Key Insights

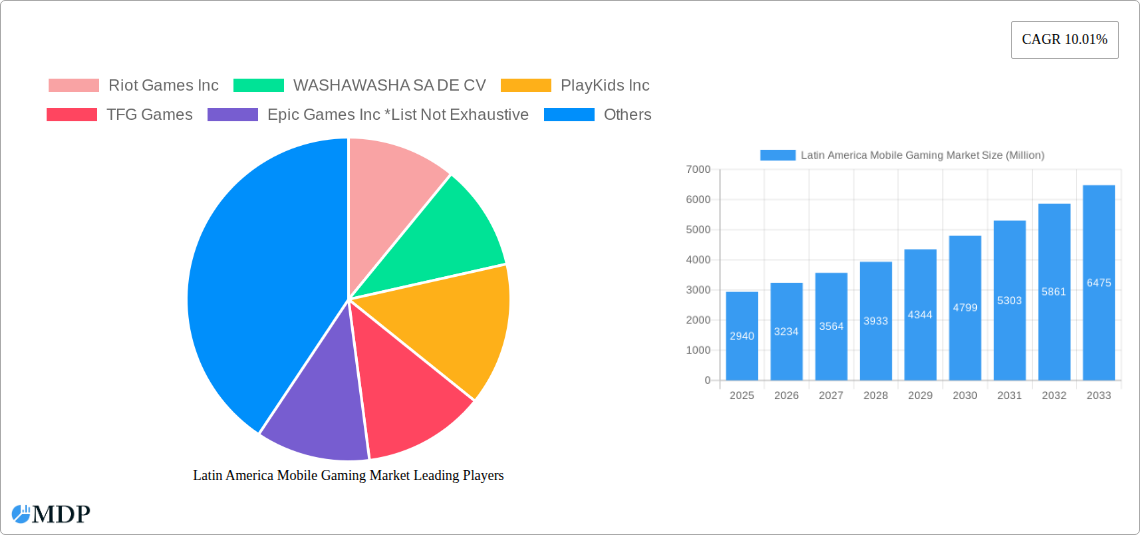

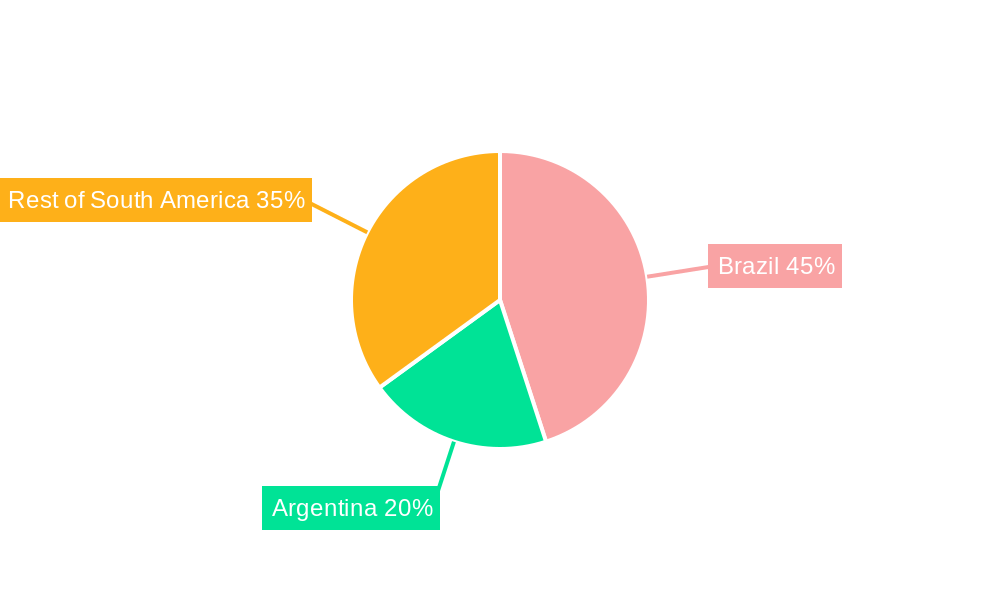

The Latin American mobile gaming market, valued at $2.94 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.01% from 2025 to 2033. This expansion is driven by several factors. Increasing smartphone penetration, particularly in Brazil and Argentina, fuels the accessibility of mobile games. The rising popularity of casual and hyper-casual games, coupled with the growing engagement with esports and competitive gaming, further contributes to market growth. Moreover, localized game development and marketing strategies focusing on culturally relevant content cater to the diverse preferences within the region. The diverse segmentations, including Android and iOS platforms, Action, Adventure, Strategy, and Sports genres, and age groups spanning children, teenagers, and adults, highlight the market's breadth and potential for further diversification. The presence of both international giants like Riot Games and Activision, and regional developers like WASHAWASHA SA DE CV and PlayKids Inc, demonstrates a robust and competitive ecosystem. The market's success also relies on addressing challenges such as inconsistent internet access in certain areas and maintaining user engagement in the face of increasing competition.

This dynamic market is expected to see continued growth driven by the expanding middle class with increasing disposable income, leading to higher spending on entertainment. The influx of investment into mobile game development and the rising adoption of in-app purchases and subscriptions are also key contributors. Future growth strategies for companies will likely focus on personalized in-game experiences, innovative monetization models, and a deeper understanding of regional preferences to further tap into the market's potential. The continued expansion into less-penetrated regions within South America beyond Brazil and Argentina will also be crucial for sustaining high growth rates. Competition will remain fierce, necessitating continuous innovation and adaptation to changing user behavior and technological advancements.

Latin America Mobile Gaming Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Latin America mobile gaming market, offering valuable insights for industry stakeholders, investors, and businesses seeking to capitalize on this rapidly expanding sector. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, trends, leading players, and future growth potential. The study period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033) provide a complete historical and future perspective. Expected market value for 2025 is predicted at xx Million.

Latin America Mobile Gaming Market Dynamics & Concentration

The Latin American mobile gaming market exhibits a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderate, with several key players holding significant shares, but also with ample room for smaller companies to flourish. Innovation, driven by technological advancements and evolving consumer preferences, plays a crucial role. Regulatory frameworks vary across the region, creating both opportunities and challenges. The prevalence of mobile devices and increasing internet penetration are strong positive factors. Substitutes for mobile gaming are limited, with other forms of entertainment facing competition from mobile gaming’s convenience and accessibility. End-user trends show a preference for diverse gaming genres, with a strong emphasis on social interaction and multiplayer experiences.

- Market Share: While precise market share data for individual companies is proprietary information, it can be concluded that the market is not dominated by a small number of players. The market is relatively fragmented.

- M&A Activities: The number of mergers and acquisitions (M&A) in the Latin American mobile gaming sector has been steadily increasing in recent years. xx M&A deals were recorded in 2024, indicating a trend of consolidation and expansion among industry players.

Latin America Mobile Gaming Market Industry Trends & Analysis

The Latin American mobile gaming market is experiencing robust growth, driven by factors such as rising smartphone penetration, increasing internet access, and a growing young population. Technological advancements, including the rise of 5G technology and improvements in mobile hardware, are enhancing the gaming experience, attracting further participation. The market's CAGR during the forecast period (2025-2033) is projected at xx%. This robust growth is fueled by evolving consumer preferences towards casual games, esports, and mobile-first titles. Competitive dynamics are intense, with both established international players and local studios vying for market share. Market penetration, currently at xx%, is expected to reach xx% by 2033. The shift towards subscription models and in-app purchases adds further dynamism to the market.

Leading Markets & Segments in Latin America Mobile Gaming Market

Brazil and Mexico stand out as the dominant markets in Latin America, accounting for a combined market share of xx%. This dominance is attributable to a larger population, higher smartphone penetration, and robust digital economies. The Android platform holds a significant market share compared to iOS due to affordability and availability, with Action and Adventure genres proving particularly popular across all age groups, reflecting diverse preferences in gameplay.

Key Drivers for Brazil & Mexico:

- High smartphone penetration.

- Increasing internet access.

- Strong digital economies.

- Favorable demographics.

Segment Dominance:

- Platform: Android significantly dominates.

- Genre: Action and Adventure genres lead in popularity, followed by Strategy and Sports.

- Age Group: Teenagers and Adults are the largest gaming segments.

Latin America Mobile Gaming Market Product Developments

The Latin American mobile gaming market is witnessing rapid product innovation, with a focus on enhanced graphics, immersive gameplay, and social features. Developers are leveraging advanced technologies like augmented reality (AR) and virtual reality (VR) to create more engaging gaming experiences, targeting specific market niches. The focus is on creating games that are easily accessible to a broader audience, especially considering the growing demand for casual games.

Key Drivers of Latin America Mobile Gaming Market Growth

Several factors contribute to the growth of the Latin American mobile gaming market. Technological advancements in mobile hardware and software constantly improve user experience and allow for more sophisticated game design. The region's expanding digital economy, including improved internet infrastructure and greater mobile phone affordability, has fostered gaming growth. Favorable regulatory environments in some countries, supporting and encouraging the growth of the gaming industry, further stimulate the market.

Challenges in the Latin America Mobile Gaming Market

Challenges include inconsistent regulatory frameworks across the region, creating inconsistencies and difficulties for companies operating across borders. Issues with internet access and infrastructure, especially in more remote areas, restrict the market's expansion. Strong competition from both domestic and international companies leads to pricing pressures and necessitates continuous innovation to retain market share. Piracy and unauthorized distribution of games also represent significant challenges.

Emerging Opportunities in Latin America Mobile Gaming Market

The increasing popularity of esports, the potential for growth in cloud gaming, and the expansion into emerging markets outside Brazil and Mexico present significant opportunities. Strategic partnerships with telecommunications companies and technology firms can enhance market access and distribution. Furthermore, the development of hyper-casual games, localized content, and mobile-first games tailored to the region's unique preferences continues to offer huge potential for growth.

Leading Players in the Latin America Mobile Gaming Market Sector

- Riot Games Inc

- WASHAWASHA SA DE CV

- PlayKids Inc

- TFG Games

- Epic Games Inc

- Dynamic Games (Dynamic Games Entretenimento)

- Konami Holdings Corporation

- Media Design and Creative Entertainment S A de C V (Ennui Studio)

- AmnesiaGames Inc

- Activision Publishing Inc

- Abstract Digital Works

- HyperBeard Inc

- Focka Games

- Tapps Games

Key Milestones in Latin America Mobile Gaming Market Industry

- June 2022: New regulations for online casino operators in Brazil mandate a USD 4.4 Million license fee, impacting market entry and operations.

- November 2022: Inclusion of Hipodromo Argentino de Palermo and Casino Buenos Aires in online gaming proposals expands the market in Argentina. The Buenos Aires City Lottery's approval of Codere's Online Gaming Platform Implementation Program signals further growth.

Strategic Outlook for Latin America Mobile Gaming Market

The Latin American mobile gaming market is poised for continued expansion. Strategic investments in technology, localization, and user engagement will be crucial for success. Partnerships with telecom providers and expansion into underserved markets present significant opportunities. The focus should be on creating engaging, accessible games tailored to the diverse preferences of Latin American gamers, along with adopting robust anti-piracy measures.

Latin America Mobile Gaming Market Segmentation

-

1. Geography

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Columbia

- 1.5. Rest of Latin America(Peru, Bolivia etc.)

Latin America Mobile Gaming Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Chile

- 4. Columbia

- 5. Rest of Latin America

Latin America Mobile Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Mobile Gaming Players and In-game Purchases

- 3.3. Market Restrains

- 3.3.1 Unstable political landscape

- 3.3.2 internet infrastructure

- 3.3.3 local payment solutions and also alternative payments etc

- 3.4. Market Trends

- 3.4.1. Growing Number of Smartphone users will drive the demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Brazil

- 5.1.2. Argentina

- 5.1.3. Chile

- 5.1.4. Columbia

- 5.1.5. Rest of Latin America(Peru, Bolivia etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Chile

- 5.2.4. Columbia

- 5.2.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Brazil Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Brazil

- 6.1.2. Argentina

- 6.1.3. Chile

- 6.1.4. Columbia

- 6.1.5. Rest of Latin America(Peru, Bolivia etc.)

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Argentina Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Brazil

- 7.1.2. Argentina

- 7.1.3. Chile

- 7.1.4. Columbia

- 7.1.5. Rest of Latin America(Peru, Bolivia etc.)

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Chile Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Brazil

- 8.1.2. Argentina

- 8.1.3. Chile

- 8.1.4. Columbia

- 8.1.5. Rest of Latin America(Peru, Bolivia etc.)

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Columbia Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Brazil

- 9.1.2. Argentina

- 9.1.3. Chile

- 9.1.4. Columbia

- 9.1.5. Rest of Latin America(Peru, Bolivia etc.)

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Rest of Latin America Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Brazil

- 10.1.2. Argentina

- 10.1.3. Chile

- 10.1.4. Columbia

- 10.1.5. Rest of Latin America(Peru, Bolivia etc.)

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Brazil Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of South America Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Riot Games Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 WASHAWASHA SA DE CV

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 PlayKids Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 TFG Games

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Epic Games Inc *List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Dynamic Games (Dynamic Games Entretenimento)

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Konami Holdings Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Media Design and Creative Entertainment S A de C V (Ennui Studio)

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 AmnesiaGames Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Activision Publishing Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Abstract Digital Works

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 HyperBeard Inc

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Focka Games

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Tapps Games

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Riot Games Inc

List of Figures

- Figure 1: Latin America Mobile Gaming Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Mobile Gaming Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Mobile Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Mobile Gaming Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 3: Latin America Mobile Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Latin America Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Brazil Latin America Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Argentina Latin America Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of South America Latin America Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Latin America Mobile Gaming Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Latin America Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Latin America Mobile Gaming Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: Latin America Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Latin America Mobile Gaming Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Latin America Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Latin America Mobile Gaming Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Latin America Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Latin America Mobile Gaming Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Latin America Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Mobile Gaming Market?

The projected CAGR is approximately 10.01%.

2. Which companies are prominent players in the Latin America Mobile Gaming Market?

Key companies in the market include Riot Games Inc, WASHAWASHA SA DE CV, PlayKids Inc, TFG Games, Epic Games Inc *List Not Exhaustive, Dynamic Games (Dynamic Games Entretenimento), Konami Holdings Corporation, Media Design and Creative Entertainment S A de C V (Ennui Studio), AmnesiaGames Inc, Activision Publishing Inc, Abstract Digital Works, HyperBeard Inc, Focka Games, Tapps Games.

3. What are the main segments of the Latin America Mobile Gaming Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Mobile Gaming Players and In-game Purchases.

6. What are the notable trends driving market growth?

Growing Number of Smartphone users will drive the demand in the Market.

7. Are there any restraints impacting market growth?

Unstable political landscape. internet infrastructure. local payment solutions and also alternative payments etc.

8. Can you provide examples of recent developments in the market?

November 2022: According to Yonoget S.A gaming report, Hipodromo Argentino de Palermo and Casino Buenos Aires, two of the city of Buenos Aires's entertainment hotspots, are now included in the online proposal. The Buenos Aires City Lottery (LOTBA in Spanish), which also approved Boldt in February 2022 and Grupo Slots and Gaming Innovation Group (GIG) in March 2022, has accepted the Online Gaming Platform Implementation Program offered by Codere, which plans to begin operations soon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Mobile Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Mobile Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Mobile Gaming Market?

To stay informed about further developments, trends, and reports in the Latin America Mobile Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence