Key Insights

The North American HVDC (High-Voltage Direct Current) transmission market is experiencing robust growth, driven by the increasing demand for reliable and efficient long-distance power transmission. The region's aging grid infrastructure, coupled with the rising integration of renewable energy sources like wind and solar power located far from population centers, necessitates the adoption of HVDC technology. Submarine HVDC transmission systems are particularly crucial for connecting offshore wind farms to the mainland grid, significantly contributing to the market's expansion. Converter stations, a key component of HVDC systems, represent a substantial portion of the market value, as they are essential for the conversion of AC to DC and vice versa. While underground HVDC transmission systems offer advantages in terms of land use and environmental impact, their higher cost compared to overhead systems might slightly restrain their widespread adoption in the near term. Major players like ABB, Siemens, and General Electric are heavily investing in research and development to enhance the efficiency and reliability of HVDC technology, further fueling market growth. The market is segmented by transmission type (submarine, overhead, underground) and component (converter stations, transmission medium), offering diverse investment and growth opportunities. We project continued strong growth throughout the forecast period (2025-2033), driven by government initiatives promoting renewable energy integration and grid modernization.

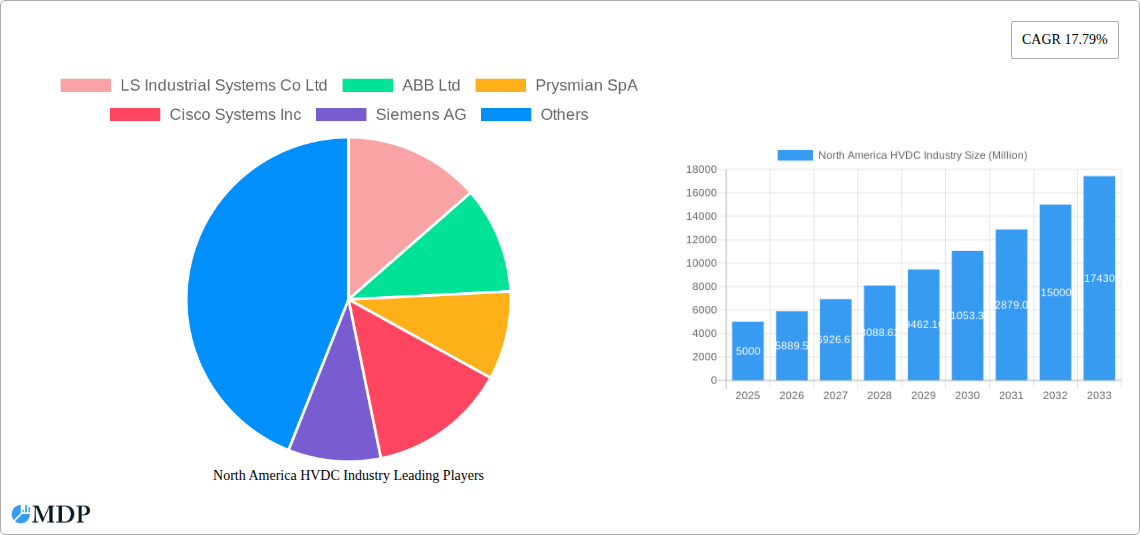

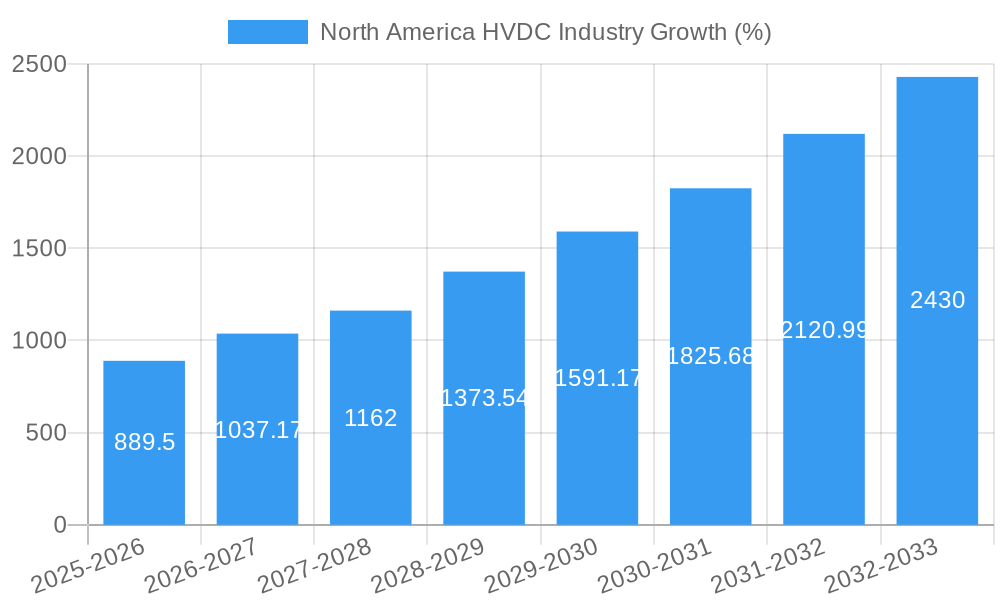

The market's CAGR of 17.79% indicates substantial growth potential. Considering the base year of 2025, and assuming a market size (XX) of approximately $5 billion (a reasonable estimate for a mature yet rapidly growing technology sector in North America), we can project significant expansion. The continued investment in renewable energy infrastructure, coupled with ongoing grid modernization efforts, suggests a consistent demand for HVDC solutions. Factors such as regulatory support for renewable energy integration and advancements in HVDC technology are expected to mitigate potential restraints and drive sustained market growth in the coming years. Competition among major industry players is intense, fostering innovation and driving prices down, making HVDC solutions increasingly accessible for grid operators. While the cost of implementation remains a factor, the long-term benefits of increased grid reliability and renewable energy integration outweigh the initial investment for many stakeholders.

North America HVDC Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North American High-Voltage Direct Current (HVDC) industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The analysis incorporates data on market size (in Millions), key segments, leading players, and significant industry developments.

North America HVDC Industry Market Dynamics & Concentration

The North American HVDC industry is experiencing robust growth driven by increasing demand for efficient and reliable power transmission, particularly for renewable energy integration. Market concentration is moderate, with several major players holding significant market share. However, the market is witnessing increased competition from new entrants and technological advancements.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025. This indicates a relatively concentrated market, although smaller players are gaining traction.

- Innovation Drivers: Technological advancements in converter technology, transmission mediums (cables), and grid integration strategies are key innovation drivers, enhancing efficiency and reducing costs.

- Regulatory Frameworks: Government initiatives promoting renewable energy integration and grid modernization are fostering industry growth. However, navigating complex regulatory landscapes and permitting processes remains a challenge.

- Product Substitutes: While alternatives exist (primarily HVAC transmission), HVDC systems offer superior long-distance transmission capabilities and reduced transmission losses, making them the preferred choice for many large-scale projects.

- End-User Trends: The growing demand for reliable power transmission from renewable energy sources (solar, wind) is a major driver, along with the need for interregional power transfer and grid modernization.

- M&A Activities: The number of M&A deals in the industry has averaged xx per year during the historical period (2019-2024), indicating consolidation and strategic expansion within the sector.

North America HVDC Industry Industry Trends & Analysis

The North American HVDC market exhibits a strong growth trajectory, primarily driven by the increasing need for long-distance power transmission, renewable energy integration, and grid modernization initiatives. The market is anticipated to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the development of more efficient and cost-effective converter stations and cables, are further accelerating market growth. Market penetration of HVDC technology in new grid infrastructure projects is also increasing, with a predicted penetration rate of xx% by 2033. Competitive dynamics remain intense, with established players facing increasing competition from new entrants, pushing innovation and efficiency improvements. Consumer preferences are shifting towards sustainable energy solutions, indirectly boosting demand for HVDC technology.

Leading Markets & Segments in North America HVDC Industry

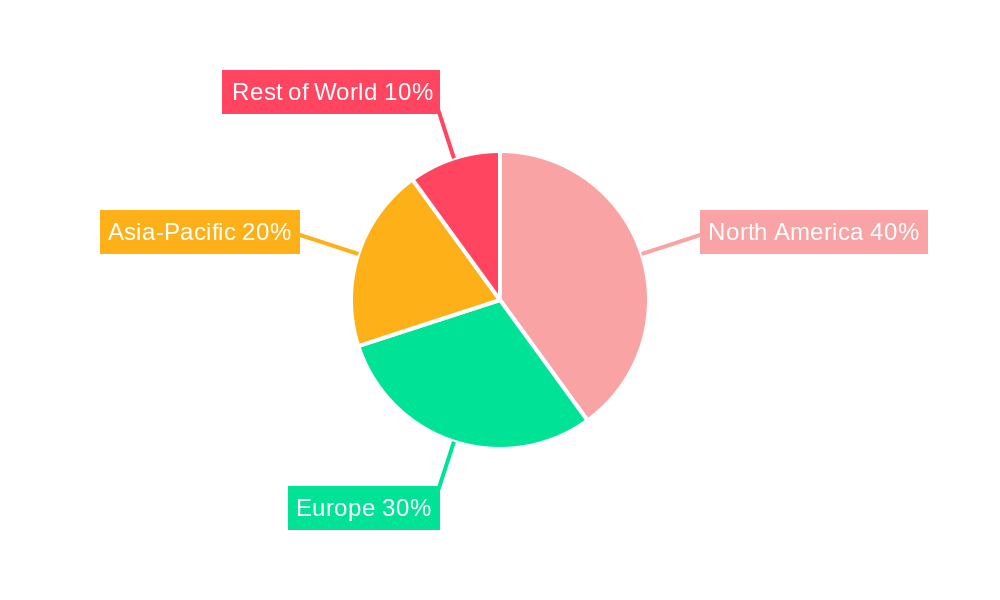

The Western United States is currently the leading region for HVDC deployment, driven by its vast renewable energy resources and the need for efficient long-distance power transmission. Within segments:

Transmission Type:

- Submarine HVDC Transmission System: Growth is driven by offshore wind farm development and coastal power transmission needs.

- HVDC Overhead Transmission System: This segment continues to dominate due to established infrastructure and cost-effectiveness for long-distance terrestrial applications.

- HVDC Underground Transmission System: This segment is experiencing moderate growth, driven by urbanization and the need for environmentally friendly power transmission in densely populated areas.

Component:

- Converter Stations: This segment is crucial, with ongoing advancements improving efficiency and reducing costs. High demand for new converter stations accompanies the growing number of HVDC projects.

- Transmission Medium (Cables): Technological innovation in cable materials and designs is driving cost reduction and improved performance, boosting the segment's growth.

Key Drivers:

- Economic Policies: Government incentives and subsidies for renewable energy and grid modernization projects.

- Infrastructure Development: The ongoing expansion of transmission infrastructure and grid modernization initiatives.

- Technological Advancements: Continuous improvements in converter technology, cable designs, and grid integration strategies.

North America HVDC Industry Product Developments

Significant advancements are observed in converter technology, with increased efficiency and power ratings. The development of more compact and cost-effective converter stations is driving adoption. Similarly, advancements in cable technology (e.g., higher voltage capacity, improved insulation) are expanding the range and applicability of HVDC systems. These innovations enhance the competitiveness of HVDC technology against traditional HVAC systems. These developments are improving market fit by offering solutions for long-distance power transmission with reduced land use and environmental impact.

Key Drivers of North America HVDC Industry Growth

The North American HVDC industry's growth is fueled by several key factors. The increasing integration of renewable energy sources (solar, wind) necessitates efficient long-distance power transmission, creating a significant demand for HVDC technology. Furthermore, government regulations supporting grid modernization and renewable energy initiatives are driving investments in HVDC infrastructure. Cost reductions in HVDC equipment, coupled with advancements in technology, are making it a more economically viable solution.

Challenges in the North America HVDC Industry Market

The HVDC industry faces challenges, including the high upfront capital costs of HVDC projects, which can deter investment. Furthermore, regulatory complexities and permitting processes can delay project implementation. Supply chain disruptions and fluctuations in raw material prices also pose challenges. Intense competition among established and emerging players puts pressure on profit margins. These factors can collectively reduce market growth.

Emerging Opportunities in North America HVDC Industry

The long-term growth outlook for the HVDC industry in North America is positive, driven by technological breakthroughs such as advancements in flexible AC transmission systems (FACTS) integration with HVDC and the development of more efficient and reliable converter stations. Strategic partnerships between technology providers and grid operators will further accelerate market expansion. The increasing focus on offshore wind energy is poised to significantly boost demand for submarine HVDC transmission systems. Expansion into new geographical areas and application segments also holds significant potential.

Leading Players in the North America HVDC Industry Sector

- LS Industrial Systems Co Ltd

- ABB Ltd

- Prysmian SpA

- Cisco Systems Inc

- Siemens AG

- Alstom SA

- Schneider Electric SE

- Toshiba Corporation

- NKT A/S

- General Electric Company

Key Milestones in North America HVDC Industry Industry

- December 2022: TransWest Express LLC selected Siemens Energy Inc. to supply high-voltage direct current transmission technology for the TransWest Express Transmission Project, a significant milestone showcasing the growing adoption of HVDC technology for large-scale interregional transmission. This 732-mile project includes HVDC and HVAC segments, connecting Wyoming and Utah to the ISO Controlled Grid in southern Nevada.

Strategic Outlook for North America HVDC Industry Market

The North American HVDC market is poised for substantial growth, driven by strong demand for efficient power transmission, renewable energy integration, and grid modernization. Strategic investments in R&D, focusing on enhancing efficiency, reducing costs, and improving reliability, will be crucial for maintaining a competitive edge. Strategic partnerships and collaborations between technology providers, grid operators, and renewable energy developers will unlock significant market opportunities. The long-term potential is considerable, presenting attractive opportunities for industry players to capitalize on.

North America HVDC Industry Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Overhead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America HVDC Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America HVDC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 HVDC systems facilitate efficient cross-border energy trading

- 3.2.2 allowing for the exchange of electricity between regions with varying energy demands and supply conditions. This capability is particularly beneficial in North America

- 3.2.3 where interconnected grids can optimize energy distribution and enhance grid resilience.

- 3.3. Market Restrains

- 3.3.1 The initial investment required for HVDC systems is substantial

- 3.3.2 which can be a barrier for utilities and energy providers. While HVDC systems offer long-term operational benefits

- 3.3.3 the upfront costs may deter some stakeholders from adopting the technology

- 3.4. Market Trends

- 3.4.1 The expansion of offshore wind power technology is creating significant opportunities for the HVDC market. HVDC systems are ideal for transmitting power from offshore wind farms to onshore grids

- 3.4.2 supporting the growth of renewable energy infrastructure.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America HVDC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Overhead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. United States North America HVDC Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6.1.1. Submarine HVDC Transmission System

- 6.1.2. HVDC Overhead Transmission System

- 6.1.3. HVDC Underground Transmission System

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Converter Stations

- 6.2.2. Transmission Medium (Cables)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7. Canada North America HVDC Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7.1.1. Submarine HVDC Transmission System

- 7.1.2. HVDC Overhead Transmission System

- 7.1.3. HVDC Underground Transmission System

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Converter Stations

- 7.2.2. Transmission Medium (Cables)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8. Rest of North America North America HVDC Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8.1.1. Submarine HVDC Transmission System

- 8.1.2. HVDC Overhead Transmission System

- 8.1.3. HVDC Underground Transmission System

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Converter Stations

- 8.2.2. Transmission Medium (Cables)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9. United States North America HVDC Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America HVDC Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America HVDC Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America HVDC Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 LS Industrial Systems Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Prysmian SpA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cisco Systems Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Siemens AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Alstom SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Schneider Electric SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Toshiba Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 NKT A/S

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 General Electric Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 LS Industrial Systems Co Ltd

List of Figures

- Figure 1: North America HVDC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America HVDC Industry Share (%) by Company 2024

List of Tables

- Table 1: North America HVDC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America HVDC Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 3: North America HVDC Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: North America HVDC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America HVDC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America HVDC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America HVDC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America HVDC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America HVDC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America HVDC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America HVDC Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 12: North America HVDC Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 13: North America HVDC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America HVDC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America HVDC Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 16: North America HVDC Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 17: North America HVDC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America HVDC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America HVDC Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 20: North America HVDC Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 21: North America HVDC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America HVDC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America HVDC Industry?

The projected CAGR is approximately 17.79%.

2. Which companies are prominent players in the North America HVDC Industry?

Key companies in the market include LS Industrial Systems Co Ltd, ABB Ltd, Prysmian SpA, Cisco Systems Inc, Siemens AG, Alstom SA, Schneider Electric SE, Toshiba Corporation, NKT A/S, General Electric Company.

3. What are the main segments of the North America HVDC Industry?

The market segments include Transmission Type, Component, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

HVDC systems facilitate efficient cross-border energy trading. allowing for the exchange of electricity between regions with varying energy demands and supply conditions. This capability is particularly beneficial in North America. where interconnected grids can optimize energy distribution and enhance grid resilience..

6. What are the notable trends driving market growth?

The expansion of offshore wind power technology is creating significant opportunities for the HVDC market. HVDC systems are ideal for transmitting power from offshore wind farms to onshore grids. supporting the growth of renewable energy infrastructure..

7. Are there any restraints impacting market growth?

The initial investment required for HVDC systems is substantial. which can be a barrier for utilities and energy providers. While HVDC systems offer long-term operational benefits. the upfront costs may deter some stakeholders from adopting the technology.

8. Can you provide examples of recent developments in the market?

In December 2022, TransWest Express LLC selected Siemens Energy Inc. to supply the high-voltage direct current transmission technology for the TransWest Express Transmission Project. Under the contract, Siemens Energy will engineer, procure, and construct the HVDC converter stations, ancillary equipment, and systems. The project is a 732-mile high-voltage interregional transmission system with HVDC and HVAC segments that will connect to the existing grid in Wyoming and Utah and directly to the ISO Controlled Grid in southern Nevada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America HVDC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America HVDC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America HVDC Industry?

To stay informed about further developments, trends, and reports in the North America HVDC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence