Key Insights

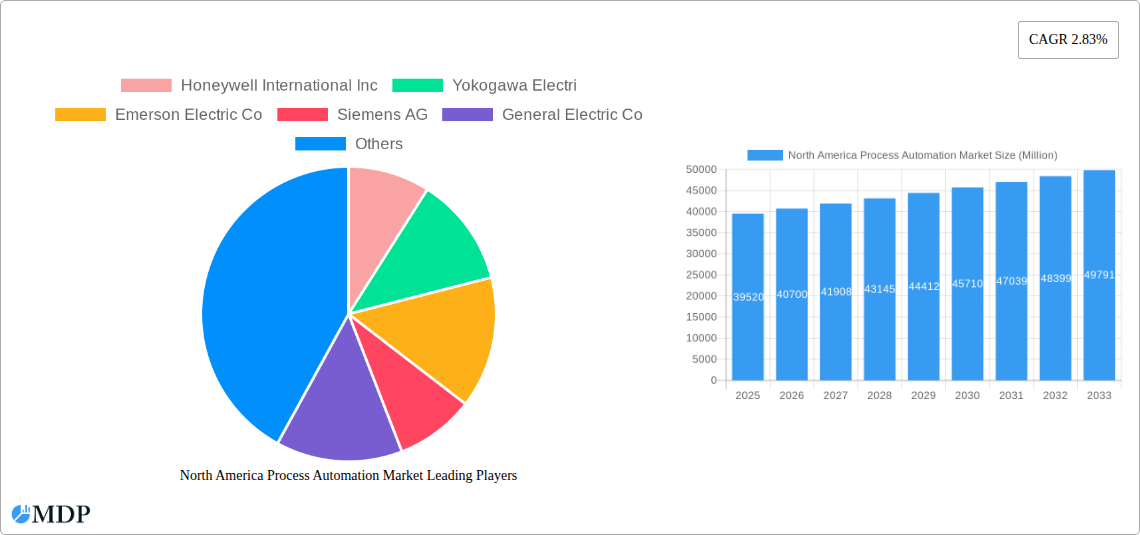

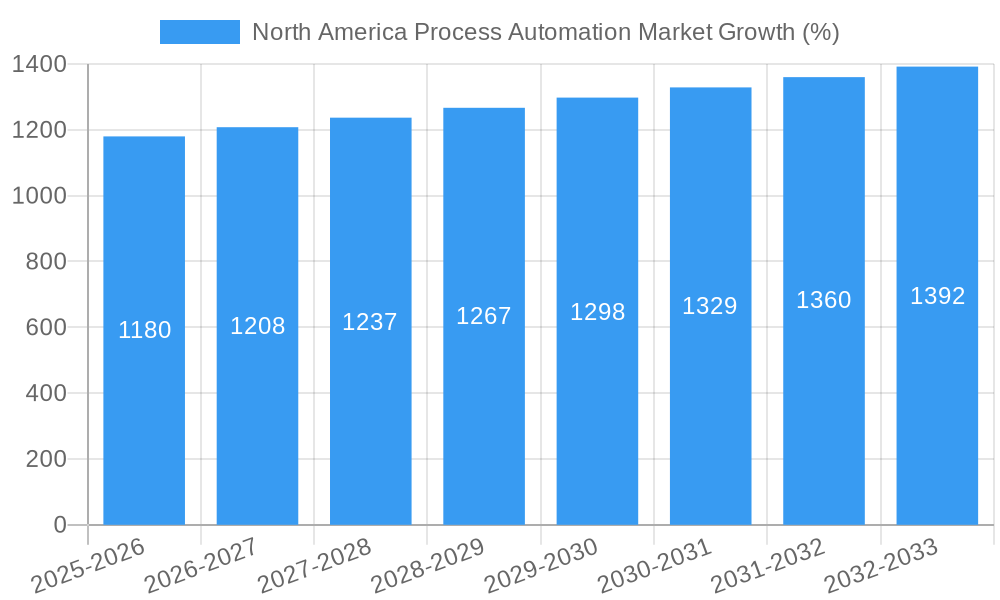

The North America process automation market, valued at $39.52 billion in 2025, is projected to experience steady growth, driven by increasing industrial automation adoption across key sectors. The Compound Annual Growth Rate (CAGR) of 2.83% from 2025 to 2033 indicates a consistent expansion, fueled primarily by the oil and gas, chemical, and power and utilities industries' demand for enhanced efficiency, safety, and optimized production processes. These sectors are investing significantly in advanced technologies such as advanced regulatory control systems, multivariable models, and inferential control strategies to improve operational performance and reduce operational costs. Furthermore, the rising adoption of wireless communication protocols in process automation is streamlining data acquisition and remote monitoring, leading to improved decision-making and reduced maintenance costs. Growth is also propelled by the increasing focus on sustainability initiatives within these industries, demanding energy-efficient and environmentally friendly solutions offered by process automation.

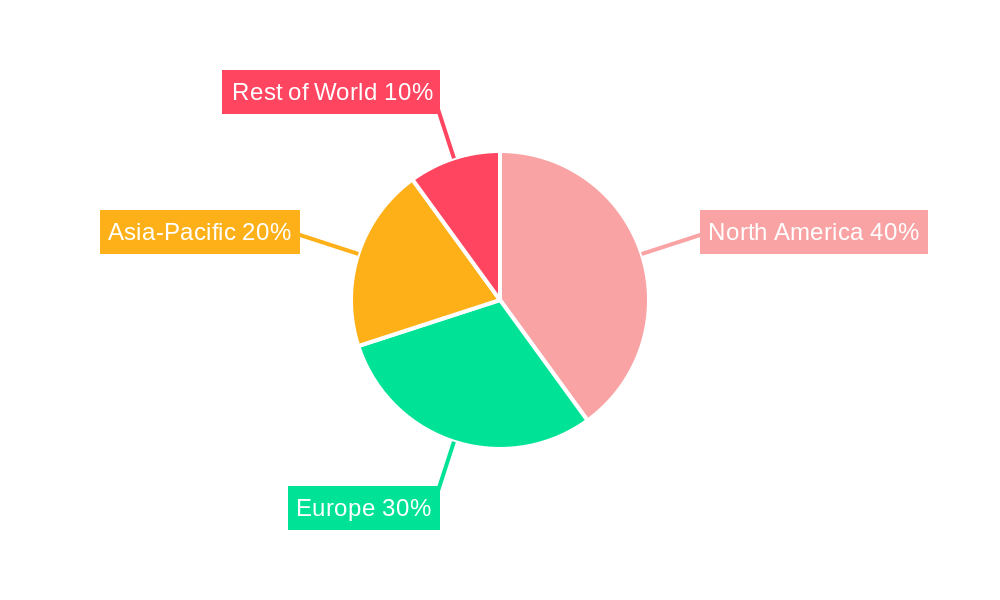

The market segmentation reveals that system hardware, including sensors and transmitters, constitutes a substantial portion of the market. The software segment, particularly advanced process control (APC) solutions, both standalone and customized, is showing robust growth. The United States holds the largest market share within North America, followed by Canada. While specific regional breakdowns beyond North America are absent, considering global trends, the market is likely to witness significant growth in other regions as well, though at varying rates. The presence of major industry players like Honeywell, Yokogawa, Emerson, Siemens, and others indicates a competitive landscape, driving innovation and fostering market growth through continuous product development and technological advancements. This competitive landscape, along with sustained investment in R&D, assures continuous improvement and expansion in the capabilities of process automation systems across North America.

North America Process Automation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America process automation market, encompassing market dynamics, industry trends, leading segments, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Process Automation Market Market Dynamics & Concentration

The North American process automation market is characterized by a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors such as technological advancements, regulatory changes, and strategic mergers and acquisitions (M&A). The market exhibits strong innovation drivers, fueled by the increasing demand for enhanced operational efficiency, improved safety, and reduced operational costs across various industries. Stringent regulatory frameworks, particularly concerning environmental compliance and data security, are shaping market dynamics. While there are limited direct substitutes for process automation systems, alternative solutions such as manual operations and legacy systems are gradually being phased out due to their inherent limitations.

End-user trends indicate a growing preference for integrated, scalable, and cloud-based solutions that offer improved data analytics and real-time monitoring capabilities. The market has witnessed a significant number of M&A activities in recent years, with major players strategically acquiring smaller companies to expand their product portfolios and enhance their market reach. The number of M&A deals in the past five years is estimated to be around xx, with a majority focused on strengthening technological capabilities and market penetration. Market share analysis reveals that the top five players collectively account for approximately xx% of the total market revenue. Furthermore, the presence of a substantial number of small and medium-sized enterprises (SMEs) indicates a diverse and dynamic market structure.

North America Process Automation Market Industry Trends & Analysis

The North American process automation market is experiencing robust growth driven by several key factors. The increasing adoption of Industry 4.0 technologies, including Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning (ML), is significantly impacting market growth. These technologies enhance operational efficiency, predictive maintenance, and real-time decision-making. The rising demand for automation solutions across various end-user industries, particularly in oil and gas, chemical, and pharmaceuticals, is driving market expansion. Consumer preferences are shifting towards sustainable and environmentally friendly automation solutions, encouraging manufacturers to develop eco-conscious technologies. Intense competition among industry players is fostering innovation and pushing down prices, benefiting end-users. The market is expected to witness continued growth, driven by increasing investments in digital transformation initiatives across various industries. The market penetration of advanced automation systems is gradually increasing, and is expected to reach xx% by 2033.

Leading Markets & Segments in North America Process Automation Market

The United States represents the largest market for process automation in North America, driven by a strong manufacturing base, advanced technological infrastructure, and significant investments in industrial automation. Canada also exhibits considerable growth potential, propelled by its robust energy and mining sectors.

By System Type: The demand for advanced control systems and sophisticated sensor technologies is high. System hardware, specifically distributed control systems (DCS), programmable logic controllers (PLCs), and industrial robots, holds a significant market share, fueled by its critical role in automation. Sensor and transmitter technologies experience consistent growth due to the rising need for real-time data acquisition and process monitoring.

By Software Type: Advanced Process Control (APC) solutions, encompassing standalone and customized solutions, are experiencing significant adoption. Advanced regulatory control, multivariable model predictive control, inferential control, and sequential control strategies are prevalent in various industrial applications. Standalone APC solutions dominate the market currently, however customized solutions are rapidly gaining traction due to their tailored nature.

By End-user Industry: The oil and gas sector is a major driver of process automation market growth, owing to the need for efficient resource management and optimized production processes. The chemical and petrochemical industries also contribute substantially to market growth, driven by complex process operations and stringent safety requirements. Other significant end-user industries include power and utilities, water and wastewater, food and beverage, paper and pulp, and pharmaceuticals.

By Communication Protocol: Wired communication protocols are currently dominant, but wireless technologies are steadily gaining traction due to their flexibility and ease of deployment in challenging environments.

North America Process Automation Market Product Developments

Recent product innovations focus on enhancing system integration, improving data analytics capabilities, and leveraging AI and ML to optimize operational efficiency. New products emphasize modularity, scalability, and cloud connectivity to offer flexibility and cost-effectiveness. Competitive advantages are achieved through superior performance, advanced features, and robust support services. The market is witnessing a shift towards cloud-based platforms and integrated solutions that provide seamless data exchange across various industrial systems.

Key Drivers of North America Process Automation Market Growth

Technological advancements, particularly in IIoT, AI, and ML, are primary drivers of market growth. The increasing demand for enhanced operational efficiency, improved safety standards, and reduced operational costs across various industries is propelling market expansion. Favorable government policies and incentives promoting industrial automation are stimulating market growth. Examples include tax benefits and grants targeted towards companies adopting advanced automation technologies.

Challenges in the North America Process Automation Market Market

High initial investment costs for implementing process automation systems can pose a barrier for some businesses, especially smaller companies. Supply chain disruptions can impact the availability of components and systems. Intense competition among industry players can lead to price pressure and affect profitability. Regulatory complexities and compliance requirements can add to the challenges faced by businesses. The estimated impact of these challenges on market growth is approximately xx% annually.

Emerging Opportunities in North America Process Automation Market

The increasing adoption of Industry 4.0 technologies opens up significant opportunities for growth. The growing demand for digital twins and predictive maintenance solutions presents promising prospects. Strategic partnerships between automation vendors and technology providers can drive innovation and market expansion. The development of standardized communication protocols and interoperable systems is creating new opportunities.

Leading Players in the North America Process Automation Market Sector

- Honeywell International Inc

- Yokogawa Electri

- Emerson Electric Co

- Siemens AG

- General Electric Co

- Schneider Electric SE

- Omron Corporation

- Fuji Electric

- Rockwell Automation Inc

- Delta Electronics Limited

- ABB Limited

- Mitsubishi Electric

Key Milestones in North America Process Automation Market Industry

March 2024: Emerson launches a new comprehensive automation platform, integrating SCADA, MES, operations management software, DCS, and SIS to deliver smarter and more sustainable operations. This significantly enhances Emerson's market position and product offering.

October 2023: Rockwell Automation and Microsoft expand their partnership to leverage generative AI capabilities, accelerating time-to-market and enhancing productivity for industrial automation systems. This collaboration strengthens both companies' standing in the AI-driven automation market.

Strategic Outlook for North America Process Automation Market Market

The North American process automation market is poised for sustained growth, driven by technological advancements, increasing industrial digitization, and the growing demand for enhanced operational efficiency and sustainability. Strategic partnerships, investments in research and development, and expansion into emerging technologies will be crucial for success. The market's future potential lies in the integration of AI, ML, and edge computing to create more intelligent and responsive automation systems.

North America Process Automation Market Segmentation

-

1. Communication Protocol

- 1.1. Wired

- 1.2. Wireless

-

2. System Type

-

2.1. By System Hardware

- 2.1.1. Supervis

- 2.1.2. Distributed Control System (DCS)

- 2.1.3. Programmable Logic Controller (PLC)

- 2.1.4. Valves and Actuators

- 2.1.5. Electric Motors

- 2.1.6. Human Machine Interface (HMI)

- 2.1.7. Process Safety Systems

- 2.1.8. Sensors and Transmitters

-

2.2. By Software Type

-

2.2.1. APC (Standalone and Customized Solutions)

- 2.2.1.1. Advanced Regulatory Control

- 2.2.1.2. Multivariable Model

- 2.2.1.3. Inferential and Sequential

- 2.2.2. Data Analytics and Reporting-based Software

- 2.2.3. Manufacturing Execution Systems (MES)

- 2.2.4. Other Software and Services

-

2.2.1. APC (Standalone and Customized Solutions)

-

2.1. By System Hardware

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Chemical and Petrochemical

- 3.3. Power and Utilities

- 3.4. Water and Wastewater

- 3.5. Food and Beverage

- 3.6. Paper and Pulp

- 3.7. Pharmaceutical

- 3.8. Other End-user Industries

North America Process Automation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Process Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Energy Efficiency and Cost Reduction; Demand for Safety Automation Systems; Emergence of IIoT

- 3.3. Market Restrains

- 3.3.1. Initial Outlay Needed For the Systems Installation and Ongoing Maintenance Expenses

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Process Automation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Communication Protocol

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by System Type

- 5.2.1. By System Hardware

- 5.2.1.1. Supervis

- 5.2.1.2. Distributed Control System (DCS)

- 5.2.1.3. Programmable Logic Controller (PLC)

- 5.2.1.4. Valves and Actuators

- 5.2.1.5. Electric Motors

- 5.2.1.6. Human Machine Interface (HMI)

- 5.2.1.7. Process Safety Systems

- 5.2.1.8. Sensors and Transmitters

- 5.2.2. By Software Type

- 5.2.2.1. APC (Standalone and Customized Solutions)

- 5.2.2.1.1. Advanced Regulatory Control

- 5.2.2.1.2. Multivariable Model

- 5.2.2.1.3. Inferential and Sequential

- 5.2.2.2. Data Analytics and Reporting-based Software

- 5.2.2.3. Manufacturing Execution Systems (MES)

- 5.2.2.4. Other Software and Services

- 5.2.2.1. APC (Standalone and Customized Solutions)

- 5.2.1. By System Hardware

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Chemical and Petrochemical

- 5.3.3. Power and Utilities

- 5.3.4. Water and Wastewater

- 5.3.5. Food and Beverage

- 5.3.6. Paper and Pulp

- 5.3.7. Pharmaceutical

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Communication Protocol

- 6. United States North America Process Automation Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Process Automation Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Process Automation Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Process Automation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Yokogawa Electri

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Emerson Electric Co

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Electric Co

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schneider Electric SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Omron Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Fuji Electric

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rockwell Automation Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Delta Electronics Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ABB Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Mitsubishi Electric

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Process Automation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Process Automation Market Share (%) by Company 2024

List of Tables

- Table 1: North America Process Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Process Automation Market Revenue Million Forecast, by Communication Protocol 2019 & 2032

- Table 3: North America Process Automation Market Revenue Million Forecast, by System Type 2019 & 2032

- Table 4: North America Process Automation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Process Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Process Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Process Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Process Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Process Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Process Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Process Automation Market Revenue Million Forecast, by Communication Protocol 2019 & 2032

- Table 12: North America Process Automation Market Revenue Million Forecast, by System Type 2019 & 2032

- Table 13: North America Process Automation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Process Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Process Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Process Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Process Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Process Automation Market?

The projected CAGR is approximately 2.83%.

2. Which companies are prominent players in the North America Process Automation Market?

Key companies in the market include Honeywell International Inc, Yokogawa Electri, Emerson Electric Co, Siemens AG, General Electric Co, Schneider Electric SE, Omron Corporation, Fuji Electric, Rockwell Automation Inc, Delta Electronics Limited, ABB Limited, Mitsubishi Electric.

3. What are the main segments of the North America Process Automation Market?

The market segments include Communication Protocol, System Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Energy Efficiency and Cost Reduction; Demand for Safety Automation Systems; Emergence of IIoT.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Initial Outlay Needed For the Systems Installation and Ongoing Maintenance Expenses.

8. Can you provide examples of recent developments in the market?

March 2024 - Emerson’s New Comprehensive Automation Platform Empowers Decisive Action from Plant to Enterprise. The newly expanded automation platform will include supervisory control and data acquisition (SCADA) systems, manufacturing execution systems (MES), and operations management software alongside distributed control (DCS) and safety systems (SIS) and other technologies that have been part of the brand for decades. The evolution builds a more comprehensive automation platform to make it easier for users to deliver smarter, safer, more optimized, and more sustainable operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Process Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Process Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Process Automation Market?

To stay informed about further developments, trends, and reports in the North America Process Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence