Key Insights

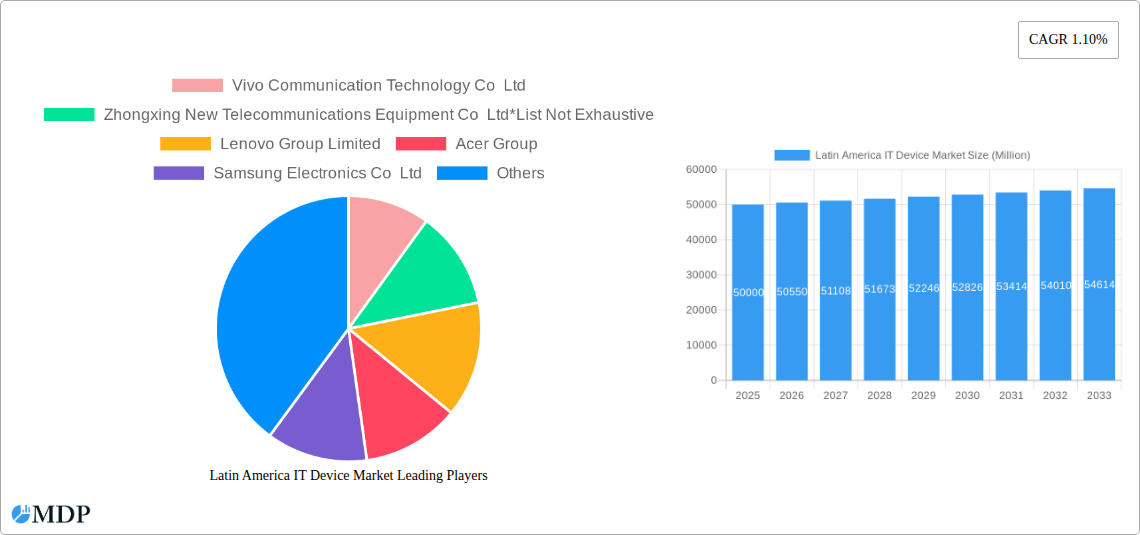

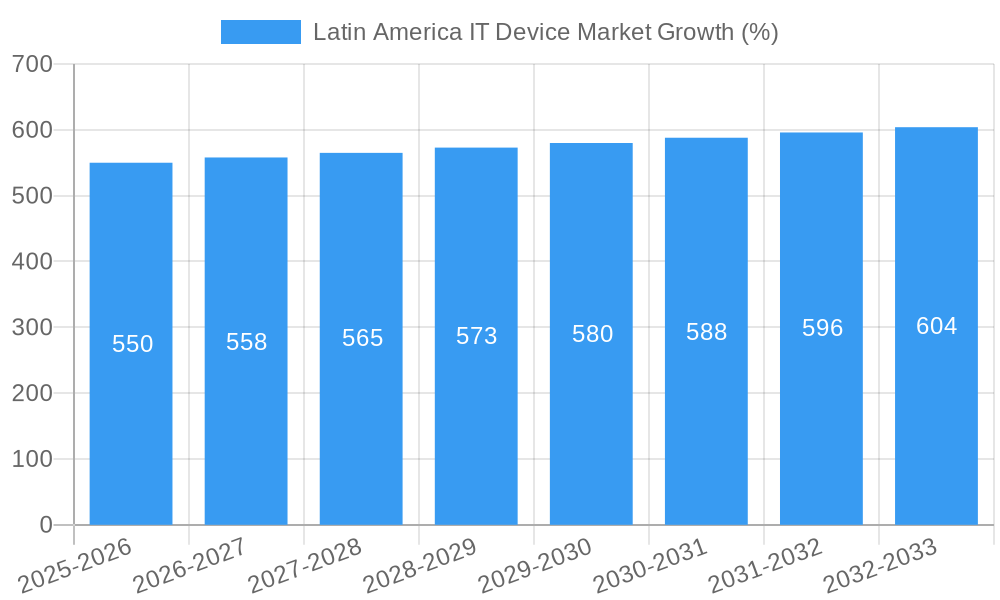

The Latin American IT device market, encompassing tablets, phones, and PCs, is experiencing steady growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 1.10% from 2025 to 2033. This relatively moderate growth reflects a mature market with significant penetration already achieved in major economies like Brazil, Mexico, and Argentina. While the overall market size isn't explicitly stated, considering similar emerging markets and the presence of major players like Samsung, Apple, and Xiaomi, we can reasonably infer a substantial market value (potentially in the tens of billions of USD in 2025) driven by increasing smartphone adoption, particularly in the lower and middle-income segments. Key growth drivers include rising disposable incomes, expanding internet penetration, and the increasing demand for remote work and e-learning solutions. However, economic volatility in certain Latin American countries and fluctuating currency exchange rates pose significant restraints. Furthermore, the competitive landscape is highly dynamic, with established international brands facing competition from local players and budget-friendly Chinese manufacturers. The segment breakdown shows a significant share from smartphones, likely exceeding 50%, followed by PCs and then tablets. This distribution is influenced by affordability and the prevalence of mobile-first internet access.

The forecast for the 2025-2033 period indicates continued growth, albeit at a gradual pace. Market expansion will likely be concentrated in less saturated regions within Latin America, and growth will depend significantly on economic stability and improvements in digital infrastructure. Technological advancements such as 5G adoption and the growing demand for advanced computing power for both personal and business use will likely stimulate further growth, though the pace will be influenced by factors such as economic conditions and consumer purchasing power. Companies are expected to focus on strategies such as localization, affordability, and value-added services to compete effectively within this complex and multifaceted market.

Latin America IT Device Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America IT device market, covering the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. This crucial resource is designed for industry stakeholders, investors, and businesses seeking actionable insights into this dynamic and rapidly evolving market. The report examines market dynamics, leading players, technological trends, and future growth opportunities across various segments including PCs, tablets, and phones. Expect detailed analysis supported by robust data and forecasts, allowing for informed strategic decision-making. Discover the key drivers and challenges impacting market growth, along with projected market sizes in Millions.

Latin America IT Device Market Market Dynamics & Concentration

The Latin America IT device market exhibits a moderately concentrated landscape, with a handful of global giants holding significant market share. However, the presence of several strong regional players and the rapid rise of new entrants are creating a more competitive environment. Market concentration is further influenced by regulatory frameworks varying across Latin American countries, impacting device import and distribution. Product substitution, primarily driven by the increasing affordability and functionality of smartphones, continues to reshape the market. End-user trends, such as the growing preference for mobile computing and cloud-based services, are impacting demand for specific device types. Mergers and acquisitions (M&A) activity in the region has been moderate but is expected to increase as larger players seek to expand their market reach and consolidate their positions.

- Market Share: Top 5 players hold approximately xx% of the market share in 2024, with this expected to slightly decrease to xx% by 2033 due to increased competition.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024. This is projected to increase to xx deals between 2025 and 2033.

- Innovation Drivers: Advancements in processing power, battery technology, and connectivity are driving innovation across various segments.

- Regulatory Frameworks: Varying import duties and regulations across countries affect market access and pricing.

Latin America IT Device Market Industry Trends & Analysis

The Latin America IT device market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing internet penetration, and government initiatives promoting digital inclusion. The market is witnessing a significant shift towards mobile devices, particularly smartphones, due to their affordability and convenience. The CAGR for the overall market is projected to be xx% from 2025 to 2033, with a market penetration rate projected to reach xx% by 2033. Technological disruptions, including the rise of 5G technology and the increasing adoption of cloud computing, are reshaping the industry landscape. Consumer preferences are shifting towards premium devices with enhanced features, while the competitive dynamics are marked by increased price wars and intense innovation in features and design.

Leading Markets & Segments in Latin America IT Device Market

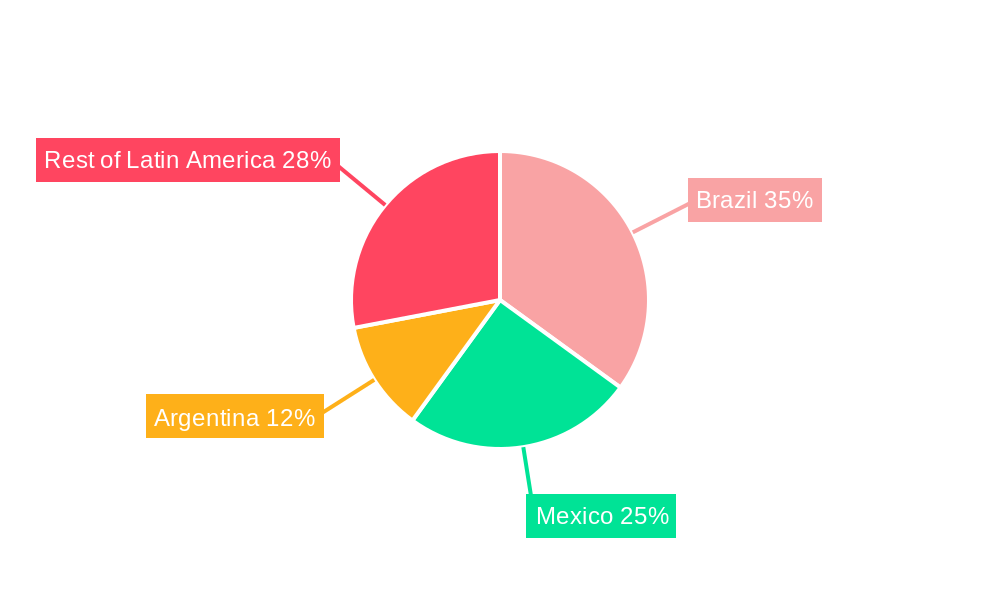

Brazil and Mexico dominate the Latin America IT device market, accounting for a combined xx% of total market value in 2024. This dominance is primarily attributed to their larger populations, higher purchasing power, and relatively developed infrastructure. Other key markets include Colombia, Argentina, and Chile.

Dominant Segment: Smartphones constitute the largest segment in terms of volume, while PCs and tablets remain significant but with slower growth.

Key Drivers for Brazil and Mexico:

- Strong economic growth (relatively to other countries in Latin America)

- Robust telecommunications infrastructure

- Government initiatives supporting digital transformation

- Growing middle class with increased purchasing power

The dominance of Brazil and Mexico is expected to continue throughout the forecast period, although other countries are expected to exhibit faster growth rates. This growth will be fueled by increasing smartphone adoption in these markets.

Latin America IT Device Market Product Developments

The market is witnessing continuous product innovations, with a focus on improved processing power, enhanced battery life, advanced camera technology, and better connectivity features. The increasing adoption of foldable devices and the integration of Artificial Intelligence (AI) features are further shaping product development. Competition is fierce, with companies vying for market share through improved features, design, and pricing strategies.

Key Drivers of Latin America IT Device Market Growth

Several factors contribute to the market's expansion:

- Rising Disposable Incomes: A growing middle class with increasing disposable income fuels demand for IT devices.

- Expanding Internet Penetration: Increased internet access drives the demand for mobile devices and associated services.

- Government Initiatives: Policies promoting digital inclusion and infrastructure development boost market growth.

- Technological Advancements: Innovations in processing power, battery technology, and connectivity enhance device features and appeal.

Challenges in the Latin America IT Device Market Market

The market faces challenges including:

- Economic Volatility: Economic instability in some Latin American countries creates uncertainties in consumer spending.

- Supply Chain Disruptions: Global supply chain issues can impact device availability and pricing.

- Competitive Pressures: Intense competition among manufacturers and distributors can lead to price wars, affecting profit margins.

- Regulatory Hurdles: Differing regulations and import duties across countries can complicate market access and increase costs. These factors contribute to xx Million in lost revenue annually.

Emerging Opportunities in Latin America IT Device Market

The market offers significant long-term growth potential fueled by several factors:

- 5G Deployment: The rollout of 5G networks will create opportunities for new devices and applications.

- Growth of E-commerce: The expansion of e-commerce increases demand for mobile devices for online shopping.

- Strategic Partnerships: Collaborations between device manufacturers and telecom operators can drive market penetration.

- Market Expansion: Untapped potential in smaller Latin American countries presents opportunities for growth.

Leading Players in the Latin America IT Device Market Sector

- Vivo Communication Technology Co Ltd

- Zhongxing New Telecommunications Equipment Co Ltd

- Lenovo Group Limited

- Acer Group

- Samsung Electronics Co Ltd

- Microsoft Corporation

- HP Inc

- Xiaomi Corporation

- Huawei Technologies Co Ltd

- Motorola Inc

- Nokia Corporation

- ASUSTek Computer Inc

- Guangdong Oppo Mobile Telecommunications Corp Ltd

- Honor Technology Inc

- Apple Inc

- Dell Technologies

Key Milestones in Latin America IT Device Market Industry

- June 2022: Huawei Cloud hosted COMPASS, Latin America's Internet Summit 2022, signifying a strategic push into the region's internet sector.

- August 2022: Nokia partnered with Furukawa Electric LatAm to accelerate optical LAN deployment in Brazil, impacting network infrastructure and potentially stimulating related device sales.

Strategic Outlook for Latin America IT Device Market Market

The Latin America IT device market holds substantial long-term growth potential. Continued economic development, rising internet penetration, and government support for digitalization will drive demand. Strategic partnerships, investments in research and development, and a focus on innovative products will be key to success in this competitive market. The focus should be on providing affordable, high-quality devices tailored to the specific needs of Latin American consumers, while also capitalizing on the growing demand for 5G-enabled devices and cloud-based services.

Latin America IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Mexico

- 2.4. Colombia

- 2.5. Rest of Latin America

Latin America IT Device Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Mexico

- 4. Colombia

- 5. Rest of Latin America

Latin America IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in E-commerce Business; Robust Demand for Smart Phones

- 3.3. Market Restrains

- 3.3.1. Intense Inflation Disrupting the Demand

- 3.4. Market Trends

- 3.4.1. Upsurge in Smartphone Adoption in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Mexico

- 5.2.4. Colombia

- 5.2.5. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Mexico

- 5.3.4. Colombia

- 5.3.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. PC's

- 6.1.1.1. Laptops

- 6.1.1.2. Desktop PCs

- 6.1.1.3. Tablets

- 6.1.2. Phones

- 6.1.2.1. Landline Phones

- 6.1.2.2. Smartphones

- 6.1.2.3. Feature Phones

- 6.1.1. PC's

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Mexico

- 6.2.4. Colombia

- 6.2.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. PC's

- 7.1.1.1. Laptops

- 7.1.1.2. Desktop PCs

- 7.1.1.3. Tablets

- 7.1.2. Phones

- 7.1.2.1. Landline Phones

- 7.1.2.2. Smartphones

- 7.1.2.3. Feature Phones

- 7.1.1. PC's

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Mexico

- 7.2.4. Colombia

- 7.2.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. PC's

- 8.1.1.1. Laptops

- 8.1.1.2. Desktop PCs

- 8.1.1.3. Tablets

- 8.1.2. Phones

- 8.1.2.1. Landline Phones

- 8.1.2.2. Smartphones

- 8.1.2.3. Feature Phones

- 8.1.1. PC's

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Mexico

- 8.2.4. Colombia

- 8.2.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Colombia Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. PC's

- 9.1.1.1. Laptops

- 9.1.1.2. Desktop PCs

- 9.1.1.3. Tablets

- 9.1.2. Phones

- 9.1.2.1. Landline Phones

- 9.1.2.2. Smartphones

- 9.1.2.3. Feature Phones

- 9.1.1. PC's

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Mexico

- 9.2.4. Colombia

- 9.2.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Latin America Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. PC's

- 10.1.1.1. Laptops

- 10.1.1.2. Desktop PCs

- 10.1.1.3. Tablets

- 10.1.2. Phones

- 10.1.2.1. Landline Phones

- 10.1.2.2. Smartphones

- 10.1.2.3. Feature Phones

- 10.1.1. PC's

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Brazil

- 10.2.2. Argentina

- 10.2.3. Mexico

- 10.2.4. Colombia

- 10.2.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Brazil Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 14. Peru Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 15. Chile Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Latin America Latin America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Vivo Communication Technology Co Ltd

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Zhongxing New Telecommunications Equipment Co Ltd*List Not Exhaustive

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Lenovo Group Limited

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Acer Group

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Samsung Electronics Co Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Microsoft Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 HP Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Xiaomi Corporation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Huawei Technologies Co Ltd

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Motorola Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Nokia Corporation

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 ASUSTek Computer Inc

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Guangdong Oppo Mobile Telecommunications Corp Ltd

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Honor Technology Inc

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 Apple Inc

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.16 Dell Technologies

- 17.2.16.1. Overview

- 17.2.16.2. Products

- 17.2.16.3. SWOT Analysis

- 17.2.16.4. Recent Developments

- 17.2.16.5. Financials (Based on Availability)

- 17.2.1 Vivo Communication Technology Co Ltd

List of Figures

- Figure 1: Latin America IT Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America IT Device Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Latin America IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Latin America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Latin America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Latin America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Latin America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Latin America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Latin America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Latin America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Latin America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Latin America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Latin America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Latin America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Latin America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Latin America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America IT Device Market?

The projected CAGR is approximately 1.10%.

2. Which companies are prominent players in the Latin America IT Device Market?

Key companies in the market include Vivo Communication Technology Co Ltd, Zhongxing New Telecommunications Equipment Co Ltd*List Not Exhaustive, Lenovo Group Limited, Acer Group, Samsung Electronics Co Ltd, Microsoft Corporation, HP Inc, Xiaomi Corporation, Huawei Technologies Co Ltd, Motorola Inc, Nokia Corporation, ASUSTek Computer Inc, Guangdong Oppo Mobile Telecommunications Corp Ltd, Honor Technology Inc, Apple Inc, Dell Technologies.

3. What are the main segments of the Latin America IT Device Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in E-commerce Business; Robust Demand for Smart Phones.

6. What are the notable trends driving market growth?

Upsurge in Smartphone Adoption in the Region.

7. Are there any restraints impacting market growth?

Intense Inflation Disrupting the Demand.

8. Can you provide examples of recent developments in the market?

August 2022: Nokia unveiled its strategic alliance with the market-leading network cable company Furukawa Electric LatAm to expedite the implementation of optical LAN in Latin America. The program of deploying optical LAN in partnership with both companies would start in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America IT Device Market?

To stay informed about further developments, trends, and reports in the Latin America IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence