent mergers and acquisitions (M&A) activities shaping the competitive landscape. In the last five years, there were approximately xx M&A deals, primarily focused on expanding production capacity and securing feedstock supplies.

Key innovation drivers include advancements in conversion technologies, the development of sustainable feedstocks, and the ongoing research into cost-effective production methods. Stringent environmental regulations, particularly around carbon emissions from the aviation sector, are pushing the adoption of renewable aviation fuels. The availability of alternative fuels and the fluctuating prices of traditional jet fuel also influence market dynamics. End-user trends reflect a growing preference for sustainable travel options, further driving market growth.

North America Renewable Aviation Fuel Market Industry Trends & Analysis

The North America renewable aviation fuel market is experiencing robust growth, fueled by a confluence of factors. The increasing awareness of aviation's environmental impact, coupled with government regulations aimed at reducing carbon emissions, is a primary driver. This is reflected in the market's impressive CAGR of xx% from 2019-2024 and a projected CAGR of xx% between 2025 and 2033. Technological advancements, such as improvements in HEFA and AJT processes, are significantly reducing production costs and improving fuel efficiency. Market penetration of renewable aviation fuels remains relatively low compared to conventional jet fuel, but it is steadily increasing, with projections indicating a significant rise in market share by 2033. Consumer preferences are shifting towards environmentally friendly travel options, creating a demand pull for sustainable aviation fuels. The competitive dynamics are marked by intense rivalry among established players and emerging entrants, leading to innovation and cost optimization.

Leading Markets & Segments in North America Renewable Aviation Fuel Market

The Commercial segment dominates the application landscape, driven by the substantial size of the commercial aviation industry. The HEFA technology currently holds the largest market share among production methods, owing to its relatively mature technology and availability of feedstock.

- Key Drivers for Commercial Segment: Stringent emission regulations for airlines, growing passenger numbers, and increasing corporate social responsibility initiatives.

- Key Drivers for HEFA Technology: Established technology, readily available feedstock (used cooking oil, animal fats), and relatively lower production costs compared to other technologies.

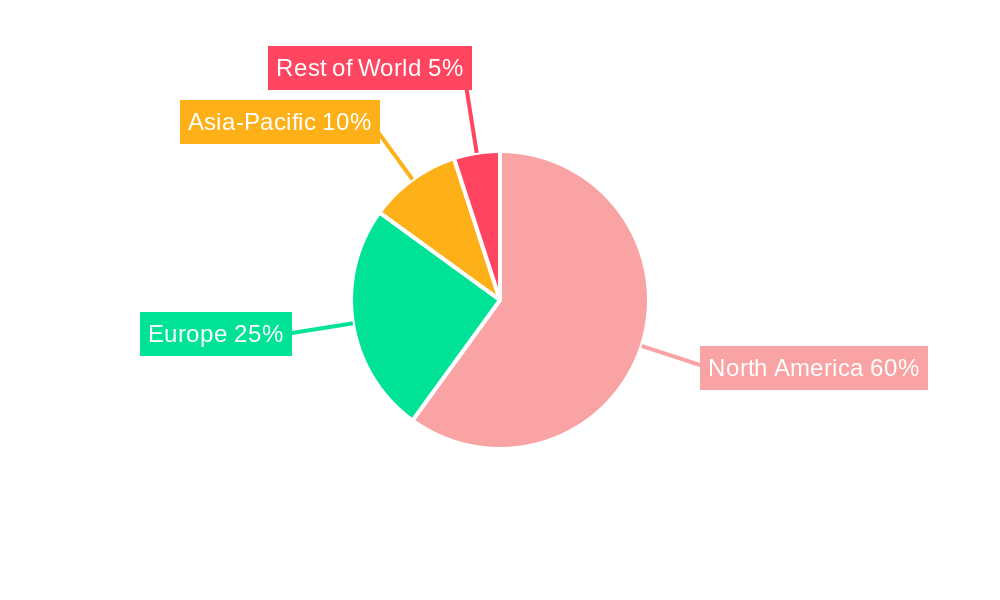

- Geographic Dominance: California and other states with proactive climate policies are leading in renewable aviation fuel production and consumption. The presence of established biofuel infrastructure and government incentives play a key role in regional dominance.

North America Renewable Aviation Fuel Market Product Developments

Recent product innovations have focused on improving the efficiency and sustainability of production processes, exploring novel feedstocks, and enhancing fuel quality to meet stringent aviation standards. New technologies, such as advanced catalysts and process optimization techniques, are being deployed to reduce production costs and improve overall efficiency. The emphasis is on developing drop-in fuels that can be seamlessly blended with conventional jet fuel, eliminating the need for significant modifications to aircraft engines. This aligns with the market's need for cost-effective and readily deployable solutions.

Key Drivers of North America Renewable Aviation Fuel Market Growth

Several key factors are driving the expansion of the North America renewable aviation fuel market. Firstly, stringent government regulations aimed at reducing greenhouse gas emissions from the aviation sector are compelling airlines and fuel producers to adopt sustainable alternatives. Secondly, technological advancements are making renewable fuel production more efficient and cost-competitive. Thirdly, growing consumer awareness of environmental issues and a preference for sustainable travel options are creating a significant demand pull. Finally, strategic partnerships between fuel producers, airlines, and technology providers are accelerating market growth and facilitating the development of sustainable supply chains.

Challenges in the North America Renewable Aviation Fuel Market Market

Despite the strong growth potential, the North America renewable aviation fuel market faces several challenges. High production costs remain a significant barrier to wider adoption, limiting its competitiveness against conventional jet fuel. The scalability of production and securing reliable, sustainable feedstock supplies remain crucial bottlenecks. Furthermore, the complex regulatory landscape and varying standards across different jurisdictions pose challenges for market expansion. These factors, coupled with the competitive pressures from established energy players, can limit growth in the short term. The lack of widely available, cost-effective infrastructure for distribution and handling of renewable aviation fuel also presents a challenge.

Emerging Opportunities in North America Renewable Aviation Fuel Market

The long-term growth trajectory of the North America renewable aviation fuel market is promising. Technological breakthroughs, particularly in advanced biofuel conversion technologies and the use of waste feedstocks, are poised to significantly reduce production costs and enhance sustainability. The increasing strategic partnerships between airlines, fuel producers, and technology providers are fostering innovation and accelerating market adoption. The expansion of supportive government policies and incentives will create further impetus for market growth. Exploring alternative feedstocks and developing more efficient production processes hold significant potential for growth.

Leading Players in the North America Renewable Aviation Fuel Market Sector

- Honeywell International Inc

- LanzaTech Inc

- Total Energies SA

- Fulcrum BioEnergy Inc

- Neste Oyj

- Red Rock Biofuels LLC

- SG Preston Company

- Gevo Inc

Key Milestones in North America Renewable Aviation Fuel Market Industry

- March 2022: Aemetis Inc. announced a deal with Qantas Airways Limited to supply 20 Million liters of blended renewable aviation fuel starting in 2025, signifying a significant commitment to SAF adoption by a major airline.

- January 2022: Airbus SE commenced manufacturing aircraft at its US facility, committing to using a blend of renewable and conventional jet fuel, signaling a commitment from a major aircraft manufacturer to the SAF industry.

Strategic Outlook for North America Renewable Aviation Fuel Market Market

The future of the North America renewable aviation fuel market is bright, driven by strong tailwinds of environmental regulations, technological innovation, and growing consumer demand for sustainable travel. Strategic partnerships and investments in research and development will play a crucial role in driving down production costs and enhancing the scalability of renewable aviation fuel production. The market is poised for significant expansion, presenting lucrative opportunities for both established players and new entrants. Companies that can effectively navigate the regulatory landscape, secure sustainable feedstock sources, and adapt to technological advancements will be well-positioned to capture significant market share.

North America Renewable Aviation Fuel Market Segmentation

-

1. Technology

- 1.1. Fischer-Tropsch (FT)

- 1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 1.3. Synthesi

-

2. Application

- 2.1. Commercial

- 2.2. Defense

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Renewable Aviation Fuel Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Renewable Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 60.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Defense Sector to be the Fastest-Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fischer-Tropsch (FT)

- 5.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 5.1.3. Synthesi

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fischer-Tropsch (FT)

- 6.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 6.1.3. Synthesi

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fischer-Tropsch (FT)

- 7.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 7.1.3. Synthesi

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fischer-Tropsch (FT)

- 8.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 8.1.3. Synthesi

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. United States North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 LanzaTech Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Total Energies SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fulcrum BioEnergy Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Neste Oyj

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Red Rock Biofuels LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 SG Preston Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gevo Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Renewable Aviation Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Renewable Aviation Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 5: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: United States North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 23: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 30: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 31: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 35: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 37: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 38: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 39: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 41: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 43: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Renewable Aviation Fuel Market?

The projected CAGR is approximately > 60.00%.

2. Which companies are prominent players in the North America Renewable Aviation Fuel Market?

Key companies in the market include Honeywell International Inc, LanzaTech Inc *List Not Exhaustive, Total Energies SA, Fulcrum BioEnergy Inc, Neste Oyj, Red Rock Biofuels LLC, SG Preston Company, Gevo Inc.

3. What are the main segments of the North America Renewable Aviation Fuel Market?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Defense Sector to be the Fastest-Growing Segment.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

March 2022: Aemetis Inc announced that it agreed with Qantas Airways Limited to supply 20 million liters of blended renewable aviation fuel from 2025. The blended fuel will be produced at a facility in California and will primarily be used to power Boeing and Airbus planes being operated between the countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Renewable Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Renewable Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Renewable Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the North America Renewable Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence