Key Insights

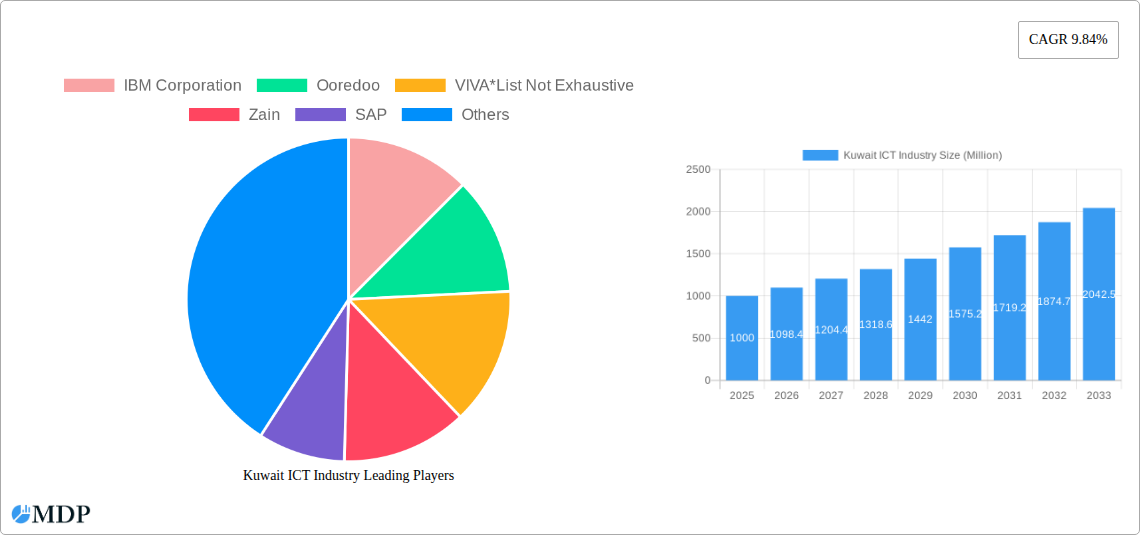

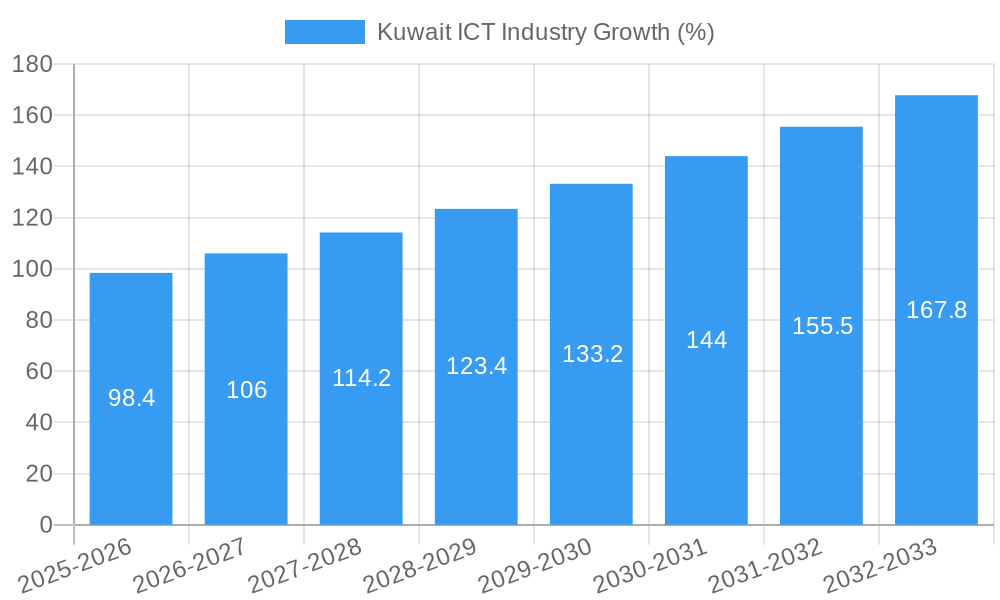

The Kuwaiti ICT market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.84% from 2025 to 2033. This expansion is driven by several key factors. Firstly, substantial government investments in digital infrastructure and initiatives aimed at fostering a knowledge-based economy are creating a fertile ground for technological advancements. Secondly, the burgeoning adoption of cloud computing, big data analytics, and mobile technologies across various sectors, including oil & gas, finance, and healthcare, is fueling demand for ICT solutions. Furthermore, the increasing need for enhanced cybersecurity measures and the rising penetration of high-speed internet are contributing to market growth. However, challenges remain, including the need for skilled workforce development to meet the demands of a rapidly evolving technological landscape and potential regulatory hurdles that could impede market expansion. The market segmentation reveals a strong demand for hardware, software, and communication services, with the oil & gas and financial sectors leading the adoption curve. Companies like IBM, SAP, and Cisco are key players capitalizing on these opportunities, while local telecom providers like Ooredoo and Zain are also significantly contributing to the market's evolution.

The forecast period (2025-2033) anticipates continuous market expansion, primarily driven by increasing digitalization across all sectors. The rising adoption of Internet of Things (IoT) devices and the development of smart city initiatives will further contribute to this growth. However, maintaining sustainable growth will hinge upon addressing the challenges mentioned earlier. Strategic investments in education and training to build a robust ICT talent pool will be crucial. Moreover, proactive regulatory frameworks promoting innovation while ensuring cybersecurity and data privacy will be essential for fostering long-term, sustainable market development in Kuwait. This blend of governmental support, private sector investment, and technological advancements positions the Kuwaiti ICT sector for significant growth over the next decade.

Kuwait ICT Industry Market Report: 2019-2033

Dive deep into the dynamic Kuwait ICT sector with this comprehensive report, projecting a vibrant future fueled by technological advancements and strategic investments. This detailed analysis covers market size, key players, emerging trends, and future growth opportunities, providing invaluable insights for industry stakeholders.

Kuwait ICT Industry Market Dynamics & Concentration

The Kuwaiti ICT market, valued at $XX Million in 2024, is experiencing robust growth driven by increasing government investments in digital infrastructure and a burgeoning demand for advanced technologies across various sectors. Market concentration is moderate, with a few large players dominating specific segments while numerous smaller companies cater to niche markets. Significant mergers and acquisitions (M&A) activity further shapes the competitive landscape.

Market Concentration Metrics (2024):

- Top 3 players hold approximately XX% market share.

- Number of M&A deals in the last 5 years: XX

Innovation Drivers:

- Government initiatives promoting digital transformation.

- Focus on developing a robust digital ecosystem.

- Growing adoption of cloud computing, big data, and AI.

Regulatory Frameworks:

- Supportive regulatory environment encouraging foreign investment.

- Focus on data privacy and cybersecurity regulations.

- Government initiatives to promote digital literacy.

Product Substitutes:

- Competition from regional and international ICT providers.

- Open-source alternatives impacting certain software segments.

End-User Trends:

- Increasing demand for digital solutions across all sectors.

- Shift towards cloud-based services and mobile technologies.

- Focus on enhancing cybersecurity and data protection.

M&A Activity: Recent high-profile acquisitions, such as Kalaam Telecom's acquisition of Zajil and Kamco Invest's acquisition of E-Portal Holding, demonstrate the ongoing consolidation within the sector and a push for integrated digital solutions.

Kuwait ICT Industry Industry Trends & Analysis

The Kuwaiti ICT market exhibits a strong Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033), reaching an estimated value of $XX Million by 2033. Several factors fuel this expansion. The government’s commitment to digital transformation is a key driver, alongside the increasing adoption of advanced technologies across various end-user industries. The private sector's investment in digital infrastructure and cloud computing is significantly impacting market growth. Furthermore, growing consumer preference for mobile and cloud-based services contributes to the expanding market. However, challenges remain, including competition from regional and global players, and the need for continuous investments in infrastructure. Market penetration for key technologies varies considerably; cloud computing adoption shows the highest penetration, with approximately XX% market share, compared to XX% for big data analytics and XX% for 5G network technologies in 2024.

Leading Markets & Segments in Kuwait ICT Industry

By Component: Software and Services currently hold the largest market share, driven by the growing demand for customized digital solutions, and cloud-based applications.

By End-User Industry: The Oil, Gas, and Utilities sector remains the largest consumer of ICT solutions due to its reliance on advanced technologies for automation, operations optimization, and safety management.

By Technology: Cloud computing shows the highest growth trajectory, driven by the government's initiatives to promote digital transformation. The increasing adoption of cloud solutions across different sectors and the availability of high-speed internet connections are contributing to its rapid expansion.

- Key Drivers:

- Government's investments in digital infrastructure.

- Growing demand for advanced technologies across all sectors.

- High internet penetration rates.

- Supportive regulatory environment.

Kuwait ICT Industry Product Developments

Recent product innovations are centered on cloud-based solutions, 5G connectivity, and Big Data Analytics. Companies are focusing on developing tailored solutions for specific end-user industries, focusing on improving operational efficiency, enhancing customer experiences, and boosting cybersecurity. The market is witnessing a significant shift towards AI-powered applications and the implementation of Internet of Things (IoT) devices across multiple sectors, highlighting market fit for advanced technologies.

Key Drivers of Kuwait ICT Industry Growth

The Kuwaiti ICT industry's growth is primarily driven by:

- Technological Advancements: The adoption of emerging technologies like 5G, cloud computing, AI, and Big Data analytics is revolutionizing businesses and consumer experiences. The initiatives launched by Huawei exemplify this, promoting startup growth in cloud technologies.

- Economic Growth: Kuwait's continued economic development and diversification are creating a strong demand for advanced ICT solutions across various sectors.

- Government Initiatives: Government-led initiatives promoting digital transformation, infrastructure development, and investment in technological innovation are crucial for stimulating growth.

Challenges in the Kuwait ICT Industry Market

The industry faces several challenges:

- Cybersecurity Threats: The increasing reliance on digital technologies exposes the market to significant cybersecurity risks, requiring robust security measures.

- Talent Acquisition: A shortage of skilled IT professionals is hindering growth, requiring investment in training and education.

- Competition: Intense competition from regional and international players necessitates constant innovation and strategic adaptation.

Emerging Opportunities in Kuwait ICT Industry

Long-term growth in the Kuwaiti ICT sector is driven by several factors. Expansion into newer technologies, including AI-driven solutions, is expected to create significant new opportunities. Strategic partnerships between local and international companies, as demonstrated by ZainTech's collaboration with Huawei, will drive innovation and market growth. Further development of digital infrastructure and the government's focus on digital transformation will provide an enhanced platform for the continued expansion of the sector.

Leading Players in the Kuwait ICT Industry Sector

- IBM Corporation

- Ooredoo

- VIVA

- Zain

- SAP

- Amadeus IT Group

- Cisco Systems

- Huawei Technologies

- Oracle

- HP Middle East

Key Milestones in Kuwait ICT Industry Industry

- December 2022: Huawei launches the Huawei Cloud Startup Program in Kuwait, fostering local startup growth.

- March 2022: ZainTech partners with Huawei to accelerate 5G network deployment in Kuwait.

- April 2022: Kalaam Telecom acquires Zajil International Telecom, solidifying its position as a leading ISP.

- April 2022: Kamco Invest acquires E-Portal Holding, expanding its ICT portfolio.

Strategic Outlook for Kuwait ICT Industry Market

The Kuwaiti ICT market presents considerable future potential, driven by sustained government support, a growing private sector, and increasing adoption of cutting-edge technologies. Strategic partnerships, investments in digital infrastructure, and a focus on innovation will be key to unlocking this potential and ensuring the sector continues to grow significantly in the coming years. The continuous development and adoption of cutting-edge technologies will be a crucial aspect of maintaining competitiveness and driving growth in this dynamic market.

Kuwait ICT Industry Segmentation

-

1. Technology

- 1.1. Big Data Analytics

- 1.2. Mobility

- 1.3. Cloud Computing

- 1.4. Storage

- 1.5. Business Process Outsourcing

- 1.6. Other Technologies

-

2. Component

- 2.1. Hardware

- 2.2. Devices

- 2.3. Software and Services

- 2.4. Communication and Connectivity

-

3. End-User Industry

- 3.1. Oil, Gas and Utilities

- 3.2. Transportation and Logistics

- 3.3. Healthcare

- 3.4. Financial Services

- 3.5. Manufacturing and Construction

- 3.6. Other En

Kuwait ICT Industry Segmentation By Geography

- 1. Kuwait

Kuwait ICT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government policies and PPP initiatives such as National Development Plan called New Kuwait; Early adoption of 5G network; Increasing penetration of technology giants

- 3.3. Market Restrains

- 3.3.1 ; Alternative Protocols

- 3.3.2 such as Bluetooth

- 3.3.3 Wi-Fi

- 3.3.4 and Z-Wave

- 3.3.5 Among Others

- 3.4. Market Trends

- 3.4.1. Early Adoption of 5G Network Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait ICT Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Big Data Analytics

- 5.1.2. Mobility

- 5.1.3. Cloud Computing

- 5.1.4. Storage

- 5.1.5. Business Process Outsourcing

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Hardware

- 5.2.2. Devices

- 5.2.3. Software and Services

- 5.2.4. Communication and Connectivity

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Oil, Gas and Utilities

- 5.3.2. Transportation and Logistics

- 5.3.3. Healthcare

- 5.3.4. Financial Services

- 5.3.5. Manufacturing and Construction

- 5.3.6. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ooredoo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VIVA*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zain

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SAP

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amadeus IT Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HP Middle East

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Kuwait ICT Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait ICT Industry Share (%) by Company 2024

List of Tables

- Table 1: Kuwait ICT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait ICT Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Kuwait ICT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Kuwait ICT Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Kuwait ICT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Kuwait ICT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Kuwait ICT Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: Kuwait ICT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 9: Kuwait ICT Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 10: Kuwait ICT Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait ICT Industry?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the Kuwait ICT Industry?

Key companies in the market include IBM Corporation, Ooredoo, VIVA*List Not Exhaustive, Zain, SAP, Amadeus IT Group, Cisco Systems, Huawei Technologies, Oracle, HP Middle East.

3. What are the main segments of the Kuwait ICT Industry?

The market segments include Technology, Component, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government policies and PPP initiatives such as National Development Plan called New Kuwait; Early adoption of 5G network; Increasing penetration of technology giants.

6. What are the notable trends driving market growth?

Early Adoption of 5G Network Drives the Market Growth.

7. Are there any restraints impacting market growth?

; Alternative Protocols. such as Bluetooth. Wi-Fi. and Z-Wave. Among Others.

8. Can you provide examples of recent developments in the market?

December 2022: Huawei is launching the Huawei Cloud Startup Program in Kuwait in collaboration with local partners. The initiative helps Kuwaiti startups grow their businesses by utilizing Huawei technology. The initiative was developed with local partners such as the Central Agency for Information Technology, Rasameel Investment Company, Kuwait Youth Assembly, and eWTP Arabia Capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait ICT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait ICT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait ICT Industry?

To stay informed about further developments, trends, and reports in the Kuwait ICT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence