Key Insights

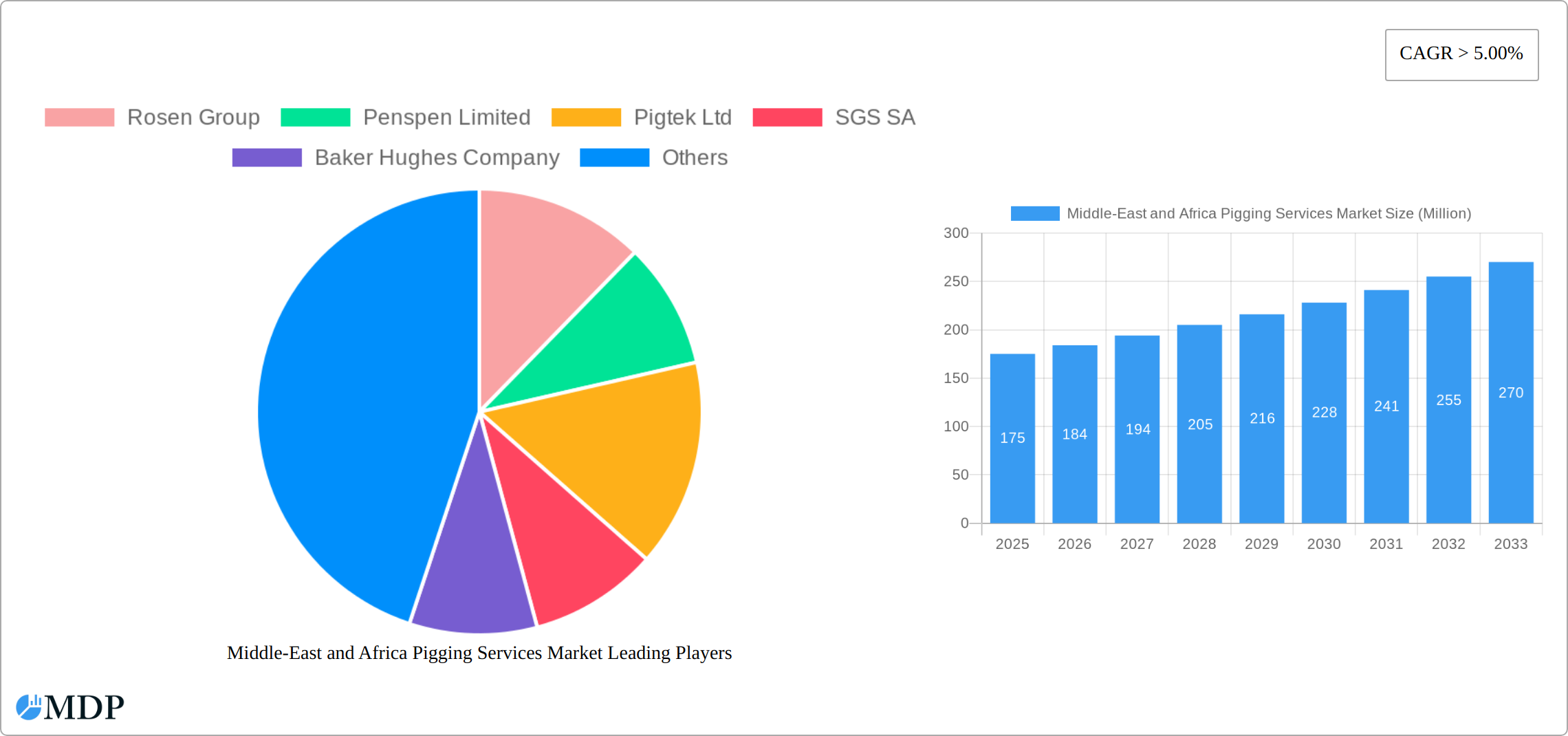

The Middle East and Africa pigging services market is experiencing robust growth, driven by increasing oil and gas exploration and production activities across the region. The market's expansion is fueled by the need for efficient pipeline maintenance and integrity management, particularly in aging infrastructure. Intelligent pigging, offering advanced capabilities in crack and leakage detection, metal loss/corrosion assessment, and geometry/bend detection, is a key driver of market growth, surpassing other pigging types in adoption rate. The prevalent use of oil and gas pipelines further bolsters demand. While specific market size data for the Middle East and Africa is unavailable, considering a global CAGR of over 5% and regional growth in energy infrastructure development, a reasonable estimate for the 2025 market size could be in the range of $150-200 million, with a projected increase to $250-350 million by 2030. This growth, however, could face some restraints including high initial investment costs associated with advanced pigging technologies and the need for skilled personnel to operate and interpret the data generated. The market is segmented by pigging type (intelligent and other), application (leak detection, corrosion detection, geometry measurement, etc.), and pipeline fluid type (oil and gas). Key players like Rosen Group, Penspen, Pigtek, SGS, Baker Hughes, TD Williamson, and NDT Global are competing to serve the growing demand.

The substantial investments in new pipeline infrastructure across the Middle East and Africa, coupled with stringent regulations emphasizing pipeline safety and environmental protection, are contributing significantly to market expansion. Regional governments are increasingly mandating regular pipeline inspections and maintenance, creating substantial opportunities for pigging service providers. Focus is shifting towards intelligent pigging technologies due to their enhanced accuracy and efficiency compared to traditional methods. Further growth will depend on factors such as oil and gas price volatility, government policies supporting energy infrastructure development, and advancements in pigging technology. Competition among established players and new entrants is expected to intensify, leading to a focus on cost optimization, technological innovation, and superior service delivery.

Dive deep into the lucrative Middle East & Africa Pigging Services market with this comprehensive report, providing a detailed analysis of market dynamics, leading players, and future growth opportunities. Valued at xx Million in 2025, this market is poised for significant expansion. This report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025.

Middle-East and Africa Pigging Services Market Market Dynamics & Concentration

The Middle East & Africa pigging services market presents a moderately fragmented landscape, characterized by several key players competing for market share. Prominent companies such as Rosen Group, Penspen Limited, Pigtek Ltd, SGS SA, Baker Hughes Company, T D Williamson Inc, and NDT Global Services Ltd. are actively engaged in this sector. While precise market share data remains confidential, Rosen Group and Baker Hughes Company are understood to hold significant positions. The market's competitive structure is expected to remain relatively dispersed throughout the forecast period, although strategic mergers and acquisitions (M&A) activity is anticipated to gradually increase consolidation. Over the past five years, approximately xx M&A deals have been observed within the region, largely driven by expansion strategies aimed at broadening service offerings and extending geographical reach. Innovation within the sector is fueled by advancements in intelligent pigging technologies, enhancing the precision of pipeline inspection and maintenance procedures. The regulatory environment plays a pivotal role in market growth, with stringent pipeline safety and environmental regulations significantly influencing market dynamics. The availability of substitute technologies is limited, with pigging services remaining the most efficient solution for pipeline inspection and cleaning. End-user trends indicate a growing preference for proactive pipeline maintenance to mitigate operational risks and downtime, thereby reducing potential financial losses.

- Market Concentration: Moderately fragmented, with several significant competitors.

- M&A Activity: Approximately xx deals in the past five years, indicating consolidation efforts.

- Innovation Drivers: Advancements in intelligent pigging technology, improving efficiency and accuracy.

- Regulatory Framework: Stringent pipeline safety and environmental regulations shaping market practices.

- Product Substitutes: Limited viable alternatives to pigging services for pipeline maintenance.

- End-User Trends: Increasing adoption of proactive pipeline maintenance strategies.

Middle-East and Africa Pigging Services Market Industry Trends & Analysis

The Middle East & Africa pigging services market is poised for significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is primarily attributed to the increasing exploration and production activities within the region's oil and gas sector. Substantial investments in pipeline infrastructure development, particularly in countries with significant hydrocarbon reserves, are further stimulating market growth. Technological advancements, including the integration of advanced data analytics and remote monitoring capabilities, are enhancing the efficiency and precision of pigging services. Market preferences are shifting towards reliable, technologically advanced solutions that minimize downtime and operational disruptions. Competitive dynamics are shaped by factors such as pricing strategies, service quality, technological capabilities, and geographic reach. While market penetration is relatively high in established oil and gas producing regions, significant growth opportunities exist in emerging markets and regions undergoing infrastructure development.

Leading Markets & Segments in Middle-East and Africa Pigging Services Market

The Middle East, particularly the Gulf Cooperation Council (GCC) countries, and parts of North Africa currently represent the dominant regions for pigging services. Within the segments:

- Pigging Type: Intelligent pigging holds a larger market share compared to other pigging types due to its enhanced capabilities and data analysis potential.

- Application: Crack and leakage detection dominates, driven by stringent safety regulations and the need to prevent environmental incidents. Metal loss/corrosion detection is also a significant application.

- Pipeline Fluid Type: Oil pipelines currently account for a larger market share than gas pipelines due to higher production and pipeline density.

Key Drivers:

- Significant Oil and Gas Reserves: Abundant natural resources drive pipeline infrastructure development.

- Government Investments: Large-scale infrastructure projects funded by governments fuel market growth.

- Stringent Safety Regulations: Growing emphasis on pipeline safety mandates regular inspections.

- Technological Advancements: Adoption of intelligent pigging technologies boosts efficiency.

Middle-East and Africa Pigging Services Market Product Developments

Recent product innovations focus on enhancing the capabilities of intelligent pigging tools. This includes improved data acquisition and analysis techniques, allowing for more precise defect detection and pipeline characterization. New applications are emerging in areas like pipeline integrity management and advanced leak detection. The competitive advantage lies in offering comprehensive, technologically advanced services backed by robust data analytics and experienced personnel.

Key Drivers of Middle-East and Africa Pigging Services Market Growth

The growth of the Middle East & Africa pigging services market is driven by a confluence of factors. The region's substantial oil and gas reserves necessitate extensive pipeline networks, creating a strong demand for pigging services. Stringent safety regulations and growing environmental concerns mandate regular pipeline inspections and maintenance, further driving market expansion. Finally, the continuous advancement of intelligent pigging technologies, offering improved efficiency and accuracy, contributes significantly to market growth.

Challenges in the Middle-East and Africa Pigging Services Market Market

Significant challenges include navigating complex regulatory landscapes across diverse countries. Supply chain disruptions, particularly concerning specialized equipment and skilled personnel, can also impact service delivery. Intense competition among established players adds pressure on pricing and profitability. These factors collectively restrict market growth to some extent.

Emerging Opportunities in Middle-East and Africa Pigging Services Market

Significant long-term growth opportunities exist in expanding into emerging markets with developing pipeline infrastructure. Strategic partnerships with local operators and technology providers can unlock access to new markets and enhance service offerings. Technological breakthroughs in areas such as autonomous pigging and artificial intelligence for data analysis are poised to create new revenue streams.

Leading Players in the Middle-East and Africa Pigging Services Market Sector

- Rosen Group

- Penspen Limited

- Pigtek Ltd

- SGS SA

- Baker Hughes Company

- T D Williamson Inc

- NDT Global Services Ltd

Key Milestones in Middle-East and Africa Pigging Services Market Industry

- July 2022: The Nigeria-Morocco Gas Pipeline (NMGP) project receives significant support, signaling increased investment in regional gas infrastructure and boosting demand for pigging services.

- November 2021: The resolution of route clearance issues for the East African crude oil pipeline opens up opportunities for pigging service providers in that region.

Strategic Outlook for Middle-East and Africa Pigging Services Market Market

The future potential for the Middle East & Africa pigging services market is substantial, driven by continued investment in pipeline infrastructure, stringent safety regulations, and technological advancements. Strategic partnerships, expansion into new markets, and investment in advanced technologies will be key to success for market players. The market is expected to continue its growth trajectory throughout the forecast period.

Middle-East and Africa Pigging Services Market Segmentation

-

1. Pigging Type

- 1.1. Intelligent Pigging

- 1.2. Other Pigging Types

-

2. Application

- 2.1. Crack and Leakage Detection

- 2.2. Metal Loss/Corrosion Detection

- 2.3. Geometry Measurement and Bend Detection

- 2.4. Other Applications

-

3. Pipeline Fluid Type

- 3.1. Oil

- 3.2. Gas

-

4. Geography

- 4.1. United Arab Emirates

- 4.2. Saudi Arabia

- 4.3. Rest of Middle East and Africa

Middle-East and Africa Pigging Services Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Rest of Middle East and Africa

Middle-East and Africa Pigging Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Intelligent Pigging Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Pigging Type

- 5.1.1. Intelligent Pigging

- 5.1.2. Other Pigging Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Crack and Leakage Detection

- 5.2.2. Metal Loss/Corrosion Detection

- 5.2.3. Geometry Measurement and Bend Detection

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Pipeline Fluid Type

- 5.3.1. Oil

- 5.3.2. Gas

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. Rest of Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Arab Emirates

- 5.5.2. Saudi Arabia

- 5.5.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Pigging Type

- 6. United Arab Emirates Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Pigging Type

- 6.1.1. Intelligent Pigging

- 6.1.2. Other Pigging Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Crack and Leakage Detection

- 6.2.2. Metal Loss/Corrosion Detection

- 6.2.3. Geometry Measurement and Bend Detection

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Pipeline Fluid Type

- 6.3.1. Oil

- 6.3.2. Gas

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United Arab Emirates

- 6.4.2. Saudi Arabia

- 6.4.3. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Pigging Type

- 7. Saudi Arabia Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Pigging Type

- 7.1.1. Intelligent Pigging

- 7.1.2. Other Pigging Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Crack and Leakage Detection

- 7.2.2. Metal Loss/Corrosion Detection

- 7.2.3. Geometry Measurement and Bend Detection

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Pipeline Fluid Type

- 7.3.1. Oil

- 7.3.2. Gas

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United Arab Emirates

- 7.4.2. Saudi Arabia

- 7.4.3. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Pigging Type

- 8. Rest of Middle East and Africa Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Pigging Type

- 8.1.1. Intelligent Pigging

- 8.1.2. Other Pigging Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Crack and Leakage Detection

- 8.2.2. Metal Loss/Corrosion Detection

- 8.2.3. Geometry Measurement and Bend Detection

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Pipeline Fluid Type

- 8.3.1. Oil

- 8.3.2. Gas

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United Arab Emirates

- 8.4.2. Saudi Arabia

- 8.4.3. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Pigging Type

- 9. South Africa Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Middle-East and Africa Pigging Services Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Rosen Group

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Penspen Limited

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Pigtek Ltd

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 SGS SA

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Baker Hughes Company

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 T D Williamson Inc

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 NDT Global Services Ltd

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.1 Rosen Group

List of Figures

- Figure 1: Middle-East and Africa Pigging Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Pigging Services Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Pigging Type 2019 & 2032

- Table 3: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Pipeline Fluid Type 2019 & 2032

- Table 5: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Middle-East and Africa Pigging Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan Middle-East and Africa Pigging Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda Middle-East and Africa Pigging Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania Middle-East and Africa Pigging Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya Middle-East and Africa Pigging Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa Middle-East and Africa Pigging Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Pigging Type 2019 & 2032

- Table 15: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Pipeline Fluid Type 2019 & 2032

- Table 17: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Pigging Type 2019 & 2032

- Table 20: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Pipeline Fluid Type 2019 & 2032

- Table 22: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Pigging Type 2019 & 2032

- Table 25: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Pipeline Fluid Type 2019 & 2032

- Table 27: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle-East and Africa Pigging Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Pigging Services Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Middle-East and Africa Pigging Services Market?

Key companies in the market include Rosen Group, Penspen Limited, Pigtek Ltd, SGS SA, Baker Hughes Company, T D Williamson Inc, NDT Global Services Ltd.

3. What are the main segments of the Middle-East and Africa Pigging Services Market?

The market segments include Pigging Type, Application, Pipeline Fluid Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Intelligent Pigging Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

July 2022: The Strategic gas pipeline from Nigeria to Morocco was supported by ILF and DORIS. The consortium consisting of NNPC (Nigerian National Petroleum Corporation), Nigeria and ONHYM (Office National Des Hydrocarbures et Des Mines), Morocco, is progressing with the plans for its mega-project Nigeria-Morocco Gas Pipeline (NMGP).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Pigging Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Pigging Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Pigging Services Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Pigging Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence