Key Insights

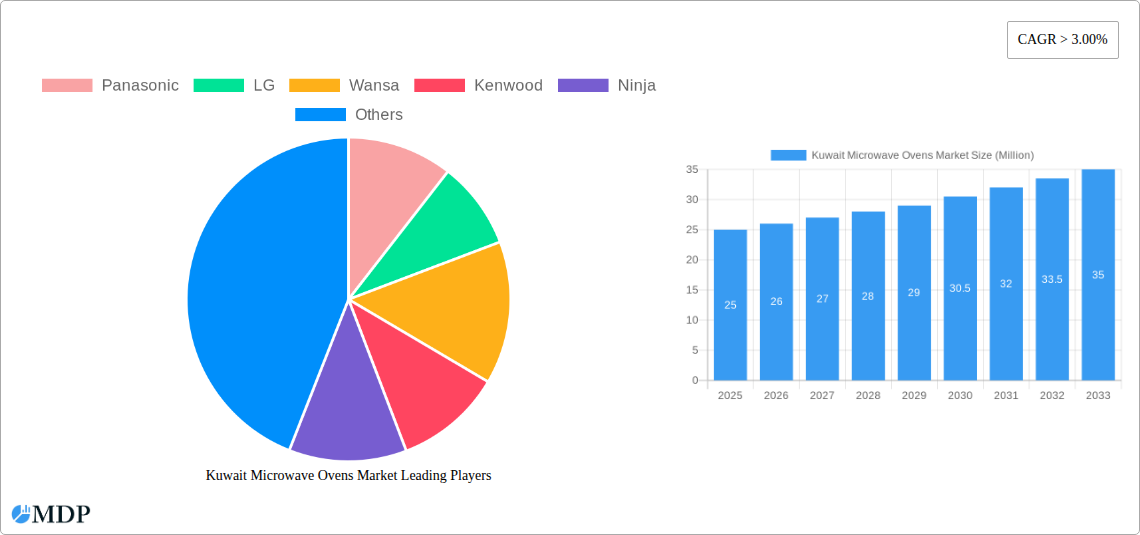

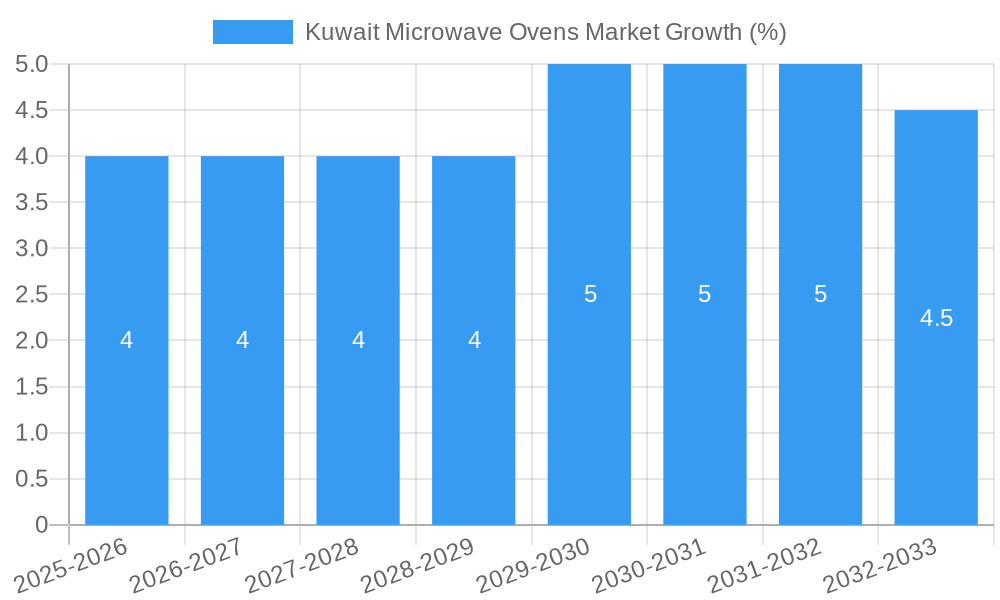

The Kuwait microwave oven market, valued at approximately $XX million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. This expansion is driven by several key factors. The rising adoption of convenience foods and quick meal preparations amongst Kuwait's increasingly urban and time-constrained population fuels demand for faster cooking solutions. Furthermore, technological advancements leading to innovative features like sensor cooking, inverter technology, and smart connectivity are enhancing the appeal of microwave ovens. The market segmentation reveals strong growth in online sales channels, reflecting the broader e-commerce boom in Kuwait. While conventional microwave ovens remain dominant, the demand for grill and solo models is increasing, driven by consumer preferences for versatility and compact designs suitable for smaller households. The residential segment accounts for the largest share, though the commercial segment shows significant potential for growth, particularly within restaurants and food service establishments. Major players like Panasonic, LG, Samsung, and Midea are key competitors, engaging in intense product differentiation and marketing efforts to capture market share. The forecast period suggests continued growth, supported by rising disposable incomes and a focus on modernizing kitchen appliances.

However, certain restraints could potentially moderate market growth. Fluctuations in consumer spending due to economic factors might influence purchasing decisions. The prevalence of traditional cooking methods in some segments of the population could also limit penetration. Competition within the market is fierce, placing pressure on pricing strategies and requiring manufacturers to constantly innovate to remain competitive. Despite these challenges, the overall outlook for the Kuwait microwave oven market remains positive, with the projected CAGR suggesting considerable market expansion throughout the forecast period, driven by consumer demand and technological innovation. This is particularly noticeable considering the increase in adoption of online sales channels, showcasing a shift in purchasing behaviour. The commercial sector also presents exciting opportunities for growth as businesses seek to enhance efficiency and speed of service.

Kuwait Microwave Ovens Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Kuwait microwave ovens market, offering invaluable insights for stakeholders including manufacturers, distributors, investors, and market researchers. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. Discover key trends, growth drivers, challenges, and opportunities shaping this dynamic market. The report leverages extensive data and analysis to provide a clear understanding of market size, segmentation, competitive landscape, and future outlook. High-traffic keywords like "Kuwait microwave ovens market," "microwave oven market Kuwait," "Kuwait appliance market," and "Kuwait kitchen appliances" are strategically integrated for maximum search engine visibility.

Kuwait Microwave Ovens Market Dynamics & Concentration

The Kuwait microwave ovens market exhibits a moderately concentrated landscape, with key players like Panasonic, LG, Samsung, and Midea holding significant market share. Market concentration is influenced by factors including brand recognition, distribution network strength, and product innovation. The market share of the top five players is estimated at xx% in 2025.

- Innovation Drivers: Technological advancements, such as the incorporation of smart features and improved energy efficiency, are driving market growth. The integration of mobile apps for recipe access and cooking guidance, as seen with LG's ThinQ app, is a prime example.

- Regulatory Framework: Government regulations concerning energy consumption and safety standards influence product design and market competitiveness. Compliance costs can impact profitability for smaller players.

- Product Substitutes: While microwave ovens are popular, other cooking methods like conventional ovens and air fryers present competitive pressures. This necessitates continuous innovation to maintain market share.

- End-User Trends: Increasing urbanization, changing lifestyles, and growing preference for convenient cooking solutions boost demand for microwave ovens, particularly in residential settings.

- M&A Activities: The number of M&A deals in the Kuwaiti microwave oven market during the historical period (2019-2024) was xx. Consolidation is expected to continue as larger players seek to expand their market presence.

Kuwait Microwave Ovens Market Industry Trends & Analysis

The Kuwait microwave oven market is experiencing robust growth, fueled by several factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%. This growth is driven by increasing disposable incomes, expanding urbanization, and evolving consumer preferences for convenient and time-saving kitchen appliances. Market penetration is expected to reach xx% by 2033.

Technological disruptions are shaping the market with smart features, energy-efficient models, and improved designs gaining popularity. Consumer preferences are shifting towards multi-functional microwave ovens with features like convection, grilling, and steaming. Competitive dynamics are intensifying as established players and new entrants vie for market share, triggering price wars and product differentiation strategies.

Leading Markets & Segments in Kuwait Microwave Ovens Market

The residential segment dominates the Kuwait microwave ovens market, accounting for approximately xx% of total sales in 2025. Multi-branded stores represent the largest distribution channel, followed by exclusive stores and online retailers.

By Distribution Channel:

- Multi-Branded Stores: Wide reach, established customer base, and ease of access contribute to its dominance.

- Exclusive Stores: Offer specialized product knowledge and personalized customer service but have a smaller market presence.

- Online Stores: Growing rapidly due to increasing internet penetration and consumer preference for online shopping.

- Other Distribution Channels: This category includes smaller retailers and direct sales, contributing a relatively smaller share.

By Type:

- Conventional Microwave Ovens: Remain the most popular due to affordability and functionality.

- Grill Microwave Ovens: Growing in popularity due to increased versatility.

- Solo Microwave Ovens: A significant segment, catering to budget-conscious consumers and those with smaller kitchens.

By End-User:

- Residential: The largest segment driven by increasing household penetration.

- Commercial: Smaller segment but showing growth potential as restaurants and food service businesses adopt microwaves for quick food preparation.

Key Drivers:

- Strong economic growth in Kuwait

- Government initiatives promoting consumer spending

- Growing preference for convenient cooking methods

Kuwait Microwave Ovens Market Product Developments

Recent innovations in the Kuwaiti microwave oven market include smart features, improved energy efficiency, and multi-functional designs. Manufacturers are integrating mobile app connectivity for recipe access and guided cooking experiences. The emphasis is on enhancing convenience and user experience, creating a strong market fit for diverse consumer needs. Features like steaming and air frying capabilities are becoming increasingly common, catering to the growing health-conscious consumer base.

Key Drivers of Kuwait Microwave Ovens Market Growth

Several key factors fuel the growth of the Kuwait microwave ovens market. Rising disposable incomes, coupled with the increasing urbanization and preference for convenience, are major contributors. The adoption of advanced cooking technologies, like smart features, and the growing importance of time-saving kitchen appliances further drive market expansion.

Challenges in the Kuwait Microwave Ovens Market

The Kuwait microwave ovens market faces challenges, including intense competition from established and new entrants, leading to price pressures and the need for continuous product innovation. Supply chain disruptions and fluctuations in raw material costs can impact profitability and availability. Regulatory changes related to energy efficiency standards might necessitate adjustments in product designs and manufacturing processes.

Emerging Opportunities in Kuwait Microwave Ovens Market

Significant opportunities exist for growth in the Kuwaiti microwave oven market. Strategic partnerships with retailers and online marketplaces can enhance market reach and brand visibility. The introduction of innovative designs, such as energy-efficient and multi-functional models, can capture a larger market share. Expansion into niche segments, such as commercial kitchens, presents potential for further growth.

Leading Players in the Kuwait Microwave Ovens Market Sector

Key Milestones in Kuwait Microwave Ovens Market Industry

- December 2021: LG launched its InstaView Double Oven Gas Slide-in Range and Over-the-Range Microwave Oven, integrating with the LG ThinQ Recipe app. This enhanced the user experience and broadened the appliance's appeal.

- March 2021: Samsung expanded its kitchen appliance range with the "Baker Series Microwaves," featuring steaming, grilling, and frying capabilities. This catered to the growing trend of home cooking and healthy eating habits, attracting young millennials.

Strategic Outlook for Kuwait Microwave Ovens Market Market

The future of the Kuwait microwave ovens market looks promising. Sustained economic growth, coupled with increasing urbanization and the ongoing demand for convenient cooking solutions, will drive long-term growth. Strategic investments in research and development, focusing on innovation and product diversification, will be crucial for maintaining competitiveness. Companies that effectively leverage technological advancements and cater to evolving consumer preferences are poised for significant success in this dynamic market.

Kuwait Microwave Ovens Market Segmentation

-

1. Type

- 1.1. Convectional

- 1.2. Grill

- 1.3. Solo

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Multi-Branded Stores

- 3.2. Exclusive Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

Kuwait Microwave Ovens Market Segmentation By Geography

- 1. Kuwait

Kuwait Microwave Ovens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Vehicle Safety

- 3.2.2 Emission

- 3.2.3 and Fleet Management Regulations; Advancements Such as Route Calculation

- 3.2.4 Vehicle Tracking

- 3.2.5 and Fuel Pilferage

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Increase in the percentage of Sales through Online mode

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Microwave Ovens Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Convectional

- 5.1.2. Grill

- 5.1.3. Solo

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi-Branded Stores

- 5.3.2. Exclusive Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wansa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ninja

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daewoo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Comfee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toshiba

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Microwave Ovens Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Microwave Ovens Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Microwave Ovens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Kuwait Microwave Ovens Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Kuwait Microwave Ovens Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Kuwait Microwave Ovens Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Kuwait Microwave Ovens Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: Kuwait Microwave Ovens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Kuwait Microwave Ovens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Kuwait Microwave Ovens Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 15: Kuwait Microwave Ovens Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Kuwait Microwave Ovens Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 17: Kuwait Microwave Ovens Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 19: Kuwait Microwave Ovens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Microwave Ovens Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Kuwait Microwave Ovens Market?

Key companies in the market include Panasonic, LG, Wansa, Kenwood, Ninja, Daewoo, Comfee, Toshiba, Samsung, Midea.

3. What are the main segments of the Kuwait Microwave Ovens Market?

The market segments include Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Vehicle Safety. Emission. and Fleet Management Regulations; Advancements Such as Route Calculation. Vehicle Tracking. and Fuel Pilferage.

6. What are the notable trends driving market growth?

Increase in the percentage of Sales through Online mode.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

On December 2021, LG has launched LG's InstaView Double Oven Gas Slide-in Range and the Over-the-Range Microwave Oven connect with the LG ThinQ Recipe app which will allow owners to find recipes and cook thousands of step-by-step recipes with guidance from their appliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Microwave Ovens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Microwave Ovens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Microwave Ovens Market?

To stay informed about further developments, trends, and reports in the Kuwait Microwave Ovens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence