Key Insights

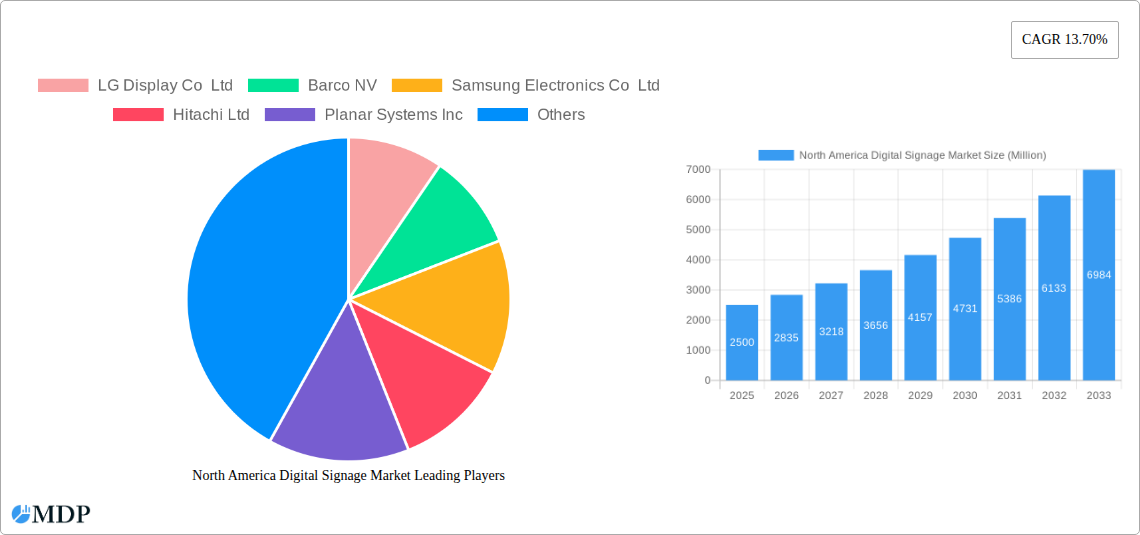

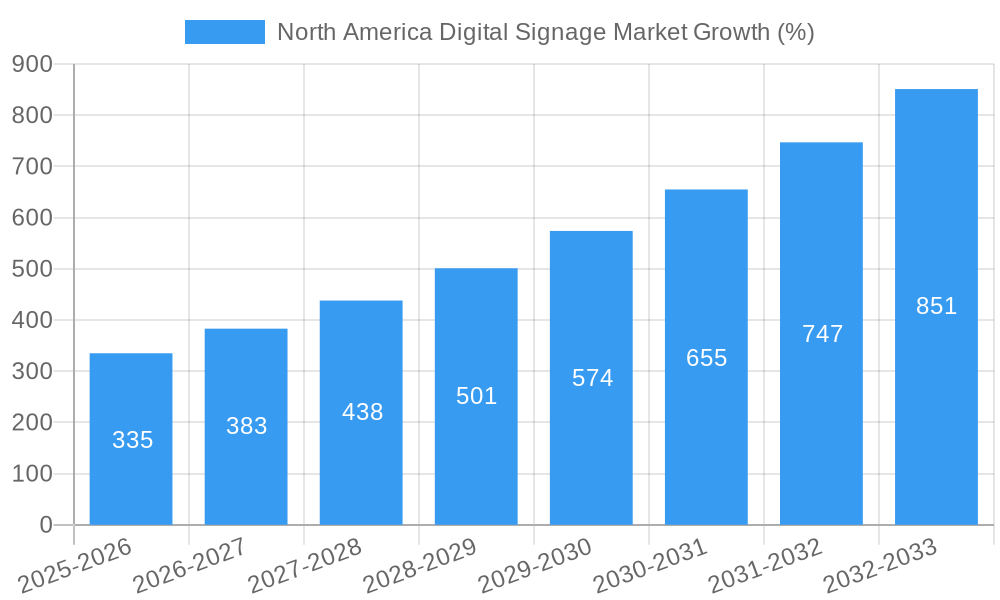

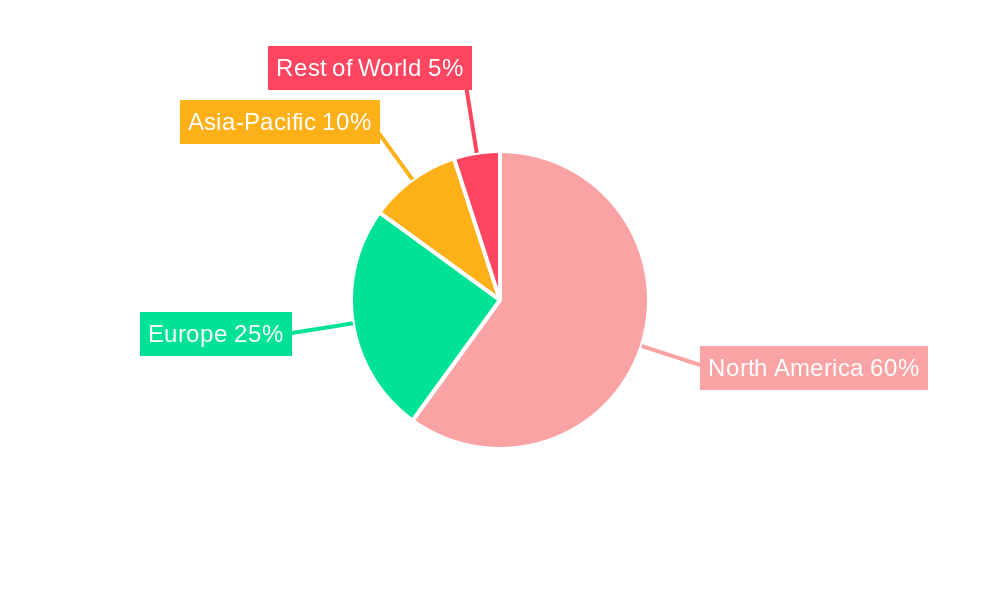

The North American digital signage market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 13.70% from 2025 to 2033. This expansion is fueled by several key factors. Increasing adoption of digital signage across diverse sectors like retail (for enhanced customer engagement and targeted advertising), transportation (for real-time information dissemination and passenger convenience), and hospitality (to improve guest experience and operational efficiency) is a primary driver. Technological advancements, such as the emergence of high-resolution displays, interactive touchscreens, and advanced content management systems, are further boosting market growth. Furthermore, the increasing preference for data-driven marketing strategies and the need for improved communication within organizations contribute to the market's upward trajectory. While the market faces challenges like high initial investment costs and concerns about content management complexity, these are being mitigated by innovative financing options and user-friendly software solutions. The competitive landscape is characterized by prominent players like LG Display, Samsung Electronics, and others, continuously innovating to enhance their product offerings and expand their market share. The United States and Canada represent the largest segments within North America, reflecting high levels of digital infrastructure and technological adoption.

The forecast period, 2025-2033, promises continued expansion, propelled by the growing integration of digital signage into smart city initiatives and the rise of programmatic advertising within the digital signage space. The market segmentation, encompassing hardware, software, and services, offers multiple avenues for growth. The increasing adoption of cloud-based solutions and the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies are expected to reshape the market further, creating new opportunities for both established players and emerging entrants. The focus on improving customer experiences and enhancing operational efficiency across diverse industry verticals remains the core driver for the continuous growth of the North American digital signage market.

North America Digital Signage Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America digital signage market, covering the period 2019-2033. It offers invaluable insights into market dynamics, trends, leading players, and future growth potential, equipping stakeholders with the knowledge needed to make informed strategic decisions. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Key players analyzed include LG Display Co Ltd, Barco NV, Samsung Electronics Co Ltd, Hitachi Ltd, Planar Systems Inc, NEC Display Solutions Ltd, Cisco Systems Inc, Sharp Corporation, Goodview, Panasonic Corporation, and Sony Corporation. The report segments the market by type (Hardware, Software, Services), end-user vertical (Retail, Transportation, Hospitality, Corporate, Education, Government, Others), and country (United States, Canada).

North America Digital Signage Market Market Dynamics & Concentration

The North America digital signage market is characterized by moderate concentration, with several major players holding significant market share. However, the market also exhibits a dynamic competitive landscape with ongoing innovation and mergers & acquisitions (M&A) activity. The market share of the top 5 players is estimated at xx% in 2025. Innovation drivers include advancements in display technology (e.g., LED, OLED, interactive displays), software enhancements (e.g., content management systems, analytics), and the increasing adoption of cloud-based solutions. Regulatory frameworks related to data privacy and accessibility are influencing market dynamics. Product substitutes, such as traditional signage and print media, are facing declining market share due to the advantages of digital signage in terms of flexibility, cost-effectiveness, and targeted advertising. End-user trends favor interactive and dynamic displays, increasing demand for advanced features like touchscreens and integrated analytics. The number of M&A deals in the sector averaged xx per year between 2019 and 2024.

North America Digital Signage Market Industry Trends & Analysis

The North America digital signage market is experiencing robust growth driven by several key factors. The increasing adoption of digital signage across various sectors, fueled by the need for enhanced customer engagement and improved communication, is a primary growth driver. Technological advancements, such as the introduction of high-resolution displays, improved software capabilities, and the integration of Internet of Things (IoT) devices, are revolutionizing the digital signage landscape. Consumer preferences are shifting towards personalized and interactive digital experiences, demanding more innovative and engaging content. The market penetration of digital signage in the retail sector is estimated at xx% in 2025, projected to reach xx% by 2033. The competitive dynamics are characterized by intense rivalry among established players and emerging entrants, leading to continuous innovation and price competition. This dynamic market is expected to maintain a healthy growth trajectory, with the market value anticipated to grow significantly over the forecast period.

Leading Markets & Segments in North America Digital Signage Market

By Country: The United States dominates the North American digital signage market, driven by its large and diverse economy, advanced infrastructure, and high adoption rates across various industries. Canada presents a significant but smaller market compared to the US.

By Type: The hardware segment holds the largest market share, reflecting the fundamental need for physical display units. However, the software and services segments are experiencing faster growth, driven by increasing demand for sophisticated content management systems, analytics, and remote management capabilities.

By End-user Vertical: The retail sector is a key market segment for digital signage, utilizing it for promotions, wayfinding, and customer engagement. Transportation (airports, train stations), hospitality (hotels, restaurants), and corporate environments also represent significant market segments due to the need for clear communication and targeted advertising. Growth in the education and government sectors is driven by increasing investment in infrastructure and technology.

Key Drivers:

- United States: Strong economic growth, advanced technological infrastructure, high consumer spending, and a large retail sector contribute significantly to market dominance.

- Canada: A growing economy, government initiatives promoting digital technologies, and investments in infrastructure are driving market growth.

- Retail: High customer traffic, the need for engaging promotional displays, and efficient inventory management drive high adoption rates.

- Transportation: Improved customer experience and enhanced communication are key drivers of digital signage adoption in airports and transit systems.

North America Digital Signage Market Product Developments

Recent product innovations have focused on improving display resolution, enhancing interactivity (touchscreens, gesture recognition), and integrating advanced analytics capabilities. The market is seeing increased adoption of LED and OLED displays, offering superior image quality and energy efficiency. Many new products emphasize seamless integration with cloud-based platforms and content management systems, allowing for easier deployment, management, and content updates. These advancements improve the market fit by offering enhanced customer engagement, streamlined operations, and valuable data-driven insights.

Key Drivers of North America Digital Signage Market Growth

Technological advancements, particularly in display technology (higher resolutions, energy efficiency), software (enhanced content management, analytics), and connectivity (cloud integration, IoT), are major growth drivers. The robust economic growth in North America, combined with increasing investments in infrastructure and technology across various sectors, fuels market expansion. Government initiatives promoting digital technologies and supportive regulatory frameworks contribute to a positive market environment. For instance, the increasing adoption of digital signage in public transportation systems showcases the role of government policies.

Challenges in the North America Digital Signage Market Market

Regulatory hurdles related to data privacy and accessibility standards can pose challenges for digital signage deployment. Supply chain disruptions and component shortages can impact production and delivery timelines. Intense competition among established players and the emergence of new entrants create pricing pressures and require continuous innovation. These factors could potentially limit market growth if not appropriately addressed. For example, a potential xx% increase in component costs could negatively impact profit margins.

Emerging Opportunities in North America Digital Signage Market

The integration of artificial intelligence (AI) and machine learning (ML) into digital signage offers opportunities for personalized content delivery, improved analytics, and enhanced customer experiences. Strategic partnerships between hardware and software providers are creating innovative solutions that simplify deployment and management. Expanding into emerging markets within North America, such as smaller cities and towns, presents significant untapped potential for market growth. Furthermore, focusing on solutions that cater to niche markets with specialized needs (e.g., healthcare, finance) will generate new avenues for growth.

Leading Players in the North America Digital Signage Market Sector

- LG Display Co Ltd

- Barco NV

- Samsung Electronics Co Ltd

- Hitachi Ltd

- Planar Systems Inc

- NEC Display Solutions Ltd

- Cisco Systems Inc

- Sharp Corporation

- Goodview

- Panasonic Corporation

- Sony Corporation

Key Milestones in North America Digital Signage Market Industry

- October 2021: L.B. Foster Company launched a new service providing sign language accessibility for its mobile Inform Media digital display units, enhancing accessibility in rail transit and air travel.

- July 2021: 22Miles Inc. launched "Digital Signage Ready" (DSR), a portfolio of software and service bundles for quick digital signage setup and deployment, expanding market access for smaller businesses.

Strategic Outlook for North America Digital Signage Market Market

The North America digital signage market is poised for continued expansion, driven by technological innovations, increasing demand for engaging customer experiences, and the growing adoption across various sectors. Strategic partnerships, focusing on integrated solutions, and expanding into new market segments present significant opportunities for growth. Companies that invest in R&D, offer comprehensive solutions, and adapt to evolving customer needs will be well-positioned to capitalize on the market's future potential.

North America Digital Signage Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. LCD/LED Display

- 1.1.2. OLED Display

- 1.1.3. Media Players

- 1.1.4. Projectors/Projection Screens

- 1.1.5. Other Hardware

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

-

2. End-user Vertical

- 2.1. Retail

- 2.2. Transportation

- 2.3. Hospitality

- 2.4. Corporate

- 2.5. Education

- 2.6. Government

- 2.7. Other End-user Verticals

North America Digital Signage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Digital Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Turnkey Solutions; Trends Favoring the Growth of Context-aware Advertising as Opposed to Conventional Modes of Advertising; Steady Increase in DOOH Spending in the North America to Continue to Supplement Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns Over Invasion of Customer Privacy

- 3.4. Market Trends

- 3.4.1. Retail Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. LCD/LED Display

- 5.1.1.2. OLED Display

- 5.1.1.3. Media Players

- 5.1.1.4. Projectors/Projection Screens

- 5.1.1.5. Other Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Retail

- 5.2.2. Transportation

- 5.2.3. Hospitality

- 5.2.4. Corporate

- 5.2.5. Education

- 5.2.6. Government

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 LG Display Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Barco NV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Samsung Electronics Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Planar Systems Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NEC Display Solutions Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cisco Systems Inc *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sharp Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Goodview

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sony Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 LG Display Co Ltd

List of Figures

- Figure 1: North America Digital Signage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Digital Signage Market Share (%) by Company 2024

List of Tables

- Table 1: North America Digital Signage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Digital Signage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Digital Signage Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: North America Digital Signage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Digital Signage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Digital Signage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America Digital Signage Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: North America Digital Signage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Digital Signage Market?

The projected CAGR is approximately 13.70%.

2. Which companies are prominent players in the North America Digital Signage Market?

Key companies in the market include LG Display Co Ltd, Barco NV, Samsung Electronics Co Ltd, Hitachi Ltd, Planar Systems Inc, NEC Display Solutions Ltd, Cisco Systems Inc *List Not Exhaustive, Sharp Corporation, Goodview, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the North America Digital Signage Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Turnkey Solutions; Trends Favoring the Growth of Context-aware Advertising as Opposed to Conventional Modes of Advertising; Steady Increase in DOOH Spending in the North America to Continue to Supplement Market Growth.

6. What are the notable trends driving market growth?

Retail Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Concerns Over Invasion of Customer Privacy.

8. Can you provide examples of recent developments in the market?

October 2021 - L.B. Foster Company launched a new service to provide sign language accessibility for its mobile. It fixed Inform Media digital display units currently offered to rail transits and air travel system operators throughout the Americas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Digital Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Digital Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Digital Signage Market?

To stay informed about further developments, trends, and reports in the North America Digital Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence