Key Insights

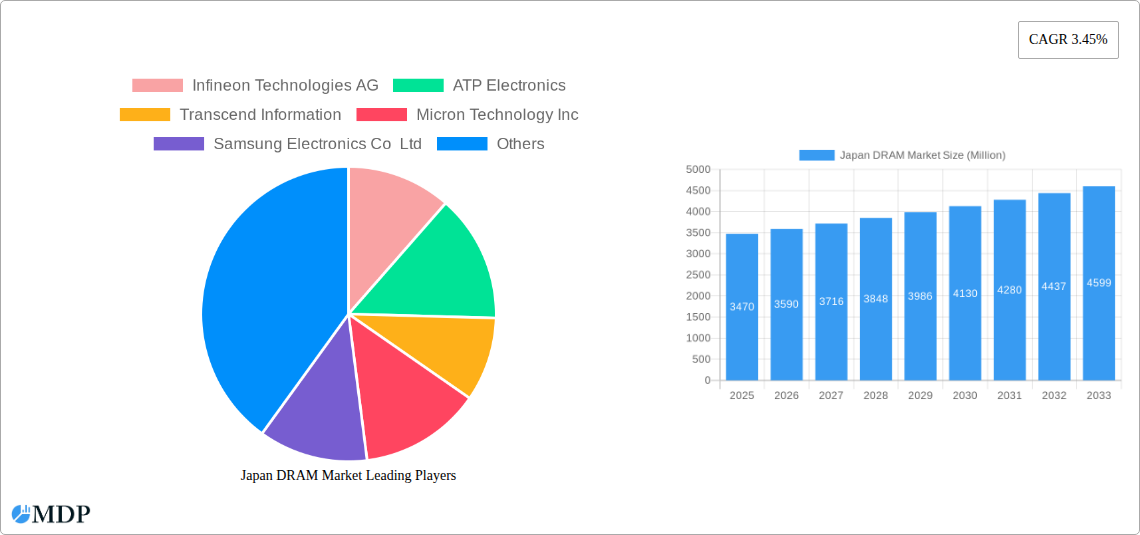

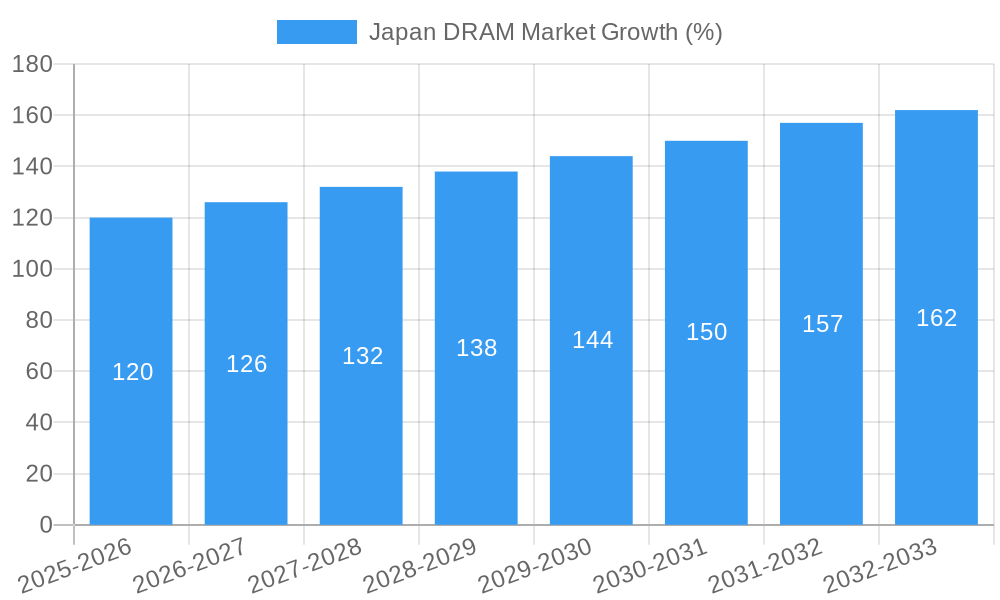

The Japan DRAM market, valued at approximately ¥3.47 billion (assuming "Million" refers to Japanese Yen) in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 3.45% from 2025 to 2033. This growth is driven by several factors. The increasing demand for high-performance computing in sectors like datacenters and automotive is a key driver. The proliferation of smartphones, tablets, and PCs, coupled with the growing adoption of artificial intelligence (AI) and the Internet of Things (IoT), fuels the need for faster and more efficient memory solutions, thus boosting DRAM demand. Technological advancements in DRAM architecture, such as the transition to higher-density DDR5 and beyond, also contribute to market expansion, although the exact market share distribution across DDR, DDR2, DDR3, DDR4, and DDR5 architectures within Japan requires further specific data. However, based on global trends, it's likely that DDR4 and DDR5 will dominate the market in the forecast period.

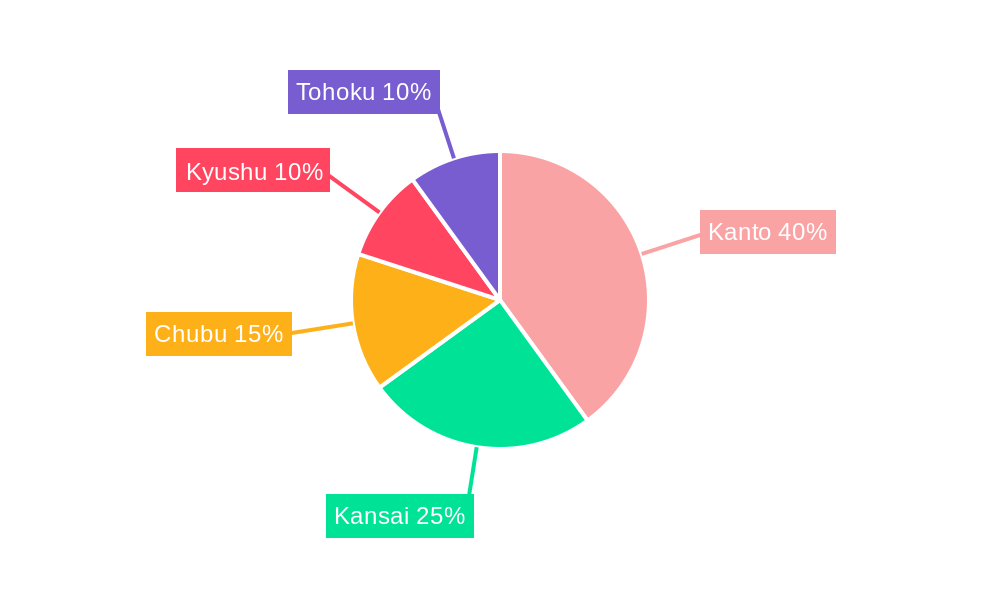

Despite the positive outlook, certain restraints could impact market growth. Fluctuations in global semiconductor supply chains, geopolitical uncertainties, and potential economic slowdowns could influence the demand for DRAM in the Japanese market. Furthermore, competitive pressures from established players like Samsung, SK Hynix, and Micron, along with emerging players, will necessitate continuous innovation and cost optimization for market participants. The regional distribution across Kanto, Kansai, Chubu, Kyushu, and Tohoku will likely follow existing population and industrial concentrations, with Kanto and Kansai regions commanding larger market shares. The historical period (2019-2024) likely reflects a similar growth trajectory, although specific data points are needed to create a complete market profile. Further segmentation analysis will be required to determine market shares across specific application segments (smartphones/tablets, PCs/laptops, etc.).

Japan DRAM Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan DRAM market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, trends, leading players, and future growth opportunities. Unlock crucial data and actionable intelligence to navigate the complexities of this dynamic market.

Japan DRAM Market Market Dynamics & Concentration

The Japan DRAM market exhibits a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors such as economies of scale in manufacturing, high capital expenditure requirements, and intense technological competition. While precise market share figures for individual companies are proprietary, a review of recent M&A activities suggests ongoing consolidation. The number of M&A deals in the sector has increased (xx deals in the last 5 years), primarily driven by strategic acquisitions aimed at expanding production capacity, technological advancements, and securing access to specialized technologies.

- Innovation Drivers: Continuous advancements in DRAM architecture (DDR, DDR2, DDR3, DDR4, DDR5, and other architectures) are key drivers, enabling higher speed, increased capacity, and reduced power consumption. Research and development efforts focused on emerging technologies like 3D stacking are reshaping the market.

- Regulatory Framework: The Japanese government's supportive policies, including incentives for semiconductor investments, significantly influence market dynamics. Regulatory frameworks relating to data security and environmental standards also play a role.

- Product Substitutes: While DRAM is the dominant memory type in many applications, competing technologies like NAND flash memory are gaining traction, particularly in certain segments. The market share of these substitute technologies is currently (xx)% and is projected to reach (xx)% by 2033.

- End-User Trends: Growth in data centers, the expanding smartphone and IoT market, and the increasing demand for high-performance computing are driving market demand. Changing consumer preferences towards higher-capacity devices and enhanced multimedia capabilities influence market dynamics.

- M&A Activity: The recent increase in mergers and acquisitions (xx deals in the past 5 years) suggests ongoing consolidation in the market, with larger players seeking to enhance their market share and technological capabilities.

Japan DRAM Market Industry Trends & Analysis

The Japan DRAM market is experiencing robust growth, driven by multiple factors. Technological advancements, particularly in the development of higher-density and high-speed DRAM chips, are a key catalyst. The increasing penetration of high-performance computing applications, including data centers and artificial intelligence, fuels market demand. Consumer demand for high-resolution displays and improved gaming experiences also significantly impacts the market. Competitive dynamics are fierce, with leading players constantly investing in R&D to develop advanced technologies and enhance their product offerings.

The market has demonstrated a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration in key segments like smartphones and data centers is (xx)% currently, and expected to reach (xx)% by 2033. Technological disruptions, such as the introduction of new DRAM architectures, are continuously reshaping the competitive landscape.

Leading Markets & Segments in Japan DRAM Market

While detailed regional breakdowns are not available, the market within Japan is expected to be the dominant market region, particularly in relation to the other countries in the East Asian region. The PC/laptop and data center segments are currently the largest application markets for DRAM in Japan.

- Key Drivers for PC/Laptop Segment: Growing demand for high-performance laptops, increased adoption of cloud computing services, and expansion of the gaming market.

- Key Drivers for Data Center Segment: Rapid growth of cloud computing infrastructure, Big Data analytics, and the increasing demand for high-performance computing.

- Other Application Segments: Smartphones/Tablets, Graphics, Consumer Products, and Automotive segments also contribute significantly to the overall market demand. The automotive segment is experiencing the fastest growth due to increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies.

The DDR4 architecture currently holds the largest market share, driven by its widespread adoption in PCs and servers. However, the adoption of DDR5 is gaining momentum, especially in high-performance computing applications.

Japan DRAM Market Product Developments

Recent product innovations focus on enhancing memory density, speed, and power efficiency. Manufacturers are actively developing advanced DRAM architectures like DDR5 and exploring emerging technologies like 3D stacking to achieve higher performance and lower power consumption. These advancements are enabling a wider range of applications and expanding the market's reach. The competitive advantage lies in achieving superior performance, cost-effectiveness, and lower energy consumption.

Key Drivers of Japan DRAM Market Growth

Several factors fuel the growth of the Japan DRAM market. Firstly, advancements in semiconductor technology consistently improve memory capacity and performance. Secondly, the booming data center market requires substantial DRAM capacity for cloud computing and data storage. Finally, government support, such as subsidies and incentives, encourages domestic manufacturing and technological innovation.

Challenges in the Japan DRAM Market Market

The Japan DRAM market faces several challenges. Firstly, the high capital expenditure required for manufacturing facilities is a barrier for new entrants. Secondly, global supply chain disruptions can impact production and availability. Finally, intense competition among established players puts downward pressure on prices.

Emerging Opportunities in Japan DRAM Market

The Japan DRAM market presents significant long-term opportunities. Technological breakthroughs in areas like 3D stacking and high-bandwidth memory (HBM) will open new avenues for growth. Strategic partnerships and collaborations between DRAM manufacturers and technology companies will drive innovation and market expansion.

Leading Players in the Japan DRAM Market Sector

- Infineon Technologies AG

- ATP Electronics

- Transcend Information

- Micron Technology Inc

- Samsung Electronics Co Ltd

- SK Hynix

- Kingston Technology

- Nanya Technology Corporation

- Elpida Memory Inc

- Winbond Electronics Corporation

Key Milestones in Japan DRAM Market Industry

- March 2023: Micron Technology Inc. announced a JPY 500 Billion (USD 3.70 Billion) investment in DRAM and EUV technology with government support.

- May 2023: TSMC announced an USD 8.6 Billion investment in a new foundry in Kumamoto Prefecture, Japan, in partnership with Sony.

Strategic Outlook for Japan DRAM Market Market

The Japan DRAM market is poised for continued growth, driven by technological innovations, increasing demand from key application segments, and government support. Strategic partnerships and collaborations will play a crucial role in shaping future market dynamics. Focusing on high-value applications and developing advanced technologies will be essential for achieving sustained growth and profitability.

Japan DRAM Market Segmentation

-

1. Architecture

- 1.1. DDR3

- 1.2. DDR4

- 1.3. DDR5

- 1.4. DDR2/Other Architecture

-

2. Application

- 2.1. Smartphones/Tablets

- 2.2. PC/Laptop

- 2.3. Datacenter

- 2.4. Graphics

- 2.5. Consumer Products

- 2.6. Automotive

- 2.7. Other Applications

Japan DRAM Market Segmentation By Geography

- 1. Japan

Japan DRAM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of High-End Smartphones and Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Design and Complexity Challenges for the Development of High-Efficiency Microphones

- 3.4. Market Trends

- 3.4.1. Automotive Sector Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 5.1.1. DDR3

- 5.1.2. DDR4

- 5.1.3. DDR5

- 5.1.4. DDR2/Other Architecture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smartphones/Tablets

- 5.2.2. PC/Laptop

- 5.2.3. Datacenter

- 5.2.4. Graphics

- 5.2.5. Consumer Products

- 5.2.6. Automotive

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 6. Kanto Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ATP Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Transcend Information

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Micron Technology Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Electronics Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SK Hynix

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kingston Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nanya Technology Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Elpida Memory Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Winbond Electronics Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Japan DRAM Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan DRAM Market Share (%) by Company 2024

List of Tables

- Table 1: Japan DRAM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan DRAM Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 3: Japan DRAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Japan DRAM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan DRAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan DRAM Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 12: Japan DRAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Japan DRAM Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan DRAM Market?

The projected CAGR is approximately 3.45%.

2. Which companies are prominent players in the Japan DRAM Market?

Key companies in the market include Infineon Technologies AG, ATP Electronics, Transcend Information, Micron Technology Inc, Samsung Electronics Co Ltd, SK Hynix, Kingston Technology, Nanya Technology Corporation, Elpida Memory Inc *List Not Exhaustive, Winbond Electronics Corporation.

3. What are the main segments of the Japan DRAM Market?

The market segments include Architecture, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of High-End Smartphones and Consumer Electronics.

6. What are the notable trends driving market growth?

Automotive Sector Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Design and Complexity Challenges for the Development of High-Efficiency Microphones.

8. Can you provide examples of recent developments in the market?

May 2023: Taiwan Semiconductor Manufacturing Co. (TSMC) announced plans to further expand its investments in Japan and strengthen its collaboration with semiconductor partners in the country. Currently, TSMC is in the process of building its inaugural foundry in Kumamoto Prefecture, located in Southern Japan, in partnership with Sony Group Corp. This ambitious venture, expected to require an investment of USD 8.6 billion, is on track to commence chip production next year. TSMC will leverage advanced technologies, including 12nm, 16nm, and 22nm processes, as well as the specialized 28nm technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan DRAM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan DRAM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan DRAM Market?

To stay informed about further developments, trends, and reports in the Japan DRAM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence