Key Insights

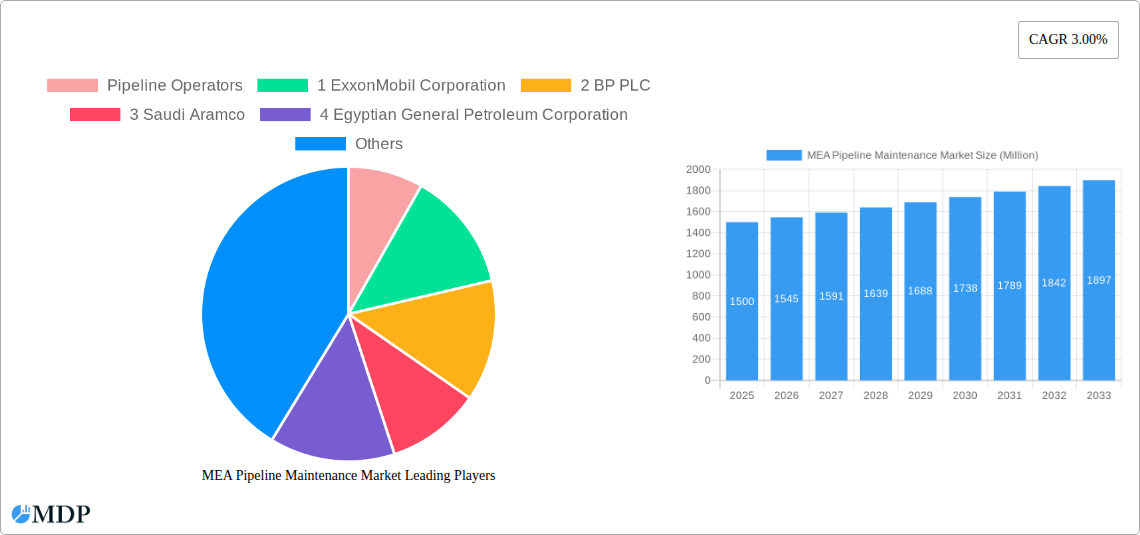

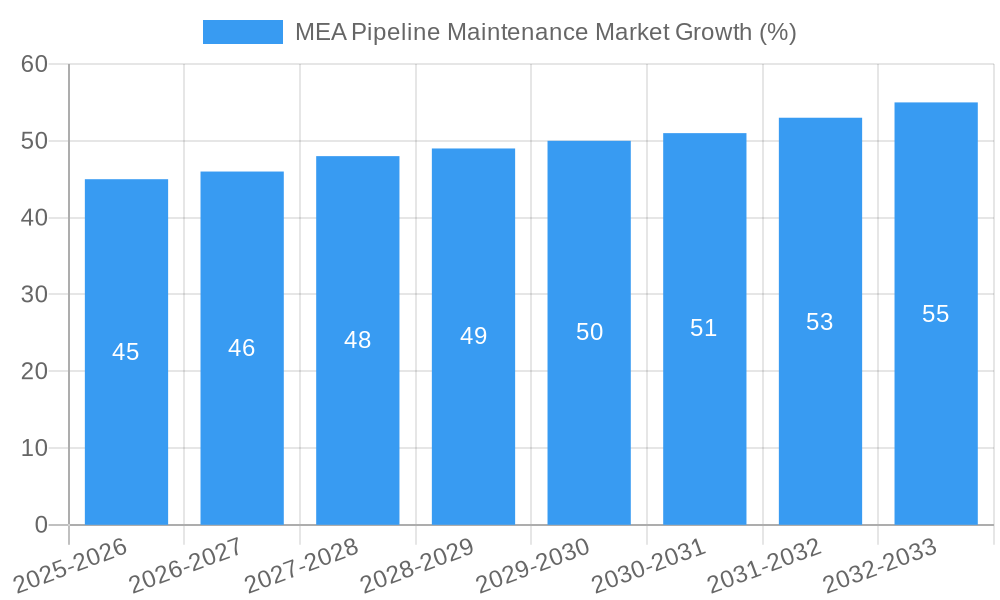

The Middle East and Africa (MEA) pipeline maintenance market is experiencing steady growth, driven by the increasing demand for energy resources and the expansion of existing pipeline networks. The market's Compound Annual Growth Rate (CAGR) of 3.00% from 2019 to 2024 suggests a robust and consistent trajectory. This growth is fueled by several key factors including aging pipeline infrastructure requiring more frequent maintenance, stringent government regulations on pipeline safety and environmental protection, and rising investments in oil and gas exploration and production activities across the region. Major players such as ExxonMobil, BP, and Saudi Aramco are significantly contributing to this market through their extensive pipeline networks and associated maintenance needs. Furthermore, the growing focus on preventive maintenance strategies, coupled with technological advancements in pipeline inspection and repair technologies, are contributing to market expansion. The presence of several specialized pipeline maintenance service providers like Arabian Pipes Company, Rezayat Group, and Vallourec SA further demonstrates a developed and competitive market landscape.

While the market exhibits significant growth potential, challenges remain. These include the high initial investment costs associated with pipeline maintenance, the geopolitical instability in certain regions of MEA impacting project timelines and operational efficiency, and the need for skilled workforce to handle sophisticated maintenance operations. However, the long-term outlook remains positive, with continued growth anticipated as energy demand and pipeline infrastructure development persist. The segmentation of the market into pipeline operators and maintenance service providers highlights the interconnected nature of this industry and the diverse opportunities for different stakeholders. Future growth will likely be influenced by the ongoing technological advancements in pipeline integrity management and the increasing adoption of digital solutions for efficient pipeline monitoring and maintenance scheduling. The market’s relatively high concentration among key players also suggests opportunities for mergers, acquisitions, and strategic partnerships in the coming years.

MEA Pipeline Maintenance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the MEA Pipeline Maintenance Market, offering invaluable insights for stakeholders across the pipeline sector. Covering the period 2019-2033, with a base year of 2025, this study meticulously examines market dynamics, industry trends, leading players, and future growth opportunities. The report is essential for pipeline operators, maintenance service providers, investors, and anyone seeking to understand this crucial market. Download now to gain a competitive edge.

MEA Pipeline Maintenance Market Dynamics & Concentration

The MEA Pipeline Maintenance Market exhibits a moderately concentrated landscape, with a handful of major players commanding significant market share. Pipeline operators, such as ExxonMobil Corporation, BP PLC, Saudi Aramco, and Egyptian General Petroleum Corporation, play a dominant role, influencing demand for maintenance services. The market's dynamics are shaped by several key factors:

- Innovation Drivers: Technological advancements in pipeline inspection, repair, and maintenance techniques drive market growth. This includes the adoption of advanced materials, robotics, and data analytics for predictive maintenance.

- Regulatory Frameworks: Stringent safety regulations and environmental concerns imposed by governments across the MEA region significantly influence pipeline maintenance practices and investment decisions. Compliance costs and regulations affect market dynamics.

- Product Substitutes: Limited viable substitutes for traditional pipeline maintenance techniques exist, making the market relatively insulated from substitution threats. However, technological advancements are continuously providing incremental improvements over existing technologies.

- End-User Trends: The increasing demand for energy in the MEA region fuels pipeline infrastructure development, directly impacting the maintenance market's growth. This demand is projected to sustain robust growth in the market.

- M&A Activities: The market has witnessed a moderate level of mergers and acquisitions (M&As), with xx major deals recorded between 2019 and 2024, primarily driven by the consolidation among service providers seeking economies of scale and expanded service portfolios. The market share of top 5 players is estimated to be xx% in 2025.

MEA Pipeline Maintenance Market Industry Trends & Analysis

The MEA Pipeline Maintenance Market is projected to experience significant growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is driven by:

- Market Growth Drivers: The expansion of oil and gas infrastructure, coupled with aging pipeline networks requiring extensive maintenance, is a primary driver. Government initiatives to enhance energy security further contribute to market growth.

- Technological Disruptions: The adoption of advanced technologies like robotic inspection, smart pipelines, and predictive analytics significantly impacts market dynamics, increasing efficiency and reducing downtime. These technologies are rapidly improving the market's operational capabilities.

- Consumer Preferences: Pipeline operators are increasingly prioritizing safety, environmental compliance, and operational efficiency, shaping the demand for sophisticated and reliable maintenance services. This preference is driving growth in the high-end pipeline maintenance sector.

- Competitive Dynamics: Intense competition among service providers is leading to innovation, price optimization, and a focus on customer service. Market penetration is increasing as new entrants compete for market share. The market penetration rate is estimated to be xx% in 2025.

Leading Markets & Segments in MEA Pipeline Maintenance Market

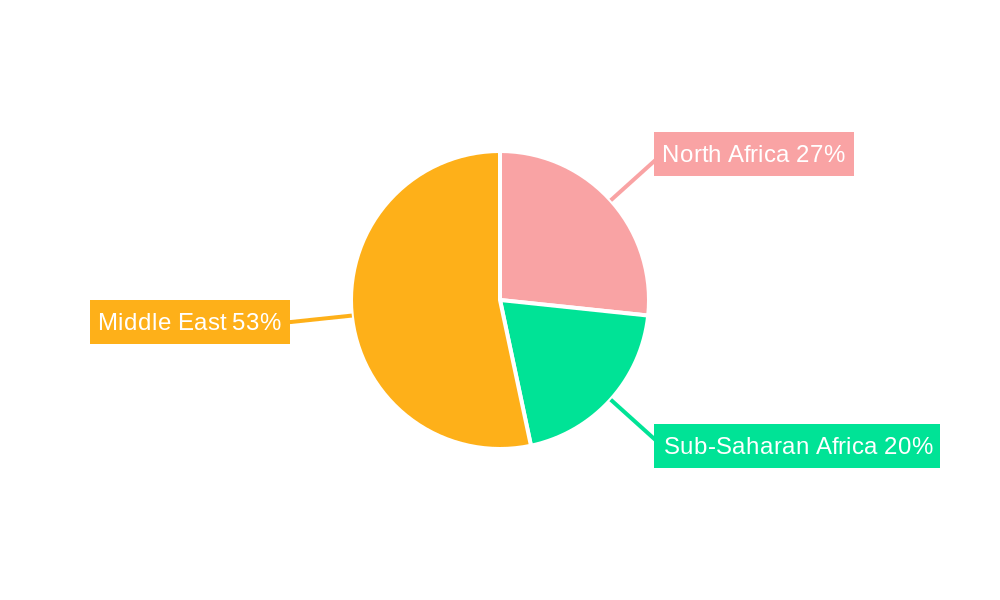

The report identifies Saudi Arabia as a leading market within the MEA region, driven by:

- Key Drivers: Saudi Arabia's substantial oil and gas reserves, large pipeline network, and ongoing investments in infrastructure development make it a dominant force in the market.

- Dominance Analysis: The country's strong economic performance, government support for infrastructure projects, and significant presence of major pipeline operators drive demand for maintenance services. This dominance is projected to continue through the forecast period. Other significant markets include the UAE, Egypt, and other gas-rich nations of the region. Specific factors vary according to the development of the respective oil and gas infrastructure.

MEA Pipeline Maintenance Market Product Developments

Recent product developments focus on enhancing pipeline inspection technologies, leveraging data analytics for predictive maintenance, and employing advanced repair techniques. These innovations minimize downtime, improve safety, and extend the lifespan of pipelines. The integration of IoT sensors and AI-powered diagnostics is rapidly transforming the industry, improving operational efficiency and predictive capabilities.

Key Drivers of MEA Pipeline Maintenance Market Growth

Several factors fuel the growth of the MEA Pipeline Maintenance Market:

- Technological Advancements: The adoption of advanced inspection and repair techniques, driven by improved sensors and data analytics, significantly enhances efficiency and reduces maintenance costs.

- Economic Growth: Continued economic growth across the MEA region drives energy demand, leading to increased pipeline infrastructure development and subsequent maintenance needs.

- Government Regulations: Stringent safety and environmental regulations necessitate higher standards of pipeline maintenance, stimulating market growth. These regulations are shaping market behavior towards safer practices and sustainable solutions.

Challenges in the MEA Pipeline Maintenance Market

The market faces several challenges:

- Regulatory Hurdles: Navigating complex regulatory environments and obtaining necessary permits can be time-consuming and costly. This impacts project timelines and budgets.

- Supply Chain Issues: The availability and cost of specialized equipment and materials can fluctuate, impacting project execution and profitability.

- Competitive Pressures: The market's competitive intensity leads to price pressures, requiring service providers to constantly enhance their efficiency and service offerings. Margins can be impacted by fierce competition.

Emerging Opportunities in MEA Pipeline Maintenance Market

The MEA Pipeline Maintenance Market presents several promising opportunities:

- Technological Breakthroughs: The continued development and adoption of advanced technologies, such as AI-powered predictive maintenance and robotic inspection systems, present significant opportunities for enhanced efficiency and cost savings.

- Strategic Partnerships: Collaborative ventures between pipeline operators and maintenance service providers can unlock synergies and lead to innovative solutions.

- Market Expansion: The growth of renewable energy infrastructure, particularly natural gas pipelines, presents expansion opportunities for service providers.

Leading Players in the MEA Pipeline Maintenance Market Sector

- ExxonMobil Corporation

- BP PLC

- Saudi Aramco

- Egyptian General Petroleum Corporation

- East Mediterranean Gas Company

- Chevron Corporation

- West African Gas Pipeline Company

- SECO

- Arabian Pipes Company

- Rezayat Group

- Vallourec SA

- EEW Group

- Frontier Pipeline services

- OLEUM Process & Pipeline Services

- STATS Group

- Halliburton Company

- T D Williamson Inc

- *List Not Exhaustive

Key Milestones in MEA Pipeline Maintenance Market Industry

- February 2022: Aramco announced a USD 15.5 Billion lease and leaseback deal for its gas pipeline network, signaling significant investment in pipeline infrastructure and consequently, future maintenance needs.

- August 2022: Seplat Petroleum Development Company commissioned the Amukpe-Escravos Pipeline, adding to the region's pipeline network and increasing the overall demand for maintenance services.

Strategic Outlook for MEA Pipeline Maintenance Market

The MEA Pipeline Maintenance Market is poised for sustained growth, driven by rising energy demand, aging pipeline infrastructure, and technological advancements. Strategic partnerships, investments in cutting-edge technologies, and a focus on sustainable practices will be crucial for success in this dynamic market. The market's future potential is substantial, with opportunities for both established players and new entrants.

MEA Pipeline Maintenance Market Segmentation

-

1. Service Type

- 1.1. Pigging

- 1.2. Flushing & Chemical Cleaning

- 1.3. Pipeline Repair & Maintenance

- 1.4. Drying

- 1.5. Others

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. UAE

- 3.2. Algeria

- 3.3. Nigeria

- 3.4. Saudi Arabia

- 3.5. Rest of Middle East & Africa

MEA Pipeline Maintenance Market Segmentation By Geography

- 1. UAE

- 2. Algeria

- 3. Nigeria

- 4. Saudi Arabia

- 5. Rest of Middle East

MEA Pipeline Maintenance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Pigging Segment to have a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pigging

- 5.1.2. Flushing & Chemical Cleaning

- 5.1.3. Pipeline Repair & Maintenance

- 5.1.4. Drying

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. UAE

- 5.3.2. Algeria

- 5.3.3. Nigeria

- 5.3.4. Saudi Arabia

- 5.3.5. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. UAE

- 5.4.2. Algeria

- 5.4.3. Nigeria

- 5.4.4. Saudi Arabia

- 5.4.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. UAE MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Pigging

- 6.1.2. Flushing & Chemical Cleaning

- 6.1.3. Pipeline Repair & Maintenance

- 6.1.4. Drying

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. UAE

- 6.3.2. Algeria

- 6.3.3. Nigeria

- 6.3.4. Saudi Arabia

- 6.3.5. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Algeria MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Pigging

- 7.1.2. Flushing & Chemical Cleaning

- 7.1.3. Pipeline Repair & Maintenance

- 7.1.4. Drying

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. UAE

- 7.3.2. Algeria

- 7.3.3. Nigeria

- 7.3.4. Saudi Arabia

- 7.3.5. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Nigeria MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Pigging

- 8.1.2. Flushing & Chemical Cleaning

- 8.1.3. Pipeline Repair & Maintenance

- 8.1.4. Drying

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. UAE

- 8.3.2. Algeria

- 8.3.3. Nigeria

- 8.3.4. Saudi Arabia

- 8.3.5. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Saudi Arabia MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Pigging

- 9.1.2. Flushing & Chemical Cleaning

- 9.1.3. Pipeline Repair & Maintenance

- 9.1.4. Drying

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. UAE

- 9.3.2. Algeria

- 9.3.3. Nigeria

- 9.3.4. Saudi Arabia

- 9.3.5. Rest of Middle East & Africa

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Rest of Middle East MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Pigging

- 10.1.2. Flushing & Chemical Cleaning

- 10.1.3. Pipeline Repair & Maintenance

- 10.1.4. Drying

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.2.1. Onshore

- 10.2.2. Offshore

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. UAE

- 10.3.2. Algeria

- 10.3.3. Nigeria

- 10.3.4. Saudi Arabia

- 10.3.5. Rest of Middle East & Africa

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pipeline Operators

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 1 ExxonMobil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 2 BP PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3 Saudi Aramco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 4 Egyptian General Petroleum Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 5 East Mediterranean Gas Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 6 Chevron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 7 West African Gas Pipeline Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 8 SECO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pipeline Maintenance Services Providers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 1 Arabian Pipes Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 3 Rezayat Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 4 Vallourec SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 5 EEW Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 6 Frontier Pipeline services

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 7 OLEUM Process & Pipeline Services

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 8 STATS Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 9 Halliburton Company

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 10 T D Williamson Inc*List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Pipeline Operators

List of Figures

- Figure 1: Global MEA Pipeline Maintenance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2024 & 2032

- Figure 3: UAE MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 4: UAE MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 5: UAE MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 6: UAE MEA Pipeline Maintenance Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: UAE MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: UAE MEA Pipeline Maintenance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: UAE MEA Pipeline Maintenance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Algeria MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2024 & 2032

- Figure 11: Algeria MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 12: Algeria MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 13: Algeria MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 14: Algeria MEA Pipeline Maintenance Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: Algeria MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Algeria MEA Pipeline Maintenance Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Algeria MEA Pipeline Maintenance Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Nigeria MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2024 & 2032

- Figure 19: Nigeria MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 20: Nigeria MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 21: Nigeria MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 22: Nigeria MEA Pipeline Maintenance Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Nigeria MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Nigeria MEA Pipeline Maintenance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Nigeria MEA Pipeline Maintenance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Saudi Arabia MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2024 & 2032

- Figure 27: Saudi Arabia MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 28: Saudi Arabia MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 29: Saudi Arabia MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 30: Saudi Arabia MEA Pipeline Maintenance Market Revenue (Million), by Geography 2024 & 2032

- Figure 31: Saudi Arabia MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 32: Saudi Arabia MEA Pipeline Maintenance Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Saudi Arabia MEA Pipeline Maintenance Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of Middle East MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2024 & 2032

- Figure 35: Rest of Middle East MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 36: Rest of Middle East MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 37: Rest of Middle East MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 38: Rest of Middle East MEA Pipeline Maintenance Market Revenue (Million), by Geography 2024 & 2032

- Figure 39: Rest of Middle East MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 40: Rest of Middle East MEA Pipeline Maintenance Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of Middle East MEA Pipeline Maintenance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 7: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 8: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 12: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 15: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 16: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 19: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 20: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 23: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 24: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Pipeline Maintenance Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the MEA Pipeline Maintenance Market?

Key companies in the market include Pipeline Operators, 1 ExxonMobil Corporation, 2 BP PLC, 3 Saudi Aramco, 4 Egyptian General Petroleum Corporation, 5 East Mediterranean Gas Company, 6 Chevron Corporation, 7 West African Gas Pipeline Company, 8 SECO, Pipeline Maintenance Services Providers, 1 Arabian Pipes Company, 3 Rezayat Group, 4 Vallourec SA, 5 EEW Group, 6 Frontier Pipeline services, 7 OLEUM Process & Pipeline Services, 8 STATS Group, 9 Halliburton Company, 10 T D Williamson Inc*List Not Exhaustive.

3. What are the main segments of the MEA Pipeline Maintenance Market?

The market segments include Service Type, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Pigging Segment to have a Significant Share in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022: Seplat Petroleum Development Company began commercial injection of crude oil through the new Amukpe-Escravos Pipeline. The 67-kilo-meter, mostly underground pipeline is expected to provide a more reliable and secure export route for liquids from Seplat Energy's major assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Pipeline Maintenance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Pipeline Maintenance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Pipeline Maintenance Market?

To stay informed about further developments, trends, and reports in the MEA Pipeline Maintenance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence