Key Insights

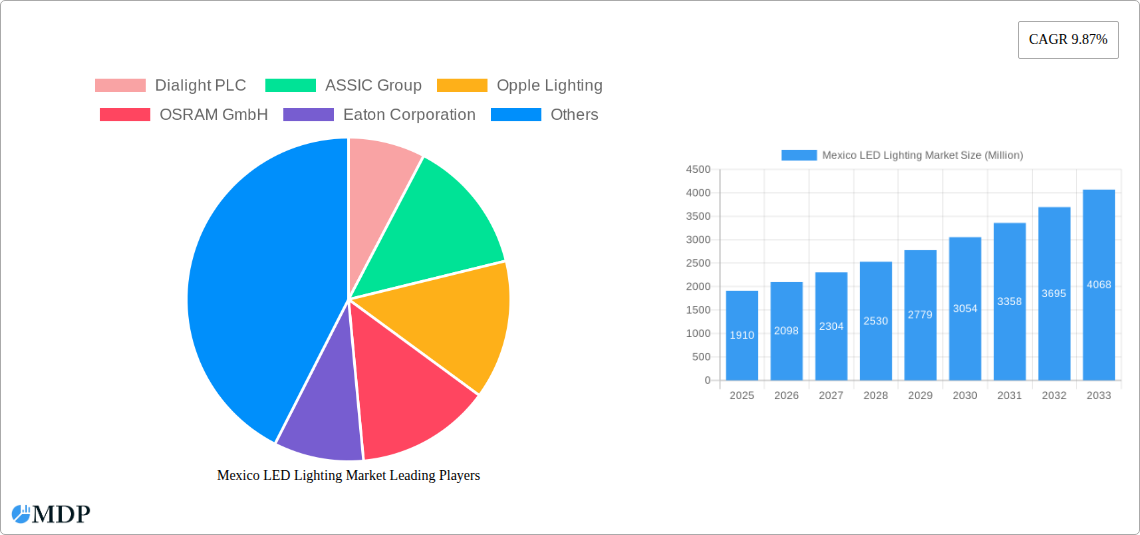

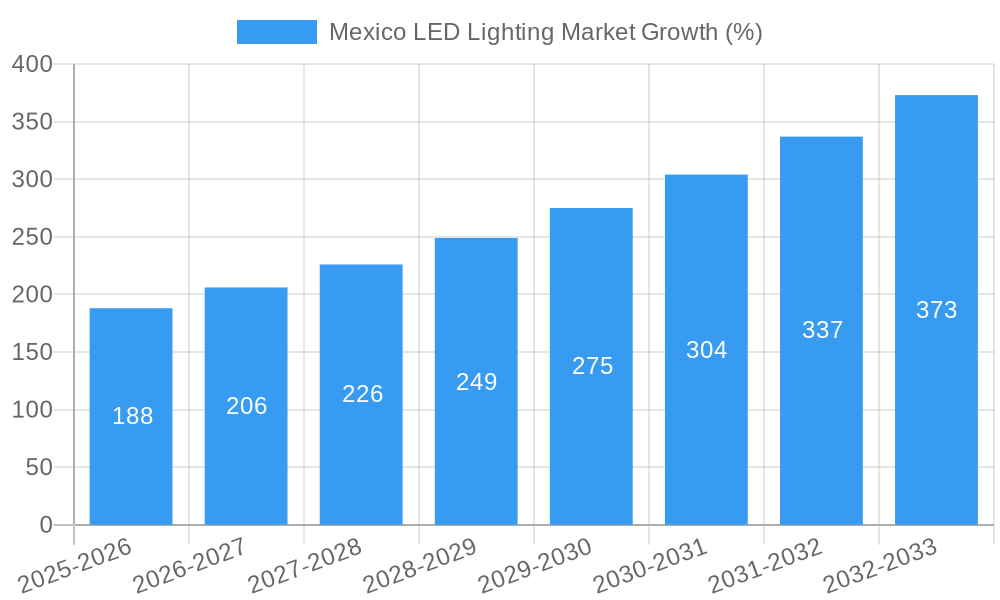

The Mexico LED lighting market presents a robust growth opportunity, projected to be valued at $1.91 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.87% from 2019 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives promoting energy efficiency and sustainability are fostering the adoption of energy-saving LED lighting solutions across residential, commercial, and industrial sectors. Secondly, the declining cost of LED technology makes it a financially attractive alternative to traditional lighting, particularly for large-scale installations. Furthermore, the rising demand for smart lighting systems, offering enhanced control and energy management capabilities, is further boosting market growth. The market is segmented by product type (lamps and luminaires) and end-user vertical (residential, commercial, industrial, and specialized applications like horticulture and entertainment). Major players like Dialight PLC, ASSIC Group, Opple Lighting, OSRAM GmbH, Eaton Corporation, Acuity Brands Inc, GE Lighting (Savant), and Signify Holdings BV are actively shaping the competitive landscape through technological innovations and strategic partnerships. The strong growth trajectory is expected to continue, driven by ongoing infrastructure development and increasing urbanization in Mexico.

The significant growth in the Mexican LED lighting market is further fueled by advancements in LED technology, leading to improved efficacy and longer lifespans. This reduces both operational and maintenance costs, appealing to cost-conscious consumers and businesses. The increasing awareness of the environmental benefits of LEDs, such as reduced carbon footprint, also contributes to the market's expansion. While challenges remain, such as the need to address the existing infrastructure and overcome potential regulatory hurdles, the overall market outlook for LED lighting in Mexico remains highly positive throughout the forecast period (2025-2033). The diverse end-user segments offer multiple avenues for growth, with the commercial and industrial sectors anticipated to lead the expansion due to large-scale deployments and modernization efforts.

Mexico LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico LED lighting market, offering invaluable insights for industry stakeholders, investors, and businesses looking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and incorporates the latest industry developments to present a robust and future-oriented perspective. The report covers key market segments, including lamps and luminaires, and analyzes end-user verticals such as residential, commercial, industrial, and urban/street lighting, with special attention paid to emerging sectors like horticulture. The total market value is expected to reach xx Million by 2033.

Mexico LED Lighting Market Dynamics & Concentration

This section analyzes the competitive landscape, examining market concentration, innovation drivers, regulatory influences, and the impact of mergers and acquisitions (M&A) activity. We delve into the market share of key players like Dialight PLC, ASSIC Group, Opple Lighting, OSRAM GmbH, Eaton Corporation, Acuity Brands Inc, GE Lighting (Savant), and Signify Holdings BV. The report assesses the impact of technological advancements, government regulations promoting energy efficiency, and the increasing adoption of smart lighting solutions.

- Market Concentration: The Mexico LED lighting market exhibits a moderately concentrated structure, with a few major players holding significant market share. The exact market share distribution will be detailed in the full report.

- Innovation Drivers: Continuous advancements in LED technology, focusing on improved efficacy, longer lifespan, and smart features, are key drivers of market growth.

- Regulatory Framework: Government initiatives promoting energy efficiency and sustainable practices significantly influence market dynamics. Specific regulations and their impact are analyzed in detail.

- Product Substitutes: While LED lighting enjoys a dominant position, the report examines the presence and potential impact of alternative lighting technologies.

- End-User Trends: Shifting consumer preferences toward energy-efficient and aesthetically pleasing lighting solutions shape market demand. Detailed analysis of end-user behavior and preferences across different segments is included.

- M&A Activities: The report analyzes recent mergers and acquisitions, including the impact of Signify's acquisition of Fluence, highlighting their effect on market consolidation and competitive dynamics. We quantify the number of M&A deals during the study period and analyze their impact on market share and innovation.

Mexico LED Lighting Market Industry Trends & Analysis

This section explores the key trends shaping the Mexico LED lighting market. It examines market growth drivers, including increasing urbanization, infrastructure development, rising energy costs, and government support for energy efficiency programs. The analysis encompasses the impact of technological disruptions, consumer preferences for smart and connected lighting, and the competitive dynamics among key players. The report projects a CAGR of xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Leading Markets & Segments in Mexico LED Lighting Market

This section identifies the dominant segments within the Mexico LED lighting market. It analyzes the performance of different product types (lamps, luminaires) and end-user verticals (residential, commercial, industrial, urban/street lighting, and others).

- By Product Type: Luminaires are anticipated to dominate the market due to their versatility and integration with smart lighting systems. Lamps continue to hold a significant share, particularly in the replacement market.

- By End-User Vertical: The commercial sector, including offices, retail, and hospitality, is projected to be the largest segment due to high adoption rates and government incentives. The industrial segment is also experiencing strong growth driven by efficiency improvements and safety considerations. The residential sector shows steady growth driven by increasing awareness of energy savings and technological upgrades. Urban and street lighting projects represent a large growth opportunity, driven by government investment in infrastructure.

Detailed analysis of market drivers for each segment, including economic policies and infrastructure investments, is provided in the full report.

Mexico LED Lighting Market Product Developments

Recent product innovations highlight advancements in LED technology, with a focus on energy efficiency, smart features, and improved design. Acuity Brands' Verjure, a professional-grade horticulture LED lighting solution, exemplifies the trend towards specialized applications. This innovation caters to the growing horticultural sector within the broader LED lighting market.

Key Drivers of Mexico LED Lighting Market Growth

Several factors contribute to the robust growth of the Mexico LED lighting market. These include government policies promoting energy efficiency, increasing urbanization leading to greater lighting needs, and the cost advantages of LED technology compared to traditional lighting solutions. The ongoing development of smart lighting technologies and the integration of IoT capabilities further accelerate market expansion.

Challenges in the Mexico LED Lighting Market

The market faces certain challenges, including potential supply chain disruptions, price competition from cheaper imports, and the need for ongoing technological innovation to maintain a competitive edge. Regulatory hurdles in specific regions can also impede market growth.

Emerging Opportunities in Mexico LED Lighting Market

Significant opportunities exist for players who can leverage technological advancements to develop advanced lighting systems and cater to evolving consumer preferences. The expansion of smart cities initiatives, coupled with the growing demand for energy-efficient solutions in the industrial and agricultural sectors, presents promising avenues for growth. Strategic partnerships and mergers & acquisitions (M&A) activity can significantly influence this growth.

Leading Players in the Mexico LED Lighting Market Sector

- Dialight PLC

- ASSIC Group

- Opple Lighting

- OSRAM GmbH

- Eaton Corporation

- Acuity Brands Inc

- GE Lighting (Savant)

- Signify Holdings BV

Key Milestones in Mexico LED Lighting Market Industry

- July 2022: ZKW's USD 102 Million investment in its Silao plant significantly boosts automotive lighting production capacity in Mexico.

- May 2022: Signify's acquisition of Fluence strengthens its presence in the agricultural lighting market.

- March 2022: Acuity Brands' introduction of Verjure expands the professional horticulture LED lighting segment.

Strategic Outlook for Mexico LED Lighting Market

The future of the Mexico LED lighting market is bright, with sustained growth anticipated driven by technological innovation, supportive government policies, and increasing demand across various sectors. Companies adopting strategic partnerships, focusing on product diversification and smart lighting solutions, are well-positioned to capture significant market share.

Mexico LED Lighting Market Segmentation

-

1. Product Type

- 1.1. Lamps

- 1.2. Luminaires

-

2. End-user Vertical

- 2.1. Residential

- 2.2. Commercial (Offices, Retail, and Hospitality)

- 2.3. Urban and Street Lighting

- 2.4. Industrial

- 2.5. Other

Mexico LED Lighting Market Segmentation By Geography

- 1. Mexico

Mexico LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand for LED lighting in the outdoor lighting segment driven by smart development initiatives; Increasing awareness among households on LED and favorable government regulations; Steady reduction in the prices of LED lighting products and higher shelf life

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installations

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Outdoor Lighting Due to Smart Development Initiatives to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lamps

- 5.1.2. Luminaires

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Residential

- 5.2.2. Commercial (Offices, Retail, and Hospitality)

- 5.2.3. Urban and Street Lighting

- 5.2.4. Industrial

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Dialight PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ASSIC Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Opple Lighting

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OSRAM GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eaton Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acuity Brands Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GE Lighting (Savant)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Signify Holdings BV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Dialight PLC

List of Figures

- Figure 1: Mexico LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Mexico LED Lighting Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Mexico LED Lighting Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Mexico LED Lighting Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Mexico LED Lighting Market Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 7: Mexico LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Mexico LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Mexico LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Mexico LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Mexico LED Lighting Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Mexico LED Lighting Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 13: Mexico LED Lighting Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 14: Mexico LED Lighting Market Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 15: Mexico LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Mexico LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico LED Lighting Market?

The projected CAGR is approximately 9.87%.

2. Which companies are prominent players in the Mexico LED Lighting Market?

Key companies in the market include Dialight PLC , ASSIC Group, Opple Lighting, OSRAM GmbH, Eaton Corporation, Acuity Brands Inc , GE Lighting (Savant), Signify Holdings BV.

3. What are the main segments of the Mexico LED Lighting Market?

The market segments include Product Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

High demand for LED lighting in the outdoor lighting segment driven by smart development initiatives; Increasing awareness among households on LED and favorable government regulations; Steady reduction in the prices of LED lighting products and higher shelf life .

6. What are the notable trends driving market growth?

Increasing Demand for Outdoor Lighting Due to Smart Development Initiatives to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Initial Cost of Installations.

8. Can you provide examples of recent developments in the market?

July 2022 - ZKW, a specialist in lighting systems, disclosed its plan to invest a substantial sum of over USD 102 million in the expansion of its production plant located in Silao. This 3rd Phase expansion was expected to enable ZKW México to augment its production capacity with an impressive 1.5 million headlights. The newly constructed facility will be equipped with cutting-edge technologies, including plastic injection molding systems, surface treatments, and painting systems, to facilitate the production of automotive lighting systems. By the year 2025, ZKW Mexico aims to manufacture approximately 3.5 million headlights annually, employing a workforce of 2,522 individuals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico LED Lighting Market?

To stay informed about further developments, trends, and reports in the Mexico LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence