Key Insights

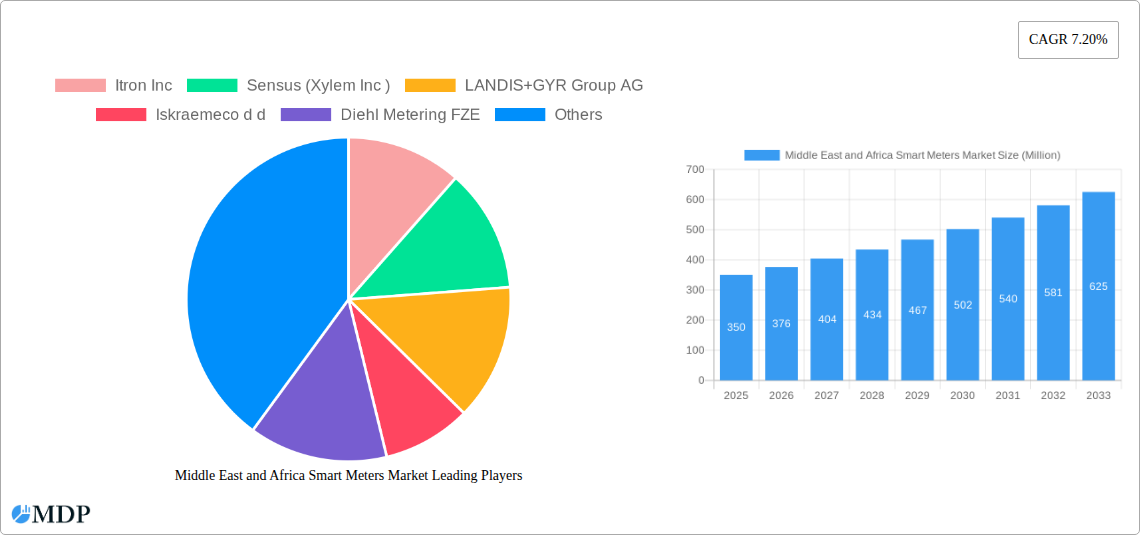

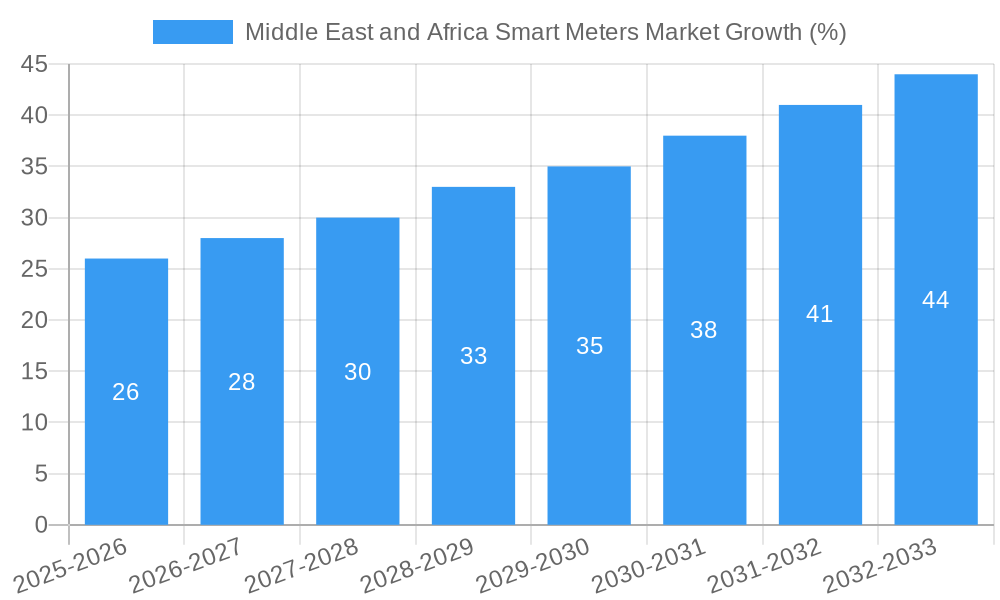

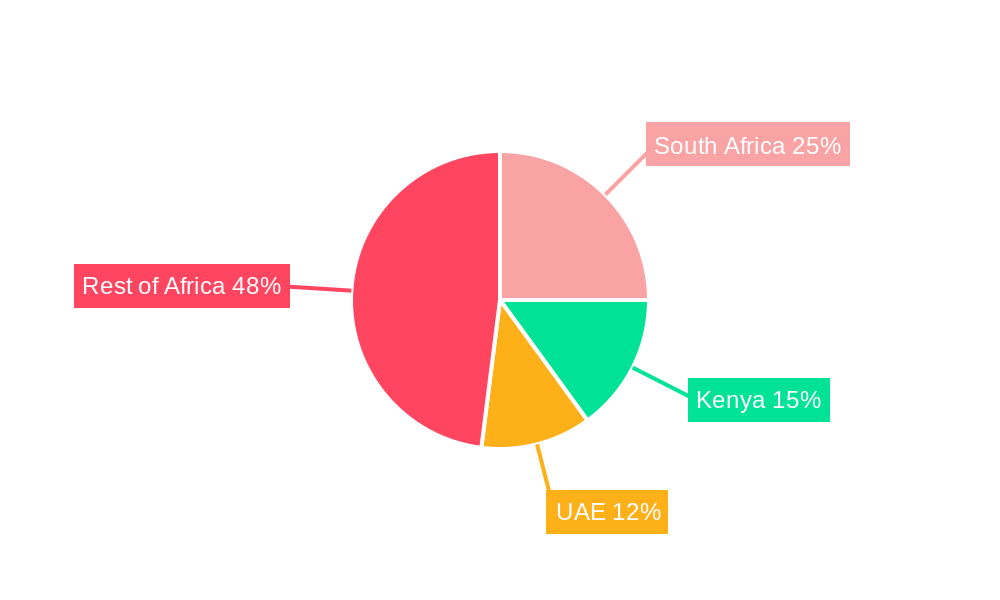

The Middle East and Africa (MEA) smart meters market is experiencing robust growth, driven by increasing urbanization, rising energy consumption, and government initiatives aimed at improving grid efficiency and reducing energy losses. A CAGR of 7.20% from 2019 to 2024 suggests a strong foundation for continued expansion. While precise market size figures for the MEA region are not provided, extrapolating from a global perspective and considering the rapid infrastructure development across several African nations, we can estimate the 2025 market value to be approximately $350 million. This figure accounts for the significant investments in smart grid infrastructure observed in countries like South Africa, Kenya, and the UAE. The market segmentation reveals a high demand across residential, commercial, and industrial sectors, with smart electricity meters currently dominating the market share, followed by smart gas and water meters. The adoption of smart meters is further accelerated by the growing adoption of advanced metering infrastructure (AMI) and the implementation of smart city projects across the region. Factors such as improving digital infrastructure and increasing awareness of the benefits of smart metering technologies, like real-time monitoring and reduced operational costs, contribute to the market’s upward trajectory. However, challenges persist, including high initial investment costs for infrastructure upgrades and the need for robust cybersecurity measures to protect against data breaches. Despite these challenges, the long-term outlook for the MEA smart meters market remains positive, with significant growth potential across various segments and geographies within the region.

The presence of established players like Itron, Sensus, and Landis+Gyr, alongside regional players, indicates a competitive landscape. Further market expansion is anticipated in underserved regions of Africa, particularly as governments prioritize reliable and efficient utility services. The growing adoption of renewable energy sources, coupled with the need for efficient energy management, will fuel further demand for smart meters in the coming years. This will likely lead to increased focus on developing cost-effective and user-friendly smart metering solutions tailored to the specific requirements of different countries and communities within the MEA region. This market presents opportunities for both established multinational companies and local businesses to capitalize on the growing demand for technologically advanced energy management solutions.

Middle East & Africa Smart Meters Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa smart meters market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Covering the period 2019-2033, with a focus on 2025, this report unveils key trends, challenges, and opportunities shaping the future of smart metering across the region. We analyze market dynamics, leading players, and significant industry developments, providing actionable intelligence for informed decision-making.

Middle East and Africa Smart Meters Market Dynamics & Concentration

The Middle East and Africa smart meters market is experiencing significant growth, driven by factors such as increasing urbanization, rising energy consumption, and government initiatives promoting smart grid infrastructure. Market concentration is moderate, with several key players vying for market share. Innovation is a crucial driver, with companies constantly developing advanced metering technologies to enhance efficiency and data analytics capabilities. Regulatory frameworks, while evolving, are increasingly supportive of smart meter deployments, further stimulating market growth. Product substitution is limited, with smart meters offering a superior solution compared to traditional metering systems. End-user trends indicate a strong preference for smart meters due to their advanced features, convenience and cost savings. Mergers and acquisitions (M&A) activity in the sector has been steady, with several strategic partnerships and acquisitions aimed at expanding market reach and technological capabilities. The xx% market share held by the top 5 players highlights a relatively concentrated market, although smaller players continue to innovate and expand. M&A deal counts have averaged xx per year over the historical period, reflecting continued industry consolidation.

Middle East and Africa Smart Meters Market Industry Trends & Analysis

The Middle East and Africa smart meters market is projected to witness robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing government investments in smart grid infrastructure projects, driven by the need to enhance energy efficiency and grid reliability. Technological disruptions, such as the emergence of advanced metering infrastructure (AMI) and the Internet of Things (IoT) integration, are further accelerating market expansion. Consumer preferences are shifting towards smart meters due to their ability to provide real-time consumption data, enabling better energy management and cost savings. Competitive dynamics are characterized by intense competition among established players and emerging companies, leading to continuous innovation and pricing pressures. Market penetration for smart meters in the residential sector is xx%, while the commercial and industrial sectors show higher penetration rates at xx% and xx%, respectively.

Leading Markets & Segments in Middle East and Africa Smart Meters Market

The residential segment dominates the Middle East and Africa smart meters market, accounting for the largest share of overall revenue. This is primarily due to the high concentration of residential consumers across the region and increasing government support for smart meter installations in residential areas. Key drivers include government initiatives to promote energy efficiency, rising disposable incomes leading to higher electricity consumption, and rising awareness about the benefits of smart metering among residential consumers.

- Key Drivers for Residential Segment:

- Government subsidies and incentives for smart meter adoption.

- Increasing awareness about energy conservation and cost-saving benefits.

- Rising disposable incomes in urban areas.

The UAE and Saudi Arabia are the leading markets within the region, benefiting from significant investments in smart grid infrastructure and the adoption of advanced metering technologies. Several factors contribute to this dominance, including strong governmental support for smart city initiatives and favorable regulatory environments.

- Key Drivers for UAE and Saudi Arabia:

- Large-scale smart city projects.

- High levels of government funding for infrastructure development.

- Proactive policies supporting renewable energy integration.

- Well-developed telecommunications infrastructure.

Within the different meter types, smart electricity meters hold the largest market share, followed by smart water and gas meters. This is a reflection of the higher demand for electricity across the region and the significant government investments in the power sector. However, growth in smart gas and water meters is accelerating, particularly in urban areas facing water scarcity challenges.

Middle East and Africa Smart Meters Market Product Developments

Recent product innovations focus on advanced communication technologies, such as Narrowband-IoT (NB-IoT) and LoRaWAN, to enhance connectivity and data transmission capabilities. These advancements improve the reliability and efficiency of smart meter data collection. New applications include real-time monitoring of energy consumption, advanced analytics for predictive maintenance, and improved customer engagement through personalized feedback and billing systems. Smart meters with integrated power quality monitoring features are gaining popularity, offering enhanced grid management capabilities. These advancements provide a significant competitive advantage for companies able to offer such advanced solutions.

Key Drivers of Middle East and Africa Smart Meters Market Growth

Technological advancements, including the development of sophisticated AMI systems and IoT integration, are driving significant market growth. Government regulations and initiatives promoting smart grid modernization and energy efficiency are also major catalysts. Economic factors, such as rising energy consumption and the need to optimize resource management, further stimulate demand. Specific examples include the extensive smart grid initiatives undertaken by various governments in the region, along with significant investments in renewable energy sources that rely on smart meters for efficient integration.

Challenges in the Middle East and Africa Smart Meters Market

The high initial investment cost associated with smart meter deployment remains a significant challenge, particularly for smaller utilities. Supply chain disruptions and logistical issues associated with project implementation in remote areas can also cause delays and increase project costs. Regulatory uncertainties and varying standards across different countries can create barriers to market entry and widespread adoption. These challenges combined reduce the overall rate of adoption and could impede projected market growth by approximately xx% if not addressed.

Emerging Opportunities in Middle East and Africa Smart Meters Market

The increasing adoption of smart city initiatives across the region offers significant opportunities for smart meter vendors. Strategic partnerships between utilities, technology providers, and government agencies are creating synergies and accelerating market expansion. The integration of smart meters with renewable energy resources is creating new avenues for growth. The expansion into underserved rural markets presents considerable potential for future market development and growth.

Leading Players in the Middle East and Africa Smart Meters Market Sector

- Itron Inc

- Sensus (Xylem Inc)

- LANDIS+GYR Group AG

- Iskraemeco d.d.

- Diehl Metering FZE

- Kamstrup AS

- Hexing Electric Co Ltd

- Electromed (Termikel Group)

- Sagemcom SAS

- Holley Technology

Key Milestones in Middle East and Africa Smart Meters Market Industry

- June 2022: The National Iranian Gas Company (NIGC) plans to install 26 Million smart gas meters across Iran over four years, significantly boosting the gas metering market.

- May 2022: Dubai Electricity & Water Authority (DEWA)'s USD 1.9 Billion investment in its Smart Grid Strategy (2021-2035) demonstrates a strong commitment to smart meter deployment and grid modernization. The previous phase (2015-2020) saw significant smart meter replacements.

- April 2022: DEWA launched a self-assessment tool for residential customers, leveraging smart meters to enhance customer engagement and promote efficient energy consumption.

Strategic Outlook for Middle East and Africa Smart Meters Market

The Middle East and Africa smart meters market presents significant long-term growth potential, driven by continued investment in smart grid infrastructure, increasing urbanization, and the growing adoption of renewable energy sources. Strategic opportunities exist for companies focusing on advanced metering technologies, data analytics capabilities, and customer engagement solutions. Partnerships with local utilities and government agencies are crucial for successful market penetration. The focus on energy efficiency and sustainability will continue to drive demand for smart meters in the coming years.

Middle East and Africa Smart Meters Market Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

Middle East and Africa Smart Meters Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Smart Meters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need For Improvement in Energy Efficiency and Smart City Investments; Supportive Government Initiatives and Regulations

- 3.3. Market Restrains

- 3.3.1. High Costs and Integration Difficulties with Smart Meters; Lack of Capital Investment for Infrastructure Installation

- 3.4. Market Trends

- 3.4.1. Commercial Sector to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Smart Meters Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. South Africa Middle East and Africa Smart Meters Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa Smart Meters Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa Smart Meters Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa Smart Meters Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa Smart Meters Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa Smart Meters Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Itron Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sensus (Xylem Inc )

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 LANDIS+GYR Group AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Iskraemeco d d

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Diehl Metering FZE

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kamstrup AS

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Hexing Electric Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Electromed (Termikel Group)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sagemcom SAS*List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Holley Technology

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Itron Inc

List of Figures

- Figure 1: Middle East and Africa Smart Meters Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Smart Meters Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Smart Meters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Smart Meters Market Revenue Million Forecast, by End User 2019 & 2032

- Table 3: Middle East and Africa Smart Meters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Middle East and Africa Smart Meters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Middle East and Africa Smart Meters Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Middle East and Africa Smart Meters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Saudi Arabia Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Arab Emirates Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Israel Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Qatar Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Kuwait Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Oman Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Bahrain Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Jordan Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Lebanon Middle East and Africa Smart Meters Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Smart Meters Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Middle East and Africa Smart Meters Market?

Key companies in the market include Itron Inc, Sensus (Xylem Inc ), LANDIS+GYR Group AG, Iskraemeco d d, Diehl Metering FZE, Kamstrup AS, Hexing Electric Co Ltd, Electromed (Termikel Group), Sagemcom SAS*List Not Exhaustive, Holley Technology.

3. What are the main segments of the Middle East and Africa Smart Meters Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need For Improvement in Energy Efficiency and Smart City Investments; Supportive Government Initiatives and Regulations.

6. What are the notable trends driving market growth?

Commercial Sector to Hold Significant Share.

7. Are there any restraints impacting market growth?

High Costs and Integration Difficulties with Smart Meters; Lack of Capital Investment for Infrastructure Installation.

8. Can you provide examples of recent developments in the market?

June 2022: The National Iranian Gas Company (NIGC) intends to install 26 million smart gas meters across Iran over the next four years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Smart Meters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Smart Meters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Smart Meters Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Smart Meters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence