Key Insights

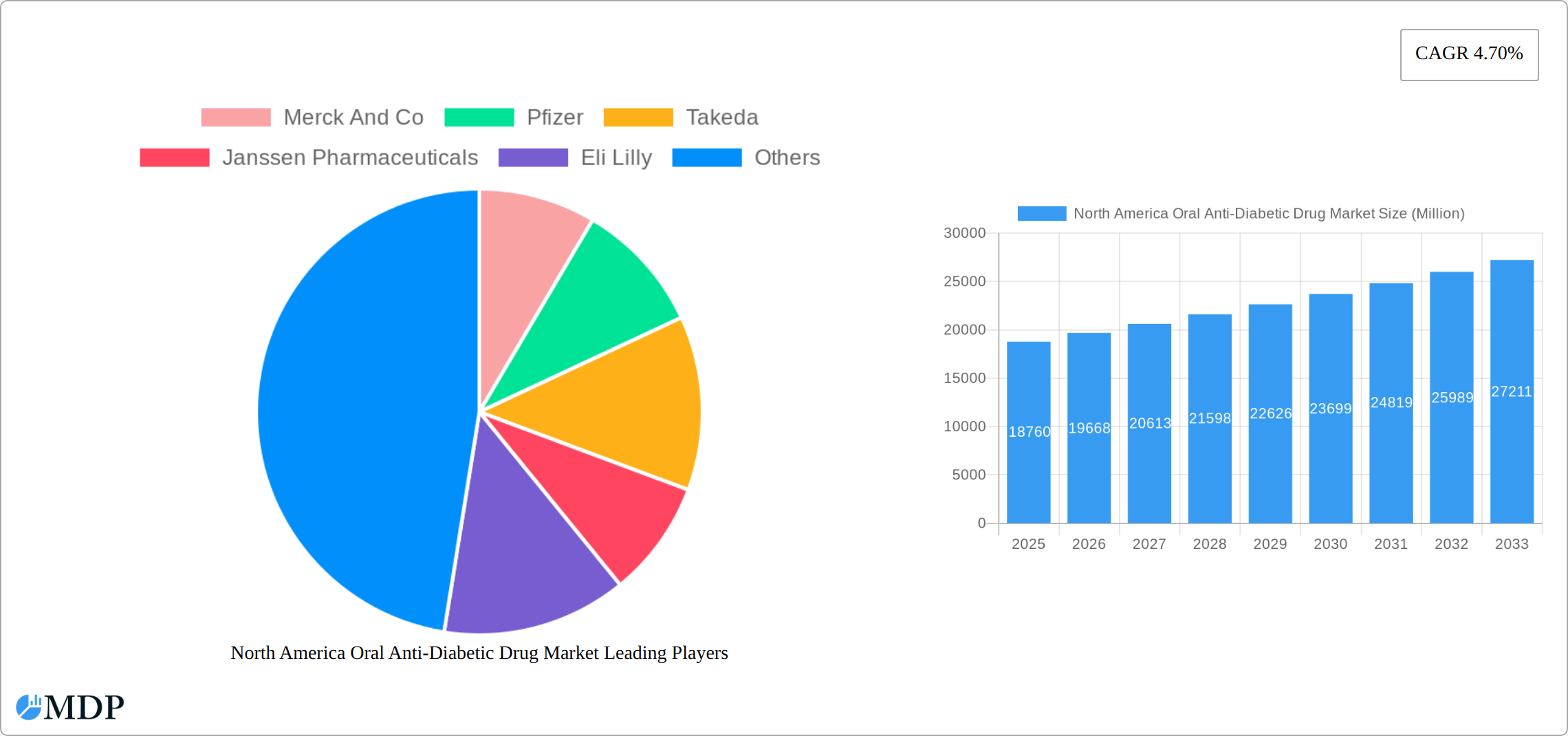

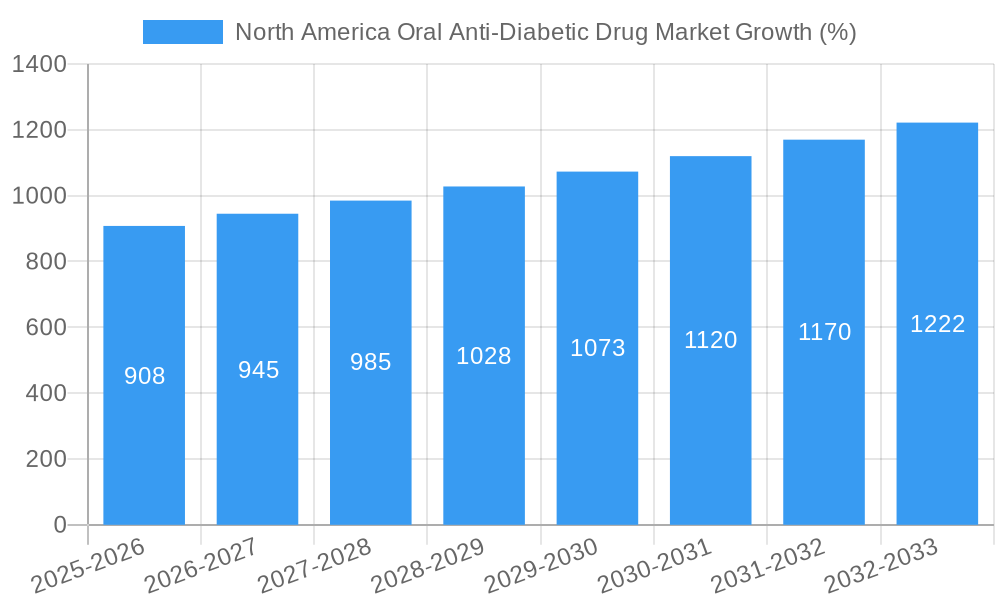

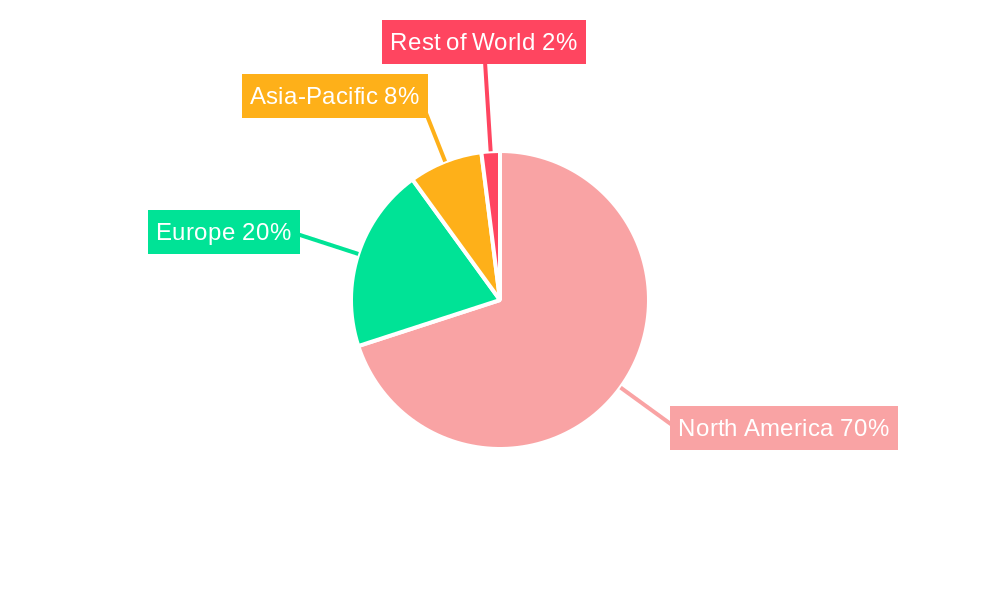

The North America oral anti-diabetic drug market, valued at approximately $18.76 billion in 2025, is projected to experience steady growth, driven by the rising prevalence of type 2 diabetes and an aging population. The market's compound annual growth rate (CAGR) of 4.70% from 2025 to 2033 indicates a consistent expansion, fueled by increasing awareness of diabetes management and the availability of diverse treatment options. Key growth drivers include the introduction of novel drug classes such as SGLT-2 inhibitors and GLP-1 receptor agonists, alongside advancements in existing medications like Metformin and Sulfonylureas, offering improved efficacy and reduced side effects. While the market is segmented by drug class (e.g., Biguanides, Sulfonylureas, DPP-4 inhibitors, SGLT-2 inhibitors, Alpha-glucosidase inhibitors), the increasing adoption of combination therapies and personalized medicine approaches contributes to market diversification and growth. Major pharmaceutical companies like Merck, Pfizer, and Novo Nordisk are key players, driving innovation and competition in this space. The United States, as the largest market within North America, significantly influences overall market dynamics, primarily due to high diabetes prevalence and robust healthcare infrastructure. However, market growth may be tempered by factors such as increasing healthcare costs and the potential for generic competition.

The market's segmentation highlights the dominance of Metformin within the Biguanides class, reflecting its established role as a first-line treatment. The popularity of newer classes like SGLT-2 inhibitors and DPP-4 inhibitors reflects their efficacy in managing blood glucose levels and offering cardiovascular benefits. Regional analysis focuses primarily on the North American market, specifically the US, Canada, and Mexico. The ongoing research and development of newer, more effective, and safer anti-diabetic drugs will likely continue to shape the market's growth trajectory. The increasing focus on preventative measures and lifestyle modifications to mitigate diabetes risk also represents an important indirect influence on market dynamics. Competition among established pharmaceutical companies and emerging players drives innovation and offers patients a wider range of therapeutic choices.

North America Oral Anti-Diabetic Drug Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America oral anti-diabetic drug market, covering the period from 2019 to 2033. It delves into market dynamics, industry trends, leading segments, and key players, offering valuable insights for stakeholders across the pharmaceutical and healthcare sectors. With a focus on actionable data and future projections, this report is essential for strategic decision-making. The study period is 2019–2033, with 2025 as the base and estimated year, and a forecast period of 2025–2033. The historical period covered is 2019–2024.

North America Oral Anti-Diabetic Drug Market Market Dynamics & Concentration

The North American oral anti-diabetic drug market is characterized by a high level of concentration, with a few major players holding significant market share. Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, and Astellas are key players driving innovation and competition. Market concentration is further influenced by the ongoing mergers and acquisitions (M&A) activity, with an estimated xx M&A deals in the last five years resulting in market share shifts.

- Innovation Drivers: The market is driven by continuous R&D efforts focused on developing novel therapies with improved efficacy, safety profiles, and convenience (e.g., Oramed's oral insulin capsule).

- Regulatory Frameworks: Stringent regulatory approvals impact market entry and product lifecycle. Changes in reimbursement policies also affect market access and pricing.

- Product Substitutes: Competition from insulin therapies and other diabetes management strategies necessitates continuous innovation and differentiation.

- End-User Trends: Growing awareness of diabetes, coupled with increasing prevalence, fuels market expansion. However, patient preferences for specific drug classes and treatment regimens influence market segmentation.

- Market Share: The top 5 companies hold approximately xx% of the market share, indicating a highly consolidated landscape.

North America Oral Anti-Diabetic Drug Market Industry Trends & Analysis

The North America oral anti-diabetic drug market exhibits a robust CAGR of xx% during the forecast period (2025-2033). Market growth is fueled by the escalating prevalence of type 2 diabetes, an aging population, and increasing healthcare expenditure. Technological advancements, including the development of novel drug classes like SGLT-2 inhibitors and GLP-1 receptor agonists, are reshaping the therapeutic landscape. Market penetration of these newer drugs is steadily increasing, driven by their superior efficacy and safety profiles compared to older agents. However, increasing generic competition for older drugs and pricing pressures pose challenges to market growth. Consumer preference shifts toward oral medications due to convenience and reduced injection frequency influence market dynamics. Competitive dynamics are shaped by product launches, patent expirations, and strategic alliances, creating both opportunities and threats for existing players.

Leading Markets & Segments in North America Oral Anti-Diabetic Drug Market

The United States dominates the North American market, driven by high diabetes prevalence, robust healthcare infrastructure, and high healthcare expenditure. Within the drug classes, SGLT-2 inhibitors (e.g., Suglat (Ipragliflozin)) show significant growth, owing to their proven cardiovascular benefits and improved glycemic control. DPP-4 inhibitors (e.g., Galvus (Vildagliptin)) also maintain a substantial market presence. Metformin, a mainstay in type 2 diabetes management, continues to be a significant segment due to its cost-effectiveness.

Key Drivers for US Dominance:

- High prevalence of type 2 diabetes.

- Well-developed healthcare infrastructure.

- High per capita healthcare expenditure.

- Favorable regulatory environment.

Segment Analysis: While Metformin remains dominant by volume, the value share of newer drug classes like SGLT-2 and DPP-4 inhibitors is rapidly increasing. The Alpha-Glucosidase Inhibitors and Sulfonylureas segments are showing slower growth due to increased competition and safety concerns.

North America Oral Anti-Diabetic Drug Market Product Developments

Recent product developments focus on improved efficacy, safety, and patient convenience. The emergence of oral insulin (Oramed's ORMD-0801) represents a significant technological breakthrough, potentially revolutionizing diabetes management. Further innovations include fixed-dose combinations (FDCs) and novel drug delivery systems aiming to improve patient adherence and therapy outcomes. This focus on patient-centric product design is driving market growth and shaping competitive landscapes. Glenmark Pharmaceuticals' launch of SITAZIT FDCs in India reflects the global push towards affordability and wider access to treatment.

Key Drivers of North America Oral Anti-Diabetic Drug Market Growth

- Increasing Prevalence of Diabetes: The rising incidence of type 2 diabetes is the primary driver of market growth.

- Technological Advancements: Novel drug classes and delivery systems improve treatment outcomes and patient compliance.

- Favorable Regulatory Environment: Regulatory support for innovative therapies accelerates market entry and expansion.

- Growing Healthcare Expenditure: Increased spending on healthcare enables greater access to advanced diabetes medications.

Challenges in the North America Oral Anti-Diabetic Drug Market Market

- High Drug Prices: The cost of newer, innovative drugs limits patient access, particularly for those with limited insurance coverage. This negatively impacts market penetration, albeit this can be seen as an opportunity for developing more affordable generics.

- Generic Competition: Patent expirations for established drugs intensify price competition and affect profitability for originator companies.

- Stringent Regulatory Approvals: The lengthy and rigorous approval processes for new drugs can delay market entry and increase development costs.

Emerging Opportunities in North America Oral Anti-Diabetic Drug Market

The market presents significant opportunities for growth through strategic partnerships, expansion into emerging markets, and development of personalized medicine approaches to diabetes management. The potential success of oral insulin and other novel therapies is expected to fuel expansion. Furthermore, focusing on patient education and improving adherence strategies can significantly increase the market’s reach and impact.

Leading Players in the North America Oral Anti-Diabetic Drug Market Sector

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- Sanofi

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Astellas

Key Milestones in North America Oral Anti-Diabetic Drug Market Industry

- July 2022: Glenmark Pharmaceuticals launched sitagliptin and its FDCs in India, increasing access to affordable treatment options, potentially influencing the market through increased competition and alternative pricing strategies in similar regions in North America.

- March 2022: Oramed announced positive Phase 3 trial results for ORMD-0801, an oral insulin capsule, signaling a potential paradigm shift in diabetes management and posing a threat/opportunity depending on market share acquisition. This development is expected to significantly impact the market through the introduction of a novel drug delivery method.

Strategic Outlook for North America Oral Anti-Diabetic Drug Market Market

The North America oral anti-diabetic drug market is poised for continued growth driven by technological innovation, increasing diabetes prevalence, and expanding access to care. Strategic partnerships, focused R&D efforts, and the launch of innovative products will shape future market dynamics. Companies that effectively adapt to changing consumer preferences, address cost-effectiveness concerns, and navigate regulatory landscapes will secure a competitive advantage in this dynamic market.

North America Oral Anti-Diabetic Drug Market Segmentation

-

1. Drug Types

- 1.1. Biguanides

- 1.2. Alpha-Glucosidase Inhibitors

- 1.3. Dopamine D2 Receptor Agonist

- 1.4. SGLT-2 Inhibitors

- 1.5. DPP-4 Inhibitors

- 1.6. Sulfonylureas

- 1.7. Meglitinides

-

2. Patient Type

- 2.1. Adults

- 2.2. Geriatric

- 2.3. Pediatric

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Biguanide Segment Occupied the Highest Market Share in the North America Oral Anti-Diabetic Drugs Market in 2022

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Types

- 5.1.1. Biguanides

- 5.1.2. Alpha-Glucosidase Inhibitors

- 5.1.3. Dopamine D2 Receptor Agonist

- 5.1.4. SGLT-2 Inhibitors

- 5.1.5. DPP-4 Inhibitors

- 5.1.6. Sulfonylureas

- 5.1.7. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Patient Type

- 5.2.1. Adults

- 5.2.2. Geriatric

- 5.2.3. Pediatric

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Drug Types

- 6. United States North America Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug Types

- 6.1.1. Biguanides

- 6.1.2. Alpha-Glucosidase Inhibitors

- 6.1.3. Dopamine D2 Receptor Agonist

- 6.1.4. SGLT-2 Inhibitors

- 6.1.5. DPP-4 Inhibitors

- 6.1.6. Sulfonylureas

- 6.1.7. Meglitinides

- 6.2. Market Analysis, Insights and Forecast - by Patient Type

- 6.2.1. Adults

- 6.2.2. Geriatric

- 6.2.3. Pediatric

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Drug Types

- 7. Canada North America Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug Types

- 7.1.1. Biguanides

- 7.1.2. Alpha-Glucosidase Inhibitors

- 7.1.3. Dopamine D2 Receptor Agonist

- 7.1.4. SGLT-2 Inhibitors

- 7.1.5. DPP-4 Inhibitors

- 7.1.6. Sulfonylureas

- 7.1.7. Meglitinides

- 7.2. Market Analysis, Insights and Forecast - by Patient Type

- 7.2.1. Adults

- 7.2.2. Geriatric

- 7.2.3. Pediatric

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Drug Types

- 8. Mexico North America Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug Types

- 8.1.1. Biguanides

- 8.1.2. Alpha-Glucosidase Inhibitors

- 8.1.3. Dopamine D2 Receptor Agonist

- 8.1.4. SGLT-2 Inhibitors

- 8.1.5. DPP-4 Inhibitors

- 8.1.6. Sulfonylureas

- 8.1.7. Meglitinides

- 8.2. Market Analysis, Insights and Forecast - by Patient Type

- 8.2.1. Adults

- 8.2.2. Geriatric

- 8.2.3. Pediatric

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Drug Types

- 9. United States North America Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Merck And Co

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Pfizer

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Takeda

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Janssen Pharmaceuticals

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Eli Lilly

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Novartis

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sanofi

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 AstraZeneca

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bristol Myers Squibb

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Novo Nordisk

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Boehringer Ingelheim

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Astellas

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Merck And Co

List of Figures

- Figure 1: North America Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Oral Anti-Diabetic Drug Market Share (%) by Company 2024

List of Tables

- Table 1: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Types 2019 & 2032

- Table 4: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Types 2019 & 2032

- Table 5: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Patient Type 2019 & 2032

- Table 6: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Patient Type 2019 & 2032

- Table 7: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States North America Oral Anti-Diabetic Drug Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Oral Anti-Diabetic Drug Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Oral Anti-Diabetic Drug Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Oral Anti-Diabetic Drug Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Oral Anti-Diabetic Drug Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Oral Anti-Diabetic Drug Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Oral Anti-Diabetic Drug Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Oral Anti-Diabetic Drug Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Types 2019 & 2032

- Table 22: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Types 2019 & 2032

- Table 23: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Patient Type 2019 & 2032

- Table 24: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Patient Type 2019 & 2032

- Table 25: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Types 2019 & 2032

- Table 30: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Types 2019 & 2032

- Table 31: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Patient Type 2019 & 2032

- Table 32: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Patient Type 2019 & 2032

- Table 33: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Types 2019 & 2032

- Table 38: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Types 2019 & 2032

- Table 39: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Patient Type 2019 & 2032

- Table 40: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Patient Type 2019 & 2032

- Table 41: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 43: North America Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the North America Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the North America Oral Anti-Diabetic Drug Market?

The market segments include Drug Types, Patient Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Biguanide Segment Occupied the Highest Market Share in the North America Oral Anti-Diabetic Drugs Market in 2022.

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

July 2022: Glenmark Pharmaceuticals Limited announced that it launched sitagliptin and its Fixed Dose Combinations (FDCs) for adults with Type 2 diabetes in India. Glenmark has introduced 8 different combinations of sitagliptin-based drugs under the brand name SITAZIT and its variants at an affordable price.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the North America Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence