Key Insights

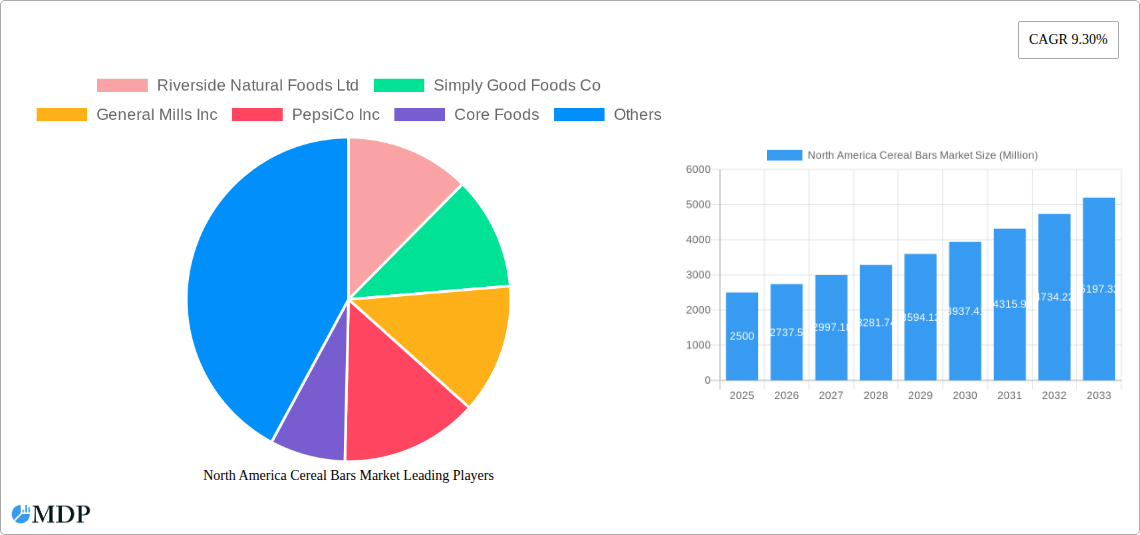

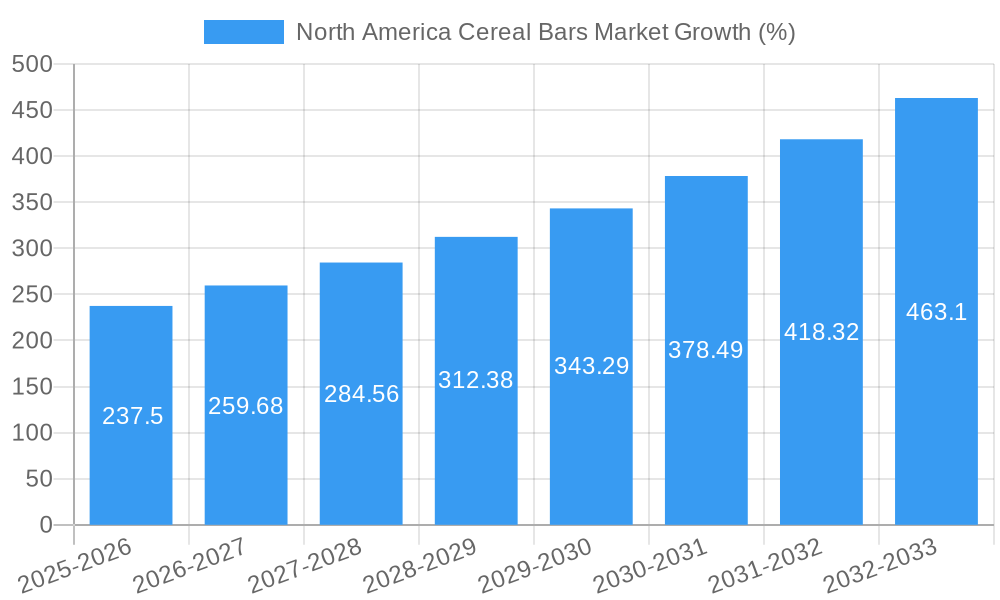

The North America cereal bars market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 9.30% from 2025 to 2033. This expansion is fueled by several key factors. The increasing consumer preference for convenient, on-the-go breakfast and snack options is a significant driver. Health-conscious consumers are increasingly seeking healthier alternatives to traditional processed snacks, leading to a surge in demand for cereal bars fortified with nutrients and whole grains. Furthermore, the growing popularity of fitness and active lifestyles is boosting the consumption of energy-boosting cereal bars. The market is segmented by distribution channel (convenience stores, online retail, supermarkets/hypermarkets, and others) and geography (United States, Canada, Mexico, and Rest of North America). Major players like General Mills, Kellogg's, and PepsiCo are leveraging their established brand recognition and distribution networks to capture significant market share, while smaller companies like Riverside Natural Foods and Probar are focusing on niche markets with specialized offerings, such as organic or gluten-free options.

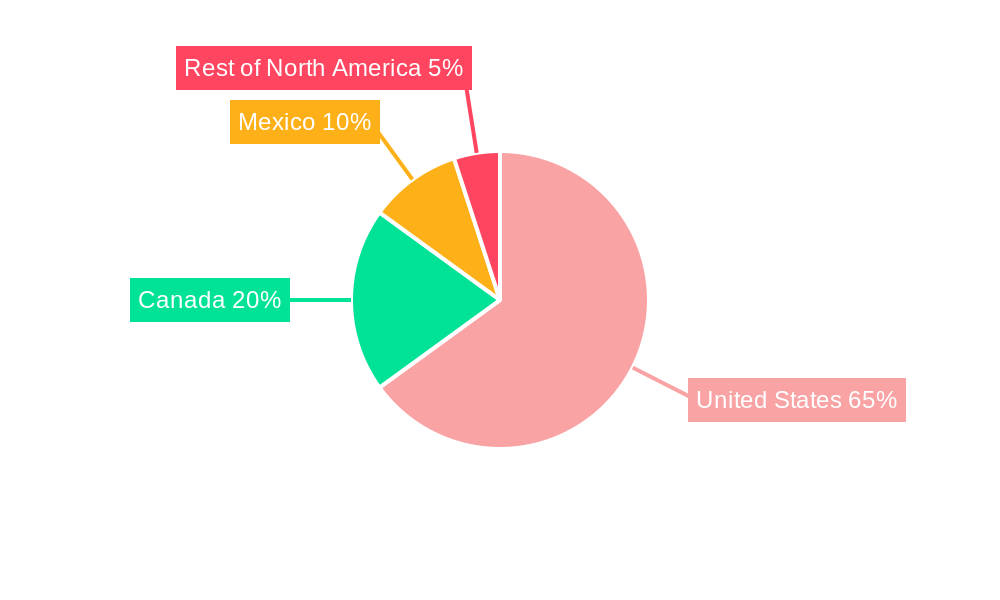

The competitive landscape is characterized by both established multinational corporations and smaller, specialized brands. This dynamic environment encourages innovation in product development, with a growing focus on natural ingredients, functional benefits (e.g., protein bars, fiber-rich bars), and sustainable packaging. While the market exhibits considerable growth potential, certain challenges exist, including price volatility of raw materials and evolving consumer preferences that necessitate ongoing adaptation. The United States currently dominates the market within North America, followed by Canada and Mexico. The "Rest of North America" segment is expected to show modest growth, driven by increasing disposable incomes and changing consumer habits in this region. The forecast period of 2025-2033 presents significant opportunities for expansion and market penetration for both established players and emerging brands.

North America Cereal Bars Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Cereal Bars Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report projects robust growth, reaching an estimated value of xx Million by 2033. Download now to unlock actionable strategies for success in this dynamic market.

North America Cereal Bars Market Dynamics & Concentration

The North American cereal bars market exhibits a moderately concentrated landscape, with key players like General Mills Inc, PepsiCo Inc, and Kellogg Company holding significant market share. However, the market also accommodates several smaller, niche players focusing on organic, gluten-free, and other specialized offerings. Market concentration is further analyzed through the Herfindahl-Hirschman Index (HHI), which reveals a value of xx, suggesting a moderately competitive environment.

Innovation Drivers: The market is propelled by continuous innovation in flavors, ingredients, and formulations, catering to evolving consumer preferences for healthier, convenient, and functional snacking options. The rise of protein bars, organic bars, and bars with added functional ingredients like probiotics and adaptogens is a key driver.

Regulatory Frameworks: Regulations concerning food labeling, ingredient standards, and health claims influence product development and marketing strategies. Compliance with these regulations is crucial for market entry and sustained success.

Product Substitutes: The market faces competition from other convenient snack options, including energy bars, fruit snacks, and yogurt. The competitive landscape necessitates continuous innovation to maintain a competitive edge.

End-User Trends: Health-conscious consumers increasingly favor cereal bars with reduced sugar, high protein, and natural ingredients. This trend has driven the growth of specialized segments within the market.

M&A Activities: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx M&A deals recorded between 2019 and 2024. These activities reflect strategic efforts by major players to expand their product portfolios and market reach. Larger companies are acquiring smaller, specialized brands to diversify their offerings and cater to evolving consumer preferences. This activity is expected to continue at a similar pace through the forecast period, potentially increasing market consolidation.

North America Cereal Bars Market Industry Trends & Analysis

The North American cereal bars market is experiencing robust growth, driven by increasing demand for convenient and nutritious snacking options. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was xx%, and is projected to reach xx% during the forecast period (2025-2033). Market penetration stands at xx% in 2025, indicating significant growth potential. Key growth drivers include:

- Health & Wellness Trends: The increasing awareness of health and wellness among consumers drives the demand for healthier cereal bars with reduced sugar, increased protein, and whole grains.

- Busy Lifestyles: Convenience is a significant factor, with cereal bars serving as a quick and easy snack or meal replacement for busy individuals.

- Product Innovation: Continuous innovation in flavors, ingredients, and functional benefits keeps the market dynamic and appealing to a broad range of consumers. This includes the introduction of vegan, gluten-free, and keto-friendly options.

- E-commerce Growth: Online retail channels are expanding rapidly, creating new avenues for brands to reach consumers.

- Strategic Partnerships and Branding: Companies are increasingly partnering with influencers and athletes to promote their brands and increase visibility within target demographics.

Leading Markets & Segments in North America Cereal Bars Market

The United States dominates the North American cereal bars market, owing to its large population, high disposable incomes, and established retail infrastructure. The Supermarket/Hypermarket distribution channel holds the largest market share, followed by convenience stores and online retail stores.

Key Drivers by Country:

- United States: Strong consumer demand for convenient snacks, established retail networks, and high levels of disposable income contribute to the US dominance.

- Canada: Growing health consciousness and a preference for natural and organic products are driving market growth in Canada.

- Mexico: Rising middle class and increasing urbanization are fostering market growth, although still lagging behind the US and Canada.

- Rest of North America: This segment experiences slower growth compared to the major countries, due to smaller population sizes and varying levels of economic development.

Key Drivers by Distribution Channel:

- Supermarket/Hypermarket: Wide product availability, established distribution networks, and consumer familiarity with these channels drive high market share.

- Convenience Stores: The convenience factor attracts impulsive purchases, particularly among time-constrained consumers.

- Online Retail Stores: E-commerce channels provide access to a wider range of products and cater to consumers who prefer online shopping.

- Others: This segment includes smaller retail outlets and direct-to-consumer channels, representing a smaller, but growing share of the market.

North America Cereal Bars Market Product Developments

Recent product innovations include the launch of gluten-free, vegan, and high-protein bars. Manufacturers are increasingly focusing on natural ingredients, reduced sugar content, and functional benefits such as added probiotics or fiber. These developments cater to the evolving demands of health-conscious consumers and enhance product differentiation within a competitive market. Technological advancements in processing and packaging are also contributing to improvements in product quality, shelf life, and sustainability.

Key Drivers of North America Cereal Bars Market Growth

Technological advancements in food processing and packaging, coupled with evolving consumer preferences for health and convenience, are driving market growth. Favorable economic conditions and increased disposable incomes in several regions contribute to the expanding market. The positive consumer perception of cereal bars as a convenient and relatively healthy snack also propels market growth.

Challenges in the North America Cereal Bars Market Market

Intense competition from established players and new entrants presents a significant challenge. Fluctuations in raw material prices and supply chain disruptions can impact production costs and profitability. Stringent regulatory requirements and evolving consumer preferences necessitate continuous innovation and adaptation. Maintaining brand loyalty and differentiation in a crowded marketplace also poses a significant challenge for many companies.

Emerging Opportunities in North America Cereal Bars Market

The market presents significant opportunities for growth through strategic partnerships, product diversification, and expansion into new geographic markets. Technological breakthroughs in ingredient sourcing, functional additions, and sustainable packaging will create further opportunities. Focus on personalization and customized products to cater to niche preferences represents a substantial growth avenue.

Leading Players in the North America Cereal Bars Market Sector

- General Mills Inc

- PepsiCo Inc

- Kellogg Company

- Riverside Natural Foods Ltd

- Simply Good Foods Co

- Core Foods

- Probar Inc

- Mars Incorporated

- Mondelēz International Inc

- McKee Foods Corporation

Key Milestones in North America Cereal Bars Market Industry

- December 2022: CORE® Foods partners with Alterra Mountain Company, making CORE® Bars the official nutrition bar for Alterra's US destinations. This strategic partnership significantly enhances brand visibility and market reach.

- March 2023: Cascadian Farm (General Mills) launches peanut-free, USDA-certified organic granola bars with 35% less sugar. This launch caters to growing consumer demand for healthier, allergy-friendly options.

- March 2023: CORE® Foods partners with Olympic Gold Medalist Chloe Kim, strengthening its brand image and appeal to a wider consumer base. This strategic move enhances brand awareness and association with a healthy and active lifestyle.

Strategic Outlook for North America Cereal Bars Market Market

The North American cereal bars market is poised for continued growth, driven by evolving consumer preferences and technological advancements. Strategic partnerships, product diversification, and expansion into emerging markets will be crucial for success. Focusing on sustainable and ethical sourcing of ingredients, alongside innovative product formulations, will position companies for long-term growth within this dynamic market. The continued focus on health and wellness, coupled with the convenience factor, positions the cereal bar market for a sustained period of expansion.

North America Cereal Bars Market Segmentation

-

1. Distribution Channel

- 1.1. Convenience Store

- 1.2. Online Retail Store

- 1.3. Supermarket/Hypermarket

- 1.4. Others

North America Cereal Bars Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cereal Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cereal Bars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Convenience Store

- 5.1.2. Online Retail Store

- 5.1.3. Supermarket/Hypermarket

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. United States North America Cereal Bars Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Cereal Bars Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Cereal Bars Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Cereal Bars Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Riverside Natural Foods Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Simply Good Foods Co

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Mills Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PepsiCo Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Core Foods

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Probar Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mars Incorporated

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mondelēz International Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 McKee Foods Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kellogg Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Riverside Natural Foods Ltd

List of Figures

- Figure 1: North America Cereal Bars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Cereal Bars Market Share (%) by Company 2024

List of Tables

- Table 1: North America Cereal Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Cereal Bars Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 3: North America Cereal Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: North America Cereal Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States North America Cereal Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada North America Cereal Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico North America Cereal Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America North America Cereal Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North America Cereal Bars Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: North America Cereal Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America Cereal Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Cereal Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Cereal Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cereal Bars Market?

The projected CAGR is approximately 9.30%.

2. Which companies are prominent players in the North America Cereal Bars Market?

Key companies in the market include Riverside Natural Foods Ltd, Simply Good Foods Co, General Mills Inc, PepsiCo Inc, Core Foods, Probar Inc, Mars Incorporated, Mondelēz International Inc, McKee Foods Corporation, Kellogg Company.

3. What are the main segments of the North America Cereal Bars Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: CORE® Foods has announced its partnership with American Professional Snowboarder and two-time Olympic Gold Medalist Chloe Kim. This news strengthens the recently established cooperation between CORE® and the Alterra Mountain Company, serving the company's various mountain destinations across the United States.March 2023: Cascadian Farm, a General Mills brand, has launched granola bars that are made in a peanut-free facility. The bars are also USDA-certified organic and made with 35% less sugar compared to the original Annie’s Dipped Granola Bars.December 2022: CORE® Foods has announced its partnership agreement with Alterra Mountain Company, which is designed to enhance the on-site guest experience by making CORE® Bars the official nutrition bar of Alterra Mountain Company's US destinations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cereal Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cereal Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cereal Bars Market?

To stay informed about further developments, trends, and reports in the North America Cereal Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence