Key Insights

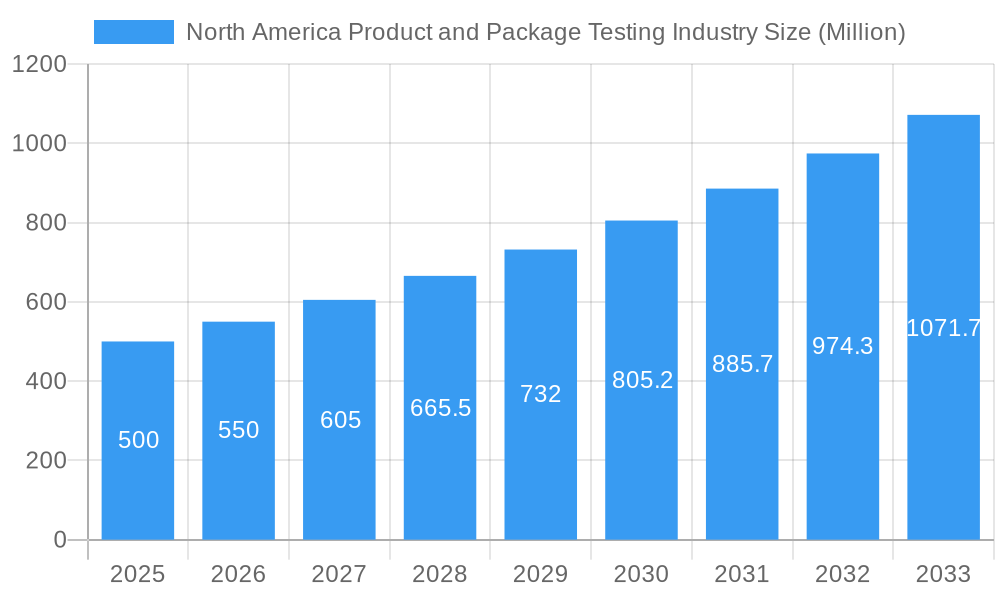

The North American product and package testing market is projected for substantial growth. Driven by stringent regulatory oversight, escalating consumer expectations for product safety and quality, and the e-commerce boom demanding advanced packaging solutions, the market is poised for expansion. The market size was valued at $2.5 billion in the base year of 2025 and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. Key growth drivers include significant demand from the food & beverage and healthcare sectors, where rigorous testing is paramount for product integrity and consumer well-being. The increasing adoption of sustainable packaging materials, such as recycled paper and biodegradable plastics, further necessitates comprehensive environmental testing, bolstering market expansion. The widespread application of physical performance, chemical, and environmental testing across diverse materials like glass, paper, plastic, and metal contributes to market dynamism and future potential. Leading market participants, including Turner Packaging, CRYOPAK, and Intertek, are instrumental in this landscape through their expertise and extensive testing capabilities. Anticipate intensified competition, with an emphasis on technological innovation and specialized testing services.

North America Product and Package Testing Industry Market Size (In Billion)

Market growth is further influenced by evolving trends. Advances in testing technologies, including automated systems and sophisticated analytical techniques, are enhancing efficiency and accuracy. Heightened consumer awareness through online product reviews and the reputational risks associated with product failures are compelling businesses to invest in more thorough testing protocols. However, market development may encounter certain challenges. The substantial investment required for specialized testing equipment and skilled personnel can present obstacles for smaller enterprises. Additionally, regional variations in regulatory frameworks across North America may introduce complexity and increase testing expenditures. Despite these considerations, the long-term outlook for the North American product and package testing market remains highly favorable, underscoring the persistent demand for quality assurance and regulatory compliance across industries.

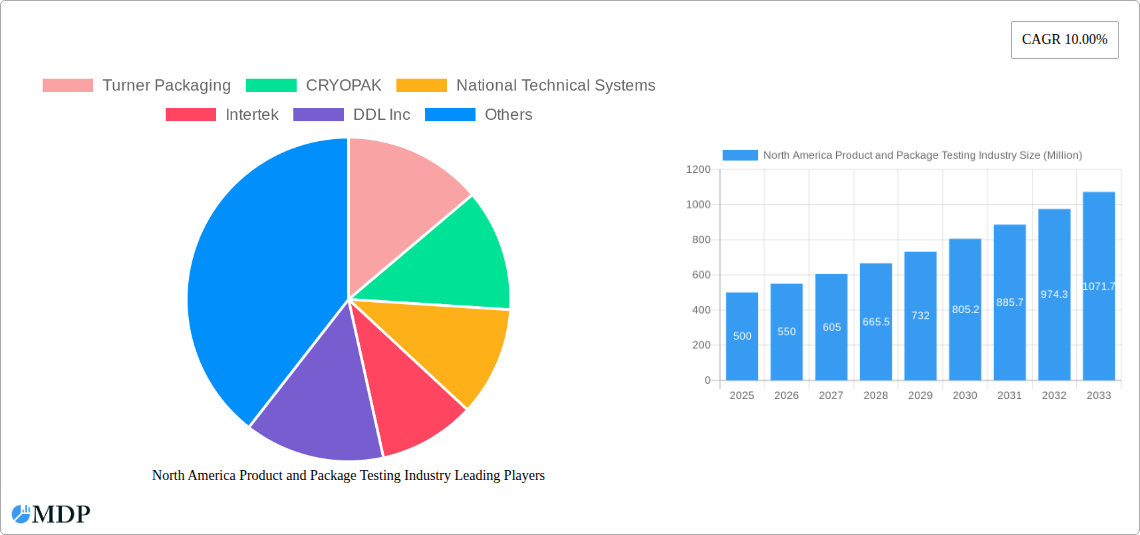

North America Product and Package Testing Industry Company Market Share

North America Product and Package Testing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America product and package testing industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, leading players, emerging trends, and future growth potential. The xx Million market is poised for significant expansion, driven by technological advancements, stringent regulatory frameworks, and evolving consumer preferences.

North America Product and Package Testing Industry Market Dynamics & Concentration

The North American product and package testing industry exhibits a moderately concentrated market structure, with a few major players commanding significant market share. The market share of the top 5 companies is estimated at xx%, reflecting both organic growth and strategic acquisitions (M&A). The last five years have seen approximately xx M&A deals, primarily driven by the need to expand testing capabilities and geographic reach. Innovation is a key driver, with companies constantly developing advanced testing techniques to meet evolving industry standards and consumer demands. Stringent regulatory frameworks, particularly regarding environmental compliance and product safety, also shape industry practices. Substitutes are limited, given the specialized nature of testing services, however, the increasing adoption of in-house testing capabilities by some large corporations presents a subtle competitive threat. End-user trends, such as the growth of e-commerce and a rising focus on sustainable packaging, are creating new opportunities within the industry.

- Market Concentration: Top 5 players hold an estimated xx% market share.

- M&A Activity: Approximately xx M&A deals in the past 5 years.

- Innovation Drivers: Advanced testing techniques, automation, and data analytics.

- Regulatory Frameworks: Stringent safety and environmental regulations.

- End-User Trends: Growth of e-commerce, focus on sustainable packaging.

North America Product and Package Testing Industry Industry Trends & Analysis

The North American product and package testing industry is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing demand for product safety and quality assurance is a major driver, particularly within sectors like food and beverage and healthcare. Technological advancements, such as the introduction of automated testing systems and advanced analytical tools, are enhancing efficiency and accuracy. Consumer preferences for sustainable and eco-friendly packaging are creating a surge in demand for environmental testing services. The competitive landscape is characterized by both intense rivalry among established players and the emergence of specialized niche players. Market penetration of advanced testing techniques is gradually increasing, driven primarily by the healthcare and food and beverage sectors.

Leading Markets & Segments in North America Product and Package Testing Industry

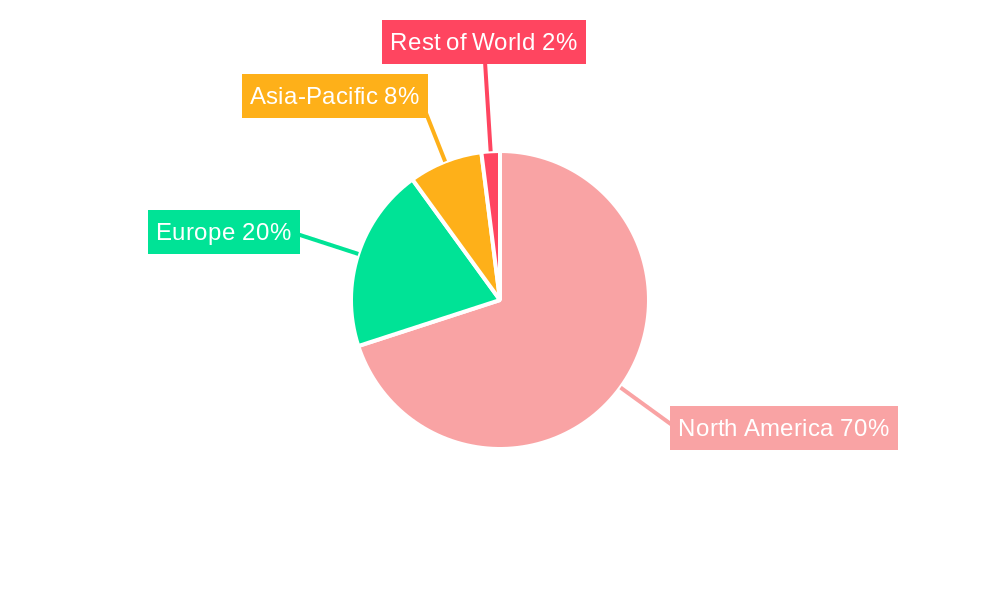

The United States dominates the North American product and package testing market, accounting for approximately xx% of the total revenue, followed by Canada at xx%. Within primary materials, plastic accounts for the largest segment, driven by its widespread use in various packaging applications. Physical performance testing constitutes the largest segment in terms of testing types, due to fundamental requirements across all product categories. The food and beverage industry is a major end-user, followed by the healthcare sector which demands rigorous quality and safety testing.

- By Country:

- United States: xx% market share, driven by strong industrial base and high regulatory standards.

- Canada: xx% market share, with steady growth fueled by increasing consumer demand.

- By Primary Material:

- Plastic: Largest segment due to high consumption in packaging.

- Paper: Significant demand for testing due to environmental concerns.

- Glass & Metal: Smaller but stable segments with specific testing needs.

- By Type of Testing:

- Physical Performance Testing: Largest segment due to universal application.

- Chemical Testing: Strong demand driven by safety and regulatory compliance.

- Environmental Testing: Growth driven by sustainability and eco-consciousness.

- By End-user Industry:

- Food & Beverage: Largest segment due to stringent safety regulations.

- Healthcare: High demand for quality and safety testing.

- Industrial & Personal/Household Products: Significant and steady demand.

North America Product and Package Testing Industry Product Developments

Recent product innovations include the integration of advanced analytical techniques (e.g., spectroscopy and chromatography) into testing workflows, enhancing accuracy and efficiency. Automated testing systems are becoming increasingly prevalent, reducing human error and accelerating turnaround times. The focus on sustainability is driving the development of eco-friendly testing methods that minimize environmental impact. These developments are improving efficiency, enhancing accuracy, and adapting to evolving environmental regulations.

Key Drivers of North America Product and Package Testing Industry Growth

Several factors are driving growth in the North American product and package testing industry. Stringent government regulations on product safety and environmental compliance mandate regular testing. The rising consumer awareness of product quality and safety is increasing demand for independent testing services. Technological advancements, such as the development of faster and more accurate testing methods, are boosting efficiency and expanding testing capabilities. The growth of e-commerce necessitates robust packaging testing to ensure product integrity during transit.

Challenges in the North America Product and Package Testing Industry Market

The industry faces challenges such as intense competition, fluctuating raw material prices which affect operational costs, and the need to keep pace with rapidly evolving technologies. Meeting increasingly stringent regulatory requirements can also pose significant challenges, requiring continuous investment in new technologies and expertise. Maintaining a highly skilled workforce in a competitive labor market is also crucial for the industry's success. The high initial investment for advanced technologies can be a barrier to entry for smaller companies.

Emerging Opportunities in North America Product and Package Testing Industry

Significant opportunities exist for industry players to capitalize on emerging trends. Expanding into new markets, particularly within the growing e-commerce sector, presents strong potential. Strategic partnerships with leading technology providers can enable access to cutting-edge testing solutions. Developing specialized testing services for niche industries such as pharmaceuticals and medical devices offers significant scope for growth. Focusing on sustainable and eco-friendly testing practices to align with the growing consumer demand for environmentally conscious products presents a strong opportunity.

Leading Players in the North America Product and Package Testing Industry Sector

- Turner Packaging

- CRYOPAK

- National Technical Systems

- Intertek

- DDL Inc

- SGS

- Nefab

- Advance Packaging

- Caskadetek

- CSZ Testing Services Laboratories

Key Milestones in North America Product and Package Testing Industry Industry

- April 2021: SGS introduces a new comprehensive footwear packaging testing technique, setting a new industry standard for footwear packaging quality and sustainability.

- July 2021: Cryopak launches its PUR-Forma Long Range Duration line of polyurethane shipping solutions, expanding its offering in the cold chain packaging sector. This launch addresses increased demand for reliable, pre-qualified cold chain solutions.

Strategic Outlook for North America Product and Package Testing Industry Market

The North American product and package testing industry is poised for continued growth, driven by sustained demand for quality assurance, environmental compliance, and innovation. Strategic investments in advanced technologies, coupled with expansion into high-growth segments, will be critical for sustained success. A focus on providing value-added services, such as consulting and regulatory compliance support, will further enhance competitiveness. The industry's future lies in adapting to technological advancements, responding to evolving regulatory requirements, and meeting the demands of a sustainability-conscious market.

North America Product and Package Testing Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Industries

North America Product and Package Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Product and Package Testing Industry Regional Market Share

Geographic Coverage of North America Product and Package Testing Industry

North America Product and Package Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Glass Segment Observing Gradual Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Product and Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Turner Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CRYOPAK

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Technical Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intertek

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DDL Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SGS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nefab

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advance Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caskadetek

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CSZ Testing Services Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Turner Packaging

List of Figures

- Figure 1: North America Product and Package Testing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Product and Package Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Product and Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: North America Product and Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: North America Product and Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Product and Package Testing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Product and Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: North America Product and Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 7: North America Product and Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Product and Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Product and Package Testing Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the North America Product and Package Testing Industry?

Key companies in the market include Turner Packaging, CRYOPAK, National Technical Systems, Intertek, DDL Inc, SGS, Nefab, Advance Packaging, Caskadetek, CSZ Testing Services Laboratories.

3. What are the main segments of the North America Product and Package Testing Industry?

The market segments include Primary Material, Type of Testing, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Glass Segment Observing Gradual Growth.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

In April 2021, SGS introduced a new comprehensive footwear packaging testing technique. The industry-first testing package assists brand owners and retailers, including e-commerce, in creating packaging that performs effectively, meets environmental and sustainability criteria, and ensures consumers receive quality footwear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Product and Package Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Product and Package Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Product and Package Testing Industry?

To stay informed about further developments, trends, and reports in the North America Product and Package Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence