Key Insights

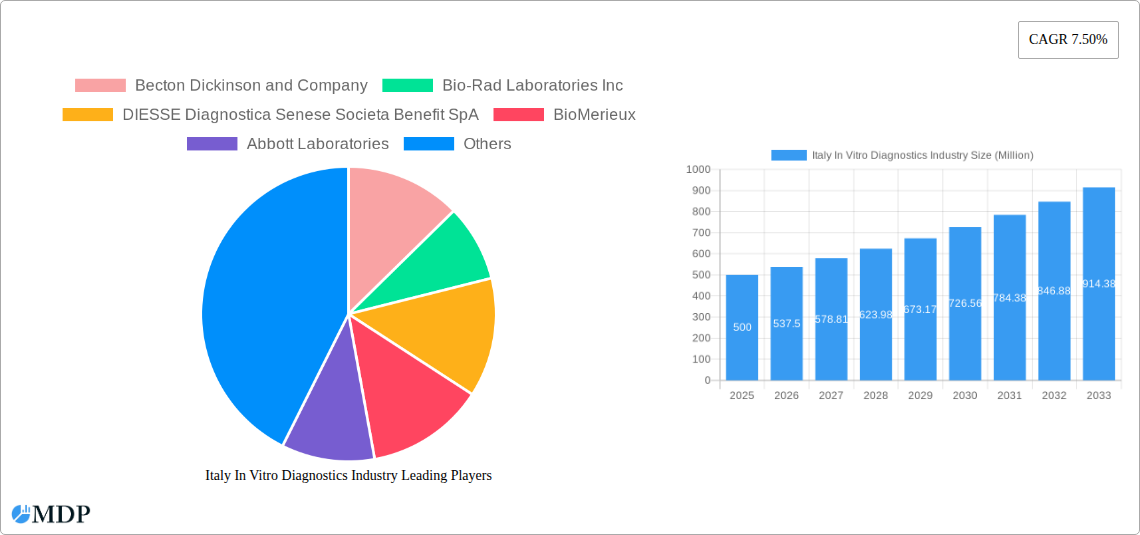

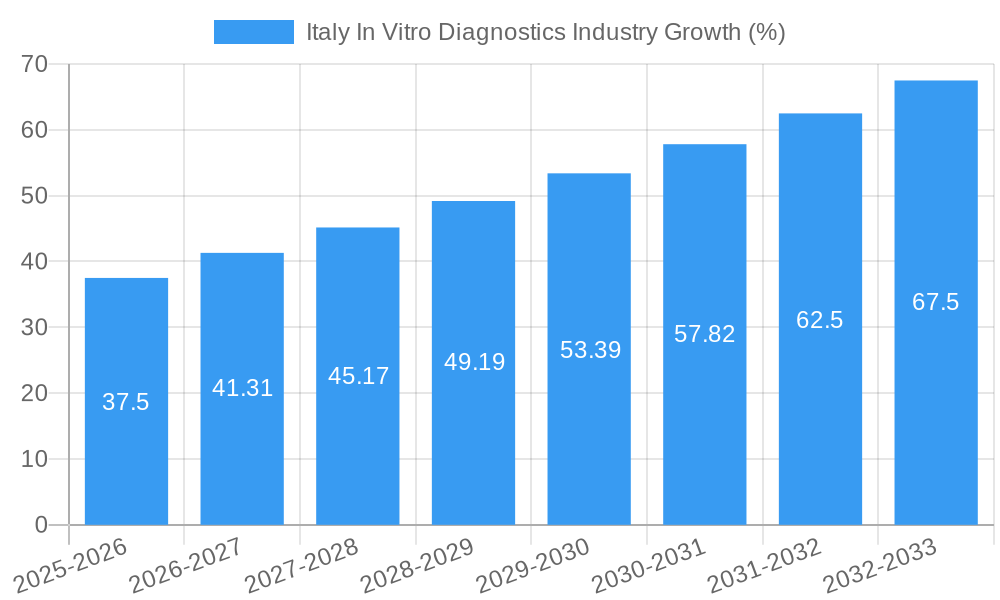

The Italian In Vitro Diagnostics (IVD) market, valued at approximately €[Estimate based on market size XX and value unit Million; let's assume €500 million in 2025 for example purposes] in 2025, is projected to experience robust growth, driven by factors such as increasing prevalence of chronic diseases (diabetes, cancer, cardiovascular diseases), rising geriatric population, and advancements in diagnostic technologies. The 7.50% CAGR indicates a significant expansion over the forecast period (2025-2033). This growth is fueled by the adoption of advanced molecular diagnostics and immunoassays, enabling earlier and more accurate disease detection and personalized medicine approaches. The market is segmented by test type (clinical chemistry leading, followed by molecular diagnostics and immuno diagnostics experiencing strong growth), product (reagents commanding a larger share due to recurring demand), usability (disposable devices more prevalent due to convenience and infection control), application (infectious diseases and cancer diagnostics holding significant shares), and end-users (diagnostic laboratories and hospitals and clinics dominating). Key players like Becton Dickinson, Bio-Rad, Abbott, and Siemens are actively shaping the market through technological innovation and strategic partnerships.

However, market growth may face certain challenges. These include stringent regulatory approvals, high costs associated with advanced technologies, and potential reimbursement constraints. Nevertheless, the increasing focus on preventative healthcare and government initiatives to improve healthcare infrastructure in Italy suggest that the long-term outlook for the IVD market remains positive. The competitive landscape is characterized by both global and regional players, with a focus on expanding product portfolios and geographical reach. The market shows particular promise in molecular diagnostics due to its application in personalized medicine and oncology. Further growth is expected from the increasing use of point-of-care diagnostics to improve access and speed of diagnoses.

Italy In Vitro Diagnostics Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Italy In Vitro Diagnostics (IVD) industry, offering invaluable insights for stakeholders including manufacturers, investors, and regulatory bodies. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. With a focus on key segments like Clinical Chemistry, Molecular Diagnostics, and Immuno Diagnostics, this report unveils the opportunities and challenges shaping this dynamic sector. Discover crucial data points including market size (in Millions), CAGR, and market share analysis, allowing you to make informed strategic decisions.

Italy In Vitro Diagnostics Industry Market Dynamics & Concentration

The Italian IVD market, valued at xx Million in 2024, exhibits a moderately concentrated landscape with key players such as Abbott Laboratories, Becton Dickinson and Company, and Siemens Healthineers AG holding significant market share. Market concentration is influenced by factors including the presence of established multinational corporations and a growing number of domestic players. Innovation is a key driver, fueled by advancements in molecular diagnostics, automation, and point-of-care testing. The regulatory landscape, significantly impacted by the implementation of the EU In Vitro Diagnostic Regulation (IVDR) in May 2022, is a crucial factor shaping market dynamics. This regulation mandates stricter conformity assessments and has led to increased compliance costs. The market sees competition from substitute products, such as alternative diagnostic methods and telehealth solutions, albeit limited currently. End-user trends indicate a shift towards more sophisticated testing technologies and personalized medicine, driving demand for advanced IVD solutions. M&A activity, while not exceptionally high in recent years (xx deals in the past 5 years), remains a significant factor influencing market consolidation.

- Market Size (2024): xx Million

- Market Concentration: Moderately concentrated

- Number of M&A deals (2019-2024): xx

- Key Regulatory Impact: IVDR implementation (May 2022)

Italy In Vitro Diagnostics Industry Industry Trends & Analysis

The Italian IVD market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several key factors: rising prevalence of chronic diseases (diabetes, cancer, cardiovascular diseases), increasing demand for early diagnosis, and government initiatives promoting healthcare infrastructure development. Technological advancements, particularly in molecular diagnostics and automation, are significantly disrupting the market, enhancing diagnostic capabilities and efficiency. Consumer preferences are shifting towards faster, more accurate, and less invasive diagnostic tests. Competitive dynamics are characterized by a mix of established multinational players and emerging innovative companies, fostering innovation and price competition. Market penetration of advanced technologies like next-generation sequencing (NGS) is gradually increasing, although still in its early stages compared to other European nations.

Leading Markets & Segments in Italy In Vitro Diagnostics Industry

The Italian IVD market is dominated by the Northern region, owing to a higher concentration of diagnostic laboratories and hospitals. Within the market, Clinical Chemistry remains the largest segment by test type, driven by high volumes of routine tests. However, Molecular Diagnostics is witnessing the fastest growth, fueled by advancements in PCR and NGS technologies. In terms of product types, Reagents hold the largest market share, reflecting the substantial demand for consumable items associated with various diagnostic tests. Disposable IVD devices dominate the market due to convenience, cost-effectiveness, and hygiene concerns. Hospitals and Clinics are the primary end-users, representing a substantial portion of the market demand.

- Key Drivers:

- Strong healthcare infrastructure in Northern Italy.

- Growing prevalence of chronic diseases.

- Government investments in healthcare technology.

- Dominant Segments:

- Test Type: Clinical Chemistry (largest market share), Molecular Diagnostics (fastest growth)

- Product: Reagents (largest market share), Disposable IVD Devices (largest market share by usability)

- End-User: Hospitals and Clinics (largest market share)

Italy In Vitro Diagnostics Industry Product Developments

Recent product innovations focus on improving diagnostic accuracy, speed, and ease of use. Miniaturized and portable diagnostic devices are gaining traction, particularly in point-of-care settings. There is a strong trend towards automation and digitalization, integrating AI and machine learning for enhanced data analysis and diagnostic support. These innovations are improving the efficiency and effectiveness of diagnostic workflows and improving patient outcomes. Companies are focusing on developing products with superior analytical performance and better integration with existing healthcare information systems (HIS).

Key Drivers of Italy In Vitro Diagnostics Industry Growth

The Italian IVD market's growth is fueled by several key factors:

- Technological Advancements: Development of advanced diagnostic techniques (NGS, PCR) and automation.

- Rising Prevalence of Chronic Diseases: Increasing incidence of diabetes, cancer, cardiovascular diseases driving demand for diagnostic testing.

- Government Initiatives: Investments in healthcare infrastructure and supportive regulatory policies.

- Growing Awareness: Increased public awareness about preventive healthcare and early diagnosis.

Challenges in the Italy In Vitro Diagnostics Industry Market

The Italian IVD market faces certain challenges:

- Regulatory Hurdles: Strict regulatory requirements (IVDR) increase compliance costs and time to market.

- Price Pressure: Competition from generic and low-cost providers.

- Reimbursement Policies: Negotiating favorable reimbursement rates from healthcare providers.

- Supply Chain Disruptions: Potential supply chain vulnerabilities impacting availability and costs of reagents and instruments. (Estimated impact on market growth: xx% in 2024).

Emerging Opportunities in Italy In Vitro Diagnostics Industry

The Italian IVD market presents significant growth opportunities driven by technological breakthroughs in personalized medicine, liquid biopsies, and point-of-care diagnostics. Strategic partnerships between IVD manufacturers and healthcare providers are facilitating the adoption of innovative technologies. Expansion into underserved areas and development of cost-effective diagnostic solutions for emerging infectious diseases offer promising avenues for growth.

Leading Players in the Italy In Vitro Diagnostics Industry Sector

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- DIESSE Diagnostica Senese Societa Benefit SpA

- BioMerieux

- Abbott Laboratories

- Siemens Healthineers AG

- F Hoffmann-La Roche AG

- Thermo Fischer Scientific Inc

- MTD Diagnostics S R L

- Sysmex Corporation

- Danaher

- QIAGEN

- SCLAVO Diagnostics International

Key Milestones in Italy In Vitro Diagnostics Industry Industry

- April 2023: Biovica International partners with IT Health Fusion to commercialize the DiviTum TKa assay in Italy.

- May 2022: The EU In Vitro Diagnostic Regulation (IVDR) becomes effective in Italy, impacting all new IVDs and certain low-risk IVDs already on the market.

Strategic Outlook for Italy In Vitro Diagnostics Industry Market

The Italian IVD market is poised for continued growth driven by technological innovation, increasing healthcare expenditure, and favorable government policies. Strategic partnerships, expansion into new segments (e.g., personalized medicine), and focus on cost-effective solutions will be key success factors for market players. The long-term outlook is positive, with significant potential for growth in the coming years.

Italy In Vitro Diagnostics Industry Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Immuno Diagnostics

- 1.4. Other Techniques

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Devices

- 3.2. Reusable IVD Devices

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer

- 4.4. Cardiology

- 4.5. Other Applications

-

5. End-users

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End-users

Italy In Vitro Diagnostics Industry Segmentation By Geography

- 1. Italy

Italy In Vitro Diagnostics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. Molecular Diagnostics Segment is Expected to Hold a Major Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy In Vitro Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Immuno Diagnostics

- 5.1.4. Other Techniques

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Devices

- 5.3.2. Reusable IVD Devices

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer

- 5.4.4. Cardiology

- 5.4.5. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End-users

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End-users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bio-Rad Laboratories Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DIESSE Diagnostica Senese Societa Benefit SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BioMerieux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Healthineers AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 F Hoffmann-La Roche AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fischer Scientific Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MTD Diagnostics S R L

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sysmex Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Danaher

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 QIAGEN

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SCLAVO Diagnostics International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Italy In Vitro Diagnostics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy In Vitro Diagnostics Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 4: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 5: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 7: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2019 & 2032

- Table 8: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2019 & 2032

- Table 9: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 11: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 12: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by End-users 2019 & 2032

- Table 13: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 18: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 19: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 20: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 21: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2019 & 2032

- Table 22: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2019 & 2032

- Table 23: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 26: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by End-users 2019 & 2032

- Table 27: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy In Vitro Diagnostics Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Italy In Vitro Diagnostics Industry?

Key companies in the market include Becton Dickinson and Company, Bio-Rad Laboratories Inc, DIESSE Diagnostica Senese Societa Benefit SpA, BioMerieux, Abbott Laboratories, Siemens Healthineers AG, F Hoffmann-La Roche AG, Thermo Fischer Scientific Inc, MTD Diagnostics S R L , Sysmex Corporation, Danaher, QIAGEN, SCLAVO Diagnostics International.

3. What are the main segments of the Italy In Vitro Diagnostics Industry?

The market segments include Test Type, Product, Usability, Application, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics.

6. What are the notable trends driving market growth?

Molecular Diagnostics Segment is Expected to Hold a Major Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In April 2023, Biovica International signed a commercial partnership with IT Health Fusion with an aim to commercialize the DiviTum TKa assay in Italy. This is an in-vitro-diagnostic device that is used for semi-quantitative measurement of thymidine kinase activity (TKa) in human serum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy In Vitro Diagnostics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy In Vitro Diagnostics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy In Vitro Diagnostics Industry?

To stay informed about further developments, trends, and reports in the Italy In Vitro Diagnostics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence