Key Insights

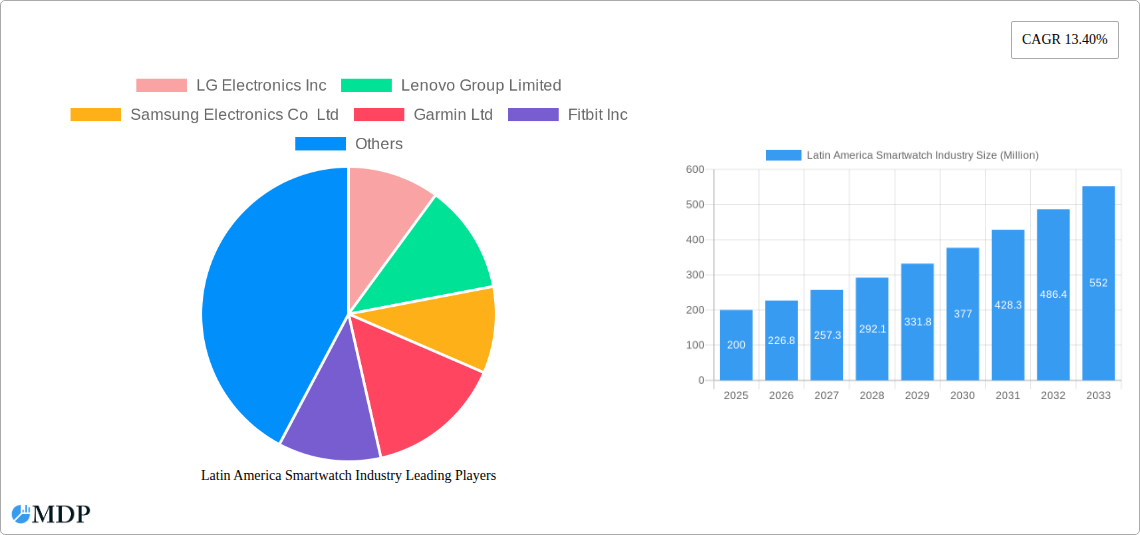

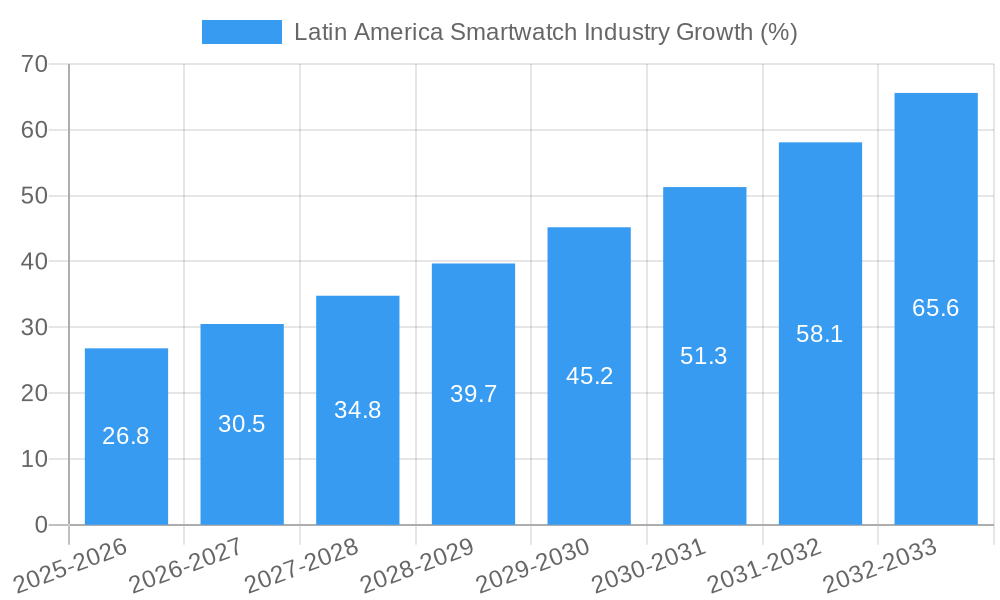

The Latin American smartwatch market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.40% from 2025 to 2033. This surge is driven by several key factors. Increasing disposable incomes across the region, particularly in Brazil and Argentina, are fueling consumer demand for wearable technology. The rising adoption of smartphones and mobile internet connectivity is creating a fertile ground for smartwatch penetration. Furthermore, the increasing focus on health and fitness, combined with the availability of sophisticated health tracking features in smartwatches, is a significant driver. The market is segmented by operating system (WatchOS, Android/Wear OS, others), display type (AMOLED, PMOLED, TFT LCD), and application (personal assistance, medical, sports, others). Brazil and Argentina currently dominate the market, but growth potential exists across other Latin American countries like Mexico, Peru, and Chile as affordability improves and awareness increases. While challenges remain, such as price sensitivity in certain market segments and the competition from established players like Apple, Samsung, and Fitbit, the overall outlook remains positive.

The competitive landscape is characterized by a mix of global giants and regional players. Companies like Apple, Samsung, and Fitbit are leveraging their brand recognition and established distribution networks to capture significant market share. However, regional players are adapting to local preferences and offering competitive pricing strategies. The market's growth trajectory is likely to be influenced by technological advancements, including improved battery life, enhanced health monitoring capabilities, and the integration of innovative features like contactless payments. The development of more affordable smartwatches catering to price-sensitive consumers will also play a crucial role in driving market expansion throughout the forecast period. A continued focus on marketing and customer education will be essential for sustained growth in the Latin American smartwatch market.

Latin America Smartwatch Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America smartwatch industry, covering market dynamics, leading players, technological advancements, and future growth projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders seeking actionable insights. The report leverages detailed data and analysis to provide a clear understanding of the market's current state and future trajectory. Expect detailed breakdowns by operating system (Watch OS, Android/Wear OS, Other), display type (AMOLED, PMOLED, TFT LCD), application (Personal Assistance, Medical, Sports, Other), and country (Brazil, Argentina, Rest of Latin America). The report projects a market size of xx Million by 2033, with a CAGR of xx%.

Latin America Smartwatch Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, innovation drivers, regulatory influences, and market trends impacting the Latin American smartwatch market. We delve into market concentration, examining the market share held by key players such as LG Electronics Inc, Lenovo Group Limited, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit Inc, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Polar Electro OY, and Sony Corporation.

- Market Concentration: The Latin American smartwatch market exhibits a moderately concentrated structure, with the top 5 players commanding approximately xx% of the market share in 2024.

- Innovation Drivers: Advancements in health tracking capabilities, longer battery life, improved design aesthetics, and integration with smart home ecosystems are driving innovation.

- Regulatory Frameworks: Regulatory compliance concerning data privacy and consumer safety plays a significant role in shaping market dynamics.

- Product Substitutes: Fitness trackers and basic smartbands pose competitive threats to the smartwatch market.

- End-User Trends: Growing consumer interest in health and wellness, combined with increasing smartphone penetration, fuels market demand.

- M&A Activities: The number of M&A deals in the Latin American smartwatch industry averaged xx per year during the historical period (2019-2024).

Latin America Smartwatch Industry Industry Trends & Analysis

This section provides a detailed overview of market growth drivers, technological advancements, consumer preferences, and competitive dynamics within the Latin American smartwatch market. The report analyzes factors influencing market growth, including the rising adoption of smart wearables, increasing disposable incomes, the growth of e-commerce, and the expansion of mobile network infrastructure. Technological innovations such as improved sensor technology, longer battery life, and enhanced user interfaces also contribute significantly. Consumer preferences for sleek designs, advanced health tracking features, and seamless integration with smartphones are impacting product development and market share. The competitive landscape is characterized by intense competition among global and regional players. Key metrics such as CAGR and market penetration rates are analyzed in detail. The market is expected to experience substantial growth, driven by factors such as increasing smartphone penetration, rising consumer disposable incomes, and the growing popularity of fitness and health tracking. A deeper understanding of these trends is crucial for businesses and investors to gain a competitive edge in this dynamic market.

Leading Markets & Segments in Latin America Smartwatch Industry

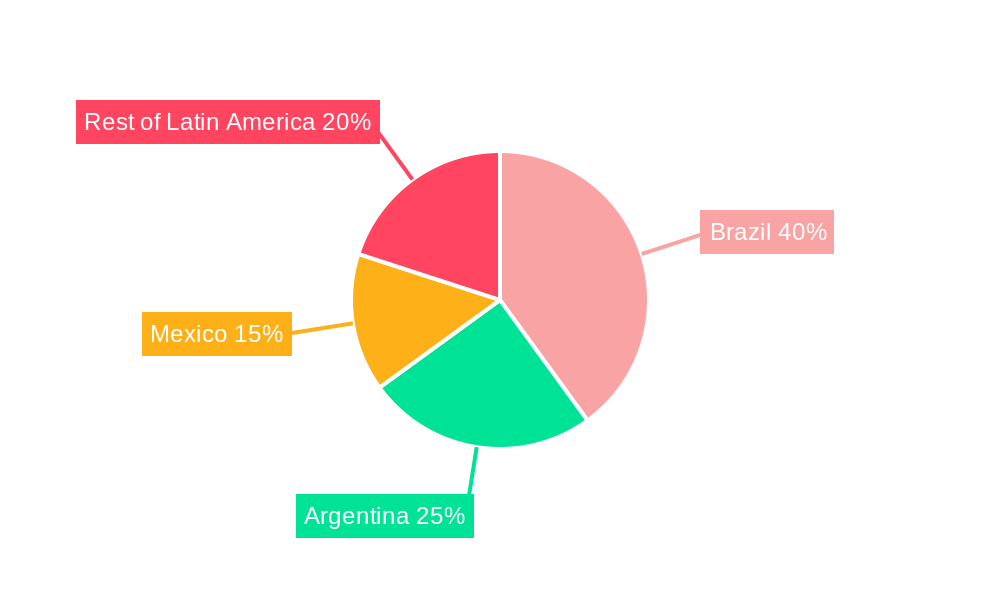

This section identifies the dominant regions, countries, and segments within the Latin American smartwatch market. We highlight key drivers for market dominance, including economic policies, infrastructure development, and consumer preferences.

Dominant Regions/Countries:

- Brazil: Brazil is expected to remain the largest market in Latin America due to its large population, growing middle class, and increasing smartphone penetration.

- Argentina: Argentina holds significant potential due to its relatively high tech adoption rates.

- Rest of Latin America: Markets in Mexico, Colombia, and Chile are exhibiting strong growth.

Dominant Segments:

- Operating Systems: Android/Wear OS holds the largest market share due to its wider device compatibility.

- Display Type: AMOLED displays are becoming increasingly popular due to their superior visual quality.

- Application: Fitness and health tracking applications are a key driver of market growth.

Latin America Smartwatch Industry Product Developments

Recent years have witnessed significant product innovations in the Latin American smartwatch market, including advancements in health monitoring, longer battery life, and improved design aesthetics. The introduction of new operating systems, like Wear OS 3, has enhanced user experience and app compatibility. This convergence of technology and design is creating highly competitive products tailored to the needs and preferences of consumers in Latin America. Companies are focusing on creating smartwatches with superior health tracking capabilities to cater to the growing health-conscious population.

Key Drivers of Latin America Smartwatch Industry Growth

Several key factors are driving growth in the Latin American smartwatch industry:

- Technological Advancements: Improvements in battery life, sensor technology, and display quality are making smartwatches more attractive to consumers.

- Economic Growth: Rising disposable incomes in several Latin American countries are increasing consumer spending on technology products.

- Favorable Regulatory Environment: Supportive government policies towards technology adoption and development facilitate market expansion.

Challenges in the Latin America Smartwatch Industry Market

Despite the growth potential, the Latin American smartwatch market faces challenges:

- High Import Tariffs: High import duties on imported smartwatches can increase prices and limit market accessibility.

- Supply Chain Disruptions: Global supply chain issues can affect the availability and affordability of smartwatches.

- Intense Competition: Competition among established brands and new entrants puts pressure on profit margins.

Emerging Opportunities in Latin America Smartwatch Industry

The Latin American smartwatch market presents several emerging opportunities:

- Expansion into Underserved Markets: There's significant potential for market penetration in rural areas and among lower-income segments.

- Development of Localized Applications: Creating region-specific applications tailored to local consumer needs can boost market share.

- Strategic Partnerships: Collaborations between smartwatch manufacturers and local telecom operators can expand market reach.

Leading Players in the Latin America Smartwatch Industry Sector

- LG Electronics Inc

- Lenovo Group Limited

- Samsung Electronics Co Ltd

- Garmin Ltd

- Fitbit Inc

- Huawei Technologies Co Ltd

- Fossil Group Inc

- Apple Inc

- Polar Electro OY

- Sony Corporation

Key Milestones in Latin America Smartwatch Industry Industry

- January 2022: Fossil and Razer collaborated to launch a smartwatch.

- May 2022: Google debuted its first smartwatch, the Google Pixel Watch.

- May 2022: Huawei launched several new smartwatches and wearables.

- July 2022: Qualcomm announced the Snapdragon W5+ Gen 1 and Snapdragon W5 Gen 1 platforms.

- August 2022: Samsung unveiled the Galaxy Watch5 and Galaxy Watch5 Pro.

Strategic Outlook for Latin America Smartwatch Industry Market

The Latin American smartwatch market shows immense growth potential driven by increasing smartphone penetration, rising disposable incomes, and improving infrastructure. Strategic partnerships with local distributors, development of localized applications, and expansion into underserved markets will be critical for success. Companies focusing on affordability, superior health-tracking features, and seamless integration with local ecosystems are well-positioned to capture significant market share in the coming years.

Latin America Smartwatch Industry Segmentation

-

1. Operating Systems

- 1.1. Watch OS

- 1.2. Android/Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

Latin America Smartwatch Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Smartwatch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices and Limited Use of Features

- 3.3.2 augmented With Security Risks

- 3.4. Market Trends

- 3.4.1. Medical and Fitness to Account for a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 5.1.1. Watch OS

- 5.1.2. Android/Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6. Brazil Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 LG Electronics Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lenovo Group Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung Electronics Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Garmin Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fitbit Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Huawei Technologies Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fossil Group Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Apple Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Polar Electro OY

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sony Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 LG Electronics Inc

List of Figures

- Figure 1: Latin America Smartwatch Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Smartwatch Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Smartwatch Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Smartwatch Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Latin America Smartwatch Industry Revenue Million Forecast, by Operating Systems 2019 & 2032

- Table 4: Latin America Smartwatch Industry Volume K Unit Forecast, by Operating Systems 2019 & 2032

- Table 5: Latin America Smartwatch Industry Revenue Million Forecast, by Display Type 2019 & 2032

- Table 6: Latin America Smartwatch Industry Volume K Unit Forecast, by Display Type 2019 & 2032

- Table 7: Latin America Smartwatch Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Latin America Smartwatch Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Latin America Smartwatch Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin America Smartwatch Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Latin America Smartwatch Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Latin America Smartwatch Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Brazil Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Argentina Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Peru Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Chile Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Chile Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Latin America Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Latin America Smartwatch Industry Revenue Million Forecast, by Operating Systems 2019 & 2032

- Table 26: Latin America Smartwatch Industry Volume K Unit Forecast, by Operating Systems 2019 & 2032

- Table 27: Latin America Smartwatch Industry Revenue Million Forecast, by Display Type 2019 & 2032

- Table 28: Latin America Smartwatch Industry Volume K Unit Forecast, by Display Type 2019 & 2032

- Table 29: Latin America Smartwatch Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Latin America Smartwatch Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 31: Latin America Smartwatch Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Latin America Smartwatch Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Brazil Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Brazil Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Argentina Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Chile Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Chile Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Colombia Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Mexico Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Peru Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Peru Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Venezuela Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Venezuela Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Ecuador Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ecuador Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Bolivia Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Bolivia Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Paraguay Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Paraguay Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Smartwatch Industry?

The projected CAGR is approximately 13.40%.

2. Which companies are prominent players in the Latin America Smartwatch Industry?

Key companies in the market include LG Electronics Inc, Lenovo Group Limited, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit Inc, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Polar Electro OY, Sony Corporation.

3. What are the main segments of the Latin America Smartwatch Industry?

The market segments include Operating Systems, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer.

6. What are the notable trends driving market growth?

Medical and Fitness to Account for a Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices and Limited Use of Features. augmented With Security Risks.

8. Can you provide examples of recent developments in the market?

August 2022 : Samsung Electronics Co., Ltd. unveiled the Galaxy Watch5 and Galaxy Watch5 Pro, which will help shape fitness and wellness behaviors through intelligent insights, sophisticated features, and significantly more robust capabilities. The Galaxy Watch5 improves aspects that users depend on daily, while the Galaxy Watch5 Pro, the new introduction to the Galaxy Watch series, is Samsung's most robust and feature-packed wristwatch ever.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Smartwatch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Smartwatch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Smartwatch Industry?

To stay informed about further developments, trends, and reports in the Latin America Smartwatch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence